The year is 2050. John, a seasoned CPA, faces the reality that his meticulous number-crunching skills that once defined his career are no longer in demand.

The world has fully embraced a new era where automation and artificial intelligence (AI) seamlessly handle all financial tasks, relegating accountants like John to the sidelines. The accounting profession is no more!

While the scenario above may sound like a Christopher Nolan movie script, some accountants and bookkeepers fear it could soon become the new normal.

However, this is far from the case.

The accounting industry has always benefited from advances in technology. From calculators to spreadsheets, every wave of innovation has helped accountants enhance their abilities and improve efficiency.

AI and automation are no different. These technologies enable accountants to work faster, smarter, and more efficiently. It also allows them to focus on high-value tasks, such as strategic financial planning, risk management, and advisory services.

This trend will continue well into the future as more accounting and CPA firms adopt these technologies. An SNS Insider report projects the AI in Accounting Market size to reach $39.57 billion by 2030. A massive 45.31% CAGR from $1.99 billion in 2022.

So, the question is: Would AI or automation go beyond being a reliable assistant to replacing accountants?

That’s what this article seeks to address. We’ll also discuss the benefits of AI and automation and how to use them to scale your accounting firm.

Will AI Replace Accountants?

The short answer? No.

Artificial intelligence, which dates back to the 1950s, plays a vital role in the accounting industry. It automates manual work with greater speed, increased accuracy, and minimal errors.

It can also provide real-time financial insights, detect fraud, and forecast trends.

Despite its advantages and giant strides in recent years, AI will not replace accountants. Here’s why:

Artificial intelligence lacks the human judgment, communication skills, and critical thinking that accounting professionals like you possess.

These are traits you need to help clients understand the nuances of their challenge and proffer the most logical solution.

Joe Atkinson, Chief Product and Technology Officer at PwC echoes the same thought:

AI tools are really good at pulling out information and making predictive choices but they can't replace human judgment."

For this reason, accountants should see AI as a tool to augment their abilities and productivity.

By embracing AI and automation as supportive systems, you can provide better services to your clients and grow your firm.

Also, people trust your advice and decision-making over that of machines or robots.

Elliot Brown, an Advisor and Marketing Consultant, sums this up nicely:

Our research shows that 86% of small business owners see their accountant as a trusted advisor for a wide range of business advice. They trust their accountant for advice more than their lawyer, their banker, or their friends and family.

While some duties that accountants handle may be automated, streamlined, or outsourced over time, the need for a good advisor will never go away.

Successful accountants are likely to take on increasingly consultative roles where they spend more time interpreting data, answering questions, and helping clients prepare for the future, but automation is not likely to replace them anytime soon."

The Human Touch in Accounting Processes

Think about the last time you had to make a crucial decision for either your firm or clients.

You considered various factors, weighed the pros and cons, and ultimately relied on your judgment to make an informed decision.

That’s why the human element is invaluable in the accounting profession.

AI is indeed exceptional at processing vast amounts of data and providing insights.

But it’s limited by predefined algorithms and lacks the human ability to understand contextual nuances, make professional judgments, and factor in ethical considerations. These qualities are vital in ensuring regulatory compliance and maintaining financial integrity.

Also, interactions with clients often require interpersonal skills and emotional intelligence, two crucial traits AI cannot replicate.

On the contrary, you bring a wealth of experience, strategic thinking, and human judgment to the table. You can understand your client’s unique situation, consider other perspectives, show empathy, and offer tailor-made solutions.

So, rather than one or the other, a blend of AI and human expertise is what will ultimately lead to the best outcomes in the accounting profession.

Goodhew, global assurance innovation and emerging technology leader at EY shares a similar opinion:

Humans are still needed, as they can make the appropriate judgment calls based on the data. AI can process data much faster than people, so it can Interrogate the data more robustly in a way that enables the accountant to ask better questions and gain better insights."

Continuous Learning is a Must for Accountants

The U.S. Bureau of Labor Statistics expects accounting and auditor jobs to grow by 4% from 2022 to 2032, more than the average for all other occupations.

Judging by this stat, it’s safe to say AI won’t reduce accounting jobs in the near future. However, it will change roles within the profession.

With AI taking over routine tasks, accountants would have to shift their focus to more strategic, advisory, and management roles.

Pisey Daung, ACCA, CPA corroborates this point:

When automation exists, accountants will not spend much time on those basic tasks. Instead, they will spend more time on value-added activities or tasks. For example, they will spend much more time on financial analysis, budgeting, projection, variance analysis, and other tasks that involve more strategic decisions to further grow the company.

The accountants will become more trusted and business partners to senior management and also more holistic business advisors to its clients. They will manage and oversee the automation process to ensure that the information is processed accurately.”"

Therefore, accountants would need to adapt and upskill to remain relevant in the industry. This includes staying updated on the latest technological advancements and proficient use of AI-powered and automation software for accountants.

Accountants would also need to get hands-on experience in emerging technologies like blockchain, RPA, cloud technology, and data analytics.

To quote Brian Clare, CEO and founder of Blueprint Accounting:

If you don’t start using AI, you will be replaced by accountants that use AI."

Recommended Resource

Download: Accounting Firm Automation Guide.

How to Utilize Artificial Intelligence and Automation in Accounting

You’ve understood AI and automation isn’t a threat, but a tool to complement your skills and expertise as an accountant. Great!

The next step is to learn how to use it to scale your accounting firm. You can start by familiarizing yourself with this list of top accounting AI software.

Let’s look at some use cases.

Workflow Automation

In our State of the Accounting Automation Workflow survey, 66.7% of firm owners cited workflow as the biggest challenge they faced in 2022. And the reason for this bottleneck isn’t far-fetched.

Having no automation in place makes it difficult to streamline tasks and work efficiently. You spend hours on tedious manual work leading to errors, reduced productivity, and missed deadlines.

Accounting workflow automation software solves this issue. It streamlines your accounting processes by automating recurring tasks. This saves time, improves accuracy, and increases efficiency.

Also, automation frees up time to handle more core activities. In our aforementioned survey, firm owners who implemented workflow automation cut time spent on manual work from an average of 1-10 hours to an average of 0-5 hours.

Client Communication

When dealing with clients, it’s essential to always keep them informed. This shows you value their involvement and ensures transparency in your relationship. AI and automation play a significant role in achieving this.

For instance, AI-powered chatbots can provide instant responses to common queries on your website. This way, leads can get the information they need to make instant buying decisions.

You can also use automation to send timely updates or reminders to clients. For example, upcoming tax deadlines or payment reminders.

In addition, an AI-powered tool like ChatGPT makes it easy to draft and send timely emails to your clients. This saves time and improves customer experience.

I feel like if we had to pick one thing that is the most broad application of AI that you can use in your practice today, it's going to be that of writing emails"

Blake Oliver, CPA, during our Grow and Scale seriesJason Staats, CPA also agrees:

It's a huge opportunity. It's already really useful for sticky emails that are hard to word the right way. I think they're really helpful. Where I find myself using it most is I'll take a first stab at something and it's like nope this is too mean. Can you rewrite this for me? So yeah, I think that's probably the most universally applicable use case."

It’s why accounting software companies like Financial Cents integrate ChatGPT into their platform, making it easy to craft emails and create workflow templates in seconds.

Data Analysis and Insights

AI-powered software can analyze large volumes of financial data, identify patterns, and provide valuable insights in minutes.

You can use these insights to understand financial trends, identify risks, and make data-driven decisions for your firm.

Content creation

Creating content online helps you grow an audience, build a personal brand, promote your services, and generate quality leads for your accounting firm.

But you probably neither have the time nor skills to create content for your firm.

Enter AI tools like ChatGPT, Microsoft’s Bing AI, or Google’s Bard.

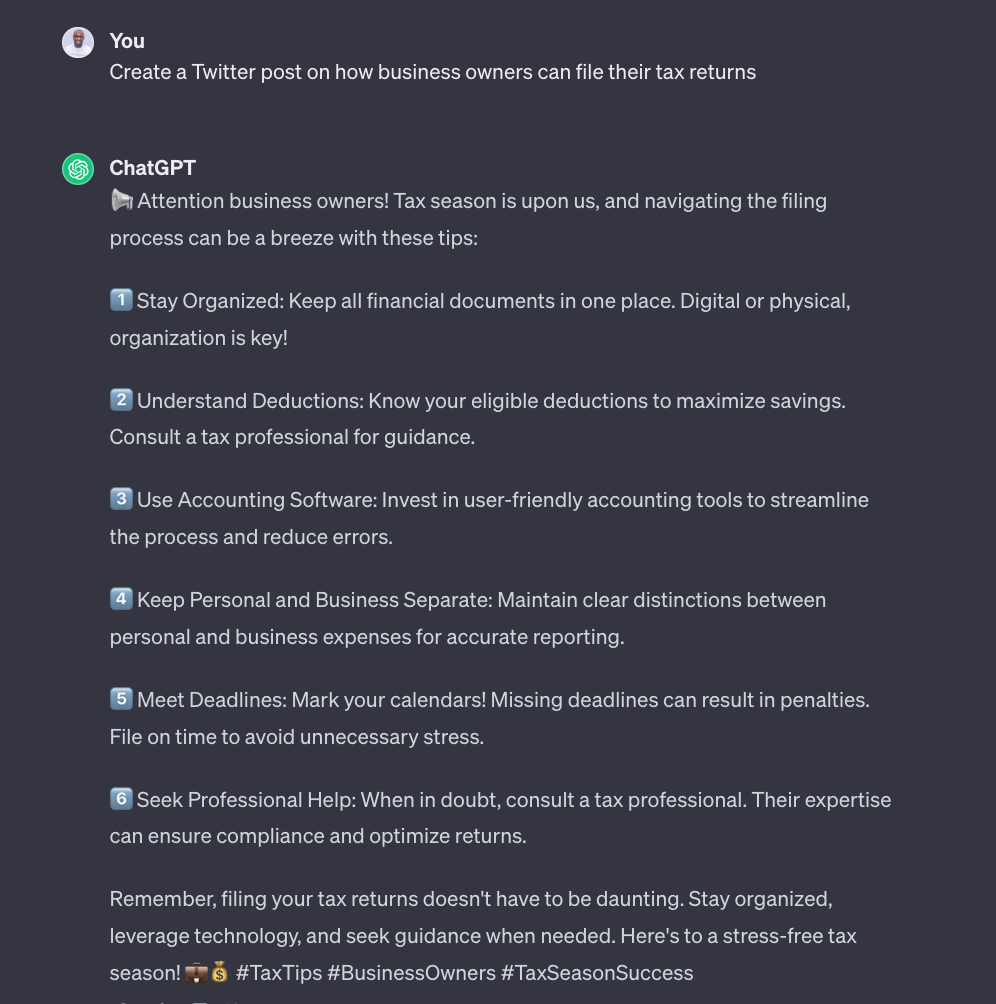

You can use them to create email newsletters, social media content, or blog posts simply by entering a prompt.

Here’s an example:

An AI-powered tool like Grammarly also makes it easy to check for grammar, punctuation, and spelling errors and suggests improvements to your content’s flow and readability.

Using these tools saves time and resources that you would have spent on writing and editing.

Recommended Resource

Benefits of AI and Automation for Your Accounting Firm

Now, let’s discuss some benefits of implementing AI and automation in your accounting firm.

1. Increased Efficiency

Using AI-powered software to automate repetitive tasks in your firm streamlines workflows and improves overall efficiency.

Workers have more time to focus on other strategic activities that could land more clients and grow company revenue.

2. Reduced Errors

Working on tedious manual tasks for several hours means errors are bound to happen.

But when you automate these mundane tasks, it significantly reduces human errors and increases accuracy in financial statements.

Accountants can be more confident in the data they are working with, making it easier to make informed decisions and provide reliable insights to clients.

3. Save Time

The saying, ‘time is money’ holds water, especially in the accounting profession where time management is crucial for maximizing productivity and profitability.

AI and automation save precious time by handling tasks that would otherwise be time-consuming for accountants.

Also, efficient time management allows you to meet deadlines; a crucial factor in building successful long-term client relationships.

4. Future Proof Your firm

In a recent Thomas Reuters ChatGPT and Generative AI survey, only 15% of tax & accounting firms said they are currently using or planning to integrate AI into their operations.

This shows some firm owners are still reluctant to embrace AI. But as technology continues to advance and accountants’ roles evolve, it’s only a matter of time before AI adoption increases.

But those that have integrated AI and automation in their firms, experience:

- Enhanced workflow efficiency

- Improved client communication & collaboration

- Competitive advantage

- Visible business growth

These benefits future-proof your company and position it for continued success in an ever-evolving technological world.

5. Take on More Clients

What’s better than one client? 10 clients.

Yep, that’s right. More clients lead to higher revenue and faster business growth.

Automating basic tasks increases your firm’s efficiency. This allows you to channel more time into marketing activities to land more clients.

6. Better Work-Life Balance

In a FlexJobs career survey, 68% of respondents chose better work-life balance over better pay when searching for jobs.

In an economy where finding top talent is getting difficult and more expensive, you’ll be better served keeping your current staff happy.

Automating repetitive tasks reduces the need for working overtime or late nights at the office. This allows your staff to enjoy more personal time and maintain a healthy work-life balance.

Start Your AI and Automation Journey with Financial cents

Artificial intelligence, automation, and other emerging technologies are here to stay. This much is certain.

They will not replace accountants, but change the profession in ways we can’t imagine.

As such, accounting and CPA firms must immediately embrace these technologies to stay relevant and competitive in the industry.

You can kickstart your AI and automation journey by adopting Financial Cents for your firm. It’s a workflow automation software designed to help firm owners like you:

- Save time & increase efficiency

- Store client information

- Automate recurring tasks

- Track deadlines

- Collaborate with team members

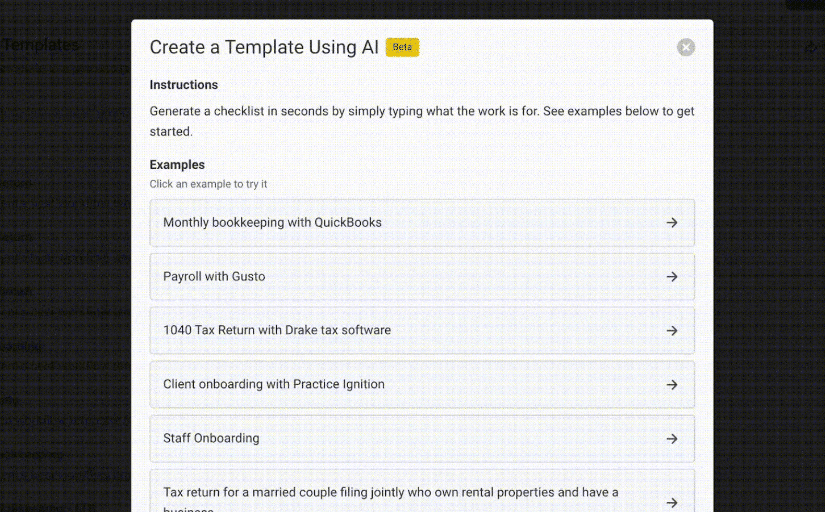

Also, Financial Cents’ ChatGPT integration makes it easy to create checklist templates in seconds such as monthly bookkeeping or client onboarding.

You can also use it to write client emails and save email templates for future use. Awesome isn’t it?

So what are you waiting for?

Use Financial Cents Accounting Practice Management Software to manage your firm.