Every month, accountants and bookkeepers close the books for their clients. Yet, for many, it continues to be a struggle. According to a 2017 study, 60% of finance and accounting professionals say their stress levels increase during month-end close periods, and 87% face challenges with their close processes. This number has likely risen due to the increasing complexity of financial reporting, stricter compliance requirements, and more sophisticated accounting standards. And for those handling this process for multiple clients with a range of service needs it’s even more time-consuming and overwhelming.

Without a clear, structured process, you risk missing deadlines, skipping important steps, and making costly errors. Maintaining consistency across multiple clients also becomes more challenging, and you may have to guide your team through every stage every single time. That’s not just stressful; it’s unsustainable.

The good news? A well-defined month-end close process can change that. With a standardized checklist, you can improve accuracy, save time, and make the close more predictable. Even better, when your team follows the same structured workflow, they can complete the process confidently without your constant oversight.

That’s why we put together this guide. You’ll get a complete month-end close checklist to help you stay on track, plus two free Excel templates to keep everything organized. Let’s get started!

What Is the Month-End-Close Process?

The month-end close process is the steps accountants and bookkeepers follow to review, reconcile, and finalize a company’s financial records at the end of each month. The goal is to ensure that all transactions are accurately recorded, that accounts are balanced, and that financial reports reflect the company’s true financial position.

This process typically includes reconciling bank statements, verifying account balances, reviewing revenue and expenses, and preparing financial statements. A well-structured month-end close helps businesses track performance, make informed decisions, and comply with tax and regulatory requirements.

For accounting and bookkeeping firm owners, having a consistent and repeatable month-end close process is essential. It ensures accuracy, saves time, and allows your team to handle the close efficiently without unnecessary back-and-forth.

Challenges in the Month-End Close Process

Here are some of the most common issues accountants and bookkeepers face when closing the books at the end of the month.

Missing or Incomplete Records

It’s frustrating when the client submits incomplete records, as you must spend extra time tracking down the missing information. Otherwise, you’ll find reconciling the accounts and producing reliable financial statements difficult. This can lead to compliance issues, incorrect tax calculations, and poor financial decision-making for your client.

Tight Deadlines and Time Constraints

Month-end close is always time-sensitive, and while you’re managing multiple clients’ needs, the pressure increases. There’s a limited window to review transactions, reconcile accounts, and finalize reports. If there are delays—whether from missing records, last-minute adjustments, or slow internal processes—you’re left rushing to meet deadlines.

This can lead to mistakes in reconciliations and journal entries, increased stress for you and your team, and delayed client financial reports.

Miscommunication Between Teams

When multiple people are involved in the month-end close—whether it’s your internal team or your client’s staff—there’s a good chance they’ll miscommunicate or misunderstand each other. Maybe the client forgets to inform you about a large purchase, your team isn’t clear on who’s responsible for certain tasks, or there’s confusion about deadlines.

When this happens, it can lead to duplicated work, missed work, overlooked transactions, and unnecessary back-and-forths. This wastes time and increases the risk of errors in the financials.

Manual Errors in Reconciliations

Reconciling bank accounts, credit cards, or other financial records manually increases the risk of mistakes like duplicate entries, incorrect amounts, or missing transactions. These errors can throw off the entire financial close process, causing discrepancies between the books and actual account balances. If not caught, they can cause inaccurate financial reports, compliance issues, and extra time spent fixing mistakes.

Inconsistent Quality of Work

When there’s no standardized month-end close process, the quality of work can vary, whether between different team members or across multiple clients. Some reconciliations might be thorough, while others are rushed or missed altogether. One client’s reports might be accurate and timely, while another has errors or delays.

This inconsistency can lead to financial statements that don’t always reflect the true financial position of a business. It also creates inefficiencies, as you or your team may have to go back and fix errors, clarify missing details, or redo certain steps. Over time, this can impact your firm’s reputation and make it harder to scale your firm.

The Complete Month-End Close Checklist

Below is a breakdown of the key steps to include in your accounting month-end close checklist:

Pre-Close Preparation

Start by gathering all the necessary information before the actual close begins. This helps you avoid delays later on. Here,

- Ensure all transactions are recorded: Go through bank feeds, receipts, and client-provided documents to confirm that every income, expense, and balance sheet transaction is posted in the accounting system. Missing transactions can cause discrepancies and delay the close process.

- Collect and reconcile vendor bills: Check that all bills are received, recorded, and matched with purchase orders and/or payment records. Reconcile these bills against payments made to identify any outstanding or duplicate entries.

- Review accounts receivable and follow up on overdue invoices: Ensure all issued invoices are recorded and payments are applied correctly. Follow up with clients on any overdue invoices to help maintain an accurate cash flow picture.

Reconciliation Tasks

Reconciling accounts is one of the most important parts of the month-end close. This ensures your records match external statements and internal reports.

- Reconcile bank accounts and credit card statements: Compare bank and credit card statements with the transactions recorded in the accounting system. Make sure every deposit, expense, transfer, and withdrawal is accounted for. Flag any discrepancies and investigate missing or duplicate entries.

- Verify intercompany transactions (if applicable): If the business operates across multiple entities, confirm that all intercompany transactions are recorded correctly on both sides. This helps avoid mismatched balances between entities.

- Match inventory counts with records: Cross-check physical inventory counts with what’s recorded in the accounting system. Adjust for any discrepancies and investigate missing stock or errors in product quantities.

Adjustments and Journal Entries

At this stage, you’ll make any necessary adjustments to align the books with the actual financial activity of the business. This step ensures that income and expenses are recorded in the correct periods.

- Review and record depreciation: Calculate monthly depreciation for fixed assets like equipment or property. Post journal entries to reflect the asset’s reduced value over time.

- Check prepaid expenses and deferred revenue: Review prepaid expenses (like insurance or software subscriptions) and deferred revenue. Recognize the portion that applies to the current month and adjust the remaining balance accordingly.

- Post necessary accruals: Record any accrued expenses or revenue that haven’t yet been invoiced or paid. This includes things like unpaid bills, payroll expenses, or interest income

Review and Reporting

The review and reporting stage is where everything comes together. This step ensures the financial reports are accurate and ready to be shared with the client.

- Validate the trial balance: Make sure that all accounts in the trial balance are accurate and balanced. Look for unusual balances or discrepancies that could signal errors in the previous steps.

- Prepare and review financial statements: Generate key financial reports, including the Profit & Loss statement, Balance Sheet, and Cash Flow statement. Review the reports to ensure they align with the client’s financial activity and that no critical information is missing.

- Obtain approvals and close the period: Share the final reports with the client or relevant stakeholders for review. Once approved, officially close the period in your accounting system to prevent further changes to the books.

Free Month-End Close Excel Templates

1. Basic Month-End Close Template

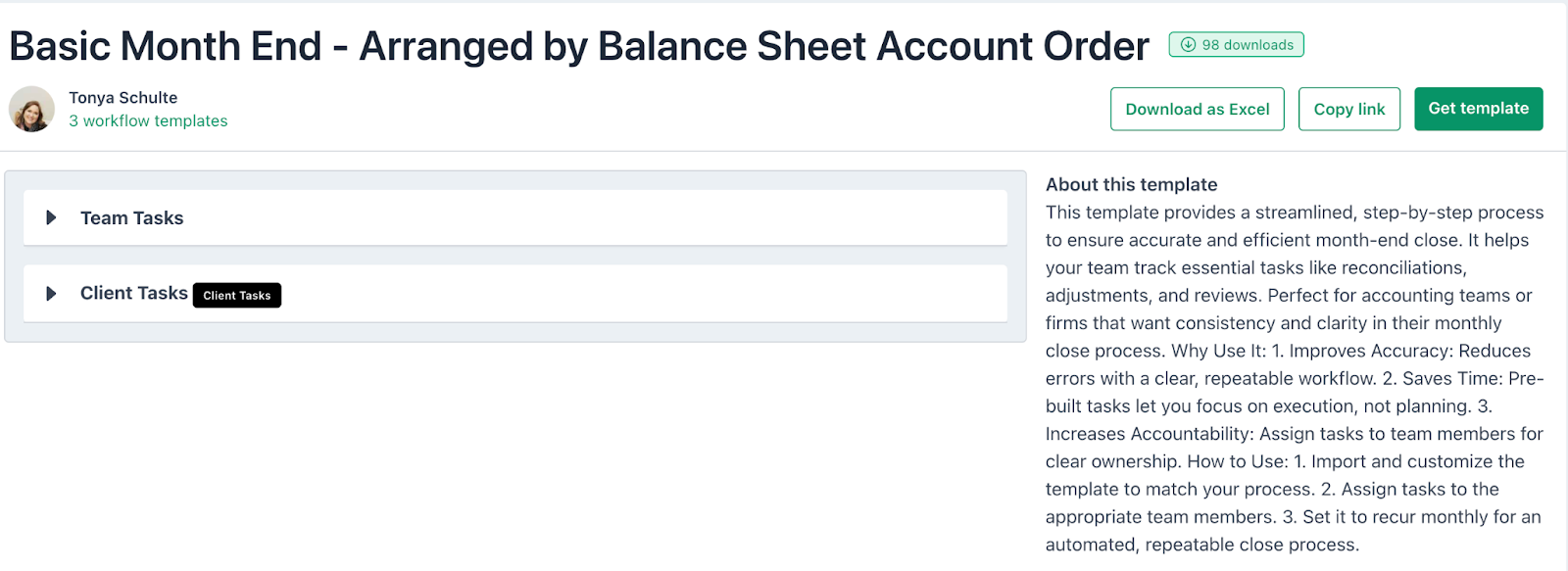

This basic month-end template was created by Tonya Schulte, Construction Accounting Specialist and CEO of The Profit Constructors. It’s designed to help accounting and bookkeeping teams organize their month-end close process efficiently. It’s arranged by Balance Sheet Account Order, meaning tasks are listed in the order that accounts typically appear on the balance sheet—from assets to liabilities and equity.

This template is grouped into two:

- Team Tasks: A step-by-step list of tasks for your team to perform, like reconciling accounts, downloading statements, and reviewing payroll liabilities.

- Client Tasks: Requests for information or documents from clients, such as tax reports, loan documents, and payroll reports.

It’s great for accounting firms that want a standardized, repeatable month-end close process across multiple clients.

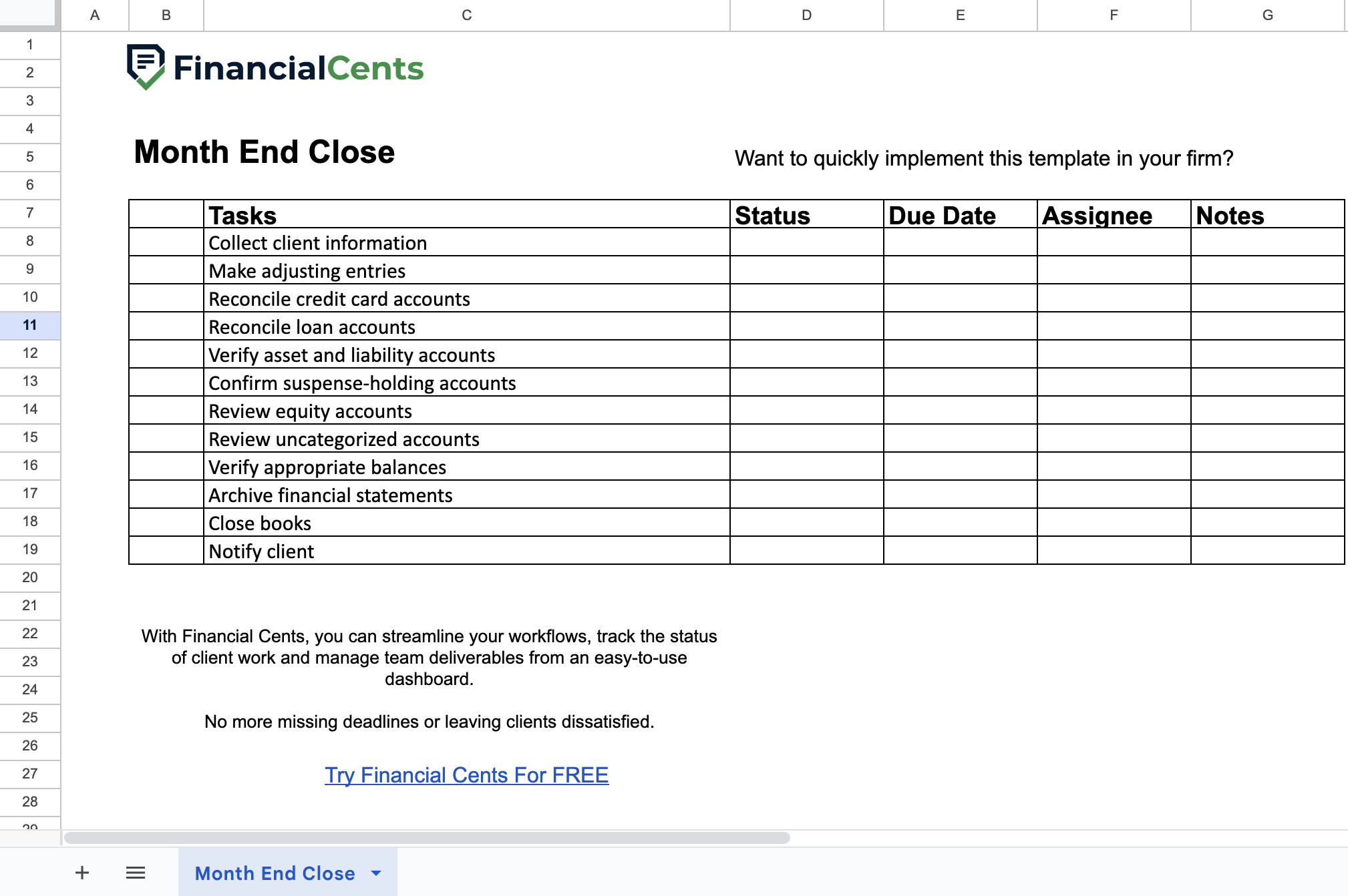

2. Free Month-End Close Checklist Template

This is a Financial Cents’ own template, designed to help accounting and bookkeeping firms organize their month-end close process. It breaks down key month-end close tasks into a simple table with columns for:

- Tasks: Steps to complete during the month-end close, like posting adjusting entries, reconciling accounts, verifying balances, and notifying the client.

- Status: To track the progress for each step.

- Due Date: To assign deadlines to each task.

- Assignee: To delegate responsibilities to team members.

- Notes: To add any additional information or special instructions.

Using this template helps your team collaborate well and improves accountability by assigning tasks to specific team members. This ensures you all work together to close clients’ books accurately.

Tips for an Efficient Month-End Close

Here are a few tips to help your close process run efficiently and smoothly.

Automate Repetitive Tasks Where Possible

Automating repetitive tasks is one of the easiest ways to speed up your month-end close. Many steps in the process—like bank feed rules, invoice matching, and generating recurring reports—can be time-consuming when done manually.

With accounting software or workflow management tools, you can set up automatic processes to handle these tasks. This saves time and reduces the risk of human errors that could delay the close.

By automating what you can, your team can focus on more high-value tasks like reviewing reconciliations and financial statements and spotting potential errors while keeping the entire close process on schedule.

Assign Clear Responsibilities to Team Members

Clearly defining who is responsible for each task in the month-end close process helps prevent confusion and delays. When team members know exactly what they need to do and by when, they can work more efficiently and avoid tasks falling through the cracks.

The checklist template we provided has broken down the entire close process into smaller, actionable tasks, so just assign each task to a specific team member and set deadlines using a tool like Financial Cents. You can also track progress with the software.

With clear responsibilities, everyone on the team is accountable, which makes the closing process more organized and consistent.

Use Collaboration Tools To Improve Communication

Communication breakdowns can happen when multiple team members work on different tasks, which delays the process. So use collaboration tools like Financial Cents to keep everyone on the same page by providing a central place to share updates, ask questions, and flag issues.

This reduces back-and-forth emails and makes tracking what’s been done and what’s still pending easier.

Review Processes Regularly To Identify Areas for Improvement

Even with a solid month-end close process in place, there’s always room to improve. Regularly reviewing your workflows helps you spot inefficiencies, recurring errors, or steps that could be automated or simplified.

At the end of each month-end close, take time to evaluate what went well and what didn’t. Did any tasks take longer than expected? Were there frequent bottlenecks? Getting feedback from your team can also help you understand where the process could be smoother.

By consistently refining your processes, you can make each month-end close faster, more accurate, and less stressful.

Document the Month-End Close Process

Having a documented month-end close process creates a clear, standardized guide that everyone on your team can follow. It ensures that tasks are completed consistently and reduces the risk of missed steps, especially when onboarding new team members or delegating work.

Your documentation should outline every step of the process, including task descriptions, responsible team members, deadlines, and tools or software used. A detailed checklist (like the one shared in this guide) helps your team follow the same process every time—no guesswork or confusion.

Keeping this documentation up-to-date also makes it easier to improve the process over time and maintain quality as your firm scales.

Train Staff on Month-End Close Procedures

Even with a detailed checklist and documented process, your team needs proper training to execute the month-end close accurately and efficiently. Regular training sessions help ensure that everyone understands their responsibilities, how to use accounting software, and the best practices for completing each task.

Training also helps your team stay updated on changes to accounting standards, internal processes, or new automation tools. When everyone is on the same page, you’ll reduce the likelihood of errors, speed up the closing process, and improve overall consistency across client accounts.

Streamline Your Month-End Close Process with Financial Cents

Financial Cents is a practice management tool for accounting and bookkeeping firms to get organized, stay on top of deadlines, and scale faster. Here are some of our features:

Workflow Management and Automation

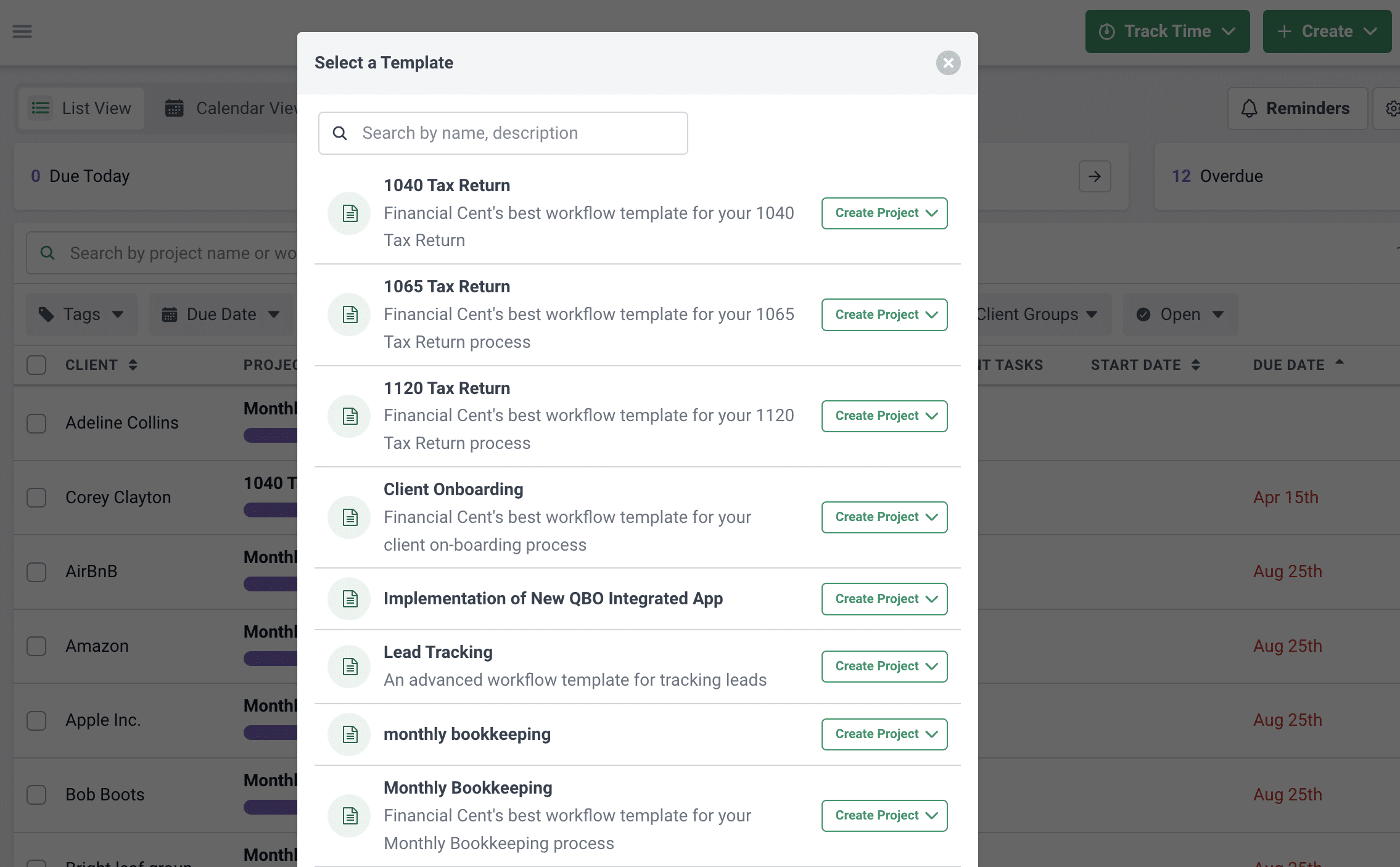

Financial Cents provides customizable workflow templates that allow you to document and standardize your month-end close procedures. These templates serve as detailed guides, outlining each step required to complete the process. By implementing these templates, you ensure that every team member follows the same procedures, maintaining uniform quality of work regardless of who manages the task.

You can choose from one of our 100 free templates across different use cases:

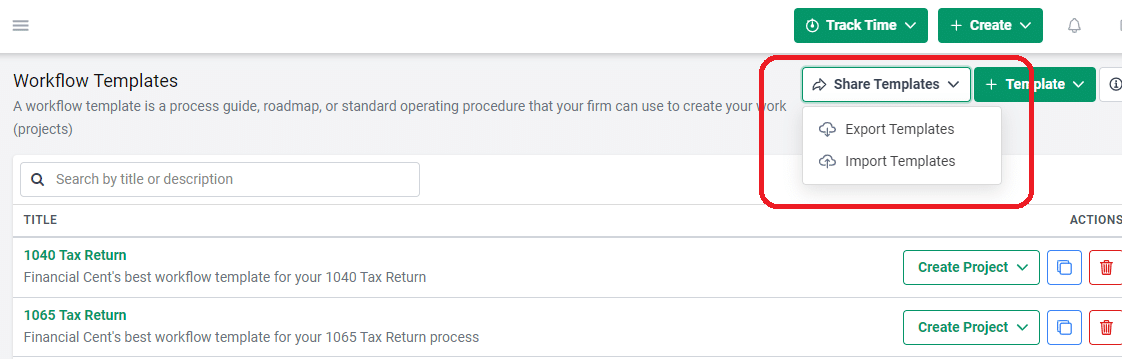

Or, if you have existing workflow templates already, you can import them into Financial Cents by direct copy/paste or uploading them:

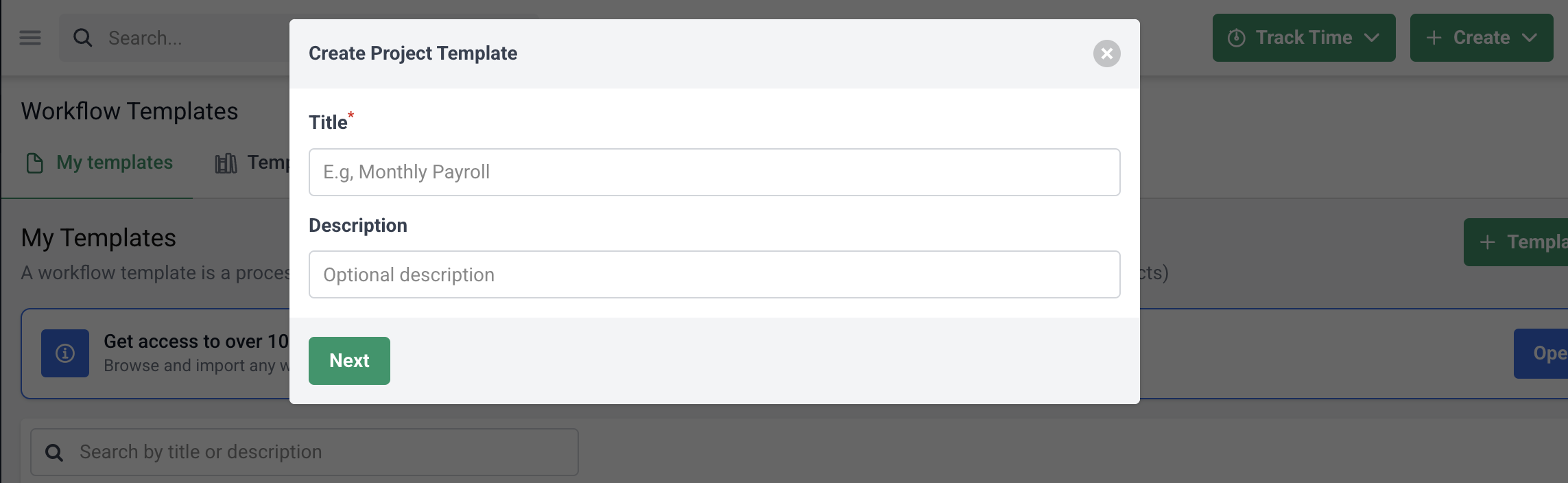

Alternatively, you can create your own workflow template from scratch and save it for future use:

In addition to standardization, Financial Cents enables effective task delegation. Within each workflow, you can assign specific tasks to team members, set due dates, and monitor progress in real time.

Automate Recurring/Repetitive Tasks

Financial Cents allows you to set projects to recur on certain schedules, such as semi-monthly, on the last day of the month, or specific weekdays. This is great for repetitive tasks like month-end closing. It saves you the effort of manually creating the project every month.

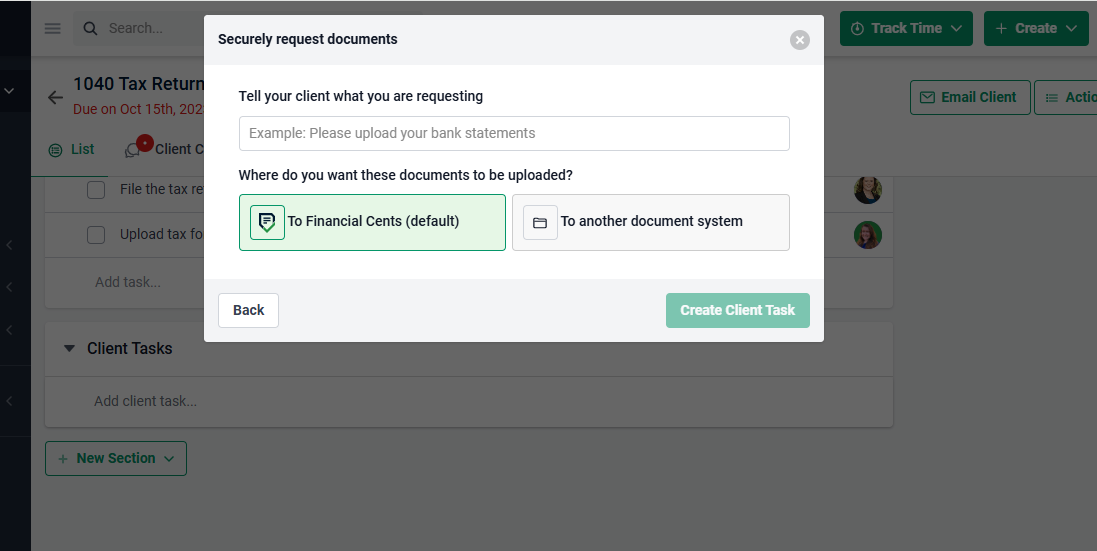

Automate Client Requests

Instead of chasing clients for documents, Financial Cents automates client information requests, making it easy to send and manage document requests through a secure portal. It then provides a secure client portal where clients can easily upload requested documents.

This centralized platform ensures that all client communications and document submissions are organized and accessible, reducing the risk of misplaced information and enhancing data security.

There are also automated reminders to ensure clients provide the information you need without unnecessary delays.

Document Storage

Financial Cents provides unlimited document storage, allowing your firm to securely store all necessary files without worrying about space limitations. This ensures that historical data and essential documents are always accessible when needed, even when you archive them (we don’t delete archive documents or projects).

Deadline Tracking

Upon logging into Financial Cents, you’re greeted with a comprehensive workflow dashboard that provides an overview of all ongoing projects and their respective deadlines. This centralized view allows you to monitor the status of client work and ensures that no task slips through the cracks.

Projects are automatically sorted by due dates, with the most urgent tasks prominently displayed at the top, enabling you to prioritize effectively.

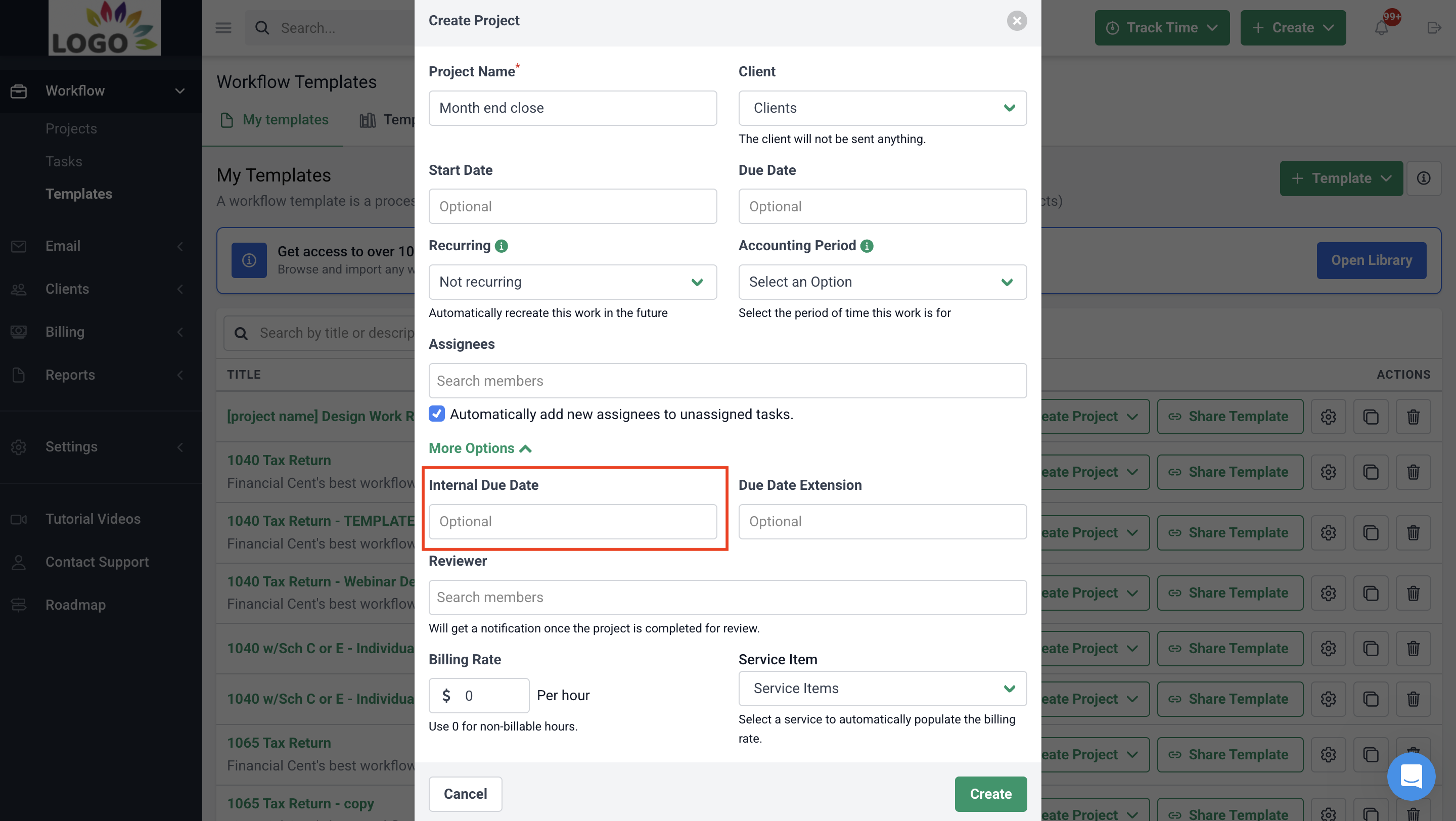

You can even set internal due dates that precede the actual client deadlines. This feature enables your team to complete tasks ahead of schedule, providing a buffer for reviews and unforeseen delays:

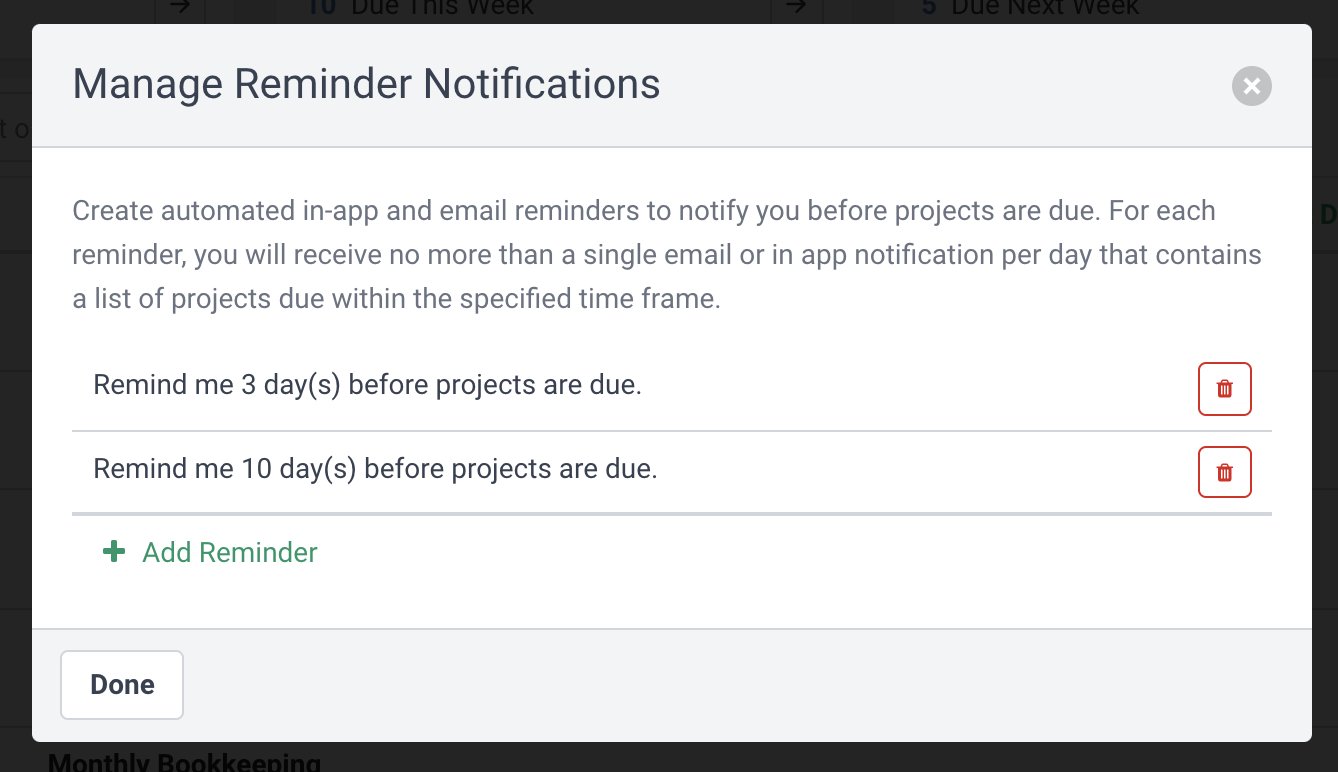

Financial Cents also lets you set automated reminders for approaching deadlines, ensuring that critical tasks receive the necessary attention and are completed promptly.

Team Collaboration

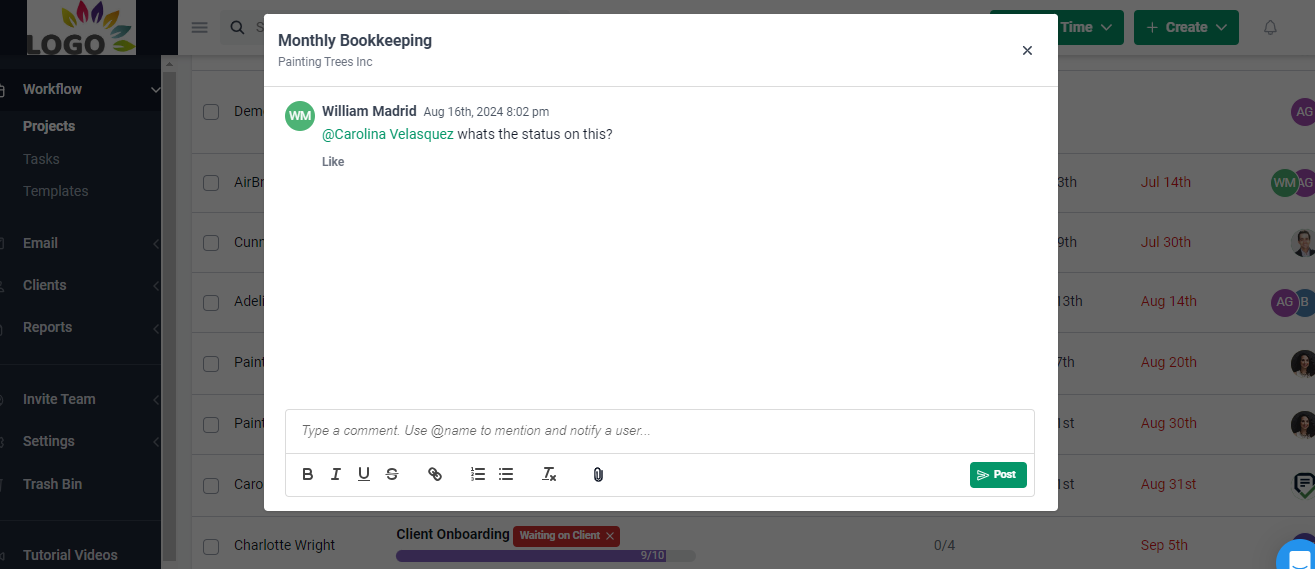

For each project created in Financial Cents, there’s a comments tab that facilitates real-time communication among staff. This feature allows team members to discuss project details, share updates, resolve issues, @mention specific colleagues to get their attention all within the project space. This reduces reliance on external communication tools and ensures that all relevant information is centralized.

A files tab also centralizes all documents linked to a project in one location. This saves time by eliminating the need to search through email threads or shared drives. Plus, automated notifications alert you whenever you’re tagged in a comment, assigned a task, or when a client uploads a document—so you’re always in the loop. All these enhance team collaboration and communication for increased efficiency.

Use Financial Cents to manage your month-end close process.