Expenses are one of the most fundamental pieces of any business’s finances, and one of the easiest areas to get wrong.

When recorded accurately, they give business owners a clear view of what it costs to operate, help ensure compliance during tax season, and make financial reports more reliable. But when expenses are uncategorized, misclassified, or poorly tracked, it leads to messy books, missed deductions, and time-consuming cleanup work for your team.

As an accounting or bookkeeping firm, you need to understand how expenses work, how they’re recorded, and how to keep them organized across multiple client files.

In this guide, we’ll explore what expenses are in accounting, the different types, practical examples of expenses in accounting, best practices for tracking them, and how to manage uncategorized expenses.

What Are Expenses in Accounting?

In accounting, expenses are the costs a business incurs in the course of its normal operations. These include things like employee wages, rent, utilities, office supplies, and software subscriptions.

Expenses are recorded on the income statement and reduce the company’s net income for a given period. Unlike assets, which provide future economic benefit, or liabilities, which represent future obligations, expenses represent money that has already been spent or committed as part of running the business.

Recording expenses accurately allows businesses to understand how much it costs to operate and how those costs affect profitability. It also ensures tax compliance, since many business expenses are tax deductible. Without a clear record of expenses, a business may overstate its profits, underpay taxes, or fail to detect cash flow issues until it’s too late.

Beyond tracking the right expenses, it’s also important to record them at the right time. That’s where the expense recognition principle, also known as the matching principle, comes in.

This principle, which is core to accrual accounting, requires that expenses be recorded in the same period as the revenue they help generate. This gives business owners and stakeholders a more accurate view of profitability for each reporting period.

For example, if your client hires a freelancer in December but pays them in January, that cost should still be recorded in December if the work supported December revenue. Matching expenses to revenue ensures the income statement reflects the true cost of doing business in each period.

The Impact of Expenses on Businesses

Accurately recording and categorizing expenses plays a direct role in how businesses make decisions, plan for growth, and stay financially healthy. Here’s how:

Helps with Budgeting and Forecasting

When expenses are tracked properly, it’s easier to analyze historical trends and build realistic budgets. For example, if a client’s marketing spend spikes every Q4, you can flag that early and help them plan ahead. Clean expense data also makes forecasting more reliable because you’re working with consistent, category-level insights instead of guesswork.

Ensures Tax Compliance and Deductions

Many business expenses are tax-deductible. But if they’re not properly categorized or supported with documentation, your client may miss out on deductions or raise red flags during an audit. Good expense tracking helps firms confidently claim what’s deductible and stay compliant with IRS rules.

Prevents Cash Flow Surprises

Untracked or delayed expense entries can distort the financial picture and lead to unexpected cash shortfalls. When your firm records expenses in real time and ties them to the right periods, it helps clients see their actual spend and manage outflows before they become a problem.

Aids in Identifying Waste or Overspending

Clear expense categories make it easier to spot unnecessary costs or bloated line items. If a client is spending more than usual on travel, subscriptions, or contractors, you can quickly identify it and recommend adjustments. That kind of insight builds trust and positions your firm as a strategic partner, not just a service provider.

Types and Examples of Expenses in Accounting

Expenses in accounting can be classified into three main categories on the income statement:

Operating Expenses (OpEx)

These are the day-to-day costs of running the business. They show up on the income statement and are deducted from revenue to calculate operating income.

Examples of operating expenses include rent or lease payments for office space, employee wages and benefits, software subscriptions (like QuickBooks or Slack), office supplies, marketing and advertising costs, insurance premiums, utilities (electricity, water, internet), etc.

Non-Operating Expenses

These are costs not tied to the core business operations. They’re often irregular or one-time expenses, and they’re reported separately to give a clearer picture of operational performance.

They include interest expenses on loans or credit lines, losses on asset disposals, lawsuit settlements, currency exchange losses, restructuring or layoff costs.

Cost of Goods Sold (COGS)

COGS represents the direct costs of producing goods or delivering services. They are subtracted from revenue to determine gross profit. The lower your COGS, the higher your gross margin.

For product-based businesses, COGS can include raw materials, packaging, and labor directly tied to production. For service-based businesses, COGS might include subcontractor fees, delivery costs, or credit card processing fees.

Other Common Classifications

Beyond the standard financial statement groupings, there are additional classifications for reporting, planning, or tax purposes, like:

Capital Expenses (CapEx)

Capital expenses are costs incurred to buy or improve long-term assets like equipment, vehicles, or buildings. Unlike regular expenses, CapEx isn’t fully deducted in the year it’s paid. Instead, it’s capitalized and depreciated over time. Examples of capital expense include purchasing a new computer or server, buying a company vehicle, renovating office space, or upgrading manufacturing equipment.

CapEx doesn’t hit the income statement right away; it shows up on the balance sheet as an asset and is expensed gradually through depreciation or amortization.

Prepaid Expenses

These are payments made in advance for goods or services that will be used over time. On the balance sheet, prepaid expenses are initially recorded as assets. They become expenses as the benefit is realized.

Examples include annual insurance premiums, rent paid for future months, software or service subscriptions paid upfront, and prepaid maintenance contracts.

Properly tracking prepaid expenses ensures your income statement only reflects what’s been used up in a given period.

Fixed Expenses

Fixed expenses stay the same regardless of business activity or revenue fluctuations. They make budgeting easier, but can also increase financial pressure during slow periods.

Examples include office rent, salaried employee wages, monthly software subscriptions, business loan payments, and insurance premiums.

These predictable costs are essential to keep the business running, even when revenue dips.

Variable Expenses

Variable expenses change based on business activity. They typically scale with revenue or production.

Examples include hourly contractor or freelance payments, sales commissions, raw materials, shipping and delivery charges, and transaction processing fees. Tracking variable expenses helps businesses stay agile and adjust spend based on performance.

How Expenses are Recorded

Accounting follows the double-entry principle: every transaction affects at least two accounts, one debit, one credit, so the books always stay in balance. Here’s how that works when you record an expense.

A. When an expense is incurred, say the business pays $150,000 for office rent:

- Debit the Rent Expense account — this increases the expense on the income statement

- Credit the Cash account — this reduces the cash balance on the balance sheet

The expense flows straight to the income statement, lowering net income for the period. On the balance sheet, cash is lower. And because net income flows into retained earnings, the reduction in earnings also reduces owner’s equity.

B. When an expense is incurred on credit, e.g., the business receives a $45,000 utilities bill but hasn’t paid it yet:

- Debit the Utilities Expense account — this increases the expense for the period

- Credit Accounts Payable — this increases a liability until the bill is paid

When the business later settles the bill, you debit Accounts Payable (to reduce the liability) and credit Cash (to reduce the asset). The expense itself stays in the period it was incurred, not the period it was paid, applying the matching principle introduced earlier.

The Role of Expenses in Financial Statements

Expenses appear on both the income statement and the balance sheet, but in different ways. Understanding their role in each report is essential for producing accurate financials and advising clients with confidence.

Income Statement

The income statement (also called the profit and loss statement) is where all business expenses are recorded for a specific period. Operating expenses, non-operating expenses, and COGS are subtracted from revenue to calculate net income.

The better the expenses are categorized, the more useful the income statement becomes for tracking trends, calculating margins, and identifying areas of overspending.

Balance Sheet

On the balance sheet, expenses don’t appear as a direct line item. Instead, they affect retained earnings, which is part of owner’s equity.

Here’s how: when expenses are recorded on the income statement, they reduce net income. At the end of the period, net income flows into retained earnings on the balance sheet. So as expenses increase, net income decreases, and retained earnings (and equity) go down.

Additionally, some expense-related accounts like prepaid expense and accrued expense appear on the balance sheet too. Prepaid expenses are listed as current assets until they’re used, and accrued expenses show up as liabilities until they’re paid.

Tips for Managing and Tracking Expenses Effectively

Here are five essential tips you should know for managing expenses more effectively.

Categorize Expenses Properly

Start with a clean, well-structured chart of accounts that reflects your client’s industry and reporting needs. Every expense should be categorized to the right account. No vague labels like “Miscellaneous” or “Other.” Clear categorization makes it easier to generate meaningful reports, claim tax deductions, and spot irregularities.

Always Keep Records

Whether it’s a receipt, invoice, or digital proof of payment, backup documentation is critical. The IRS requires supporting documents for most deductible expenses, and not having them could trigger penalties during an audit. Encourage clients to send receipts promptly and use tools like Financial Cents that make document collection seamless.

Perform Regular Reviews

Don’t wait until year-end to clean up the books. Review expense accounts monthly or quarterly to catch errors, identify duplicate charges, and ensure entries are posted to the correct period. These reviews are especially important for accounts like meals and entertainment, travel, or contractor payments, where errors are common and scrutiny is high.

Budgeting

When expenses are properly categorized and reviewed regularly, it becomes much easier to compare actuals against budgeted amounts. Use historical expense data to build realistic budgets and adjust spending proactively.

Utilize Software

Manual expense tracking leads to missed entries, late reconciliations, and more time spent chasing down details. Cloud-based accounting software can automate expense categorization, sync receipts, and flag unusual activity. Tools like Financial Cents also help your team stay on top of client work and ensure nothing slips through the cracks during month-end close.

Managing Uncategorized Expenses

Uncategorized expenses are transactions that haven’t been assigned to a specific account in the chart of accounts. These often show up as “Uncategorized Expense” or similar placeholders in accounting software when clients upload vague bank feeds, forward unlabeled receipts, or don’t provide enough context for a transaction.

Leaving these transactions uncategorized can lead to several problems like inaccurate financial reports, missed tax deductions, delayed closes, and client confusion. And the more they pile up, the longer it takes your team to deliver clean, reliable reports.

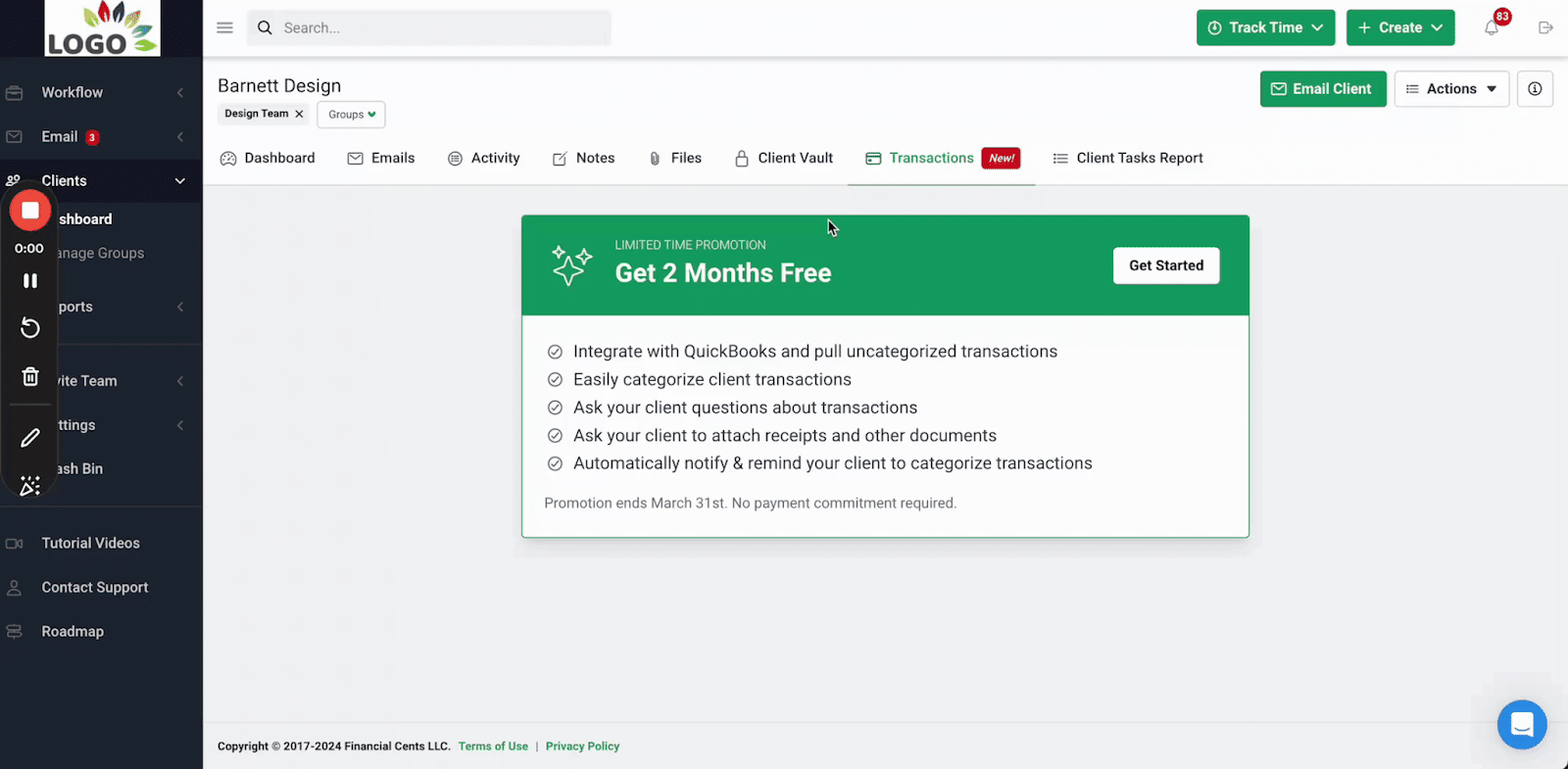

To make this easier, Financial Cents offers Month End Close software, a feature built to help firms review, reclassify, and manage uncategorized transactions directly from one platform.

Here’s what ReCats allows you to do:

- Automatically pull uncategorized transactions from QuickBooks Online: No more exporting spreadsheets or jumping into client files one by one. ReCats syncs with QuickBooks Online so you and your clients always have up-to-date transaction data, without manual work.

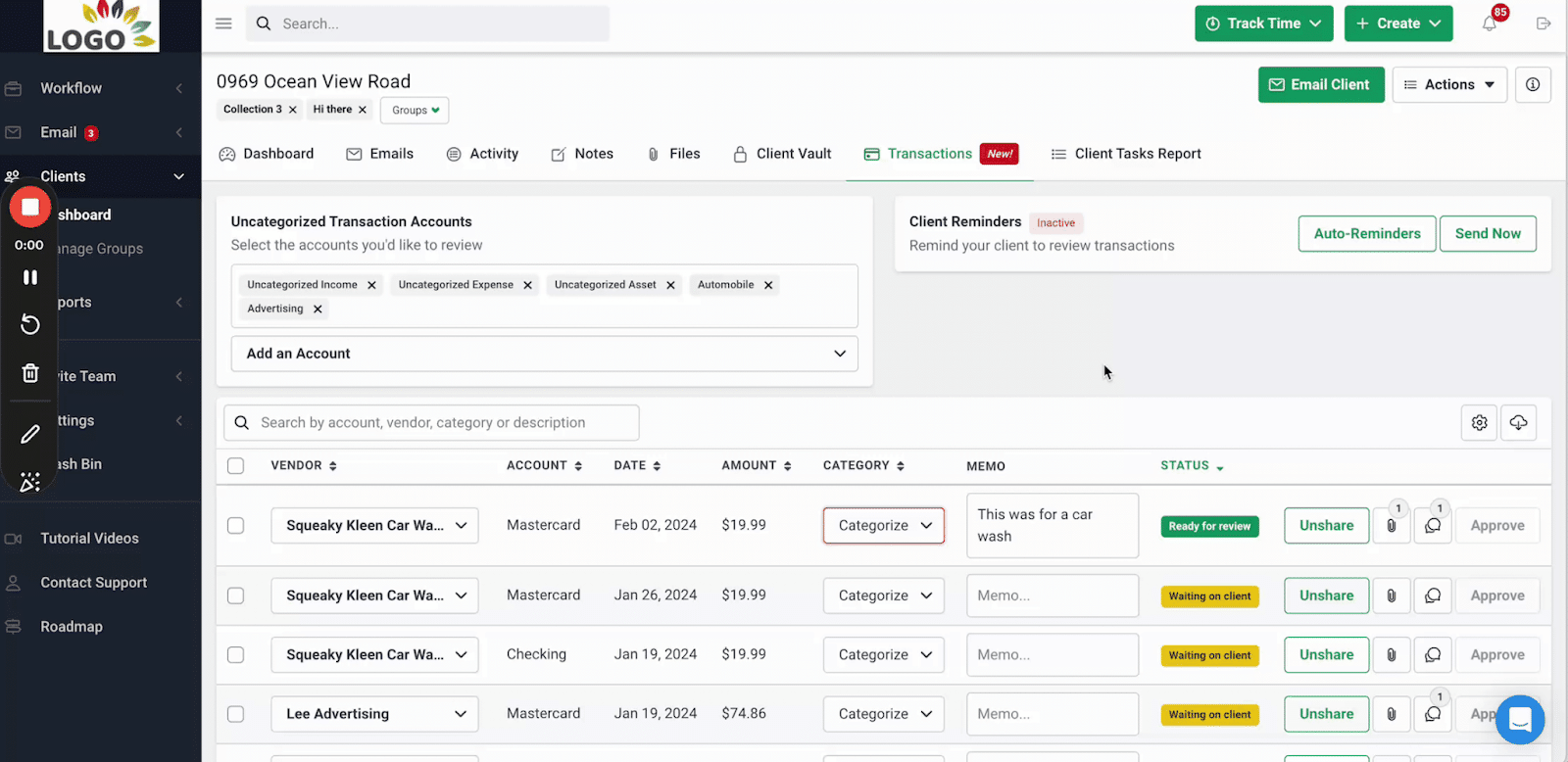

- Request missing details directly from clients: You can ask clients questions, request receipts, or ask for clarification, all within Financial Cents. Clients can respond within the tool so everything stays in one place.

- Send automated reminders: ReCats lets you schedule reminders for clients who haven’t responded, helping you keep workflows moving without constantly following up.

- Categorize transactions with ease: ReCats’ interface makes it easy to review and assign categories quickly. No clunky exports or switching between tools.

- Approve updated transactions: Once categorized, you can sync everything — transaction updates, notes, and documents — back to the client’s QBO file to maintain a single source of truth.

To integrate QuickBooks Online with ReCats, go to the “Transactions” tab in your client’s profile in Financial Cents and click “Get Started.” Then select “Connect to QuickBooks.”

You’ll be prompted to log in to your QuickBooks Online Accountant account. After logging in, select your firm and the client you want to connect. Choose which accounts you want to pull transactions from and assign team members to receive notifications. Click “Continue,” and ReCats will begin syncing your client’s uncategorized transactions.

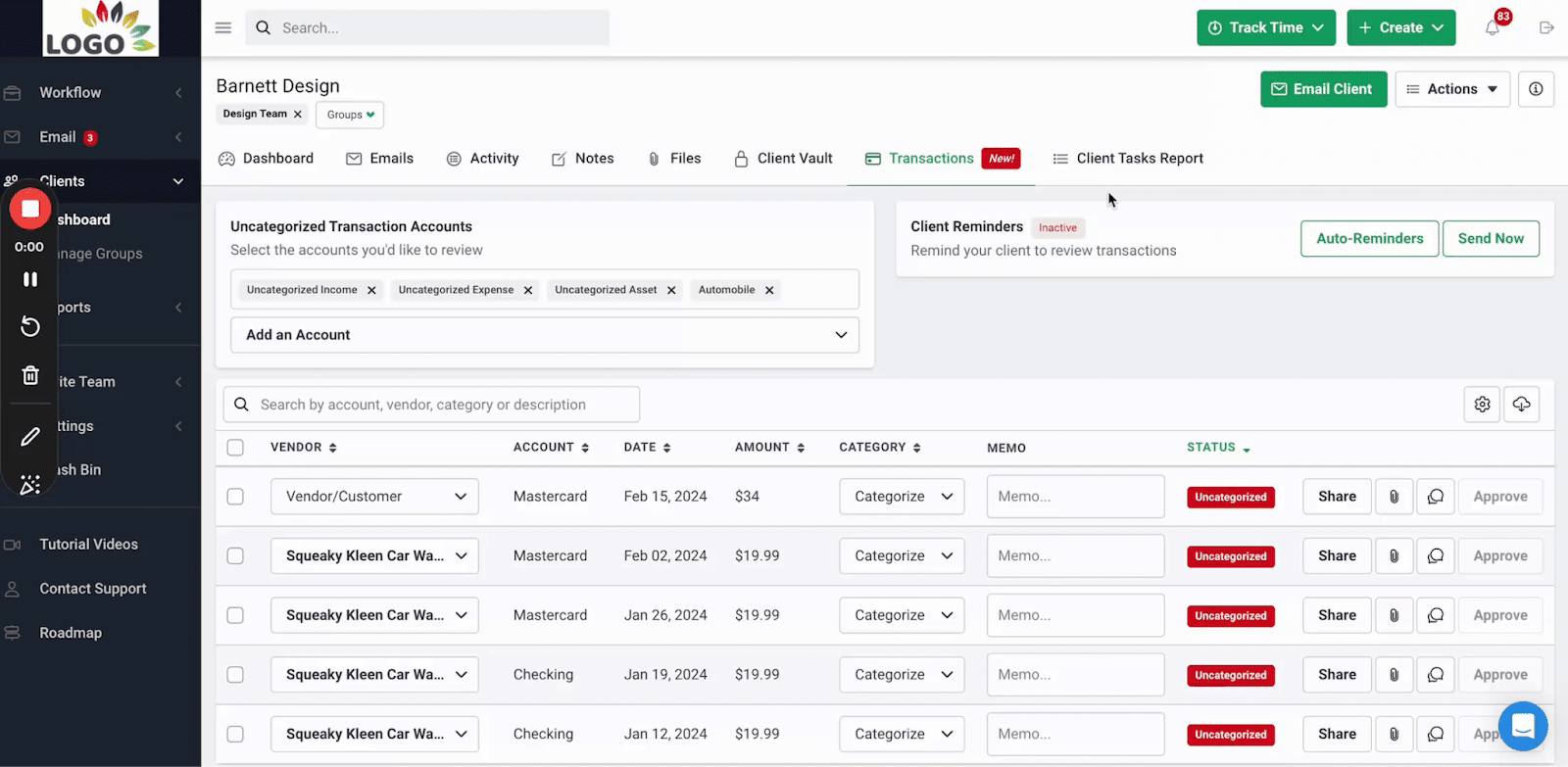

Once connected, you’ll find ReCats under the “Uncategorized Transactions” view in your Financial Cents dashboard. Here’s how it looks:

Master Your Expense Game

A clear, consistent process for recording and categorizing expenses in accounting helps your team work more efficiently and gives your clients better insight into their financial health. It also reduces errors, speeds up month-end close, and ensures nothing gets missed come tax season.

Financial Cents gives your firm the tools to make that process seamless. From managing recurring tasks and team workflows to cleaning up uncategorized transactions with ReCats, everything is built to help you stay organized and save time.

Ready to streamline expense tracking across your client base? Try Financial Cents today.