85% of American citizens pay their taxes voluntarily and on time, according to the IRS tax gap report. Yet, the U.S. loses a staggering $190 billion to tax evasion each year.

Also, Statista data shows the US loses $188.8 billion yearly to tax avoidance more than any other country.

What could be responsible for these enormous tax losses?

For starters, tax evasion stems from deliberate or unintentional schemes by individuals to avoid paying taxes.

There are also cases where taxpayers take part in certain transactions that generate tax benefits. However, failure to report such transactions means avoiding or evading paying taxes. This leads to reduced tax revenues for the U.S. government to run the economy.

To curb this issue, the IRS requires taxpayers to disclose these reportable transactions i.e. transactions that have the potential for tax avoidance or evasion using Form 8886: Reportable Transaction Disclosure Statement.

This helps the IRS identify potential abusive tax schemes and take appropriate actions. Failure to comply could lead to severe tax and legal penalties.

As such, accounting professionals like you must help your clients understand Form 8886 filing requirements to ensure they remain tax-compliant.

We recently published an article discussing all you need to know about Form 8886. But if you need step-by-step filing instructions, read on.

Understanding the Purpose of IRS Form 8886

Whenever taxpayers engage in reportable transactions, they must file Form 8886. Doing this provides the IRS with detailed information about these transactions such as:

- Nature of the transaction

- Parties involved

- Expected tax benefits

- Tax strategy employed

For instance, your client purchases partial ownership interests in land and donates the development rights to a charity, generating substantial tax deductions.

This transaction would be considered reportable as it falls under transactions the IRS deems as a tax avoidance transaction. As such, your clients need to file Form 8886 to disclose the details of this transaction to the IRS.

Filing form 8886 serves two primary purposes:

- Transparency: It allows the IRS to identify the details of certain transactions. This information helps them ensure compliance with tax laws and uncover potential attempts to circumvent tax obligations.

- Deterrence: By requiring disclosure of potentially abusive transactions, the IRS aims to discourage taxpayers from engaging in them.

- Assess tax risks: Understanding the nature and intended tax benefits of a transaction helps the IRS assess its potential impact on tax revenue and prioritize its resources accordingly.

- Take appropriate action: When there are red flags, the IRS can initiate investigations, audits, and other measures to hold individuals and businesses accountable for their tax obligations.

Preparing to File Form 8886 for Clients

If your clients don’t complete Form 8886 per the IRS instructions, it means they’ve not complied with the disclosure requirements. This can lead to future penalties.

Therefore, ensure you make adequate preparations before filing Form 8886. Here are some steps to ensure accurate reporting and compliance in line with IRS requirements:

Gather Essential Client Information and Documentation

Before completing Form 8886, request your client’s information such as their full name, contact details, and taxpayer identification number.

Also, gather all relevant supporting documents related to the reportable transactions. This may include contracts, agreements, invoices, receipts, financial statements, or any other records that provide evidence of the transactions.

These documents are important in supporting the information you provide on the form.

Identify reportable transactions and potential tax consequences

Once you’ve gathered all the necessary documents, the next step is to identify the reporting transactions your clients participated in.

Analyze each transaction to determine if it meets the IRS criteria for reportability. Some key factors to consider include the complexity of the transaction, potential tax benefits, and the entities involved.

Assess the client’s level of participation in the transactions

When identifying your client’s reportable transactions, it’s essential to assess their level of participation in these transactions. This helps ensure accurate reporting and compliance with IRS requirements.

You can interview your clients and analyze their financial records to gather as much information as you can about their level of participation.

Recommended Resource

Step-by-Step Form 8886 Instructions

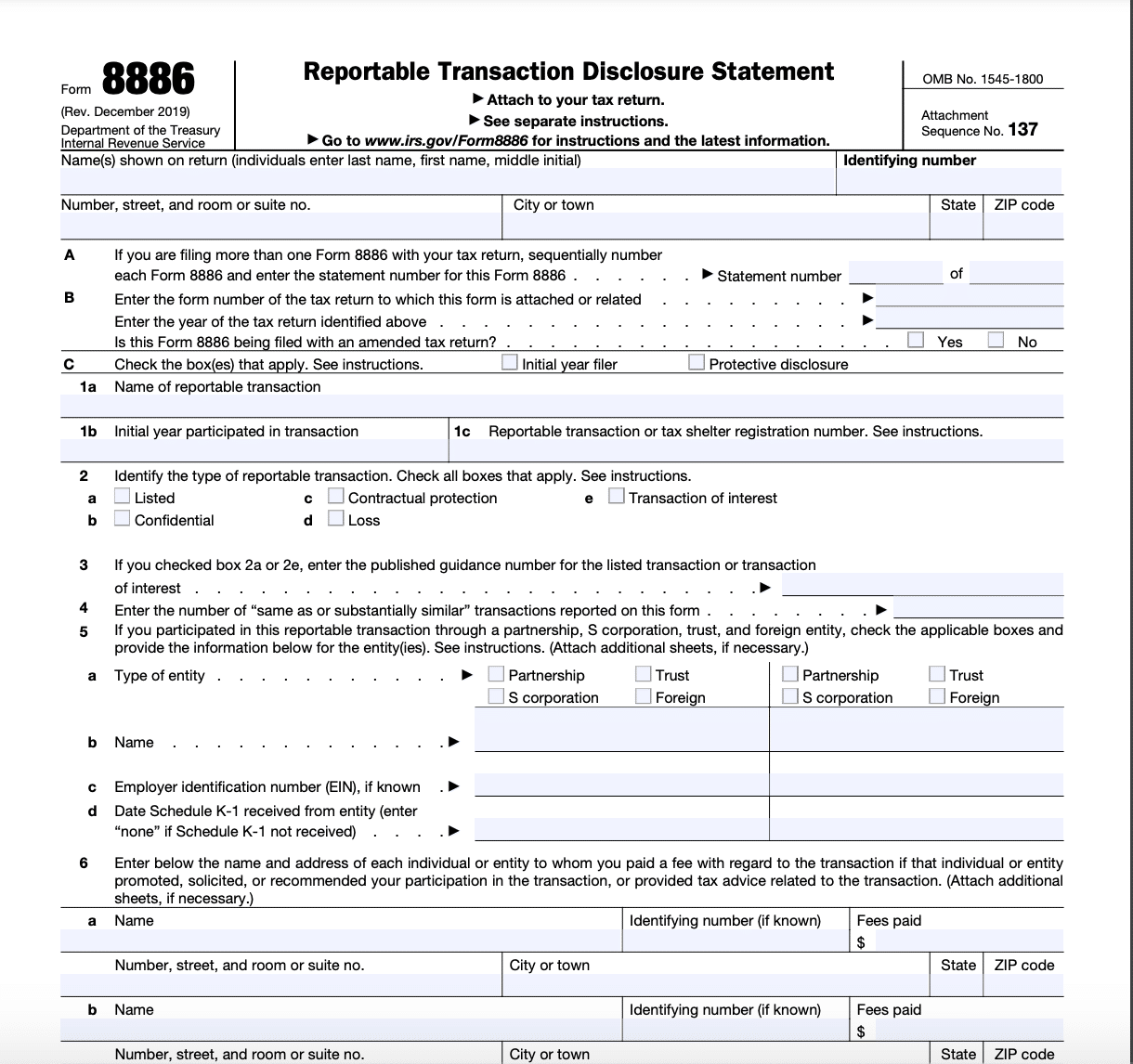

Form 8886 is typically filed together with an income tax return. Keep it handy as you’ll need some information from it.

Filing form Form 8886 has one part and two pages. Follow the filing instructions to ensure your clients don’t encounter any unforeseen issues.

[Source]

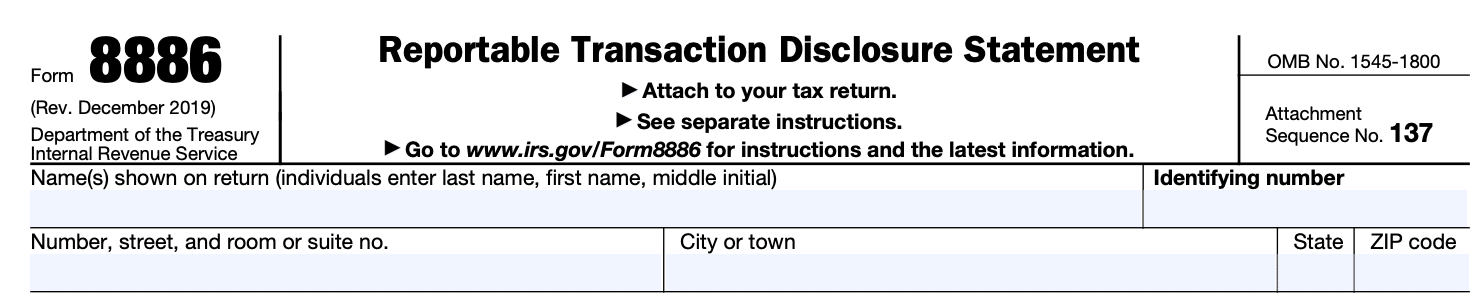

At the topmost part of the form is where taxpayers enter their basic information such as full name, identifying number (SSN, ITIN, or EIN), and address.

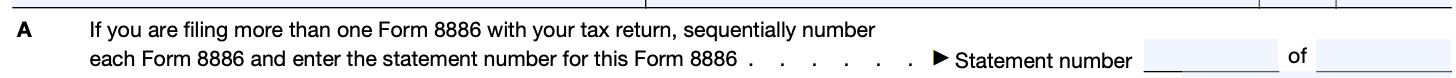

Line A: Clients are required to file a separate form for each reportable transaction they take part in and label them sequentially. In this line, provide the specific statement number for the current form.

For example, if you’re filing two Form 8886s, you label the first form as “Statement number 1 of 2” while the second would be Statement number 2 of 2.

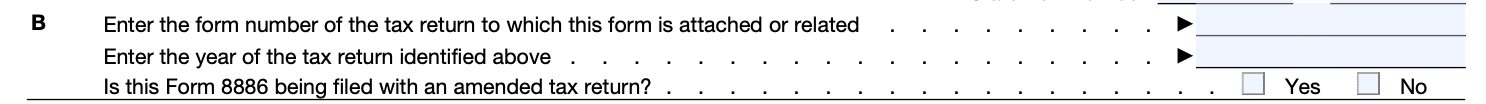

Line B: Provide the attached tax return form number, tax return year, and check the appropriate box to confirm if you’re filing this form with an amended tax return.

Line C: Check the appropriate box to disclose if:

- This is your first year of filing a Form 8886. If it is, then you’ll need to file a duplicate copy of the disclosure statement with the IRS Office of Tax Shelter Analysis (OTSA).

- It is a protective disclosure. Checking this option means you’re filing this form on a protective basis. According to the IRS regulations, taxpayers can file a protective disclosure without providing the complete details of the transaction. However, for the IRS to consider this form as a valid protective disclosure, you must properly complete and file it. Also, provide all required information upon the IRS request.

Note: The IRS does not treat Form 8886 filed on a protective basis differently from other forms 8886. This means a protective disclosure does not grant any special treatment or immunity scrutiny.

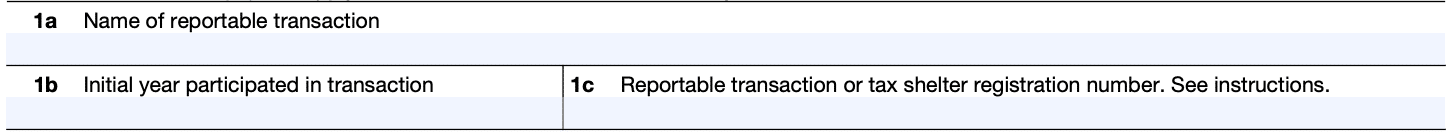

Line 1a: Enter the name of the reportable transaction that your client participated in. Where none exists, simply fill in a description that’s different from other reportable transactions. If no name exists, provide a short description of this transaction that differentiates it from other transactions on the form.

Line 1b: Enter the first year that the client participated in the reportable transaction in year format (YYYY). Reporting for more than one transaction requires you to enter all initial years.

Line 1c: Material advisors involved in any reportable transactions are required to file Form 8918. Once filed, the IRS issues reportable transaction numbers, also known as tax shelter numbers. As such, material advisors must provide this number to their advisees.

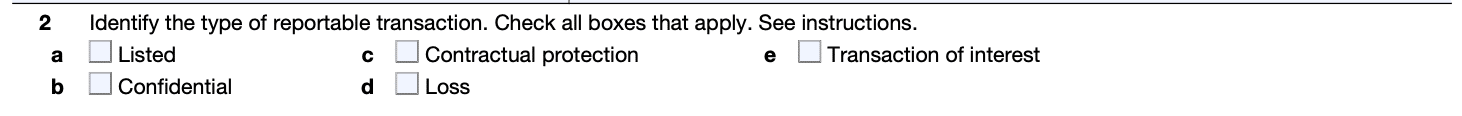

Line 2: There are five types of reportable transactions namely: listed, contractual protection, transaction of interest, confidential and loss transactions. Check the box that applies to the one being reported.

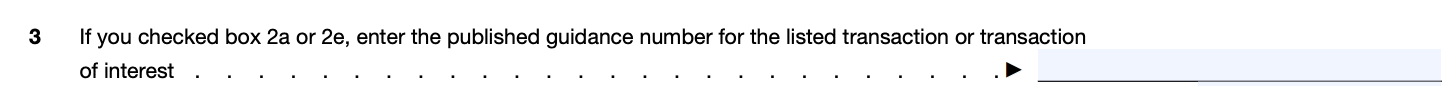

Line 3: Choosing listed transactions or transactions of interest in line 2 above requires you to provide the published guidance number. Find a full list of listed transactions in Notice 2009-59, 2009-31 I.R.B. 170, on this existing IRS guidance page. For transactions of interest, identify them on this IRS guidance page.

Line 4: As a rule of law, you must not report more than one transaction on each Form 8886 unless the transactions are the same or substantially similar.

According to the IRS, “a transaction is substantially similar to another if it is expected to obtain the same or similar types of tax consequences and is either factually similar or based on the same or similar tax strategy.”

If you have such reportable transactions, enter the total number in this line.

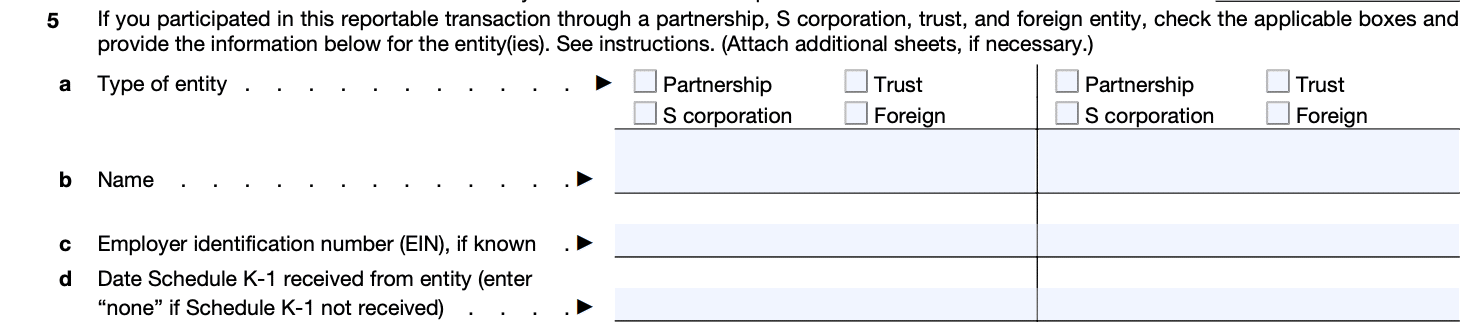

Line 5: If clients take part in reportable transactions through other entities such as partnership, S corporation, foreign, or trust, indicate the type of entity in this line.

In Line 5b, provide the complete name of the entity.

In Line 5c, if you know the entity’s employer identification number, enter it here

In Line 5d, provide the date you received the Schedule K-1 from the reporting entity. Enter ‘none’ if you never received a Schedule K-1.

If you’re reporting more than one entity, use a separate column for each entity. For two or more entities, attach additional sheets.

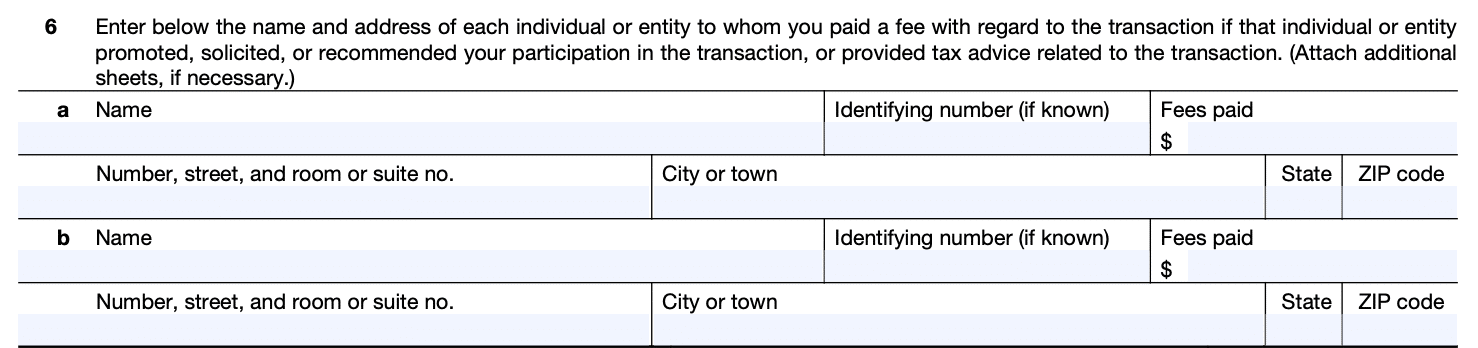

Line 6: Provide information such as name, address, SSN or EIN, and fees paid to material advisors involved in the reportable transaction.

These fees include payment in cash or kind, for a tax strategy or advice. Fees also include consideration for services to:

- Analyze the transaction (whether related to the tax consequences of the transaction)

- Implement the transaction

- Document the transaction

- Prepare tax returns to the extent the return preparation fees are unreasonable.

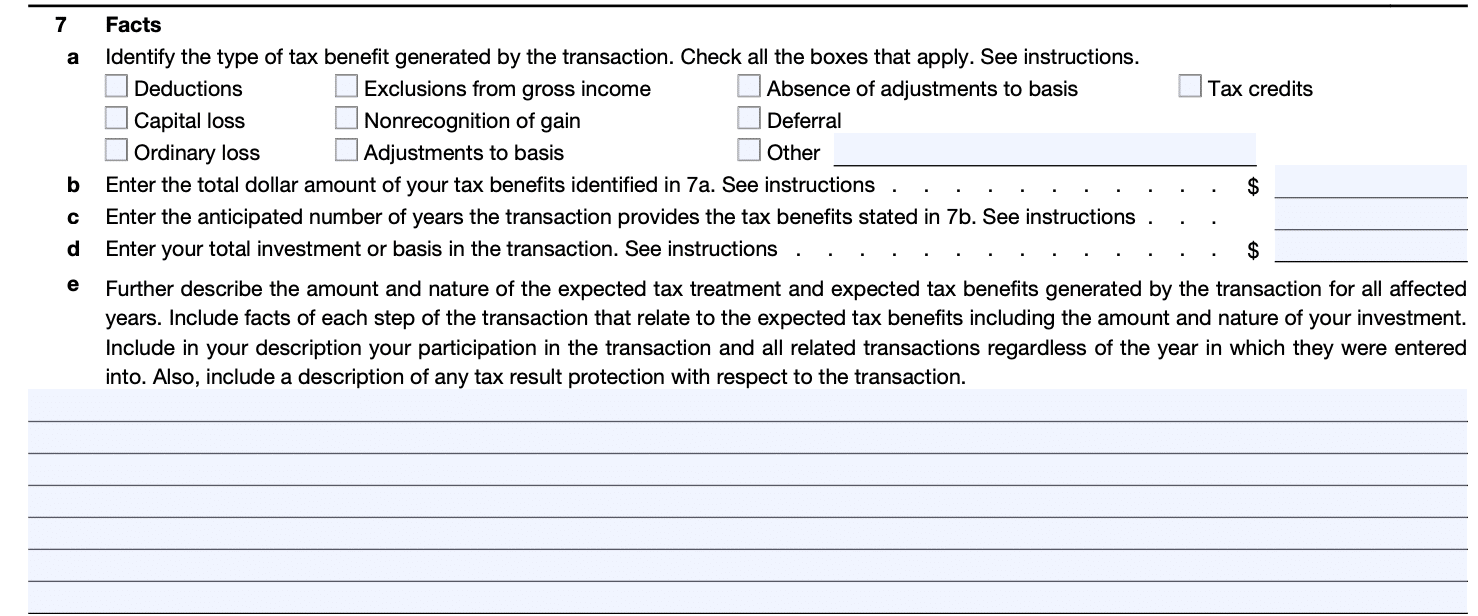

Line 7: Check the box to identify the type of tax benefit the reportable transaction generated. If you can’t identify the tax benefit, check the “other” box and write it in the space provided.

In line 7b, enter the expected total amount of all tax benefits checked in line 7a (in dollars).

In line 7c, enter the expected number of years it will take to claim all tax benefits.

In line 7d, fill in the total investment or basis in the transaction i.e. According to the IRS, this is the total amount your client paid including cash, fair market value of property or services transferred or acquired, adjustments to basis, valuation of notes, obligations, shares, or other securities.

In line 7e, give a detailed description of your client’s participation in reportable transactions. Also, state all the amounts, facts, and tax benefits that made it a reportable transaction.

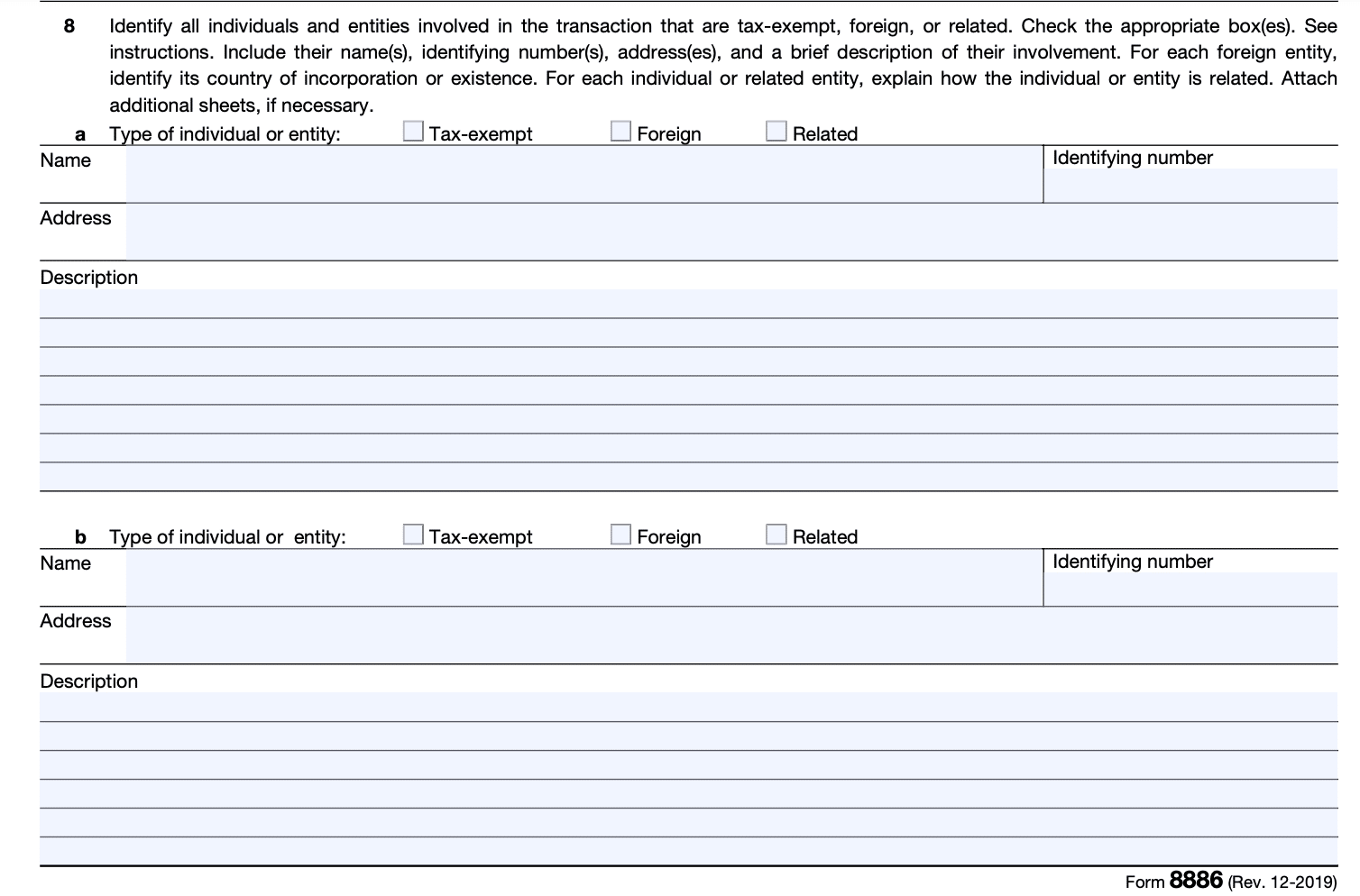

Line 8: Identify all individuals and entities involved in the transaction. Tick the checkbox to indicate if they are tax-exempt, foreign, or related. Include their names, EIN/SSN, addresses, and a brief description of their involvement in the transaction.

Also, taxpayers must explain their relationship with each individual or entity. For each foreign entity, identify its country of incorporation.

There you have it! A step-by-step guide on how to complete Form 8886 for your clients. Remember, we mentioned the IRS has strict penalties for providing incomplete or inaccurate information when filing Form 8886.

Recommended Reading

All You Need to Know About IRS Form 8886 Reportable Transactions

Common Errors to Avoid When Filing Form 8886

Here are some common errors to watch out for when filing Form 8886 and how to avoid them.

- Failure to identify reportable transactions: Not recognizing reportable transactions and failing to file Form 8886 when due might lead to severe fines. Ensure you stay updated on the IRS guidelines and regulations regarding reportable transactions to identify and report them accurately.

- Incomplete information: Ensure all required fields on Form 8886 are complete and accurate. Double-check the information provided, such as transaction details, taxpayer identification numbers, and dates to avoid any inconsistencies or omissions.

- Insufficient supporting documentation: It’s important to maintain thorough and proper documentation related to the reportable transactions. Be sure you have all the necessary documents and records that validate the information reported on Form 8886. Keep these documents organized and easily accessible for reference or a request from the IRS.

- Late or missed filing: Stay updated with filing deadlines for Form 8886, and ensure you submit it on time. Late or missed filings can incur penalties. You can use software like Financial Cents to set up a system to track filing deadlines and ensure timely submission.

Taking precautions and being diligent when completing Form 8886 helps you avoid these common errors.

How to File Form 8886

You can file Form 8886 electronically or via mail. Let’s look at how to file both ways:

How to File Electronically

The IRS advises taxpayers to file electronically because it’s easier, faster, safer, accurate, and more convenient. Also, it ensures processing and refunds.

To e-file your tax return and Form 8886, go through any IRS e-filing options or contact an authorized e-file Provider.

How to File via Mail

To File form 8886:

- Download the exact copy from the IRS website.

- Complete the form, ensuring all the information provided is accurate

- Attach any required documentation or supporting documents

- Mail it with your client’s income tax or information return. Find where to file via mail here.

Note: If this is the first year of filing Form 8886, send an exact copy to the Office of Tax Shelter Analysis (OTSA) after filing the form with your income tax return. Failure to do this could lead to penalties.

Mail the exact copy to

Internal Revenue Service

OTSA Mail Stop 4915

1973 Rulon White Blvd.

Ogden, UT 84201

Via fax:

You can fax the exact copy to 844-253-2553.

What Next After Filing Form 8886

After successfully filing Form 8886, the next step is to await a response from the IRS. E-filing typically takes a few weeks before getting a response. However, filing via mail may take six months or more to process according to the IRS.

If the IRS rejects the form, they will notify you in writing, outlining the reasons for rejection. The notification will specify the errors or missing information that you must correct before they can accept the form.

Ensure you act promptly upon receiving a rejection and resolve all issues before refiling the form to avoid further delays or complications

Grow Your Firm With Financial Cents

To recap all we’ve covered so far:

- IRS Form 8886 is used to report reportable transactions – transactions with the potential for tax avoidance or evasion – to the IRS. Remember, you file it together with your income tax return.

- Disclosing reportable transactions is crucial for tax compliance and helps the IRS identify potential tax abuses and enforce tax regulations effectively.

- Before filing Form 8886, gather relevant client information. Also, identify and assess your client’s level of participation in reporting transactions. This ensures accurate reporting and compliance with IRS requirements.

- After completing Form 8886, file electronically or via mail. E-filing is faster, safer, and more convenient.

If there’s any confusion, you can either check the full instructions on the IRS Website or contact the IRS for guidance.

Filing Form 8886 for clients is not a simple task. When you combine it with other accounting obligations, it gets overwhelming.

However, using accounting software like Financial Cents to streamline your tax workflow processes:

- Saves time

- Makes work faster

- Increases efficiency

- Boosts productivity.

Use Financial Cents to manage your accounting practice.