To file IRS form 2553 or not? This is a question many small business owners face and struggle with. As you know, a business’s tax classification and structure significantly impact the business. E.g., it can put it at a tax disadvantage or make it more challenging to raise money.

But deciding to file form 2553 means the business is changing its tax classification and electing the S corporation (S-corp) status. This comes with a few benefits, the biggest of which is tax savings options.

So, if your client’s business is small or mid-sized, an S-corp might be what they need as it helps them save more money.

Note: Only a C corporation (the default tax classification) or a Limited Liability Company (LLC) can change to an S-corp. Cooperatives (a corporation elected to be taxed under subchapter T of the Internal Revenue Code) are illegible and can’t migrate.

Our detailed guide explains all you need to know about form 2553. But if you need form 2553 instructions on completing and filing it, keep reading as we’ve outlined the steps below.

Understanding the Purpose of IRS Form 2553

Filing form 2553 is the major thing a business needs to do to move from a C corporation (C-corp) or LLC to an S-corp. If the IRS accepts and approves the submitted form, the business’s tax status changes.

Here are some differences between an S-corp, C-corp, and LLC to know why an S-corp is attractive to smaller businesses.

| S-corporation | C Corporation | Limited Liability Company (LLC) |

| It’s a corporation with 100 shareholders or less. | It’s a corporation with an unlimited number of shareholders. | It’s not a corporation and has no shareholders. What it has is (an unlimited number of) members. |

| Shareholders must be citizens or legal residents. | It admits non-US citizens as shareholders. | It allows foreign members. |

| Shareholders pay taxes on the business, not the business itself. | Both the shareholders and the business pay taxes, leading to double taxation | Like an S-corp, it’s only taxed once, and that’s on the members’ side. |

| Losses are also passed on to the shareholders’ personal tax returns and deducted. | Losses are not passed on to shareholders. | Members can deduct their share of businesses’ losses on their personal tax returns. |

| They can only issue one class of stock, mostly the “common stock” type. | They can distribute different classes of stock. | Not applicable. |

| Formation requires submitting Articles of incorporation, and form 2553 | Formation requires submitting Articles of incorporation. | Formation requires submitting Articles of organization. |

Preparing to File IRS Form 2553

Before filing form 2553, you must get a few things in order. Here are the steps you need to take.

- First, ensure the client is eligible for S-corp status. There are specific requirements your client’s business must meet, like:

-

- It must be a domestic corporation

- It has no more than 100 shareholders

- Shareholders must be qualified, meaning they must be individuals, certain trusts, or estates. And must be US citizens or residents.

- It isn’t an ineligible corporation like certain financial institutions that account for bad debts using Section 585, insurance companies that pay taxes under Subchapter L, and current or former Domestic International SaleS-corporation (DISC).

- It has only one class of stock

- Its business year is one of the following:

- A tax year ending December 31.

- A natural business year.

- An ownership tax year.

- A tax year elected under section 444.

- A 52-53-week tax year ending with reference to a year listed above.

- Any other tax year (including a 52-53-week tax year) for which the corporation (entity) establishes a business purpose

If your client meets these criteria, move to the next step.

- Receive essential client information and documentation. Since you’re filing on behalf of your client, you must collect certain documents and details you’ll need during the process. They include:

-

- Entity information: Corporation’s true name, mailing address, date incorporated, state of incorporation and Employee Identification Number (EIN).

- Effective date and tax year

- Officer or legal representative information: If your client wants someone else (not you) to be the contact person for the IRS, collect the person’s name, title, and telephone number.

- Shareholders’ information: Name, address, Social Security Number (SSN) or EIN, ownership percentage, shareholder’s tax year ends, and signatures to consent.

- Information of eligible Trusts who want to become shareholders: Income beneficiary’s name and address, Trust’s name and address, SSN, and EIN.

- Operating Agreement or Bylaws: Technically, this is not part of the IRTS requirements, but having the business’s bylaws is helpful as it could contain relevant information about the business.

You can use this clients tax preparer checklist to ensure you get these information from clients.

Once you’ve received and verified these details,

- Review instructions. You need to review and understand the IRS instructions, like deadlines and filing methods, to avoid making mistakes.

Now, let’s get into how to file the form.

Step-by-Step Form 2553 Instructions

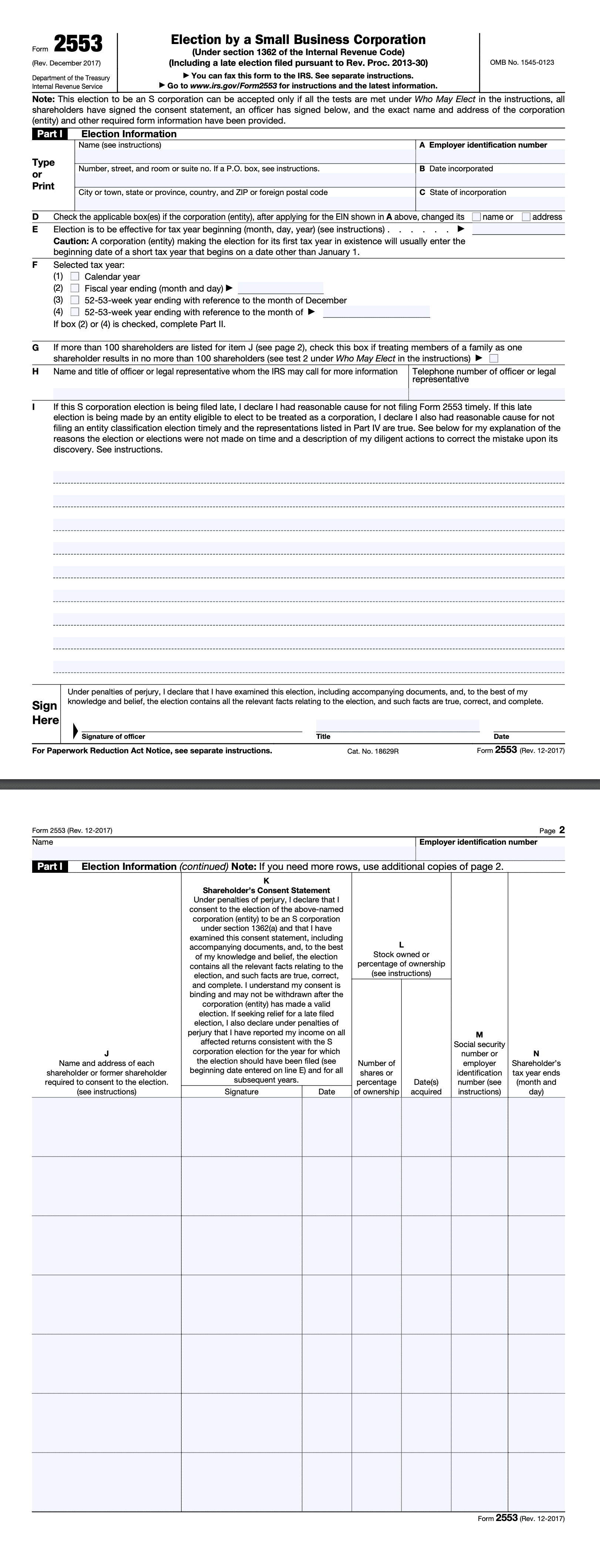

IRS form 2553 has four sections and five pages. See how to complete each section.

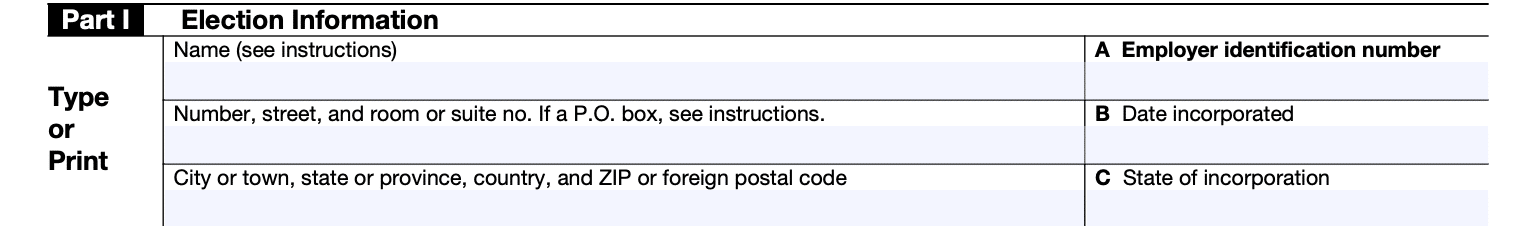

1. Fill in the corporation’s name, street, address (with country), date incorporated (date the entity was formed with the state), state of incorporation, and EIN. If the corporation doesn’t have an EIN, it must apply for one by following the instructions here. If the EIN isn’t ready when filing, write “Applied for” in the field.

2. Check the appropriate box if the corporation or entity changed its name or address after applying for EIN.

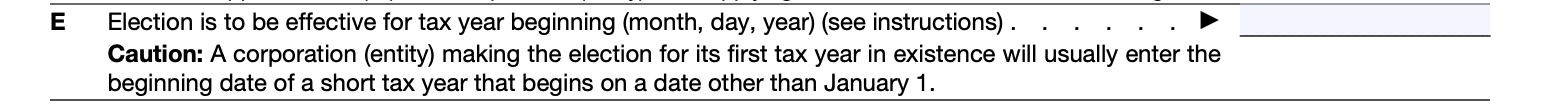

3. Write the date (month/day/year) you want the election to start.

A few things to note.

If it’s the corporation’s first tax year, put the earliest of any of these dates:

- The date the entity first had shareholders (owners),

- The date the entity first had assets,

- The date the entity began doing business.

If it’s not the corporation’s first tax year and it’s keeping its current tax year, enter the beginning date of the first tax year for which it wants the election to be effective.

If it’s not the corporation’s first year, but it wants to change its tax year and become an S-corp for the short tax year needed to switch tax years, enter the beginning date of that short tax year. However, if it doesn’t want to be an S-corp for this short tax year, enter the beginning date of the tax year following this short tax year and file Form 1128, Application To Adopt, Change, or Retain a Tax Year.

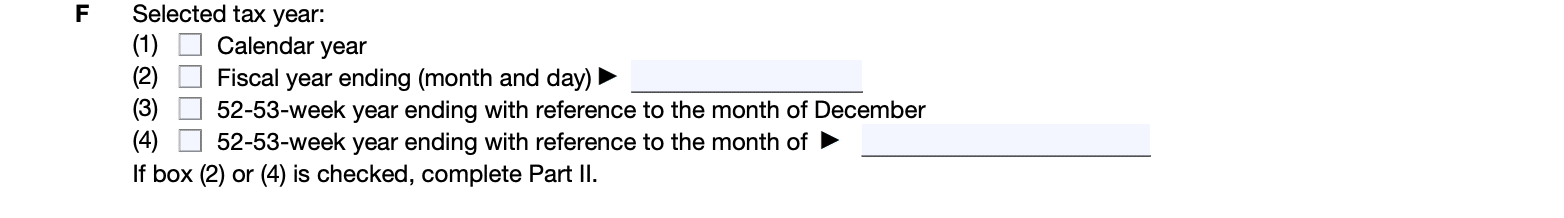

4. Select the tax year the business will use. If you check box (2) or (4), you must complete Part II of the form.

5. The law sees family members as one shareholder, so check this box if treating family members as such.

6. Fill in your name, title, and phone number as legal representative. Or, if the client wants someone else, fill in the person’s details.

7. Filing late i.e. after the deadline? Provide a reasonable explanation why in this field. Add the representations in part IV (you’ll see them soon) to your statement. You can only request late relief filing within three years and 75 days of the intended election date you entered on Line E.

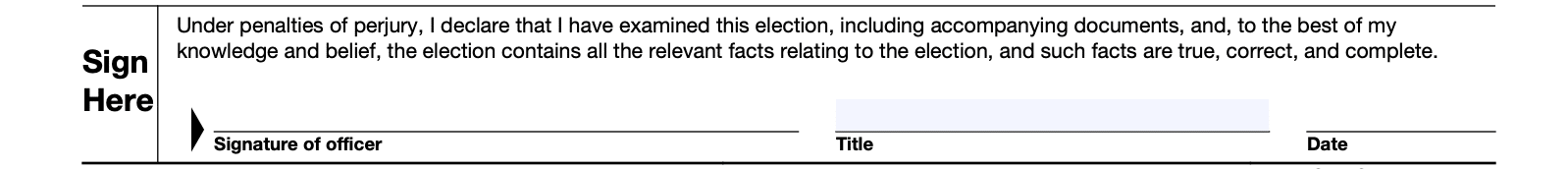

8. If you have the legal authority to act on behalf of the company, then wet sign (not e-sign) here and enter your title and date. If not, have someone holding an executive position (e.g. president, vice president, or treasurer) in the company to sign.

9. Put the company’s name and EIN at the top on the next page.

10. Then enter each shareholder’s name, and address, have them sign (no e-signatures), and put the date.

If you’re filing before the effective date entered on line E, only enter shareholders who own stock on the election day. If filing on or after the date, all shareholders (current and former) who owned stocks during the period that begins on the effective date and ends on the day of the election must consent.

Next, include the number of shares they own, date acquired (usually the date of incorporation except for new shareholders whose data is after), their SSN or EIN (for trusts, estate, or exempt organizations), and the month and date each shareholder’s tax year ends.

For those in community property states — Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin — you must include the spouse’s details in the same format as the shareholders.

Enter their name, put “(Consenting Spouse)” after the name, enter their address (usually the same as the owner’s), have them sign, and add the date. Put “N/A” for the number of shares and date acquired, then add their SSN and the date their tax year ends.

However, if the spouse is a shareholder, don’t put “(Consenting Spouse)” after their name. Also, put their actual number of shares and the date acquired.

Print and use additional copies of this page if you need more rows to fill in more shareholders’ information.

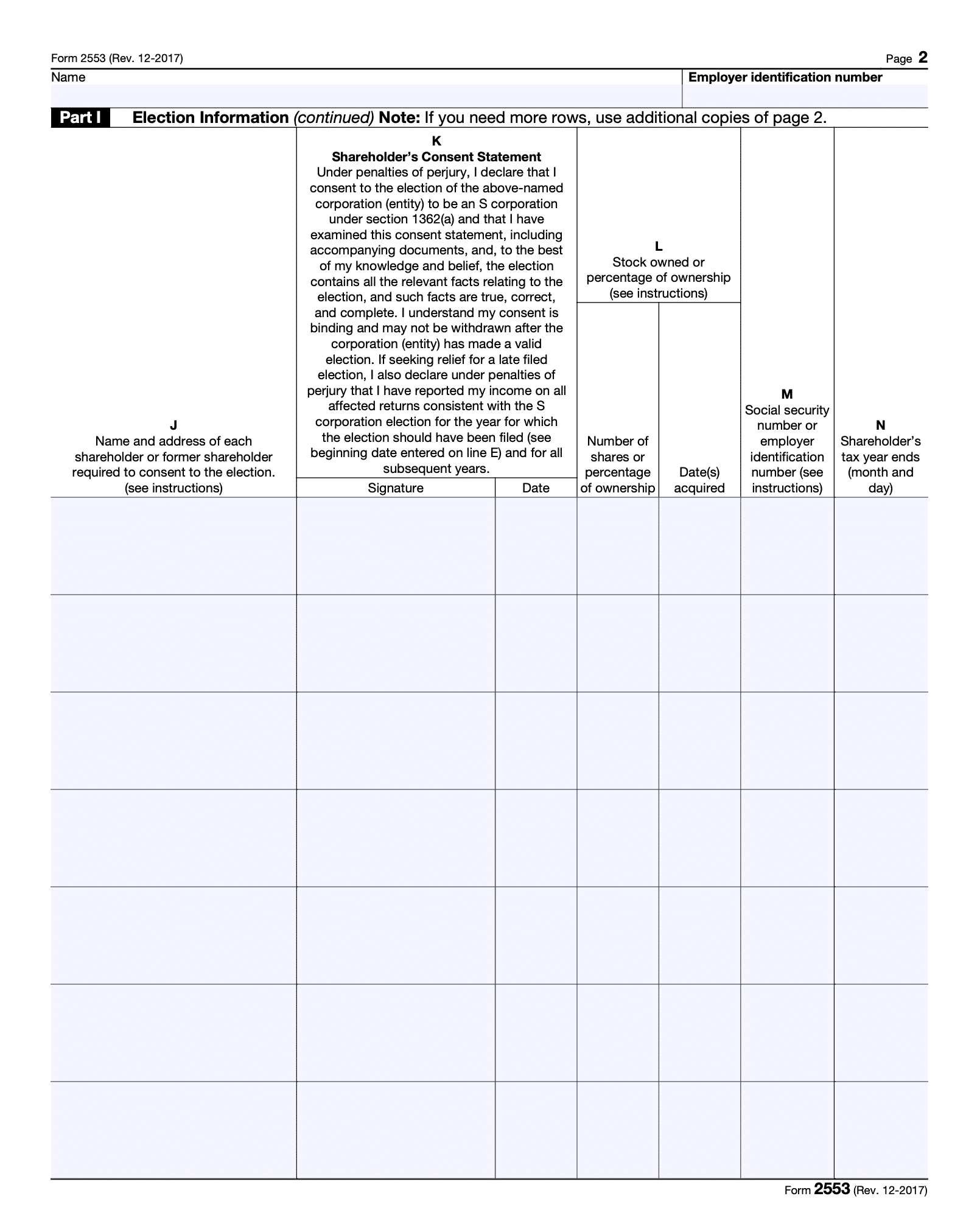

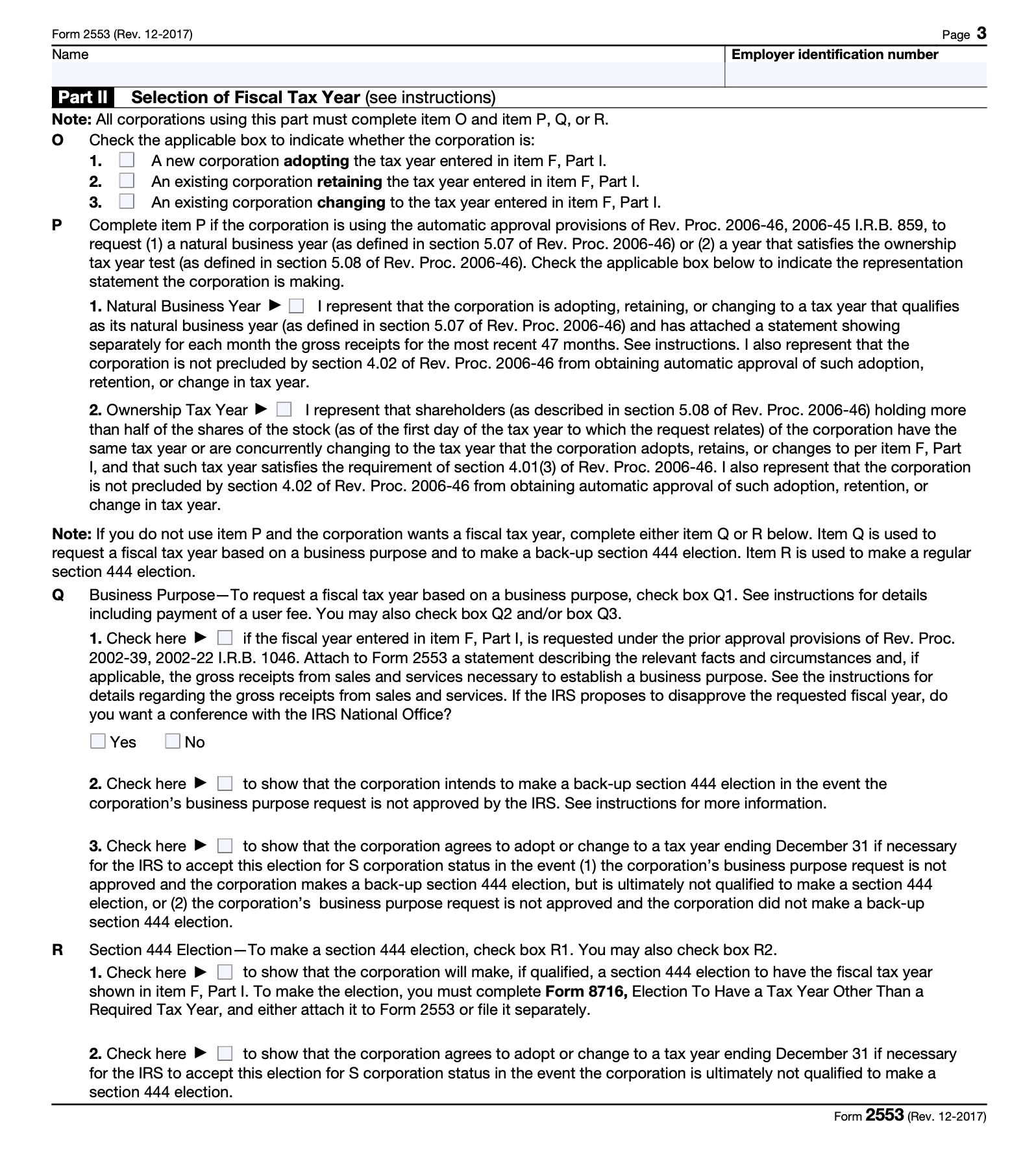

Part II – Selection of Fiscal Tax Year

Complete part II only if you checked checkbox (2) or (4) in Part I, line F i.e. the tax year line.

1. Fill in the company’s name and EIN at the top of the page.

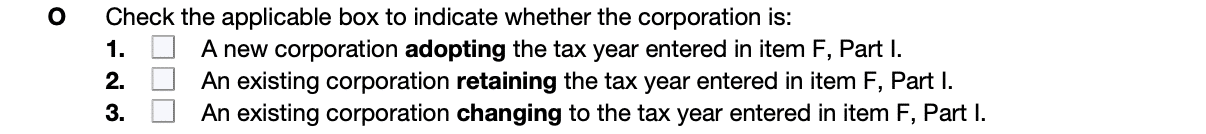

2. Check the appropriate box if you’re adopting, retaining, or changing the tax year entered in Part I.

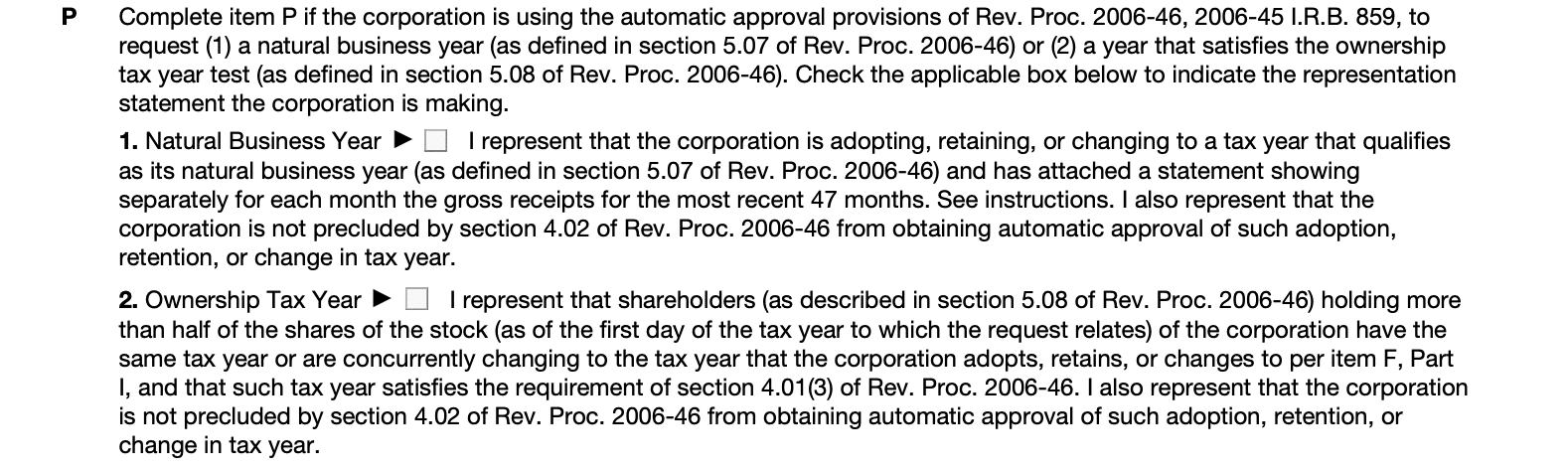

3. Check the type of tax year the business uses: natural business year or ownership tax year. The former is also known as fiscal year and aligns with a business’s regular operating cycle, i.e., its peak periods and seasonal fluctuations.

The latter is the tax year used for tax reporting purposes based on the tax years of majority interest owners or partners in the business.

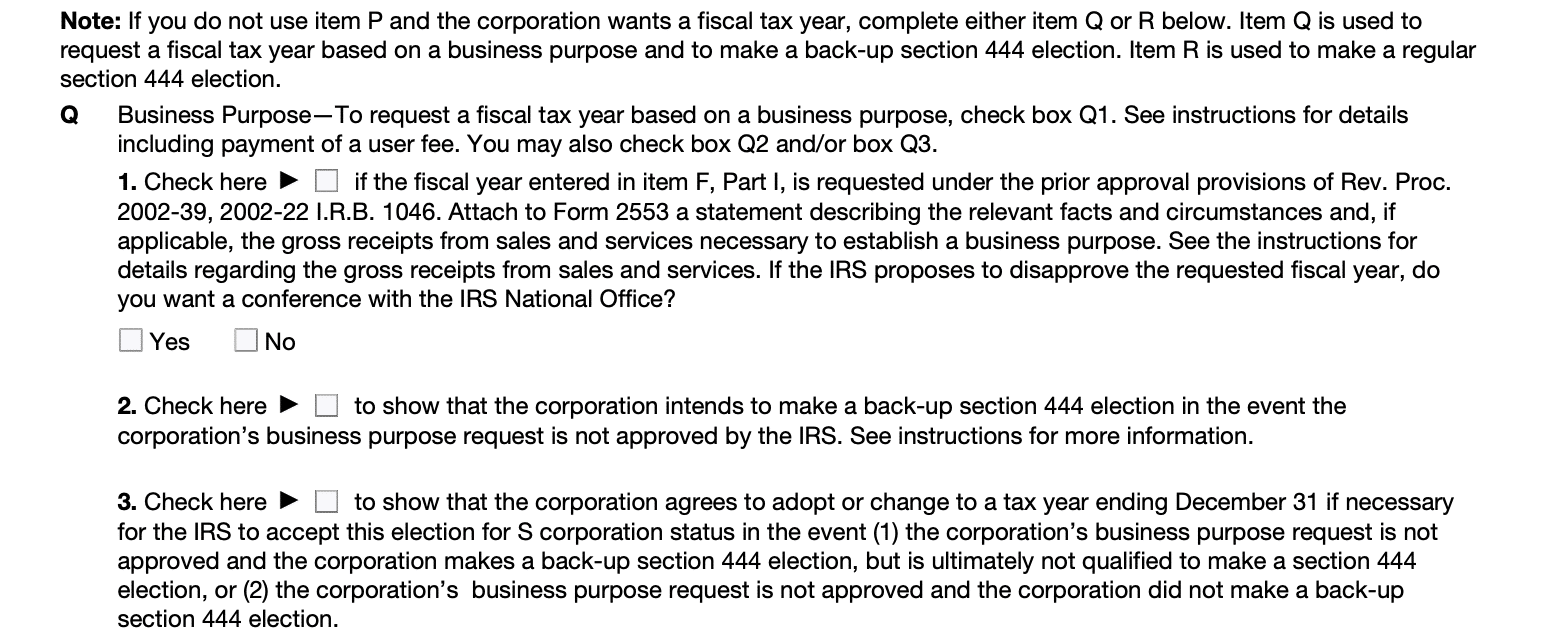

4. If the corporation doesn’t use a natural business or ownership tax year and still wants a fiscal year, request one based on a business purpose in this section. Read the terms and check the necessary boxes. Attach a statement establishing the “business purpose” and why the IRS should grant the fiscal year request. Check the appropriate box if you want to make a backup fiscal selection in case the IRS denies your fiscal year request.

Also, if the IRS denies the business purpose and backup fiscal year request (or you didn’t make a backup), check the appropriate box to agree to adopt or change to a tax year ending December 31.

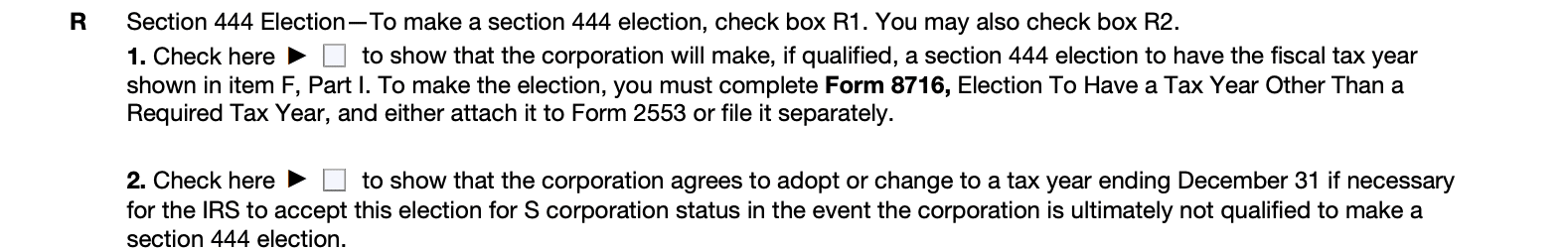

5. If you intend to make a 444-section election, fill out this part, and agree to adopt or change to a tax year ending December 31 if necessary.

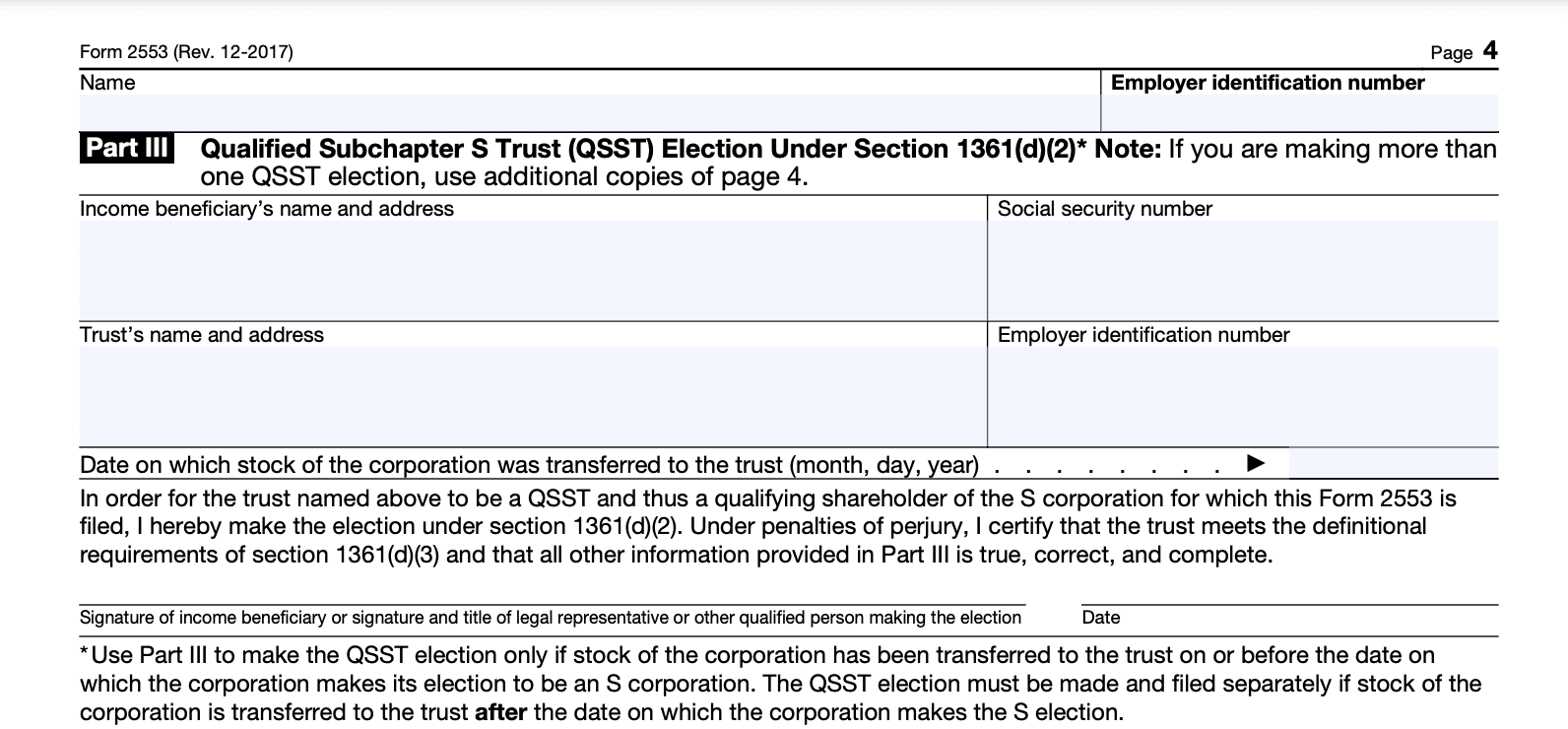

Part III – Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)

This section is for certain trusts qualified to become shareholders. Chances are you’ll not need to complete it, but here’s how to do it for the rare occasions you might need to.

1. Fill in the company’s name and EIN at the top of the page.

2. Enter the Income beneficiary’s name, address, and Social Security Number (SSN).

3. Enter the Trust’s name, address, and Employee Identification Number (EIN).

4. Put the date (Month/Day/Year) on which stock of the corporation was transferred to the trust.

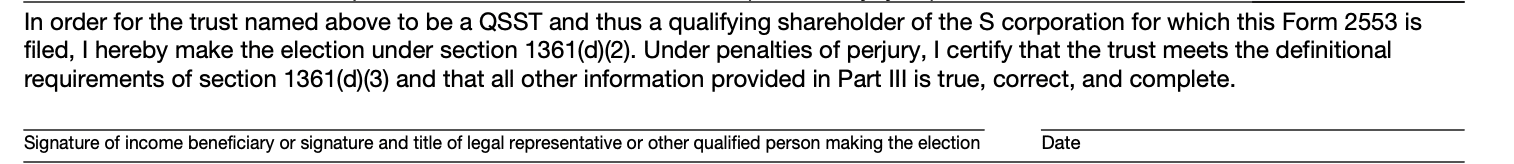

5. Wet signature of income beneficiary or your signature and title or that of any other legal representative.

If you are making more than one QSST election, make and use copies of this page (page 4).

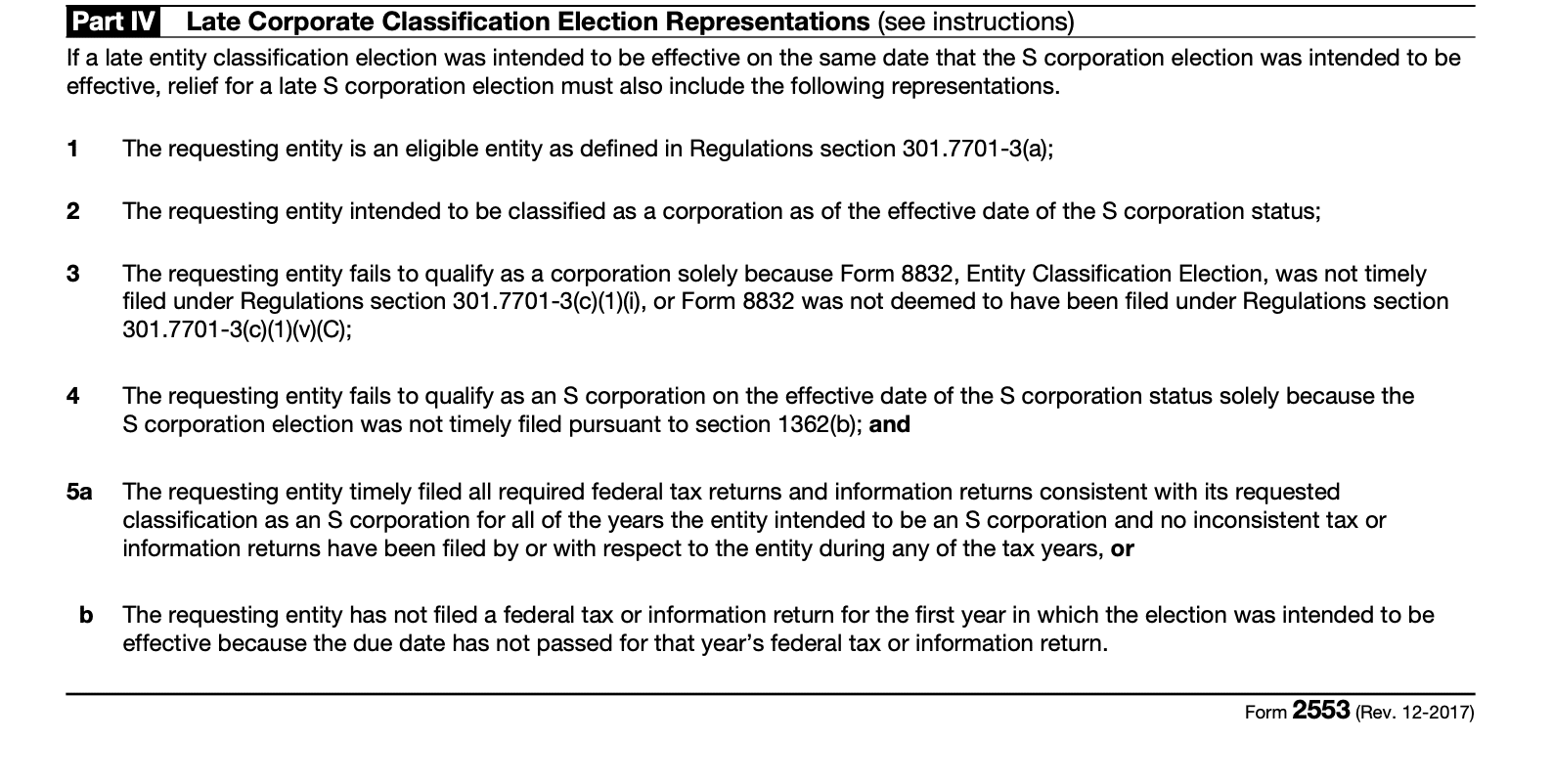

Part IV – Late Corporate Classification Election Representations

This section is for filing late and requesting ‘relief from a late election’. It includes representations you can add to the statement you made in Part I, line I, for late filing.

You don’t need this section if you’re filing within the deadline.

You may be interested in:

How to File: Filing Methods

After completing the form, you can send original copies of your filed election to the IRS by mail or fax.

If the business is in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin, mail to the “Department of the Treasury Internal Revenue Service Kansas City, MO 64999.” Or fax to # 855-887-7734.

However, if the corporation is in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, mail to the “Department of the Treasury Internal Revenue Service Ogden, UT 84201.” Or fax to # 855-214-7520.

Alternatively, you can use a Private Delivery Service (PDS) to submit. Find the list of the IRS-approved PDS here. If you’re using a PDS, only send it only to the following mailing addresses:

- Austin – Internal Revenue Submission Processing Center

3651 S IH35,

Austin TX 78741 - Kansas City – Internal Revenue Submission Processing Center

333 W. Pershing,

Kansas City, MO 64108 - Ogden – Internal Revenue Submission Processing Center

1973 Rulon White Blvd.

Ogden, UT 84201

Don’t forget to keep your fax or delivery confirmation, as it may be useful in the future.

What Next?

After filing, wait for the IRS to approve or deny your request. The waiting period is usually 60 days.

If they accept your application, you or your client will receive a CP261 Notice or S-corp approval notice. Make copies of the original, keep one copy for your records, and give the rest to the clients to keep.

But if they reject your application, you or your client will receive a CP264 Notice. Review the rejection notice if you get it. The IRS will reveal why they didn’t accept the application. Correct these issues or errors and resubmit. They should accept it the second time if you do exactly as they say.

If you don’t hear from them after 60 days for approval or rejection, call them at 800-829-4933 or contact your local IRS office to check on the status of your application.

TL;DR

- A business’s tax classification is, by default, a C-corp.

- However, it has the option of electing to become an S-corp if it wants to enjoy certain benefits like paying less taxes.

- To become an S-corp, the business has to file form 2553, which is where you come in as the accountant or bookkeeper.

- Before filing, confirm if the business meets the IRS S-corp requirements first, then collect all the necessary information you need.

- Fill it out with the form 2553 instructions outlined above and submit it by mail to the correct address or fax to the correct number.

- Wait 60 days for the IRS to accept or reject your application.

- If rejected, correct the mistake you made in the previous application and reapply. They should accept it this time.

- And that’s all there is to it! If you’re ever in doubt while filling out the form, you can either check the full 2553 instructions on the IRS Website or contact the IRS for guidance.

With multiple clients, juggling all their needs and keeping track of deadlines is difficult. So, use Financial Cents to manage your firm to stay on top of it all and avoid making silly mistakes like missing the deadlines for submitting important documents. We help you track your clients and organize everything in one place.

Why not take our software for a free spin?