Imagine this: It’s the end of the quarter, and your accounting firm is buzzing with activity.

Clients are calling non-stop, emails are piling up, and your team is stretched thin trying to meet deadlines. As the firm owner, you find yourself working late nights, meticulously checking every detail, ensuring nothing falls through the cracks. The stress is palpable, and the bottleneck effect is in full force.

Every decision and task needs your direct input, leaving you overwhelmed and exhausted.

This scenario is all too common in accounting firms. The sheer volume of tasks and the high stakes associated with accuracy make it challenging to manage everything effectively.

As the firm grows, the pressure mounts, and without proper delegation, the quality of work and overall productivity can suffer significantly.

Effective delegation is not just a managerial buzzword; it’s a strategic necessity. It enables you to break free from the bottleneck, redistributing tasks so that the firm can function more efficiently.

Doing this will empower your team, leveraging their skills and allowing you to focus on high-impact activities that drive growth and innovation.

The Benefits of Effective Delegation

Effective delegation can improve the way your accounting firm operates. Here are some significant benefits:

- Increased productivity and profitability: Delegating tasks allows you to focus on high-value activities, leading to increased efficiency and profitability.

According to a study by Gallup, CEOs who delegate effectively generate 33% more revenue than those who don’t. This boost in productivity translates to more clients served, faster turnaround times, and, ultimately, higher profits. Consider how much more efficient your firm would be if routine tasks like data entry and initial client communications were handled by junior staff, freeing up senior accountants to focus on complex financial analysis and strategic planning.

Alyssa J. Dillon, CEO and Financial Consultant of AD Finance Manager, realized how important it was to delegate certain tasks for the sake of growth. “Having Lindsey take care of these clients and communicate back and forth with them allowed me to focus on growth.” This action is one of the factors that grew her firm to $324,000 in one year.

- Improved employee morale and engagement: When employees are entrusted with responsibilities, they feel valued and are more engaged. This empowerment leads to higher job satisfaction and retention rates. Research from the Harvard Business Review highlights that employees who feel their strengths are recognized are 23% more likely to be engaged at work. Delegation helps employees develop new skills and gain confidence, fostering a culture of growth and development.

- More time for strategic initiatives: By delegating routine tasks, accounting firm owners can focus on strategic initiatives such as business development, client relationships, and long-term planning. This shift in focus can drive the firm’s growth and innovation.

It also allows you to explore new service offerings, attend industry conferences, or cultivate high-value client relationships without being bogged down by day-to-day operational tasks.

You may be interested in:

15 Examples of Client Accounting Services (CAS) You Can Offer

Common Delegation Challenges

Despite its benefits, delegation comes with its own set of challenges. Understanding these can help you address them effectively:

- Fear of losing control or quality: Many accounting firm owners hesitate to delegate because they fear that tasks won’t be completed to their standards. This fear can be mitigated by selecting the right tasks and people and providing clear instructions and support. This can be done through implementing a thorough training program and establishing standard operating procedures (SOPs) to ensure quality control.

You need to let your employees know what they are to expect by highlighting the uniqueness of the firm "

Ryan Lazanis, Founder of Future Firm.- Not having enough time to train others: Training employees to take on new tasks requires an initial time investment. However, this investment pays off as employees become more competent and independent. A practical approach is to develop training modules that can be reused and updated as necessary, reducing the time burden on managers.

Dedicate learning time, share knowledge within the team, and encourage attendance at conferences and seminars for continuous skills upgrading."

Nayo Carter-Gray, Founder 1st Step Accounting.- Difficulty identifying tasks to delegate: It can be challenging to determine which tasks should be delegated. A useful approach is to categorize tasks into those that require your unique expertise and those that can be handled by others. For example, strategic financial planning and complex tax strategies might remain under the purview of senior accountants, while routine bookkeeping and client follow-ups can be delegated.

- Choosing the right people to delegate to: Delegating to the wrong person can result in poor performance and increased frustration.

You need to ask yourself, who do I need to hire? Why do I need to hire them? What will they contribute on a daily basis to move the firm forward?"

Nicole Davis, CPAIt’s crucial to match tasks with employees’ skills and strengths. Conducting regular skill assessments and having one-on-one discussions with employees about their career aspirations and strengths can help in making informed delegation decisions.

You may be interested in

Building Teams That Last: Recruitment and Retention Strategies for Scaling Your Accounting Firm.

Strategies for Effective Delegation

Implementing effective delegation requires a strategic approach. Here are some key strategies to consider:

- Identify tasks that can be delegated: Tasks such as administrative duties, routine bookkeeping, and data entry are often ideal for delegation. By offloading these, you can focus on more critical aspects of your firm. Creating a task audit to evaluate which activities consume most of your time and can be delegated is a practical first step.

- Choose the right person for the task: Assess your employees’ skills, experience, and workload to ensure the task is assigned to someone capable and available. Matching tasks with the right people enhances efficiency and quality. For example, a detail-oriented junior accountant might be perfect for handling client data entry, while a more experienced accountant can oversee complex reconciliations.

- Provide clear instructions and expectations: Clearly outline what needs to be done, the deadlines, and the expected outcomes. Providing comprehensive guidelines helps prevent misunderstandings and ensures the task is completed to your standards. Utilizing project management tools like Financial Cents can help in tracking progress and maintaining clarity.

- Empower employees to take ownership and make decisions: Trust your employees to handle delegated tasks independently. Empowerment boosts their confidence and decision-making skills, leading to better outcomes. Encourage team members to propose solutions for recurring issues, giving them the autonomy to implement and monitor these solutions.

- Establish a feedback loop: Regularly check in with your team to monitor progress and provide support. Constructive feedback helps employees improve and ensures that any issues are addressed promptly. Scheduling regular one-on-one meetings and using performance metrics can help in providing targeted feedback.

Establish effective feedback mechanisms to encourage ongoing improvement. Regular feedback sessions help identify areas for enhancement, allowing the team to adapt and grow"

Angela Main Roberts, Owner, Main Accounting Services LLC.Cultivating a Delegation-Friendly Culture in Your Accounting Firm

Creating a culture that supports delegation is essential for long-term success. It ensures that delegation is not just an occasional practice but a core aspect of your firm’s operations. Here’s how to build it:

- Emphasize the Importance of Delegation for Employee Development: Start by communicating its value in employee development. Make it clear that it isn’t just about offloading work but about providing opportunities for growth and learning. When employees understand that taking on new tasks is a pathway to career advancement, they are more likely to embrace it. Regularly discuss the benefits of delegation in team meetings and provide examples of how it has helped others in the firm grow their skills and advance their careers.

- Recognize and Reward Successful Delegated Tasks: Acknowledge employees who excel in their delegated tasks. Recognition and rewards motivate them and reinforce the value of delegation. Implementing a recognition program, such as ‘Employee of the Month,’ can highlight and reward effective delegation practices. Rewards could include bonuses, public recognition, or opportunities for further training and development. By celebrating these successes, you reinforce the behavior and show that getting work done is valued.

- Provide Training and Resources: Equip your team with the tools and knowledge they need to get work done effectively. Offer training sessions on time management, task prioritization, and communication skills. Provide resources such as checklists, templates, and access to project management software.

By investing in their development, you signal that you trust them to take on more responsibilities and grow within the firm.

Try to provide accessible tech support resources for team members who may encounter challenges. Ensure there are resources such as videos and documentation for self-paced learning"

Dave Kersting, Founder, Capovario.- Create a supportive environment: Foster an atmosphere where employees feel comfortable asking questions and seeking guidance.

A supportive environment reduces the fear of making mistakes and encourages continuous learning. Open-door policies and regular team-building activities can contribute to a more supportive workplace culture. Encourage a culture of open communication where feedback is viewed as a positive tool for growth rather than criticism.

In our profession, rules are everywhere, and it’s easy to fall into the trap of relying on them. But relationships are everything. The people you work with are the most important. If we can build relationships and get to know our people, then instill things into the business that foster those relationships, that’s a process to strengthen culture"

Randy Crabtree, Co-founder, Tri-Merit Specialty Tax Professional.- Set clear goals and expectations: When delegating, make sure to set clear, achievable goals and expectations. This clarity helps employees understand their responsibilities and the standards they need to meet. Use SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals to guide your delegation process.

Hold your team members accountable to Key Performance Indicators (KPIs). Incorporate KPIs into performance reviews for alignment and tie bonuses, raises, and promotions to individual KPI achievements."

Amanda Owens, PAFM, Firm Administrator, Badger CPA.Break Free From Bottlenecks With Financial Cents

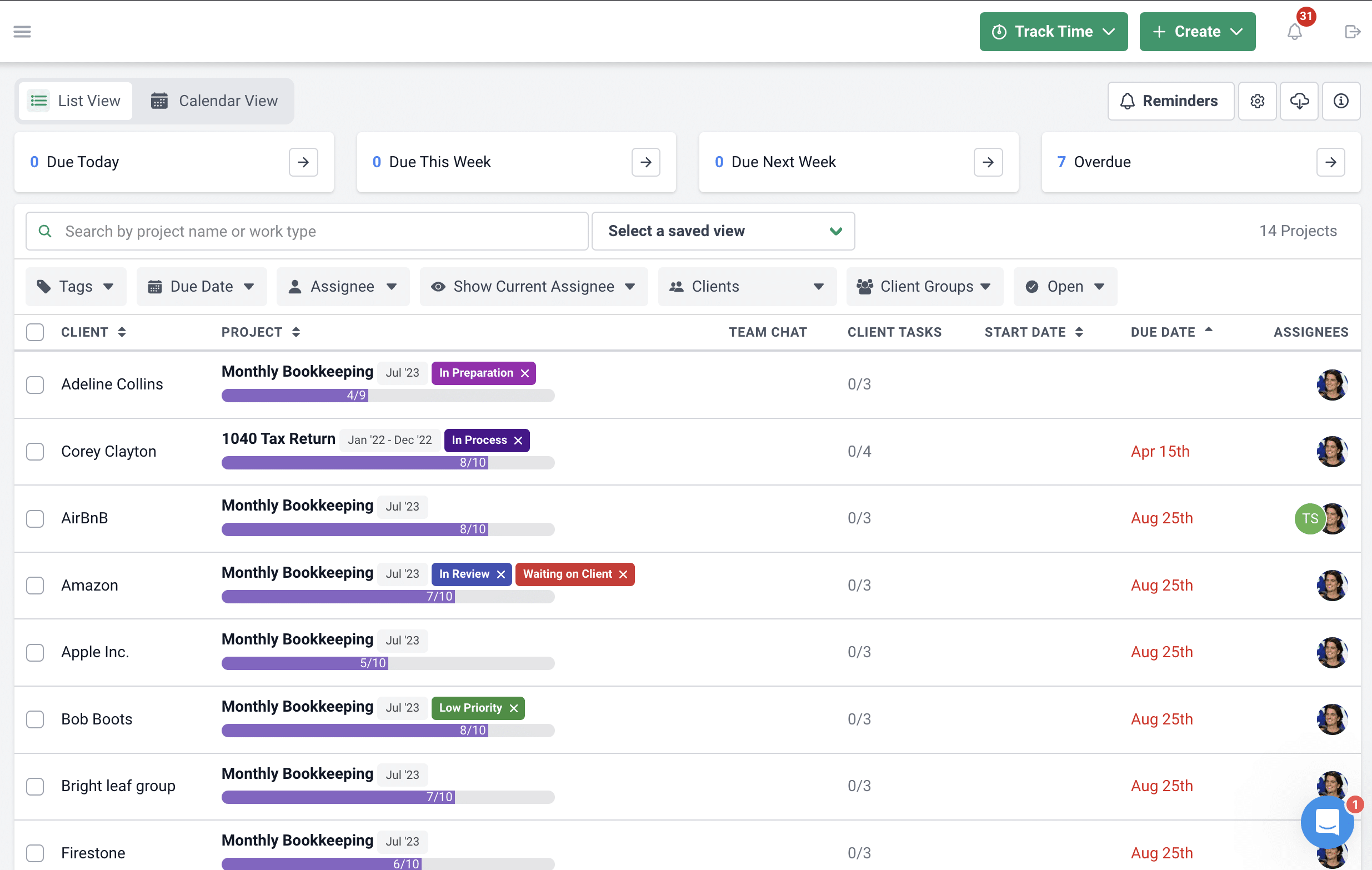

Implementing the strategies discussed above can transform how you run your firm, but to maximize efficiency, consider integrating a robust workflow management software like Financial Cents. Financial Cents is one of the top workflow accounting management software in the market, and it can minimize bottlenecks in the following ways:

- Presents an overview of all your firm’s operations in a dashboard. This will help you track all team activities at a glance to move work around and according to capacity.

- Stores all files and lets you share them with the concerned parties.

- Has a library containing 40+ accounting templates for your use. You also have the option of creating your own templates.

- Workflow filters to segment your view by employees, clients, or tags.

- Makes team collaboration easier by allowing you to send messages, share files, and receive notifications.

Leverage the power of effective delegation and workflow management today to unlock your firm’s full potential and achieve sustained success.