Accounts receivable (AR)—the money customers owe for goods or services rendered—is important in maintaining financial stability for businesses. As the accountant/bookkeeper, it may be your duty to manage your client’s AR. Without a good AR process, the business’s ability to pay bills, invest in growth, and meet financial obligations can be greatly impacted.

That’s where a detailed AR template comes in. It records and tracks all customer invoice information, improves organization, and simplifies financial reporting.

We’ve included a free downloadable accounts receivable Excel template in this piece. If you prefer, you can also use it in Google Sheets.

Things to Include in Your Accounts Receivable Template

Your AR template should contain the following details.

Customer Information

- Customer Name: This identifies the customer associated with the invoice. Accurate customer names are crucial for proper record-keeping and easy invoice association.

- Customer Contact Information (Email, Phone): Accurate contact details allow you to easily reach out to customers regarding payments or invoice-related inquiries.

- Customer Address (Optional): While not always essential, customer addresses can be helpful for specific situations, such as sending physical payment reminders or legal documents.

Invoice Details

- Invoice Number: Assign a unique number for each invoice to ensure proper tracking and eliminate confusion. This allows you to reference and retrieve specific invoices when needed easily.

- Invoice Date: Record the date the invoice was issued to establish a clear timeline for payment expectations and track overdue invoices.

- Invoice Amount: Enter the total amount due on the invoice. This reflects the value of goods or services rendered to the customer.

- Due Date: Specify the date you expect full payment. Clear due dates help you stay on top of upcoming deadlines and set expectations for customers.

- Credit Terms: Outline the payment terms offered to the customer (e.g., net 30 days, 2% discount for early payment). Credit terms define the timeframe for payment and any potential incentives for prompt settlements.

- Balance Due: It provides a real-time view of the outstanding amount the customer owes. Calculate this by subtracting any received payments from the invoice amount. Or some templates (like ours) can automatically calculate it for you.

- Status: Categorize the invoice status (e.g., Open, Paid, Partially Paid, Overdue). Clear invoice statuses allow you to easily identify which invoices require attention and prioritize your collection efforts.

Payment Information

- Payment Date: Record the date when the customer’s payment is received. This helps you track payment history and reconcile your client’s accounts.

- Payment Amount: Enter the specific amount received for the invoice to know who’s made partial payments and update the balance due accordingly.

Optional Section for a More Comprehensive AR Template

- Aging Summary: This section helps categorize outstanding receivables based on how long they’ve been overdue. For instance, you might have categories for “1-30 days past due,” “31-60 days past due,” and “60+ days past due.” This lets you prioritize collection efforts and focus on the most overdue invoices.

- Notes: Add any relevant comments or details about the invoice or customer. This could include specific payment instructions, communication history, or any internal notes for reference.

Use This Free Accounts Receivable Excel Template (Also Available in Google Sheets)

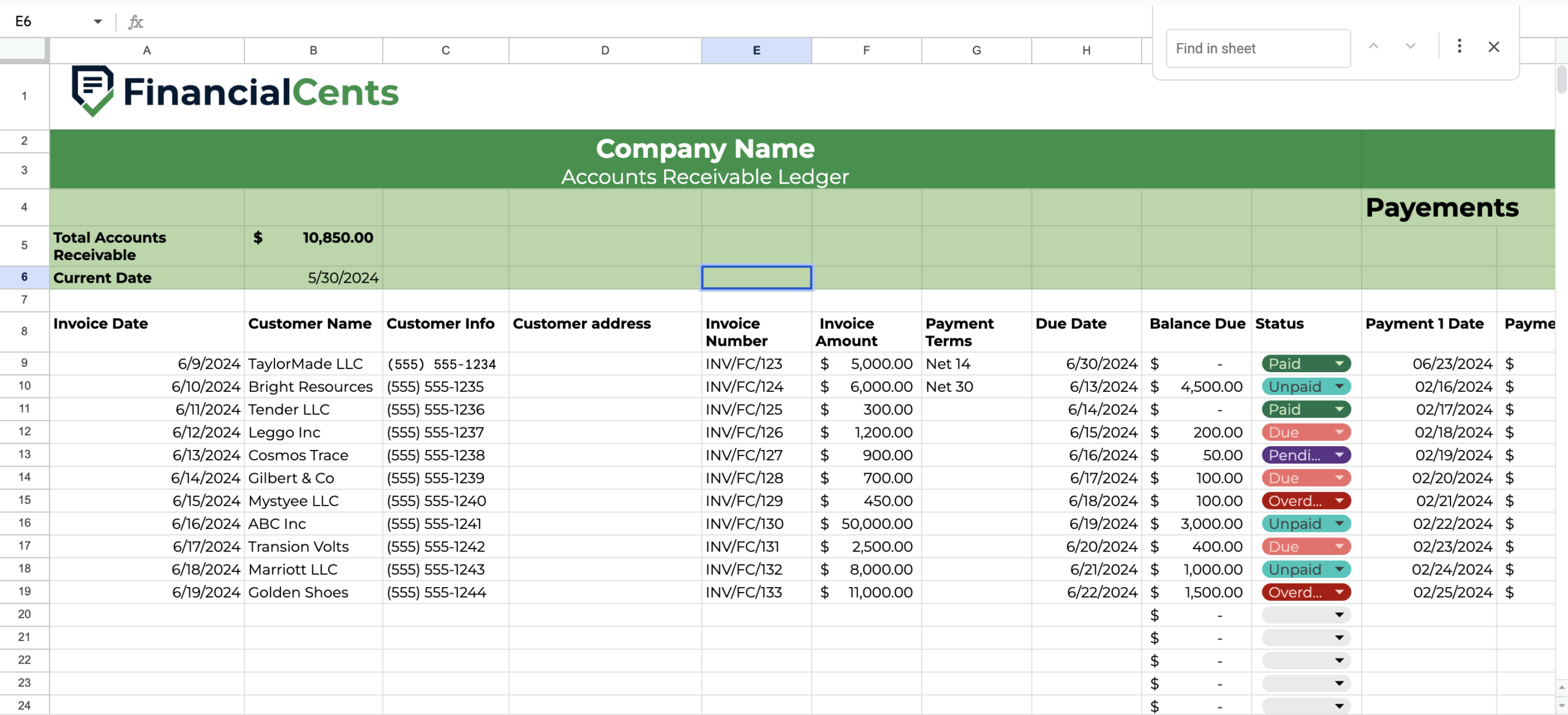

Our AR template contains all the components listed above. It looks like this :

This template is great for many reasons. For one, it’s easy to use. Just enter the relevant information, such as customer names, invoice details, and payment information, in each designated field.

We’ve also embedded formulas within the template to save you time and minimize errors. These formulas automatically calculate:

- Balance Due: When you enter a payment amount into this template, the formula subtracts it from the invoice amount to provide the updated outstanding balance.

- Total Accounts Receivable: The template automatically calculates the sum of all outstanding balances, giving you an accurate picture of your total AR. This eliminates the need for manual calculations, ensuring accuracy and efficiency.

By leveraging this automation and formulas, you can reduce the time and effort required to manage your client’s AR.

You may be interested:

Best Practices for Managing AR Process

Here are some tips to improve how you manage your client’s AR process.

Establish Clear Credit Policies and Payment Terms

Don’t just extend credit to any and every customer. Define your creditworthiness criteria to assess customer risk and apply it first before making that decision.

Also, always outline your payment terms clearly, specifying the due date and any late payment penalties. Communicate these expectations upfront to avoid any misunderstandings later on.

Send Invoices Promptly and Follow up on Overdue Payments

As soon as your client has completed their end of the bargain, i.e., delivering goods or services to the customer, send an invoice to the customer. The sooner you send the invoices, the sooner you can expect payment.

If a payment is overdue, follow up. Send multiple reminders (with tone developing from gently to more assertive) till it’s resolved.

Consider Offering Payment Incentives for Early Settlements

Discounts for early payments can motivate customers to settle their invoices quickly, thus improving your client’s cash flow and reducing the risk of bad debt.

But this strategy is not for everyone. Before deciding to go this route, weigh the cost of discounts against the benefits of faster collections. If the pros outweigh the cons, i.e., the business can absorb the discounts, go for it.

Consider Using AR Automation Software Instead of Manual Tracking

Tracking AR manually (especially when many customers are involved) is exhausting, time-consuming, and leaves room for errors. That’s why you should use AR automation software. It can streamline tasks like invoice generation, payment reminders, and overdue account management.

Examples of such software are Anchor, Plooto, and QuickBooks.

Document Your Process

Having a documented AR process ensures consistency and smoother workflows.

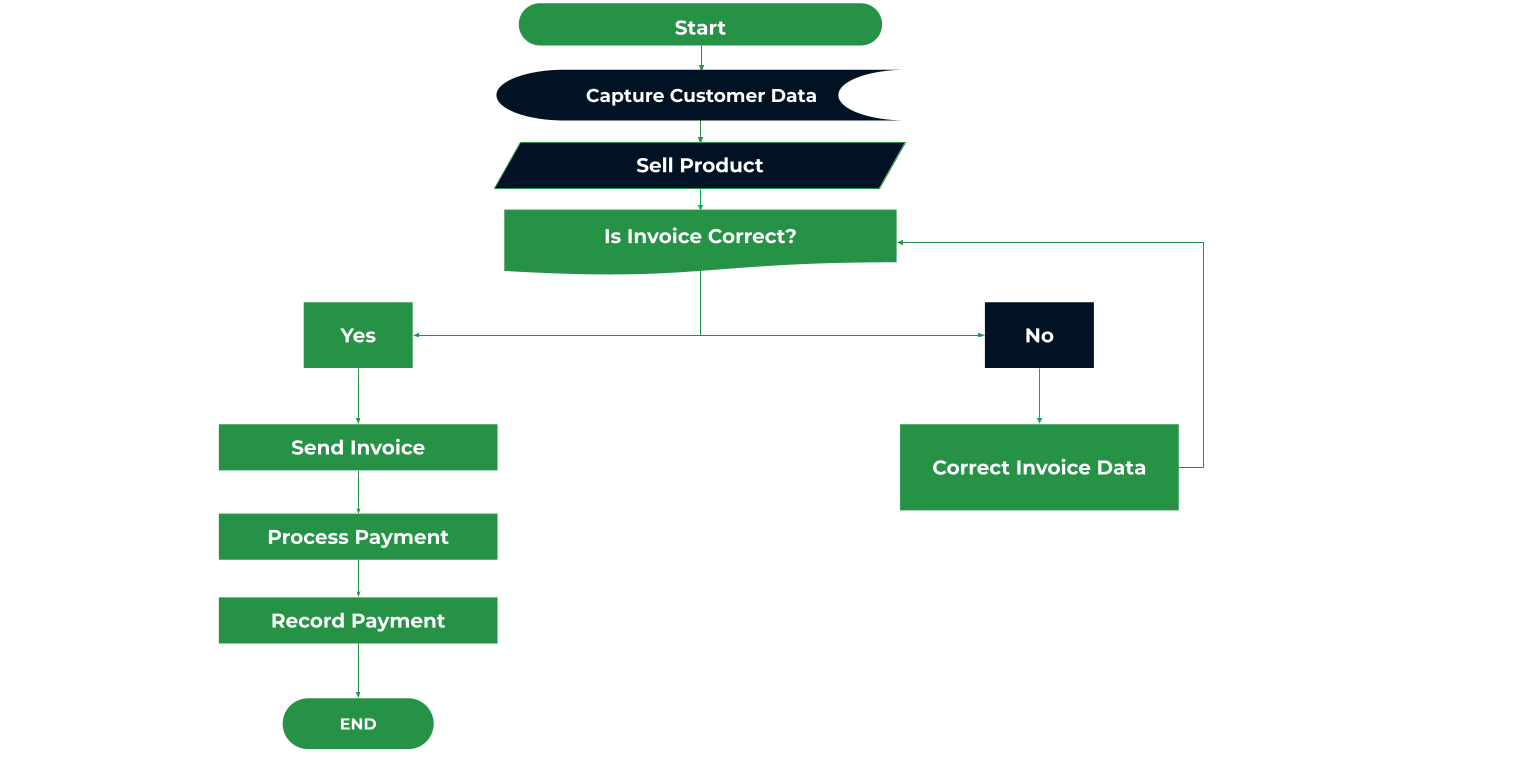

So, create an accounts receivable flowchart to visually map out the steps involved in your AR process, from invoice generation to collection. It provides a clear understanding of the process flow, responsibilities, and decision points, promoting better communication and collaboration within your team.

This flowchart can serve as a valuable training tool for new staff and a reference point for continuous improvement. It can also help identify bottlenecks and areas for optimization within your AR process.

The typical AR flowchart has the following steps:

- Fulfill the Order: Deliver the product or service as agreed, with clear payment terms outlined.

- Capture Customer Details: Gather accurate customer information for proper invoice creation.

- Generate and Send Invoices: Using captured customer data, generate and send invoices.

- Resolve Discrepancies: Address any disputes to ensure the invoice accurately reflects the quantity and cost of delivered products or services.

- Manage Collections: Follow up on overdue invoices to collect outstanding payments.

- Process Payment: Receive payment from the customer and transfer it to the business.

- Reconcile Accounts: Verify that the received payment matches the amount due on record.

And here’s the flowchart version:

You can access this flowchart and other AR flowchart here.

Manage the AR Process Efficiently With Financial Cents

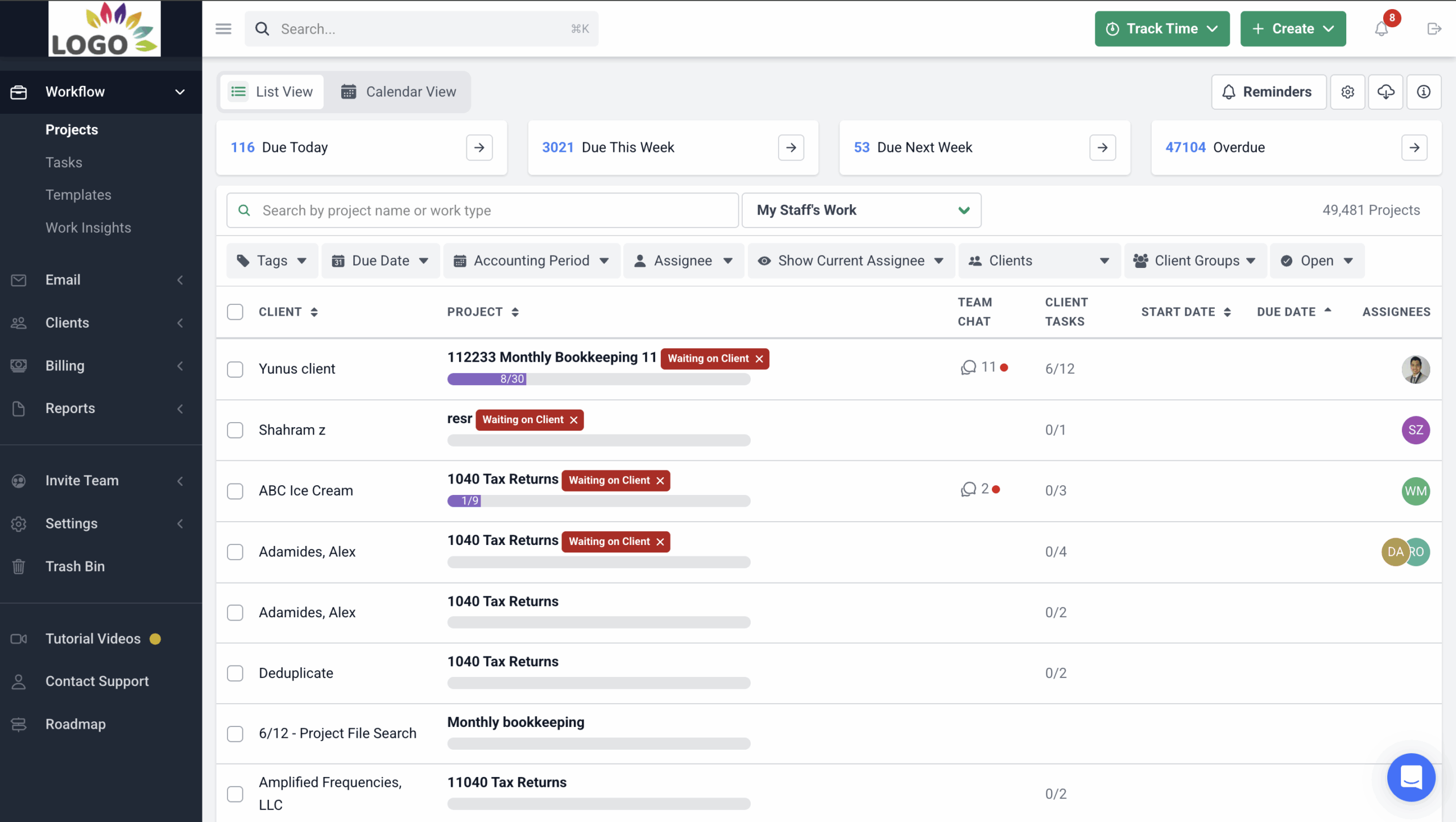

While Financial Cents is not specifically an AR automation tool, it’s a workflow management software that helps you manage your firm and your clients’ AR processes. Here’s how:

- It has a Workflow Dashboard to view the status of all AR tasks, allowing you to prioritize effectively.

- It has pre-built and customizable workflow templates that standardize your workflows and ensure consistent and efficient AR task completion through pre-built or customizable workflow templates.

- It automates manual and repetitive tasks like sending reminders and chasing clients for documents to free up your team’s time.

- It allows you to schedule recurring AR tasks to avoid missed deadlines and ensure timely completion.

- It has a capacity management feature that lets you effectively assign AR tasks based on the workload of team members.

- It aids seamless communication and information sharing within your team regarding AR projects.

With these Financial Cents features and abilities, you can manage your clients’ AR processes, improve their cash flow, and minimize bad debt.

Use Financial Cents for your workflow management.

Our major benefit from Financial Cents has been organization. We have full insight into what our team is working on. We can assign projects, create filters, and see what is assigned to each team member to help capacity management.”