Want to close the books faster and spend less time fixing messy reports? Start with your Chart of Accounts.

The Chart of Accounts (COA) is the backbone of every accounting system. It organizes every financial transaction into clear categories, making it easier to track income, expenses, assets, liabilities, and equity. When it’s set up right, it speeds up bookkeeping, simplifies reporting, and makes tax season far less stressful.

But when the COA is disorganized, everything else becomes harder. Reports get messy, tax prep takes longer, and you waste valuable time sorting through confusing or duplicated accounts.

That’s why every accounting and bookkeeping firm needs a well-structured COA.

In this guide, you’ll learn exactly what a COA is, why it matters, and how to set one up properly. You’ll also find practical examples, setup tips, and common mistakes to avoid.

What is a Chart of Accounts?

A Chart of Accounts is a systematic, organized listing of all the financial accounts used by a business to record and categorize its financial transactions in the general ledger. It serves as a foundational tool for a company’s accounting system, providing a clear structure that helps track assets, liabilities, equity, revenues, and expenses

Each account in the COA is assigned a unique number for easy identification and organization. For example, assets might be numbered 1000-1999, liabilities 2000-2999, and so on. This numbering system makes it easier to locate accounts, generate reports, and maintain consistency across the organization.

The COA works directly with the general ledger. Every transaction you record is posted to an account listed in the COA, and those postings automatically feed into the general ledger. Without a clear COA, the general ledger would be disorganized and nearly impossible to navigate.

Grab a general ledger template.

Purpose of a Charts of Accounts

The COA serves several important purposes:

- Organization: It organizes financial data in a logical, structured way. It eliminates the guesswork around where transactions belong, making it easier to keep books up to date and accurate.

- Consistency: When you use the same accounts consistently, you avoid confusion and ensure that financial reports are comparable across time periods. This is especially important for firms that manage books for multiple clients or need to compare historical data.

- Reporting: All major financial reports rely on the COA. If it’s set up poorly, reports become hard to read and misleading. A good COA ensures reports are accurate, reliable, and easy to understand.

- Analysis: Beyond compliance and reporting, a well-structured COA makes it easier to analyze business performance. You can quickly spot trends, identify unusual expenses, and provide more strategic advice to clients.

Why a Well-Structured COA is Crucial

Here are some of the benefits of a COA:

Accuracy

Every financial report starts with the COA. If accounts are vague, duplicated, or incorrectly categorized, mistakes will flow through to every report. A well-organized COA ensures that transactions are recorded correctly, so reports and ledgers stay accurate. This is key for both internal decision-making and external reporting.

Clarity & Insight

A good COA makes financial data easier to understand. It creates clear categories for assets, liabilities, revenue, and expenses, making it simple to see where money is coming from and where it’s going. This clarity helps your firm explain financials to clients and offer more meaningful insights.

Efficiency

The more organized the COA, the faster you can work. A lean, structured COA speeds up tasks like transaction categorization, account reconciliation, and report generation. Your team won’t waste time guessing where things belong or correcting errors later.

Scalability

As businesses grow, their finances become more complex. A scalable COA gives room to expand without needing to overhaul the entire account structure. You can easily add new accounts or sub-accounts without disrupting the overall system, making it easier to support growing clients.

Tax Preparation

During tax season, a well-structured COA saves time and reduces stress. It keeps tax-deductible expenses clearly separated, so you don’t need to hunt through vague or duplicated accounts. This makes it easier to identify deductions and file accurate returns for your clients.

Audit Preparedness

Audits (whether internal or external) require clear, well-documented financial records. A strong COA makes it simple to trace transactions back to their source accounts, reducing the risk of errors and helping your clients stay compliant.

Types of Chart of Accounts: The Five Core Accounts

Every Chart of Accounts is built around five essential account types. These categories form the structure for organizing all financial data and are directly tied to the accounting equation:

Assets = Liabilities + Equity.

Understanding these account types is critical because every transaction in your clients’ books falls into one of these categories. They also determine how financial reports are prepared and how the financial health of a business is assessed.

Let’s take a closer look at each one.

Assets: What Your Business Owns

Assets represent everything a business owns or controls that has monetary value. This includes cash, inventory, accounts receivable, equipment, and property. In other words, these are the resources the business uses to operate and generate revenue.

On the balance sheet, assets are listed first, usually at the top in modern, vertical reports or on the left side in traditional, side-by-side formats. They are also arranged by liquidity, starting with cash and moving toward less liquid items like long-term investments and property.

For example, a business might have separate asset accounts for cash in the bank, accounts receivable from clients, prepaid insurance, or company-owned equipment. These accounts show exactly where the business’s resources are held and how they are being used.

Assets are the starting point for many financial discussions, from budgeting to investment decisions, which is why they must be accurately tracked in the COA.

Liabilities: What Your Business Owes

Liabilities refer to the debts and obligations that a business owes to others. These can include loans, unpaid vendor bills, credit card balances, and tax liabilities. Simply put, liabilities represent money that must eventually be paid out.

Liabilities are listed after assets, usually below assets in vertical formats, or on the right side in traditional formats. They are typically broken into current or short-term liabilities, such as accounts payable and payroll taxes due within the year, and non-current or long-term liabilities, such as business loans or mortgage balances that will be paid off over several years.

Tracking liabilities properly in the COA is crucial for showing how much the business owes and when those payments are due.

Equity: The Owner’s or Shareholders’ Stake in the Business

Equity represents the owner’s or shareholders’ stake in the business. It reflects what remains after subtracting liabilities from assets … essentially, the net worth of the business.

Equity accounts track activities like owner contributions, retained earnings, and distributions to shareholders. These accounts explain how much of the business is financed by its owners versus outside creditors.

Equity plays a key role in understanding a business’s financial health. It shows whether a business is growing its retained earnings or regularly distributing profits. It also represents long-term financial stability and the value available to owners if the business were sold or liquidated.

Equity is listed after liabilities at the bottom of the balance sheet in vertical formats, or on the right side (alongside liabilities) in traditional, side-by-side formats. This completes the accounting equation and provides a full picture of the business’s financial position.

Revenue: Income Generated From Business Activities

Revenue accounts track the income a business earns from its core operations. This includes sales of goods, income from services, and other sources of business-related revenue.

In the income statement, revenue appears at the top and represents the starting point for measuring profitability. All other financial activities, such as expenses, are subtracted from revenue to calculate net income or loss.

Organizing revenue accounts clearly in the COA is essential for monitoring business performance. Whether the business earns income from product sales, consulting services, or subscription fees, keeping these income sources separate allows for easier analysis and reporting.

Expenses: Costs Incurred To Generate Revenue

Expenses are the costs a business incurs to operate and earn revenue. They include a wide range of categories, such as rent, utilities, salaries, supplies, and marketing costs.

Cost of Goods Sold (COGS): COGS refers to the direct costs associated with producing the goods or products a business sells. This typically includes materials, labor, and manufacturing overhead directly tied to production. COGS appears directly below revenue on the income statement and is subtracted from revenue to calculate **gross profit**.

Businesses that sell physical products—such as retailers, wholesalers, or manufacturers—must track COGS to understand the true cost of their inventory and assess profitability. Service-based businesses may not have COGS at all, or may use a similar concept like ‘Cost of Services’.

In the COA, COGS accounts usually fall in the 5000 or 6000 series (depending on the numbering scheme) and may include categories like ‘Raw Materials,’ ‘Direct Labor,’ or ‘Shipping Costs for Goods Sold’.

Expenses appear on the income statement directly below revenue, or COGS if used. They are subtracted from revenue to determine profitability. Accurate expense tracking in the COA is important for reporting, budgeting, cash flow management, and tax preparation.

A detailed, well-structured expense section in the COA allows a business to closely monitor spending habits, identify cost-saving opportunities, and stay compliant with tax laws.

How to Set Up a Chart of Accounts (Step-by-Step Guide)

Here’s a step-by-step guide to setting up an effective COA:

Step 1: Understand the Business Needs

Before creating the COA, it’s important to fully understand the business’s operations, reporting requirements, and tax obligations. A retail store, for example, will have very different accounts than a consulting firm or nonprofit.

Take time to identify:

- Revenue streams (products, services, memberships, etc.)

- Common expenses (payroll, rent, marketing, etc.)

- Assets and liabilities specific to the business (inventory, loans, etc.)

This step ensures the COA reflects how the business actually operates and avoids irrelevant or unnecessary accounts.

Step 2: Establish an Account Numbering System

Next, assign numbers to each account. This keeps everything organized and makes reporting easier, especially as the COA grows over time.

Most firms use a numbering system that groups accounts by type. For example:

- 1000 series for Assets

- 2000 series for Liabilities

- 3000 series for Equity

- 4000 series for Revenue

- 5000 series for COGS

- 6000 series for Expenses

The numbers also help accounts appear in the correct order on reports. You can leave gaps between numbers to allow room for new accounts later.

Step 3: List Core Accounts First (Must-Haves)

Start by creating the essential accounts every business needs. These usually include:

- Bank accounts (under Assets)

- Accounts Payable and Loans (under Liabilities)

- Owner’s Equity or Retained Earnings

- Revenue categories

- Cost of Goods Categories (if applicable)

- Common expense categories like Rent, Utilities, and Payroll

These core accounts form the base of the COA and should be included for every business, regardless of size or industry.

Step 4: Add Specific Sub-Accounts as Needed

Once the core accounts are set, you can create sub-accounts for more detailed tracking. Sub-accounts are helpful for businesses that need to break down income or expenses further.

For example, under “Marketing Expenses,” you might add sub-accounts for digital advertising, events & sponsorships, and promotional materials.

Sub-accounts allow for deeper reporting without cluttering the main chart.

Step 5: Tailor Accounts to Business Type or Client Needs

No two businesses are exactly alike, so it’s important to customize the COA to fit the specific business or client.

For instance, a construction company might need accounts for “Job Costs” or “Construction Materials,” while a law firm may need accounts for “Client Trust Accounts” or “Legal Research Expenses.”

Think about industry-specific accounts that may be required for tax reporting or internal analysis, and adjust accordingly.

Step 6: Review, Refine, and Document

Once the COA is drafted, review it carefully to ensure everything is properly categorized, there are no duplicate accounts, and the numbering sequence makes sense.

It’s also a good idea to document the structure and provide guidelines on how accounts should be used. This will help maintain consistency as your team works with the accounts and reduce confusion down the line.

Finally, revisit the COA periodically, especially as the business grows or changes. Keeping it updated ensures it stays useful and relevant.

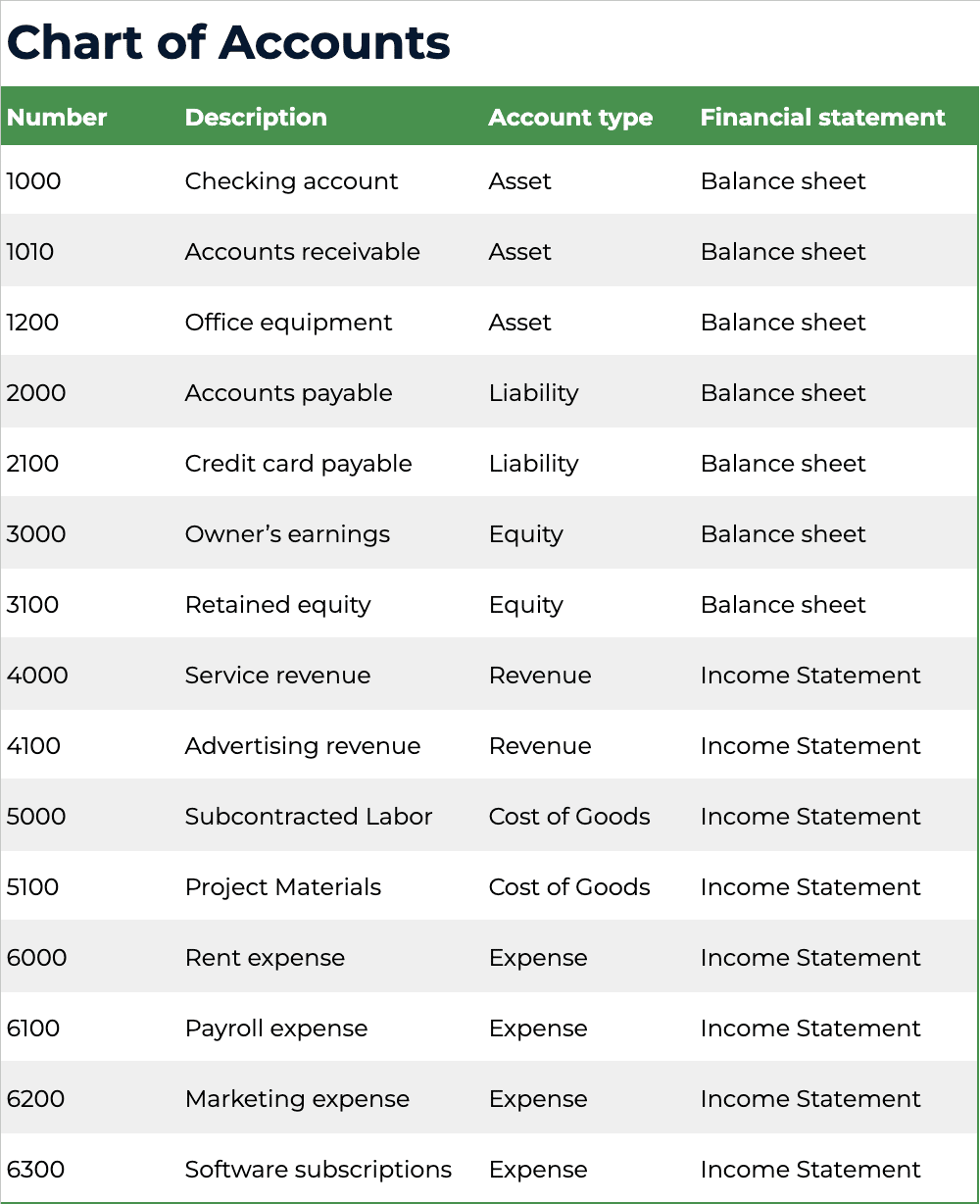

Example of a Chart of Accounts

To see how all of this comes together, here’s a sample Chart of Accounts for a fictional client, a small marketing agency. This example shows how account numbers, descriptions, account types, and related financial statements are structured in a COA.

| Number | Description | Account type | Financial statement |

| 1000 | Checking account | Asset | Balance sheet |

| 1010 | Accounts receivable | Asset | Balance sheet |

| 1200 | Office equipment | Asset | Balance sheet |

| 2000 | Accounts payable | Liability | Balance sheet |

| 2100 | Credit card payable | Liability | Balance sheet |

| 3000 | Owner’s earnings | Equity | Balance sheet |

| 3100 | Retained equity | Equity | Balance sheet |

| 4000 | Service revenue | Revenue | Income Statement |

| 4100 | Advertising revenue | Revenue | Income Statement |

| 5000 | Subcontracted Labor | Cost of Goods | Income Statement |

| 5100 | Project Materials | Cost of Goods | Income Statement |

| 6000 | Rent expense | Expense | Income Statement |

| 6100 | Payroll expense | Expense | Income Statement |

| 6200 | Marketing expense | Expense | Income Statement |

| 6300 | Software subscriptions | Expense | Income Statement |

This sample COA follows the typical numbering system where accounts are grouped by type:

- The 1000 series tracks assets like cash, accounts receivable, and equipment.

- The 2000 series covers liabilities such as accounts payable and credit card balances.

- The 3000 series holds equity accounts, including the owner’s capital and retained earnings.

- The 4000 series is for revenue accounts, such as income from services and advertising.

- The 5000 series is for Cost of Goods Sold, such as product costs, direct labor, and production materials.

- The 6000 series tracks expenses, including rent, payroll, marketing, and software costs.

Each account has a clear description and is tied to a specific financial statement (either the balance sheet or the income statement) to show where it appears in financial reporting.

This example also leaves plenty of room for sub-accounts under categories like marketing or payroll if the business wants more detailed tracking later.

Best Practices for Managing and Maintaining a COA

Once you’ve set up a COA, the next challenge is keeping it organized and efficient over time. A COA can quickly spiral out of control if too many unnecessary accounts are added or if different people manage it without a clear system.

Here are some proven best practices to help you manage and maintain a clean, functional COA:

Keep it Lean

Avoid creating an account for every minor transaction. While it can be tempting to track every detail, too many accounts make reports harder to read and bookkeeping more complicated.

For example, you don’t need separate accounts for every vendor lunch or office purchase. Instead, group similar transactions under broader categories like Meals & Entertainment or Office Supplies. You can always use sub-accounts or tags if more detail is needed.

Use Consistent Naming and Coding

Consistency is key to keeping your COA organized. Stick to a clear, predictable naming structure so anyone reviewing the books can easily understand the accounts.

For instance, decide whether you’ll use singular or plural names (e.g., “Utility Expense” vs. “Utilities”), and stick with that choice throughout. Also, follow a consistent numbering pattern that matches your initial COA structure. This prevents duplicate accounts and keeps everything easier to navigate.

Ensure Accounts Align With Reporting Needs

Every account in your COA should serve a clear reporting purpose. That’s because the COA powers financial reports like the profit and loss statement, balance sheet, and cash flow statement. If an account doesn’t contribute to useful reporting, it likely doesn’t belong in the COA.

Don’t Change Numbers Recklessly

Account numbers help maintain order within the COA. Changing them frequently or without a clear reason can cause confusion, throw off reports, and even affect accounting software integrations.

If you ever need to reorganize account numbers, do it carefully, and make sure you update every connected report, workflow, or software integration.

Train Your Team

Everyone working with the books should understand how the COA is structured and how to use it correctly. Without training, it’s easy for staff to accidentally create duplicate accounts or miscategorize transactions. Walk your team through the account naming and numbering rules, when (and when not) to create a new account, how to handle sub-accounts and reporting categories, etc.

Review the COA Regularly

Businesses change, and their COA should evolve too. Schedule periodic reviews (at least annually, or during major business changes) to remove accounts no longer in use, merge duplicate accounts, and adjust categories to match new services or expenses.

Regular reviews help prevent account bloat and keep the COA aligned with the business’s actual needs.

Archive Unused Accounts

It’s often tempting to delete old or unused accounts, but that can lead to gaps in past financial reports or cause financial audit issues.

Instead, archive or deactivate unused accounts if your accounting software allows it. This keeps your COA clean for future use while preserving historical data for reference or reporting.

Common Mistakes to Avoid with COA

It’s easy to make mistakes when setting up or managing a Chart of Accounts. These mistakes can cause confusion, lead to inaccurate reports, and create unnecessary cleanup work down the line.

Here are some of the most common mistakes to watch for and how to avoid them:

Using Vague or Duplicate Account Names

One of the biggest issues in many COAs is the use of unclear or duplicate account names. If you have multiple accounts with similar names like “Marketing,” “Marketing Expenses,” and “Advertising,” it’s only a matter of time before transactions get miscategorized.

Likewise, vague names like “Miscellaneous,” “General Expenses,” or “Other Income” don’t tell you much about the nature of the transactions. Over time, these accounts become a dumping ground for anything that doesn’t have a clear place, making reports harder to interpret.

To avoid this, use specific, consistent account names that clearly describe what’s being tracked. If needed, create sub-accounts for extra detail instead of creating multiple overlapping categories.

Failing to Regularly Review and Clean Up

Many firms neglect to review the COA regularly, allowing unnecessary accounts to pile up over time.

If left unchecked, the COA can become cluttered with old, unused accounts that no longer serve a purpose. This makes the chart harder to navigate and increases the risk of errors.

Set a schedule to review the COA at least once a year, or anytime the business undergoes major changes. Use these reviews to clean up duplicate or outdated accounts and reorganize categories where needed.

Not Customizing for the Client’s Industry

Every industry has its own financial reporting needs. A generic COA might work for basic bookkeeping, but it won’t provide the level of detail many clients need.

Always customize the COA based on the client’s industry, business model, and regulatory requirements to ensure accurate reporting.

Using the Wrong Type of Account

Misclassifying accounts is a common mistake that can create serious issues in financial reporting. So before adding or using an account, make sure it’s assigned to the correct account type: asset, liability, equity, revenue, or expense. If you’re unsure, double-check against accounting guidelines or consult with a qualified accountant.

Getting the account type right from the start prevents reporting errors and makes the books easier to maintain.

Make the Chart of Accounts Work for You

A well-structured COA is essential for every accounting and bookkeeping firm. It’s what makes accurate reporting possible, keeps financial data consistent, and allows you to deliver clear, reliable reports to clients. It also makes audits and tax prep much smoother, saving both you and your clients time and stress.

And once it’s set up correctly, it becomes much easier to manage the books, generate useful reports, and confidently advise clients on their financial decisions

But managing a clean COA is just one piece of running an efficient accounting or bookkeeping firm. If you’re looking for a way to simplify your entire workflow, Financial Cents can help.

Financial Cents is a practice management tool built specifically for accounting and bookkeeping firms. It helps you organize your client work and automate your firm’s day-to-day processes, so you can hit every deadline and focus more on serving clients.

Here’s what you can do with this software:

- Create standardized workflows for recurring tasks like bookkeeping cleanups or month-end closes.

- Track client work in one place, so nothing falls through the cracks.

- Automate client reminders and task follow-ups.

- Set up recurring projects for routine services like payroll, tax prep, or reporting.

- Collaborate with your team through built-in time tracking, task comments, and file sharing.

- Use built-in dashboards to get a clear overview of deadlines and progress.

If you’re ready to streamline your firm and spend less time on manual tasks, give Financial Cents a try.