It is vain to work long hours, miss important family occasions, and strain your mental health if you’re going to lose the money you’re making to various operating expenses—IT, staff, utility, etc.

While business success requires always looking for ways to save costs, you need to know where and how to reduce costs because getting it wrong can cost you a critical part of your business.

In this article, we’ll show you some of the smartest ways integrated billing software saves money and makes your firm more profitable.

What is an Integrated Accounting Billing Software?

Integrated billing software is an application (usually an accounting practice management tool) that allows you to perform your billing functions in the platform you use to manage your other business-critical processes, such as workflow, client management, and capacity management.

This provides your team and clients one place to manage projects, track payments, and store client information, saving you time, mental energy, and subscription costs.

The Hidden Costs of Using Disconnected or Standalone Billing Systems

1. Separate Subscription for Multiple Applications

Using some accounting billing software costs as much as $199/month. You’ll need another $59/month to use some accounting practice management software.

Integrated billing combines both solutions for as low as $59/month, saving you as much as $199 per month. For a solo firm owner, this cost can go as low as $9/month with the Financial Cents Solo Plan.

The more business functions you can accomplish with an all-in-one solution, the fewer applications you need to pay for and the fewer dollars you will spend running your firm.

2. Limited Client Management Features

The client management feature enables you to store all client information to understand the client’s needs and build quality client relationships.

Traditional billing software does not have sufficient client management features for accounting firms to store all the information they need to nurture client relationships.

An integrated billing system stores your accounting client’s information, allowing you to view their project and payment history.

3. Labor-intensive Processes Consume Valuable Time

The billing cycle is full of labor-intensive activities that can easily take up a large chunk of your day, preventing you from getting more work done (and making more money).

An integrated billing system provides automation that takes care of these time-consuming aspects of the billing and client-facing processes through automatic payment and payment reminders.

4. High Error Rates Lead to Late Payments or Disputes

Using multiple systems to manage your billing and other business processes increases manual labor.

Manual labor increases the chances of human error, and human errors lead to invoice disputes and late payments.

Correcting invoicing mistakes involves a series of activities that can cost you the money you are trying to save.

Integrated billing solutions enable the apps in your tech stack to synchronize information with one another. Since it requires no human input, errors are almost non-existent, making your invoices more accurate and faster for clients to process.

5. Missed Opportunities for Early Payment Discounts

Getting clients to pay early begins with sending invoices on time, which is more difficult when you have to go into several systems to generate the invoice.

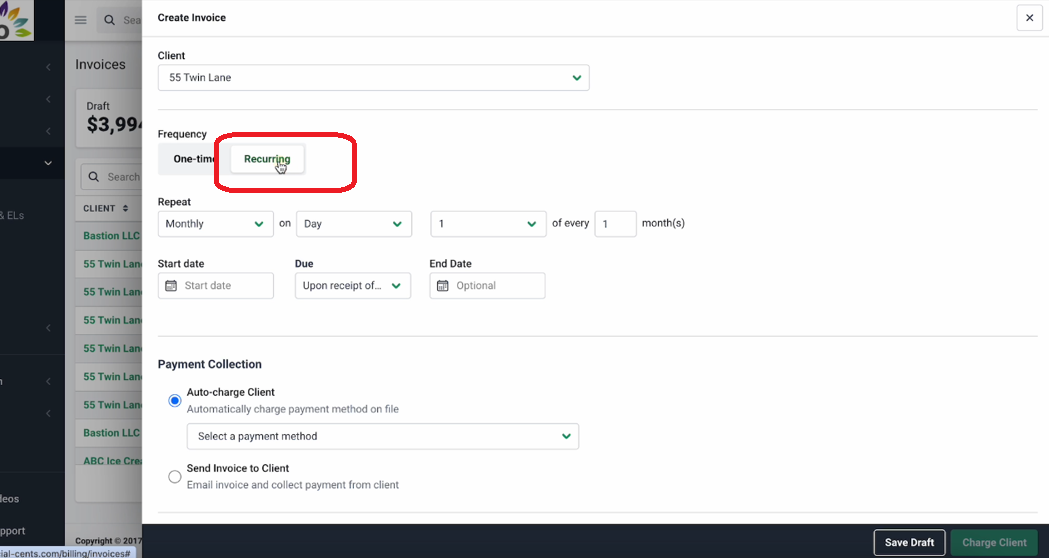

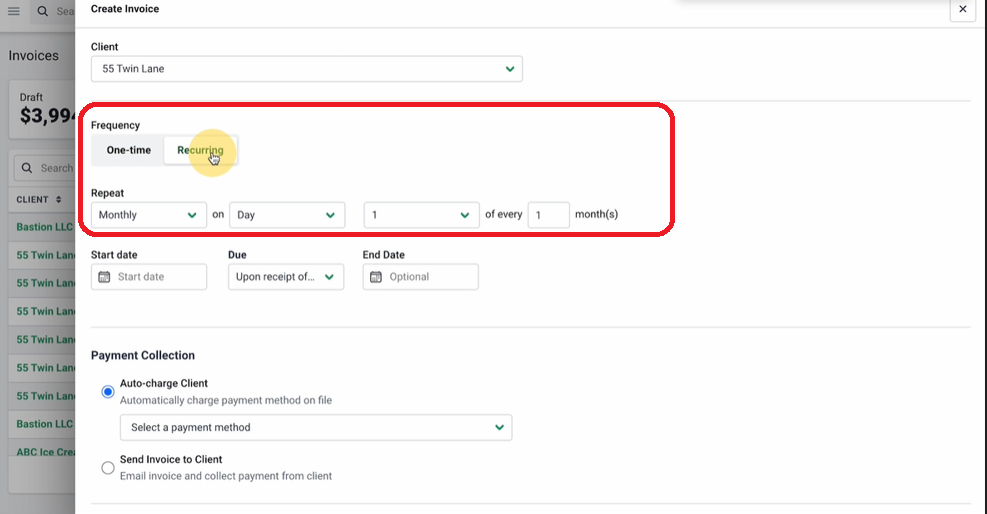

For a solution like Financial Cents, you can create recurring invoices and charge your clients at a particular time of the week, month, or year.

This allows your clients to claim an early payment discount—which encourages clients to pay you and make cash available for your firm.

Integrated Accounting Billing Tool: Unexpected Ways it Saves You Money

a. One Powerful Software (Instead of Several) to Manage Your Firm and Receive Payments

Billing is not an isolated task. It relies on the other applications in your accounting tech stack—such as your time tracking and workflow solutions—to be effective.

In a traditional billing system, these business functions are performed with different applications, which will require separate payments.

An integrated billing system enables you to perform all invoicing, time tracking, workflow management, and other business functions in one application.

For Financial Cents users, billing, time tracking, workflow, and client management are part of its all-in-one practice management features.

b. Improved Client Onboarding Process

A smooth client onboarding process saves you money by reducing the resources you invest into setting up clients in your tech stack.

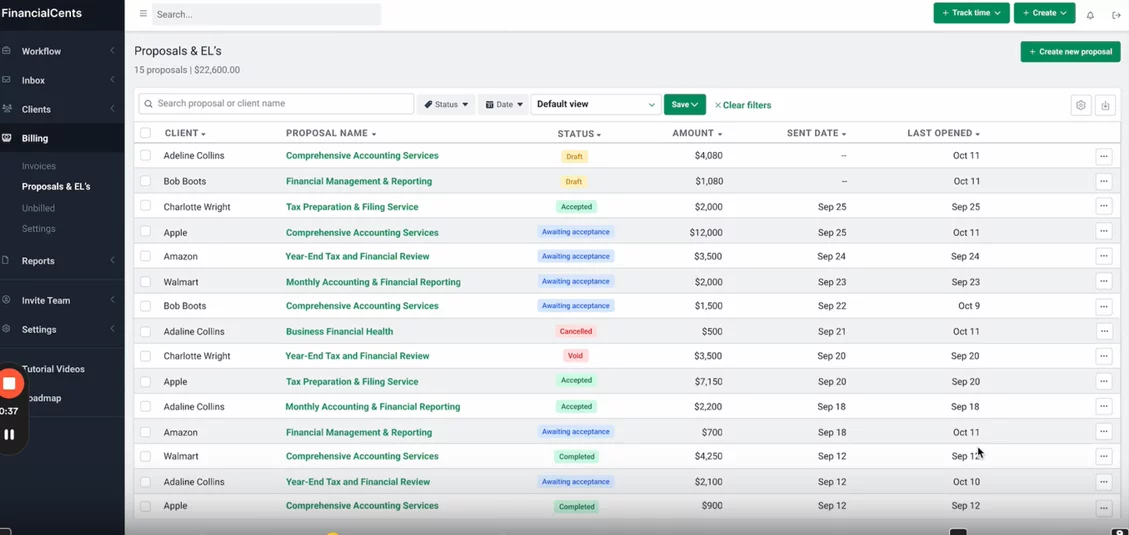

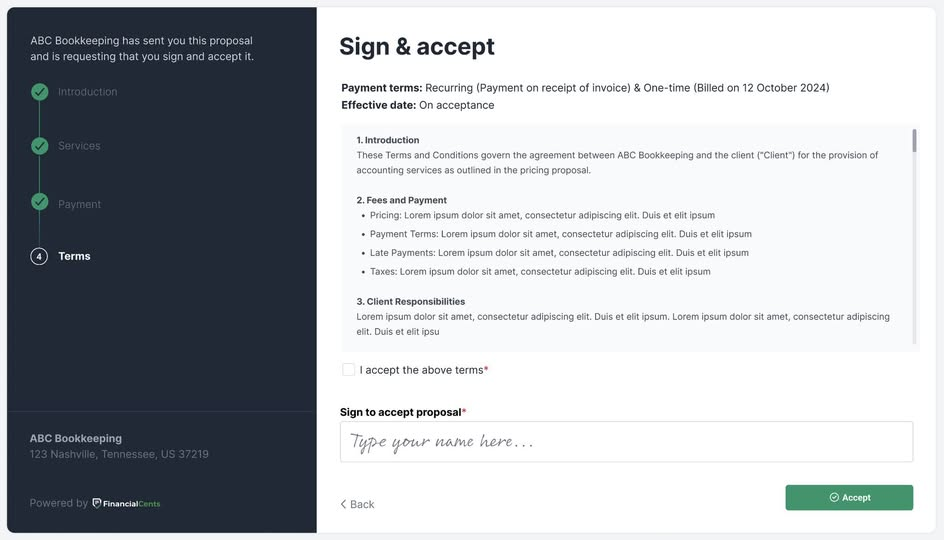

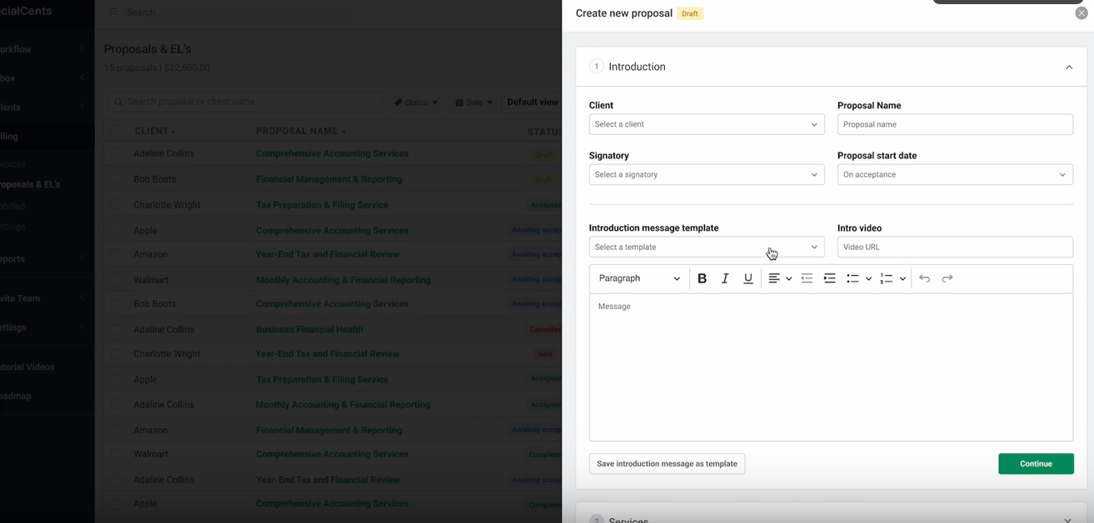

Thanks to the proposal feature in an integrated billing solution, you can generate professional proposals and engagement letters that help you align expectations and set the tone for the business relationship.

Every strong accounting proposal software has an electronic signature feature that makes it more convenient for clients to approve proposals online and seal deals faster.

Additionally, integrated billing and proposal solutions have prebuilt onboarding templates that quicken and standardize your client onboarding process, eleminating the need for a separate accounting client onboarding tool.

These prebuilt proposals can be customized to your client’s unique needs to show you understand their needs.

With the option to edit the templates (or create yours from scratch) using your design features, your proposals can look 100% on-brand. This builds trust, credibility, and confidence in your new clients.

c. Streamlined Operations (Conserves Your Firm’s Resources)

With integrated billing software like Financial Cents, you only have one application to set up and don’t need to migrate or update client data across multiple applications. These will reduce the time you need to start getting value from it.

This all-in-one accounting billing system helps your staff perform all billing tasks (such as collections and reporting) using the tool they already use daily. That way, your employees are more likely to do work they are proud of, which increases their job satisfaction and employee retention, saving you money in recruitment costs.

Managing client billing where you are getting work done also gives you visibility into your payments and collection process. This tells you when to make certain decisions, like hiding a client’s deliverable behind a paywall.

d. Reduced Administrative Costs

The manual billing process requires more time and labor because it requires creating invoices from scratch for your recurring clients (when you should have automated recurring invoices with a few clicks).

In the end, you’ll need more staff to meet all client deliverables. Meanwhile, accounting billing software frees your team to focus on billable work while machines handle the non-billable tasks.

It enables you to automate administrative tasks (like payment reminders and data entry) so that you can reinvest your time into client advisory and other tasks that require human judgment.

e. Improved Cash Flow Management

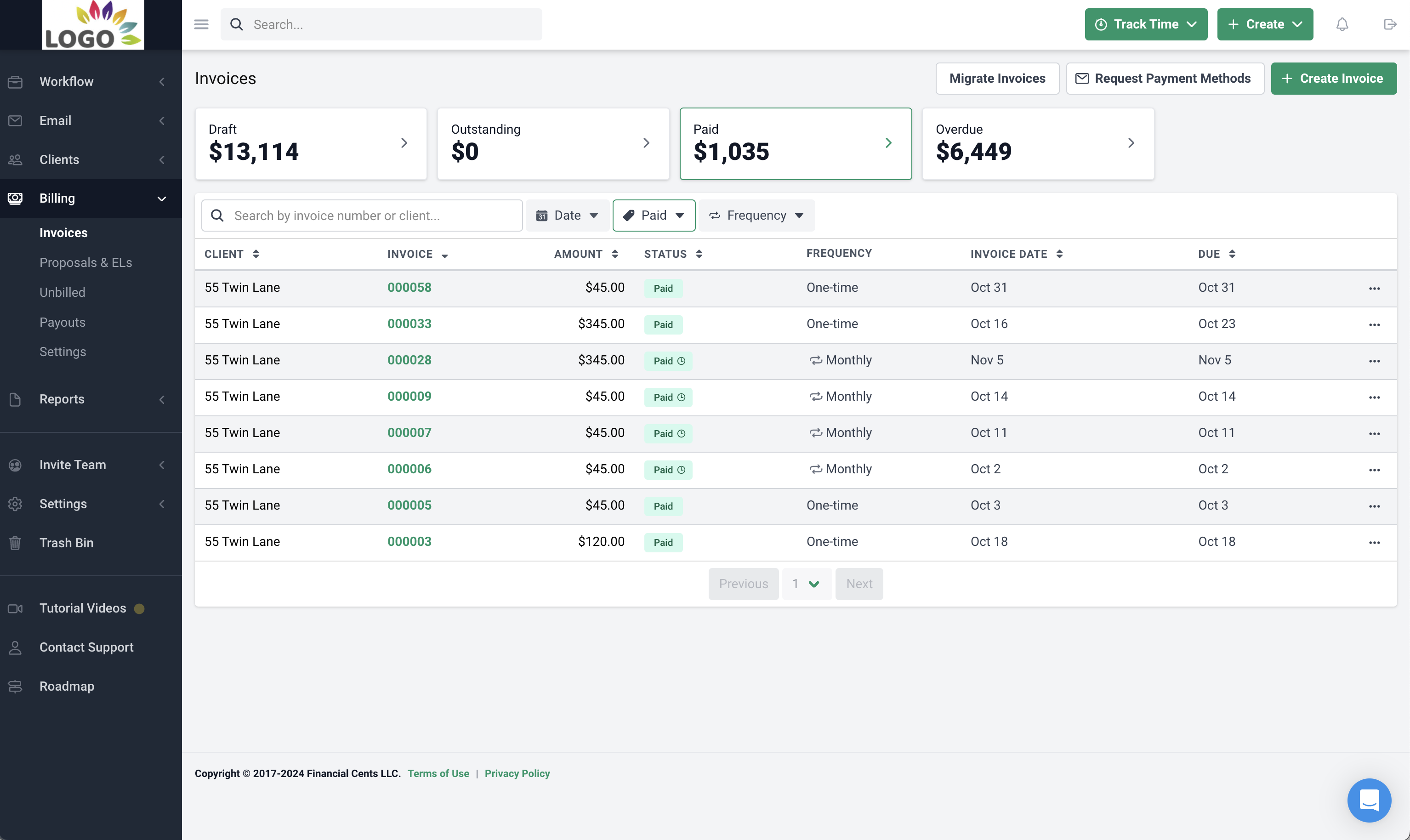

Integrated billing software enables you to accept ACH and Credit Card payments, making it easier and faster for clients to pay you.

For Financial Cents users, the client portal contains your client’s billing—among other— information, giving clients a central place to view their due and overdue invoices and make payments accordingly.

Accounting billing software also provides up-to-date insights that improve visibility into your cash flow by showing invoices that have been sent, received, opened, or disputed.

This helps you know when to follow up on outstanding invoices so you can receive payments faster.

f. Enhanced Client Relationships

Integrated billing software makes it easy for clients to make payments.

For example, Financial Cents allows you to save your client’s payment information on file. This eliminates the need to enter their payment information whenever they want to pay you.

Financial Cents also allows you to charge your clients automatically when their next payment is due. The client does not need to approve the payment manually, which saves them time.

With an integrated billing system, customer inquiries, refunds, and disputes are resolved more quickly in the client portal, which results in a smoother client relationship.

g. Integration with Other Accounting Tools

Every strong accounting billing software synchronizes data with other relevant apps in your tech stack to maintain accuracy across all the board.

For example, Financial Cents integration with QuickBooks Online enables Financial Cents users to pull service items from QuickBooks to create invoices in Financial Cents.

Another integration with Gmail and Outlook pulls all your client emails into a dedicated folder in Financial Cents.

These integrations give you access to relevant features in multiple applications from one platform.

h. Scalability Without Additional Overhead

Most people believe that growing your firm requires hiring more staff to manage the increase in workload, but that’s mostly true with manual systems.

With a manual billing system, there will be more invoices to create and payments to track, which increases your billing workload, requiring more hands to meet demand.

Since an integrated billing system automates repetitive billing-related tasks across multiple platforms, fewer human resources are needed to manage the billing process. This prevents the need to spend more money hiring more staff.

Use Financial Cents to Save Money in Your Firm

With IT support costs going through the roof, reducing the number of applications you use to manage your firm will significantly save money for your firm.

Financial Cents’ all-in-one practice management solution provides billing features that allows you to manage client billing, workflow, and client information.

This gives your team time to complete more work and make more money instead of bouncing between multiple applications.

Financial Cents’ integrated billing features include:

-

ACH and Credit Card Payment Processing

Financial Cents accepts ACH and credit card payments at the standard rate of 1% for ACH transactions (with $5 as the maximum you can pay for any amount received) and %2.9 for Credit Card payments.

With a maximum processing fee of $5 for ACH transactions, Financial Cents saves you every cent above $5 in large ACH payments.

-

Proposals and Engagement Letters

Financial Cents’ new proposal feature allows you to create and send proposals and engagement letters to clients at no additional cost. This enables you to effectively outline the services you’re providing for your client, saving you the money you’d have spent on a separate proposal software.

-

Ability to Pass on Credit Card Fees to Clients [COMING SOON]

Paying for all your clients’ credit card processing fees can drain your earnings. This feature lets you add the credit card processing fee to your client’s payment.

-

Saved Payment Methods

You can save your client’s payment information on file and spare everyone the stress of entering payment information every time.

-

Automatic Payments

This enables you to auto-charge their cards by the next payment date, removing one more barrier to early payments and improving cash flow.

-

WIP Report [COMING SOON]

This feature allows you to create invoices using the time and expenses invested in ongoing projects to prevent revenue leakages.

-

AR Report

This is helpful for getting insights into your client invoices and payment behaviour, empowering you to make smarter decisions.

-

Lock Deliverables Behind a Paywall [COMING SOON]

This feature allows you to hide the client’s deliverable (report, document, etc.) behind a paywall, requiring them to make payment to get access.

Other Features You Get in Financial Cents’ All-in-One Platform AT NO EXTRA COST

Workflow Management and Automation

This feature coordinates your accounting processes and automates manual tasks to help you hit your deadlines.

It provides

- Workflow Dashboard: shows you where your client projects stand and helps you see where your attention is needed most urgently.

- Recurring Work: saves hours of recreating repetitive projects and frees you up to do work that brings in money.

- Team Chat: helps your team collaborate inside each client project, keeping all discussions in context. Its timely in-app and email notifications ensure no important project detail falls through the cracks.

- Dependencies: ensures completion of all preceding tasks before an assignee can perform a task.

Client Management

Client service begins with adequate knowledge of the client and their needs. Financial Cents stores and organizes each client’s information in one place—the Client Profile—for easy access.

The CRM has:

- Client Notes: a tab for client updates to help your team complete work to client satisfaction.

- Client Vault: a secure place for confidential client information, such as usernames, passwords, card information, etc.

- Custom Fields: client-specific information you need to build and nurture the client relationship.

- Client Files: client-related documents that help your team complete work to standard.

Client Task and Auto-Reminders

This feature makes client data collection easier for your team and clients with

- Client Tasks: a checklist of the files, actions, and information you need to complete client work sent to the client in advance.

- Auto Follow-up: auto-remind your clients about outstanding requests until they grant the request.

- Client Chat: clarify requests for files and information with your clients in Financial Cents’ secure client portal.

Time Tracking

Accurate time logs are needed for effective client billing, and Financial Cents’ inbuilt time tracker helps you do that with

- Time Budgets: enables you to set time estimates for client projects, allowing you to see when you’re spending too much or too little time on a project.

- Billable Rates: this allows you to document the amount you’re charging on client projects to bill clients adequately.

- Billable VS Non-Billable: this allows you to analyze your team’s time usage to understand when your team spends too much time on admin work.

- Reports: data that provide insights into how your team is using its time, which helps you make data-backed decisions.

Email Integration

Jumping between your email, billing, and workflow management applications will cost hours of money (billable time). Financial Cents’ integration with Gmail and Outlook prevents that. It provides:

- A Dedicated Folder: Each client has a dedicated folder that tracks your team’s emails with them inside Financial Cents.

- Emailing Functionality Inside Financial Cents: All sending, reading, and archiving actions in Financial Cents will show up in your Gmail and Outlook accounts.

- Pin Client Emails to Projects: add client emails to the related client project to keep information from falling through the cracks and give your team more information to work with.

- Turn Client Emails into Projects: your client’s ad-hoc requests can be turned into a project in your workflow dashboard immediately.

Capacity Management

This feature helps you track your employees’ workload on demand to prevent burnout and poor performance.

You can:

- View Your Team’s Workload: a dashboard to see how much work your team members have on their plate.

- Set Capacity Limits: limit the number of hours your team can work to keep everyone fresh enough for peak performance.

- Reassign Tasks: you can drag and drop tasks between your team members to prevent some from overworking while others are underworking.

ReCats

Financial Cents’ intuitive ReCats feature simplifies the process of categorizing uncategorized transactions instead of downloading transactions in spreadsheets and chasing clients to clarify them for you.

With this feature, you can:

- Auto-Pull Uncategorized Transactions: this pulls uncategorized transactions into the Financial Cents client portal.

- Automated Reminders: draw your client’s attention to your requests for transaction-related information to get their responses faster.

- Collect Descriptions and Receipts: clients can send you transaction-related files and information to put their transactions in the right category.

- Upload Transactions to QuickBooks Online: push the files and information to related transactions in QuickBooks.

Integrated Billing Software: Get The Value of Many for the Price of One

If you’re like most accounting and bookkeeping firm owners, there is simply no time to string several disconnected applications—with their subscription costs, password management, and training requirements.

Integrated billing streamlines your operations, automates manual tasks, and synchronizes information with relevant third-party solutions (like your accounting software), helping you to do more with less.

Financial Cents’ all-in-one accounting practice management solution gives firm owners like you the right mix of features (billing, workflow, time tracking, document management, and client portal) to reduce the time and money you spend on multiple productivity apps.