Outline your responsibilities and establish credibility with your client with our professional bookkeeping engagement letter for accountants, bookkeepers and CPAs!

What is a Bookkeeping Engagement Letter?

It is a formal written agreement or a contract between you (service provider – bookkeeping or accounting firm) and your client that clearly outlines the terms of service. A typical engagement letter contains the following:

- Scope of Services

- Responsibilities of the Client

- Fees and Payment Terms

- Duration

- Termination clause

- Signatures (yours and your client’s)

You should always ensure you receive a signed copy of the engagement letter before you start any kind of work for the client to avoid disputes.

Why you need a Bookkeeping Engagement Letter

If you are an accounting or bookkeeping firm owner, you know that it’s vital to impress first-time or potential clients. A client’s first impression of your business could make or break a deal.

You need a bookkeeping engagement letter because:

1) A client’s first impression of your business can make or break a deal.

2) When you appear professional and credible, you’ll leave a good first impression and establish a good working relationship with new clients from the get go.

3) Make it easy for the customer to work with you

You must exhibit these qualities in all your interactions with your clients, whether it’s an in-person meeting, a phone call, or an engagement letter.

At Financial Cents, we understand the importance of a first impression, and we’re here to help. Our FREE bookkeeping engagement letter template will help you craft a professional accounting engagement letter that impresses your clients instead of confusing them.

How a Bookkeeping Engagement Letter will help your firm

A solid engagement letter will help you:

- Present a professional image

- Establish credibility

- Set clear expectations

- Outline your services and fee structure

- Outline responsibilities for both you and your client

- Mitigate risk by clearly describing terms and conditions

Let’s take a look at each of these 6 goals.

1. Present a professional image

An official engagement letter outlining all your terms and conditions helps you to appear professional, competent and assured. Our accounting engagement letter is a great template you can customize to suit your firm's needs. It allows you to fill in your logo and information so you can quickly create a clear-cut, professional-looking letter that your clients will immediately notice.

2. Establish credibility:

Your client needs to know that you are trustworthy and competent. A clear, confident accounting engagement letter helps assure potential clients that you are capable and will do a good job. Promptly sending a solid letter of engagement will also let your client know that your accounting business is well run and organized.

3. Set clear expectations:

In business, clarity is key! The primary purpose of a bookkeeping engagement letter is to clearly state the expectations of your agreement. If you don’t state your expectations clearly, you could run into confusion in the future. Having a clear initial engagement letter is one of the best ways to provide clarity and eliminate all confusion right off the bat. Also, if you have a clear engagement letter that eliminates doubts about your agreement, you reduce your risk of litigation. But more on that in a bit.

4. Outline your services and fee structure:

A good bookkeeping engagement letter lets your client know exactly what services they can expect to receive from you, what you expect them to pay for it, and other terms and conditions. If your engagement letter plainly outlines this information, it helps remove potential confusion and forgetfulness, saving you time, stress, and potentially from an upset client.

5. Outline responsibilities for both you and your client:

Your bookkeeping engagement letter should not only outline your responsibilities but the responsibilities of your client. For example, you may need certain bookkeeping or financial records from the client by a set time of the month in order to complete your tasks on time. Or, you may state that your accounting firm does not include any procedures designed to discover fraud or theft and cannot be relied on to find those things, and that this is your client’s responsibility. Stating clear deadlines and tasks saves you trouble, and maybe even a customer, in the future.

6. Mitigate risk by clearly describing terms and conditions:

A clear, explicit engagement letter is your first line of defense when it comes to avoiding legal trouble. An engagement letter is not a binding agreement like a contract, but it’s a written paper that states your terms and conditions and eliminates confusion. An engagement letter is a good safeguard to help you avoid confusion, anger, and ultimately, a lawsuit. An accounting engagement letter template like ours will help you make sure that you have all the bases covered so you can avoid unpleasant situations in the future.

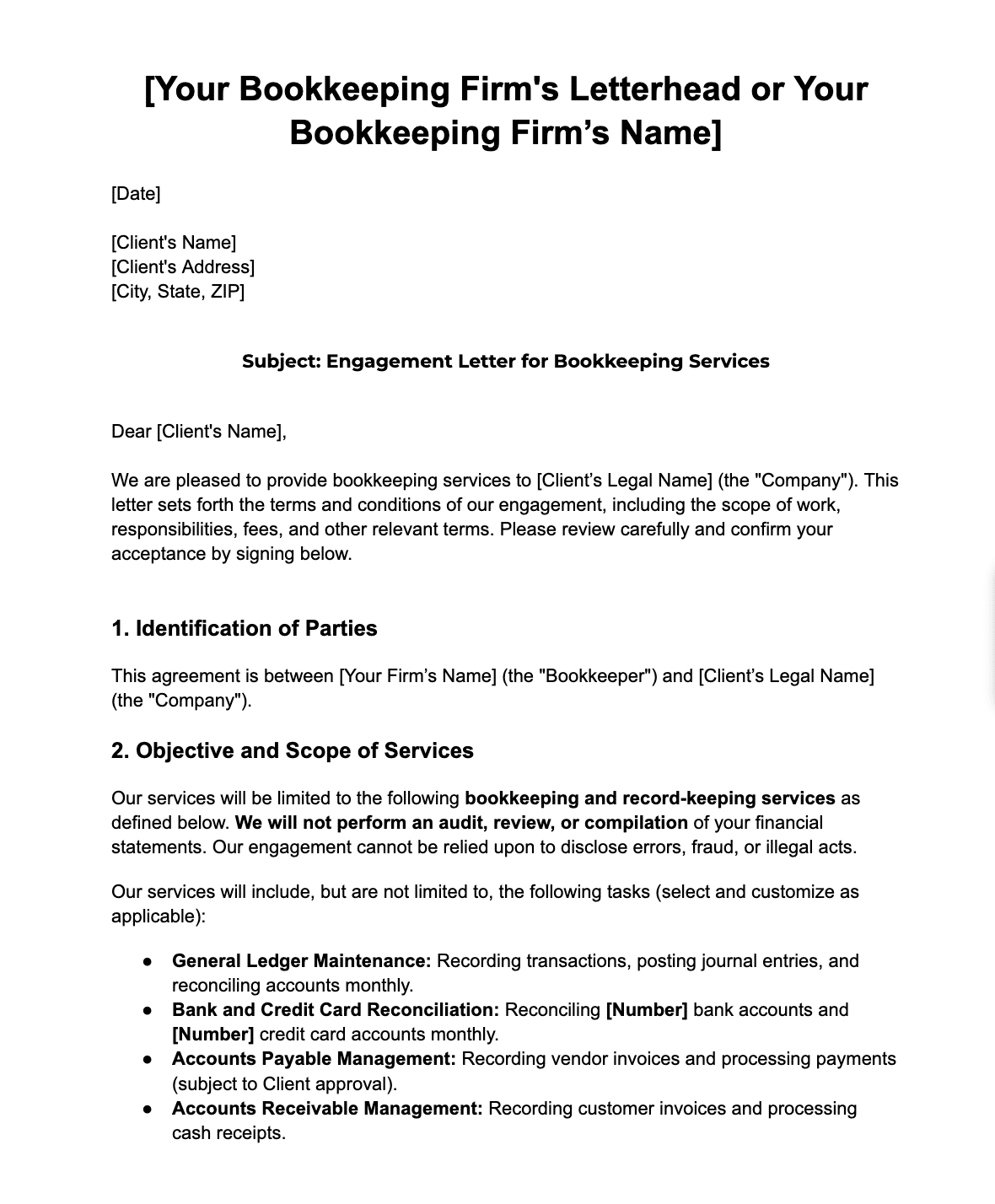

What you’ll find in our Bookkeeping Engagement Letter

In our fully editable and customizable bookkeeping engagement letter, you’ll find sections for:

- Company name

- Scope of work

- Responsibilities

- Privacy policy

- Outsourcing

- Termination

- Governing law

- Invoice procedures

- Expenses

- Fee schedule

- Company summary

These are all important items to include in a bookkeeping engagement letter so that you don’t leave room for any kind of ambiguity or confusion.

How to use the Bookkeeping Engagement letter

Once you and your client have had a verbal agreement to work together, the next step is for you to send them an engagement letter to make things official.

With our bookkeeping engagement letter template, the process of creating an engagement letter for your client is easy and fast. Simply:

- Download the template

- Or create an account with Financial Cents to access the template

After you’ve gotten your copy of the template, follow these steps to customize it to your firm:

- On page 1, insert your logo, company name, and the services you offer.

- Go through each page and change or insert necessary information like your company name, client name, specific services requested, fee information, etcetera.

- When you’re done, review everything to make sure you didn’t leave anything out.

- Email it to your client!

Best Practices for Maximizing Bookkeeping Engagements

Getting a client to sign an engagement letter is only the beginning. To build trust, deliver consistent value, and retain clients long-term, it’s important to approach every engagement with clarity, professionalism, and a proactive mindset. Below are best practices that will help you get the most out of your bookkeeping engagements:

a. Reiterate Scope in Simple Terms

Even if you’ve outlined the scope in the engagement letter, reiterate it during your kickoff call or onboarding email using everyday language. This ensures the client truly understands what services are included and what’s not.

b. Confirm Access to Necessary Information

Most client delays happen because bookkeepers don’t have access to what they need. Confirm access to bank accounts, credit cards, payroll platforms, POS systems, and any other third-party software right after signing. Include this step in your onboarding checklist.

c. Set Clear Communication Guidelines

Establish how, when, and where you’ll communicate. Let clients know what to expect (e.g., monthly summaries, access to a shared portal, turnaround time for questions). This reduces misunderstandings and keeps the relationship on track.

d. Include Client Responsibilities in the Engagement Letter

Make it clear what you need from clients to do your job effectively, such as timely document uploads, category clarifications, or monthly reviews. Putting this in writing helps keep clients accountable and prevents scope creep.

e. Address Change Requests Professionally

Things change—new entities, payroll additions, or requests for catch-up work. Use your engagement letter to include a “change in scope” clause and have a system in place (like a change order form or approval flow) to handle new requests and price adjustments.

f. Set Review Cadences

Schedule periodic check-ins (quarterly or annually) to review how things are going. This allows you to realign expectations, offer new services, and reinforce the value you’re delivering.

g. Use Technology to Stay Organized

Keeping all client tasks, notes, deadlines, and documents in one place prevents things from slipping through the cracks. Use a bookkeeping practice management software to track engagement timelines, task completion, and team assignments.

h. Document Everything

Maintain a written record of important updates, decisions, or scope changes. Whether it’s stored in your client CRM, internal notes, or a shared communication portal, documentation protects both you and the client if questions arise later.

Send, Sign & Start Faster: Simplify Engagement Letters with Financial Cents

Writing a strong engagement letter is one thing, delivering and managing it efficiently is another. Many bookkeeping firms waste valuable time trying to use multiple apps such as Word docs, email threads, and e-signature to sign client engagements. That’s where Financial Cents makes all the difference.

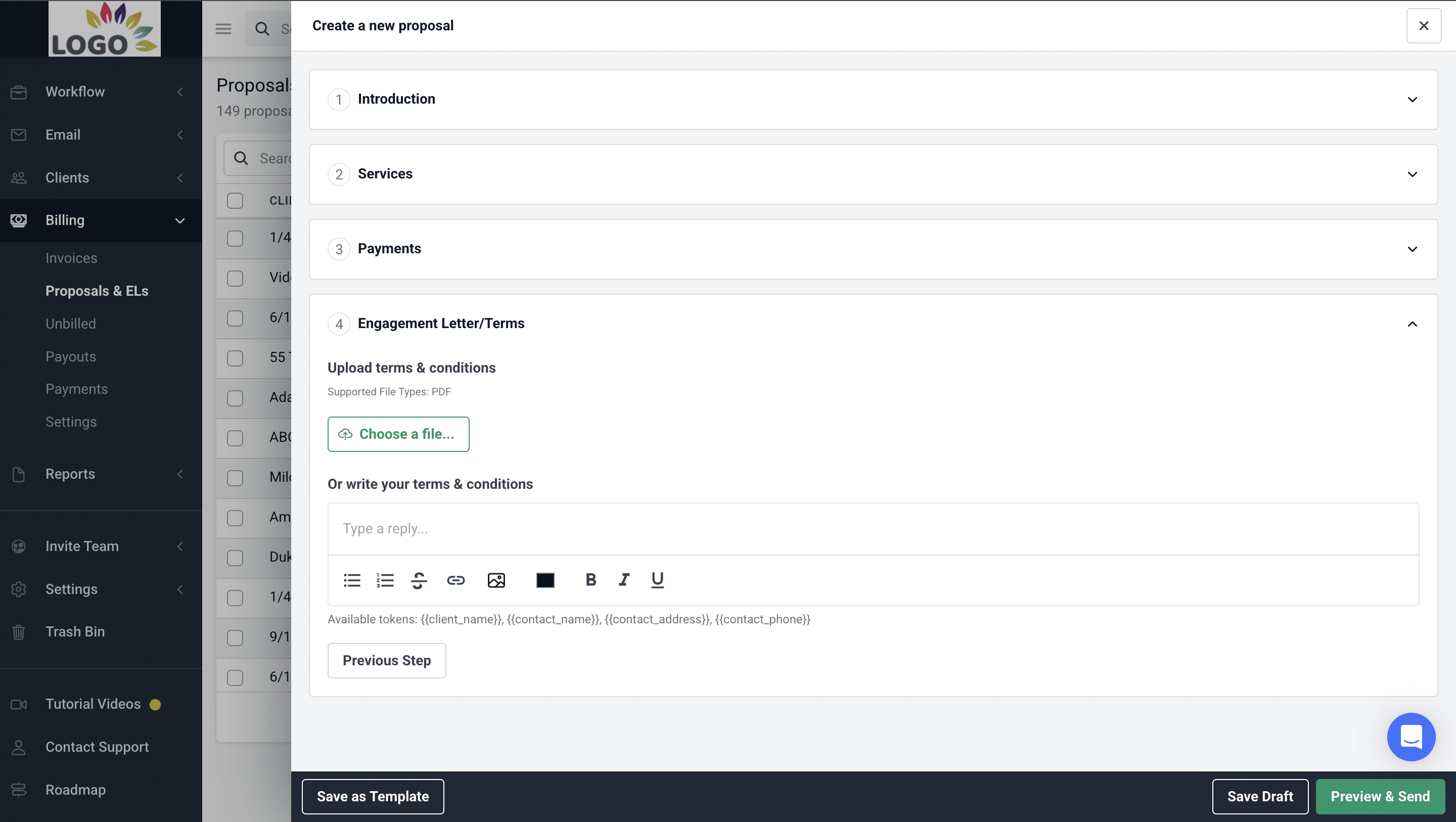

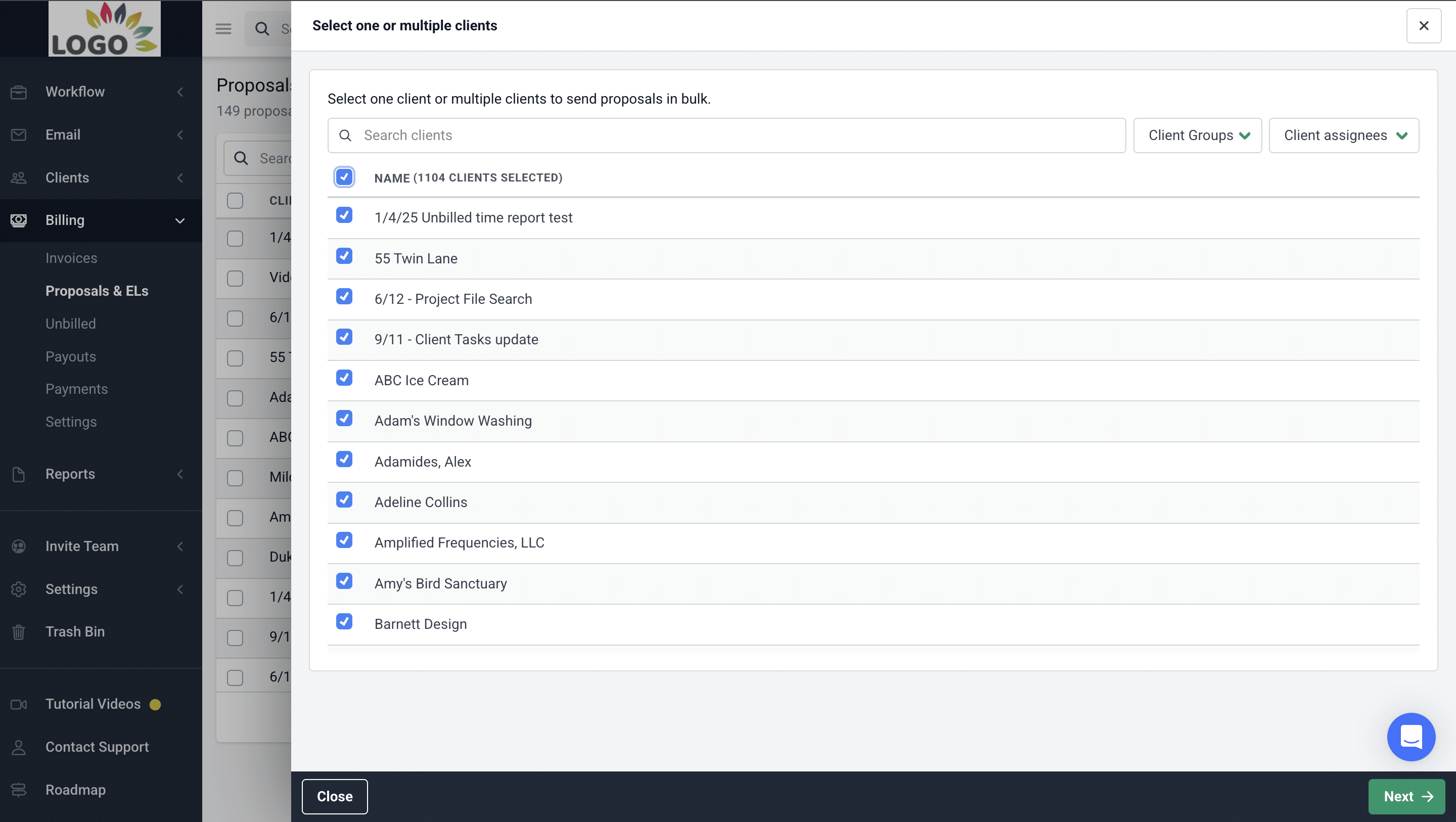

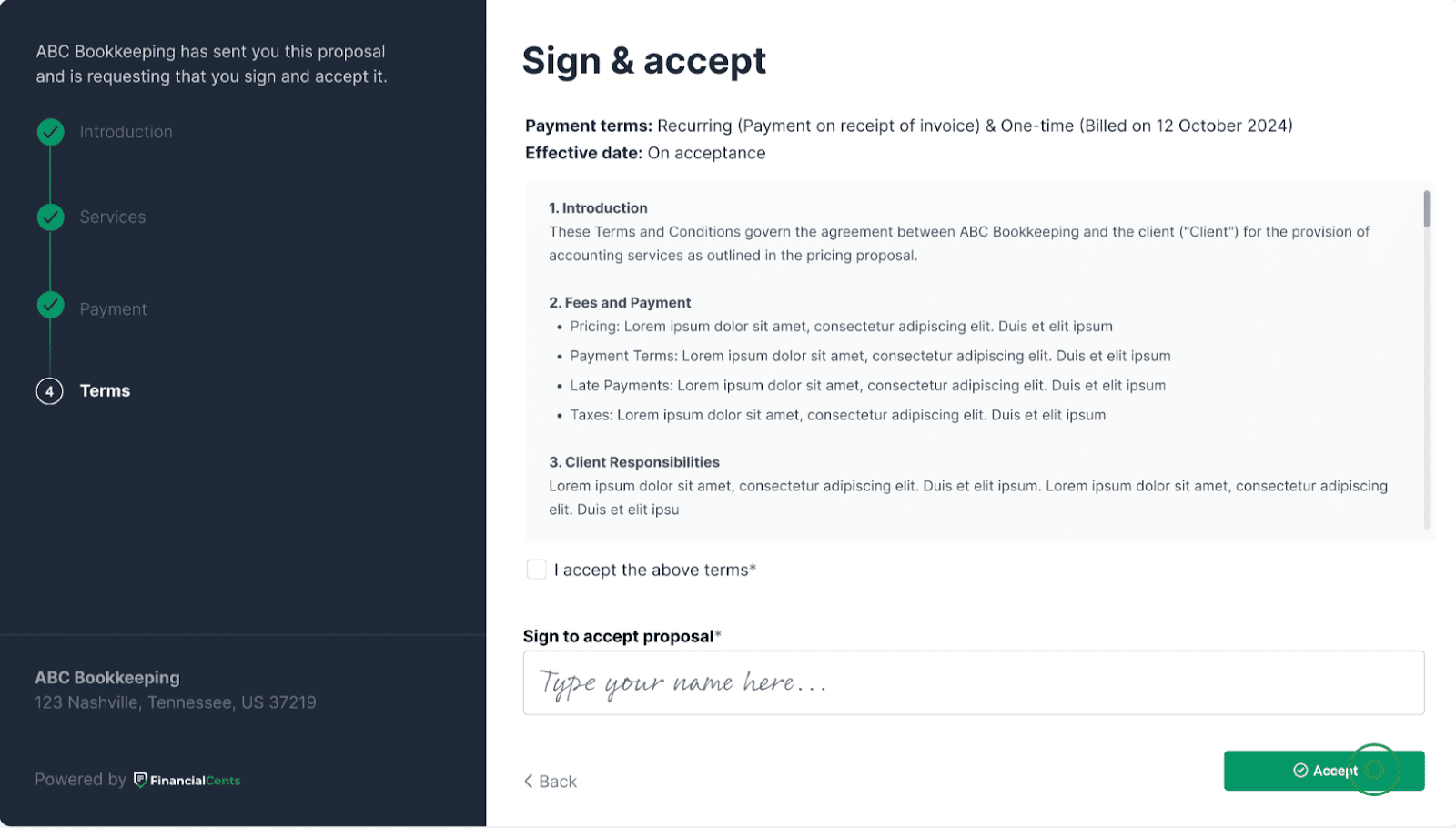

With Financial Cents, you can create, send, track, and store engagement letters in one seamless workflow designed specifically for bookkeeping and accounting firms.

Here’s how Financial Cents helps you simplify engagement letters:

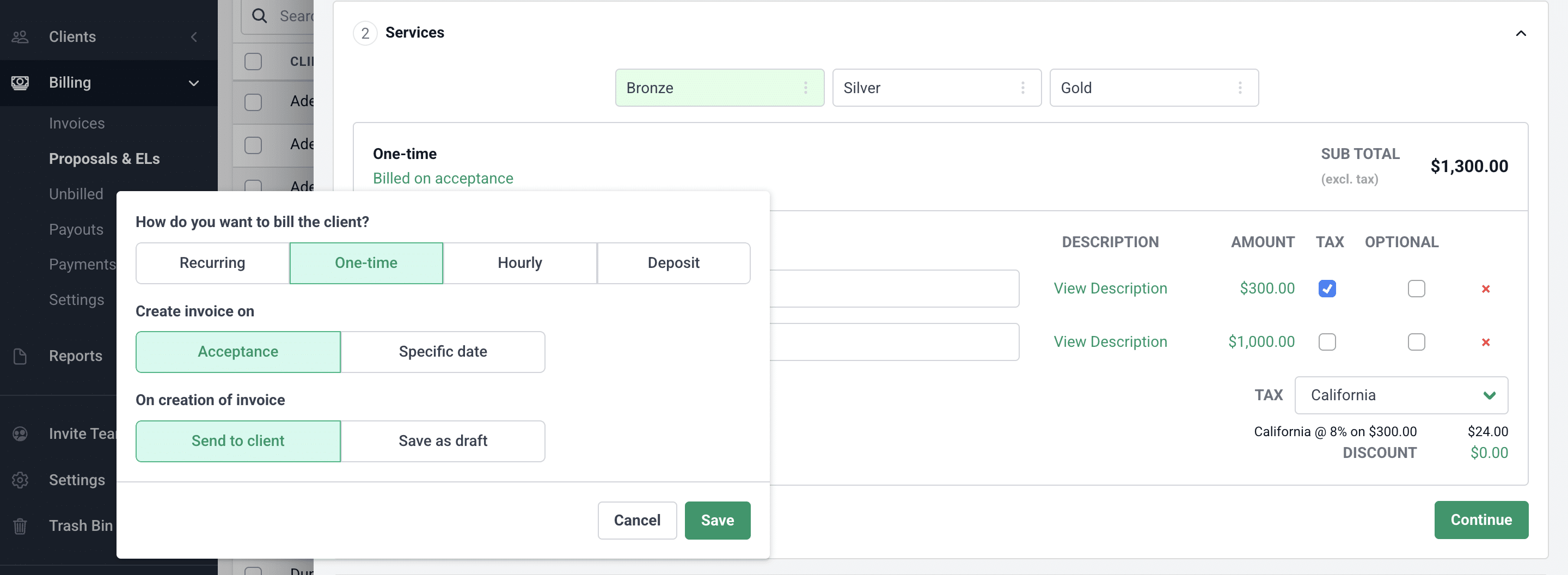

- Create Engagement Letters: Quickly draft professional engagement letters to send to your clients. You can also bulk send to multiple clients at once by checking the clients you want to send it as shown in the image above.

- Build from templates: Save your firm’s standard terms and quickly tailor them for each client or service tier.

- Embed scope & pricing: List services (monthly bookkeeping, cleanup, payroll, add‑ons) with clear fees and billing frequency.

-

Get clients e‑signatures instantly: Clients can review and sign from any device. No need for clients to print, scan and send the document back to you

-

Automate follow‑ups: Nudge unsigned engagements with friendly reminders (no manual chasing).

- Collect payment details: Get client payment information upfront so you don’t have to chase them later for these.

- Create invoices: Using the services and pricing that you list in your engagement letter, Financial Cents can create invoices that can be sent to clients immediately, at later date or saved as draft internally till you’re ready to collect payment.

- Automate reminders: With Financial Cents ELs you can automate reminders and followups with clients until they sign the engagement letter.

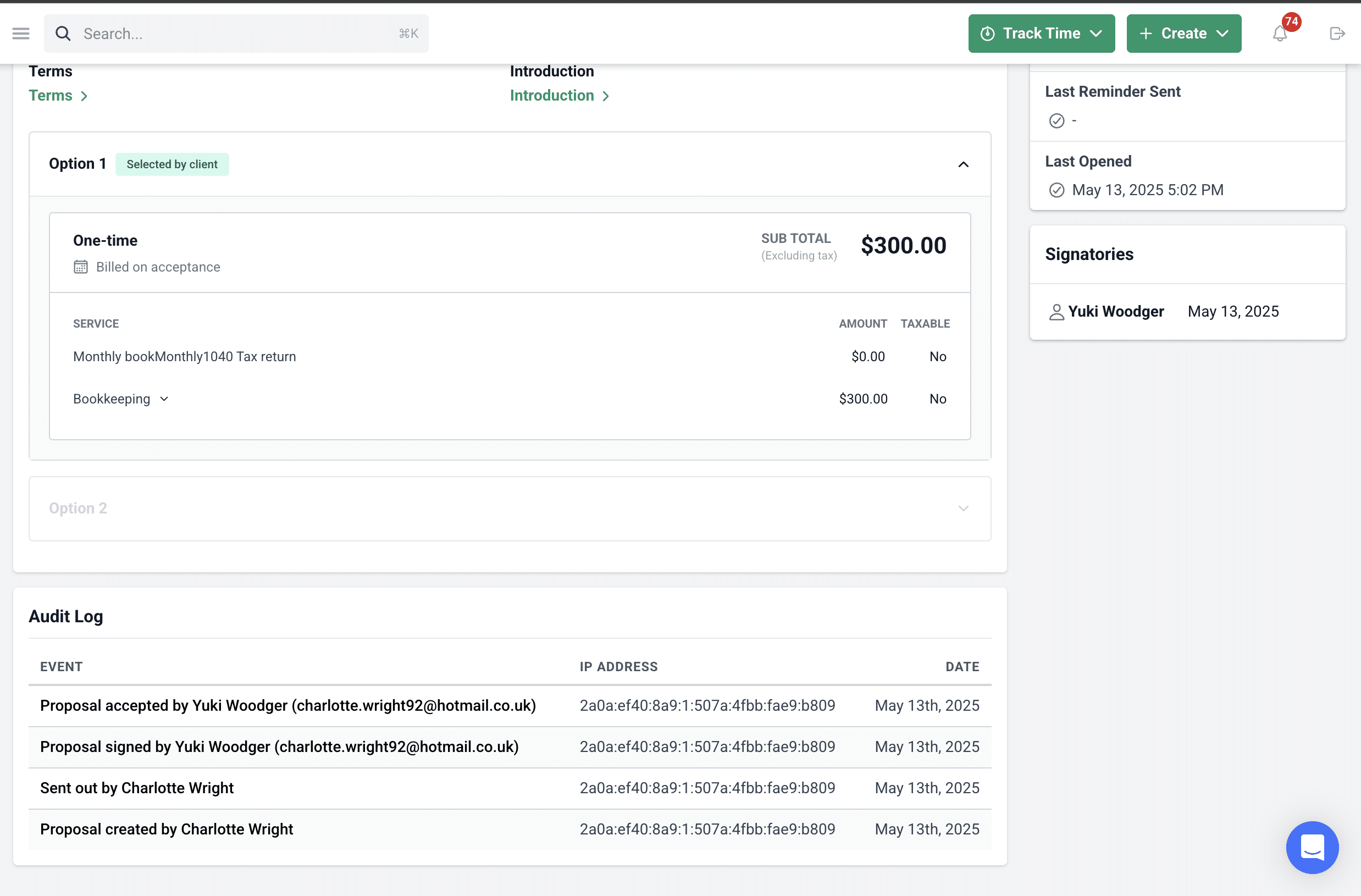

- Audit Logs: See when client viewed, signed and accepted the engagement.

Bookkeeping Engagement Letter FAQs

Do I need a lawyer to formalize my bookkeeping engagement letter?

No, you don’t. A bookkeeping engagement letter is not a legal contract but an agreement between a service provider and a client.

Can I use the same bookkeeping engagement letter for multiple clients?

Because different clients require different services from you under different conditions, it’s always good to have a template you customize for each client so you can fill in specific information about the engagement.

Do I need to send a bookkeeping engagement letter to every client I work with?

Yes, it is advisable that you send an engagement letter to every client you will be working with.

When do I need to send a bookkeeping engagement letter to my client?

According to investopedia, engagement letters need to be presented to the client at the beginning of the relationship before work commences.

Conclusion

Your first interactions with a customer matter!

First impressions lay the foundation for your relationship. It’s important to appear professional, clear, and polished.

Sending a well-written engagement letter will help you to do this.

It will also help you build a good relationship with your client and avoid unpleasantness by eliminating confusion and clearly stating expectations.

The sample bookkeeping engagement letter we offer at Financial Cents makes it easier to present a professional image.

Download your template letter today and continue building solid relationships with your clients!

You may also be interested in: