If you’re trying to grow and scale your accounting firm, you may feel frustrated by the inefficiencies in your process and exhausted by the feeling that everyone needs you at once.

Here at Financial Cents, we get it!

In this article, we’re going to talk about how you can easily create accounting workflow checklists to standardize your processes, effectively delegate work and scale your accounting firm.

Let’s get started!

What is an accounting workflow checklist?

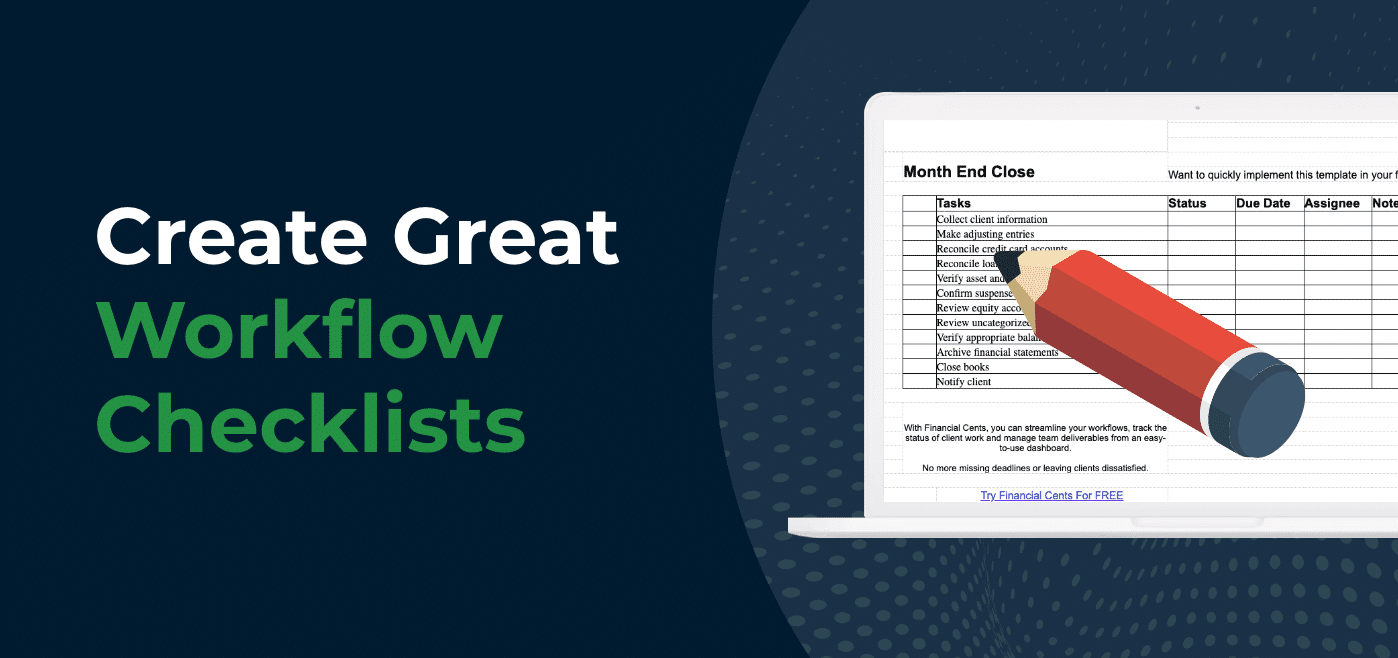

An accounting workflow checklist is a simple list that defines the process for completing client work at your firm.

An accounting workflow checklist provides:

- A list of each step that goes into getting the work done

- Details that correspond to each step, such as important notes, documents, contact info, or more

You can create your accounting workflow checklists inside Excel spreadsheets, or you can use an accounting workflow tool such as Financial Cents.

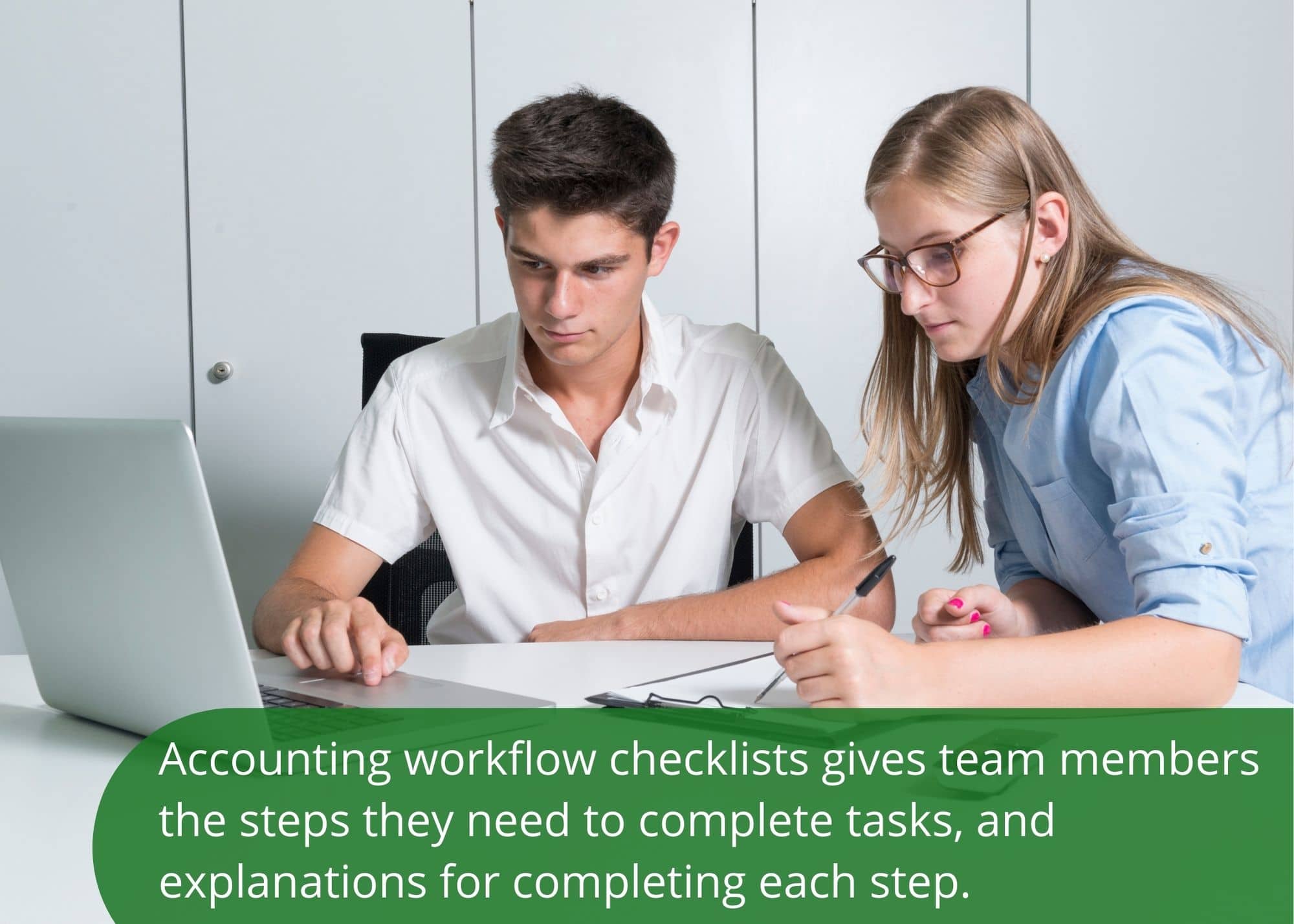

Essentially, an accounting workflow checklist is designed to give your team members the steps of a process and all the information they need to get the work done without you being involved in the process.

If you’d like a more detailed look at the types of checklists your firm could use, read our related blog post: 8 Accounting Workflow Checklists to Streamline Your Firm.

4 benefits of creating accounting workflow checklists

Now that we understand what accounting workflow checklists are, let’s talk about why they’re important and why you need them to scale your firm.

- Effectively delegate client work

- Ensure consistent, high-quality client deliverables

- Attain freedom and flexibility

- Build a foundation to scale

Benefit 1: Effectively delegate client work

When you founded your accounting firm, you did most of the work yourself. But as your firm grows and you take on more clients, this is no longer possible.

You only have so much time in the day. If you try to do everything yourself, your growth is limited by your own time constraints.

In order to scale, you have to delegate work to your team and they have to be able to do the work proficiently without you being involved in every step of the process.

How will you accomplish this?

By creating simple accounting workflow checklists.

An Accounting workflow enables you to effectively delegate your work to your team members. Using the checklist, they can understand the minute steps it takes to get the work done. Since they have a guide to follow, they can successfully complete the work competently and on time without needing your help.

Benefit 2: Ensure consistent, high-quality client deliverables

Benefit 3: Attain freedom and flexibility

From the outside, being an entrepreneur and starting an accounting firm seems brave and exciting. But when it’s your firm, you know the truth: It can be stressful and even depressing. To ensure that your business is successful, you have to wear a lot of different hats, take on financial risk, and work long hours. While you may be able to sustain this lifestyle for a time, if you let it go on too long you will burn out. On the other hand, if you successfully hire new employees, train them to do the tasks competently, and streamline your firm, you’ll end up with the freedom and flexibility that inspired you to own your own firm in the first place. Of course, you’ll need to pull yourself out of the day-to-day process in order to do this. And how will you do that? With workflow checklists. When you create workflow checklists, you provide your team with everything they need to complete tasks without you. They won’t need to ask you questions, nor will they need you to get involved in the process because they’ll have everything they need right within these checklists. When you remove yourself from the day-to-day processes, you will have the freedom and flexibility to focus on working on the business instead of in the business, growing your firm instead of wasting time on menial tasks. Not only that, but since your business can now run without you, you can slow down a bit and focus on staying healthy and not burning out. There’s no need to work seven days a week anymore. And you can finally take that vacation you’ve needed for three years!

Benefit 4: Build a foundation to scale

3 Easy Steps to Creating a Workflow Checklist

Now that we’ve talked about the benefits of accounting workflow checklists, you may be wondering how you should go about creating these checklists.

Let’s get into it!

Step 1: Keep it simple

Does the idea of creating accounting workflow checklists seem overwhelming to you?

If so, you’re not alone. Many firms never get around to creating workflow checklists because they find the idea daunting. It seems like a large undertaking, that takes too much time and energy. You simply don’t have hours and hours to dedicate to checklist creation.

That’s why it’s best to start by keeping it simple.

After all, a simple checklist is better than nothing at all. And “nothing at all” is what you’ll get if you try to do everything perfectly, get frustrated, and spend hours on the task before giving up without finishing.

Don’t overthink it! If you overthink it, you’ll end up with analysis paralysis.

Instead, tell yourself that you’re just going to start with something simple and basic. You can always optimize it later, but for now, simple is best.

Step 2: List everything out quickly

Instead of worrying about perfection, you should do a five-minute brain dump.

Decide which accounting process you need a checklist for. Let’s say, for instance, you want to create a workflow checklist for your monthly bookkeeping process. Sit down with a piece of paper or an Excel spreadsheet, and set a five-minute timer.

In those five minutes, think of every step involved in your monthly bookkeeping process and write it down.

Don’t overthink it. Don’t worry about putting things in order since you can easily re-arrange them later. Instead, focus on jotting down every step you think of in the order they come to your mind.

Step 3: Double-check your steps and re-arrange them

After your brain dump, take a critical look at your list. Is everything in the correct order? Play around with it a bit, making sure the steps logically follow each other.

Once you have the steps in the right order, double-check them to make sure you haven’t forgotten anything. If anyone else in your firm has done this task, you can ask them to double-check it as well.

And then, you’re done! Congrats, you have successfully created a quick and simple accounting workflow checklist.

That wasn’t so bad, was it?

Remember: While it’s best to start simple, every minute you spend creating workflow checklists will save you hours in the long run.

Alternatively, you can check out this blog to see how accountants and bookkeepers can use ChatGPT to create workflows in seconds.

How Financial Cents can Help

At Financial Cents, we focus on helping accounting firms scale and succeed.

That’s why we’ve created several tools to help you create quick-and-easy accounting workflow checklists for your firm.

Free Accounting Workflow Checklist Templates

Maybe the brain dump method isn’t your cup of tea. Maybe you’d rather find a checklist that’s already been created, and simply tweak it to fit your specific process.

After all, accounting processes are fairly straightforward and should be similar across firms.

If that’s you, you’re in luck!

At Financial Cents, we offer a variety of free accounting workflow checklist templates, including a weekly bookkeeping checklist template, a payroll checklist template, an individual tax return checklist template, business tax return checklist templates, a client onboarding checklist template, and more!

Accounting Workflow software

Using basic Excel sheets for your workflow checklists is a great place to start, especially when your team is still very small, with only on or two people.

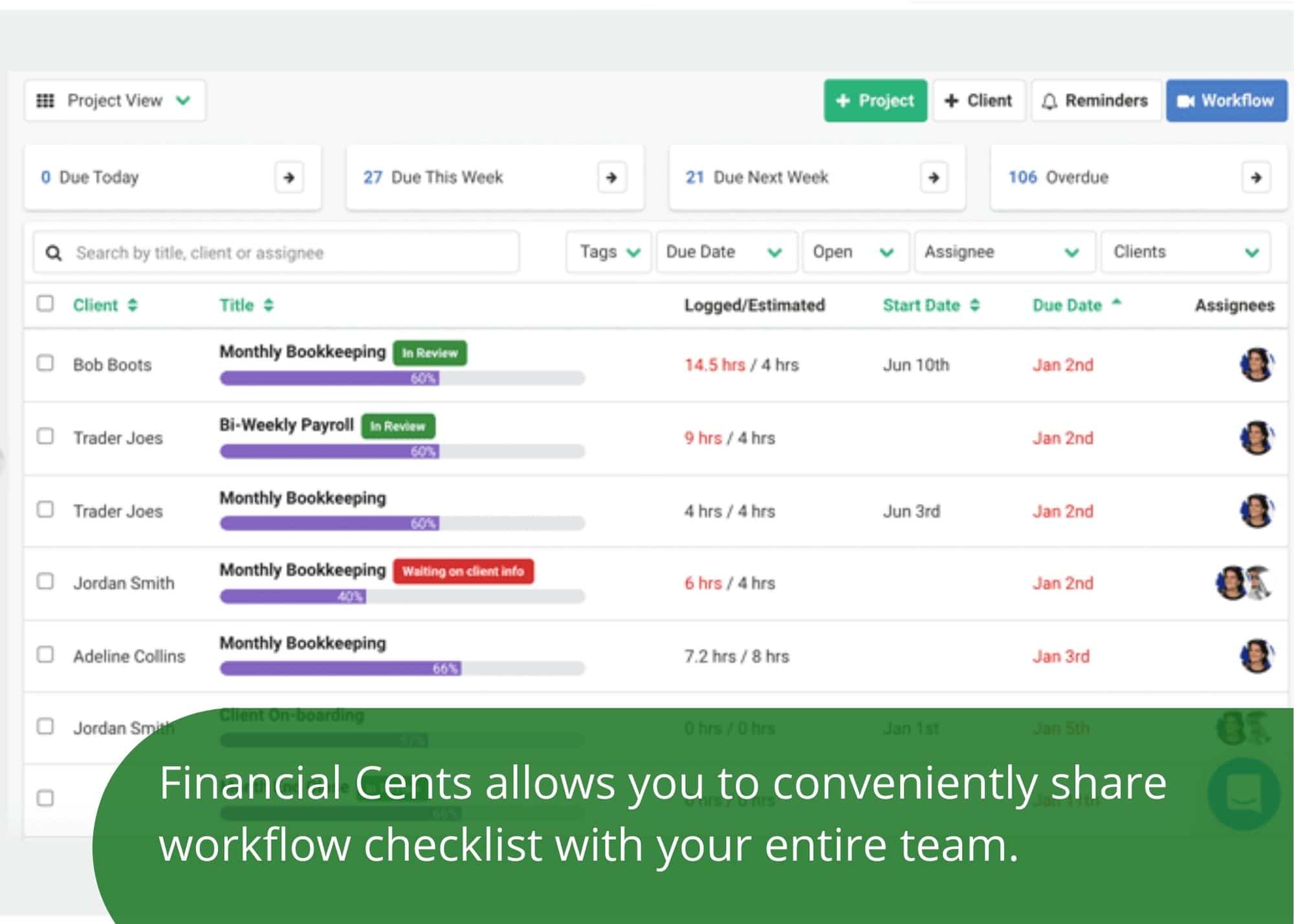

However, as your firm scales, you need a better way to manage your checklists, collaborate with your team and track the status of client work.

For this, we recommend using Financial Cents accounting workflow software. We built Financial Cents after talking to hundreds of accounting firms and understanding the struggles they face in creating and implementing workflow checklists.

And what are these struggles?

Typically firms struggle to find simple, convenient ways to share checklists with team members, delegate work, and track progress. Not only does this waste time, but mistakes start to happen and things begin to slip through the cracks, which causes you to miss important client deadlines.

Creating a checklist in Financial Cents is very simple, and you can use the same method we outlined earlier. Even better, we already have over a dozen workflow checklists for the common accounting processes already built out in Financial Cents. You can easily customize them to fit your process so you don’t have to re-invent the wheel and start from scratch.

In Financial Cents, all templates and checklists are stored in one place for your team to easily access anytime and anywhere. You can use the checklists to create work for your team and then track the status of that work in one simple view.

Not only can you easily see a list of who is working on what, but you can also see the status of that work, and when it’s due.

You’ll always know who is working on what, what the deadlines are, and where everything stands. Things will no longer slip through the cracks, and you’ll be able to consistently meet your deadlines.

If you’re interested in knowing more about Financial Cents or starting a free trial, you can find out more information by watching our four-minute demo video.

I created a checklist.

Now what?

Whether you’re using Excel sheets or an accounting workflow solution like Financial Cents, you should now have a good grasp of how to create simple, no-stress accounting workflow checklists.

You now have the knowledge to build the foundation needed to start delegating work to your team, ensuring consistent client deliverables, and buying back your time.

However, to truly set yourself up for success, you need to learn how to optimize your workflows. We will teach you how to quickly optimize your workflows in the next article: 3 Steps To Optimize Your Accounting Firm’s Workflows (plus 4 major benefits of doing so).

As we’ve explored in this article, the best way to build a foundation to optimize your firm is to start creating simple accounting workflow checklists.

And at Financial Cents, we’ve created software to help you do just that!

Watch our four-minute demo video to get an idea of what we do and how we can help you create simple workflow checklists.

Then, start your free trial today and experience the convenience of Financial Cents software for yourself.

We can’t wait to work with you!