How BookPro Satisfies Their Clients In Multiple Industries with Financial Cents

Customer Stories » How BookPro Satisfies Their Clients In Multiple Industries with Financial Cents

Denise May

Founder

BookPro, Inc.

Firm Name

Firm Type

Outsourced Bookkeeping, QuickBooks support, Payroll, and Business Incorporation

Staff Members

7

FC Start Date

2022

Location

Longwood, Florida

Working Style

On-site

BookPro Inc., founded by Denise May, is an accounting and bookkeeping firm that promises to stand by its clients through their various phases of growth, especially when confronted with those difficult financial growth decisions.

This informed the team’s decision to offer so many services within the accounting value chain in Seminole County, Florida, United States.

Not Your Regular Accounting Firm

-

Full-Service Accounting

Against the conventional method, BookPro’s services range from outsourced bookkeeping, QuickBooks support, payroll, business incorporation, and other accounting services. Their clients cut across retail, dental, medical, real estate, architecture, and engineering businesses, among others. This setup required not just the people and processes but also the right practice management system to streamline information and automate manual processes for timely service delivery and exceptional client experience.

-

Super Customized Packages

BookPro creates customized packages that address their clients’ unique needs. This has enabled them to serve each one like they are their only client; a quality that BookPro’s client, Hughetta Dudley, appreciates in clear terms:

Unlike a large corporation, BookPro is available to assist in a timely manner. BookPro continues to provide the support needed in a very timely fashion and is very attentive to those critical deadlines.”"

-

Regular Client Reporting

On top of these, BookPro promises to provide regular financial reporting to its clients to help them know where their money is going and what they can do to become more profitable. This requires a project management system that aids client communication.

Finding the Tool to Bring it All Together

Having hired the right people and built the right processes, Denise May’s primary concern had come down to finding a suitable practice management solution to help her team do their best work.

The more the practice management software could help them achieve, the better for the BookPro team. Because then, they would not need to jump between several apps to find what they need to get client work done.

Why Financial Cents?

The Need to Hold Less Information in The Head

Holding so much information is draining. It’s why high-achievers will always use assistants and organizers—human or electronic—to free up brain power for value-creating activities.

But when accounting firms are just starting, they are more likely to trust their brains with work and client information. Even when they use to-do lists, sticky notes, and Excel spreadsheets, they still need a significant amount of time to locate and make sense of the information, which slows growth in more ways than they realize.

When Denise and the BookPro team began to stretch to their limits, she knew information would be slipping through the cracks, deadlines missed, and clients would grow dissatisfied.

So, they started their search for a system that could organize and put work and client information at their fingertips. This search eventually led them to Financial Cents, where Excel Spreadsheets and Jetpack Workflows failed.

We needed to make sure that we were staying organized, and holding fewer things in our heads. Learning to operate more from that system-based workflow versus trying to remember things."

The Need to Remind Team Members About Tasks

The average accounting team has more than enough tasks to go around and almost every task is time-sensitive and screaming for attention. This makes it so easy to forget what is most urgent.

Usually, the solution would be to set up reminders in online calendars, like Outlook, which worked for BookPro until it didn’t.

With Financial Cents, every team member can set up tasks and due date reminders to stay reminded of anything that needs their attention.

Also, team members can filter work by assignees, and the system will bring up all the tasks that a particular team member needs to do, further reducing the chances of things slipping through the cracks.

I missed payroll for a client. There were just too many clients and many staff to try to keep up with it. We were relying more on Outlook reminding us and we just realized we were outgrowing that kind of more simple way of doing things."

Visibility into Client Projects

Financial Cents enabled Denise and her team to track every project they were doing for clients by their daily, weekly, or monthly schedule. Previously, Spreadsheets only showed them the percentage progress the team made on a client’s project for the entire year. This kept BookPro from knowing how much work the team had put into a client’s work, how much work was left, and which tasks they had to do next to meet the client’s deadline.

This denied Denise May the chance to see which work was falling behind schedule, who was working on what, and which team members were overworking (and might burn out) so that she could reallocate resources—where necessary—to meet deadlines and balance her team’s workload.

The most that Excel did was I could look at the dashboard and see that a client was at 50% or 30% or whatever. But that was 50 or 30% for the year, not a particular project. So basically, every client had 12 months going across. And if they had four months marked off, it updated my dashboard that we're at 40% or 30%, but there's no way to track tasks in Excel without things falling through the cracks."

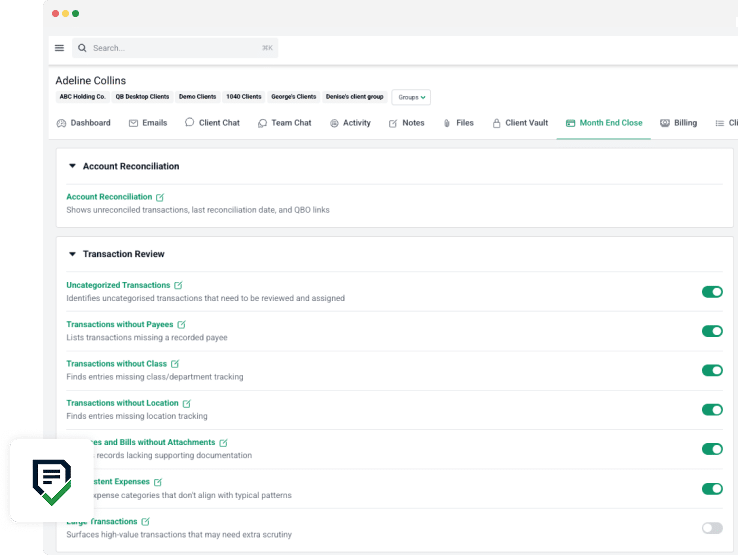

With Financial Cents, each project BookPro creates for a client includes the tasks (and subtasks) that go into completing them. As team members complete their tasks, the progress bar on the workflow dashboard will reflect the team’s progress on the individual project.

The Need to Create Recurring Projects

Most accounting projects are work that firms do for their clients on a weekly, monthly, quarterly, or yearly basis. With the recurrence feature in Financial Cents, accounting teams can set client projects to occur across all the days, weeks, and months they need to do the work so they don’t forget it.

This makes the recurrence feature project management tools one of the most important for most accounting teams. And serving clients across multiple industries, BookPro needed it even more, so they relied on Outlook to remind them of their recurring projects.

Some of BookPro’s staff would usually tell Outlook that they “needed to process so and so payroll every two Wednesdays” to avoid missing some bi-weekly payrolls. But that didn’t stop them from missing payroll deadlines.

With Financial Cents, they can now set their recurrence preferences while creating the work and the system will automatically repeat the project across relevant dates.

I know you can do a certain amount of these in Outlook, but I haven't tried to the extent of what’s possible with Outlook, I just can’t imagine it doing all we need and having access to our client information like we do in Financial Cents."

Denise MayDespite its effectiveness, Dennise May admits they are just scratching the surface of what is possible with Financial Cents.

For example, they’re still discovering the many use cases of Financial Cents’

Email Integration, which enables Denise to

- Turn client emails into projects so she can assign them to staff, give due dates, and track them from the dashboard.

- Ability to assign emails to multiple client profiles at the same time.

- Keep an audit trail of her team’s communication with clients.

Client Task, which Denise says is better than having clients create another login credential, further delaying work In the past, when clients had to create login details, she had heard them say things like “Oh, I forgot. I don’t remember my login. How do I get to that page? And they’ll say, forget it. I’ll just email it to you.”

We very much love Financial Cents, and you're doing a great job in trying to continue to enhance it.""

Denise May