First impressions last long. And while clients start forming opinions during the sales process, onboarding is often their first real experience of how your firm operates.

This is where they learn whether your team is organized and reliable or whether they’ll have to wait days for a response or resend documents because you somehow missed them the first time.

If your onboarding process is disorganized, clients will notice, and it can damage the relationship before the work even begins.

That’s why more companies are now investing in onboarding. In fact, 60% of teams either have a dedicated customer onboarding function or are in the process of building one, according to Rocketlane’s State of Customer Onboarding report.

For bookkeeping firms, a strong onboarding process starts with a checklist. It gives your team a clear sequence to follow, ensures you collect all the right information, and prevents delays or errors once monthly work begins.

In this guide, we’ll walk through a step-by-step bookkeeping client onboarding checklist and share free templates you can use and customize for your firm.

Why Bookkeeping Client Onboarding Matters

Onboarding might seem like a behind-the-scenes process, but it plays a huge role in shaping your relationship with your clients.

First impressions count, especially in bookkeeping, where clients trust you with their financial records. A smooth, professional onboarding process reassures clients that they’ve made the right choice. When you guide them step-by-step, answer their questions, and make the process easy, it sends a clear message.

Also, a structured onboarding process ensures that you collect all the necessary details upfront, from bank account information to past financial records.

This means less frustration for both you and your client, and it allows you to focus on what you do best.

Furthermore, a great onboarding process outlines what the client can expect from you—and what you need from them. Things like deadlines, preferred methods of communication, and the scope of your services all get clarified during onboarding.

A streamlined onboarding process saves time, not just for you, but for your clients too. With a checklist to guide you, you can quickly gather documents, set up software, and get to work. For your clients, this means they see results sooner. When they see how smoothly the process goes, it builds confidence in your abilities. That trust makes it easier to navigate challenges, upsell services, and retain clients for years to come.

What a Strong Bookkeeping Onboarding Process Includes

Below are the core elements every bookkeeping onboarding process should include.

Clear Expectations

Document expectations upfront in writing, this can be in the engagement letter for your bookkeeping service. Include the scope of services, scope exclusions, timing, and client responsibilities. This prevents confusion or issues with the client later on.

Secure Client Information & Document Collection

Bookkeeping requires sensitive financial information like tax returns, bank statements, and payroll reports. But email is not a safe way to collect this data.

Use a secure client portal that allows clients to upload and access files in one place. This protects client data, keeps your firm compliant, and makes it easier to track what’s been submitted.

System Access and Setup

Without access to key systems, your team can’t begin work. During onboarding, confirm access to accounting software, banks, payroll, sales tax, and payment tools.

Internal Workflow Setup

Your onboarding checklist should set your team up for success by including a recurring bookkeeping workflow template, defined roles, task assignments, and internal deadlines, a clear review process, a handoff step, etc. This ensures your team knows exactly what they need to do at any given time and can deliver consistent, on-time work every month and for every client.

Client Communication Plan

Even a great process fails without clear communication. Prevent this by defining the primary communication channel, expected response time, meeting frequency, and where and how to exchange documents.

Step-by-Step Bookkeeping Client Onboarding Checklist

Here’s an onboarding checklist you can use for every new client. Follow the steps in order to avoid delays or errors.

Step 1: Pre-Onboarding Preparation

This step happens before you request a single document. In this step, you have to:

I. Define service scope and pricing

Document exactly what you are delivering and what you are not. Add services included, services excluded, reporting frequency, pricing assumptions, and other information.

II. Send engagement letter/contract

Send a bookkeeping proposal or engagement letter that reflects the service scope and pricing. You can use Financial Cents’ Proposals & Engagement Letters feature to automate this. You can create and send the proposal, integrate billing and payment, and collect an e-signature in one platform.

III. Set billing method and payment authorization

Clarify billing frequency (monthly, upfront, or milestone-based), payment method (ACH, card), with the client. In Financial Cents, you can require clients to upload payment information before signing and automate future payments.

IV. Assign internal owner for the client

Assign one team member to manage the onboarding process for each client. This person is responsible for tracking tasks, coordinating handoffs, and meeting deadlines.

Step 2: Client Welcome

Once paperwork and billing are complete, officially welcome the client into your firm.

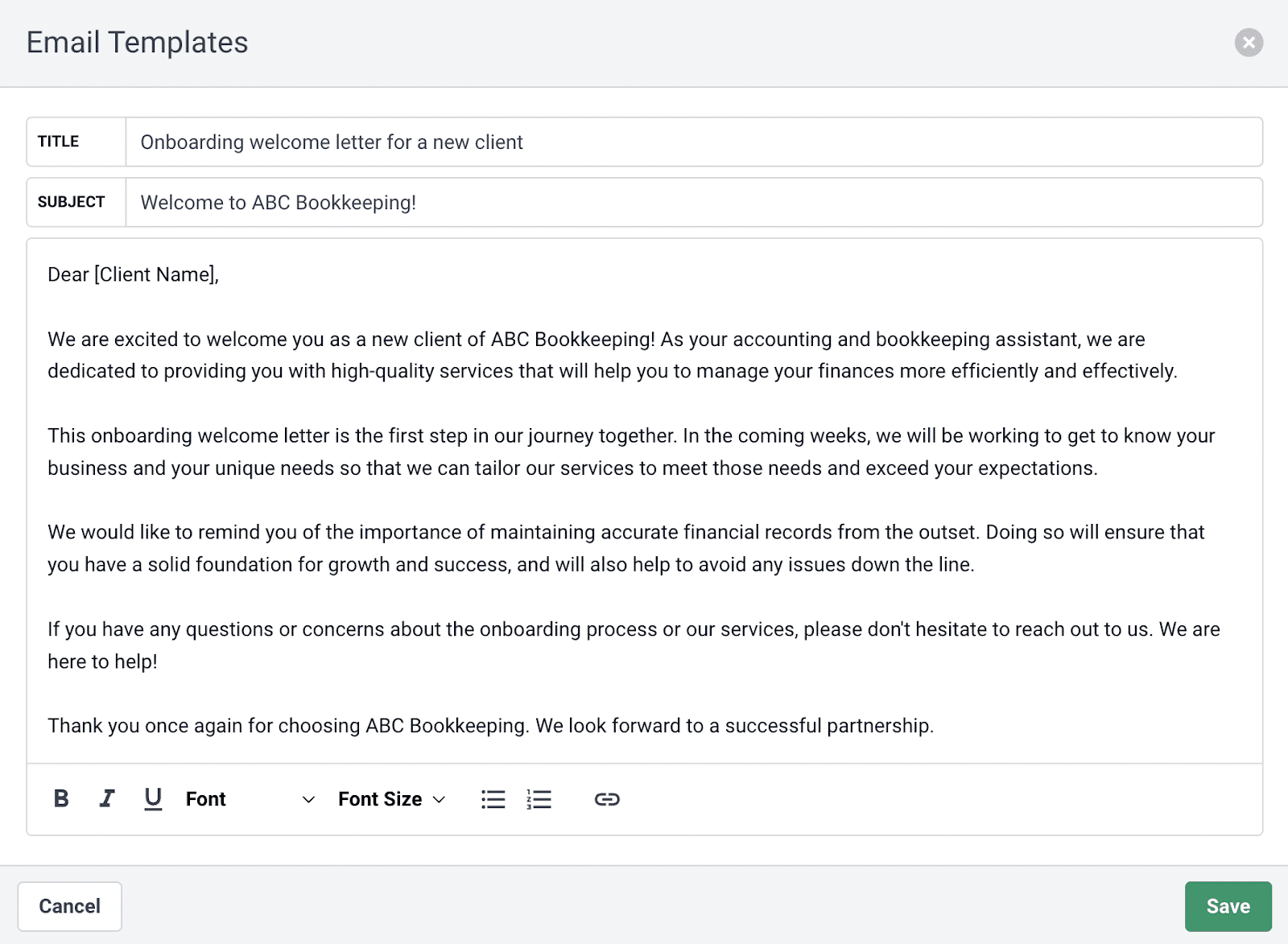

I. Welcome email

Send a message that introduces your team, outlines what happens next, and shares contact details and key timelines.

You can access our client welcome email template here.

II. Kickoff call

Host a short meeting to review scope, set communication expectations, answer client questions, and walk them through the next steps.

Step 3: Client Information & Access

You cannot do bookkeeping without the client’s business details and system access. That’s why you should:

I. Collect business details

Gather the client’s legal business name, EIN, entity type, business address, etc.

Pro tip: Use a simple client questionnaire hosted on Google Docs or a similar tool to collect this information. Check out our bookkeeping client onboarding questionnaire guide for more details on what to include.

II. Gather accounting software access

Request accountant access to software like QuickBooks, Xero, and other accounting systems. Make sure you have the right level of access and confirm whether there are multiple users or company files to manage.

III. Bank and credit card access

Request view-only access (if possible) to all business bank and credit card accounts. Confirm which accounts are active and verify that none of them are personal accounts being used for business purposes.

IV. Payroll and sales tax platform access

Get login credentials or accountant access to platforms like Gusto, ADP, QuickBooks Payroll, Avalara, and TaxJar. Ensure you have the right permissions to review reports, run payroll summaries, or reconcile filings.

VI. POS and payment platform access

Obtain access to any payment platforms the client uses, including Stripe, Shopify, Square, PayPal, and others. You’ll need this to reconcile deposits, match fees, and tie revenue back to transactions in the books.

Step 4: Engagement Scope & Expectations

Reconfirm the scope, even if it was covered in the proposal.

1. Services included

List exactly what you’re offering, e.g., monthly bookkeeping, payroll, advisory, etc.

II. Deliverables and reporting frequency

State what you’ll be delivering and how often. And if possible, specify the specific delivery date each month.

III. Client responsibilities vs firm responsibilities

Spell out clearly what you expect the client to do (like uploading docs, approving deliverables) and what you have to do (delivering reports, closing books by deadline).

IV. Communication expectations

Share communication rules so they know where and how to reach you.

Step 5: Document Collection

Now it’s time to collect the documents you’ll need to do the client’s bookkeeping tasks. Create a structured document request list that includes:

- Prior-year financials

- Prior tax returns

- Bank statements

- Credit card statements

- Outstanding invoices and bills

- Loan documents

- Chart of accounts review

Step 6: Bank Feed Setup & Opening Balance Review

This is where you confirm the numbers are reliable before month one begins.

I. Bank feed connections

Connect all active bank and credit card accounts, and ensure feeds are pulling transactions correctly and are not duplicated. Also, confirm who owns the connection (you or the client) and document it.

II. Opening balance review

Before categorizing transactions, verify opening balances. If the numbers don’t match, resolve the discrepancy before starting work.

Step 7: Internal Workflow Setup

Set up how the work will run internally every month. To do this,

I. Create recurring bookkeeping workflow

Build a standard checklist for monthly bookkeeping. Include steps like transaction review, reconciliation, and reporting.

II. Assign tasks and deadlines

At the very least, each task should have an owner and a due date. Use a tool like Financial Cents to assign and track these.

III. Set monthly close timelines

Choose a consistent month-end close schedule and stick to it so clients know when to expect their reports.

IV. Configure client reminders

Automate recurring document requests and reminders to save time and reduce manual follow-up.

Download: Free Bookkeeping Client Onboarding Checklist Templates

You don’t need to create your onboarding checklist from scratch. You can start with a template and customize it to fit your firm.

Here are four free bookkeeping client onboarding checklist templates created by accounting and bookkeeping professionals.

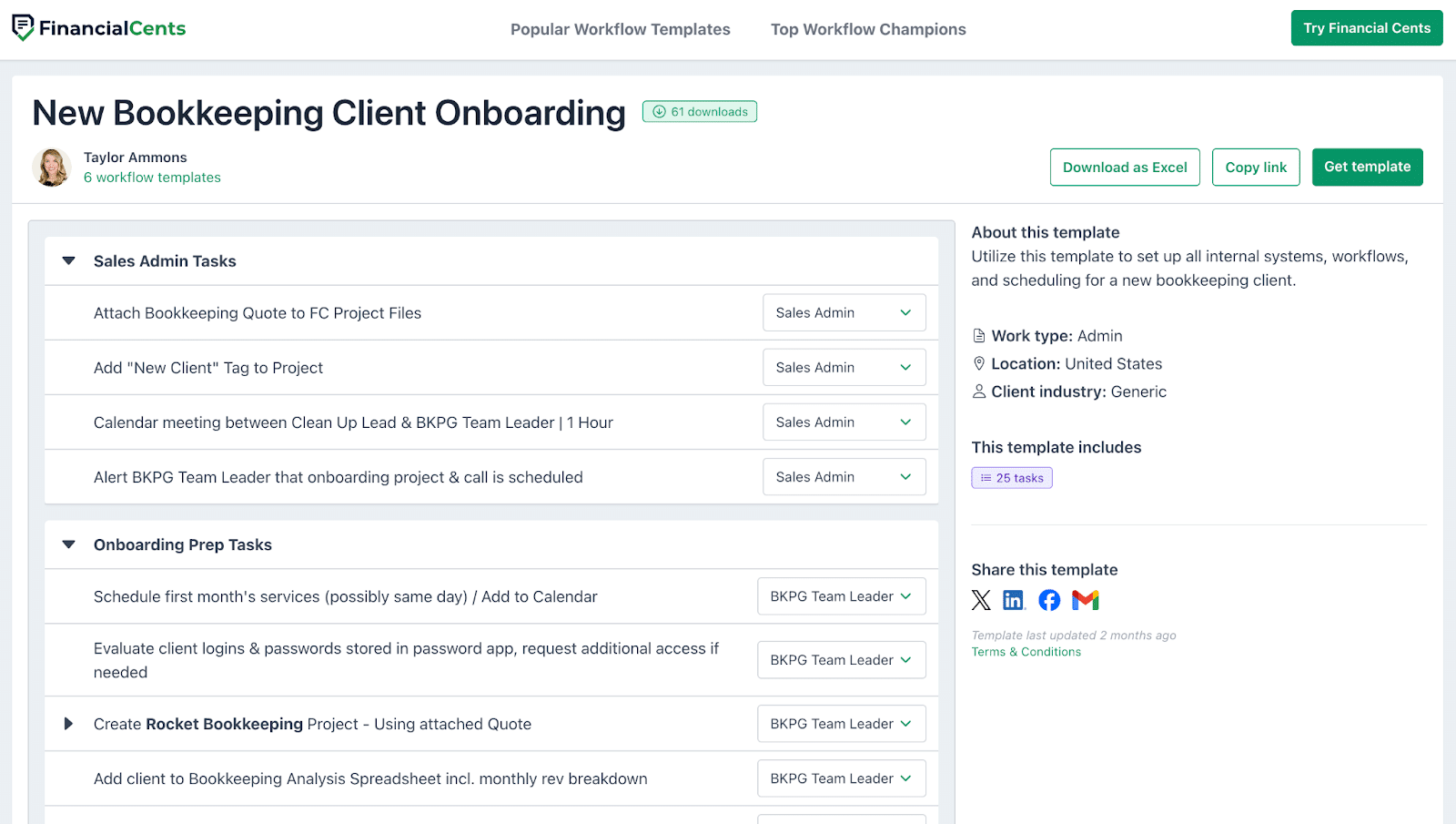

1. New Bookkeeping Client Onboarding

This is a template created by Taylor Ammons, Operations Integrator at Accounting Therapy, Inc. It’s best for firms that want a complete onboarding workflow covering internal setup, scheduling, and wrap-up tasks.

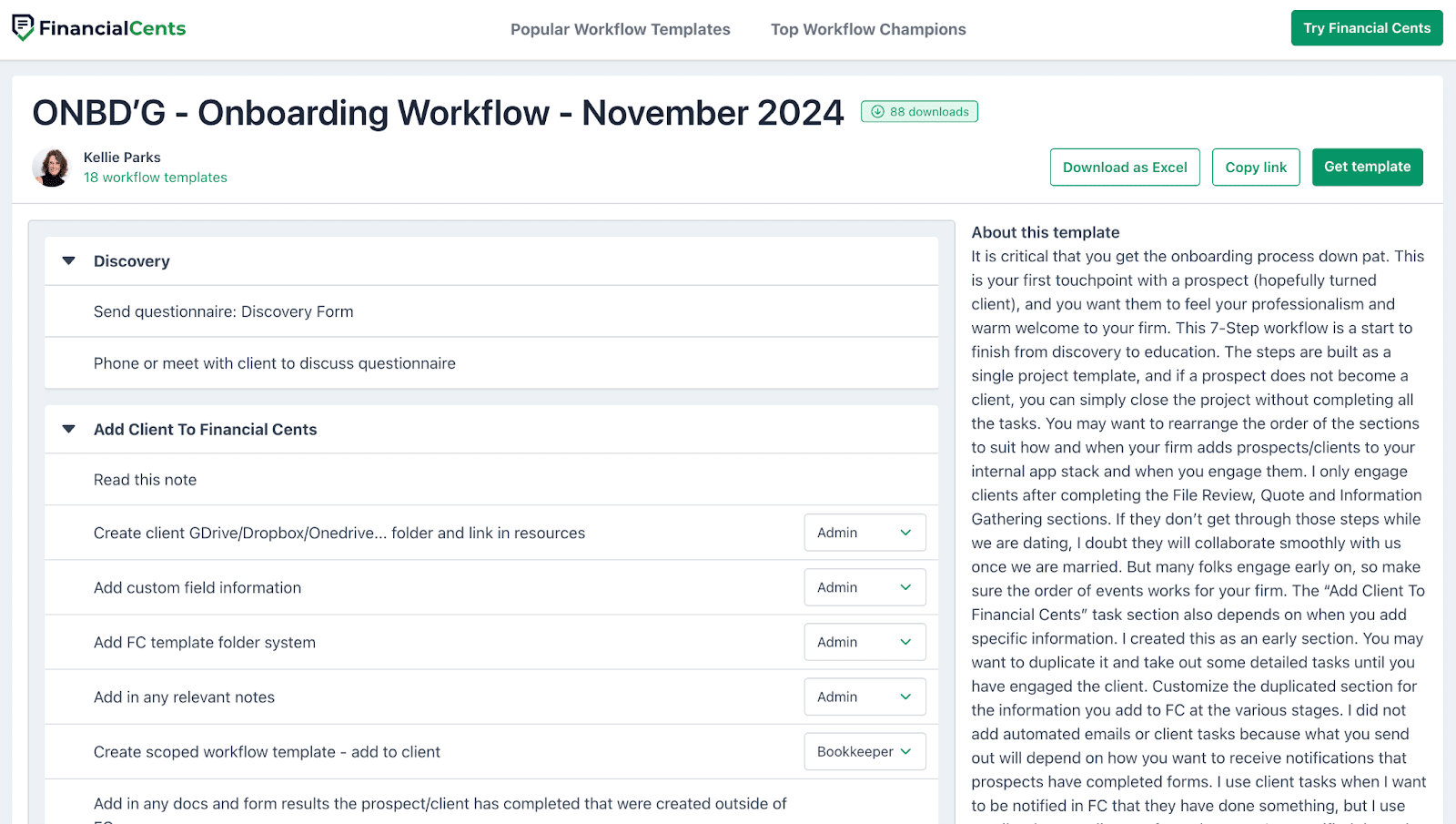

2. ONBD’G – Onboarding Workflow

This is a 7-step workflow by Kellie Parks, Cloud Accounting Process and Automation Builder at Calmwaters Cloud Accounting. It was revised in November 2024, and it covers client discovery to client education. It’s a start-to-finish process, and you can rearrange or customize anyhow you like.

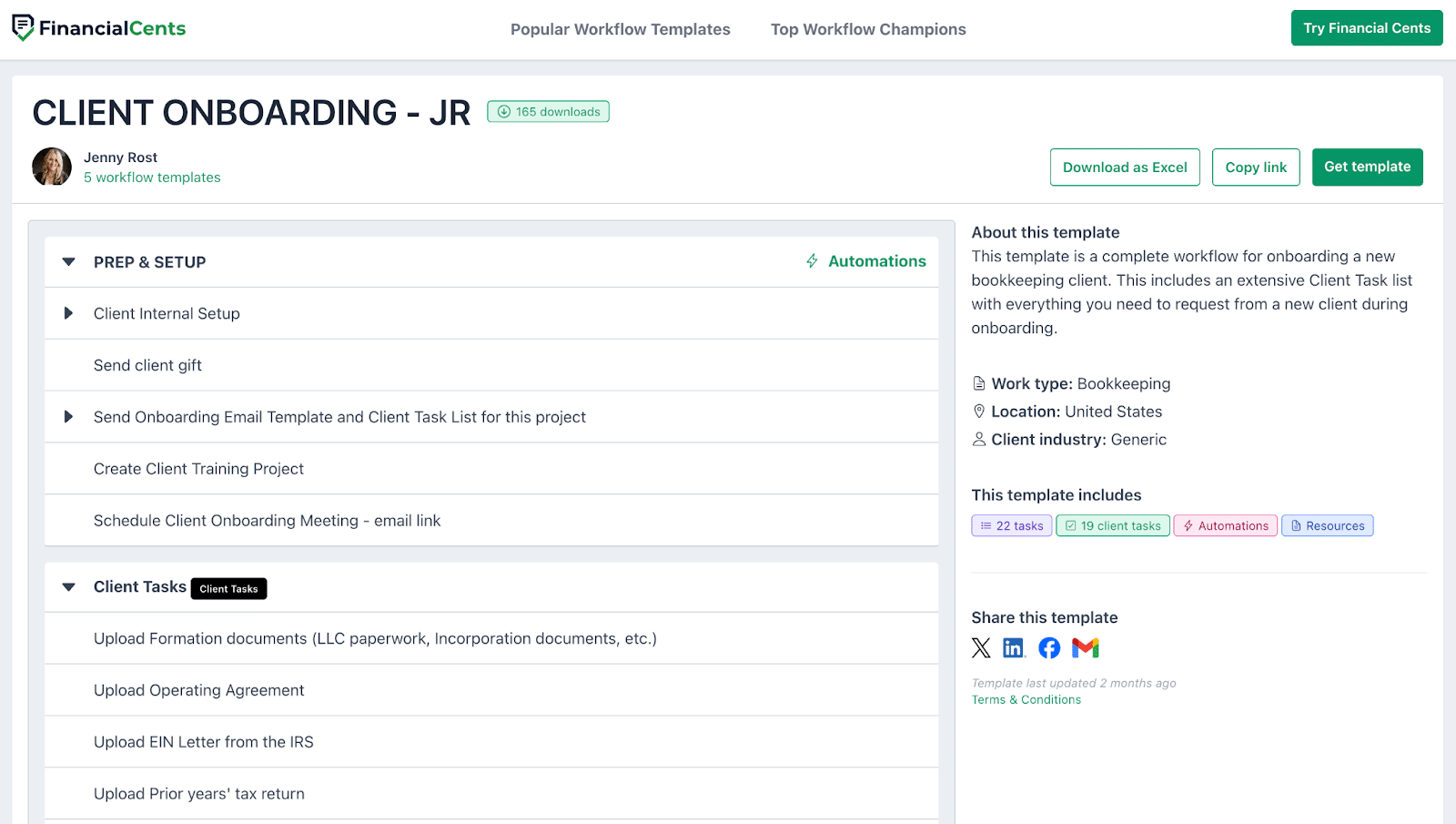

3. CLIENT ONBOARDING – JR

Created by Jenny Rost, CEO of Construct Bookkeeping, this onboarding template includes an extensive client task list with everything you need to request from a new client during onboarding and other internal tasks like meetings and follow-up.

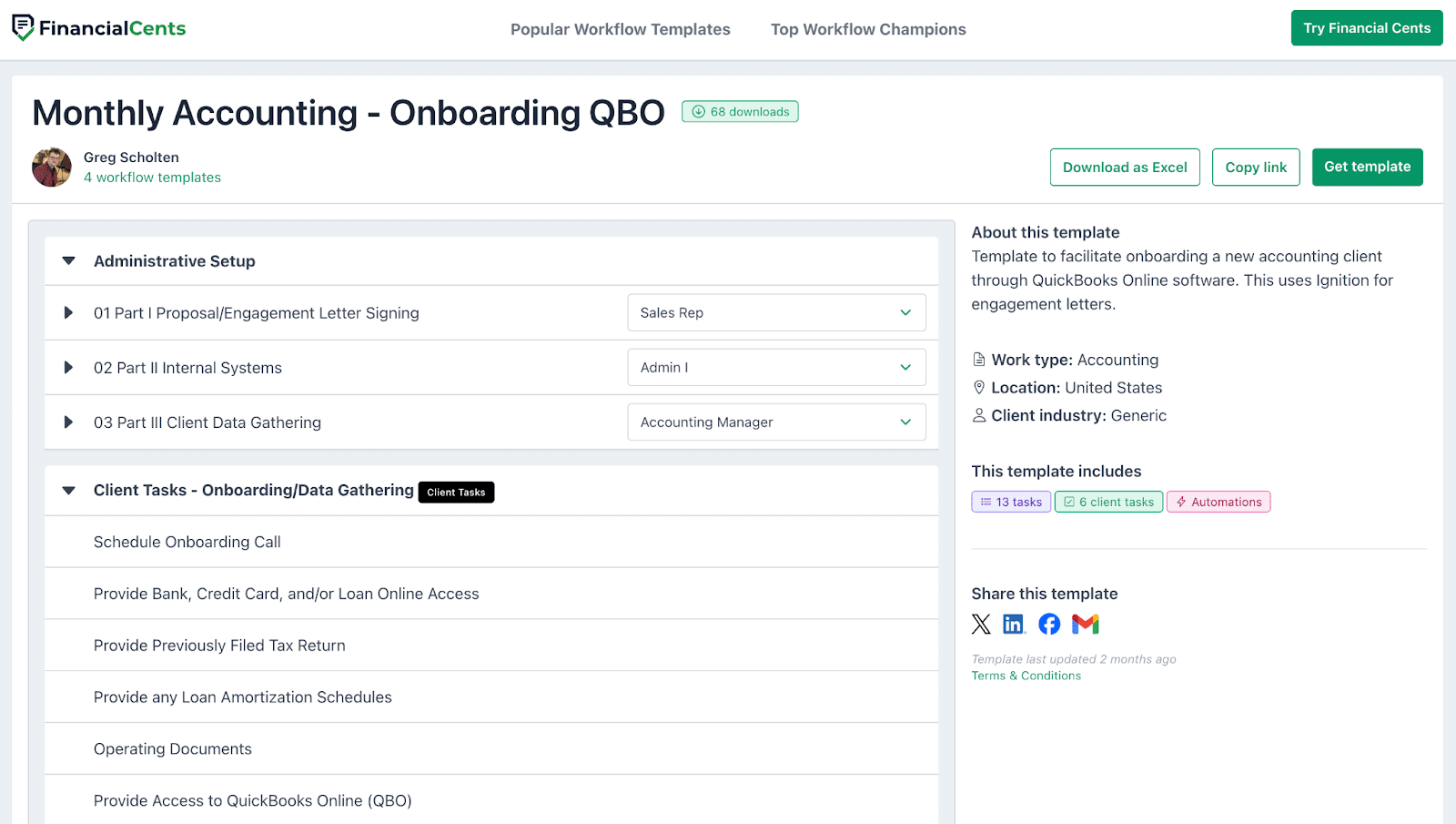

4. Monthly Accounting – Onboarding QBO

This template by Greg Scholten, President of On Track Accounting Solutions, is tailored for QBO onboarding and guides you through administrative, QBO, and Plooto setup.

Common Bookkeeping Onboarding Mistakes to Avoid

Firms often make common mistakes during onboarding, and it’s important to recognize and avoid them. Here are some of them:

a. Starting Work Before Access Is Complete

Don’t begin bookkeeping work until you have all the access and documents you need. If you do so, you’ll get stuck midway or work with incorrect opening balances and have to wait for more info or redo the work.

b. Relying on Email for Document Collection

Don’t share or collect documents via email. It’s not secure, and it’s easy to miss attachments or mix up versions. Instead, use a secure client portal like Financial Cents to collect and manage client documents in one place.

c. Not Clarifying Scope

If you don’t clearly define what’s included and excluded, clients will fill in the gaps themselves, which can lead to scope creep or confusion. So reconfirm scope in writing and review it during your kickoff call.

d. Skipping opening balance review

Opening balances must match reliable documents like prior financials, tax returns, or bank statements. If they’re wrong, every report that follows will be inaccurate. Always review and reconcile these balances before starting regular work.

e. No Internal Checklist or Owner

Without an internal checklist, your onboarding process won’t be consistent. And without a designated client owner, tasks fall through the cracks. Create a standard checklist and assign one person to own each onboarding from start to finish.

How to Automate Onboarding for Bookkeeping Clients

If you’re manually onboarding each client, you’re wasting time and increasing the risk of mistakes. Automation helps streamline the entire process so you can deliver work faster and more consistently.

Use Workflow Templates

Instead of building every onboarding process from scratch, use a pre-built workflow template that includes all standard tasks and deadlines. Just duplicate the template for each new client, fill in their details, and assign team members. This saves hours per client and makes it easier to train new hires.

Financial Cents has a large library of workflow templates, including bookkeeping client onboarding templates you can use right away.

Automate Client Reminders

Most delays happen because clients forget to upload documents or grant access.

Instead of manually following up, set automated reminders to follow up with clients. Financial Cents helps with this. You can set reminders at intervals to nudge clients until they upload the required documents to your portal.

Centralize Documents and Communication

Storing client documents in emails, folders, and Slack makes it easy to lose track of important info. With Financial Cents, everything, messages, files, notes, is kept in one place so your team always knows where to find what they need.

Track Onboarding Progress in One Place

You shouldn’t have to chase down team members to get status updates. Financial Cents gives you a full view of all client tasks and progress in one dashboard. That means less checking in, so you can get more things done.

Simplify Your Client Onboarding Process with Financial Cents

A good onboarding checklist offers so many benefits for your firm. It gives you clarity about what needs to happen, reduces errors from guessing or missing steps, and sets clear expectations for both your team and the client.

When onboarding is structured, you spend less time chasing documents and more time delivering accurate, timely work.

But a checklist isn’t enough to make onboarding smooth. You need an accounting practice management software like Financial Cents to manage the process.

Financial Cents is built specifically for accounting and bookkeeping firms to help them onboard and manage clients.

Here are some of its key features:

-

Centralized Work and Communication

Financial Cents keeps client tasks, documents, emails, and notes in one place. Instead of searching through email threads or shared drives, your team sees everything tied to the client’s profile, which reduces confusion and improves efficiency.

-

Secure Client Portal and Auto-Reminders

You can request documents through a secure portal in Financial Cents, and clients can upload them directly. If they don’t respond to the first request, you can set up automated reminders to follow up, eliminating manual follow-ups.

-

Workflow Templates

Save time by using prebuilt onboarding workflow templates or creating your own. You can apply them to every new client without starting from scratch.

-

Proposals and Engagement Letters

Send professional proposals and engagement letters, collect payment information upfront from the client, have them electronically sign and agree to your terms, and auto-generate and activate invoicing once signed, all within Financial Cents.

Start a free trial today to see how Financial Cents can simplify client onboarding for your firm.