In today’s fast-paced firm environment, many companies are turning to virtual accounting to streamline their financial operations. Virtual accounting, also known as cloud accounting or online accounting, refers to the practice of using digital tools and software to manage financial transactions, bookkeeping, and tax reporting from remote locations. It is no more of a question of “Can accountants work from home?”

Virtual accounting has gained popularity in recent years, and for good reasons. It allows firms to access real-time financial information, reduce errors and save time, and money.

You may be interested in:

How to Start a Thriving Virtual Accounting Firm

Virtual accounting to me is always the way to go due to the freedom and flexibility of it. It gives you the opportunity to work on your terms"

Nayo Carter-Gray, EA MBA, Founder of 1st Step Accounting, LLCHowever, with these advantages come unique challenges that require specialized processes to overcome. To help ensure that your virtual accounting processes are efficient and effective, we’ve compiled five essential strategies for success.

You can also watch the video below to get even more insights as shared by Nayo Carter-Gray

5 Ways to Set up Processes that Work

- Establish a standard operating procedure

- Set up communication protocols

- Have good data security and privacy in place

- Create a conducive environment for continuous learning and improvement

- Choose the right practice management software

Step 1: Establish a Standard Operating Procedure (SOP)

Establishing a standard operating procedure (SOP) is essential for efficient and effective virtual accounting. Any complex task will have gray areas and questions. When there is uncertainty and guesswork, your team will make mistakes and waste time figuring out how to complete client work correctly.

Think about the amount of time you have spent teaching your staff how to do work. It can be time-consuming training them and reviewing their work for mistakes.

It is hard for your team to know the best and most efficient way to complete client work, especially when it is all in your head due to years of experience.

Just because your firm is virtual doesn’t mean you shouldn’t have structures & processes mapped out that you can follow. List out the process for service you’re offering & this will help you figure out the part you want to automate, delegate or eliminate "

Nayo Carter-GrayYou can achieve this through accounting workflow automation. Accounting and bookkeeping firm owners in this report shared insights about its benefits.

For example, if you offer bookkeeping services, your process might include the following steps:

- Collect receipts and invoices from the client

- Enter the data into accounting software

- Reconcile bank and credit card statements

- Generate financial statements

- Send financial statements to the client for review

An SOP or workflow checklist documents the necessary steps and protocols for completing tasks, ensuring consistency across your team. To create an SOP for virtual accounting, begin by identifying the most common tasks and processes and then break them down into individual steps. Assign responsibility for each task and include specific details such as timelines, accounting workflow templates, and checklists. Be sure to keep your SOPs up-to-date as processes change.

Step 2: Set up communication protocols

Effective communication is critical in virtual accounting. Without in-person interaction, clear communication channels are essential to ensure that everyone is on the same page.

Moreover, your team might be working in different time zones, which makes it more difficult to share feedback in real time. This could slow work down, and if they chose to go on without asking questions, they will rely on guesswork which can cause errors leading to rework and client dissatisfaction.

Building that teamwork and camaraderie when you’re so spread apart is important.

– Nayo Carter-Gray

Establishing communication protocols with clients and team members helps ensure that expectations are clear, and communication is effective. Communication protocols can include:

- Regular check-ins: Schedule regular meetings or calls to discuss progress, address concerns, and provide updates.

- Shared documents: Use cloud-based tools such as Google Drive or Dropbox to share documents and collaborate in real-time.

- Task assignments: Assign tasks to team members and set clear deadlines and expectations

- Team messaging: Use team messaging apps such as Slack or Microsoft Teams to communicate quickly and efficiently

You may be interested in:

PRO TIP: Financial Cents’ communication features are tailored to accounting needs. It allows teams to collaborate within client work by tagging and mentioning people to pull them into conversations.

Step 3: Have good data security and privacy in place

In the virtual accounting world, data security and privacy are paramount concerns that cannot be overemphasized. With the sensitive financial data being stored online, it is crucial to have stringent measures in place to protect the data from unauthorized access, tampering, and data breaches.

As such, it is imperative to follow best practices to ensure the security and privacy of your virtual accounting data.

One of the essential steps to ensure data security and privacy in virtual accounting is to use secure cloud-based accounting software. By choosing a reputable and secure accounting software, you can be assured that your data is stored in a secure environment with robust security measures in place.

Additionally, cloud-based software allows you to access your financial data from anywhere, at any time, and from any device, making virtual accounting a seamless and convenient process.

Another critical aspect of data security and privacy is implementing strong passwords and using multi-factor authentication. Weak passwords and easily guessable passwords are not secure and can be easily hacked. To prevent unauthorized access, it is essential to use strong, unique passwords that are not easily guessable.

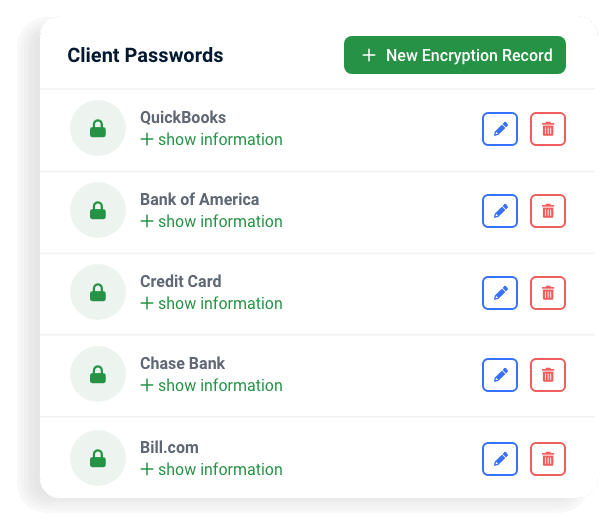

PRO TIP: Financial Cents’ client vault lets you securely store client passwords, pin, and sensitive data.

Furthermore, multi-factor authentication adds an extra layer of security by requiring an additional verification process, such as a fingerprint or a one-time code sent to your phone, before granting access to your virtual accounting data. By prioritizing data security and confidentiality, you can build trust with your clients and ensure that their financial information remains safe and secure.

Step 4: Create a conducive environment for continuous learning and improvement

In any industry, continuous learning and improvement are essential for success. In the virtual accounting industry, this is particularly true, as technology and regulations are constantly evolving.

You may be interested in: Best 25 Accounting Conferences You Should Attend in 2026

Keeping up-to-date with the latest developments in the industry, feedback from clients and team members can help ensure that virtual accounting processes remain effective and efficient. They can also take online courses relevant to the accounting/bookkeeping industry.

Step 5: Choose the right practice management software

The next step is to choose the right accounting practice management software for your firm. There are numerous cloud-based accounting practice software solutions in the market, each with its own strengths and weaknesses.

Even if you are working by yourself, a practice management system will help organize you

–Nayo Carter-Gray

With so many options available, it can be overwhelming to determine which software to use. However, it’s essential to select software that fits the needs of your firm.

When selecting accounting software, consider factors such as ease of use, the availability of features, and pricing. Additionally, it’s important to choose software that is cloud-based, enabling remote access and collaboration.

Also, one of the biggest advantages of using the right practice management software is the ability to automate repetitive tasks. By automating processes such as data entry, invoice processing, and bank reconciliations, you can save time and reduce errors. This also allows you to focus on more strategic tasks such as financial analysis and planning.

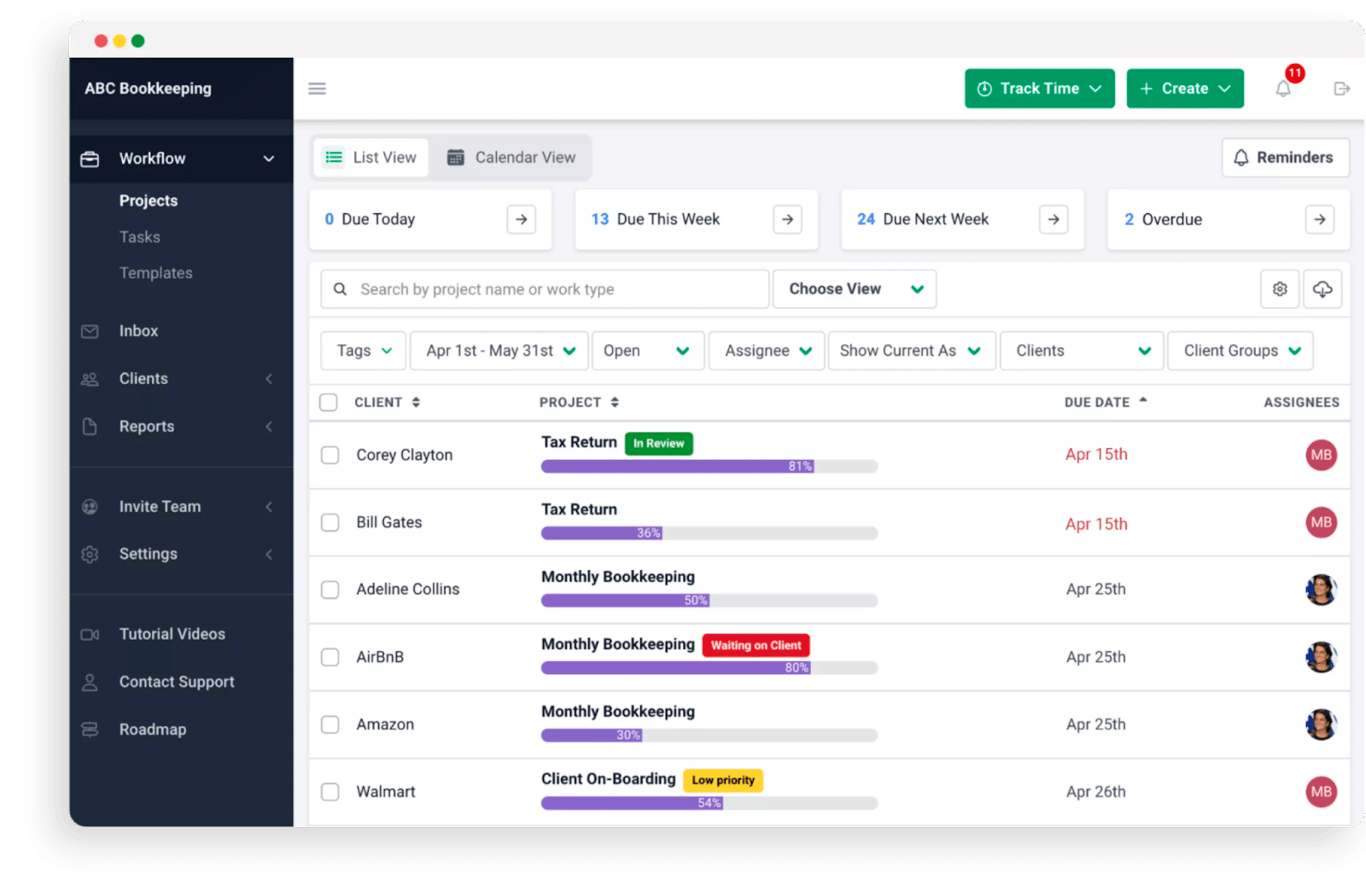

This is where a solid practice management software like Financial Cents comes in handy.

Encourage team members to regularly share feedback and suggestions for improvement. "

Nayo Carter-GrayCreating a culture of continuous improvement also involves using feedback to implement changes and improvements to virtual accounting processes. By analyzing feedback and identifying areas for improvement, virtual accounting teams can refine processes and make them more effective and efficient. To stay up-to-date, consider attending accounting conferences, webinars, and other educational events.

Financial Cents, for example, will give you complete visibility over your firm (at all times) while keeping your client work and team organized.

Its suite of features includes

- A Workflow dashboard to track client work, assignees, and due dates.

- Email integration to manage and organize communication with your virtual clients. Turn emails to projects and automatically organize client emails separate from other emails.

- Client profiles to store and organize client information..

- Task Assignment to delegate to your virtual team.

- Client Vault to store sensitive information (like social security numbers, credit card information, etc.) securely.

- Client Tasks to automate data collection and cut down time spent on chasing clients for information.

- Capacity Management to see who in your team is overworking and redistribute work as necessary.

- ChatGPT integration to create workflow templates within seconds.

You may be interested in:

How Accountants and Bookkeepers Can Use ChatGPT in their Firm

Conclusion

As the world becomes more digitized, virtual accounting will become an even more popular option for firm owners. It offers a flexible and scalable way to manage accounting processes, while providing a unique opportunity to work on your terms. However, in order to take advantage of this opportunity, it’s important to establish efficient and effective processes that maximize its benefits.

It’s worth noting that virtual accounting is a rapidly evolving industry, and it’s essential to stay up-to-date with new trends and standards. By remaining adaptable and willing to evolve, you can ensure that your virtual accounting firm stays ahead of the competition.