If someone had said back in 2000 that accounting firms would one day automate data entry, collaborate with clients entirely online, and share financial data, reports, and sensitive documents from the cloud, most people would’ve found it unbelievable. Fast forward to today, and technology isn’t just doing those things; it has become the backbone of how accounting firms of various sizes operate.

The importance of technology in our industry cannot be overstated, it is critical to long-term growth and survival.

Clients expect quicker insights, smoother communication, and more strategic advice in addition to your core skills, and all of this is possible with technology. To stay competitive, you need more than spreadsheets, accounting templates, and manual processes, you need modern tools that streamline workflows, boost productivity, and unlock new opportunities.

In this article, we’re breaking down seven key ways accounting technology can give your firm a serious competitive edge and help you work smarter, not harder.

The Role of Technology in Modern Accounting Firms

Back in the early 2000s, most accounting firms ran their workflows on Excel, the godfather of data entry and analysis. Even with earlier versions of accounting-specific software, many processes were still manual and disconnected.

Data was primarily stored on physical servers or individual computers. Sharing files meant emailing attachments, burning CDs, or plugging in USB drives. Client interactions were mostly in-person meetings, phone calls, and emails. Remote work was rare, and teams operated locally with limited flexibility.

Everything was slower, and collaboration was far from streamlined. But technology has changed everything.

Cloud-based tools now support global teams and hybrid work models. Platforms like Microsoft Teams, Slack, and Zoom make communication seamless. Shared digital workspaces (like Google Workspace) enhance collaboration. Workflow automation tools like Financial Cents makes practice management more streamlined, and AI has made firms more efficient than ever.

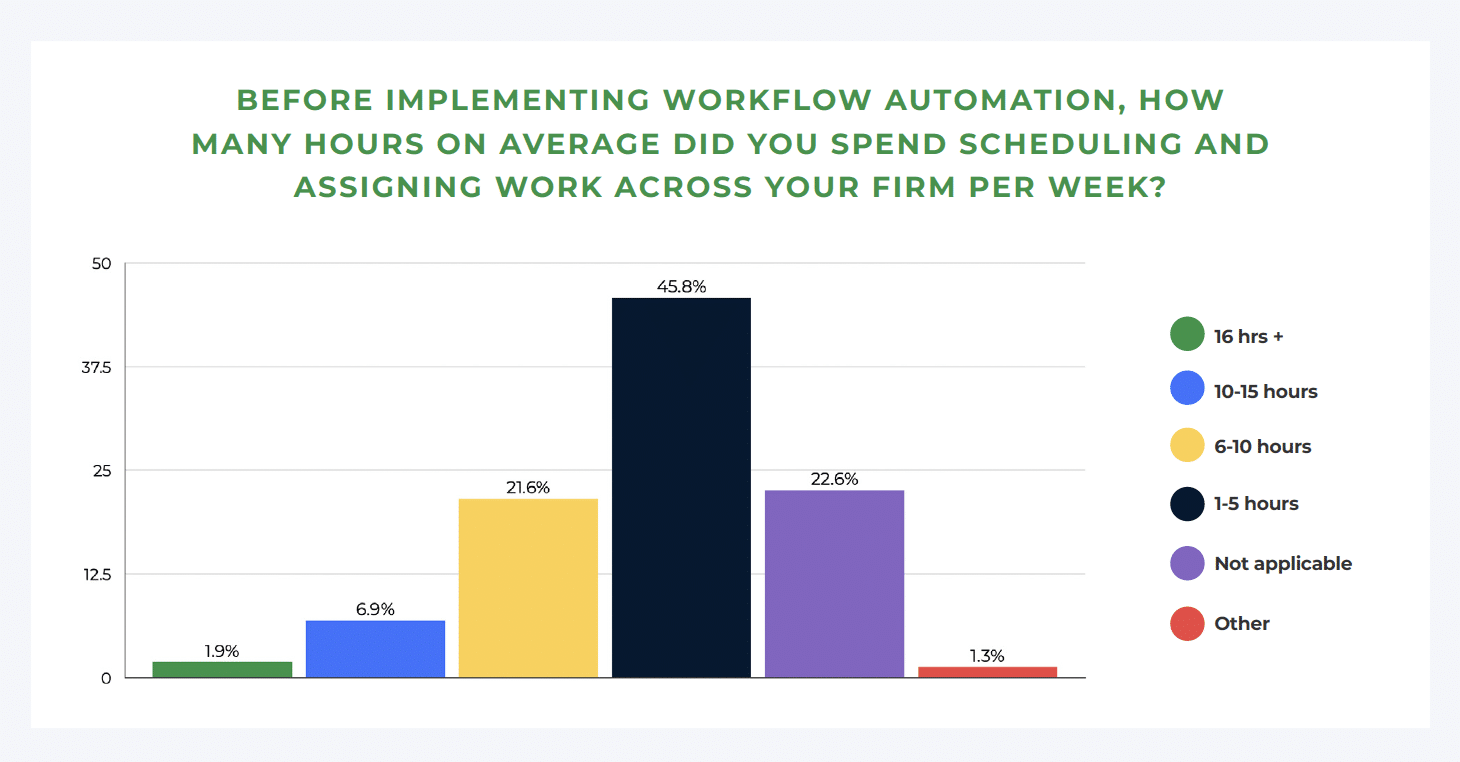

And here’s where the gap is widening. Firms that embrace technology are reducing their workload and improving their bottom line while firms that are still stuck in the old ways are spending more time and resources on activities that do not directly impact the bottom line, just like this statistic shows:

Source: The State of Accounting Workflow Automation Report

For instance, Firm A refuses to upgrade its systems. It still relies on outdated software, manual data entry, and slow processes. Work piles up, deadlines are stressful, and client expectations are harder to meet.

Firm B has embraced cloud-based automation. Routine tasks run in the background, reports auto-generate, and clients get faster, more insightful service. The team works more efficiently, freeing up time for higher-value advisory work.

The difference? Firm B is thriving. Firm A is struggling to keep up.

The accounting industry has transformed, and firms that embrace technology are leading the way. It’s not enough to “get by” with old-school processes. Clients expect more. Teams deserve better. And the only way forward is to work smarter, not harder.

The right technology can get you there. And we’ll show you seven ways it can give your firm a serious edge.

7 Ways Accounting Technology Can Give Your Firm a Competitive Edge

1. Automating Repetitive Tasks to Improve Efficiency

Accounting technology has improved so much lately that it can eliminate the manual and repetitive tasks that slow your firm down.

Think about it: scheduling work, assigning tasks, updating statuses, and chasing documents take up valuable time that could be spent on higher-value activities. With how fast the world is moving, it is futile to spend so much time on administrative tasks.

And you’re not alone in this. CPAs and firm owners like you reported that before automation, nearly 46% of them spent 1-5 hours per week just scheduling and updating work. Onboarding was clunky for 51.4%, and 52.4% struggled to get documents from clients on time. That’s hours wasted on tasks that could run in the background.

However, after implementing workflow automation, the difference was huge. 34.8% of those firms now spend just 0-1 hour per week on scheduling, and 33.5% spend the same minimal time updating work status. Onboarding is smoother for 55.2%, and 45.5% say they now receive documents from clients much faster.

This was possible because they embraced technology.

2. Enhancing Client Collaboration with Cloud-Based Accounting

Your clients are the heartbeat of your practice, and strong relationships are key to maintaining and growing your business. But traditional communication methods—endless email chains, voicemails, and waiting for documents—simply aren’t enough. Clients now expect real-time updates, instant access, and seamless collaboration.

That’s where cloud-based accounting software comes in. With Financial Cents, for instance, you can streamline communication within a single dashboard, securely share sensitive documents, and keep clients informed, using an easy-to-use client portal.

When your data is stored in the cloud, you and your clients can access it anytime, anywhere, even if you’re on vacation. Your team can work on the latest version of a document, update others on report statuses, track billable hours, and send invoices automatically, all with minimal human effort.

For firms working remotely or in hybrid setups, cloud accounting is a game-changer. Instead of chasing down client information, you can instantly share dashboards, reports, and financial insights.

And let’s not forget security. Unlike storing sensitive financial data on a local computer, cloud platforms offer encrypted, regularly backed-up storage, protecting information from loss or cyber threats.

Firms that embrace cloud accounting are staying ahead. They provide faster service, better communication, and a seamless experience for clients.

3. Leveraging AI & Data Analytics for Smarter Decision-Making

AI and big data, as intimidating as they may sound, are redefining decision-making in accounting. Hamed Abassi, CEO of Plooto, put it well when he said:

Automation and AI aren’t scary; they’re only scary because we don’t understand them and they’re new."

More accounting firms, like the rest of the world, are turning to AI tools such as ChatGPT, Grok, Claude, and DeepSeek, which run on large language models, to transform their operations. These tools are enabling more informed decision-making and proactive client advisory services, making them increasingly essential.

Shrad Rao, CEO of Wagepoint, highlights this shift when he said:

The line item for software in income statements is larger than anyone expected it to be at least ten years ago."

Shahram Zarshenas, CEO of Financial Cents, agrees as well. In his words,

ChatGPT hasn’t been around that long, yet everyone’s using it. It’s having such a big impact on businesses, especially in the accounting and bookkeeping space."

AI-powered tools can quickly process vast amounts of financial data, identifying patterns and anomalies with remarkable accuracy. This capability allows firms to detect trends, assess financial health, and pinpoint areas for improvement.

With AI-driven insights, accountants can move beyond reactive services to offer proactive strategies. AI can alert you to potential compliance issues or investment opportunities, allowing you to advise clients before problems arise or chances are missed.

Jason Staats, CPA and Founder of Realize, in an expert interview, emphasized AI’s growing role:

For accountants, the more you can have certain information in one place in a way that is searchable—from meeting transcripts to files—AI in that context becomes really powerful for your accounting firm."

By integrating AI and data analytics into daily workflows, accounting firms can enhance decision-making, optimize operations, and provide more value to clients than ever before.

4. Strengthening Data Security & Compliance

The financial industry is a prime target for cybercriminals, ranking as the second-most targeted sector, according to Statista. With sensitive client data at stake, robust security measures are essential.

Technology plays a crucial role in safeguarding data and ensuring compliance. Secure file-sharing platforms with advanced encryption protect sensitive documents from unauthorized access, unlike traditional methods like email attachments, which are vulnerable to interception.

But cyber threats aren’t always external. As Brad D. Messner, MBA, explains:

A data breach doesn’t always involve a hacker. It can be as simple as emailing the wrong document or uploading a file to the wrong client folder. When that happens, unauthorized individuals gain access to sensitive information—an all-too-common mistake."

Multi-factor authentication (MFA) adds another layer of defense, requiring users to verify their identity through multiple steps. Even if a password is compromised, MFA drastically reduces the risk of unauthorized access.

As cyber threats evolve, firms that leverage technology to strengthen security and compliance won’t just protect their clients, they’ll also build trust and credibility in an increasingly digital world.

5. Improving Client Experience with Technology

Nowadays, clients expect more than just accurate numbers, they want seamless communication, quick responses, and an effortless experience. And technology-powered client relationship management (CRM) tools can make that possible.

A dedicated accounting CRM helps firms manage client interactions, track communications, and personalize services. Instead of sifting through emails or spreadsheets, you can access client history, preferences, and pending tasks, all in one place. This makes follow-ups smoother and ensures no detail falls through the cracks.

Client portals are also in high demand, offering clients real-time access to documents, invoices, and project updates without the constant back-and-forth. With self-service options, clients can upload files, check progress, and sign documents digitally, reducing delays and improving satisfaction.

Additionally, AI-powered chatbots and virtual assistants are transforming client communication. They handle common inquiries, appointment scheduling, and reminders—freeing up your team’s time for higher-value tasks. Meanwhile, accounting document management systems streamline file organization, ensuring that important records are easily accessible and securely stored.

6. Streamlining Workflows with Accounting Practice Management Software

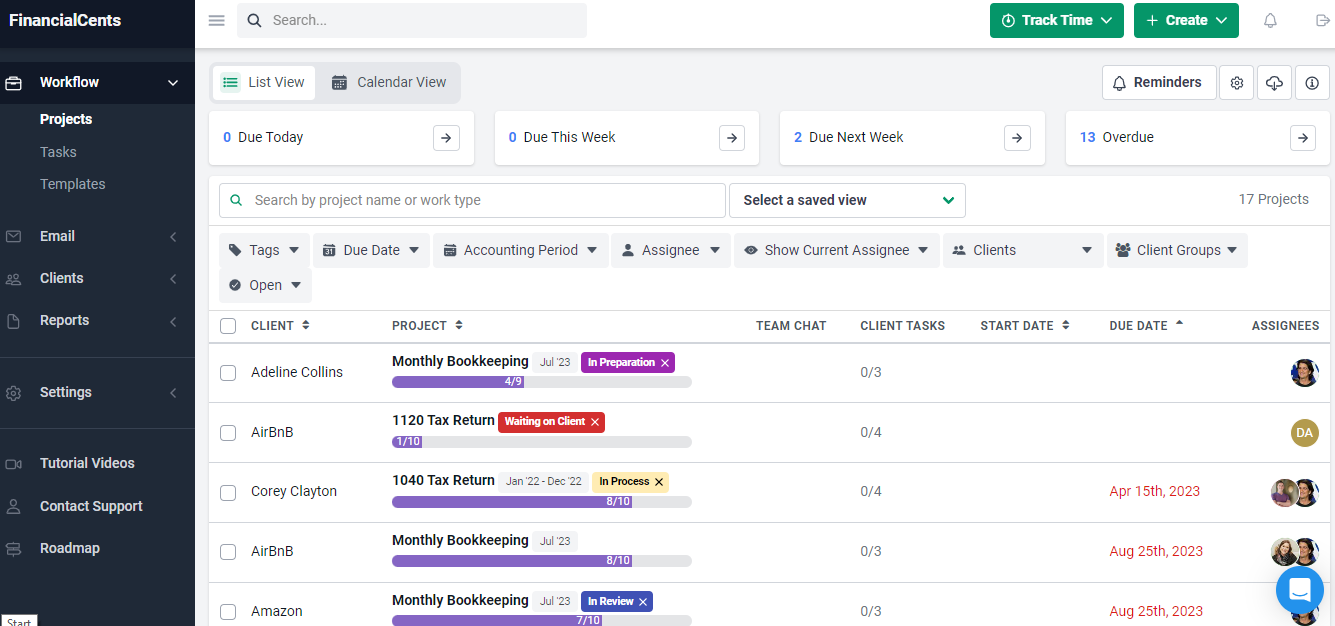

Managing deadlines, tasks, and client projects can be overwhelming without a centralized system. Accounting practice management software, like Financial Cents, helps firms stay organized, efficient, and on top of every client engagement.

With Financial Cents, your firm gets a comprehensive view of all client projects, deadlines, and tasks in one place, reducing the risk of overlooked activities. The platform also fosters seamless team communication, ensuring everyone stays aligned on project statuses and responsibilities.

Secure document management is another major advantage. Financial Cents securely stores and organizes client files, making retrieval effortless while ensuring compliance with data protection regulations.

With Financial Cents, your firm gets a comprehensive view of all client projects, deadlines, and tasks in one place, reducing the risk of overlooked activities. The platform also fosters seamless team communication, ensuring everyone stays aligned on project statuses and responsibilities.

Secure document management is another major advantage. Financial Cents securely stores and organizes client files, making retrieval effortless while ensuring compliance with data protection regulations.

When it comes to workflow automation, the software standardizes routine tasks through workflow templates, minimizing errors and ensuring consistent service delivery. Automated reminders for upcoming deadlines and pending tasks help prevent delays and keep projects on track.

Integrating practice management software like Financial Cents into your firm’s operations, helps you streamline workflows, improve collaboration, and maintain high-quality service, without the stress of manual tracking.

7. Gaining a Competitive Edge with AI-Powered Tax & Audit Solutions

AI is transforming tax and audit services, giving firms a competitive edge by increasing accuracy, efficiency, and compliance.

With the advent of machine learning, these tools analyze vast amounts of financial data at lightning speed, flagging discrepancies, identifying patterns, and predicting potential compliance risks. This reduces human error, minimizes audit risks, and ensures tax filings are accurate and up-to-date.

AI-powered audit solutions also enhance fraud detection by recognizing suspicious activity that might go unnoticed in manual reviews. Beyond compliance, these intelligent tools help firms provide more strategic tax planning. AI-driven insights allow accountants to anticipate tax liabilities, uncover deductions, and optimize tax-saving opportunities for clients, enhancing both trust and value.

Firms that adopt AI-powered tax and audit solutions can increase efficiency, reduce risk, and provide smarter, data-driven financial guidance that sets them apart from the competition.

How to Start Implementing Accounting Technology in Your Firm

1. Assess Your Firm’s Current Processes

The first step in implementing technology is understanding where your firm currently stands. Take a deep dive into your existing workflows and identify areas that are manual, time-consuming, or prone to errors. For example, are you still handling client data entry manually? Are there delays in document sharing or communication? Pinpointing these pain points is key to knowing where automation and technology can make the biggest impact.

2. Research Tools that Fit Your Needs

Once you’ve identified areas for improvement, start researching tools that can help. Look for software designed to streamline those specific tasks. Whether it’s accounting software, cloud-based storage, project management tools, or AI-driven platforms, ensure the tools align with your firm’s goals and workflows. Consider factors like scalability, security, and integration with existing systems.

3. Request Demos or Start a Free Trial

Before making a final decision, always request a demo or start a free trial. This will allow you to test the software in action, explore its features, and see how it fits with your firm’s needs. It’s essential to evaluate its ease of use, support options, and any potential learning curve for your team.

Book a demo of Financial Cents to see how it can enhance your firm’s operations.

4. Choose the Right Tools for Your Firm’s Size and Client Needs

When selecting software, consider the size of your firm and the specific needs of your clients. Smaller firms may need simple tools with basic features, while larger firms might require more robust, scalable solutions. Keep your clients’ needs in mind; tools that improve collaboration, transparency, and service speed can make a big difference in client satisfaction.

When it comes to workflow automation, the software standardizes routine tasks through workflow templates, minimizing errors and ensuring consistent service delivery. Automated reminders for upcoming deadlines and pending tasks help prevent delays and keep projects on track.

Integrating practice management software like Financial Cents into your firm’s operations, helps you streamline workflows, improve collaboration, and maintain high-quality service, without the stress of manual tracking.

-

Gaining a Competitive Edge with AI-Powered Tax & Audit Solutions

AI is transforming tax and audit services, giving firms a competitive edge by increasing accuracy, efficiency, and compliance.

With the advent of machine learning, these tools analyze vast amounts of financial data at lightning speed, flagging discrepancies, identifying patterns, and predicting potential compliance risks. This reduces human error, minimizes audit risks, and ensures tax filings are accurate and up-to-date.

AI-powered audit solutions also enhance fraud detection by recognizing suspicious activity that might go unnoticed in manual reviews. Beyond compliance, these intelligent tools help firms provide more strategic tax planning. AI-driven insights allow accountants to anticipate tax liabilities, uncover deductions, and optimize tax-saving opportunities for clients, enhancing both trust and value.

Firms that adopt AI-powered tax and audit solutions can increase efficiency, reduce risk, and provide smarter, data-driven financial guidance that sets them apart from the competition.

How to Start Implementing Accounting Technology in Your Firm

1. Assess Your Firm’s Current Processes

The first step in implementing technology is understanding where your firm currently stands. Take a deep dive into your existing workflows and identify areas that are manual, time-consuming, or prone to errors. For example, are you still handling client data entry manually? Are there delays in document sharing or communication? Pinpointing these pain points is key to knowing where automation and technology can make the biggest impact.

2. Research Tools that Fit Your Needs

Once you’ve identified areas for improvement, start researching tools that can help. Look for software designed to streamline those specific tasks. Whether it’s accounting software, cloud-based storage, project management tools, or AI-driven platforms, ensure the tools align with your firm’s goals and workflows. Consider factors like scalability, security, and integration with existing systems.

3. Request Demos or Start a Free Trial

Before making a final decision, always request a demo or start a free trial. This will allow you to test the software in action, explore its features, and see how it fits with your firm’s needs. It’s essential to evaluate its ease of use, support options, and any potential learning curve for your team.

Book a demo of Financial Cents to see how it can enhance your firm’s operations.

4. Choose the Right Tools for Your Firm’s Size and Client Needs

When selecting software, consider the size of your firm and the specific needs of your clients. Smaller firms may need simple tools with basic features, while larger firms might require more robust, scalable solutions. Keep your clients’ needs in mind; tools that improve collaboration, transparency, and service speed can make a big difference in client satisfaction.

5. Train Your Team to Adapt

Implementing new technology is only half the battle, ensuring your team adapts to it is equally important. Provide training and support to help your team understand how to use the new tools effectively. Consider creating a phased rollout plan, starting with the most tech-savvy team members and expanding to others gradually. Encourage a positive mindset toward technology, as it will ultimately help the firm work smarter and more efficiently.

You can watch this video from our WorkflowCon 2023 event for an indepth training guide:

Conclusion

Adopting accounting technology offers an opportunity to position your firm for growth and success. With the right tools, you can automate repetitive tasks, enhance client collaboration, gain smarter insights, and ensure data security.

Now is the perfect time to start embracing technology, if you haven’t started. The firms that use modern accounting tools are the ones that stay ahead of the competition, offering quicker, more accurate services and anticipating client needs before they arise.

If you’re ready to take that next step, explore Financial Cents as your all-in-one accounting practice management solution. With its powerful features designed to streamline your workflows, manage client projects, and boost team productivity, Financial Cents can be the game-changer your firm needs.