Client retention is essential to keeping your clients happy, which enables your firm to continue to grow. This allows you to retain clients, increase profits, and expand business through referrals. Simply put, it pays to focus your time and resources on client retention if you want to build a sustainable accounting practice.

Accountants know that strong communication and organization are the keys to running a successful firm — and they’re also necessary for retaining your clients. How can you achieve those goals? By using comprehensive accounting customer relationship management (CRM) software.

Below, let’s go over the benefits of client retention and how you can use accounting CRM software to help retain clients for your accounting firm.

Why Retaining Clients is Important for an Accounting Firms’ Revenue

Retaining clients can be a challenge for accounting firms of all sizes. According to a survey by Accounting Today, 26% of CPAs and accountants say that acquiring and retaining clients is the biggest issue their firm faces. While client acquisition plays a critical role in your firm’s growth, nurturing your current client relationships is essential to the long-term health of your accounting practice. Not only that, but client retention can have a positive impact on your revenue when compared to the costs of client acquisition.

Acquiring new customers costs six to seven times more than retaining existing customers. Some factors that contribute to the high costs of client acquisition include everything from marketing to potential customers to onboarding new accounting clients.

With existing clients, however, you don’t need to spend nearly as much to retain them. After onboarding, the only other costs involved are around delivering the services. As a bonus, existing clients can even help bring in more business (more on that below), making client retention even more valuable for revenue.

If you want to keep your accounting firm’s revenue high and your costs low, focus on improving client retention instead of allocating all of your resources to acquiring new clients.

3 Benefits of Client Retention

There are several benefits that client retention can deliver to your accounting firm, including:

Let’s dive into each of these benefits in more detail so you know exactly how to implement them at your firm.

1. Increased ROI

There’s a long-term value that comes with retaining clients. In financial services, a 5% increase in customer retention results in more than a 25% increase in profit. There are a couple of reasons for this. One reason is the operating costs decrease when you focus on existing clients and spend less on customer acquisition.

But another reason your firm’s profit increases with client retention is that existing clients tend to buy more over time. Clients who already trust you and value your expertise are going to hire you for more services rather than find another firm to work with. Let’s say you provide monthly bookkeeping services to a client. If they’re happy with your services, you’re the first place they’ll turn to if they also need payroll services down the road.

Simply put, your accounting firm can yield a much higher ROI from each client if you focus on exceeding the needs of your existing clients and building long-term relationships from the start.

2. Client referrals

When you focus on client retention, it leads to stronger long-term client relationships and improves loyalty. And with client loyalty comes referrals.

If a client has been working with your accounting firm for a while and you’ve built a strong relationship with them, the chances that they’ll refer you to another client are high. Keep your existing customers happy and they’ll be eager to refer you to another client that could benefit from your services — which help you scale your accounting practice.

3. Client insights

Another benefit of working with long-term clients is that you can gain better insights into how their business operates and any challenges they have. When you work with the same clients over a long period of time, you start to pick up on recurring themes. These themes emerge from frequently asked questions, types of services they need, or the business goals they talk about.

By taking note of these insights learned from existing clients, you can better refine your services or processes and tailor your accounting firm to what your ideal client is looking for.

You may be interested in:

How to use Accounting CRM Software to Build Strong Client Relationships

How to Use Accounting CRM Software to retain clients

One of the easiest ways to improve your firm’s client retention is by using an accounting CRM to stay on top of all client-related information and communication. An accounting CRM helps you store and organize all of your client’s data, documents, and notes so you and your team can stay in the loop and provide effective services.

By keeping your client information in one central location that’s accessible to anyone at your firm, you can be sure that everyone can get their work done and that your clients feel supported every step of the way.

Let’s go over exactly how to use accounting CRM software to retain more clients.

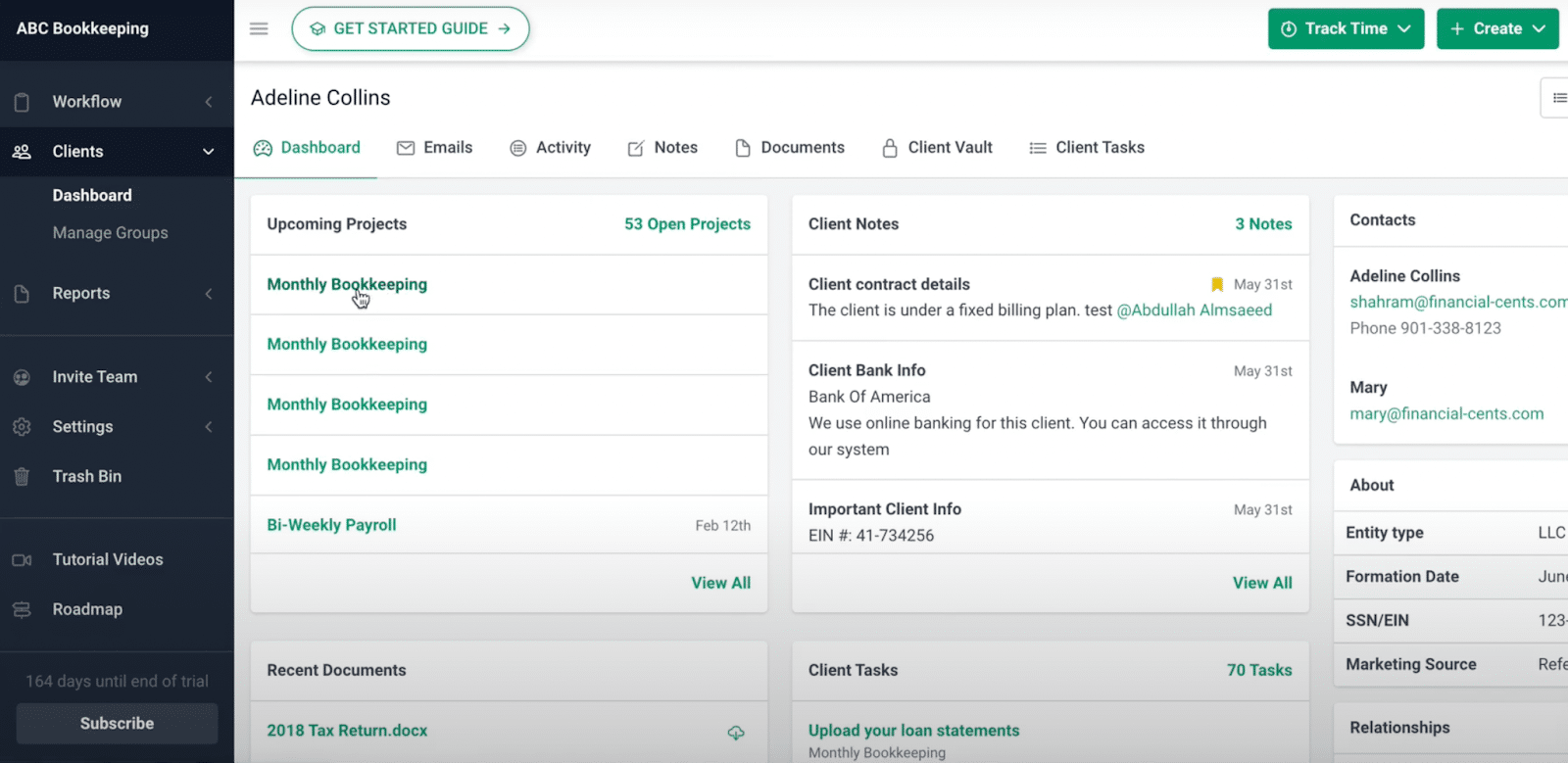

Create client dashboards

The best accounting CRM software acts as the central platform for all of your clients’ information. Not only does it securely store private client data, but it also provides an overview of the client relationship and ongoing tasks so you can better manage your workflow and never miss a deadline.

An accounting CRM is most effective when you create comprehensive profiles for each customer. Each client profile should include:

- Contact information: Easily access their information to reach out with any questions or requests without having to scramble through your inbox or old documents to find their email or phone number.

- Private data: A space where you can securely store private client information such as passwords, usernames, and security questions for apps that you use for each client. A client vault allows your team to quickly access all of the login information they need to get their work done with just a few clicks, while still keeping your client’s information safe and secure.

- Notes: A notes section is useful for keeping track of meeting notes or quick pieces of information you want to remember for your next call or task. Notes are also a good way to keep the rest of your team aware of any conversations or meeting agendas with clients.

- Client documents: A good accounting CRM helps you store and organize client documents. Use your client profile to keep track of important documents that have been uploaded.

- Custom fields: Every accounting practice has a different workflow, so your CRM should reflect the data you use most. With custom fields, you can include additional information that’s relevant to the client relationship such as entity type, formation date, EIN, or marketing source. When you set up custom fields in Financial Cents, these field options transfer from client to client so you can streamline the information you need and keep it consistent across your firm. For example, let’s say entity type is a key piece of information you like to keep handy for each client you work with. When you set this up as a custom field for one client, it will show up as an option for every client going forward.

Having easy access to all of your client’s data and work information helps ensure your team stays on top of any deadlines or tasks to deliver the best service possible. As a result, your client relationship will thrive and client retention will form organically.

Communicate regularly and effectively

Strong communication is key to retaining strong client relationships, and the right accounting CRM makes regular and effective communication easy.

A handy way to use your accounting CRM is to keep track of client notes. These notes can be any important details you want to remember such as contract details, client meeting notes, client relationships, and reminders.

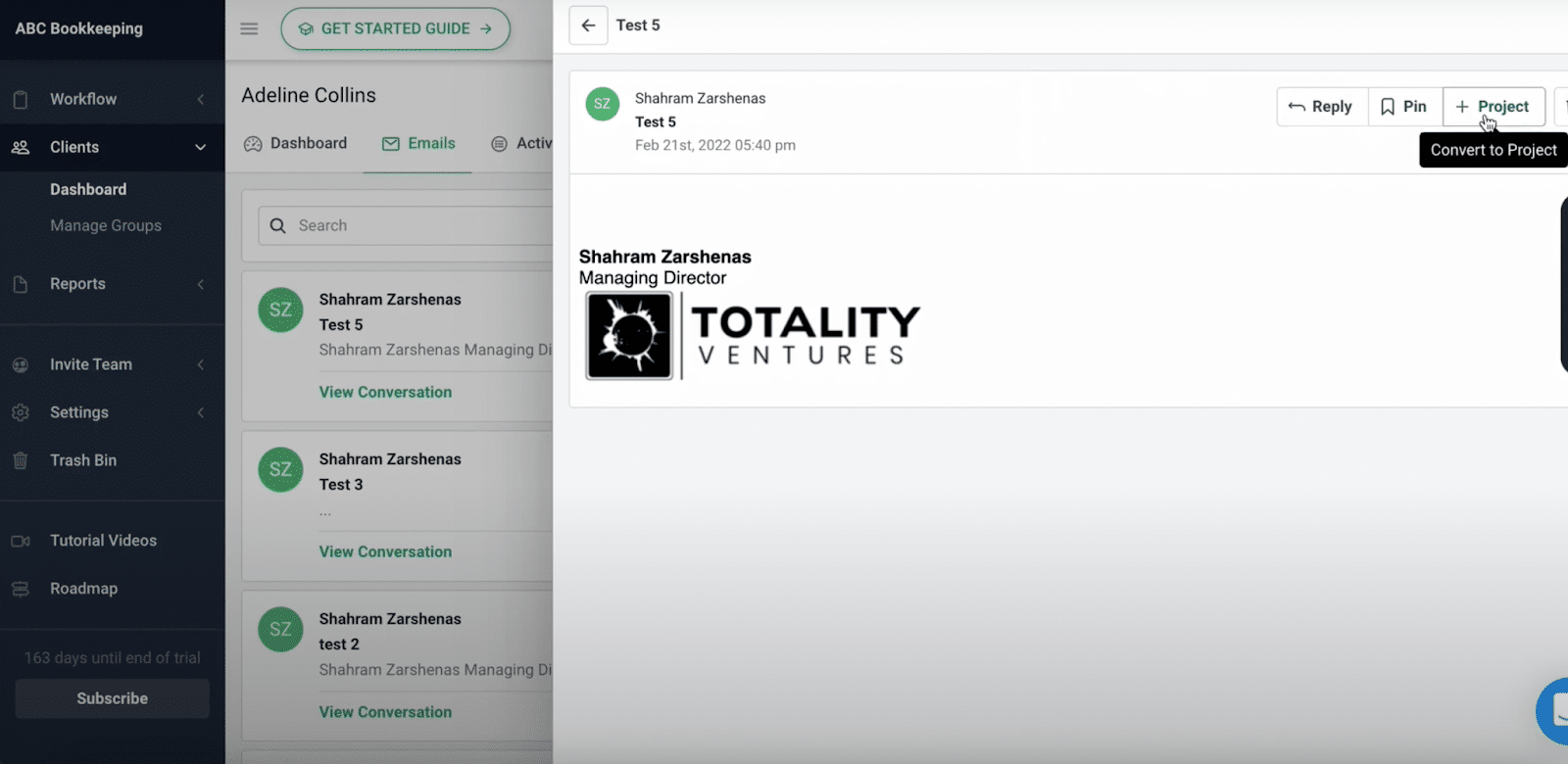

On the Financial Cents CRM, you can also use the email audit trail feature to keep track of every email conversation with your client. The audit trail gives you access to not only your personal emails with the client but every email conversation the client has had with any team member at your firm. You can then reply directly, pin the conversation to an existing task, or create a new project from it — all within your workflow.

With this level of visibility, you no longer have to chase down team members for updates or follow up with a client to see what was said. You can instead focus on providing prompt and helpful responses for your client, ensuring no request or query slips through the cracks.

Having effective communication practices in place helps strengthen your client relationships by letting them know you’re reliable and on top of every update or request.

Manage your workflow

Making sure your team gets their work done on time is critical to the operational success of any accounting firm, and the right CRM helps keep tasks moving along smoothly. There are a few ways a CRM can help you automate your team’s tasks and meet deadlines.

Some of the best workflow management features that the top accounting CRM software programs offer include:

- Requesting and receiving client documents so you never miss a deadline

- Displaying recent documents and files that have been uploaded

- Activity feed that displays every activity and interaction the client has taken such as uploading a document or logging on to their account

Staying on top of your tasks ensures you and your team get your work done and meet your deadlines, all of which give your client confidence in your team’s abilities. Not only will they feel supported, but they’ll trust your accounting firm to get the work done which ultimately leads to a happier long-term relationship.

Here are 4 dealbreaker features your accounting client management software should have.

How to retain your client relationships outside of the CRM

There are also ways to boost client retention that happen outside of your accounting CRM. These personal gestures focus on relationship building and can include:

- Referral programs: Your best clients will refer you to other clients, but you can give them more incentive to refer you by providing something in return for a referral. The referral program reward can be anything from additional services to money toward their monthly retainer.

- Gifts: Client gifts can also go a long way in showing your appreciation for the ongoing relationship. Consider sending a celebratory gift for milestones such as their business anniversary. Better yet, you can use your accounting CRM to keep track of personal dates like this to better strengthen your relationship.

How Financial Cents accounting CRM software can help accounting firms retain clients

Financial Cents accounting CRM software helps accounting firms of all sizes retain clients and see long-term success and growth for their businesses.

In fact, 100% of users say Financial Cents has helped them manage and hit their deadlines, while 95% say our accounting CRM has improved team communication.

“Working with Financial Cents is helping us bring our firm to the next level!” said Nancy Wilson, managing director of JNW Group. “It helps us track all work being done in the office from annual tax returns, monthly bookkeeping and payroll to just returning a call to a client. All of that translates into the excellent customer service [we] strive for every day with our clients.”

Jim Rogers, president of JNW Group emphasized the value Financial Cents accounting CRM software has brought to the firm’s operational process.

“Financial Cents helped us cut down a ton of running around. So for me, that increased our efficiency so we could get our projects done in a more efficient and timely manner,” said Jim.

Improving communication, building relationships, and retaining long-term clients has never been easier for accounting firms than it is with Financial Cents.

Use Financial Cents Accounting CRM to retain your clients.