Many entrepreneurs love the creative side of running a business i.e. idea generation and innovation. But keeping track of their books or money is not their forte. So they turn to accountants and bookkeepers like you to help them make better financial decisions.

Part of your responsibilities may include tax planning and corporate structure. And one of the decisions you’ll assist your client with is whether to remain as a C corporation (C-Corp) — the default by IRS rules — or choose to become an S Corporation (S-Corp).

Smaller businesses should go with the latter as it’s more startup-friendly for reasons we’ll discuss shortly.

The major requirement for migrating to an S-Corp is to file for IRS Form 2553, Election by a Small Business Corporation. So, if you are assisting a small business in handling its election to S-Corp, here’s all you need to know about the form.

Reasons to File IRS Form 2553 to Become an S-Corp

Fun fact: the term “S-Corporation” comes from Subchapter S of the Internal Revenue Code, which outlines the rules and specifications for this type of corporate entity. It’s a special tax status suitable for small to mid-sized businesses. To become one, the business must submit IRS Form 2553 to the IRS, signed by all the shareholders.

Some of the benefits include…

Pass-Through Taxation

An S-Corp can decide to ‘pass’ its income ‘through’ to shareholders where it’s reported on their personal tax returns. That way, the shareholders pay the tax on the business rather than the business itself. This helps the business avoid double taxation, unlike C-Corps who pay taxes twice — the business pays corporate taxes, and shareholders pay taxes on dividends.

Reduced Self-Employment Taxes

The current self-employment tax (Social Security + Medicare) rate is 15.3%. But an S-Corp can pay a reduced amount. How? The S-Corp distributes the remaining income (profit) as dividends after paying the owner a ‘reasonable salary.’ These dividends are not subject to Self Employment Tax.

Potential Tax Savings

Apart from the two ways above, S Corporations can also save taxes by:

- Paying the owner a lower salary (but not too low it falls below the limit of the IRS reasonable compensations)to reduce the tax amount.

- Passing any losses to the shareholders’ tax returns so they pay less individual tax

- Taking advantage of business deductions like business rent or mortgage, office supplies & equipment, travel expenses, cell phone expenses, business insurance, etc., to lower taxable income.

Ease of Transfer

Another benefit is how easy the transfer of ownership is with S-Corps. There is no complicated legal process, need for corporate approval, or even a halt to the business operations due to the transfer of interest in the company.

Limited Liability Protection

Because the S-Corp is a separate legal entity, it protects the personal assets of owners and shareholders from business debts and liabilities. So, its finances and assets are separate from their personal assets.

Eligibility Criteria to Become an S-Corp

Before the IRS can classify your client’s business as an S-Corp, it must meet certain requirements.

1. Must be a Domestic Corporation: The only business structure qualified is a domestic corporation. This means the business must incorporate itself within one of the 50 US states, Washington D.C., or one of the five inhabited US territories. It should also conduct its business affairs there.

2. Must have qualified shareholders: Having shareholders is a fundamental aspect of an S-Corp. Qualified shareholders are only individuals, certain trusts, and estates. Partnerships, corporations, or nonresident aliens are not qualified. Note, nonresident aliens are foreigners without a ‘Green Card’ or those who haven’t spent sufficient time in the US.

3. Must comply with the 100-stockholder limit: The maximum number of shareholders an S-Corp can have is 100. The only exceptions are family members because the law treats them all as one shareholder.

4. Must have only one class of stock: This prevents different voting rights and dividend distribution due to different stock classes. The ‘common stock’ is the most common type of stock class corps issue.

5. Must have or adopt or change to one of the following tax years:

- A tax year ending December 31.

- A natural business year.

- An ownership tax year.

- A tax year elected under section 444.

- A 52-53-week tax year ending with reference to a year previously listed.

- Any other tax year (including a 52-53-week tax year) for which the corporation (entity) establishes a business purpose.

6. Must not be an “Ineligible Corporation”: This includes certain financial institutions that account for bad debts using Section 585, insurance companies that pay taxes under Subchapter L, and Domestic International Sales Corporation (DISC) members.

7. All shareholders must consent to the election of the S-Corp.

Apart from these general requirements, some states have specific requirements. For instance, in Florida, there is a filing fee of $150. The business must pay franchise taxes by the last day of the 4th, 6th, 9th, and 12th months.

If your client fulfils all the requirements above, it’s time to move to the next step: Filing Form 2553.

IRS Form 2553 Due Date

To become an S-Corp, you must complete and file the form (on behalf of your client) either:

- Within 2 months and 15 days after the start of the tax year the election is to take effect.

For example, in a calendar year i.e. January 1 to December 31, the due date is within 75 days, making it anytime from January 1st to March 15th (if it’s not a leap year). But for a leap year, the due date is March 16th because February will have 29 days.

- Or at any time during the preceding tax year.

If your client wants the election to happen starting from the new tax year, January 1, you must have filed by the end of the preceding tax year, December 31. The approval process can take up to 60 days, so make sure to factor that in when filing in the preceding tax year to meet your desired election date.

P.S. If you don’t hear back from the IRS within 60 days, call them at 1-800-829-1040 or contact your local IRS office to check on the status of your application

But life happens, and it’s possible to miss the deadline to file Form 2553 for the business’s desired tax year. If that happens, you can request ‘relief from a late election,’ AKA late filing.

Form 2553 Late Filing

The late filing form is on the last page of Form 2553. To increase the chances of its acceptance, the company must:

- Have intended to become an S-Corp as of the date entered on line E of Form 2553.

- Have been behaving like an S-Corp (e.g. filing tax returns as an S-Corp would) since the effective date and only missed the deadline to file.

- Have a reasonable excuse for not filing on time. According to Amy Northard, CPA, one reason the IRS has never rejected is “The information necessary to make an informed decision about the entity’s status was not available in time to file a timely election.” You can also say something like you didn’t know you needed to file form 2553.

- File not more than 3 years and 75 days from the intended election date.

If the company meets the above requirements, fill out the form, attach its Form 1120-S, Income Tax Return for an S-Corporation, and mail them together to the correct IRS office address on the first page of the form. You can also mail them separately if you prefer.

If attaching the two forms together, write “INCLUDES LATE ELECTION(S) FILED PURSUANT TO REV. PROC. 2013-30” at the top margin of the first page of form 1120-S.

But if not, at the top margin of Form 2553 first page, write: “FILED PURSUANT TO REV. PROC. 2013-30.”

Assuming the company doesn’t meet the requirements above, all hope isn’t lost. You can request a private letter ruling and pay a user fee to request relief.

How to File Form 2553

Form 2553 has 5 pages and 4 parts, and here’s what you need to know about filling it out. If you want detailed filing instruction for IRS form 2553, we cover it here.

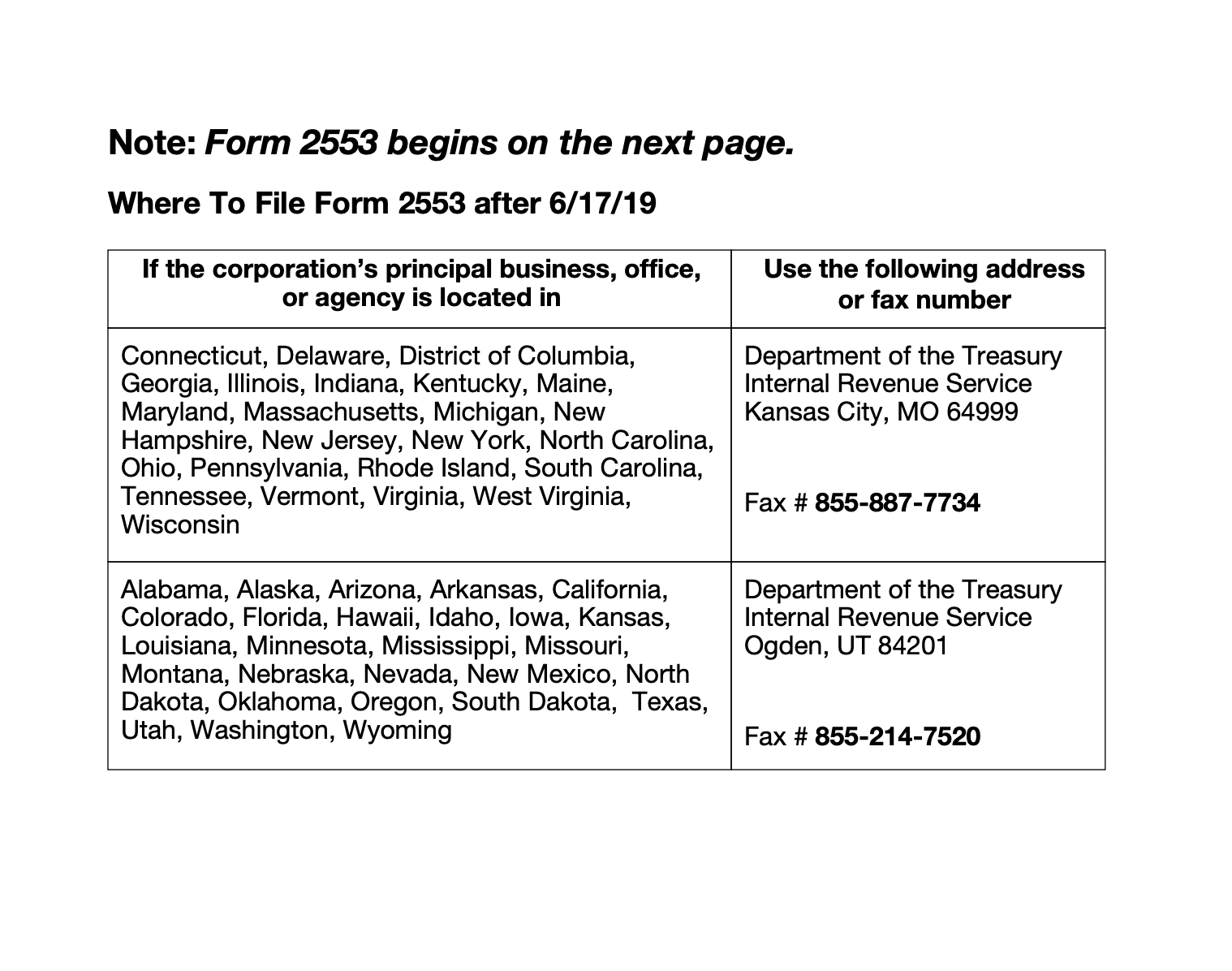

The first page contains instructions on where to send the completed form, depending on the location of your client’s company.

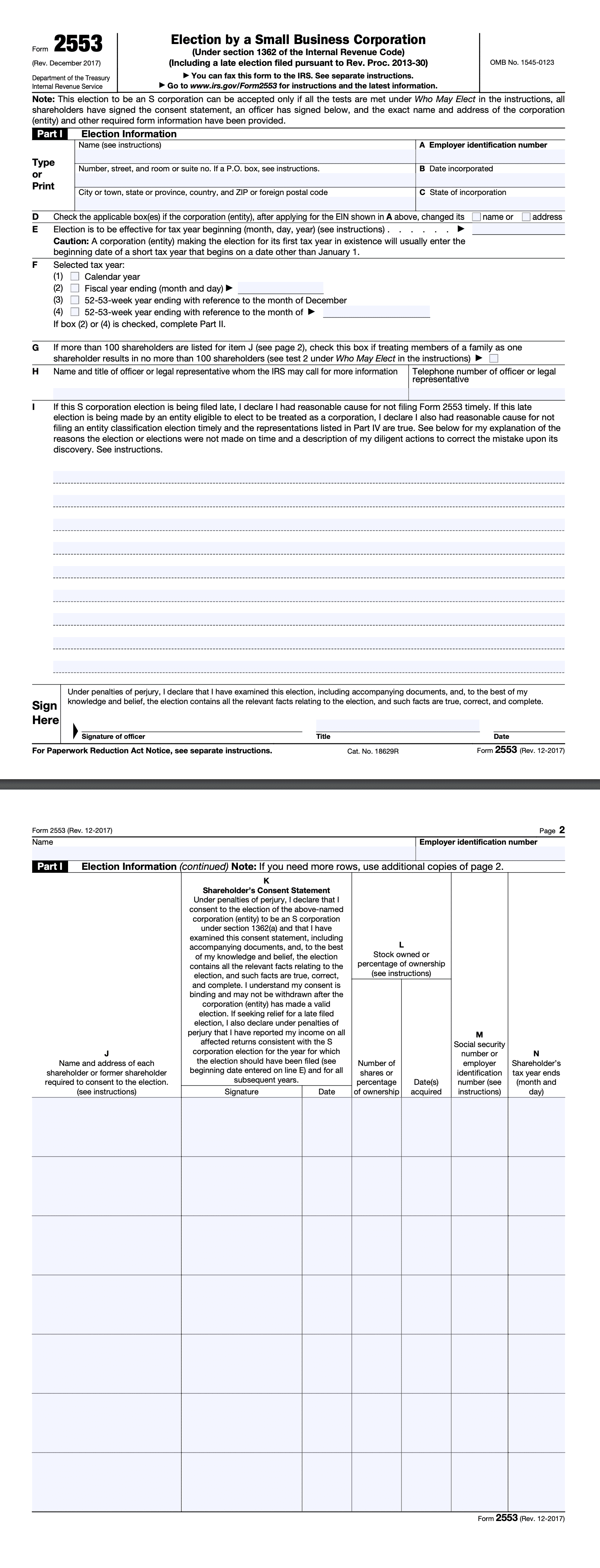

The second page (Part I) is where the form properly begins. Part I, titled Election Information, is where to fill in basic information about the business, shareholders, and the company’s corporate office or legal representative that the IRS can contact about the application. Part I takes up 2 pages or more if you need more space.

Using a tax information checklist for clients to request this information from the business can be handy at this point.

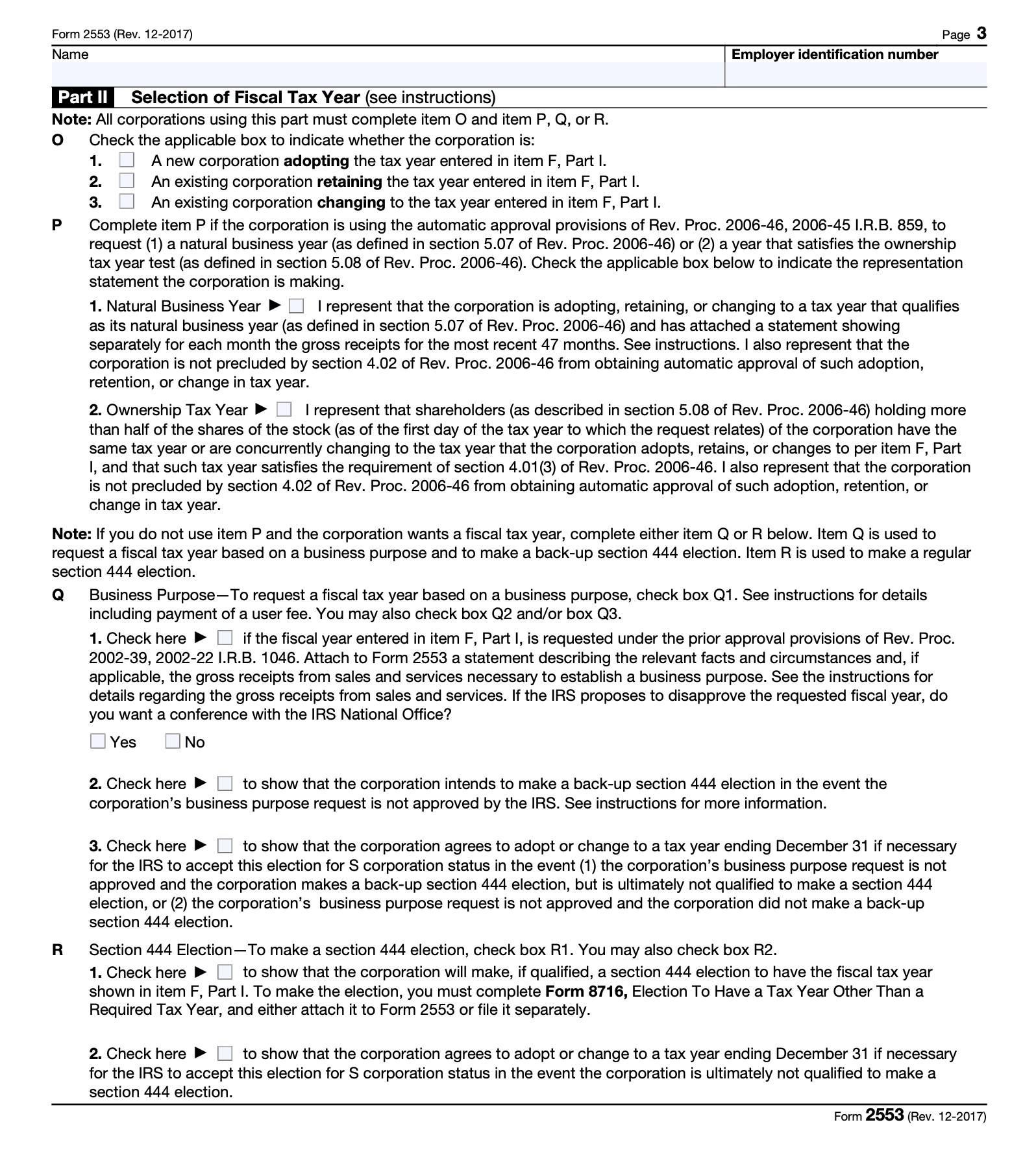

Part II is on the Selection of Fiscal Tax Year, and you have to answer whether the business is adopting/retaining or changing the fiscal year entered in Part I.

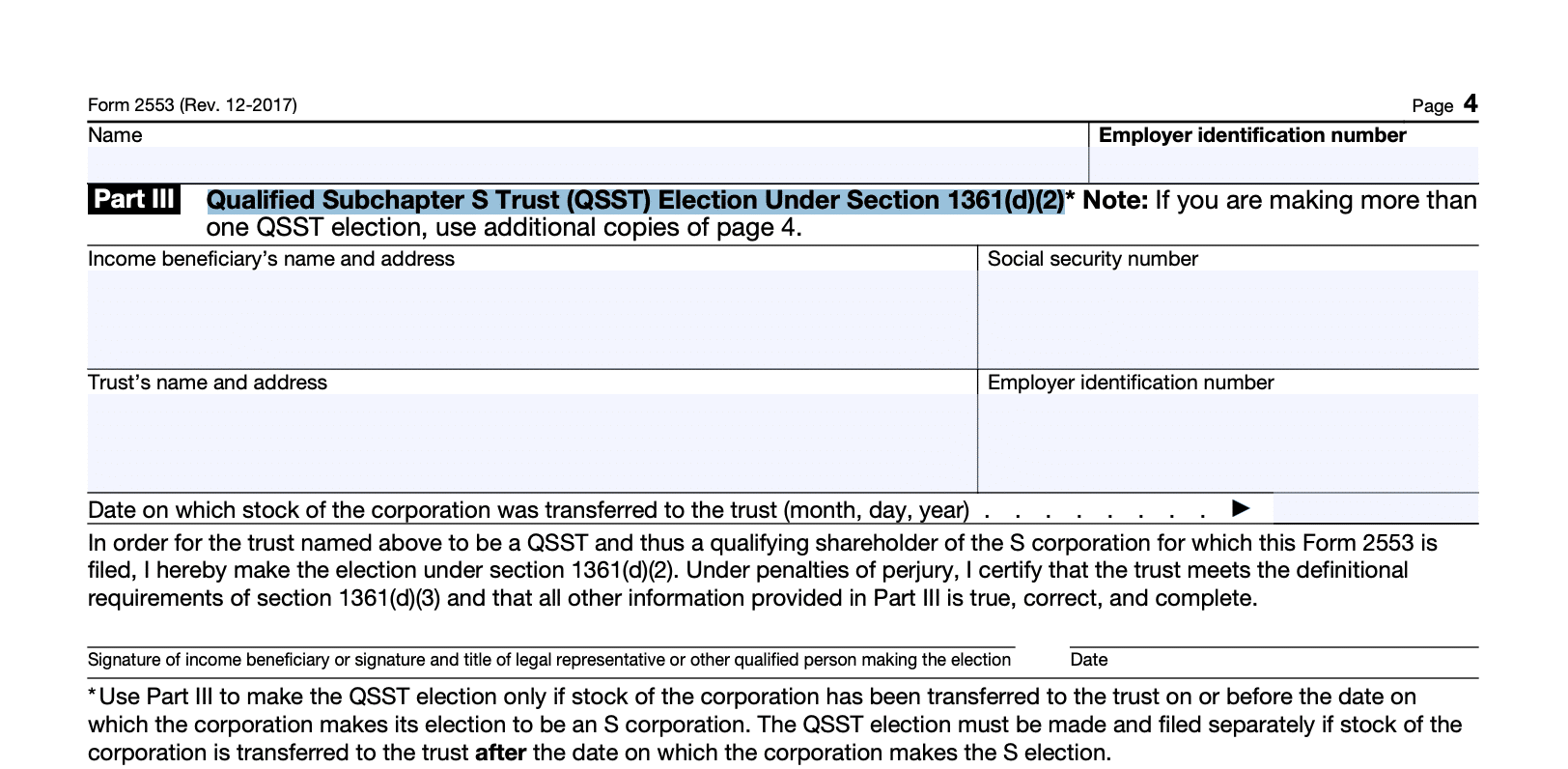

Then we get to Part III, Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2).

Recall that only certain trusts can register to become S-Corps; this section is for said trusts to fill. Provide details like the Income beneficiary’s name, address, and Social Security Number (SSN). And the Trust’s name and address, and Employee Identification Number (EIN).

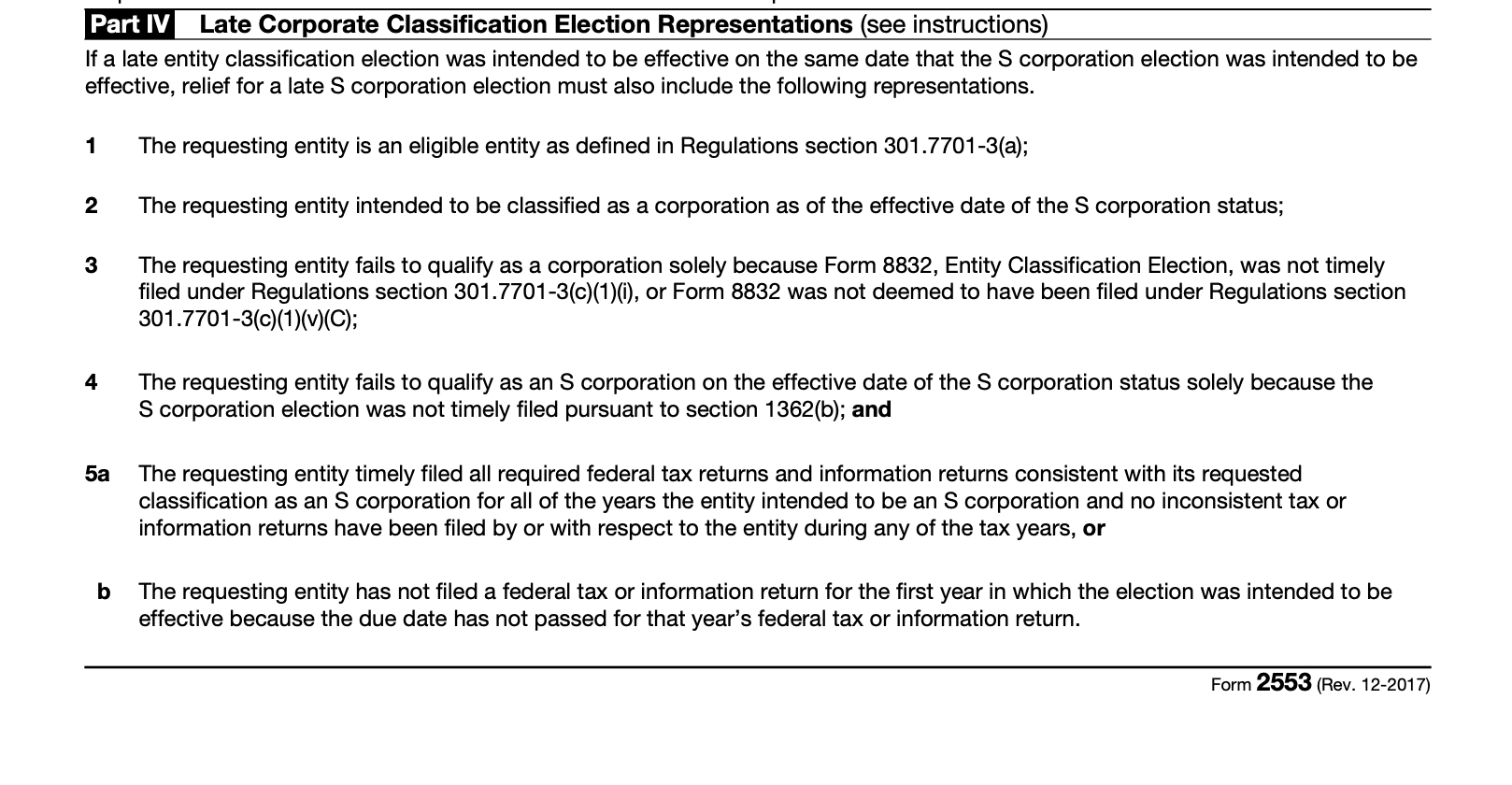

Finally, Late Corporate Classification Election Representations in Part IV is the section for late filing i.e. requesting ‘relief from a late election’. If you’re filing within the deadline, skip this section. Otherwise, complete it.

And there you have it, all you need to know about Form 2553, why your client should file it to become an S-Corp, and how to file even if it’s past the deadline.

It’s easier to navigate through IRS Form 2553 and the tax system with Financial Cents on your side. We provide you with a free checklist template to streamline the form process. You can also use our software to track the status of your clients’ work to ensure you meet deadlines and save time.

What are you waiting for? Use Financial Cents to manage your accounting practice.