The Big Four accounting firms had their biggest growth spurt ever, raking in a whopping $22 billion more between 2021 and 2022. This surge pushed their total revenue past a staggering $200 billion for the first time in 2023.

The good news? The US accounting industry mirrored this growth, with revenue reaching a record high of $145.7 billion in 2023.

Our 2024 Firm Revenue Report also confirms this trend. In 2023, 31.8% of firms made between $101,000 and $300,000, demonstrating a strong market for accounting services.

Even if you’re constantly overwhelmed or stressed and trying to keep your firm afloat, there’s a clear message here: a profitable accounting firm is achievable.

The demand for your expertise is high, and in this article, we’ll provide actionable strategies to build a thriving and balanced accounting practice that doesn’t burn you out.

How to Keep Your Accounting Firm Profitable

Keep Your Accounting Workflow in Check

The daily tasks within your accounting firm, like receiving invoices, responding to client requests, and generating reports, all form your workflow.

A smooth workflow is crucial for profitability. It minimizes wasted time and resources, leading to lower operating costs. Additionally, a well-defined workflow allows your team to complete tasks faster, freeing them to take on more clients or higher-value work.

As seen in our 2024 State of Accounting Workflow Automation Report , many firms achieved success and profitability by simplifying tasks through workflow automation. Here’s how it benefited them:

- Faster Client Onboarding: 55.2% reported a smoother onboarding process.

- Increased Collaboration: 32.9% reported improved team collaboration.

- Time Savings: 33.5% now spend less than 1 hour per week reviewing work status, and 34.8% spend less than 1 hour scheduling and assigning tasks.

- Standardized Processes: 27.6% highlighted the implementation of standardized systems as the biggest benefit.

To replicate this success and create a smooth workflow, you’ll need workflow management software like Financial Cents to streamline your activities.

Financial Cents has helped us keep track of all the various little things we need to do so things don't slip between the cracks."

Erin Louis, President Advocate Accounting LLC.Our workflow management software is designed specifically to go beyond basic task management by offering features that directly address your needs.

Let’s look at some of the features that will improve your workflow:

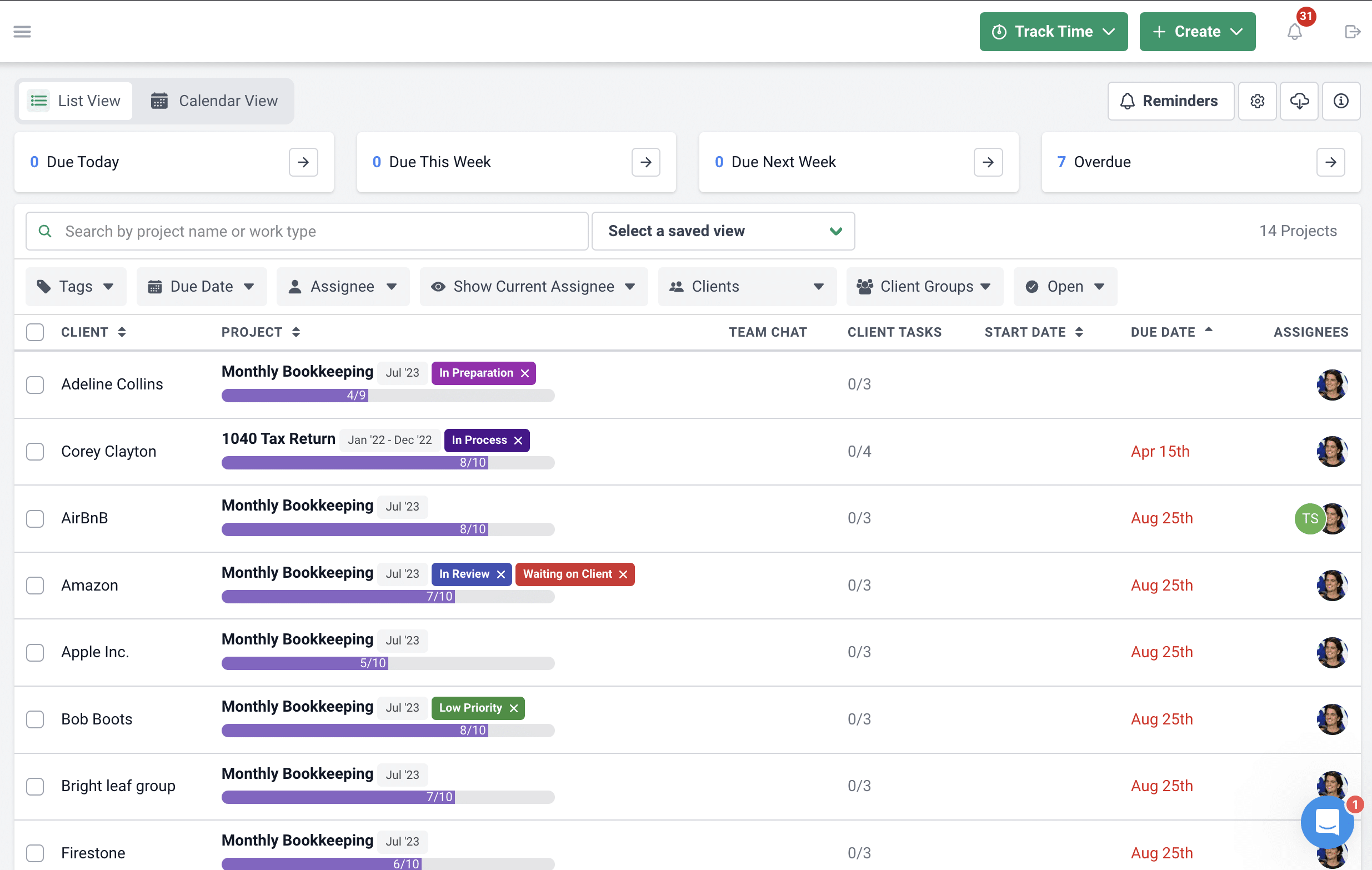

1. Workflow Dashboard: This provides a central hub for monitoring all your ongoing accounting projects and tasks. This means you can see exactly what’s happening in real-time, without needing to check multiple places or chase down updates.

The dashboard displays a clear and concise overview. It includes upcoming deadlines, assigned tasks with completion status, and any potential bottlenecks that might cause delays.

2. Automation: Instead of manually entering & storing data from receipts or other documents, Financial Cents can automatically capture and organize client information. This saves your team time from having to manually gather data and format reports each time.

You can also set up automated notifications and client reminders for upcoming deadlines, confirmations of documents, or even basic progress reports for your clients.

3. Time Tracking & Invoicing: You can accurately record the time spent on each client task. With this data, Financial Cents can then automatically generate invoices (a QBO integration is needed) based on the tracked hours and your predetermined rates. This eliminates manual calculations and ensures your billing is always accurate and efficient.

The benefit goes beyond just saving time. This allows you to focus your efforts on clients who generate the highest return and potentially adjust your pricing strategy for others.

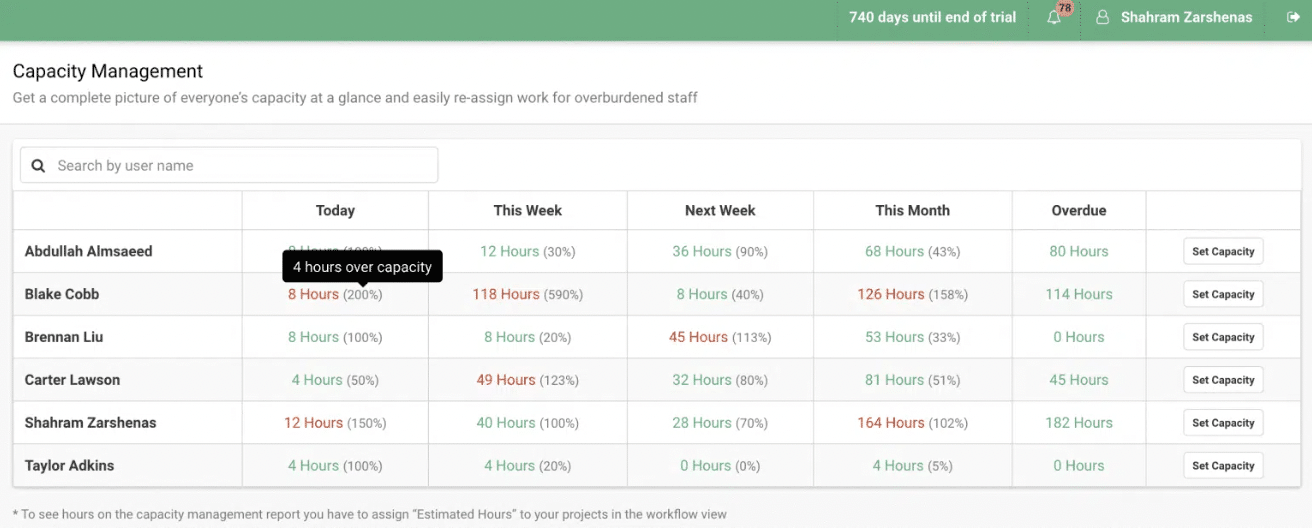

4. Capacity Management: This feature helps you avoid overworked staff and missed deadlines. You can see if a team member is overloaded with tasks and approaching burnout, allowing you to take action before it’s too late.

You can easily reassign tasks to someone with more availability, ensuring everything gets done on time without stressing your team.

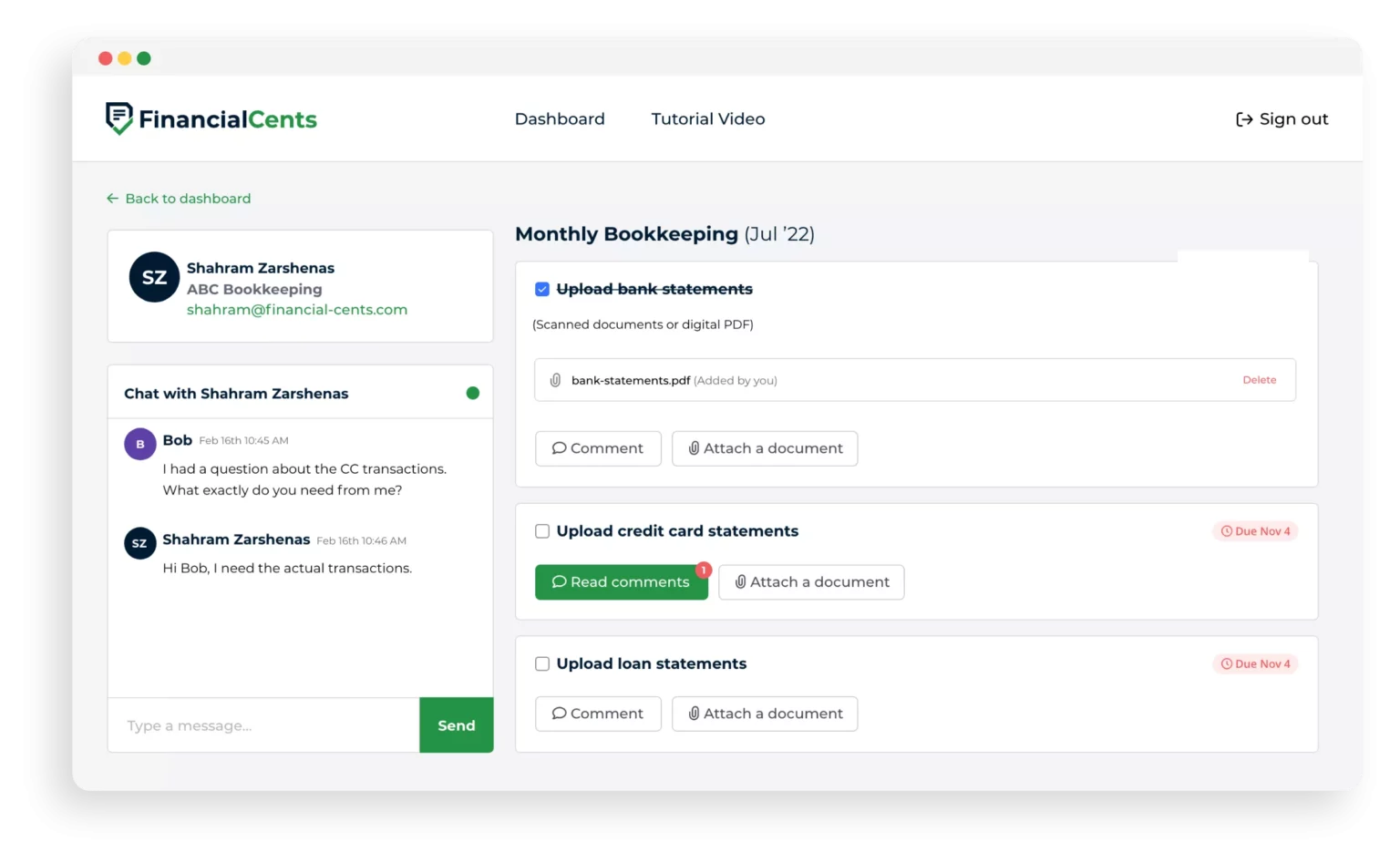

5. Month End Close: This feature is designed to handle uncategorized transactions—those that your system can’t automatically classify. Financial Cents can automatically pull uncategorized transactions directly from your QuickBooks Online account (if integrated).

It also allows you to directly communicate with your client within the platform. You can ask clarifying questions, request additional details, or even request supporting documents to categorize the transaction correctly.

Increase Your Revenue Streams

While streamlining workflows is crucial for profitability, another key strategy is to identify and offer high-value services that bring in more revenue for your firm. These services go beyond basic compliance tasks (like tax filing) and offer clients deeper financial insights and strategic guidance.

There are a couple of ways to identify these lucrative services:

- Analyze Industry Trends: Look at what services are becoming increasingly important for businesses in your niche market. For example, with the rise of e-commerce, demand for services like sales tax compliance or fraud prevention might be high.

- Client Needs Assessment: Talk to your existing clients and understand their pain points. Do they struggle with budgeting and forecasting? Are they looking for help with business valuation or merger and acquisition planning? Identifying these needs allows you to tailor high-value services that directly address their challenges.

- Analyze Your Expertise: Look at your team’s strengths and experience. Are there specific industries you excel in? Do your CPAs have specialized knowledge in tax law, valuations, or forensic accounting? Identifying your team’s niche expertise is a great starting point for high-value services.

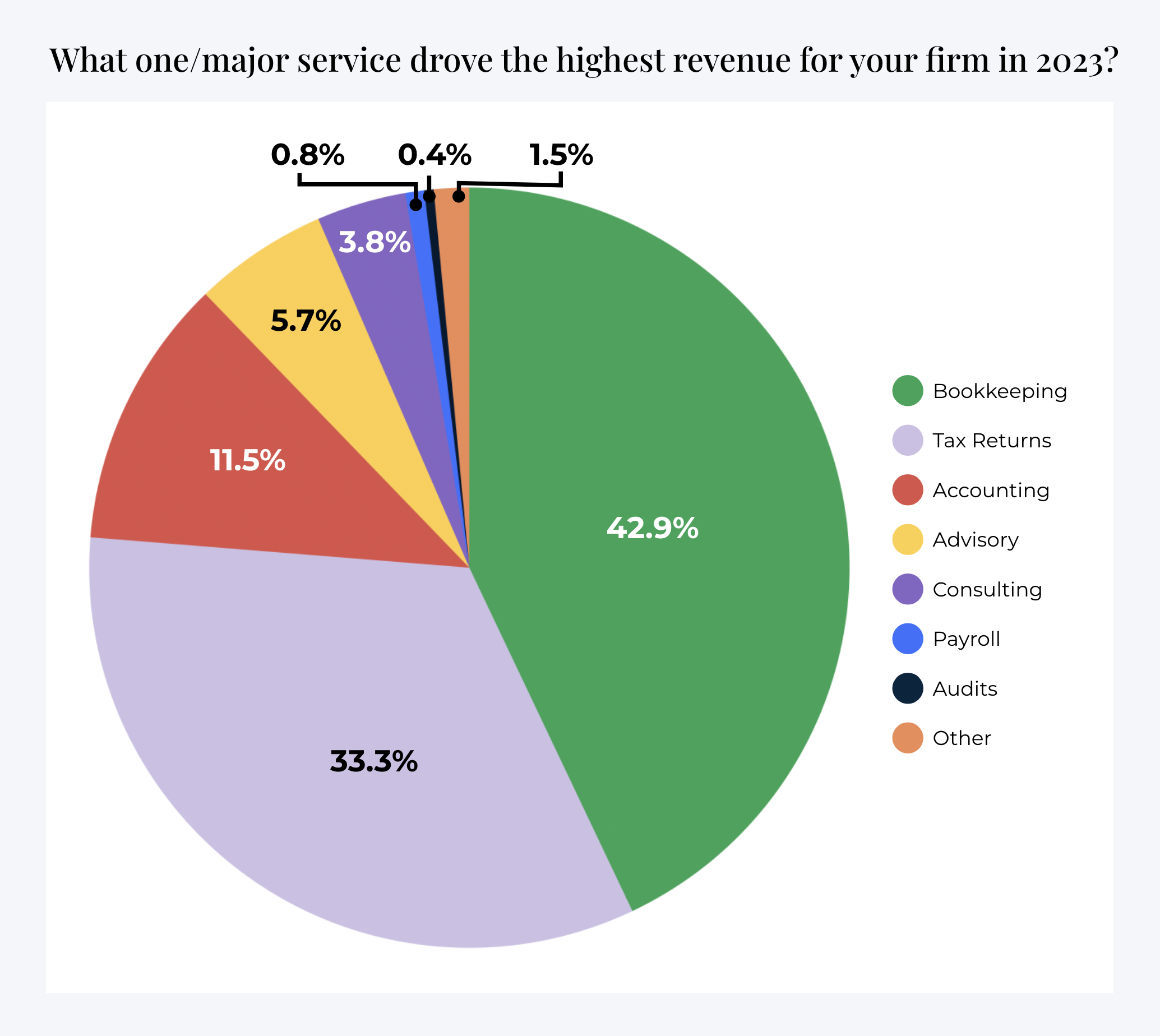

As you can see from this chart, bookkeeping services and tax returns were the top services that drove revenue for the firms that contributed to our 2024 State of Accounting Workflow Automation Report. Close contenders include accounting and advisory services.

It’s important to consider how you can make your services stand out by tapping into these revenue streams. Ask yourself and your team for ideas on what you can do differently.

If you need to offer additional services to increase your revenue, consider client accounting services like

- Virtual CFO services

- Cash flow forecasting

- Management reporting

- Budgeting

- Industry benchmarking and many more.

Once you’ve identified high-value services to offer, it’s crucial to implement pricing models that guarantee fair compensation for your expertise.

Here are some pricing approaches to consider:

- Value-Based Pricing: This model focuses on the value you deliver to the client rather than just the time spent.

Value pricing is about setting a price based on the value to the customer, not based on how something takes"

Mark Wickersham- Tiered Pricing: Offer different service packages with varying levels of complexity and deliverables. This allows clients to choose the option that best suits their needs and budget while still capturing value for your firm.

- Hourly Billing: For certain one-off tasks or consultations, hourly billing can be appropriate. However, ensure you communicate your hourly rate upfront and establish clear expectations around project scope to avoid client surprises.

- Fixed Fee Agreements: For well-defined services with predictable workloads, consider fixed fees. This provides clients with upfront cost certainty and incentivizes your team to work efficiently.

If you’re unsure where to start, consider this guide: How to Price Bookkeeping Services for Profitability.

Lastly, consider client retention and long-term relationships when seeking profitability. Securing new clients involves marketing, lead generation, and sales efforts – all of which come at a cost.

Retaining existing clients eliminates these expenses, allowing you to focus on growing profitability. The longer you work with a client, the deeper your understanding of their business becomes. This allows you to offer more personalized and strategic services, adding significant value beyond tasks.

Build a High-Performing Team

Your team is the backbone of your accounting firm. Investing in the right people with the necessary skills is crucial for maximizing efficiency, minimizing errors, and ultimately, boosting profitability.

Hiring individuals with strong skills and a clear understanding of your expectations minimizes errors and ensures tasks are completed accurately the first time.

As Nicole Davis, CPA, aptly states, “When you pass out instructions to your employees, it is necessary to make sure they process the instructions as given so the results won’t be different from what you said.”

Building a high-performing team goes beyond hiring the right people. Many factors must be considered, one of which is the need to grow, nourish, and maintain a company culture that retains top talent.

A positive and inclusive culture fosters employee engagement. Engaged employees are more productive, satisfied, and less likely to leave for other opportunities. This translates to lower recruiting and training costs, ensuring your firm retains the expertise it needs to succeed.

We’re like family. This culture attracts people. We don’t have to search for employees; they come to us through friends, family, and personal connections. This is how we grow our team"

Randy Crabtree, Co-Founder and Partner Of Tri-Merit Specialty Tax Professionals.Roman Villard CPA, CEO of Full Send Finance, sheds more light on how to improve your firm’s recruitment and retention in this article.

Furthermore, when building your team, create a diverse team with a variety of skills and experiences that bring a wealth of perspectives to the table.

As Randy Crabtree states, “Diversity in your firm is essential. Diversity creates culture. And I mean diversity in everything—skill sets, backgrounds, personal experiences. Without that diversity, we’d never succeed.”

This diversity fosters creativity, problem-solving, and a deeper understanding of your client base – crucial points for growing your revenue and achieving profitability.

Lastly, don’t neglect the importance of delegation. Running a profitable accounting firm isn’t a one-person show. Delegation is crucial for firms that want to maximize their time and expertise.

Delegation improves productivity and creates room for your team to develop their skills and knowledge. When they take on tasks with a sense of ownership, it builds their confidence, which leads to a more efficient workflow, ultimately allowing you to take on more clients.

To ensure effective delegation within your accounting firm, be sure to

- Delegate well-defined tasks.

- Match skills to assignments.

- Set clear instructions and deadlines.

- Empower ownership and decision-making.

- Implement a feedback loop.

Client Management

Another key element of growing profitability is managing client expectations effectively.

When clients clearly understand your services, turnaround times, and fees from the start, it builds trust and prevents misunderstandings later. This strengthens your relationship and encourages them to stay with you long-term.

Think of clear communication as a foundation. It should start during client onboarding and continue as your client relationship grows. Exceeding client expectations at onboarding is a powerful way to build trust and set the stage for a successful partnership.

Beyond communication, you should also select clients who match your firm’s capacity and values. Taking on clients that you can’t handle makes no sense —it’s a recipe for failure.

Here are some tips you can follow to identify ideal clients:

- Examine your current client base and single out clients that make you excited to work for them

- Determine the clients you can best serve – based on your expertise or skillset

- Learn about their goals and the services that can meet these goals

- Learn about their mode of operation

- Determine how much they’re willing to pay for your services

- Make a decision. Do you want to work for them or not?

Focus on attracting clients who value your expertise and are willing to pay a fair fee for the services you offer. This ensures your firm is adequately compensated for its time and skills.

To prevent misunderstandings and last-minute demands that can derail your profitability, consider these strategies:

- Set clear expectations at onboarding

- Be proactive in your communication

- Use an accounting CRM solution to manage your client relationship

- Be transparent about potential changes in scope or additional fees

- Set realistic deadlines for deliverables and stick to them

Conclusion

In this article, we explored several key strategies to keep your accounting firm profitable and running smoothly. If you follow them religiously, you can create a more efficient and profitable accounting firm without losing sleep.

Remember, Financial Cents can be your partner in achieving this success. Our accounting practice management software simplifies daily tasks, automates repetitive processes, and provides real-time project visibility, so you can focus on revenue-generating tasks.

Use Financial Cents to boost your profitability and reduce stress.