Collaboration in accounting firms hasn’t always been easy, has it? Think about the traditional ways of working—relying on endless stacks of paper, chasing down information stored in different places, or waiting on updates because communication was scattered across emails, phone calls, or even sticky notes. It’s not hard to see how these outdated methods create roadblocks.

Our 2024 workflow report uncovered a striking fact: 18.5% of accounting firms struggle to collaborate effectively without a cloud-based workflow tool. That’s nearly one in five firms battling disorganized chaos to keep up.

Now, picture the alternative—a workplace where collaboration simply flows. Real-time updates keep everyone on the same page, access to shared information eliminates silos, and seamless communication keeps work moving forward. This isn’t just a dream—it’s the reality modern collaboration tools can create.

These tools don’t just streamline processes—they redefine how teams work together. The results speak for themselves: 32.9% of firms that have embraced a workflow app with automation report being highly collaborative. It’s proof that the right tools can transform how your team works—and how your clients feel.

But what happens when collaboration falls short? The answer is simple: things get messy.

The Need for Better Collaboration in Accounting Firms

If you asked your team members for suggestions on improving collaboration, their answers would likely reflect the common struggles we see in firms today. Unsurprisingly, poor collaboration can often feel like running in circles, and that’s a costly problem for accounting firms.

When communication breaks down, or teams aren’t aligned, it’s easy to see issues like task duplication creeping in. Miscommunication is another big challenge—important details get lost, priorities get misaligned, and a team is constantly playing catch-up.

Also, when information is scattered across spreadsheets, email threads, and disconnected systems, it’s not just inconvenient—it’s a disaster waiting to happen. Without a single source of truth, tracking progress on deliverables, identifying bottlenecks, or ensuring everyone’s on the same page is harder.

The ripple effects of poor collaboration are hard to ignore.

Missed deadlines become more common, which isn’t just frustrating for your team and can damage client trust. Productivity takes a hit, too. Instead of focusing on meaningful work, your team spends their time untangling miscommunications or searching for the latest version of a file.

When you think about it, poor collaboration doesn’t just slow things down, it directly affects the quality of your work and the relationships you’re building with your clients. That’s why creating a more collaborative environment isn’t just about streamlining processes—it’s about setting your team up for success and ensuring your clients always get the best you have to offer.

Modern Accounting Tools Key Features that Enhance Smooth Collaboration

Centralized Task and Workflow Management

Centralized task and workflow management features are great for firms like yours, and tools like Financial Cents make it incredibly easy to stay on top of everything. When your team has a single place to manage tasks, deadlines, and projects, it creates clarity and structure that traditional methods simply can’t match.

Financial Cents create insane effectiveness, efficiency, and consistency in work, communications, and collaboration. Its intuitive interface and automation features improve efficiency."

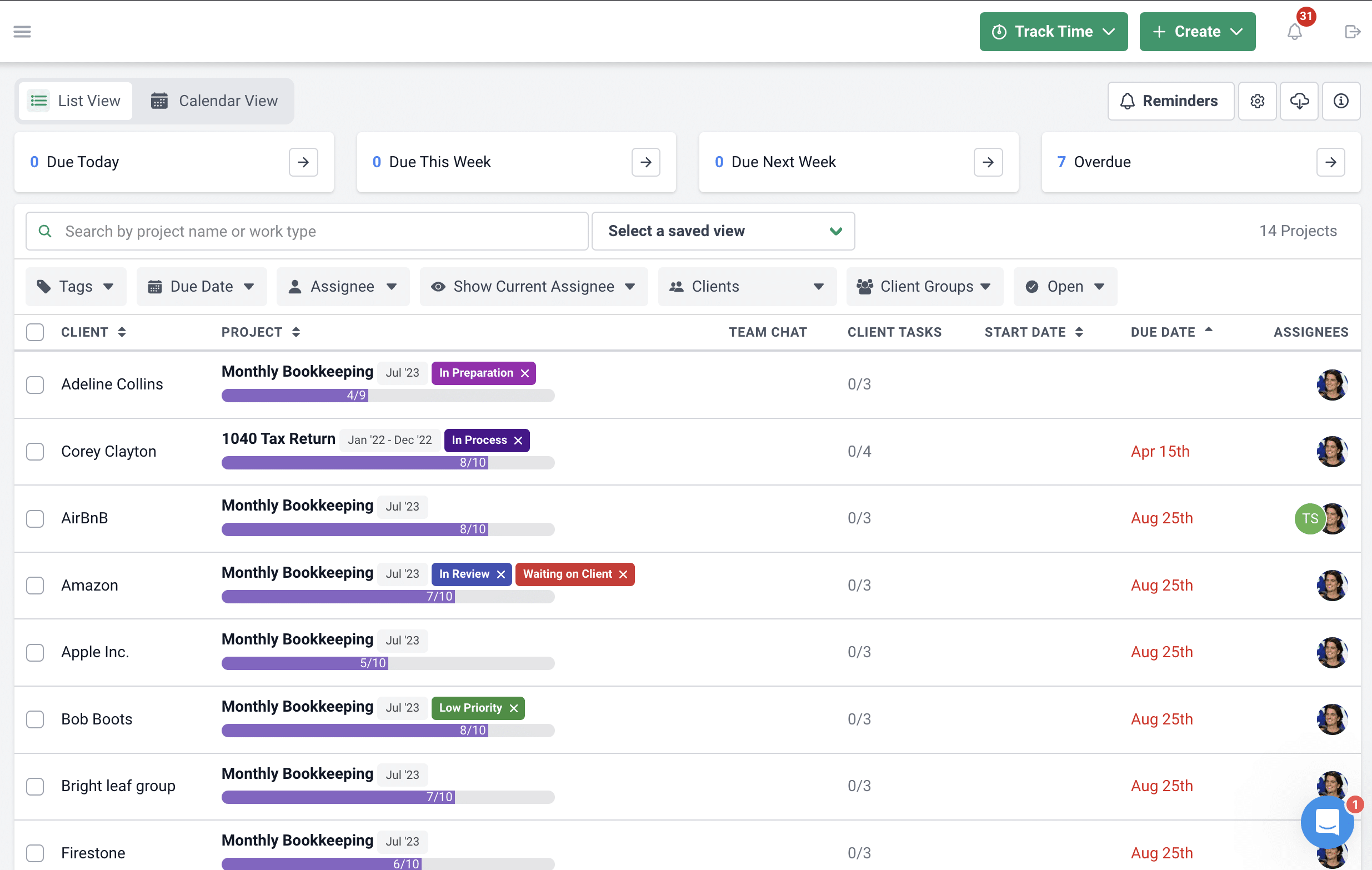

Kellie Parks CPB, Owner, Calmwaters Cloud Accounting.One of the standout features of Financial Cents is the customizable workflow dashboard.

It gives you a bird’s-eye view of all your tasks—what’s done, what’s in progress, and what’s coming up. You can set it up to display project names, start and due dates, client names, and even who’s responsible for what. This flexibility helps you focus on the most important details so nothing is missed.

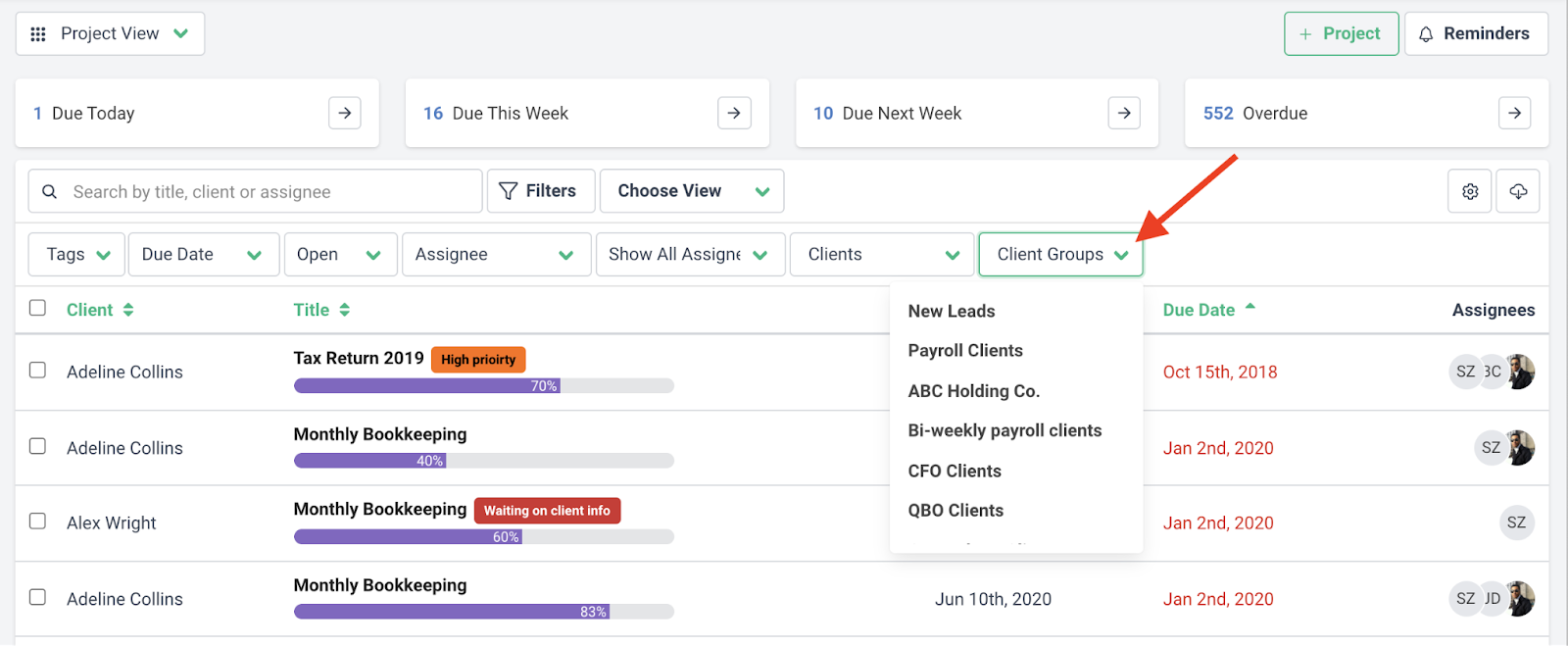

Another helpful feature is the client group filters. With these, you can sort your clients into specific categories—like bookkeeping or tax clients—and quickly access the work tied to each group.

There’s also the task dependencies feature —accessible only with the Scale plan —which is a real lifesaver for managing complex workflows. It ensures that certain tasks only begin after the previous ones are completed. This prevents your team from jumping ahead prematurely and keeps everything moving in a logical, efficient order for a high-quality work output.

Team Communication and Collaboration

Modern accounting tools like Financial Cents are designed to make team communication and collaboration effortless; honestly, we’ve nailed it with our comprehensive features.

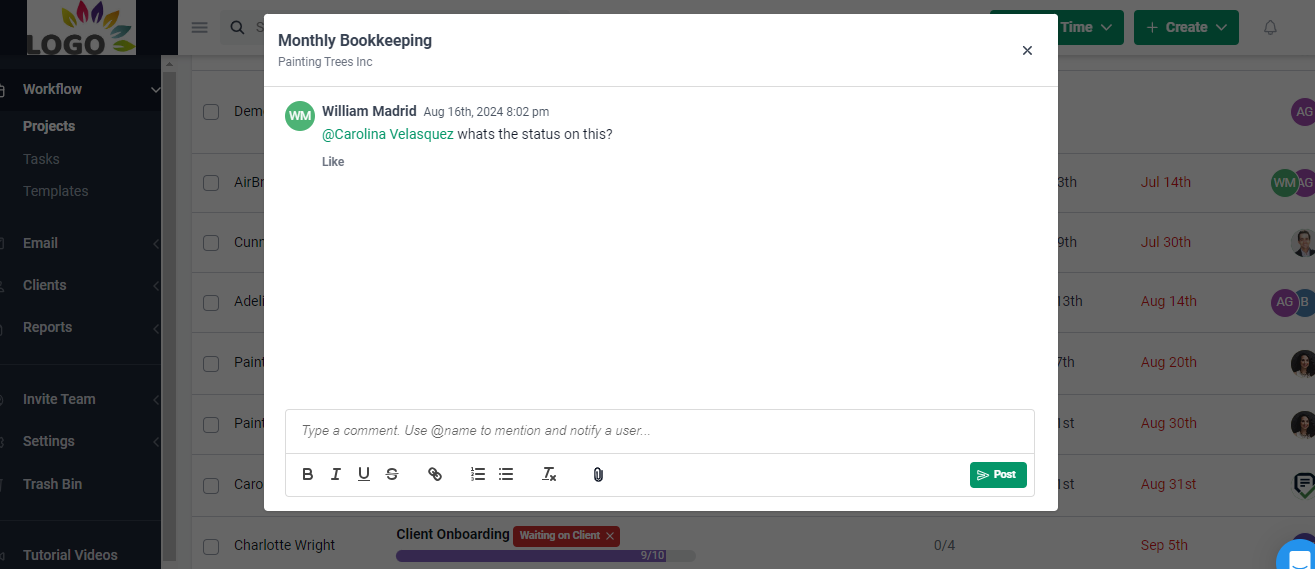

From a communication perspective, Financial Cents has worked well for communicating about a project. We can easily communicate in the Team Chat inside the project. So, everything stays within the project, which is important to us. We've always wanted to work that way"

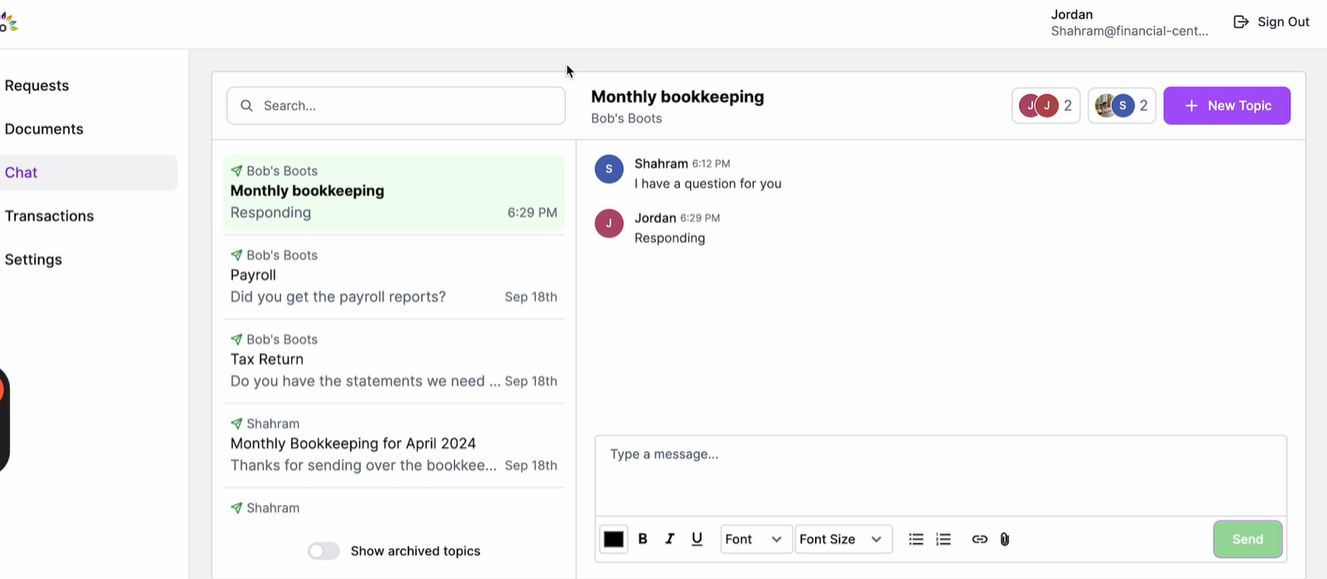

Dawn Brolin, CFE, CPA,, Founder of Powerful Accounting.Take in-project collaboration, for example. Inside Financial Cents, you’ve got the comments tab, where your team can discuss tasks, ask questions, or @mention specific colleagues to get their attention—all without leaving the project space. There’s also a files tab, where all documents tied to a project are stored in one place, so nobody has to waste time hunting through email attachments or shared drives. To top it off, automated notifications keep you up-to-date whenever you’re @mentioned in a comment, assigned a new task, or a client uploads an important document. These features work together to make your team’s communication seamless and organized.

Accounting Client Relationship Management

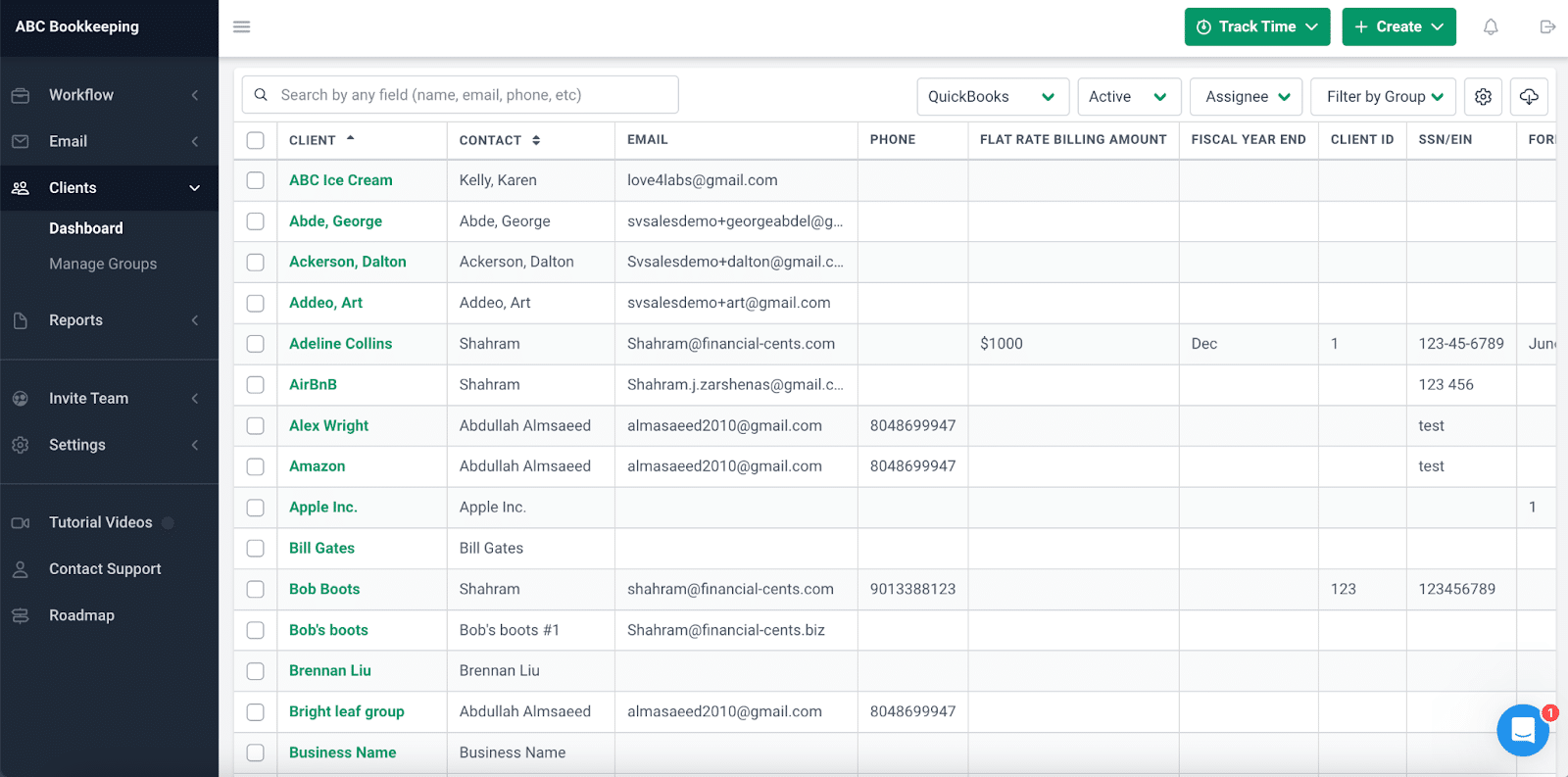

Financial Cents also sets the bar for collaboration, with accounting CRM features that are great for managing everything about your clients—conversations, documents, payments, and more—all in one place. It’s designed to make life easier for you and your team while delivering a better experience for your clients.

For example, all the details you need for a client profile —like contact info, communication history, and important documents—are stored in the accounting CRM.

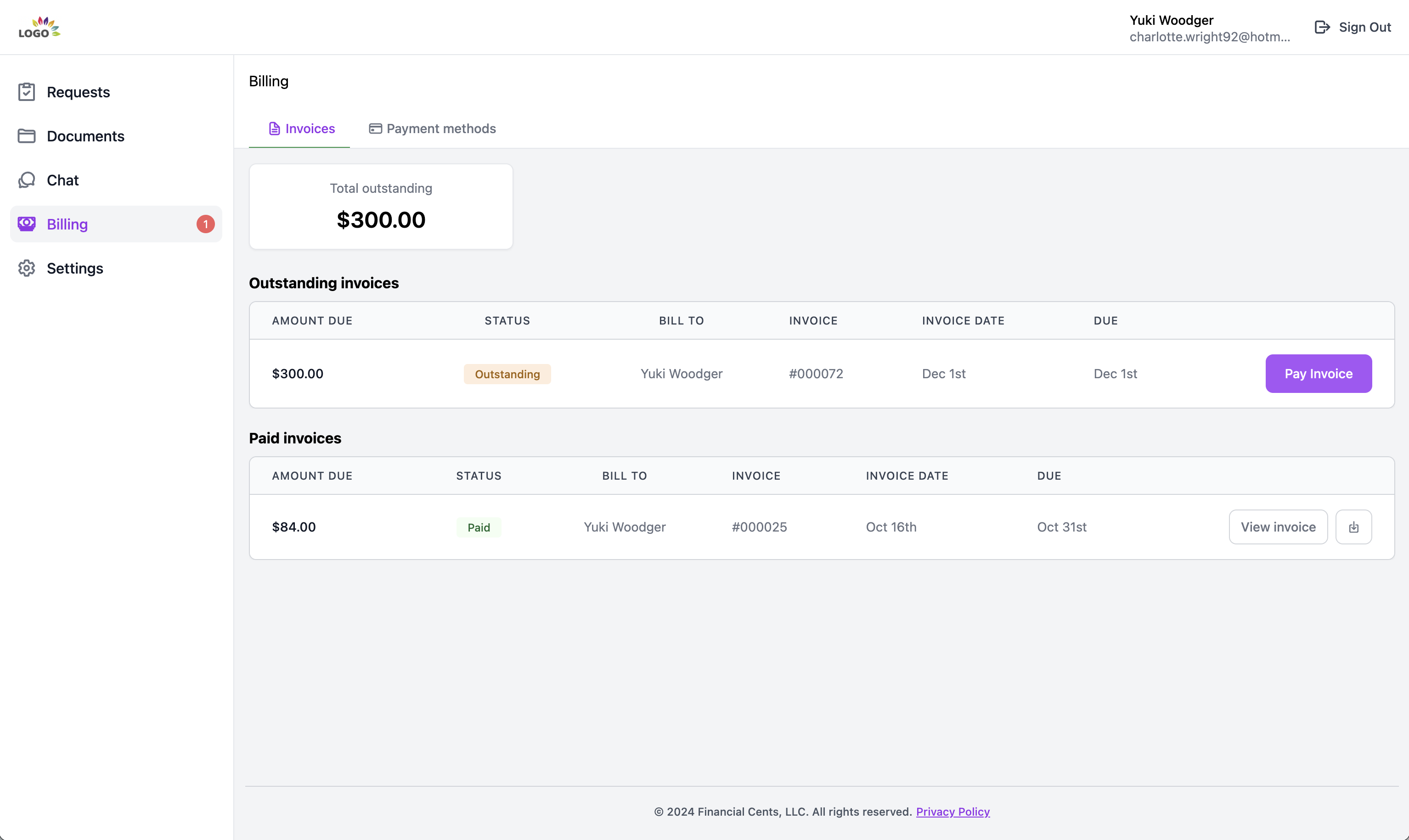

In addition, the accounting client portal is a centralized platform where your clients can interact with your firm seamlessly. They can view invoices, manage payment methods, access shared folders, or respond to requests for information—all without the back-and-forth emails or confusion.

Then, there’s the client chat feature, where you can access all the conversations with your clients. Chats can be organized into topics, making it easy to keep track of specific discussions. Plus, you can control who on your team has access to certain chats so everyone stays on the same page. And when you need to look back on a conversation, everything is searchable and neatly stored.

Finally, the audit trail for client conversations is a huge benefit when it comes to accountability and transparency. Every interaction with a client is logged in the system’s activity tab, creating a comprehensive record of your communication history. This safeguards your firm, ensuring a clear trail to reference if questions or disputes arise.

Document Management and Secure File Storage

Think about how often your team exchanges documents or needs to access critical financial files. Without an efficient system, it can get chaotic fast. But with the right features, everything becomes simpler, faster, and more secure.

Financial Cents offers a passwordless client portal that makes sharing folders and documents with clients straightforward and safe. Your clients can access archived documents, upload files when needed, and interact with shared folders based on the permissions you set. The system can notify your team and clients about new uploads or shared items to keep everyone on the same page.

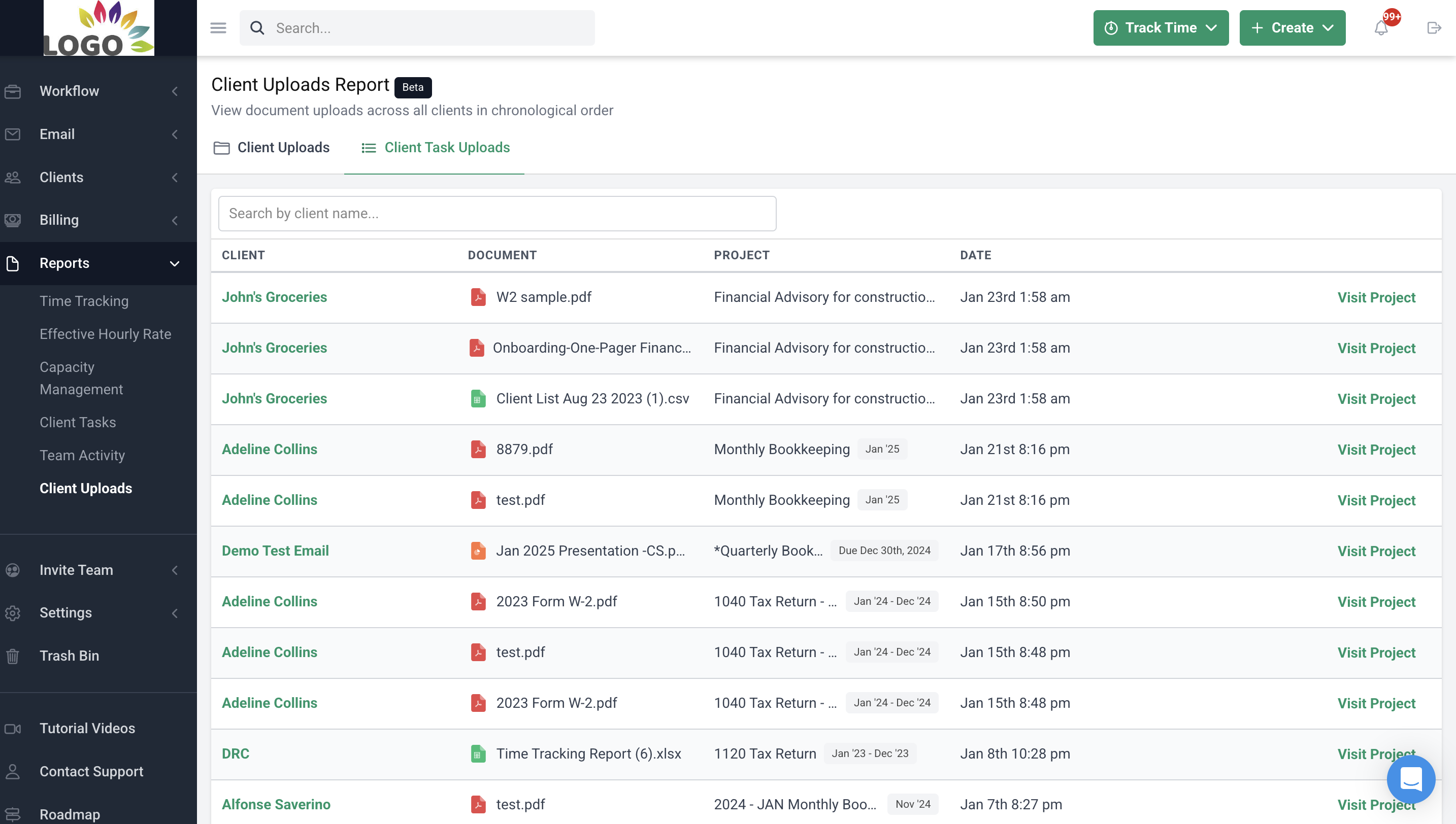

Using the Client Uploads report in the Reports tab, you can view the date and time your clients uploaded documents to client tasks and shared folders and then quickly access those files.

It also integrates with SmartVault, Google Drive and OneDrive, trusted tools for secure, cloud-based file sharing. These integrations means your sensitive financial data is safeguarded with bank-level encryption, so you can focus on your work without worrying about security breaches.

With tools like these, you’re not just managing documents—creating a more collaborative, efficient, and professional experience for your team and clients. It’s a small change with a huge impact on how your firm operates day to day.

Role-Based Permissions and Access Control

One key feature modern accounting tools offer to enhance collaboration is role-based permissions and access control, which we’ve touched on briefly in previous sections.

Financial Cents make this process seamless, ensuring your team can collaborate efficiently while securing sensitive data.

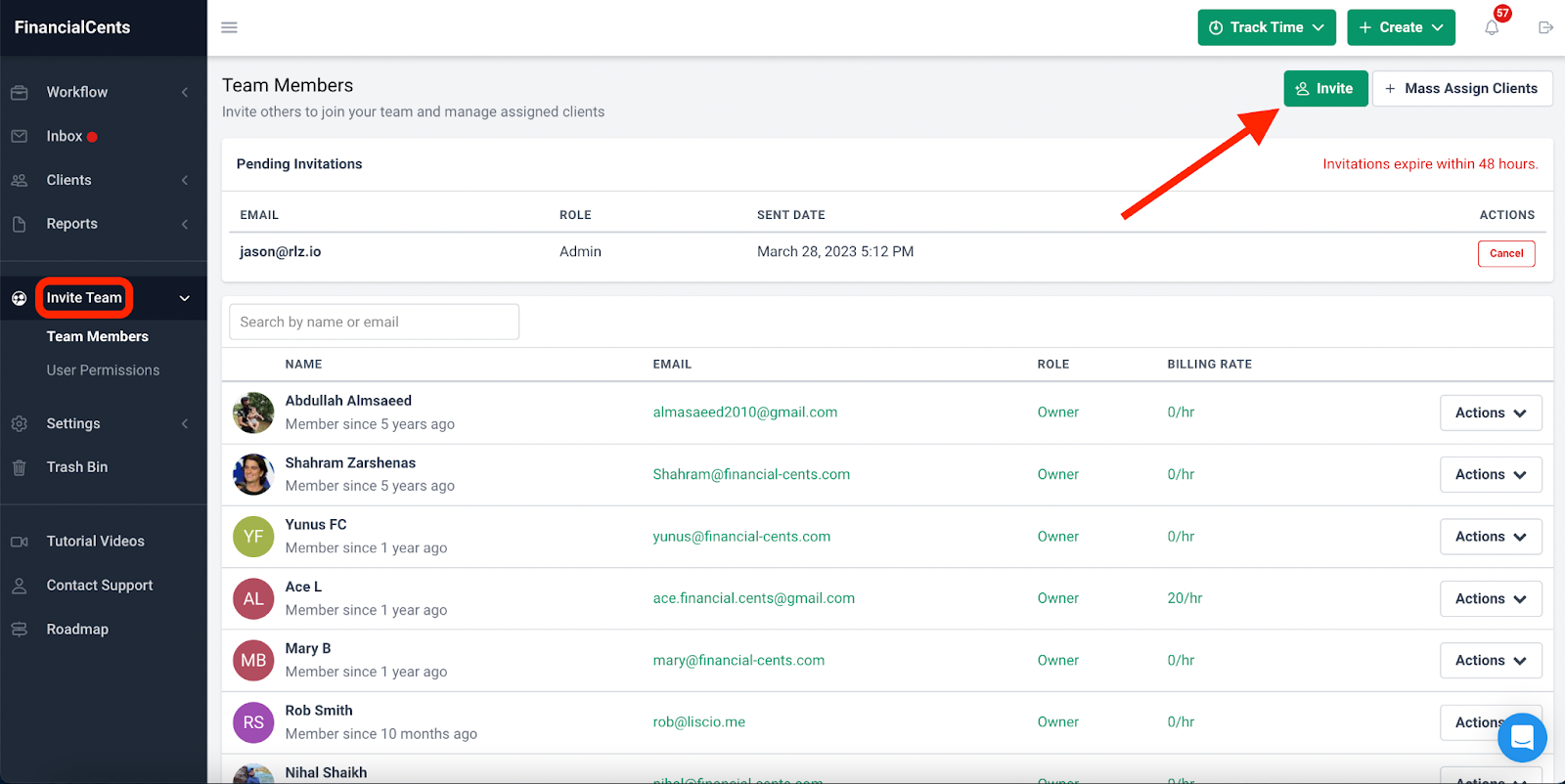

You can customize user permissions to suit your firm’s specific needs. It’s as simple as heading to the ‘Settings’ section, selecting ‘User Permissions,’ and adjusting what each role can access. This means you can control who sees client details, who can edit financial records, or even who can view confidential reports.

If you’re adding a new team member, you can click on ‘Invite Team,’ enter their email, and assign their access level immediately. This ensures that from day one, they have the tools they need to work effectively.

As the owner—or with the right permissions—you can view team members’ emails through an email audit trail. This feature promotes accountability across the board, making it easier to stay aligned as a team while ensuring nothing gets overlooked.

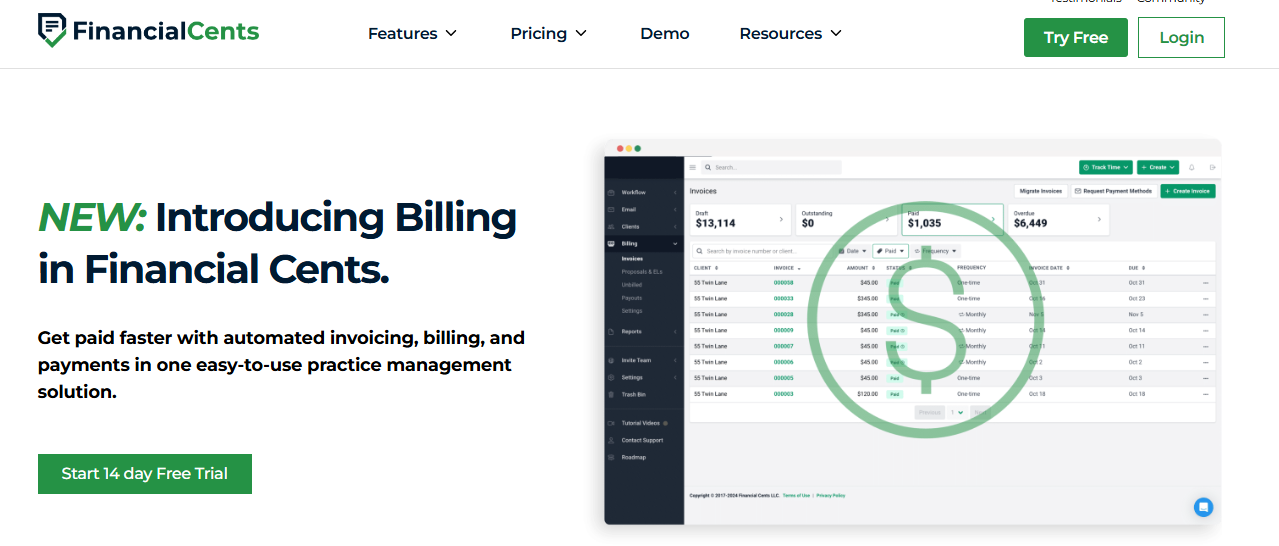

Integrated Time Tracking and Billing Management

With integrated time tracking, you can monitor how your team spends their work hours. It’s easy to distinguish between billable and non-billable tasks, so you can see which projects are eating up more time than planned. That insight helps you collaborate more efficiently and make better decisions, like reallocating resources or adjusting budgets to challenges. And let’s be honest, knowing exactly where time is going saves you from surprises later.

The billing management feature is just as helpful. Creating invoices is simple, whether it’s a one-time bill or a recurring charge for ongoing services. The integration with tools like QuickBooks Online makes managing payments seamless, while automated reminders ensure your clients pay on time. There’s even the option to accept ACH and credit card payments, so you can offer flexibility without adding extra headaches.

Lastly, time entries can be locked by administrators once they’re finalized or included in an invoice. This keeps your records clean and prevents accidental edits, giving you peace of mind that the data you’re working with is accurate.

Automated Reminders and Notifications

You can activate automated email or SMS reminders for client tasks in Financial Cents. Once you set it up, the system sends periodic reminders until the client completes the requested tasks. This means you spend less time sending follow-ups and more time focusing on high-value work.

The tool also lets you personalize client notifications to fit your firm’s voice. You can choose from pre-made templates or create your own, adding placeholders to tailor each message to the client. This makes your communication look professional and consistent while still feeling personal. It’s a small touch, but it dramatically affects how clients perceive your service.

On top of that, Financial Cents gives you control over how you stay updated within your firm. You can tweak notification settings, so you’re only alerted about what matters most—whether it’s task updates, completed client requests, or important deadlines.

With automated reminders and notifications, your team stays on track, your clients feel cared for, and those time-consuming admin tasks become a thing of the past.

Benefits of Using Modern Collaboration Tools in Accounting Firms

Improved Task Visibility and Accountability

Modern collaboration tools give you a clear view of who’s working on what and where everything stands. With features like shared dashboards, task trackers, and automated notifications, your team can easily stay on top of deadlines and priorities. This transparency not only reduces confusion but also promotes accountability. Everyone knows their role, and tracking progress or flag issues before they become bigger problems is easy.

Faster Communication and Decision-Making

Faster communication means faster problem-solving and keeping projects on track and clients happy. Tools like instant messaging platforms, integrated video conferencing, and practice management tools with chat and email features allow your team to communicate and collaborate faster than ever. When questions arise or decisions need to be made, you can address them immediately, even if team members work remotely or in different time zones.

Enhanced Client Experience

Clients expect efficiency, transparency, and timely responses—and modern accounting tools help you deliver all three. Features like secure client portals or real-time document sharing make it easier to keep clients in the loop and build trust. When clients see that your firm operates smoothly and prioritizes their needs, it strengthens the relationship and sets you apart from competitors.

Conclusion

Modern collaboration tools have changed the game. From improving task visibility and accountability to speeding up communication and enhancing the client experience, these tools are designed to help your team work smarter, not harder.

Adopting these tools is key to transforming how your firm operates. Financial Cents, with its robust automation and workflow features, is a great place to start.

Why not see the difference for yourself? Explore Financial Cents today with a free trial or demo and take the first step toward a more collaborative and efficient future for your firm.