You’re an accounting firm in the middle of tax season.

A client requests their historical financial records from the past five years.

You have some information in your email inbox; other records are stored in a spreadsheet on your computer, and the rest is on a cloud storage platform.

After hours of piecing together scattered data, you realize a few critical documents are missing.

The result?

Delays, a frustrated client, and a significant waste of time.

Many accounting firms are juggling client information across various platforms, with no central system to manage everything efficiently.

As your accounting firm grows and handles more clients, this kind of decentralized data management becomes a ticking time bomb.

The risks are real—data breaches, compliance issues, inefficiencies, and missed opportunities.

But there is a solution: centralizing client data.

In this article, we’ll break down the real risks of not keeping your client data in one place, why it’s so important for accounting firms to do so, and how centralizing your data can protect your firm while making things run more smoothly.

What is Centralized Client Data, and Why Does It Matter?

In essence, centralizing client data means consolidating all relevant information—such as financial records, tax documents, contact details, reports, and more—into one accessible location.

This could be a cloud-based platform, an enterprise resource planning (ERP) system, or specialized accounting software. Instead of having multiple systems where pieces of data are scattered, centralization ensures that everything is stored in one place, making it easier for your entire firm to access and manage client information.

So, why should you care?

First, as an accounting firm, you deal with massive amounts of sensitive information. Your clients’ financial statements, tax records, and personal details are critical pieces of data that need to be handled with care. When this information is spread across multiple systems, the likelihood of losing or mismanaging it increases significantly. A misstep here can not only damage your client relationships but also your firm’s reputation.

Second, centralizing your data streamlines your operations. Imagine the ease of pulling up all your client’s relevant information with just a few clicks without needing to switch between various platforms or chase down colleagues who have the latest documents. A centralized system allows your staff to work more efficiently, reduce duplication of efforts, and focus on higher-value tasks like advisory services rather than admin work.

The Risks of Not Centralizing Client Data

If you’re still relying on fragmented systems, you’re exposing your firm to several serious risks. Let’s break them down:

1. Data Security Vulnerabilities

Data breaches are a real and growing concern, especially for firms that handle sensitive financial information. When your client data is spread across various platforms, it’s harder to secure. You might have some documents stored on cloud-based platforms, others in local storage, and a few in email threads. The more scattered your data, the more vulnerable it becomes to security threats like hacking, phishing, or accidental leaks.

Take for instance, an employee who stores sensitive client information in a personal folder on their desktop, and their computer gets infected with malware. Or, worse, your firm experiences a cyberattack, and because your data is decentralized, the breach goes undetected for days or weeks. Your firm not only risks losing clients but could also face significant legal and financial penalties for failing to protect that data.

2. Inefficiency and Lost Productivity

If you’re not centralizing client data, your firm is likely wasting valuable time searching for information. Think about how often you’ve had to switch between systems to find the latest version of a client’s financial report or ask colleagues to resend files that were buried in email chains.

This lack of efficiency directly affects your firm’s productivity. Time spent hunting for documents could be better spent on more important work, like advising clients or optimizing their financial strategies. Building a single location for data storage frees up your staff to focus on value-added tasks instead of administrative demands.

3. Human Error and Inconsistencies

When data is fragmented, it’s easy for errors to creep in. Let’s say you have client information stored across multiple systems—one employee updates the client’s financials in the accounting software, while another makes changes to the same client’s tax records stored in an internal database. If these systems don’t communicate with each other, you could end up with conflicting information that leads to mistakes in your client reports or filings.

This kind of human error not only affects your firm’s credibility but can also have financial consequences for your clients.

4. Difficulty in Meeting Compliance Requirements

In the accounting industry, regulatory compliance is non-negotiable. From GDPR to SOC 2, there are strict rules governing how you handle client data. When that data is decentralized, it’s much harder to ensure you’re compliant with these regulations.

If a regulatory body requests specific information during an audit, how quickly can you provide it? If your data is scattered across multiple platforms, you could face delays in responding to audit requests or, worse, fail to provide the necessary documentation. This could lead to penalties or sanctions that harm your firm’s reputation and bottom line.

Additionally, decentralized data makes it difficult to track who has access to sensitive information. If your firm is audited for data security or compliance purposes, you must show that you have control over who can access client data and when. Centralizing your data ensures you have tighter control over these access points, reducing your risk of non-compliance.

The Benefits of Using a Centralized System For Your Clients’ Data

Centralizing your client data isn’t just about organizing files neatly; it’s about transforming how your accounting firm operates. When all your client information lives in one place, it opens the door to smoother processes, better security, and more time to focus on what truly matters—helping your clients succeed.

i. Stronger Data Security

One of the biggest reasons to centralize client data is to boost security.

Think of it like locking all your valuables in a high-tech safe rather than leaving some in a drawer, some under the bed, and a few on the coffee table. With modern data management systems, features like encryption (scrambling data so only authorized users can read it) and multi-factor authentication (requiring a second step, like a code sent to your phone to log in) are built-in. These extra layers of protection make it much harder for outsiders to access your sensitive client information.

In other words, centralizing your data gives you peace of mind. You won’t have to worry about whether that client’s tax return stored in someone’s email could be hacked or if a miscommunication might lead to a file being shared with the wrong person. Everything stays secure in one place.

ii. Improved Efficiency and Time-Saving

Let’s face it—hunting for files across multiple systems or asking team members where the latest version of a document is takes time, and time is money in any accounting firm. Centralizing your client data changes this.

Instead of spending valuable hours each week searching for information, your team can access everything they need in just a few clicks.

This streamlined process also reduces duplication of work. When everyone’s working off the same platform, there’s no confusion about who updated what or which document is the most recent. Everything stays up-to-date, meaning you won’t waste time reconciling conflicting files or re-doing tasks someone else has already completed.

iii. Fewer Human Errors

We all make mistakes, but having a centralized location can help reduce errors and ensure everyone works from the same source of truth.

For instance, if a client’s address changes, you update it once in your centralized system, and now everyone who accesses that client’s file will have the correct details. No more worrying about sending important documents to the wrong location because of outdated records. In this way, a centralized system helps ensure that your firm’s output is faster, more accurate, and more professional.

iv. Simplified Compliance and Regulatory Readiness

As an accounting firm, you’re no stranger to the mountain of compliance rules and regulations you must follow. Whether it’s GDPR, SOC 2, or local financial reporting laws, keeping up with compliance is no small task. A decentralized data system can make this even harder. If data is stored in multiple locations, how can you be sure you’re handling it in a fully compliant way?

Centralizing your client data significantly simplifies this process. Most centralized platforms are built with compliance in mind, offering tools to help you manage sensitive information according to regulatory standards.

Financial Cents is one of such tools. You benefit from top-tier security practices, including:

- Bi-annual third-party security assessments and regular internal testing.

- Multi-factor authentication, restricted staff access, and thorough training on handling sensitive data.

- Data encryption both at rest and during transit.

- Secure data disposal and a comprehensive incident response plan.

- Use of SOC II, SOC III, GDPR, and HIPAA-compliant cloud services.

- Enhanced security for client portals with encrypted passwords and SMS-based authentication.

You can control who has access to which data, track changes made to records, and easily produce reports when auditors come knocking.

v. Scalability and Future-Proofing

As your accounting firm grows, so does the amount of client data you manage.

A decentralized system might work fine when you’re small, but it can quickly become unwieldy as your client base expands. Centralized systems are built to scale with you, meaning you won’t have to overhaul your data management process every time you take on new clients.

A centralized platform can handle larger volumes of data efficiently, and as technology evolves, these systems are often updated with new features that keep your firm on the cutting edge. This not only makes your day-to-day operations easier but also ensures your firm is future-proofed—ready to grow without being bogged down by outdated systems.

How to Implement a Centralized Data System For Your Accounting Firm

Implementing a centralized data system may sound complicated at first, but it’s more about careful planning and taking it step by step. By the end of the process, you’ll wonder why you didn’t do it sooner.

Here’s a practical guide on how your accounting firm can move from a scattered, inefficient data system to a streamlined, centralized one.

1. Evaluate Your Current Setup

Before jumping into a new system, you need to understand what’s going on with your current data management. Start by asking yourself (and your team) some key questions:

- How many systems are we using to store client information?

- How easily can we access important client data?

- Are we spending too much time searching for documents or reconciling different systems?

This initial assessment will help you identify gaps and inefficiencies in your current workflow. It also shows you the risks your accounting firm might face regarding security or compliance if data is scattered. Plus, by involving your team in this evaluation, you get valuable insights into where they experience bottlenecks or frustrations when managing client data.

2. Choose the Right Centralized Platform

Once you’ve evaluated your current setup, it’s time to choose the right system. This is where a little research can go a long way. The right platform will depend on the size of your firm, your specific needs, and how you want to manage data moving forward.

You may be interested in:

Look for systems that are specifically designed for accounting firms. These platforms will often come with built-in tools like client management, document storage, reporting, and even audit trails.

Here are a few things to keep in mind when selecting a platform:

- Security: Since you’ll be handling sensitive client data, the platform should have strong security features, like encryption, multi-factor authentication, and role-based access (where different users have different levels of access to the system).

- Integration: Make sure the platform integrates with other software you’re already using, like accounting software (e.g., QuickBooks) or tax preparation tools. You want a system that plays well with others rather than forcing you to start from scratch.

- Ease of Use: If the software is difficult to use, your team will resist adopting it. Look for user-friendly systems with intuitive interfaces that don’t require extensive training to get started.

- Cloud vs. On-Premises: Many firms are opting for cloud-based platforms because they offer flexibility (you can access the system from anywhere) and often include automatic updates and backups. However, if you have strict security requirements, you might prefer an on-premise solution that you control entirely.

A solution like Financial Cents fits perfectly into this criteria.

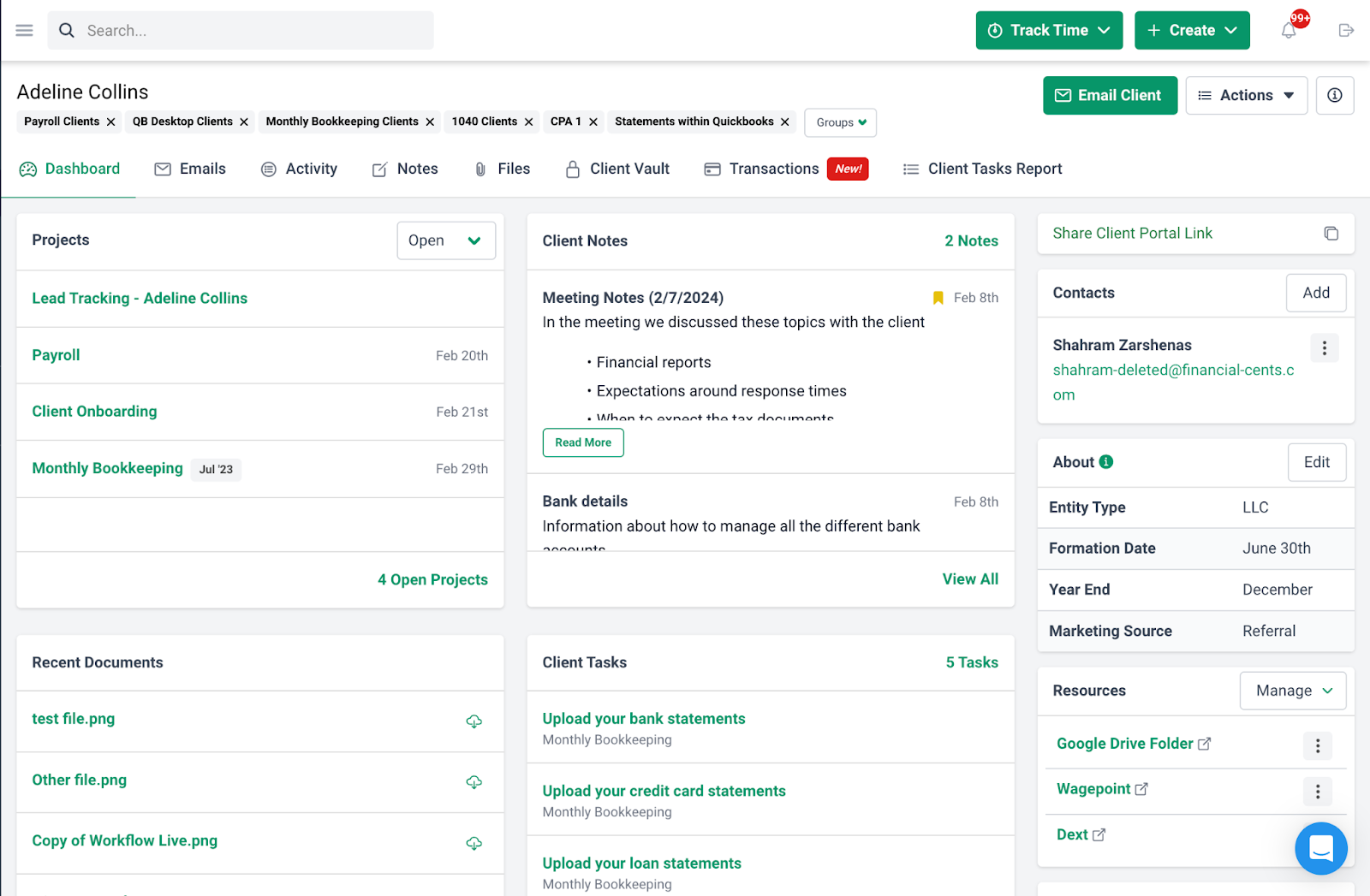

Financial Cents is accounting-based workflow management software with centralized features. Additionally, its CRM solution allows you to store all your information in one place so your team can easily find it and collaborate.

It’s also cloud-based, enabling access to documents anywhere and anytime.

It offers a variety of document organization options, including a simple and comprehensive view, folders and subfolders, client groups, and customizable data fields. Here, you’ll have all your client information in one granular view, so you don’t need to use multiple apps or spreadsheets to organize them.

Some of the sections in this profile include upcoming projects, client notes, recent documents, client groups, etc.

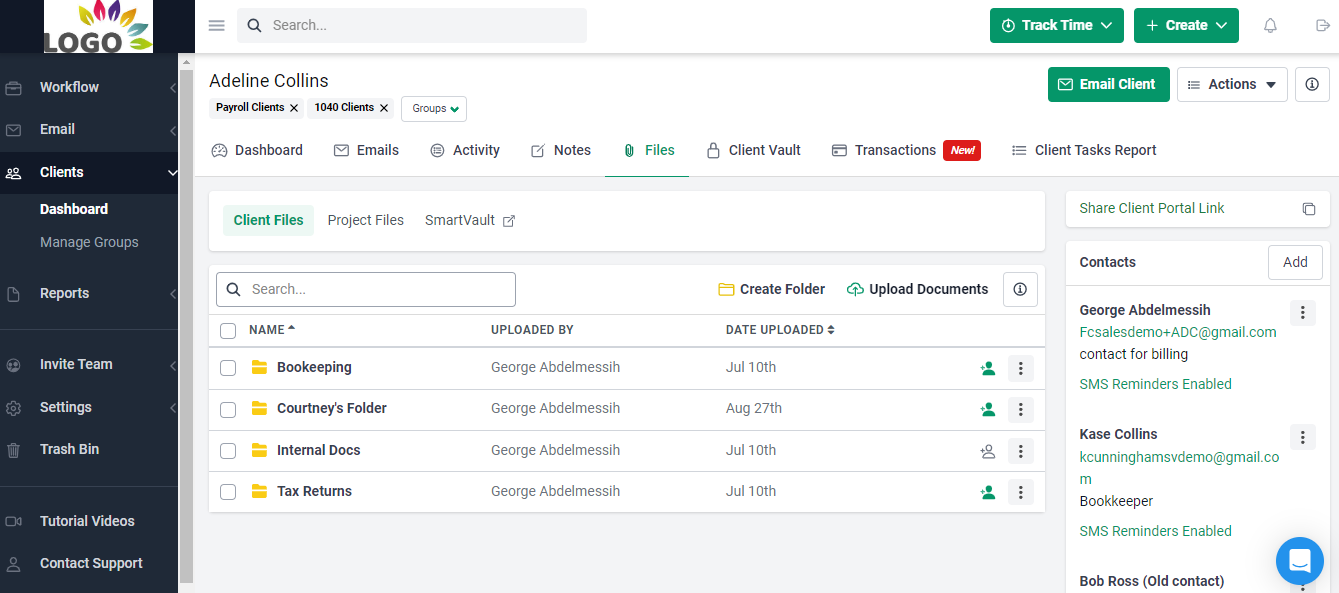

You can create any type of folder structure that reflects your specific needs. For example, categorize by client, project type, or tax year.

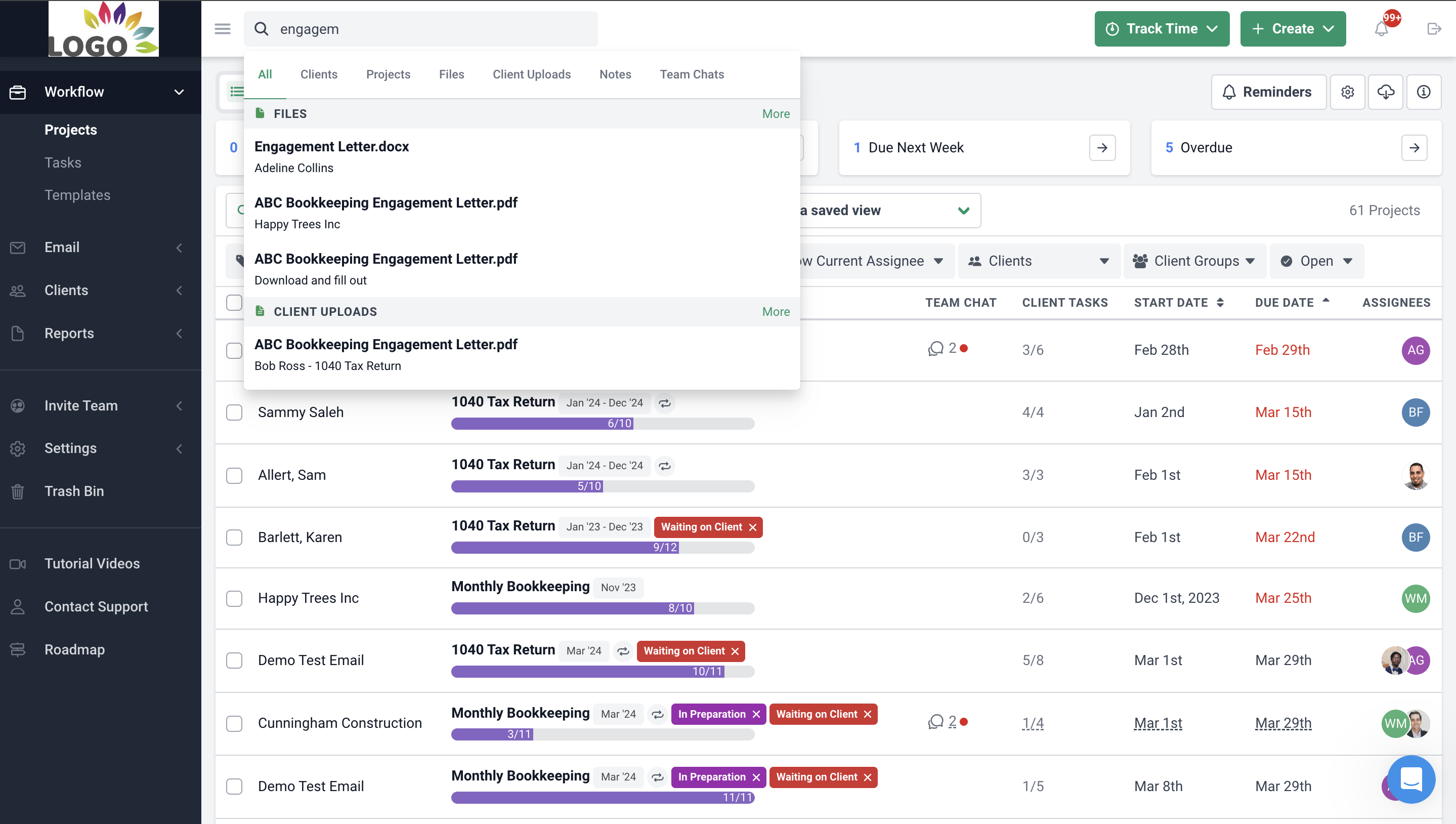

In addition, Financial Cents “Global Search” feature lets you quickly find the documents you need. It allows you to search results by categories such as clients, projects, files, notes, client uploads, and team chats.

Some Financial Cents integrations also include:

- QuickBooks: This lets you easily import and auto-sync all your clients from QuickBooks in seconds, sync your time entries to QuickBooks Online, and add your QuickBooks online service items to Financial Cents for invoicing and reporting.

- SmartVault: With the integration with SmartVault, you can

- Import or link clients from SmartVault to Financial Cents

- Automatically create clients in SmartVault when you create a client in Financial Cents

- Access SmartVault from within projects, clients, or the documents section in Financial Cents,

- Enable automatic routing of client documents uploaded to the FC client task portal directly to their designated SmartVault folder.

- Adobe E-signature: You need this integration, which allows you to request signatures from clients within Financial Cents and organize all your signed copies in one place.

- Zapier: Use Zapier to integrate Financial Cents with 5,000+ apps like Anchor, GoProposal, Ignition, Dropbox, Proposify, etc.

Once you’ve identified a few potential platforms, don’t hesitate to book demos. Involve a few team members in testing the systems so you get feedback from those who will use it daily.

3. Plan the Transition Gradually

Moving all your data to a centralized system won’t happen overnight—and it shouldn’t. A gradual, well-thought-out transition is key to minimizing disruption to your workflow and ensuring everything is transferred securely.

Start by selecting a group of clients or a department to test the new system first. This “pilot phase” helps you see how the platform works in practice without overwhelming your entire firm. During this phase, make sure to:

- Import a manageable portion of client data into the new system.

- Ensure this data is organized correctly, using a consistent structure for naming and categorizing files.

- Identify any hiccups in the process so you can address them before rolling the system out firm-wide.

Once your pilot group is up and running smoothly, you can expand the transition to include the rest of your clients or departments.

4. Train Your Team

No matter how good the platform is, if your team doesn’t know how to use it effectively, you won’t see the benefits of centralization. Training is crucial—and not just a one-time session. You’ll want to provide initial training when the system is first introduced, as well as ongoing support and refresher courses as needed.

The goal is to make your team’s transition as smooth as possible. Ensuring they’re comfortable with the new system makes you more likely to see consistent adoption and fewer mistakes during the switch.

5. Implement Best Practices for Client Data Management

Now that you have a centralized system, it’s important to establish best practices for how your firm will manage data going forward. You don’t want old habits—like saving files locally on a laptop or using personal email for client communication—resurfacing and causing issues.

Here are a few best practices to adopt:

- Access Control: Not everyone in your firm needs access to every piece of client data. Use the platform’s security features to set permissions so only authorized staff can view or edit sensitive information.

- Regular Backups: While most cloud-based platforms handle backups automatically, establishing a backup schedule for peace of mind is still a good idea. If using an on-premises system, set up regular backups to prevent data loss.

- Consistent Naming Conventions: When storing client documents, use consistent naming conventions and folder structures to make finding files easier for everyone. For example, naming a document “Smith_2023_Tax_Return” is more helpful than “Smith Final Doc.”

- Data Reviews: Schedule regular data reviews to ensure all information in the system is up-to-date. This could include cleaning out old, unnecessary files and ensuring client records are current.

Use Financial Cents For Client Data Centralization

If your firm is still using fragmented systems, now’s the time to take action.

Start by evaluating where your client data is stored. Are you relying on outdated processes? Are your systems secure and efficient?

If not, Financial Cents is a great option.

It is affordable, easy to use, and can scale with you to meet the needs of your growing firm.

Enjoy a 14-day free trial today!

Excellent article! Thanks for highlighting the risks of not centralizing client data. I will apply these security tips in my own business tax services UK.