Do you ever feel like you’re starting from scratch with every new client? One client wants their books cleaned up, another needs payroll sorted, and suddenly you’re digging through old files trying to remember how you handled it last time. It’s exhausting, right?

This happens when there’s no standard process. You spend more time figuring things out again than focusing on valuable work. As your client list grows, consistency gets harder.

Worksheets and accounting templates solve this. They give you a repeatable way to manage tasks, check accuracy, and keep projects on track. With them, you have a clear guide instead of chaos.

And here’s the kicker: when you’re more consistent and efficient, your clients feel it too. They get better service, fewer errors, and faster results. That not only makes them happier but also makes your firm more profitable in the long run.

What Are Accounting Worksheets?

An accounting worksheet is your behind-the-scenes playbook. It’s not a formal report you share with clients or regulators. It’s a place to plan, process, and proofread your work before it ever becomes a report or deliverable.

At its core, a worksheet is simply a structured document (often a spreadsheet or template) that helps you work through a specific accounting process step by step. It could be something as simple as a monthly closing checklist or as detailed as a trial balance sheet.

The goal is to make your life easier: instead of relying on memory or starting from scratch each time, you have a clear framework to follow. That way, you stay consistent and catch errors early.

7 Essential Accounting Worksheets

Here are seven worksheets that can save you time, reduce errors, and keep your firm running smoothly:

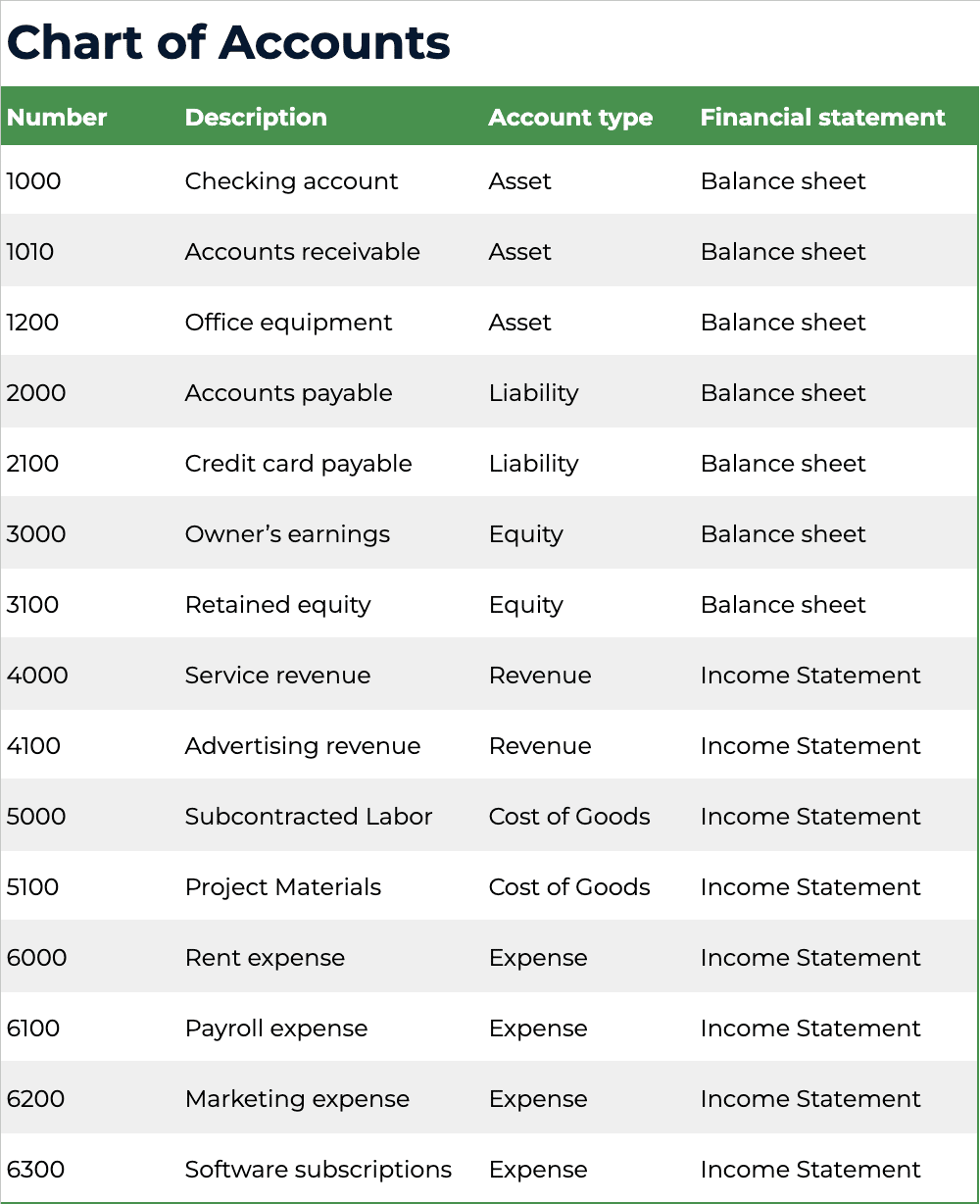

1. Chart of Accounts

If your accounting system were a house, the chart of accounts would be the foundation. It’s the structured list of every account you use to track transactions, from assets and liabilities to equity, revenue, and expenses. Without it, everything else feels shaky and unorganized.

Using a chart of accounts worksheet keeps you consistent, prevents duplication, and ensures nothing important gets left out. It also makes onboarding new clients smoother, since you don’t have to “reinvent the wheel” each time; you just adapt the worksheet to fit their business.

Download the free Chart of Accounts template

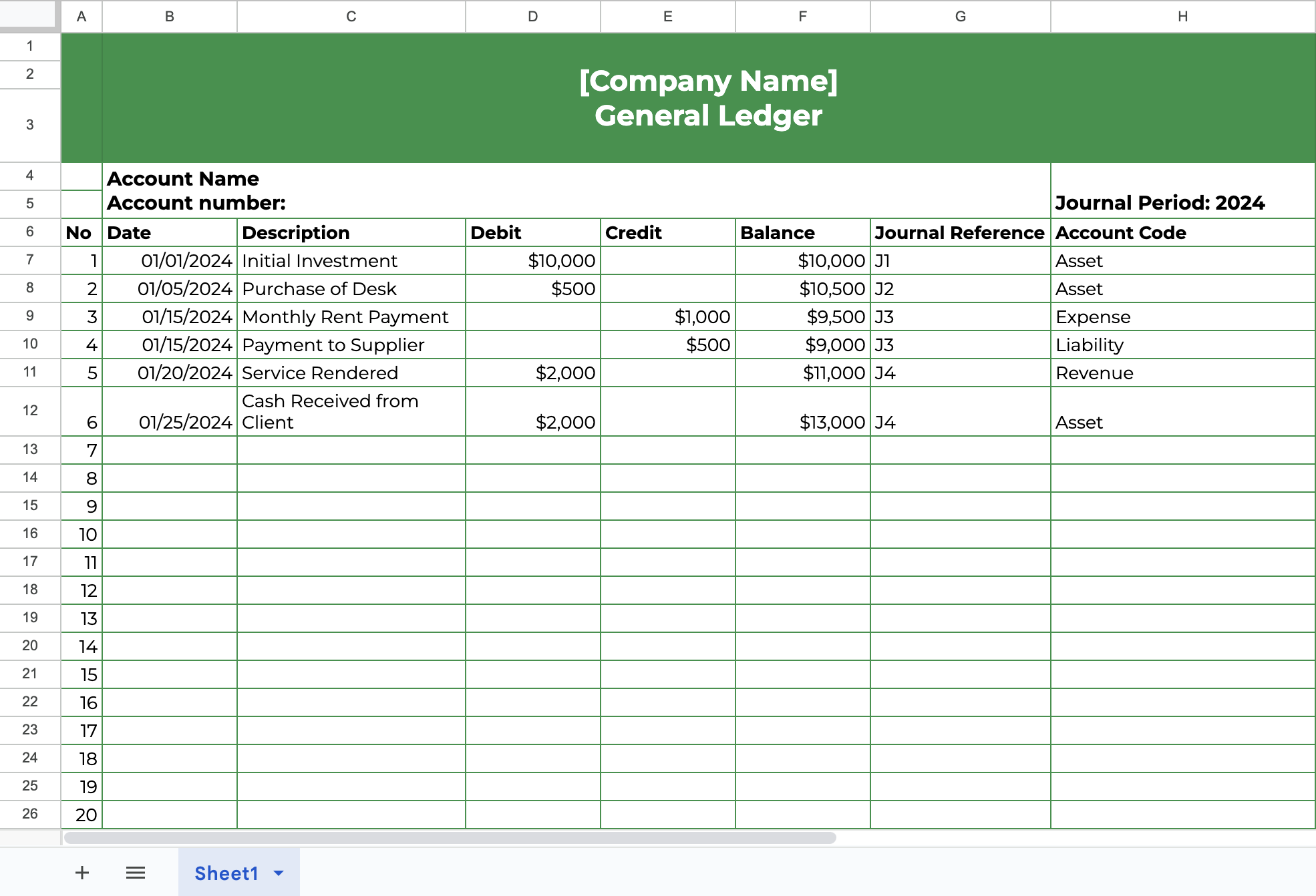

2. General Ledger

Your general ledger is where all of your client’s financial activity comes together. Every transaction (whether it’s a small office purchase or a big equipment expense) eventually lands here. It’s the place you go to see the full story of debits and credits.

A general ledger worksheet gives you a clear way to record, review, and double-check entries. It is laid out like a table with columns for the date, account name, description, debit, credit, and running balance. It keeps things organized, reduces mistakes, and makes sure the numbers you’re working with are accurate before you move on to the trial balance or financial statements.

Download the free General Ledger template

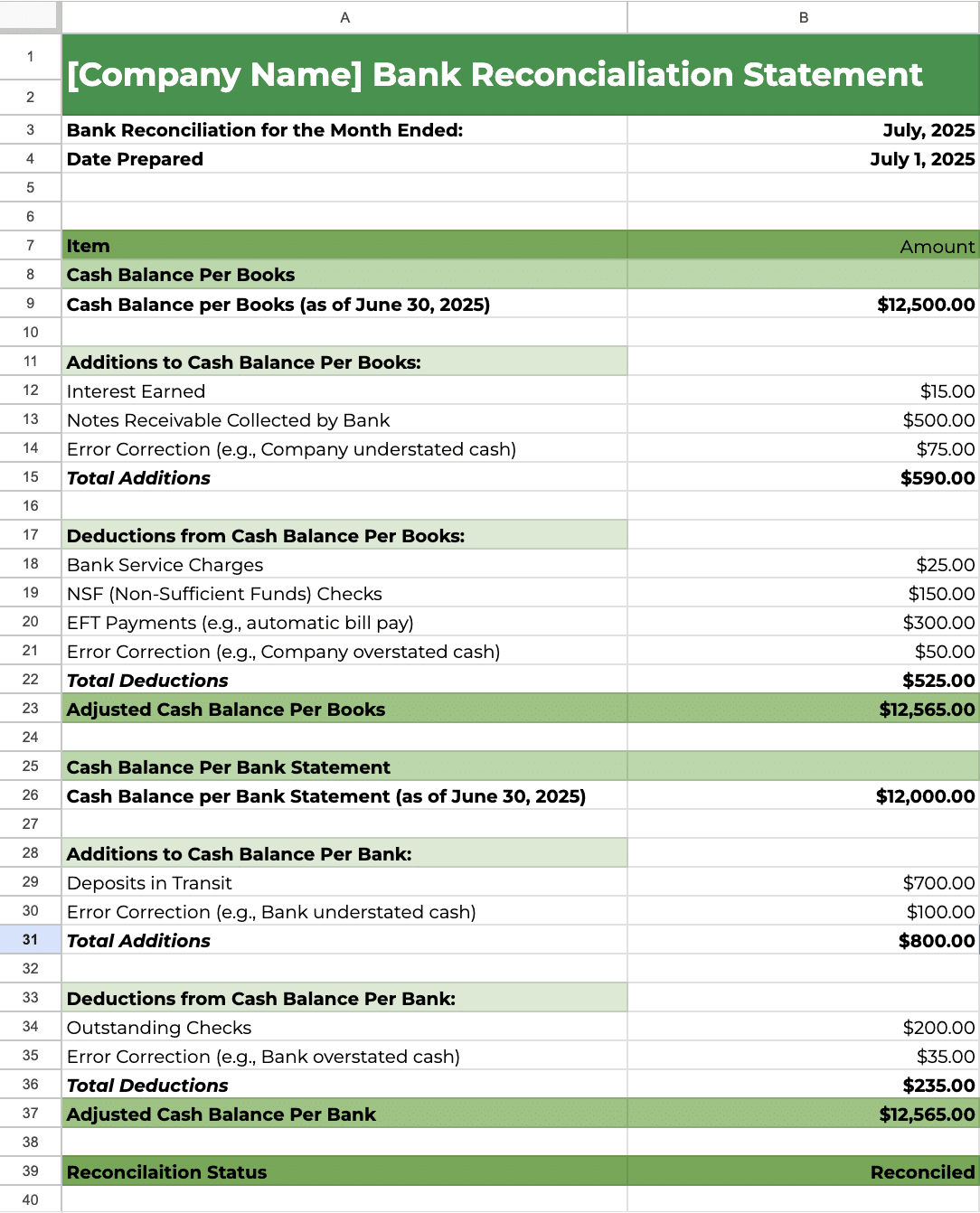

3. Bank Reconciliation

If your bank balance doesn’t match your books, you’ve got a problem. Maybe a deposit hasn’t cleared yet, a payment didn’t get recorded, or there’s a bank fee no one noticed. If you’re not reconciling regularly, those little differences add up fast.

A bank reconciliation worksheet helps you spot timing differences, errors, or missing entries. It gives you a simple, step-by-step way to compare your client’s cash records against their bank statements. You can tick off cleared transactions, track outstanding items, and spot anything that doesn’t line up.

Using this worksheet keeps cash accounts accurate and saves you from last-minute surprises. Plus, it gives clients confidence that the money showing in their books really matches what’s in the bank.

Download the free Bank Reconciliation template

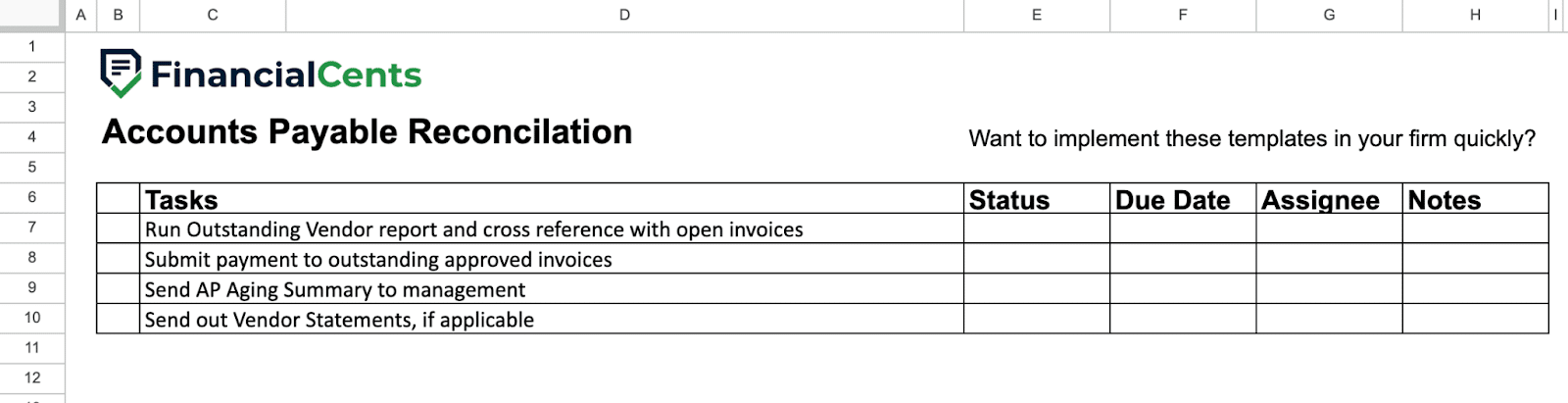

4. Accounts Payable Reconciliation Checklist

Few things can frustrate vendors more than late or incorrect payments. And for you, that often means extra calls, extra emails, and extra stress. Accounts payable reconciliation is how you make sure what’s in your books matches what you actually owe.

An accounts payable reconciliation worksheet gives you a clear process to compare your records against vendor statements. It helps you catch duplicate entries, missed invoices, or payments that didn’t get applied correctly. The result? Vendors get paid on time, and you avoid awkward conversations about balances that don’t add up.

Download the free Accounts Payable Reconciliation template

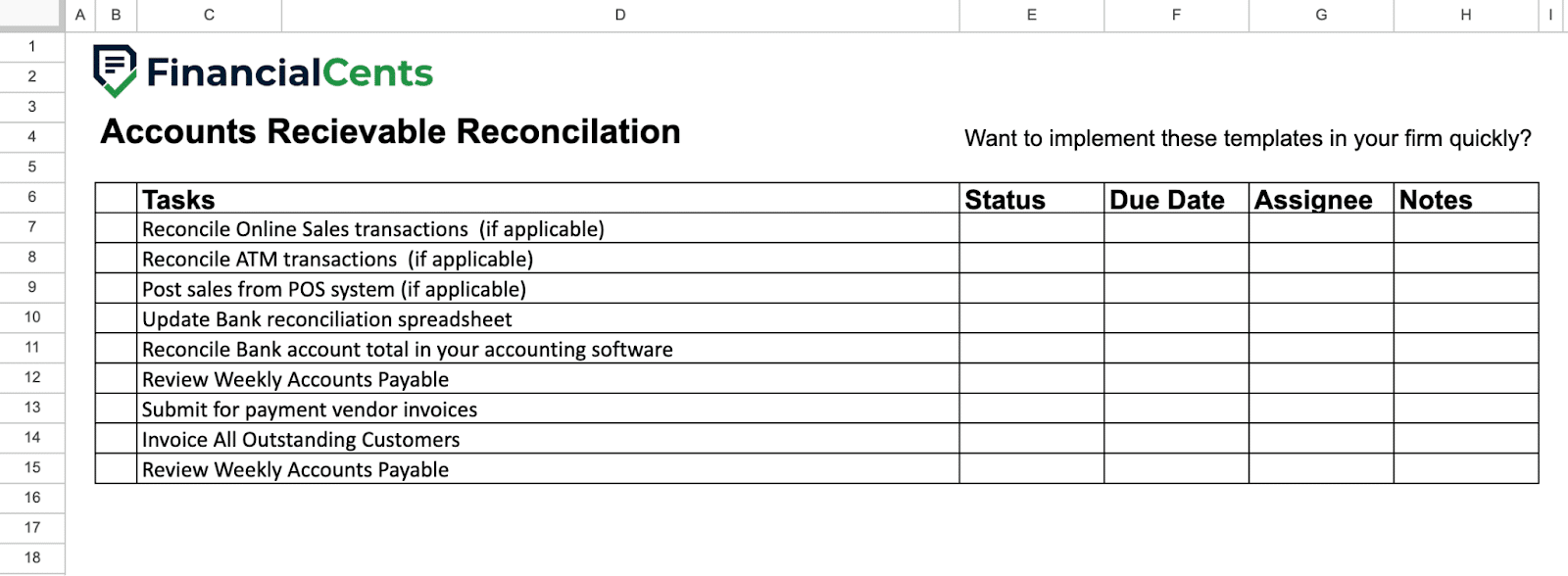

5. Accounts Receivable Reconciliation Checklist

Just as important as knowing what you owe is knowing what others owe you. Missed or misapplied payments can easily throw off your books and, worse, leave money uncollected. That’s why reconciling accounts receivable regularly is so critical.

An accounts receivable reconciliation worksheet helps you line up customer invoices with the payments you’ve actually received. It makes it easier to catch overdue accounts, track partial payments, and make sure nothing gets overlooked.

For you, this means fewer surprises and a clearer picture of your client’s cash flow. For your clients, it means confidence that they’re collecting everything they’ve earned.

Download the free Accounts Receivable Reconciliation template

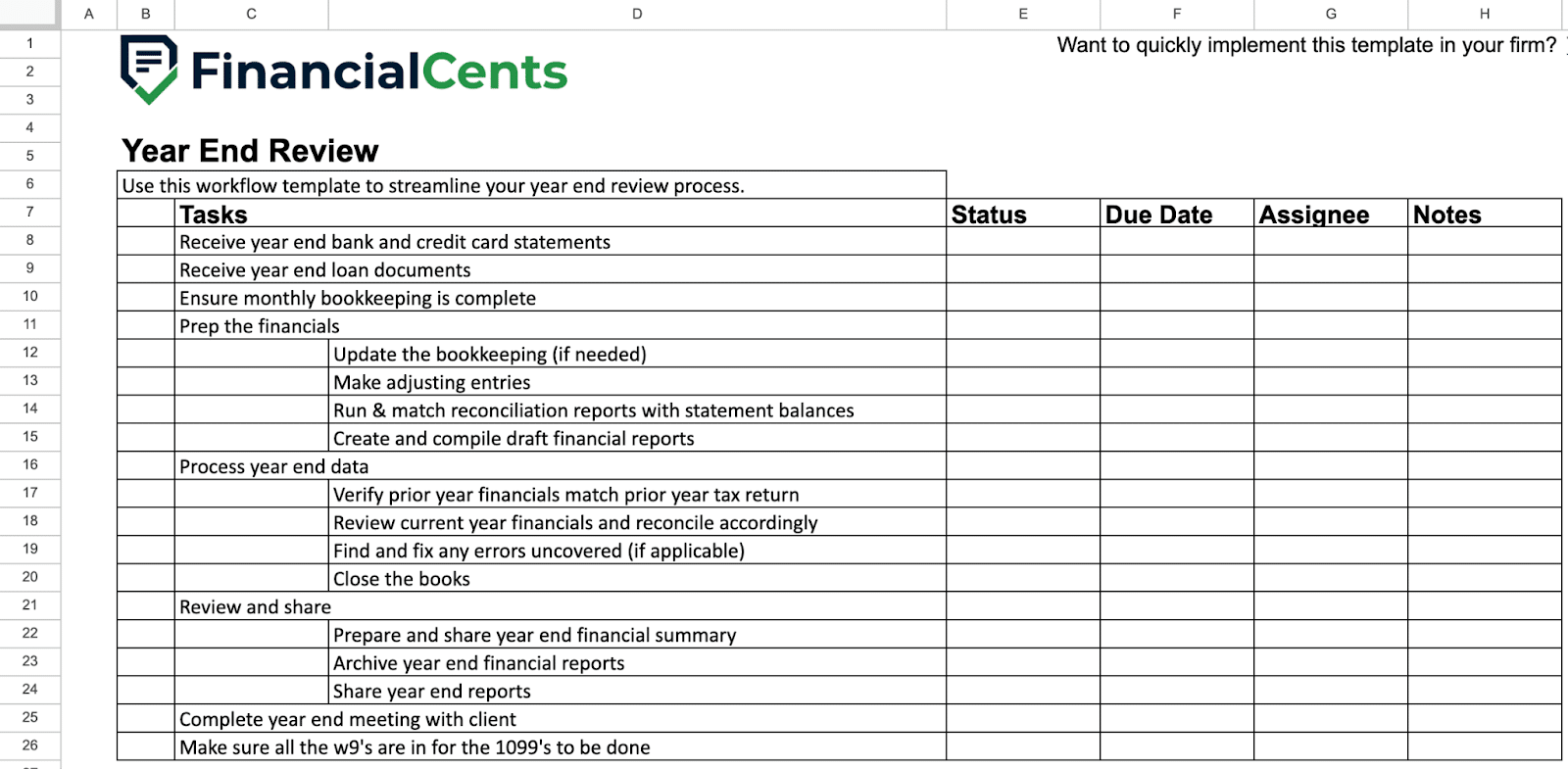

6. Year-End Accounting Checklist

Year-end accounting is one of the busiest times in any accounting firm. Between closing the books, preparing adjustments, and getting ready for tax season, it’s easy for things to get missed. A year-end checklist helps you stay organized and makes sure every box is ticked before you move on to reporting.

The worksheet walks you through all the essential steps, from reviewing reconciliations to posting adjustments, so nothing is missed. It gives you and your team peace of mind knowing you’ve covered everything. And if you’re looking for a proven process you can model, check out our Workflow Live: Refine Your Year-End Review session. In this video, our CEO interviews Malia White, MBA, who walks you through her step-by-step year-end review process that you can apply in your firm, too.

Get the free Year-End Accounting template

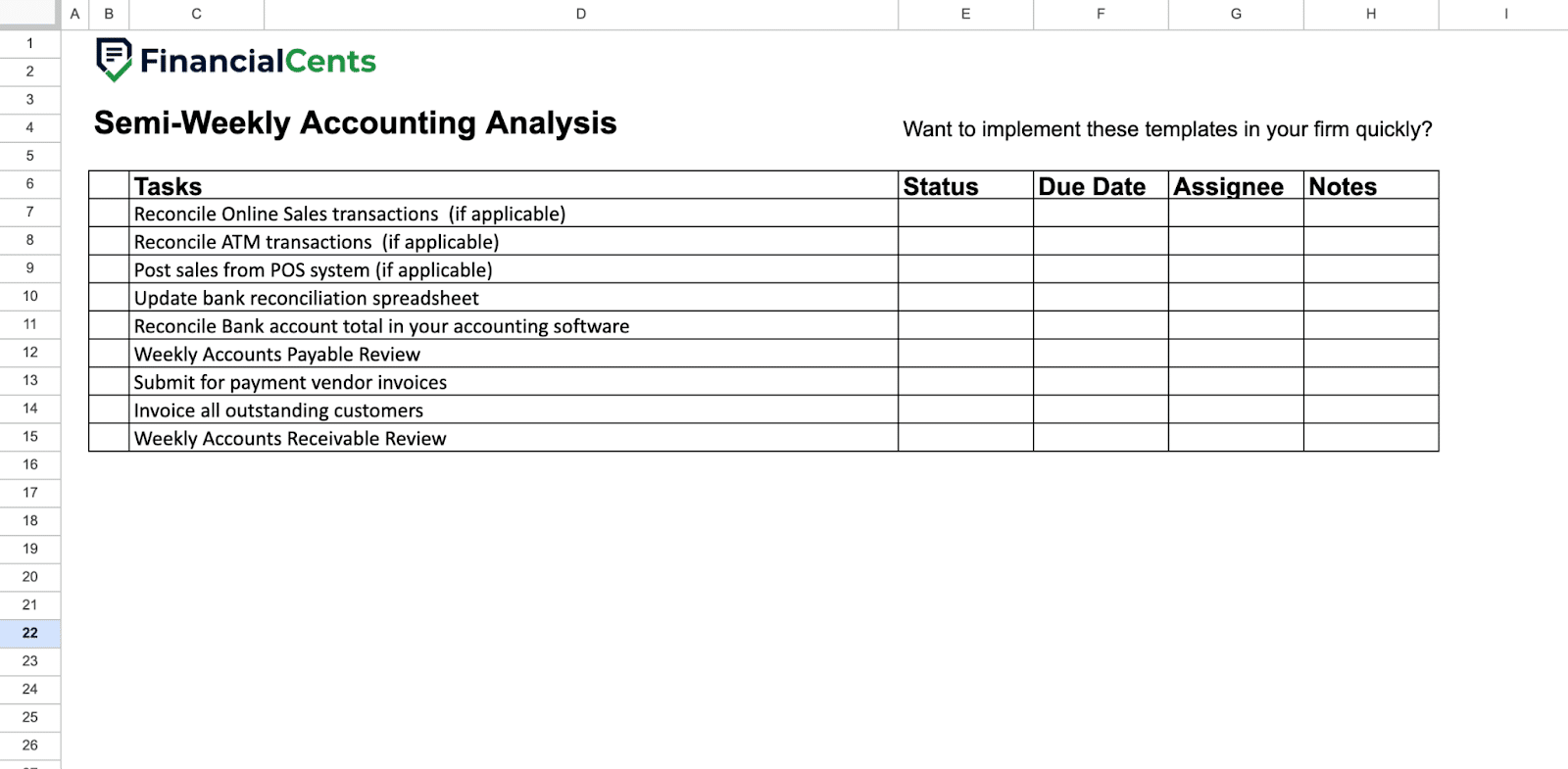

7. Semi-Weekly Accounting Analysis Checklist

Accounting isn’t just about monthly accounting or year-end. The firms that stay ahead keep an eye on things regularly. A semi-weekly analysis checklist helps you catch issues early and stay proactive instead of waiting for problems to surface.

This worksheet guides you through recurring tasks like reviewing cash flow, monitoring expenses, and checking in on bank feeds. It’s a simple way to spot red flags before they become bigger issues, and it keeps you in control of your client’s financial picture all week long.

Get the free Semi-Weekly Accounting Analysis template

How to Use Worksheets Effectively

Having worksheets is one thing; using them the right way is what makes the real difference. Here are a few tips to get the most out of them in your firm.

1. Keep Them Updated Regularly

A worksheet is only useful if the information in it is current. Make it a habit to update your checklists and templates as processes, deadlines, or client needs change. That way, you’re never working with outdated instructions.

2. Assign Ownership Within the Team

Don’t let worksheets become “everyone’s job”; that’s when tasks get missed. Assign clear ownership so someone is responsible for updating, maintaining, and following each worksheet. Accountability keeps things consistent.

3. Store Templates in a Central, Cloud-Based Location

Instead of having multiple versions floating around in emails or personal folders, keep all your templates in one central place, like an accounting practice management software. A cloud-based system means your team can access the latest version anytime, from anywhere.

4. Customize Them Based on Client Needs

No two clients are exactly alike. Start with a standard template, but don’t be afraid to tweak it to fit a client’s industry, size, or specific requirements. The goal is to balance efficiency with personalization. If you’re not sure where to start, you can take inspiration from our template library.

Turn Your Worksheets into Actionable Workflows

These 7 worksheets are a great starting point. They give you structure, consistency, and a repeatable way to handle your accounting tasks. But as your firm grows, relying on just worksheets alone can start to slow you down.

Think about it. Every time you update a worksheet, send it around to your team, or chase down client information, you’re spending time that could be better used on billable work or higher-value client advisory. What feels manageable with a few clients quickly becomes overwhelming with dozens.

On top of that, accounting is rarely a solo effort. You need collaboration between your internal team and your clients. Worksheets don’t handle that well on their own. They get lost in email chains, different versions pop up, and it’s hard to see who’s working on what.

That’s why they become much more powerful when you move them into a system that can automate workflows, track progress, and give you real-time visibility into your firm.

This is where Financial Cents comes in. It lets you turn worksheets into automated workflows, assign tasks with deadlines, collect client documents without endless follow-ups, track progress in real time, and standardize your processes while still customizing them for each client.

To see it in action, check out this quick video from our CEO on Workflow Best Practices in Financial Cents:

The shift is simple: start with the free worksheets, then bring them into Financial Cents to create workflows that practically run themselves. You’ll save hours, reduce errors, and spend more time on revenue-generating activities.