Solo practitioners wear multiple hats daily—balancing client work, administrative duties, business development, and marketing—without the support staff often found in larger accounting firms.

The pressure to manage everything independently can lead to a constant sense of “to-do list overload.” This persistent act often results in unaddressed priorities, forgotten deadlines, and reduced client satisfaction.

Additionally, research by Business & Accountancy Daily reports that over half of accountants, 55%, have admitted to suffering from stress, with many identifying it as a key contributor to burnout in their careers.

In this high-pressure environment, effective task prioritization is important not only for solo firm sustainability but also for personal well-being.

Prioritization doesn’t just help you check off tasks; it provides a structured approach that helps you achieve more in less time, improves client relationships, and brings a renewed sense of control over your workload.

In this article, we’ll explore proven prioritization methods tailored to the unique demands of solo firms, providing a roadmap for improved productivity, client satisfaction, and work-life balance.

The Importance of Task Prioritization

For you, as a solo accountant, prioritizing tasks isn’t just a productivity tactic; it’s a necessity for sustaining and growing your firm. Without a clear sense of what matters most, it’s too easy to feel overwhelmed by the competing demands of client expectations, financial management, and business development.

1. Preventing Burnout and Supporting Your Mental Health

The risk of burnout is real when you’re constantly balancing numerous responsibilities. High-stress levels and a lack of control over your workload can lead to mental fatigue, anxiety, and even physical health issues.

Effective prioritization makes it easier to establish boundaries around your time. You can better finish essential tasks during work hours, leaving personal time truly personal. As a result, you can end each day with a sense of accomplishment and peace of mind without the looming worry of unfinished work.

2. Making Work Easier and More Productive

When you prioritize well, your efficiency skyrockets. You’re able to direct your energy and resources toward the tasks with the highest impact on your business, so your time is spent more productively. For example, urgent tasks—like filing deadlines or client meetings—naturally come first, while longer-term planning can be scheduled when you have the capacity.

This approach helps you work smarter, not harder. You’ll find yourself accomplishing more in less time by honing in on what drives results and letting go of lower-impact tasks. With prioritization in place, you can stop jumping between tasks and maintain focus, increasing your productivity and reducing time lost to multitasking.

3. Strengthening Client Relationships and Satisfaction

Prioritizing tasks also plays a critical role in maintaining strong client relationships. When you put client-facing tasks at the top of your list—like responding to inquiries, preparing financial reports, or managing tax filings—you’re showing clients that their needs are your priority. This builds trust, increases client satisfaction, and strengthens your reputation.

4. Making Room for Firm Growth

Beyond day-to-day tasks, it’s essential to carve out time for growth activities, like marketing, networking, or skill-building. These tasks may not feel urgent, but they’re key to expanding your client base and increasing your revenue potential. Without prioritization, growth tasks often get pushed to the bottom of the list and can fall by the wayside.

You may be interested in:

Kelly Rohrs, CPA’s Workflow for Building Her Accounting Firm

Setting aside time to focus on firm development is an investment in your future. This proactive approach allows your accounting firm to evolve, keeping you competitive and ready to take on new opportunities.

5. Creating Work-Life Balance

When you’re handling every aspect of your solo firm, it can feel impossible to draw the line between work and personal time. Without prioritization, work often spills into evenings and weekends, making it difficult to enjoy a real break. But with a clear prioritization strategy, you can create a healthier work-life balance.

This balance helps you return to work refreshed and motivated, supporting your productivity and overall well-being.

Understanding the Types of Tasks

Not all tasks are created equal.

When you’re running a solo accounting firm, it’s essential to recognize that some tasks will have a much higher impact on your business than others. This is where you break down your workload into categories so you can better understand which tasks deserve the most attention and which can wait.

Here’s how to categorize the types of work you handle daily:

- Client-Facing Tasks: These are the core of your firm. Tasks like tax filings, bookkeeping, and client meetings are directly tied to client satisfaction and retention. By prioritizing these, you invest in the relationships that keep your firm running. Giving these tasks top priority shows your clients they’re valued and builds trust and loyalty.

- Business Operations: Every accounting firm needs a strong foundation, and these are the tasks that keep everything running smoothly behind the scenes. This includes billing, software updates, and administrative duties. Although they might not directly bring in revenue, staying on top of business operations helps you avoid chaos and ensures your firm functions seamlessly.

- Growth Tasks: It’s easy to overlook growth tasks when managing day-to-day responsibilities, but these are essential for your firm’s future. This category includes marketing, networking, professional development, and long-term planning. These tasks might not bring immediate results, but dedicating time to them consistently will help you attract new clients, increase revenue, and future-proof your business.

- Personal/Well-being Tasks: Don’t forget that you’re not just running a business but also looking out for yourself. Personal well-being tasks include taking breaks, exercising, or setting boundaries for work hours. These activities might not seem as urgent as client work, but they’re crucial for preventing burnout and keeping you energized and focused.

Prioritizing across these categories ensures that you’re not only meeting immediate client needs but also investing in your business’s growth and your personal well-being.

Methods for Prioritizing Tasks

As a solo accountant, your to-do list can feel never-ending. Without a clear strategy for prioritizing tasks, you risk wasting time on less important activities while high-impact work gets delayed. Here are some tried-and-true methods for prioritizing your workload effectively and making each day more manageable.

1. The Eisenhower Matrix

The Eisenhower Matrix is a powerful tool for distinguishing urgent tasks from important ones. Using this approach, you divide tasks into four quadrants:

- Urgent & Important: These are high-priority tasks that demand immediate attention, like client deadlines or last-minute tax filings.

- Important but Not Urgent: These tasks, such as professional development or long-term planning, contribute to your firm’s success but don’t need to be done right away. Schedule these for later to ensure they don’t get lost.

- Urgent but Not Important: Tasks like responding to non-critical emails or handling minor admin tasks can be distracting. If possible, delegate or batch them together to minimize interruptions.

- Not Urgent & Not Important: These are low-value tasks that may not need to be done at all. Eliminating them can free up time for work that truly matters.

2. The ABC Method

The ABC Method is a simple yet effective way to rank tasks based on their importance:

- A (Must Do): Tasks that are essential for keeping your business running smoothly, like meeting client deadlines or addressing urgent requests.

- B (Should Do): These are important but less critical tasks, such as catching up on industry news or updating your marketing materials.

- C (Nice to Do): Lower-priority tasks, like organizing files or checking in on less pressing emails, can wait until you’ve handled the higher-priority work.

This method helps you tackle the “must-do” tasks first, giving you peace of mind that the most critical work is complete. It’s also a great way to keep lower-priority tasks from distracting you throughout the day.

3. Time Blocking

Time blocking involves dedicating specific chunks of your day to certain types of work. This method is especially useful when you need uninterrupted focus for complex tasks, such as tax preparation or financial analysis.

This hack is even great for accountants with ADHD who struggle to focus on specific tasks.

For instance, you might block out two hours each morning for client work, an hour in the afternoon for business operations, and the last part of the day for growth tasks. Time blocking helps you avoid multitasking and creates a structured schedule, so you know exactly when to focus on each part of your business.

4. The 80/20 Rule (Pareto Principle)

The 80/20 Rule states that 20% of your efforts lead to 80% of your results. By identifying which tasks fall into that high-impact 20%, you can focus your energy on activities that bring the most value to your firm.

For example, if client interactions and networking account for the majority of your new business, these tasks should be prioritized. Similarly, if certain types of accounting tasks drive the majority of your revenue, they deserve more focus. This principle helps you cut out lower-impact work and concentrate on actions that yield the greatest results for your firm.

5. Automation

Automation can be a game-changer for solo accountants, freeing you from routine tasks and allowing you to focus on high-value activities.

Automation helps achieve synergy because it removes manual data entry and the potential for mistakes. It ensures that the data gets where it needs to get to quickly and usually without error."

Nayo Carter Gray, CEO, 1st Step AccountingBy using automation tools, you can streamline repetitive processes like invoicing, scheduling, and data entry. This reduces the time you spend on administrative tasks, so you can dedicate more of your day to client work and growth.

Practical Tips for Staying on Top of Your To-Do List

Even with a solid prioritization strategy in place, the daily habits and small techniques help you stay organized and productive. Here are some practical tips to make your workflow smoother and help you stay on top of your tasks with ease.

1. Daily Planning

Planning your day in advance is one of the simplest yet most effective ways to stay on track. Before you end each workday, take a few minutes to review your to-do list and identify the top three tasks that need attention the following day. By setting clear priorities for the next day, you can start your morning with focus and direction, avoiding that initial overwhelm of figuring out where to begin.

2. Batch Similar Tasks

Switching between different types of tasks requires mental energy and can reduce productivity. To save time and minimize distractions, try batching similar tasks together. For example, set aside a block of time to answer all emails, another for client consultations, and yet another for administrative duties. This approach, known as task batching, minimizes the “context switching” that comes with shifting between unrelated tasks.

3. Delegate or Automate Where Possible

Even as a solo accountant, there are ways to reduce your workload by leveraging delegation or automation, as mentioned earlier. While you may not have a team to delegate to, there are tools and software that can handle repetitive tasks for you.

Consider using an accounting workflow automation software like Financial Cents.

With a customized plan starting at just $9 per month (on the annual plan), it provides an economical yet powerful option to help you manage your workload efficiently while maintaining high standards of client service.

Some of the features include:

- Task management: Track the work you need to do and prevent tasks from slipping through the cracks.

- Client CRM: Centralize client information so it is easy to find.

- Email Integration: to manage and organize communication with your clients. Turn emails to projects and automatically organize client emails separately from other emails.

- Client Portal: Get client responses faster without chasing them down for information and documents

- Workflow checklist templates: Quickly get set up with 50+ templates, our AI checklist generator, or simply import your templates or a friend’s.

- Billing & QBO Integration: You can create one-off & recurring invoices and get paid faster.

4. Use Checklist Templates

Checklists are invaluable for keeping you organized, especially for recurring tasks. Creating and using checklist templates can help ensure you don’t miss any steps in routine workflows, like month-end reporting, tax filing, or new client onboarding.

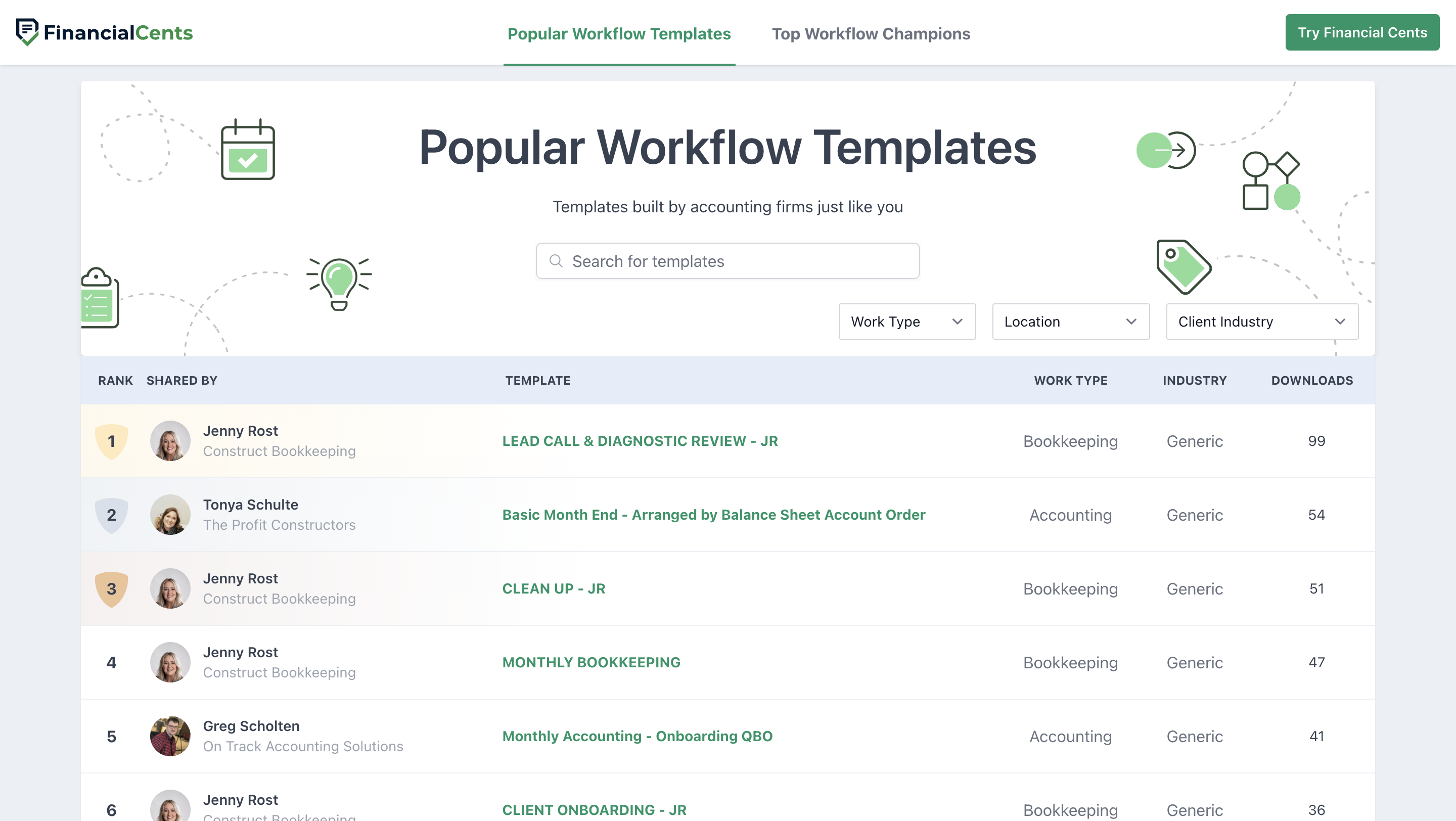

Fun Fact: Financial Cents has a Template Library where you can find free, efficient workflow templates from firm owners like you to improve your processes.

The template library is for accounting pros who:

- Want to save time, boost efficiency, and handle more work without sacrificing quality.

- Need to reduce admin tasks to focus on billable work and client relationships.

- Seek a community to stay current on client needs and technology.

- Value standardized systems to streamline and scale their operations

Financial Cents enables me to set up templates for projects. This helps me set my new clients up when I’m bringing them on. Just setting them up with those templates helps me see what they might have missed. In Canada, we have a GST filing. Setting up my GST workflow templates in Financial Cents helps me remember what I need to do over the month or quarter."

Phil McTaggart, Founder, SALAS Inc.5. Limit Your To-Do List

It can be tempting to add every possible task to your to-do list, but this can lead to an overwhelming sense of “too much to do.”

Instead, limit your daily to-do list to a manageable number of tasks.

Consider setting a cap, such as five main tasks per day. When you focus on fewer, high-priority tasks, you’ll be more likely to complete them and feel accomplished at the end of the day. This approach helps you work with intention and prevents a packed to-do list from derailing your day.

Turn Priorities into Progress in Your Solo Firm

Effective prioritization goes beyond simply crossing items off your to-do list; it’s a smart strategy to help you reduce stress and build a thriving solo practice. When you concentrate on tasks that truly matter and establish a structured workflow, you can achieve a healthy balance between client needs, business growth, and personal well-being.

A tool like Financial Cents can simplify this process. with a solo plan Designed specifically for solo firms, Financial Cents makes it easier to manage your tasks and workflows so you can focus on important work instead of getting stuck in admin tasks.