Accountants are very busy people. Client calls, team check-ins, monthly roundups, tax filings, networking, you name it. You do it all. It’s the grind you’ve signed up for.

Yet, more often than you’d like to admit, you find yourself stumbling through messy workflows at the end of each month. Without a clear structure, critical details easily slip through our minds. Deadlines get missed, client reminders never make it out, and you’re left anxiously double-checking (and triple-checking) everything in the dead of night. The path of least resistance is to continue in your chaotic, paper-strewn, unread-notifications mess. But that’s not sustainable, and you already know it.

Having a structured monthly accounting workflow eliminates chaos, streamlines your team’s efficiency, ensures nothing goes unnoticed, and most importantly, gives you peace of mind when you finally call it a day.

In this guide, we’ll walk you through exactly how to set up and follow a consistent monthly accounting process tailored specifically for your practice. Plus, we’ve included a free, ready-to-use checklist template to keep you and your team accountable and organized every month.

Why Is Monthly Accounting Important?

Accounting tasks aren’t something you can tackle once a year, especially if you care about keeping your practice running smoothly (and staying sane). Monthly accounting is routine maintenance for your firm: ignore it, and issues pile up quickly.

You might sometimes feel overwhelmed by the sheer volume of tasks at the end of each month, but don’t skip them. Instead, consider breaking these tasks into smaller, weekly chunks, like Jenny Roost does in her firm:

We do transaction reviews on a weekly basis, whereas some people wait till the end of the month. It helps us spread routine work throughout the week rather than cramming everything into the month-end."

Jenny Roost, Construct BookkeepingPerforming accounting tasks monthly gives you timely, accurate insights into your firm’s health, letting you spot issues before they snowball. You won’t be scrambling through a mountain of receipts come tax season, nor will you wonder about the status of your client’s projects.

Consistent monthly accounting helps you:

- Stay compliant: You’re always prepared for tax filings and audits, reducing stress and eliminating costly penalties.

- Manage cash flow: You’ll have a clear picture of your client’s income and expenses, allowing you to propose smarter solutions throughout the year.

- Catch mistakes early: Small oversights don’t become big headaches if you’re regularly checking the books.

Step-by-Step Monthly Accounting Checklist

Getting your monthly accounting right comes down to sticking with a clear, repeatable checklist. Here’s how you start:

Step 1: Reconcile Bank and Credit Card Statements

Reconciling statements isn’t the most glamorous accounting task, but it’s essential. At the end of each month, carefully match transactions recorded in your accounting software with those listed on your clients’ bank and credit card statements.

Why does this matter? Because reconciliation is your safety net. It helps catch discrepancies, duplicate charges, forgotten expenses, or even fraud.

Collect bank and credit card statements from clients (preferably digital copies). Cross-check each transaction with your accounting software to identify unmatched items. If discovered, investigate immediately, and correct errors promptly. Attach reconciled statements to your monthly records and note any issues or adjustments.

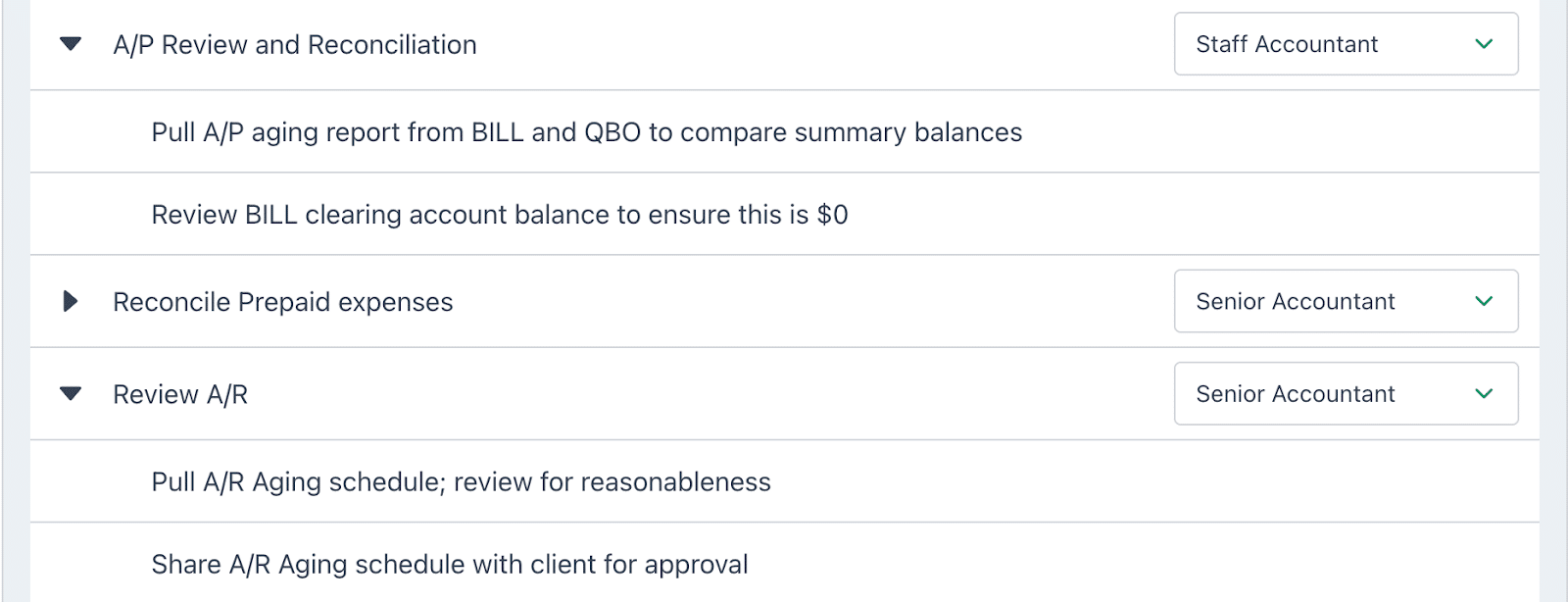

Step 2: Review Accounts Payable & Receivable

Accounts payable (AP) and accounts receivable (AR) are your client’s cash flow engine. Regularly reviewing AP and AR helps you spot trends, address problems proactively, and prevent your clients from encountering cash crunches.

On the AP side, monthly reviews ensure that bills are paid promptly and your clients maintain strong vendor relationships. For AR, timely monitoring helps prevent overdue accounts from piling up, keeping cash flowing smoothly.

Step 3: Categorize and Record Transactions

Categorizing transactions is foundational to producing accurate and actionable financial reports. Yet, it’s often a pain point, especially when your clients regularly introduce unexpected or unclear transactions into the mix.

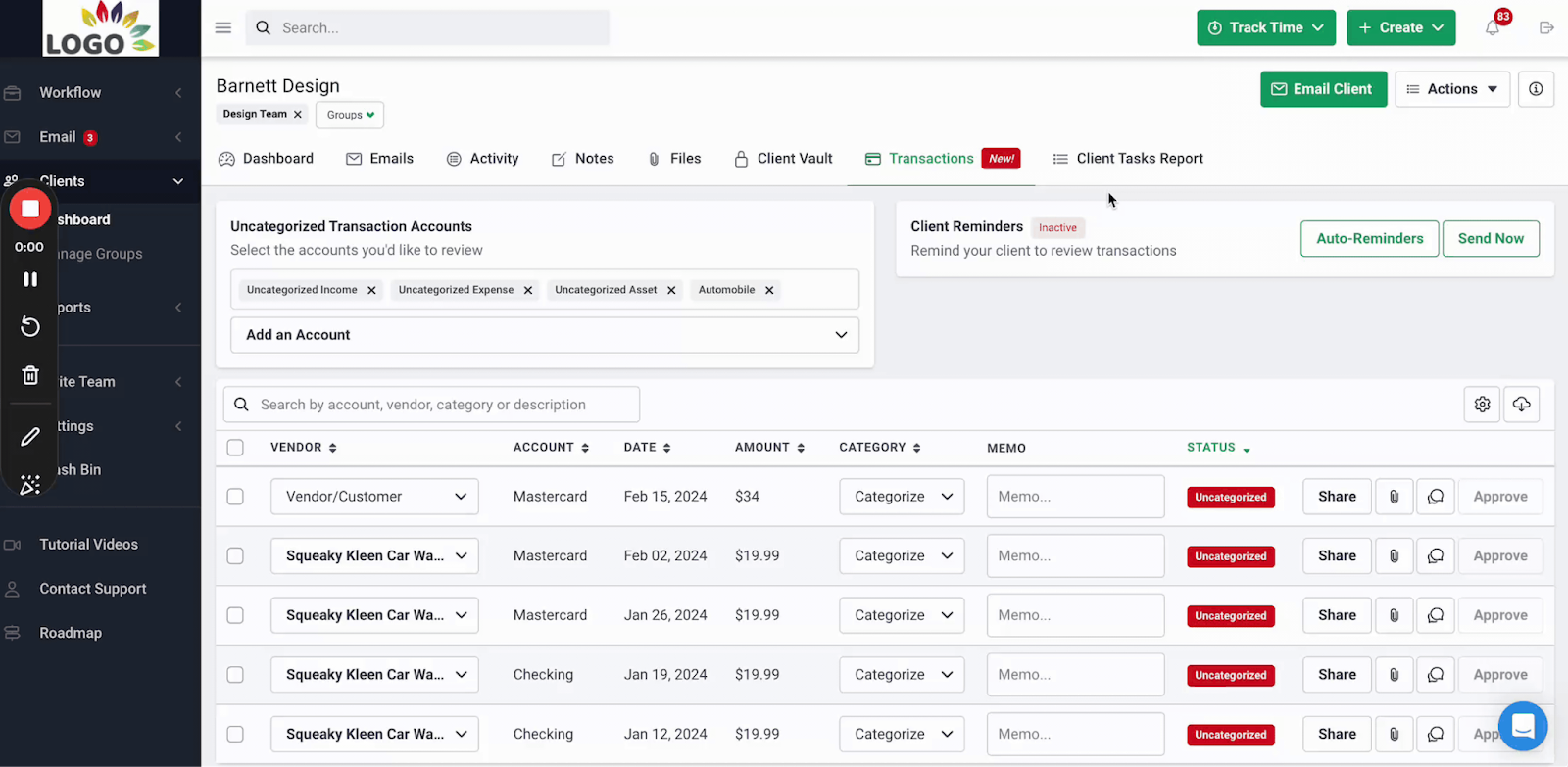

To prevent messy records and confusion down the line, dedicate time each month to properly classify and record every transaction. This clarity pays dividends at tax time, during audits, or whenever clients have urgent questions about their financial position. Use tools like Financial Cent’s ReCats, a powerful add-on that simplifies managing uncategorized transactions.

With ReCats, you can automate your categorization workflow right from your Financial Cents dashboard. This feature ensures transactions are consistently recorded in the correct categories, every single time.

Here’s how ReCats makes your monthly workflow smoother:

- Auto-pull transactions that are classified to specified GL accounts (like Uncategorized Expenses) from QuickBooks Online into the ReCats module.

- Send automated reminders (“auto-nags,” as some Financial Cents users affectionately call them) to quickly get your clients’ feedback.

- Collect detailed notes and documents directly from your clients in one streamlined interface.

- Instantly categorize transactions and push them back to QuickBooks Online with just a click.

Step 4: Payroll & Tax Compliance Checks

Payroll might feel routine, but it’s one area where small errors can lead to big headaches. Each month, dedicate time to thoroughly reviewing payroll accuracy.

Confirm employee hours, pay rates, and deductions to ensure everyone receives exactly what they’ve earned. A careful payroll review prevents overpayments, underpayments, unhappy calls from employees, and keeps your client’s business running smoothly.

Additionally, make sure payroll tax obligations are met promptly and correctly. Review deadlines and confirm that all necessary payments, whether federal, state, or local, are accurately calculated and paid on time.

Step 5: Client Communication & Document Collection

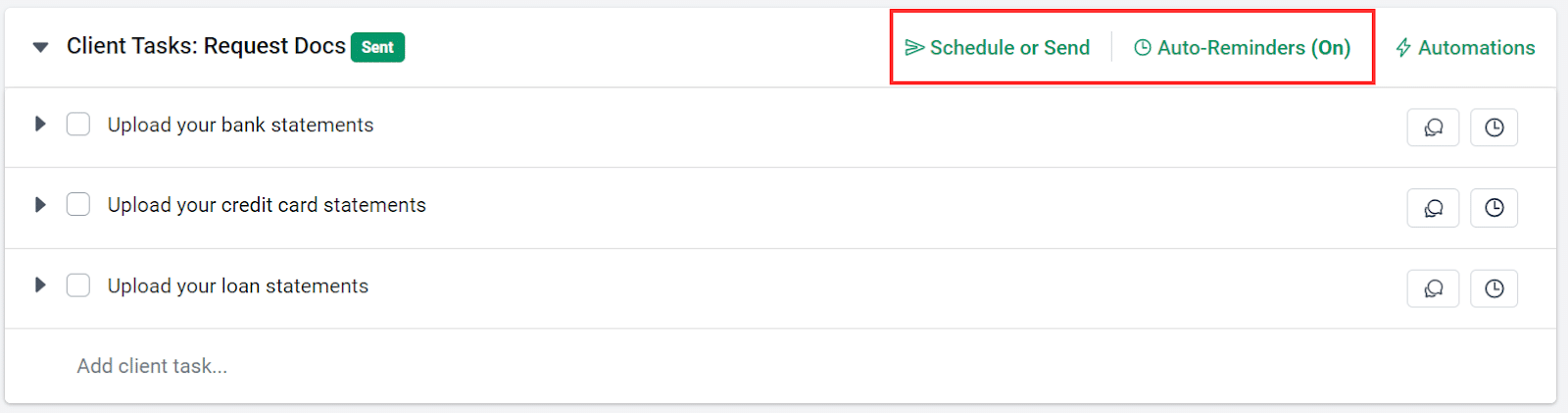

Tracking down clients to provide documents each month feels like playing hide-and-seek, but way less fun. You email, they delay. You call, they promise. Then you wait. It’s a headache, and it eats up valuable time that you could be spending actually doing the work.

Fortunately, tools like Financial Cents’ automated client reminders can handle the chasing for you. Set them up once, and your clients receive automatic nudges to send in their bank statements, payroll documents, and whatever else you’re waiting on. It’s a huge relief knowing you won’t have to personally hound anyone just to get your job done.

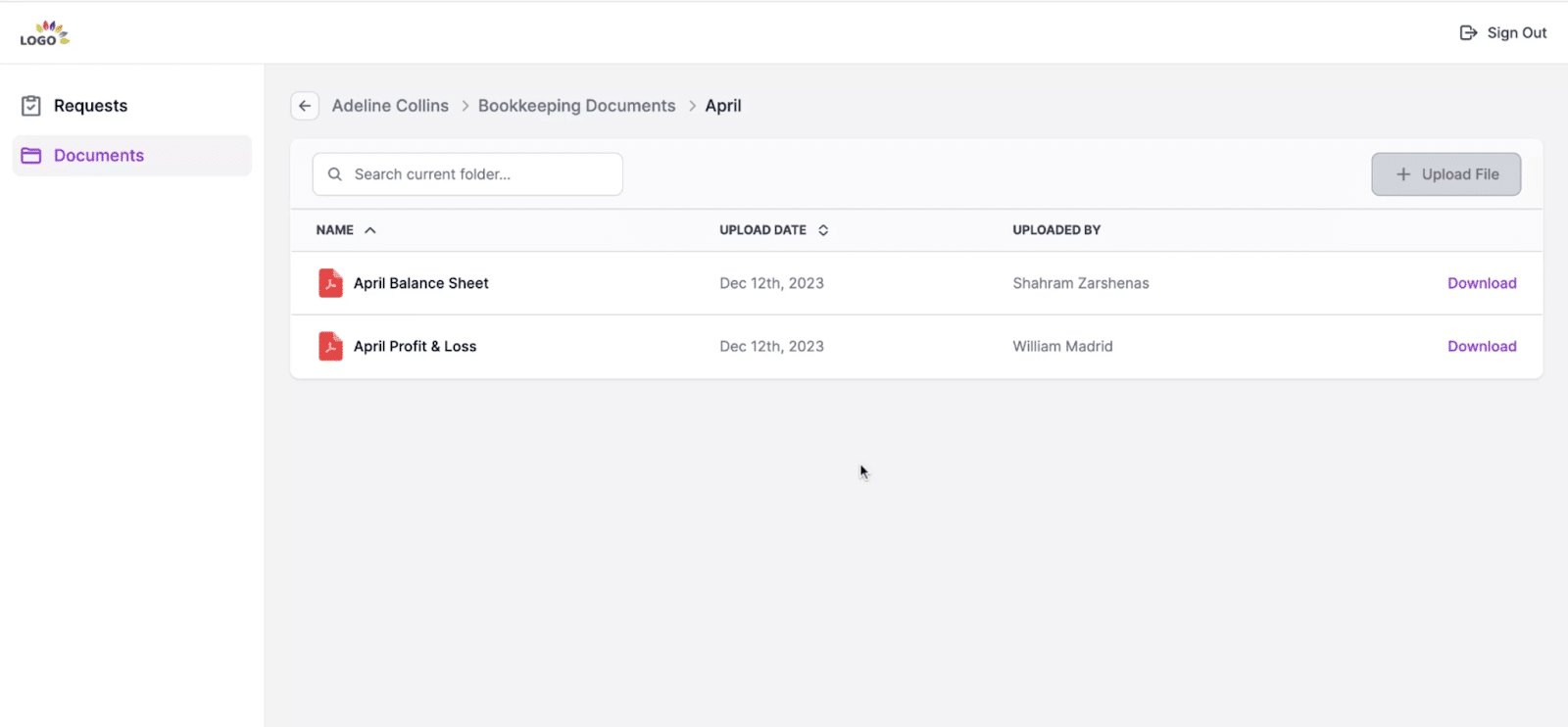

Even better, Financial Cents’ secure client portal makes document exchange and communication painless. Your clients can securely upload documents right into their dedicated portal, and you can chat back and forth instantly to clear up any questions.

Step 6: Generate Financial Reports

Once you’ve reconciled, categorized, and tracked down all those client documents, it’s finally time to produce financial reports. This is the moment when your hard work throughout the month pays off in clear, concise numbers that tell your client’s financial story.

Monthly reports typically include balance sheets, profit & loss statements, and cash flow statements. They’re not just for compliance; these reports give clients a clear snapshot of their business health. With accurate monthly reports, you can confidently show your clients exactly where their business stands and equip them to make smarter decisions moving forward.

Step 7: Review and Analyze Reports

Generating reports is one thing, but diving into them to make sense of the numbers is where your real value as an accountant shines. Review each report carefully to identify trends, unusual patterns, or potential red flags. Did revenue spike unexpectedly? Did expenses drift off course? Are receivables piling up too quickly?

Regular analysis helps you become proactive, spotting issues before they become full-blown problems. It also positions you as your client’s trusted advisor, not just someone who crunches numbers.

Step 8: Backup & Data Security

Your client’s financial information is gold; valuable, sensitive, and critical to their business. That’s why data security isn’t something you leave to chance or handle casually. Regularly backing up your records and securely storing client documents is essential.

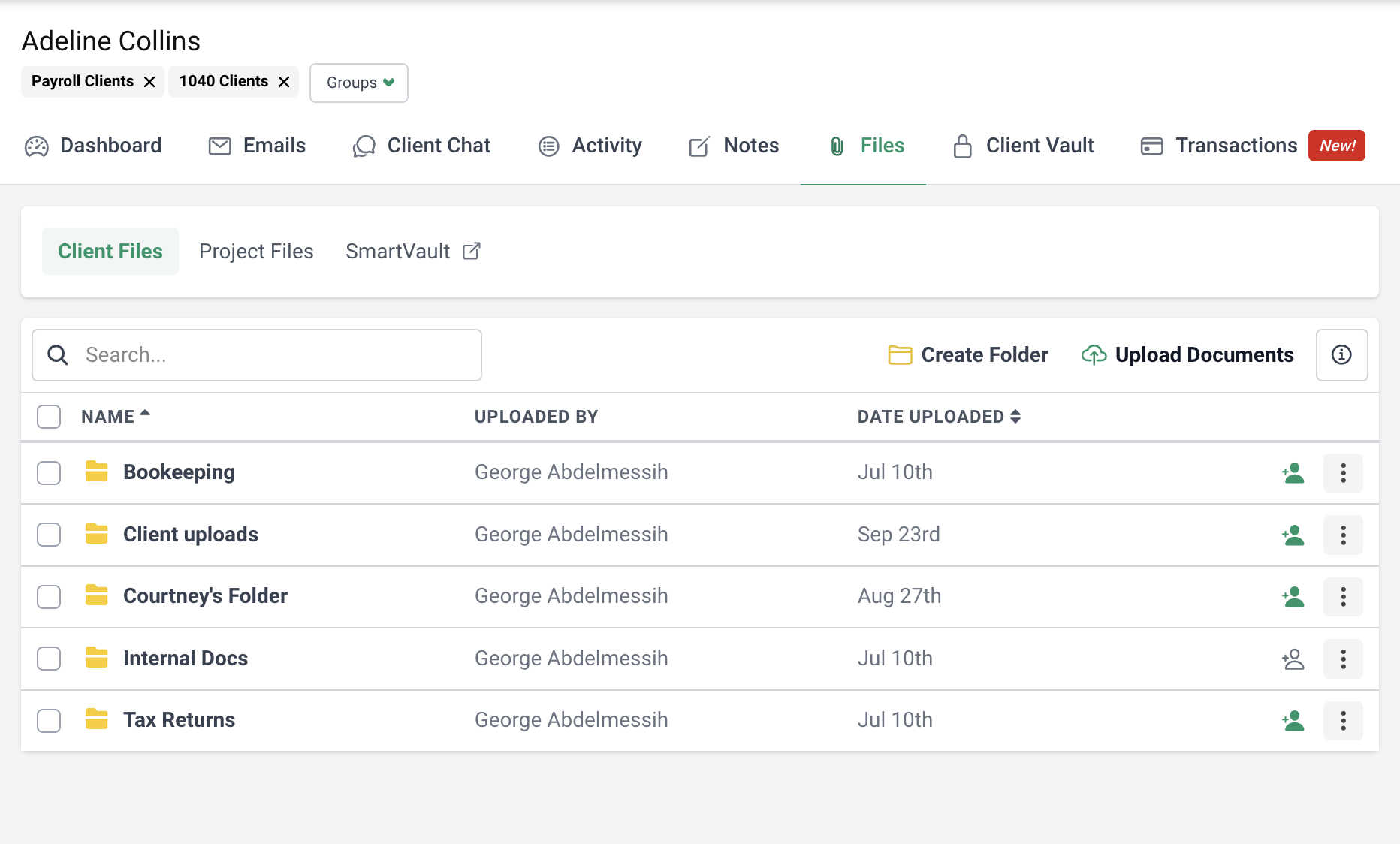

Fortunately, Financial Cents has your back here. Its secure document storage capabilities keep your client data safe, organized, and accessible—whenever and wherever you need it. Instead of risky USB drives, overflowing file cabinets, or endless email attachments, your client files are stored securely in one centralized location, protected by enterprise-grade security.

With Financial Cents, you’re not just safely storing your documents, you’re proactively protecting your clients (and your practice) from data loss, breaches, and costly compliance issues. You’ll sleep easier knowing that even if something unexpected happens, your important documents are backed up, secure, and always at your fingertips.

Free Monthly Accounting Checklist Template

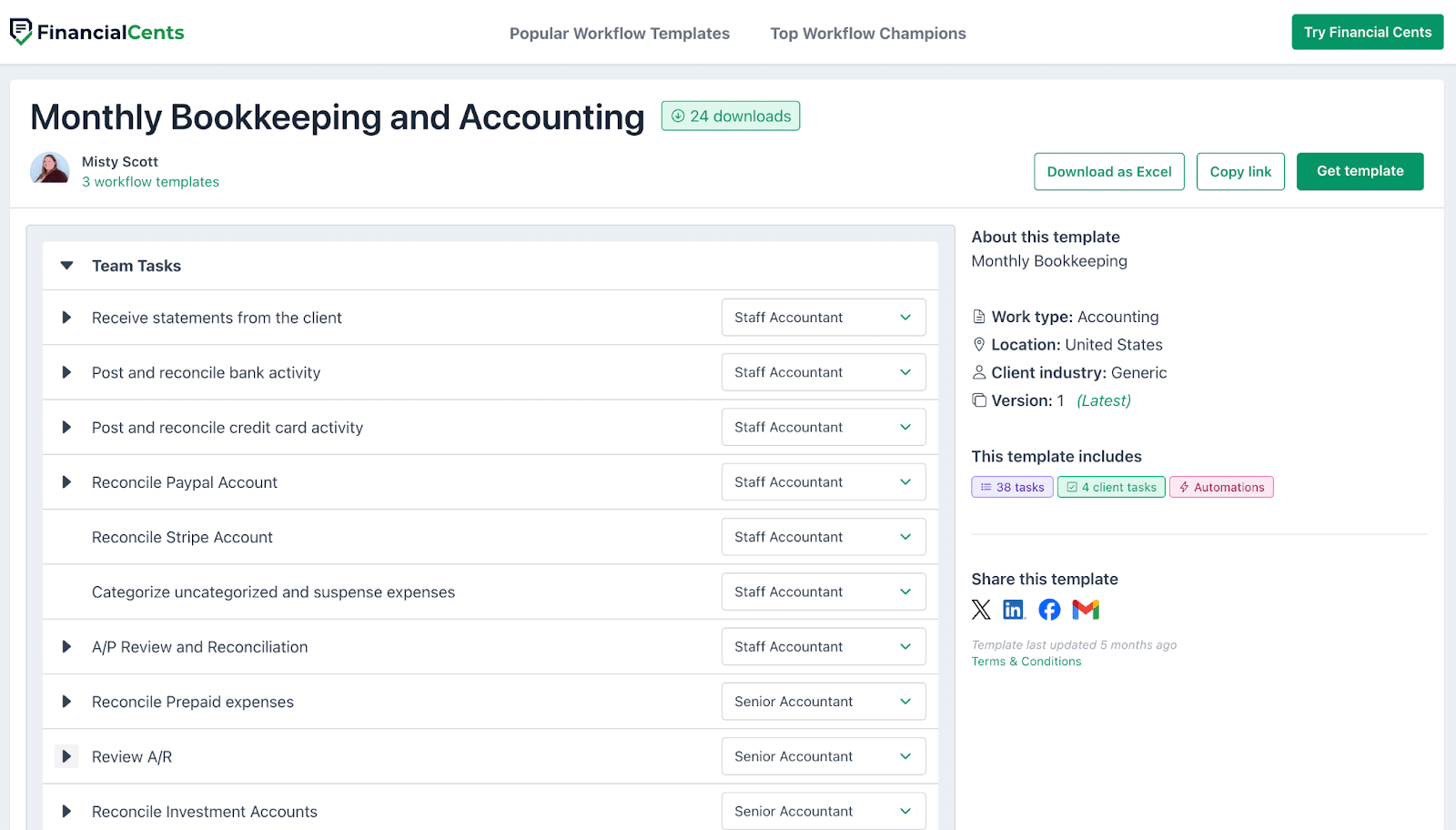

To help you (and your team) get organized quickly, we created a free, customizable Monthly Accounting Checklist Template that you can start using immediately:

This easy-to-follow template covers all the crucial tasks we’ve discussed, from bank reconciliations and client reminders to payroll checks and generating financial reports. Simply follow the structured process month after month, and you’ll never worry about missed steps or messy workflows again.

The best part? It’s fully customizable right in Financial Cents. Adjust tasks, set deadlines, assign team members, and effortlessly track your progress all in one place.

Common Pitfalls to Avoid

Even experienced accountants sometimes fall into habits that sabotage their monthly workflow. Here are four common pitfalls to keep on your radar (and how to avoid them).

Not Automating Key Processes

Doing everything manually might feel familiar, but it’s a fast lane to burnout. Automate repetitive tasks, like document collection, client reminders, and categorization. Automation saves time, reduces mistakes, and lets you focus on higher-value work.

Ignoring Client Follow-Ups

Letting client follow-ups slide creates headaches for everyone. Missed documents delay workflows, disrupt cash flow, and damage your professional reputation. Tools like Financial Cents’ automated reminders streamline follow-ups, ensuring nothing is forgotten.

Overlooking Small Expenses

Small expenses can add up quickly, creating unexpected cash flow surprises down the line. Don’t ignore tiny transactions—they matter. Carefully categorizing and tracking even minor expenses monthly helps clients maintain accurate budgets, prepare for taxes, and make better business decisions.

Failing to Prepare for Tax Liabilities

Taxes shouldn’t be an afterthought. Leaving tax preparation to the last minute risks costly penalties, rushed decisions, and unhappy clients. Monthly tax liability checks and accurate financial records ensure you (and your clients) are always tax-ready, reducing stress during filing season.

Use an All-in-one Practice Management Software to Manage Client Accounting Tasks

Spreadsheets, sticky notes, and scattered emails don’t cut it anymore when managing a busy accounting practice. An all-in-one practice management software like Financial Cents streamlines every aspect of your workflow, helping you deliver accurate, timely, and high-quality accounting services every month.

Here’s how various features work for you:

Workflow Management & Automation

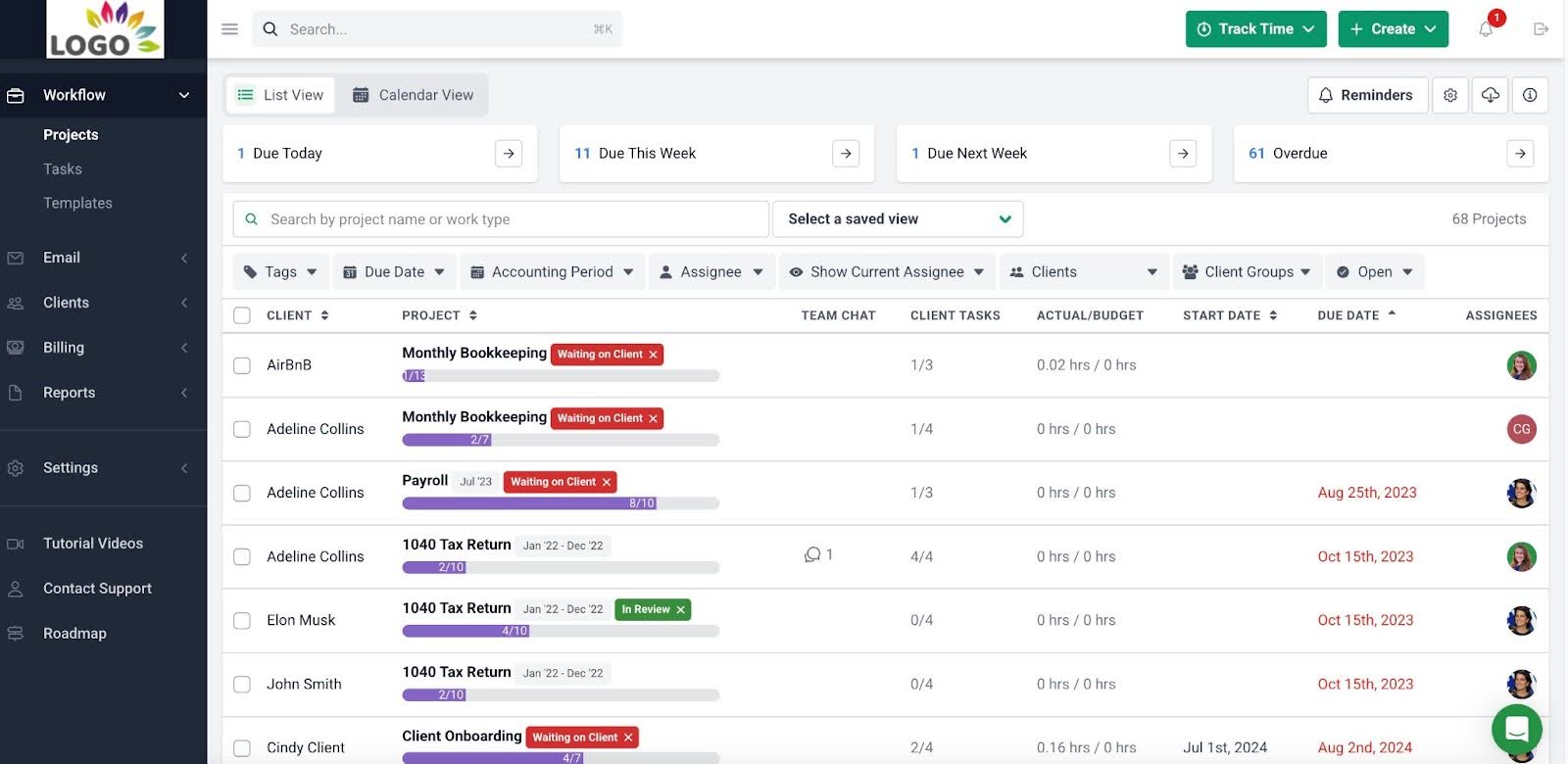

- Workflow Dashboard: Easily track the status of all client work from one intuitive dashboard. Instantly see what’s completed, what’s pending, and what’s at risk. No more guessing or endless status checks.

- Task Assignment: Assign tasks to yourself or team members, so everyone knows their responsibilities. You can instantly see who’s working on what, ensuring accountability and clarity.

- Recurring Task Automation: Set tasks once, and let them automatically recur every month. Save valuable time spent recreating the same tasks over and over again.

- Automating Client Tasks and Reminders: Schedule automatic client reminders for documents or deadlines, eliminating manual follow-ups and speeding up turnaround times.

- Deadline Tracking and Reminders: Stay ahead of crucial deadlines with automated notifications, ensuring nothing slips through the cracks.

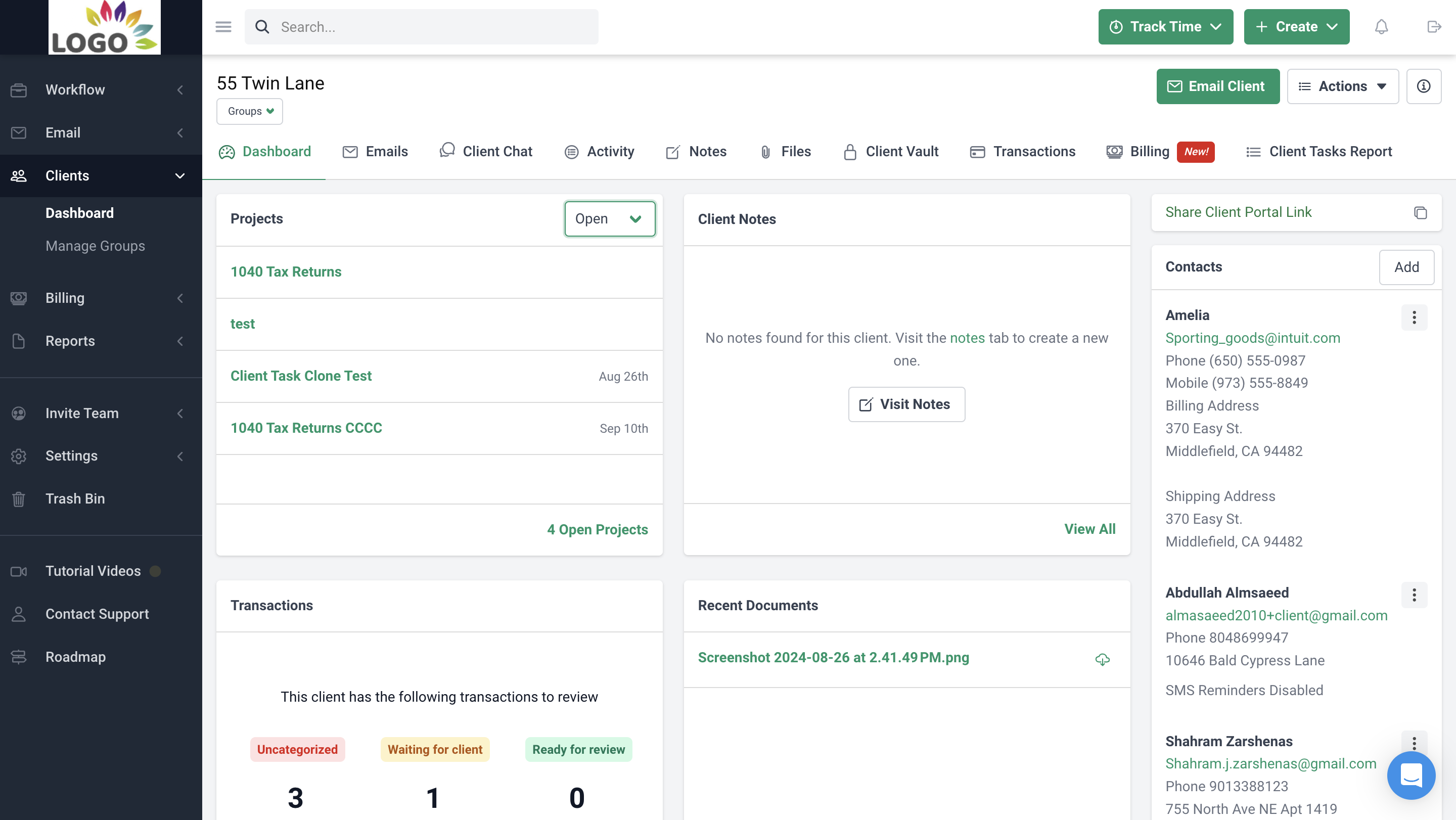

Client Relationship Management

Financial Cents stores client interactions, notes, and history all in one central location. Maintain stronger relationships by having essential client details always at your fingertips.

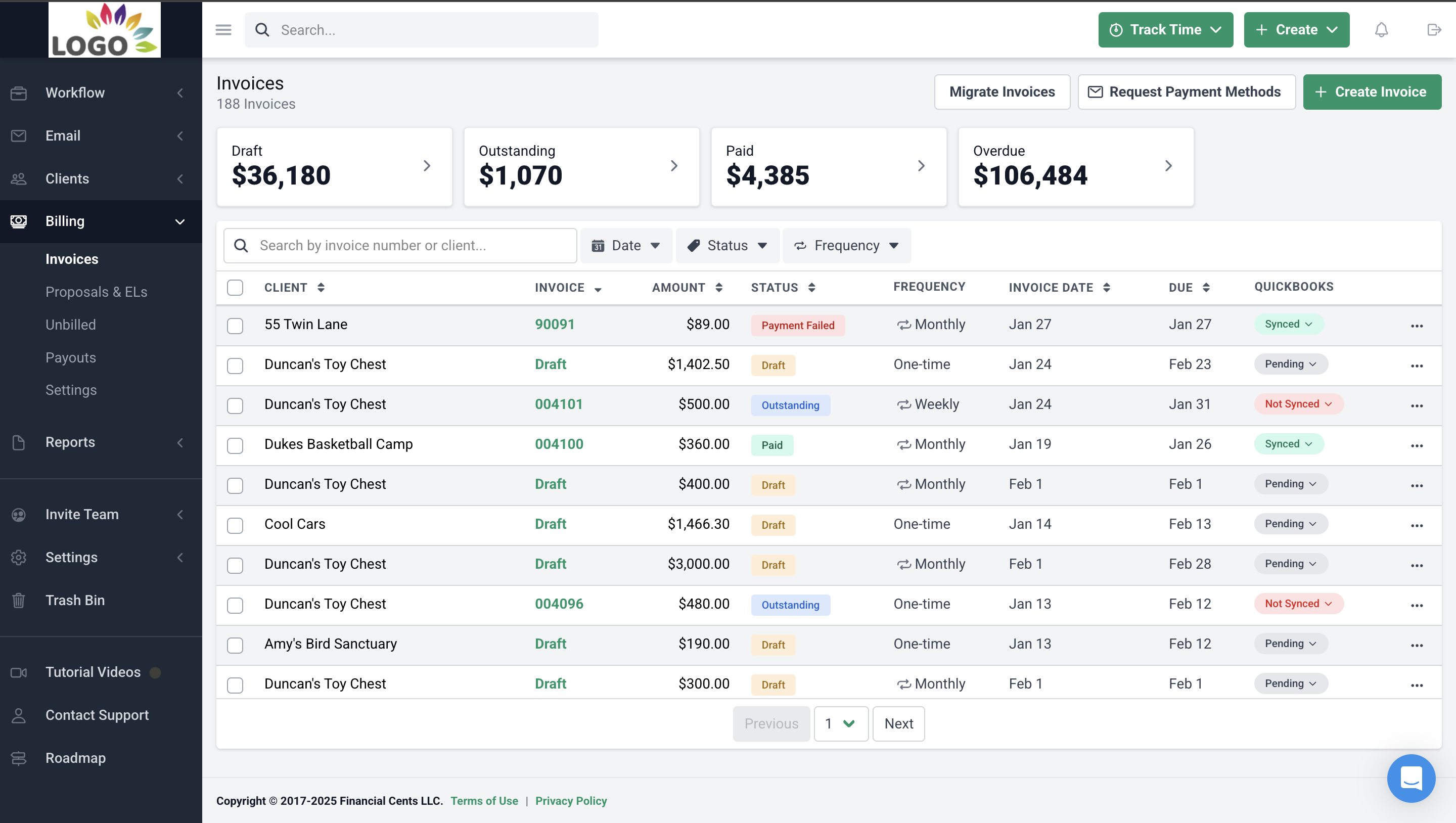

Time Tracking & Billing

Accurately track time spent on each client or project and quickly generate invoices directly within Financial Cents. This means faster payments, clearer records, and improved profitability for your practice.

Team Collaboration

With built-in collaboration features, your team can communicate directly within tasks, reducing confusion, enhancing accountability, and improving overall efficiency.

Secure File Sharing & Document Management

Financial Cents offers secure document storage and easy file sharing. Sensitive client information is safe, organized, and readily accessible whenever you or your clients need it.

Conclusion

Monthly accounting without structure is a recipe for stress, missed details, and late-night worries. But when you have a clear workflow that fits your routine and tools to automate those repetitive, time-consuming tasks, life gets much easier.

Financial Cents is built specifically for busy accountants like you. You’ll cut down on the chaos, and finally stay on top of every deadline without breaking a sweat. It brings everything into one place: client communication, task assignments, reminders, and secure document sharing.

If you’re ready to trade your monthly frenzy for a simpler, calmer, more organized way to manage your accounting practice, give Financial Cents a try. Your future self (and your clients) will thank you.

Use Financial Cents to manage work in your firm today.