Canopy is a well-known accounting practice management software that offers a suite of features to streamline operations and improve efficiency for accountants, including:

- Document management: Organize, store, and share client documents hassle-free.

- Time & billing: Track and manage time spent on tasks, then use the time you’ve tracked to bill clients. Also, collect and process payments within Canopy.

- Tax resolution: Tools to manage client tax processes and help you resolve tax issues.

- Engagement letters & electronic signatures: Simplify the client onboarding process with pre-built templates and e-signature capabilities.

- Client portal: Provide a secure platform for clients to access documents, view invoices, and communicate with your firm.

- Reporting: Get insights on how your firm is performing to make data-driven decisions.

With a 4.6/5 rating on G2 and a 4.5/5 rating on Capterra, it’s obvious users love Canopy; however, this software may not be the right fit for you.

Drawbacks of Canopy and Why You Should Consider Alternatives

Mainly Built for Tax Firms

Canopy’s offerings lean heavily towards everything tax-related, including tax preparation and issue resolution. While this is great for tax firms, it’s not well suited for accounting or bookkeeping firms with broader needs.

If you fall in the latter category, you might have to work outside the software’s strengths and struggle to perform.

Limited Workflow Features

While Canopy offers workflow management solutions, they are limited compared to some competitors. This can be a disadvantage to accounting and bookkeeping firm owners who need a comprehensive system to manage the various tasks and deadlines involved in running an accounting practice.

Complex Pricing Models

Canopy doesn’t have a straightforward or all-inclusive pricing structure. It uses a complex model with a base fee for client engagement which starts at $150/month per user for the standard plan. And then additional charges for each feature in the project management suite you want to use, like document management, workflow, time & billing, tax resolution, and collection cases.

This complexity makes it difficult to get a clear idea of the total cost upfront. Budgeting becomes a challenge, as firms might underestimate the additional costs associated with the needed features. If you need clarification on pricing, you’ll have to contact customer service, which adds an unnecessary layer of difficulty to the purchasing process.

This purchasing model also makes the software more expensive than alternatives.

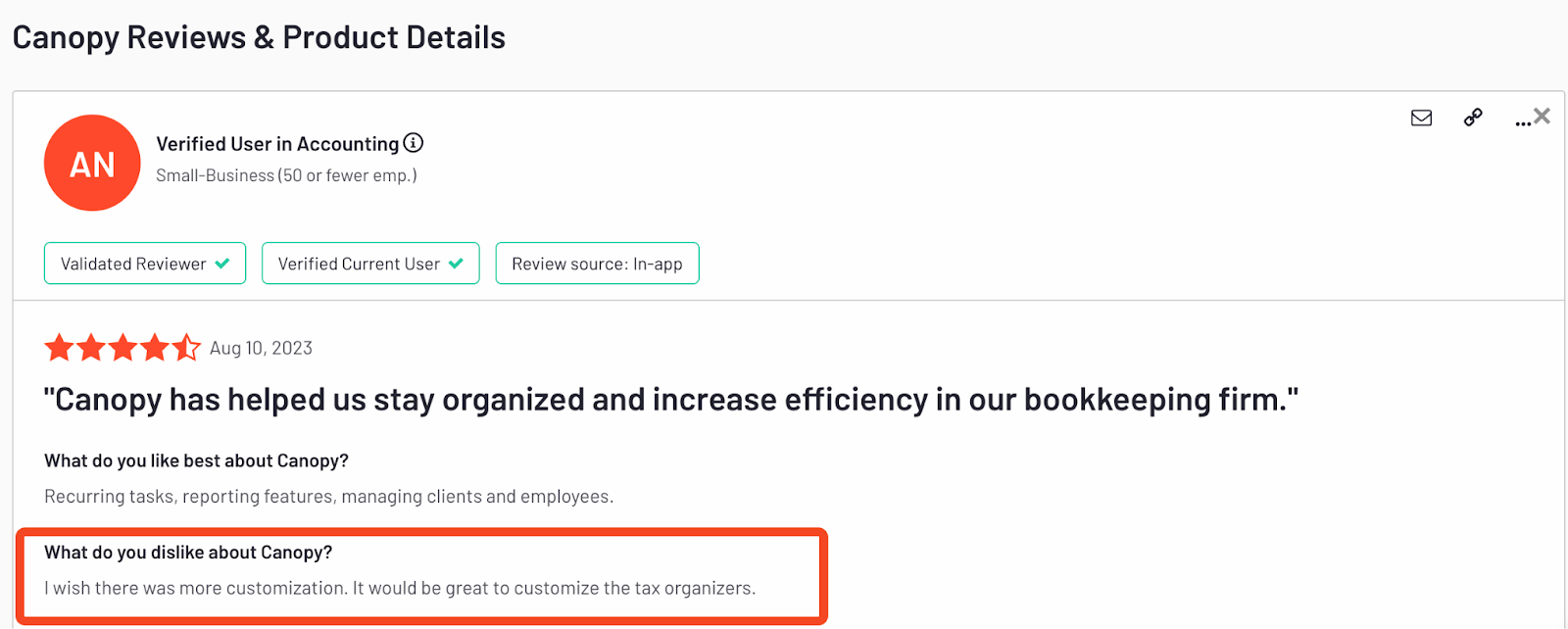

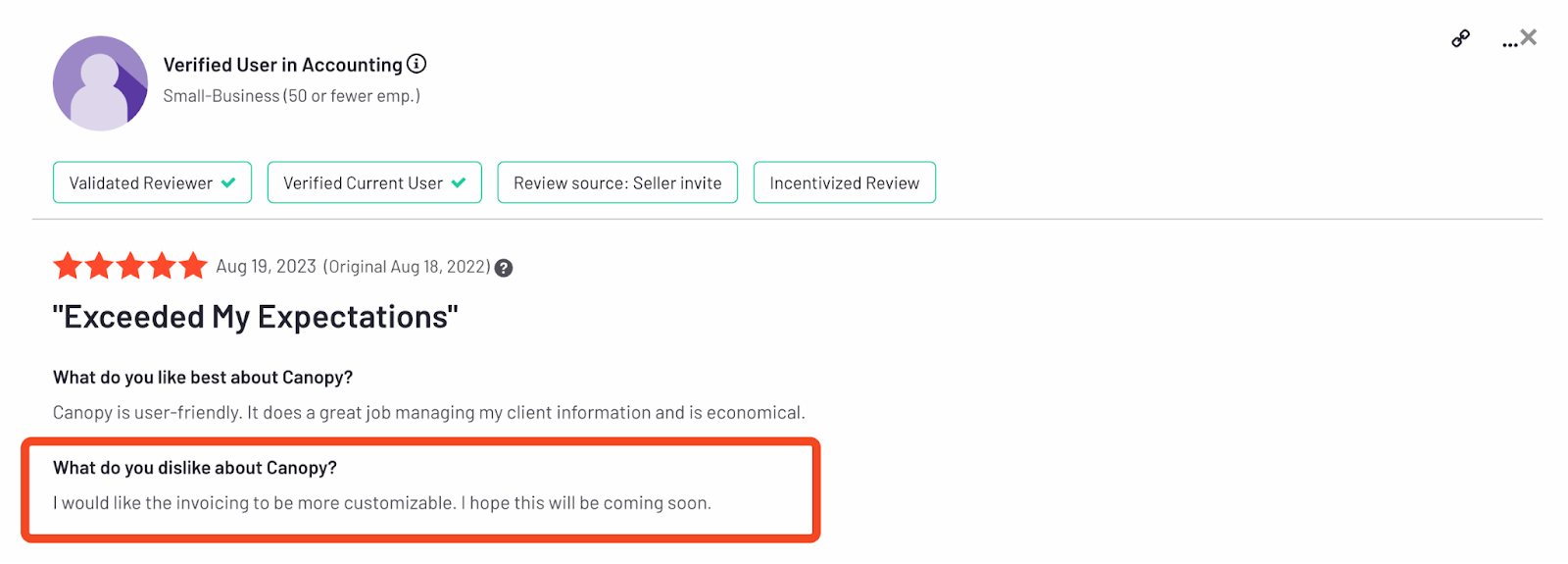

Limited Customization

Unlike some competitors that offer a high degree of personalization, Canopy restricts users’ ability to tailor the software to their specific needs regarding design features and brand colors.

6 Top Alternatives to Canopy to Explore in 2026

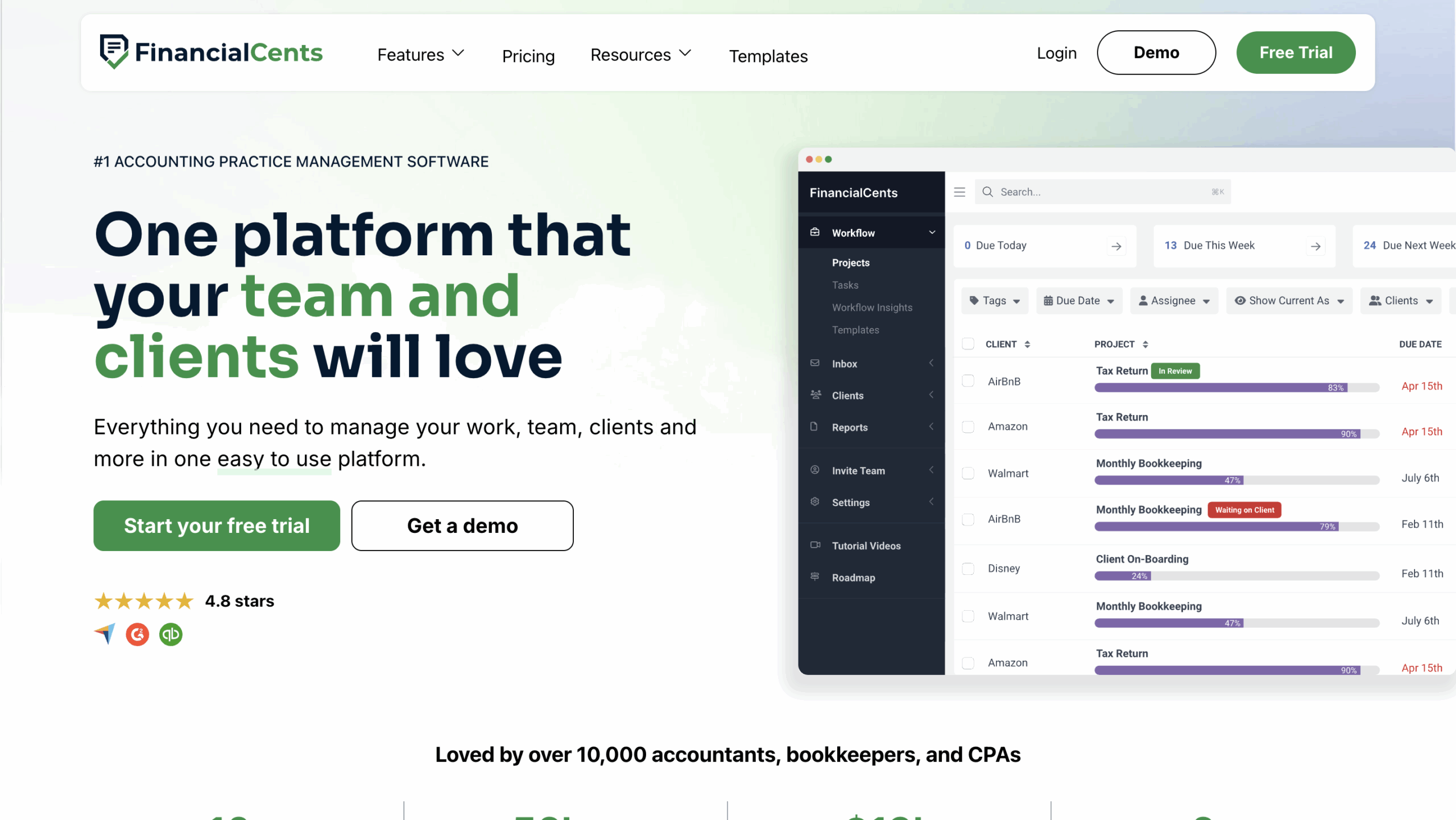

1. Financial Cents

Financial Cents an all-in-one practice management platform built specifically for accounting, bookkeeping and tax firms that want to stay organized, hit deadlines, and scale with confidence.

Financial Cents replaces spreadsheets, disconnected tools, and manual follow-ups with a single platform for managing clients, workflows, communication, billing, and month-end close. With automation, real-time visibility, and firm-wide accountability, teams always know what work needs to be done, who owns it, and what’s at risk.

Key Features

Workflow Management

Financial Cents allows you to create, manage, and track all work in one centralized system. You can create projects, assign tasks, set deadlines, and monitor progress in real time. It provides a workflow dashboard with an overview of all your firm’s work, so you can stay of on top of projects and deadlines.

With access to over 60 free accounting templates and 300+ community-driven workflow templates, firms can standardize processes and complete work more efficiently.

Client Management

Manage all your client information in one place and keep track of all client work, project and client interactions using the client dashboard feature in Financial Cents. Get documents and all the information you need from clients 10x faster using the automated client requests and tasks reminder, which helps your client upload documents and information you need through Financial Cents’ secure client portal. You can also communicate with your clients via the client portal.

Document Management

Store and organize all client and firm documents in one centralized document management system. Create folders and subfolders that match how your firm works, making collaboration easier for your entire team. With advanced search, you can quickly find the files you need without stress.

Month End Close (MEC)

The Month End Close (MEC) feature helps you streamline reviews and close books faster by bringing transaction review and vendor cleanup into one place. You can review transactions, flag issues, ask clients questions, and push approved changes back to QuickBooks Online, all without leaving system. MEC also supports 1099 and W-9 preparation by pulling vendor data from QuickBooks, requesting W-9s, and syncing updates automatically. Everything stays organized within your Projects.

Billing & Payments

With Financial Cents, you can manage billing, invoicing, and payments in one place, helping you get paid faster with less manual work. You can create one-time or recurring invoices directly from tracked time or flat-fee services, with no extra tools or exports required. Clients can pay by credit card or ACH, and automated payment reminders help reduce late payments. Two-way QuickBooks Online sync keeps invoices and payments updated automatically, eliminating duplicate entry. Built-in billing and profitability reports give you clear visibility into cash flow, realization rates, and what’s driving firm revenue.

Proposals & Engagement Letters

Standardize onboarding and service changes with proposals and engagement letters. Financial Cents lets you send proposals, collect approvals and signatures electronically, and store signed agreements directly in the client record. This helps you onboard clients faster and reduce paperwork.

You can also collect client billing information upfront, bill clients when they sign proposals or engagements or receive payments at a later date.

Time Tracking

With Financial Cents, you can track time directly inside your workflows, so you’re not jumping between apps or forgetting billable work. You can start and stop timers as you work or log time manually, all tied to the right client and project. Tracked time flows seamlessly into invoicing, making it easy to bill clients in just a few clicks and get paid faster.

You can also use built-in reports to see where your firm is spending time, which work is over budget, and which clients are most profitable.

Workflow Automation

Automate repetitive admin work so your team spends less time chasing updates and more time serving clients with Financial Cents accounting workflow automation. You can schedule recurring work, trigger automated client reminders, and keep documents and uploads tied directly to the right tasks, so nothing gets lost.

Reporting & Firm Insights

With Financial Cents, you get clear, actionable insights into your firm’s efficiency, productivity, and profitability. You can track work capacity, utilization, and completion trends to see where bottlenecks are slowing your team down. Revenue and realization reports help you understand which clients, services, and team members drive the most profit. Budget and time tracking reports make it easy to spot over-budget or out-of-scope work before it impacts margins.

Pros and Cons

| Pros | Cons |

| It is an easy-to-use and intuitive interface for accounting, and bookkeeping and tax teams. | No mobile app |

| Clients don’t need a username and password to access the client portal. | |

| Free accounting and bookkeeping workflow templates to standardize processes. | |

| AI integration to create new workflow and email templates in seconds. | |

| Automation (like automated client reminders, automatically adding client details to project resources, automatically completing tasks, etc.) to save time and improve productivity. |

Why Consider Financial Cents

Financial Cents is an excellent choice for accounting and bookkeeping firm owners looking for a user-friendly practice management solution. It provides the tools to manage all aspects of an accounting practice efficiently, streamline workflows, and ultimately boost the bottom line.

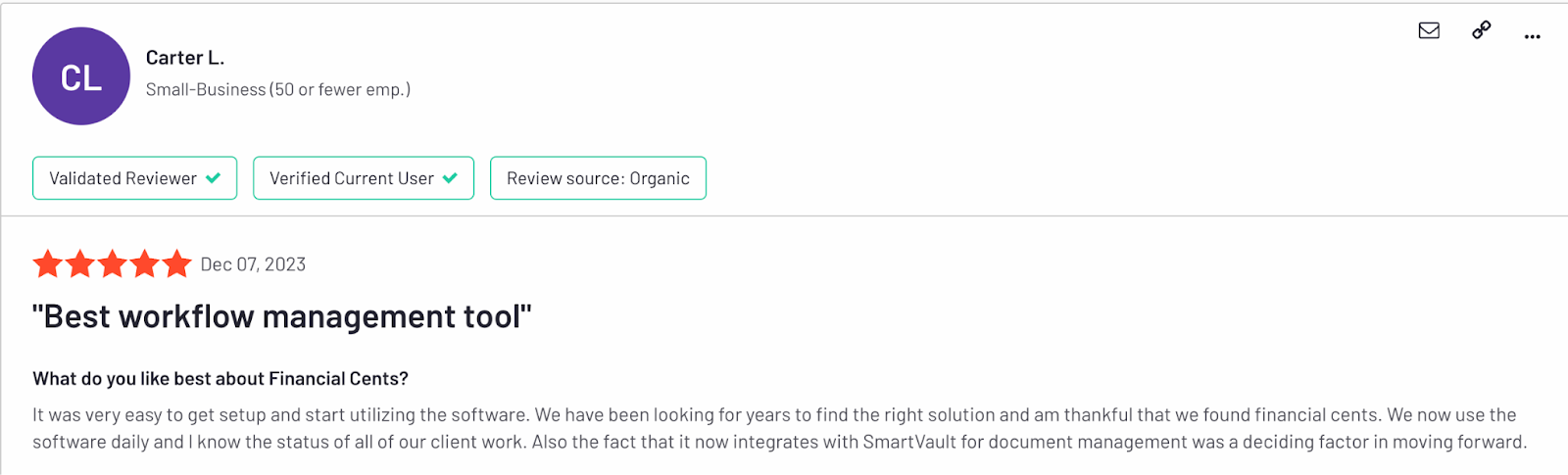

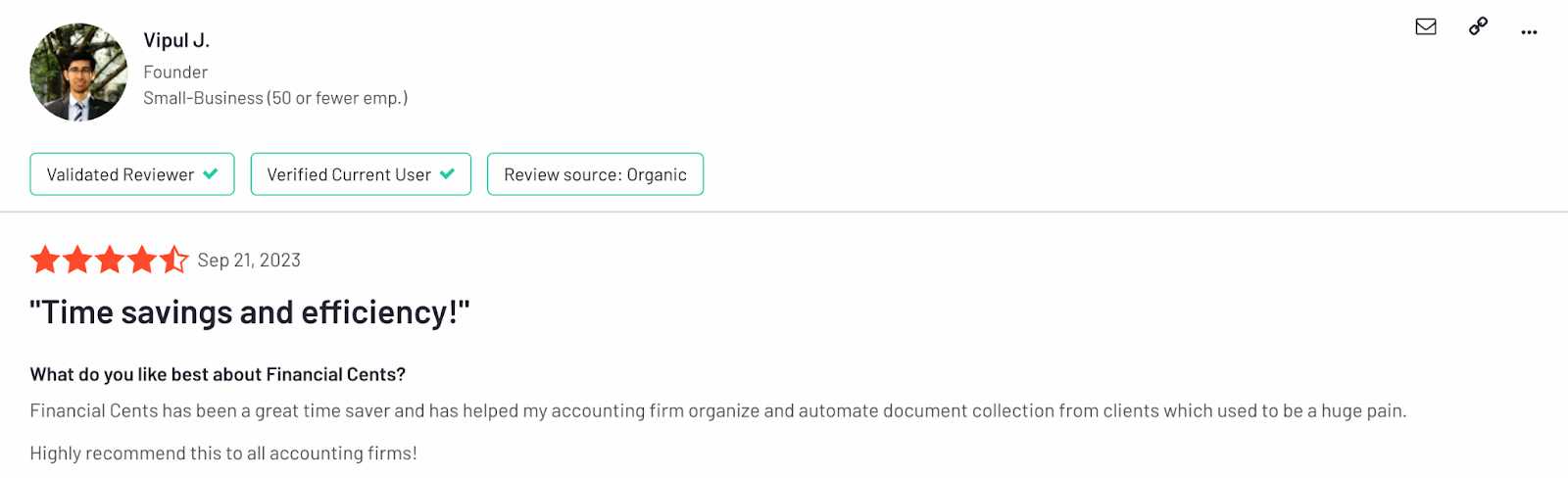

See what some customers are saying about Financial Cents:

Reviews

Pricing

Financial Cents offers a free 14-day free trial.

Paid plans:

- Solo Plan: $19/month, billed annually.

- Team Plan: $49/month, billed annually.

- Scale Plan: $69/month, billed annually.

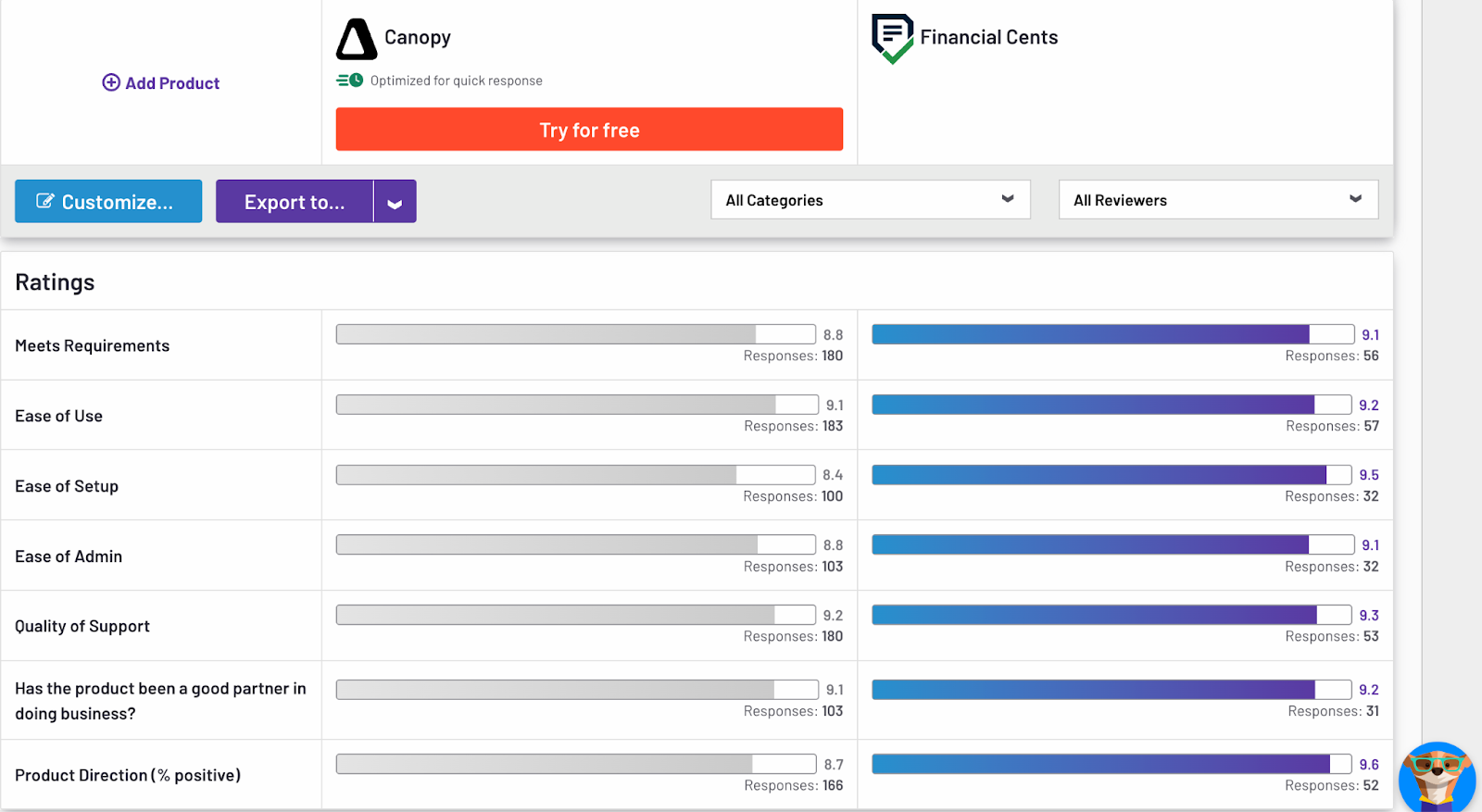

Should You Use Canopy or Financial Cents?

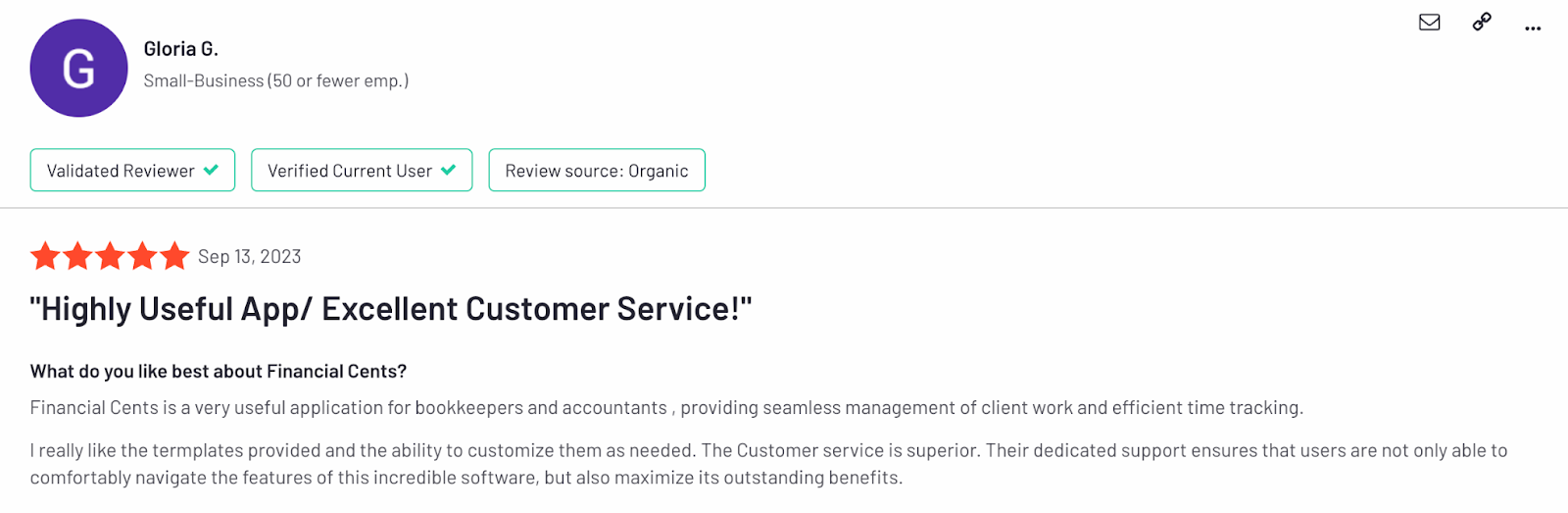

If you prioritize user-friendliness, affordability, and a feature set for broader accounting needs, then use Financial Cents. Like this user who first considered Canopy and Karbon before deciding on Financial Cents:

Below is an overview of how Financial Cents stacks up against Canopy:

2. Karbon

If collaboration and internal visibility are your top priorities, Karbon is a practice management platform designed to keep your team aligned and work moving forward. It’s especially well known for its strong internal communication tools and structured workflow approach, making it a popular option for firms that rely heavily on team coordination.

Features

- Team and client collaboration: Karbon focuses on team and client collaboration through Kanban-style boards, mentions, shared checklists, integrated email, and detailed activity timelines. This gives you a centralized view of conversations and task updates, helping reduce internal miscommunication.

- Workflow management & automation: Karbon offers tools like Work Scheduler, Automators, and auto-reminders to help manage deadlines and recurring work. You can visualize project progress, automate repetitive steps, and ensure work is completed in the right order.

- Analytics: Easy-to-read reports on client activity and firm performance to gain valuable insights for data-driven decision-making.

- Calendar integrations: Integrates with your Google or Outlook calendar to schedule and join meetings from the tool.

Pros and Cons

| Pros | Cons |

| Facilitates communication and collaboration between internal teams and clients. | Karbon has a steeper learning curve due to its extensive features. |

| Well suited for large firms with complex needs. | May be too overwhelming for smaller to mid-sized firms. |

| Provides a central hub for managing all aspects of client engagements, documents, and communication. | Expensive. |

Why Consider Karbon

If your firm prioritizes collaboration, Karbon is a strong contender. It helps teams be more efficient and collaborate better.

Reviews

Pricing

- Team plan: $59/user/month, billed annually

- Business plan: $89/user/month, billed annually.

- Enterprise plan: custom pricing.

Should You Use Canopy or Karbon?

If your firm is tax-focused and you need a simple solution, choose Canopy. However, choose Canopy if your firm is large and you need collaboration and workflow management features.

3. TaxDome

If your firm is heavily focused on tax preparation, TaxDome positions itself as an all-in-one platform built primarily for tax professionals. It’s designed to centralize client data collection, tax workflows, and client communication into a single system.

Taxdome also provides standardized, repeatable tax workflows, which can be especially helpful during busy filing seasons. You can create templates for common tax services, automate client requests, and move work through predefined stages, giving you structure and consistency when handling a high volume of returns.

That said, because TaxDome is built primarily with tax workflows in mind, it may feel more rigid if your firm offers a wider range of services such as bookkeeping, CAS, or advisory work. While it provides billing, time tracking, and workflow tools, firms that need deeper flexibility around capacity planning, month-end close, or non-tax service delivery may find the platform less adaptable outside of tax-centric use cases.

Features

- Client portal: Clients can upload documents, communicate with your firm, and electronically sign forms. Built-in secure messaging keeps conversations encrypted and tied to the client record, helping you avoid email-based communication for sensitive information.

- Tax organizers: Streamline client data collection during tax season. The tax organizers help you gather required information upfront, reducing back-and-forth and speeding up return preparation.

- Document management: Store and manage client documents in one place for easy access.

- Secure messaging: Facilitate secure and encrypted communication with clients through the client portal.

- Basic time tracking & billing: Track time, send invoices, and collect payments directly through the platform. This makes it a convenient option for firms that want tax-focused functionality in a single system.

Pros and Cons

| Pros | Cons |

| It offers functionalities geared towards tax preparation workflows, making it a suitable option for tax-centric accounting firms. | Like Canopy, TaxDome’s core strengths lie in tax preparation. Firms offering a wider range of accounting services might need additional software for those functionalities. |

| Places emphasis on security, ensuring data and client information remain safe and that communication is secure. | TaxDome’s time tracking and billing features might be too basic for complex accounting workflows. |

| Provides features for managing engagement letters and proposals electronically, facilitating a smooth onboarding process |

Why Consider TaxDome

If your accounting firm primarily focuses on tax preparation and prioritizes secure client communication, TaxDome is an alternative to Canopy. It simplifies tax workflows and client interaction.

Reviews

Pricing

TaxDome has 3 plans:

- Essentials plan (single user): starts from $700/year (3 year plan).

- Pro Plan: starts from $900/year, per user (3 year plan).

- Business Plan: starts from $1,100/per year, per use (3 year plan).

Should You Use Canopy or TaxDome?

Both Canopy and TaxDome lean heavily towards tax preparation. However, TaxDome offers a more specialized client portal with advanced security features.

Side by side comparison review: TaxDome Vs Canopy

4. Jetpack Workflow

Jetpack Workflow is a workflow and deadline-management platform built specifically for accounting and bookkeeping firms that want to standardize recurring work, stay ahead of due dates, and keep their team aligned. Its core strength is helping you turn repeatable services, like monthly bookkeeping, payroll, sales tax, and tax prep, into consistent, trackable workflows so nothing falls through the cracks.

Features

- Automated workflows: Build custom workflows to automate repetitive tasks, eliminate manual data entry, and increase overall efficiency. You can create workflow templates for common services, then generate jobs for clients and set them to repeat on schedules like monthly, quarterly, or annually, so future work is created automatically instead of rebuilt from scratch each cycle.

- Task management: Jetpack gives you a structured way to assign tasks, track progress, and manage deadlines across your team. You can see work by client, by due date, and by team member, which helps you understand what’s on track, what’s at risk, and where workload may need to be redistributed.

- Email automation: Automatically convert incoming emails into actionable tasks and client data, eliminating manual data entry. Jetpack includes email integration and client emailing workflows designed to reduce inbox chaos and keep communication tied to client work.

- Client communication: Communicate with clients directly through Jetpack Workflow, eliminating the need to switch between platforms.

Pros and Cons

| Pros | Cons |

| Tailor workflows to your needs, ensuring a smooth and consistent process for various accounting tasks. | The focus on automation may require initial setup and learning for your team to fully utilize its potential. |

| The platform can adapt to the needs of growing firms, offering functionalities suitable for various practice sizes. | Limited client collaboration features. |

| Jetpack Workflow excels in automating repetitive tasks, freeing up your team’s time for higher-value activities. |

Why Consider Jetpack Workflow

Jetpack Workflow is ideal for firms looking for a solution that helps them “work smarter, not harder.” So, if you struggle with repetitive tasks and want to automate them, choose Jetpack Workflow. It’ll free up your team’s time, minimize errors, and improve efficiency.

Reviews

Pricing

- Starter yearly: $40/user/month, billed annually

- Starter monthly: $49/user/month, billed monthly

Should You Use Canopy or Jetpack Workflow?

Use Jetpack Workflow if you seek powerful automation and customizable workflows to optimize your accounting processes and boost team efficiency. However, if you’re looking for tax practice management software, consider Canopy.

5. Aero Workflow

Aero Workflow is a workflow tool built by accountants, for accountants, with a strong focus on simplicity and structure. If you’re looking for a tool that helps you manage recurring accounting work without unnecessary complexity, Aero Workflow positions itself as a straightforward solution for keeping tasks, deadlines, and client work organized.

Features

- Client management: Aero Workflow gives you a centralized place to organize client information, documents, and interactions. You can store key client details, keep notes tied to client work, and ensure your team always has the context they need when working on tasks. Integrations with QuickBooks Online, QuickBooks Time, Office 365, and Zapier help connect Aero Workflow to the tools you already use, reducing duplicate data entry and improving efficiency.

- Project management: Manage your firm’s workload through structured tasks and projects built around accounting services. You can assign tasks, set deadlines, and track progress so you always know what work is open, what’s completed, and what’s coming up next.

- Recurring tasks: Automatically create recurring tasks on any schedule, monthly, quarterly, annually, or custom intervals. This helps you reduce manual admin work, standardize processes across clients and maintain consistency, even as your client list grows.

- Time tracking: Track time spent on tasks and projects for accurate billing and workload analysis. While the time tracking is more basic compared to some all-in-one platforms, it provides enough insight for firms that want simple tracking tied directly to their workflows.

Pros and Cons

| Pros | Cons |

| Integrates with QuickBooks Online, making certain processes easier. | Some users complain that the tool lags sometimes. |

| The timer starts automatically once you open a task. | It has a clunky interface. |

Why Consider Aero Workflow

Use Aero Workflow if you want to manage your workflow and save time.

Reviews

Pricing

- Startup (1-5 users): $108/month, billed annually.

- Growth (6-25 users): $200/month, billed annually.

- Scaling (26-50 users): $295/month, billed annually.

Should You Use Canopy or Aero Workflow?

If you need a tool to help with workflow (not practice management), go for Aero Workflow. But if you need a tax practice management tool, go for Canopy.

6. Pixie

Pixie is a user-friendly practice management tool designed primarily for solo practitioners and small accounting firms that want to stay organized without paying for or learning a complex system. It positions itself as an affordable companion rather than a full enterprise platform, making it appealing if you want simple task tracking and workflow automation without a steep setup process.

Pixie focuses on helping you manage daily accounting work more efficiently.

Features

- Task management: Pixie gives you a centralized place to manage client information, tasks, and documents so everything stays connected. You can document the detailed steps required for specific tasks and turn those processes into templates, making it easier to complete work consistently across clients. This helps reduce reliance on scattered spreadsheets or informal checklists.

- Automated workflows: Reduce manual effort by automating repetitive actions like task creation, follow-ups, and status updates. These automations help minimize errors and ensure work progresses smoothly without constant manual intervention.

- Recurring tasks: Pixie makes it easy to set up recurring tasks so routine work is automatically created on your preferred schedule. With this feature you can stay ahead of client deadlines.

- Email integration: Integrate your email with Pixie to turn emails into tasks, stay on top of the tasks, and delegate the emails to teammates if need be.

- Client reminders: Request information from your clients using automated reminders, notify clients when projects start, and collect feedback once work is complete. Reduce manual follow-ups and keep clients in the loop.

Pros and Cons

| Pros | Cons |

| Simple and intuitive interface, making it easy for accountants of all experience levels to use. | It doesn’t cater to the highly specialized needs of very large or complex accounting firms |

| Pixie caters well to the needs of solo practitioners and smaller firms, offering the core functionalities they need. | It has limited reporting and collaboration features. |

| Pre-built workflow templates provide a helpful starting point for streamlining common accounting processes. |

Why Consider Pixie

Pixie is a strong contender for solo accountants or small accounting firms seeking a user-friendly and affordable solution to improve practice management. It provides the essential tools to stay organized, automate workflows, and focus on growing your practice.

Reviews

Pricing

Pixie has a 30-day free trial and charges based on the number of clients you have, not the number of team members.

- For less than 250 clients, it costs $129/month

- For 251-500 clients, it costs $199/month

- For 501-1000 clients, it costs $329/month

- For over 1000 clients, contact them for a custom quote

Should You Use Canopy or Pixie?

Canopy’s tax-centric features might be suitable if that’s your primary focus. However, Pixie offers a broader range of features for managing various accounting tasks.

Choose the Right Software for Your Firm

Choosing the right practice management solution can feel overwhelming. While Canopy offers specific functionalities for tax-focused firms, it might not be the perfect fit for firms that offer broader accounting services.

The alternatives explored here — Financial Cents, Karbon, TaxDome, Jetpack Workflow, Aero Workflow, and Pixie — all have their unique strengths. However, if you need an accounting workflow management software with a simple interface, a feature set for diverse accounting/bookkeeping needs, and affordable pricing, consider Financial Cents.

If you’re still on the fence, try our 14-day free trial to experience firsthand how it streamlines your firm’s workflow, boosts efficiency, and helps you focus on what matters most – growing your successful accounting practice.

Excellent article!