When you manage a high volume of work as a tax firm owner, the difference between staying organized and drowning in chaos often hinges on one key factor—your systems.

Tax firms often rise or fall based on how well they handle deadlines, client documents, and workflows. Too often, outdated processes and manual tracking slow everything down, leading to stress, missed deadlines, and frustrated clients. That’s where tax practice management software makes all the difference. It streamlines operations, automates tasks, and keeps everything organized so firms can scale easily.

For Kathy Nash, founder of Nash Financial Solutions LLC, adopting the right system changed everything. Despite having only a small team of part-time staff, she now serves 300 clients efficiently, meets every deadline, and keeps operations running smoothly. Here’s how she made the shift—and how you can, too.

Background

Founded in 2016, Nash Financial Solutions is the vision of Kathy Nash, a seasoned tax professional now approaching her 33rd tax season. But her path to success was anything but ordinary. As a mother of twins, she devoted her early years to raising her children, putting her own ambitions on hold. Yet, she never let go of her dreams. At 50, she returned to college to complete her degree, proving that it’s never too late to chase your goals. Today, she stands as a testament to perseverance, building a thriving firm while balancing family, education, and entrepreneurship.

I had twins and when we first moved to Ohio, my twins were almost two, and I was a stay-at-home mum, looking for something to do. And then somebody mentioned an H&R block tax class so I started my career with them, part-time. Moved into full-time, moved into management, and then I decided to go out on my own."

Kathy Nash, Founder of Nash Financial Solutions, LLC.Today, Kathy runs her firm with the help of a small team of part-time staff. But before implementing a tax practice management software, she handled nearly everything herself. Keeping track of multiple clients, tasks, and deadlines became overwhelming. Without a centralized system, important filing dates, tasks, and key documents were sometimes muddled up.

Challenges Nash Financial Faced Before Using Tax Practice Management Software

Here are some of the challenges she faced before discovering Financial Cents.

Paper-Based Document Management

Before adopting tax practice management software, Kathy and her team were buried in stacks of paperwork. While Kathy had a mental map of where everything was, the constant shuffling of physical files was inefficient and prone to error.

I had stacks of stuff on my desk and I was digging through piles, looking for certain pieces of paper or certain files"

Kathy Nash, Founder of Nash Financial Solutions, LLC.This paper-based system left her and her team scrambling to find what they needed when they needed it, leaving little room for efficient, streamlined service.

Manually Managing Clients

Relying on spreadsheets, sticky notes, and memory to manage her clients eventually became unsustainable. Kathy spent too much time following up with clients, hunting down missing documents, and updating records manually. Without a central repository for client data, keeping track of interactions, due dates, and past communications proved nearly impossible.

‘It got to the point where I couldn’t remember which stack things were in,’ Kathy says. ‘I started looking for practice management software to help me stay on track and keep up with due dates.’ – Kathy Nash, Founder, Nash Financial Solutions, LLC.

Unable to Track Work

Without a centralized system, Kathy had trouble tracking each client’s project status. Deadlines were often at risk because there was no straightforward way to monitor pending tasks. Work got done on an ad-hoc basis, leaving Kathy unable to gauge overall progress quickly. This lack of oversight led to stress, and disorganization, and ultimately impacted her ability to serve clients.

No Standardized Process

Kathy’s firm lacked consistency in managing client tasks without standard procedures for repetitive tasks. Each employee worked in their own way, meaning workflows varied from person to person. This inconsistency made scaling the business difficult, as the same steps had to be reinvented every time a new task came up.

Kathy realized it was time to switch when her old system became unmanageable. Frustrated by poor customer support from her previous tax software provider, she began searching for a better solution.

With the previous software, I was not getting the support, so I wasn't getting any questions answered. So that made me decide it was time for another change."

Kathy Nash, Founder of Nash Financial Solutions, LLC.Overwhelmed by manual client tracking, scrambling to meet deadlines, and relying on memory to keep everything in check, Kathy knew she needed a better way to run her firm. She wanted a solution that could streamline workflows, centralize client data, and bring structure to the chaos. That’s when she found Financial Cents.

The Role of Financial Cents Tax Practice Management Solution in Transforming Nash Financial Solutions Processes

Workflow Management & Automation

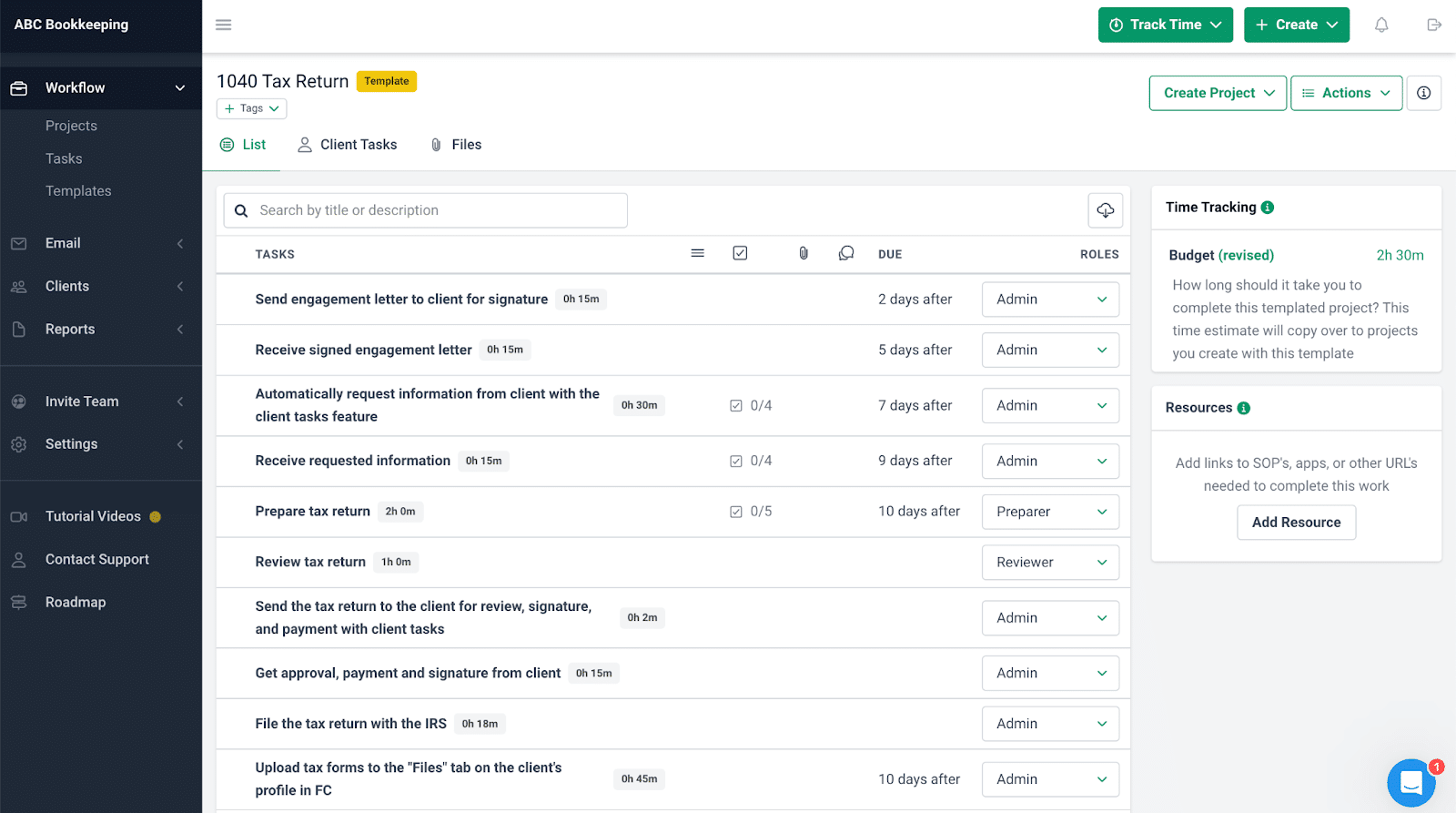

Financial Cents provided a single platform for managing all client tasks, automating reminders, document requests, and progress tracking without manual follow-ups.

Now, Kathy can view every ongoing project at a glance on the workflow dashboard, eliminating the need for sticky notes or paper stacks. Furthermore, workflow templates help her outline each step for different tax engagements, sparing her the stress of starting from scratch every time.

And if the same tasks come up month after month or quarter after quarter, recurring projects handle them automatically, saving her tons of setup time.

Kathy especially loves the client tasks feature and auto-reminders, which prompt clients to send the documents or details the team needs.

I love that I can request documents from my clients, you know, bank statements, credit card statements, invoices. I can request that automatically. I don't have to call and email and text and call and email and text again. I've got it set up so if they don't respond, well, three days later, they're going to get another email, and I'm going to bug them every three days via email until I get what I want"

Kathy Nash, Founder of Nash Financial Solutions, LLC.Finally, team and client notifications let her know the moment a staff member finishes a task or a client uploads a file. Everything flows together seamlessly, streamlining Kathy’s entire tax process.

Client Relationship Management

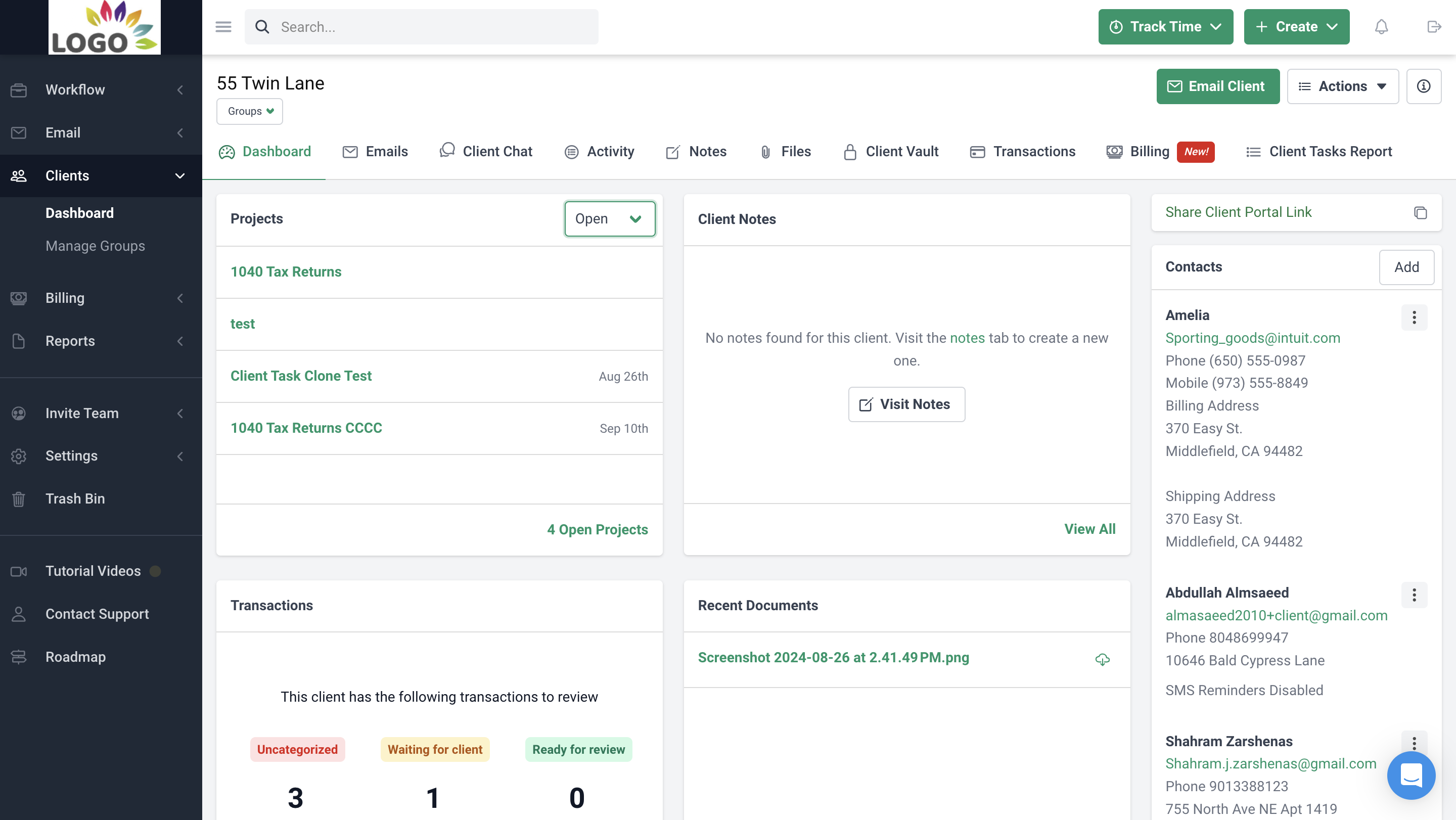

For Kathy, managing over 300 clients across multiple services once felt overwhelming, but Financial Cents’ client relationship features made it far more manageable. At the core is the workflow dashboard, which provides a 360-degree view of each client’s work, deadlines, and outstanding tasks.

Another favorite feature of Kathy’s is the automated client follow-ups that Financial Cents provides with her Scale plan. This addition keeps her at peace whenever client tasks need to be completed.

It lets me know when somebody has done what they needed to do, and if they haven't done it, Financial cents remind them. I love it"

Kathy Nash, Founder of Nash Financial Solutions, LLC.Meanwhile, the client database centralizes all critical information—contact details, organizational documents, and current projects. Whenever she needs a phone number or wants to review past filings, it’s all there with a single click. These combined features make Kathy’s client interactions smoother, leading to fewer hiccups and higher overall satisfaction.

Document Management

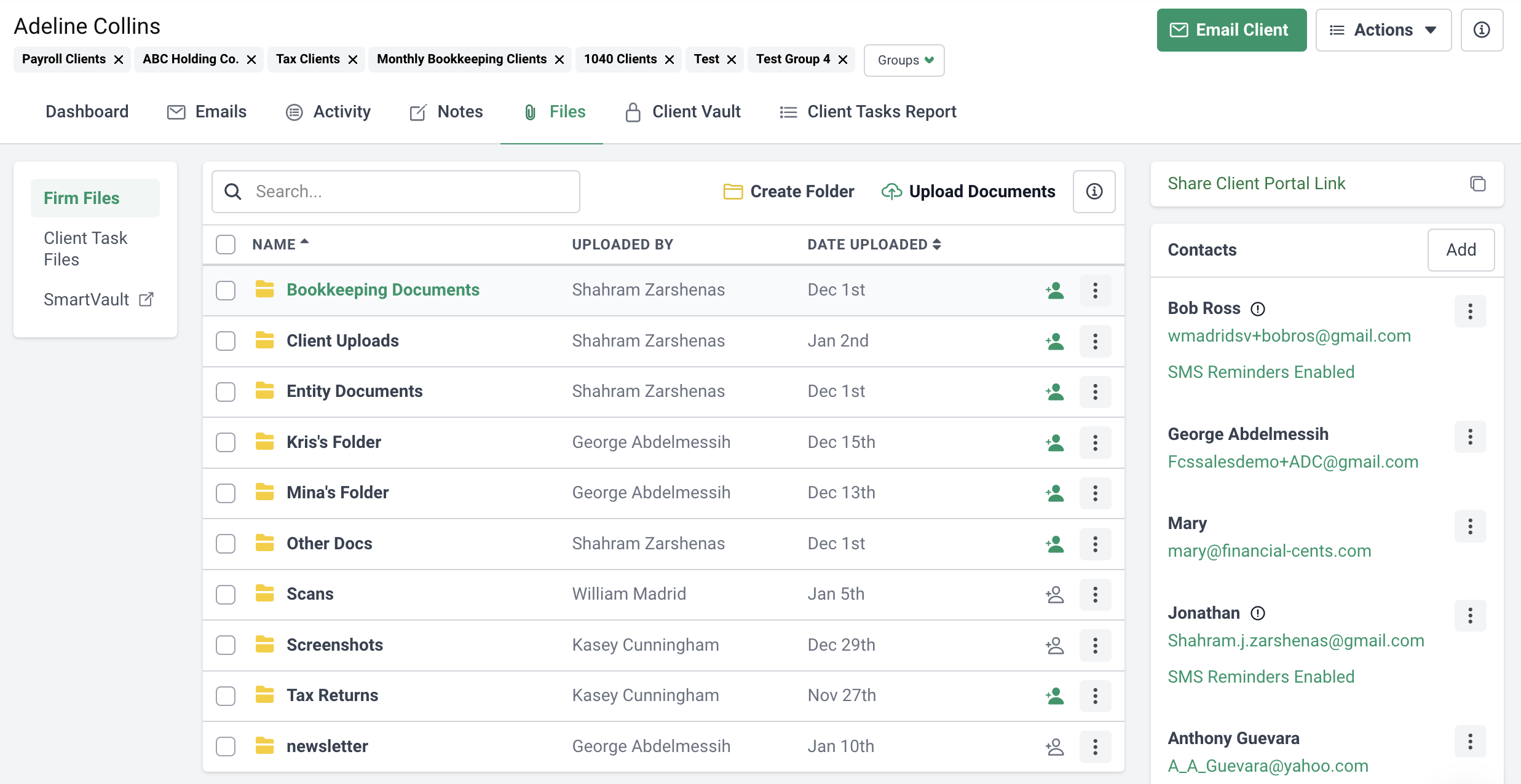

Kathy once managed mountains of paper that made finding client documents a daily challenge. Now, she stores everything in one secure, cloud-based system.

Clients can seamlessly upload statements, receipts, and tax forms directly into her workspace, where she can locate and review them with ease. Built-in reminders and notifications alert her the moment a client submits a file—saving time, improving communication, and ensuring secure document storage.

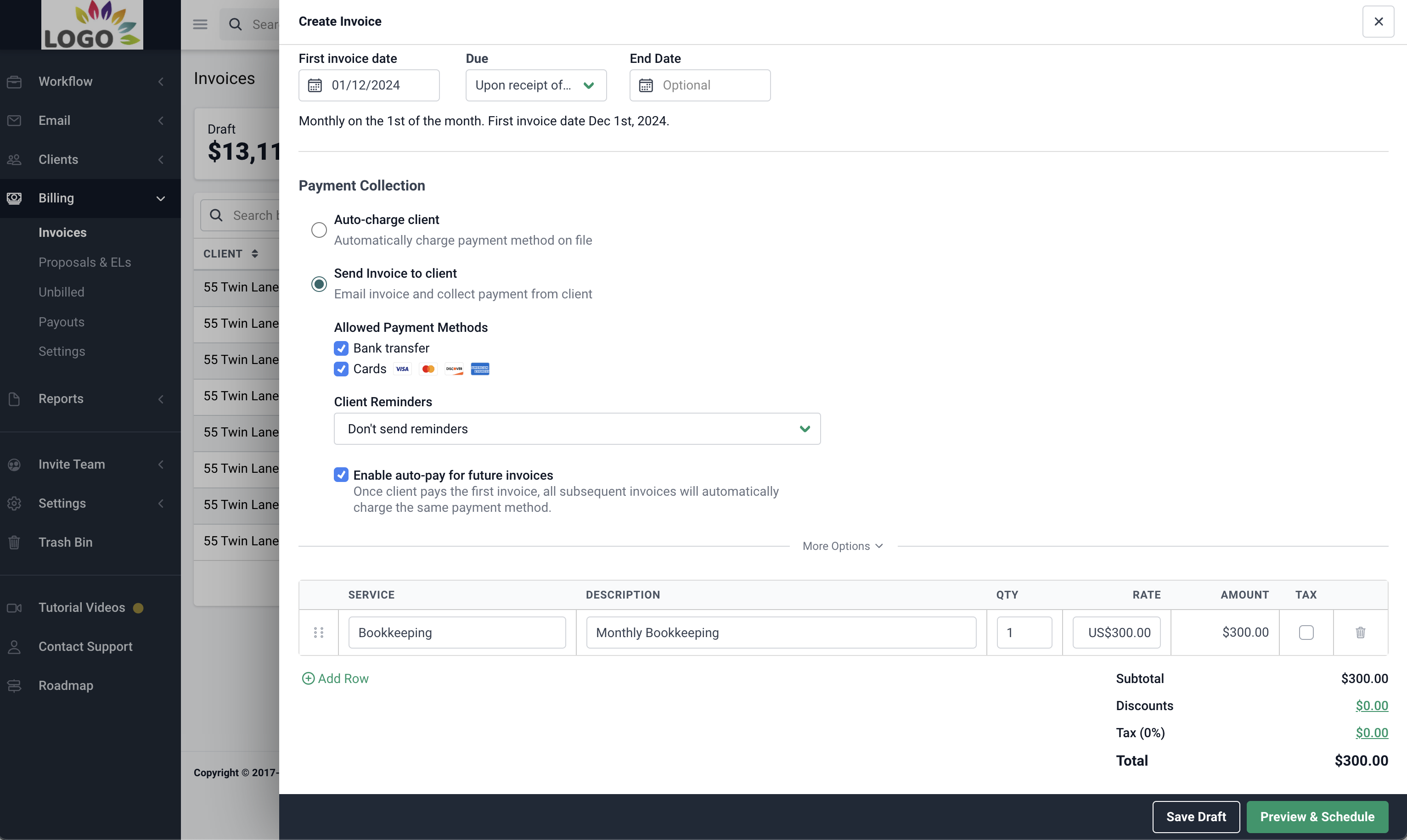

Time Tracking & Billing

Kathy’s next big goal is to streamline time logging and invoicing. Financial Cents lets her track time against specific projects and convert those hours into invoices without juggling multiple platforms.

While she’s still mastering the billing features and facing a few learning curves, the Financial Cents support team has guided her every step of the way.

Anytime I have a question, I start with the chat, and I would say 95% of the time I don't have to wait for a phone call. Anthony set me up when I first started. He was phenomenal and he would take as much time as it took to make sure my questions were answered."

Kathy Nash, Founder of Nash Financial Solutions, LLC.After frustration with other payment and invoicing systems, Kathy is eager to ditch third-party tools altogether. With Financial Cents, she can send professional invoices, accept payments, and keep a close eye on her firm’s profitability. Having everything under one roof means Kathy can reduce administrative tasks and dedicate more time to client work.

Key Things That Made A Difference

Financial Cents offers many features that streamline tax practice management, but here are the key elements that won over Kathy and her team.

Automated Client Requests & Reminders

One of Kathy’s favorite time-savers is automating client requests. When she needs W-2s, invoices, or other documents, Financial Cents follows up at set intervals. If a client hasn’t responded, the system sends polite reminders every few days until the files arrive. It’s easy to add auto-reminders to any client task and specify how often they should be sent—daily, every two days, etc.

Client Portal

Instead of juggling multiple communication channels, clients now have a single login where they can see which documents Kathy needs and any pending tasks.

This one-stop shop simplifies communication and keeps everyone on the same page.

Secure Document Exchange

Financial Cents also serves as a secure platform for uploading sensitive files, crucial for maintaining trust and compliance. Kathy can confidently request and receive statements, receipts, and tax forms without worrying about data breaches or missing paperwork.

Workflow Templates

With standard checklists for routine tasks (e.g., monthly bookkeeping or quarterly tax filings), Kathy saves time and avoids reinventing the wheel for each engagement. These templates, which can be created from scratch or imported into your workflow as shown below, kept Kathy’s team consistent ensuring no steps or document requests get overlooked.

Ease of Use

Simplicity matters to Kathy. Within the first week, she found the interface intuitive and could easily set up client tasks, schedule reminders, and create recurring projects with minimal training. She appreciates how easy it is to set up her workflow and focus on her clients.

Great Customer Support

Kathy credits the Financial Cents’ support team for making her transition smooth. Whenever she hits a snag, they’re quick to respond—whether by chat or phone. This hands-on help lets her adapt features to her firm’s exact needs, without feeling stuck or overlooked.

Conclusion

Nash Financial Solutions serves over 300 clients efficiently by consolidating all its core processes, task management, client communication, document sharing, and workflow automation into Financial Cents. With a single secure client portal, automated reminders, and clear workflow templates, the firm no longer wastes time chasing missing paperwork or worrying about missed deadlines. Everything from onboarding to final deliverables is handled in one intuitive system, freeing Kathy and her team to focus on delivering top-notch service.

If you’re looking for a similar boost in productivity and peace of mind, give Financial Cents a try. Start a free trial and see how it can transform your accounting practice.