You know it’s time to raise your rates. You’re delivering more value than ever, your workload has increased, and it costs more to run your firm today than it did a year ago. But you’re still hesitating because you’re unsure how clients will react.

The truth is, your firm can’t remain sustainable or profitable if you never update your pricing. And contrary to your concern, most clients will accept the new rates, as long as you communicate the change clearly and professionally.

I have seen my clients convert 100% of clients to their new rates, even those legacy clients that have been with them forever. I have seen them increase their rates by three times, and those legacy clients were happy to engage the services at that higher level. Statistically, you ought to be able to maintain 82% of your clients converting to your new rates. And this is by doing it through a clear process rather than by trial and error"

Loren Fogelman, Business Success Solution.Proper communication is what determines whether clients understand the increase and continue working with you, or whether they feel blindsided and start questioning the relationship.

In this guide, we’ll walk you through how to inform your clients about your price increase with confidence in a way that they’re likely to accept. You’ll also get a free customizable price increase letter for an accounting services template you can use right away.

When Should You Raise Your Prices?

You don’t need to wait for a crisis or a major client issue before updating your pricing. There are clear signs that tell you it’s time to make a change. If you’re experiencing any of the situations below, it’s likely time to adjust your rates.

Rising Operational Costs

Running a firm comes with significant operational costs. You’re paying for essential tools like Financial Cents, QuickBooks Online, Gusto, Drake, etc. You’re also responsible for staff salaries, benefits, and ongoing training. On top of that, you must stay compliant through CPE credits, certifications, insurance, and professional memberships.

When these expenses increase, and they usually do every few months, your pricing needs to adjust accordingly. If your rates stay the same while your costs rise, the difference comes directly out of your pocket. Over time, this erodes your margins and can leave you doing more work for less profit than before.

Expanded Service Offerings or Increased Client Load

A simple rule of thumb is this: if clients are getting more from you than when you originally priced the engagement, the fee should reflect the expanded scope.

Maybe you’ve added new services to your firm. According to our 2024 Firm Revenue Report, the five top revenue-driving services for firms were bookkeeping, tax returns, accounting, advisory, and consulting. If you’ve started offering any of these additional services to a client, the engagement should be repriced to match the expanded workload.

Or the client’s business may have grown. More transactions, more accounts, more tools, and more communication all require additional time and effort, even if the service list hasn’t formally changed.

If the scope increases but your fees stay the same, you end up doing more work for less money. Updating your pricing ensures the engagement remains profitable and aligned with the actual time and expertise it now requires.

Your Expertise, Capacity, or Value Has Grown

As your firm grows, so does your expertise. You’ve likely improved your processes, become faster and more accurate, and now offer better guidance than you did when you first started working with many of your clients. As a result, clients make better financial decisions, avoid penalties, remain compliant, and achieve better tax outcomes.

If this sounds like you, it’s a strong sign that your pricing needs to increase.

Clients benefit directly from your growth, and your pricing should reflect the level of expertise you bring. As Loren Fogelman puts it, “if you’re looking at it from the perspective of your clients, what they value is your expertise, your years of experience, your way of working with clients. And those things are more important than what you do.”

When the value of your expertise increases, your rates should grow alongside it.

Inflation and Industry Benchmarks

Ten years ago, in 2015, the year-over-year inflation rate in the US was 0.70%. Five years ago, in 2020, it was 1.40%. And three years ago, in 2022, it jumped to 6.5%. This steady rise in inflation directly affects what it costs to run an accounting firm, and it also shapes what clients expect to pay in the industry.

For one, your day-to-day business expenses get more expensive, and even small increases across several tools can significantly shrink your margins over time.

Also, inflation pushes industry pricing upward. As other firms raise their rates to stay profitable, market benchmarks shift. If your prices stay flat while the rest of the industry adjusts, your rates quickly become outdated compared to similar firms. Clients may even assume your lower pricing reflects lower value.

To stay profitable and aligned with industry standards, your pricing needs to keep pace with rising costs and evolving market expectations.

Free Accounting Client Price Increase Letter Template

If you’re not sure how to word your fee increase, here are some ready-to-use templates you can copy, customize, and send to your clients.

a. Accounting Fee Increase Letter Sample (Basic)

This is a basic accounting price increase letter template that explains your value and states the new pricing:

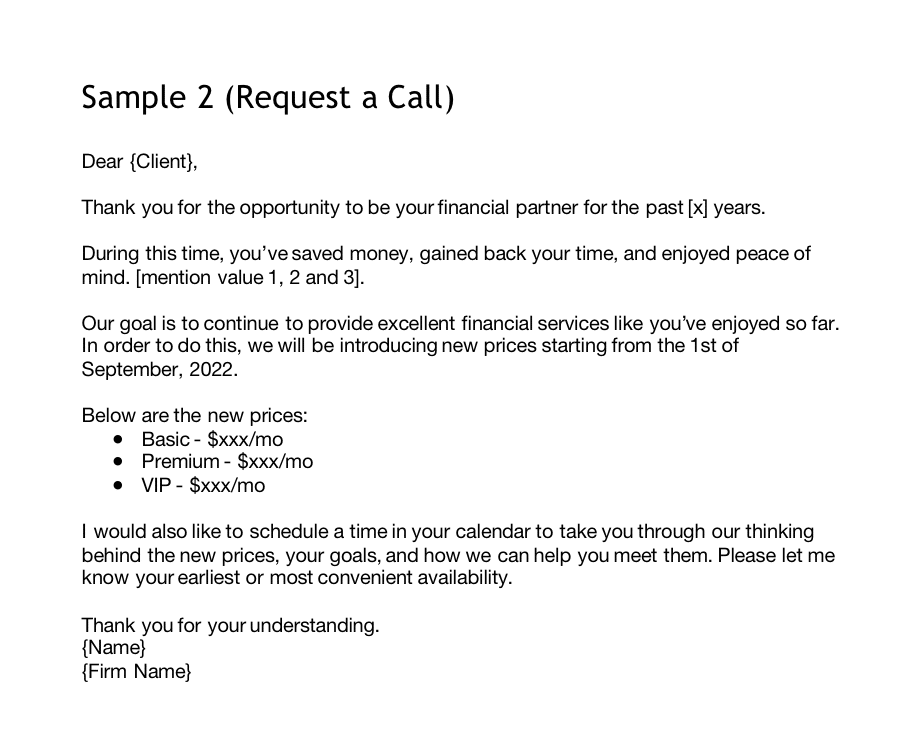

b. Request a Call – Fee Increase Letter Sample

This is a more detailed template that explains your value, states your new pricing, and directly invites clients to book a call:

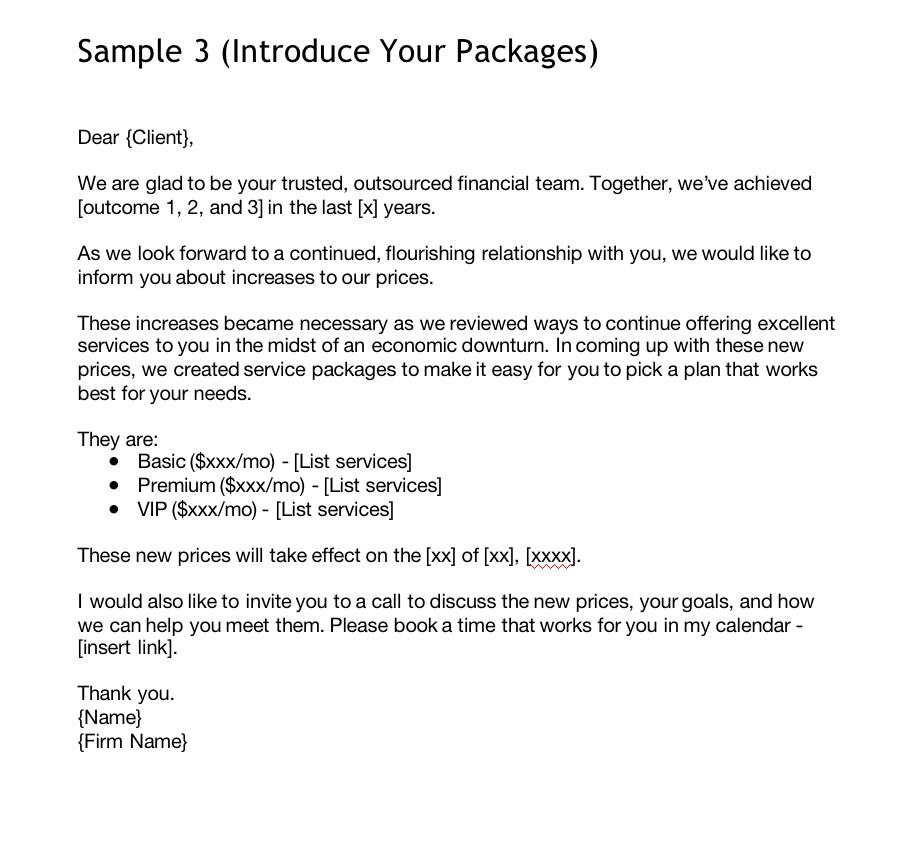

c. Introducing Your Packages – Price Increase Letter Example

This pricing template goes one step further and highlights your different packages plus the services included under each.

Price Increase Letters

How to Prepare for a Client Price Increase

Here are the steps to follow if you’re considering increasing your pricing.

Review Your Current Pricing Structure and Justify the Increase Internally

Start by reviewing how you currently price your services. If you’re pricing by the hour or fixed fee, consider using the value pricing model. Value pricing is when you charge the client based on what’s important to them, and the value from their perspective, instead of the value from your perspective. It’s great because you can earn two to three times higher than when you charge fixed or hourly fees.

For value pricing, Loren Fogelman recommends using the Good, Better, Best model to gradually test and increase your prices with confidence. Here’s how it works:

- Good (1.5× your original fee)

When a new client comes in, calculate what you would normally charge by estimating how many hours you think it’ll take, multiplied by your hourly fee, coming up with that flat fee. Then multiply that number by 1.5×. This becomes your “good” price.

You’ll be surprised by how many clients accept this without hesitation. After onboarding three clients at this level, you move up to the next tier.

- Better (2× your original fee)

For the next round of clients, calculate your original fixed fee again and multiply it by 2×. This is your “better” price, and you’re now earning twice as much without any additional time spent working.

At this stage, you’re learning how to have stronger value conversations with clients during consultation, ask better questions, and help clients see the value of working with you. After three clients accept this level, you move to the final tier.

- Best (3× your original fee)

Here, you calculate your original fixed fee and multiply it by 3×. This becomes your best price and means you’re earning three times more with no additional time spent working.

Clients at this tier usually value your expertise highly, are easier to work with, and follow your recommendations. Because each engagement is more profitable, you often don’t need as many clients to hit your revenue goals, giving you more time to focus on quality and deeper relationships.

Over time, you may find that even your “best” rate needs adjusting. If so, you simply repeat the Good–Better–Best model again with new benchmarks.

Segment Your Clients To Tailor Your Communication

Not every client should receive the same price increase message. The way you communicate with a long-term client should not be the same as how you communicate with a new client you onboarded last month. Your approach should reflect the relationship, the value you deliver, and the engagement’s profitability.

This is why segmentation matters. Common client segments include long-term clients, new clients, high-value clients, low-margin clients, etc.

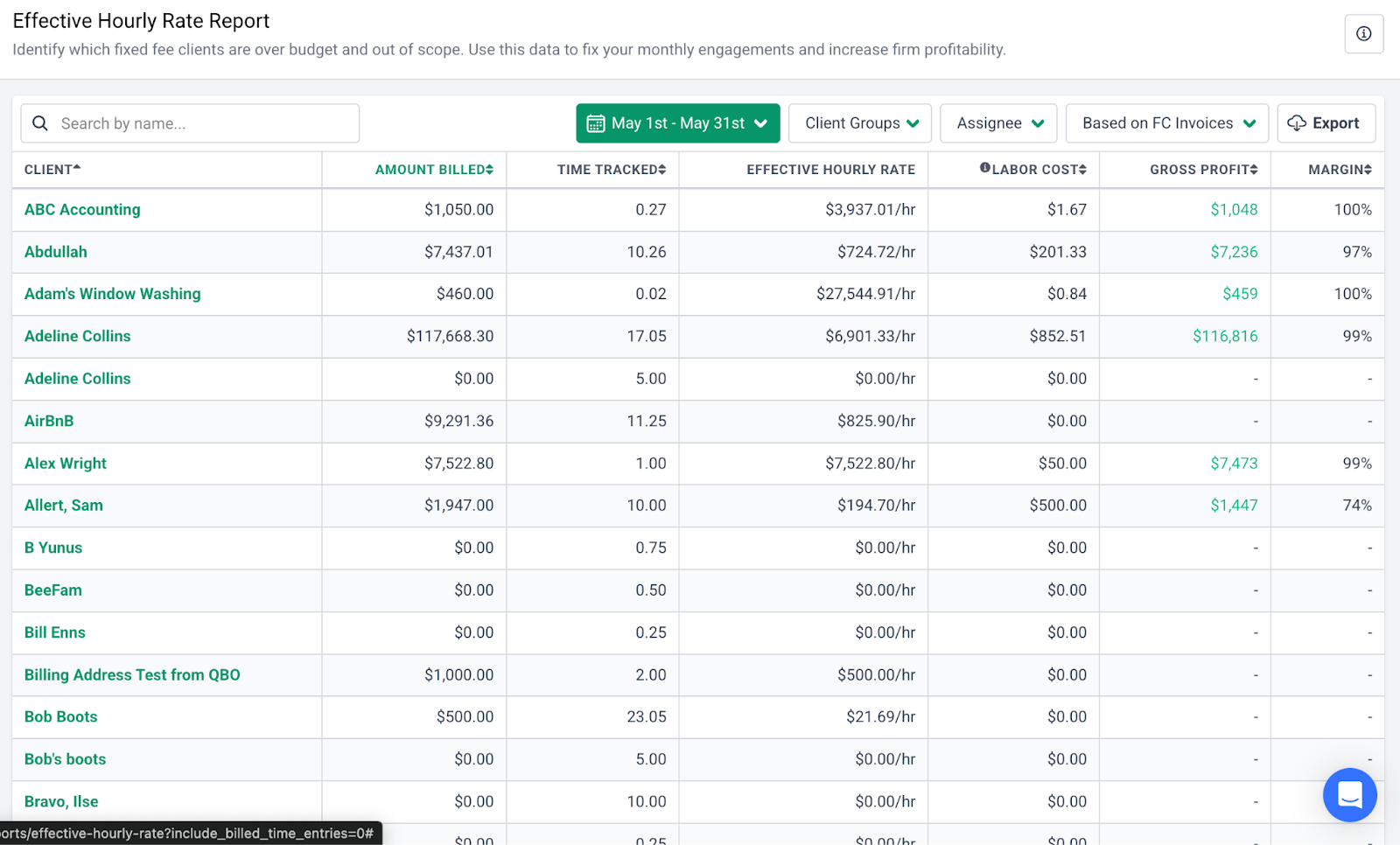

To know exactly which clients fall into the high-value or low-margin categories, you should rely on data, not gut feelings. This is where Financial Cents’ Time Tracking and Effective Hourly Rate (EHR) Report comes in.

Financial Cents has a built-in time tracker that lets you track billable and nonbillable hours at a very granular level—by client, by project, and even by specific tasks. Every time entry can include notes and details, giving you a clear picture of where your team’s time actually goes.

After tracking time, the EHR Report makes it easy to see:

- How much you’re actually earning per hour for each client

- Which clients take more time than they pay for

- Which engagements consistently fall out of scope

- Where your profit is leaking

This report shows your real earnings after comparing tracked time with the amount you billed. It’s one of the fastest ways to understand which clients need a price increase and which ones may need a scope change instead.

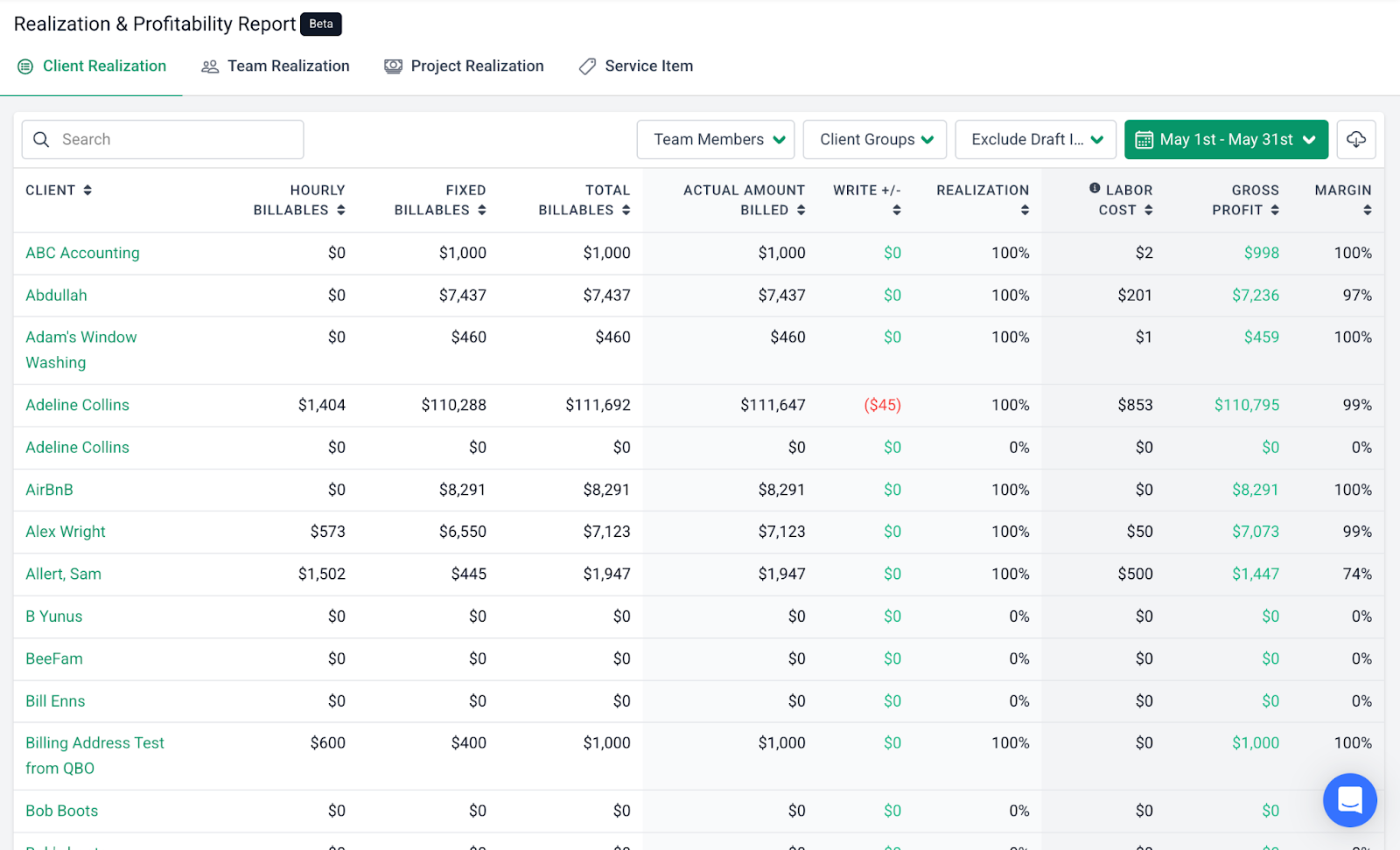

Financial Cents also gives you Realization and Profitability Reports that go beyond simple time data to show how efficiently your firm converts work into revenue by comparing total billables vs the amount you billed clients.

It’ll also show you gross profit and profit margin to identify which clients, team members, projects, or services are driving profit or not. This helps you understand your most profitable clients, how productive employees are, and how to improve your pricing.

Update Engagement Letters and Proposals To Reflect the New Pricing

Once you decide on your new pricing, update your accounting engagement letters and proposal, and pricing pages or internal pricing sheets. This ensures that your documents match the new rates and prevent you from accidentally quoting outdated pricing.

With Financial Cents, you can create and customize accounting proposals and engagement letters, then save them as templates. This makes it easy to update pricing in one place and ensure every team member uses the correct, most recent version.

Prepare Your Team To Explain the Reasoning and Value Clearly

Before you notify clients, make sure your team understands the price increase and the reasoning behind it. Walk them through the new pricing structure, review talking points, and explain how to respond to common questions or pushback.

Your team should feel confident explaining the change. If they’re caught off guard or unsure what to say, it reflects poorly on your firm. Preparing them upfront ensures clients get consistent, clear answers from everyone.

How to Inform Your Clients About a Price Increase (Step-by-Step)

Once you’ve prepared internally, it’s time to communicate the change to your clients. This is the part most firm owners worry about, but with the right approach, the conversation becomes much easier.

Here’s how to communicate your price increase professionally and confidently.

Step 1: Be Transparent and Honest

Clients appreciate clarity. Tell them directly that you’re updating your pricing and briefly explain why. But avoid framing the increase around your rising costs. As Loren explains, clients don’t care about your expenses; they care about the outcome they receive.

So instead of saying, “our software and staffing costs have gone up,” approach the conversation from an advisory standpoint. Focus on what’s in their best interest: the accuracy, reliability, turnaround time, and level of support they rely on.

When you position the change around maintaining or improving the quality of service they depend on, the price increase feels logical rather than self-serving.

Step 2: Give Advance Notice

Don’t spring the increase on your clients. Give them enough time—ideally 60–90 days—before the new rates take effect. This allows clients to process the change, adjust their budgets, or review their options without feeling rushed.

Providing ample notice also shows respect for the relationship, especially with long-term clients, and reduces the chances of pushback.

Step 3: Communicate Value First

Clients will only pay more for something they consider valuable. And value, from their perspective, isn’t the list of tasks you complete, it’s the outcome they experience because of your work.

Before you mention the new price, focus on what matters to them, not what matters to you.

As Loren advises,

The most important thing to look at is the value from the client’s perspective as opposed to pricing it according to what’s important to you."

Value can look different for each client, but often includes things like:

- Accuracy: Their books are clean, reliable, and audit-ready

- Time savings: You free up hours they’d otherwise spend on admin tasks

- Peace of mind: They don’t have to worry about compliance issues or penalties

- Better decisions: Your reports, advice, or check-ins help them understand their numbers

- Faster turnaround: They get financials or tax work completed on time, consistently

- Proactive support: You catch issues early and guide them before small problems become expensive ones

When you communicate the value they’re already receiving, the price increase feels justified and easier to accept.

Step 4: Personalize the Message

Don’t use a generic or repeat message for every client. Instead, tailor it to each relationship. Add personal touches such as how long you’ve worked together, specific results you’ve helped them achieve, or improvements you’ve made to their processes or reporting.

Personalization matters, especially for long-term and high-value clients. It shows you see them as more than an invoice, makes the message feel respectful, and significantly increases the likelihood that they’ll accept the new rate.

Step 5: Be Clear About the Price and Time of Increase

Avoid vague language like “a small increase” or “slight adjustment.” Be specific and clear about what the new fee is, when it’ll take effect, what services it covers, and whether the scope stays the same or is being updated. This helps avoid any misunderstandings or unnecessary follow-up questions.

Step 6: Offer Transition Options (If Applicable)

To show flexibility, you can offer transition options instead of requiring everyone to move to the new price immediately. These options make the change feel more manageable and reduce pushback.

Common approaches include:

- New service packages: Offer tiered options so clients can choose the level of support that fits their needs and budget.

- Scope adjustments: For clients who truly can’t afford the new rate, reduce the deliverables instead of lowering your price.

- Phased increases: Instead of raising a fee by 20% at once, you could implement four 5% increases over the year. This helps clients adjust gradually.

These options keep the relationship strong while still moving your pricing toward where it needs to be.

Step 7: Be Ready for Conversations

Some clients will accept the new rates immediately. Others may have questions, and that’s completely normal. Be prepared to explain why your pricing is changing, how it affects the value they receive, the timeline, and any scope or package options available.

Listen first, then respond calmly and confidently. Most clients simply want reassurance and clarity. When you provide both, the conversation usually ends on a positive note.

How to Improve Your Firm’s Profitability

Raising your rates is only one part of building a more profitable firm. Long-term profitability comes from optimizing your pricing strategy, improving your internal processes, and tracking performance with real data.

Here are practical ways to increase your margins and create a healthier, more scalable firm.

Switch or Refine Your Pricing Models

If you’re still billing hourly or using fixed fees, consider shifting to value-based pricing. This positions your expertise—not your time—as the core of what clients are paying for. And you attract higher-quality clients who are less price sensitive and more focused on outcomes as a result.

It also simplifies your operations. With value pricing, you typically get paid before the work begins, which reduces the stress of tracking hours for billing, generating invoices, and chasing payments. Instead of selling your time, you’re pricing based on the results and clarity you deliver, making each engagement more predictable and profitable.

Track Your Effective Hourly Rate (EHR)

Your EHR tells you exactly how much you actually earn per hour for each client after factoring in the true time spent. It’s one of the most important profitability metrics for any accounting or bookkeeping firm.

With Financial Cents, EHR is calculated automatically from your time entries, so you can quickly see which clients are profitable, where scope creep is happening, and where prices need to increase or scope needs adjusting.

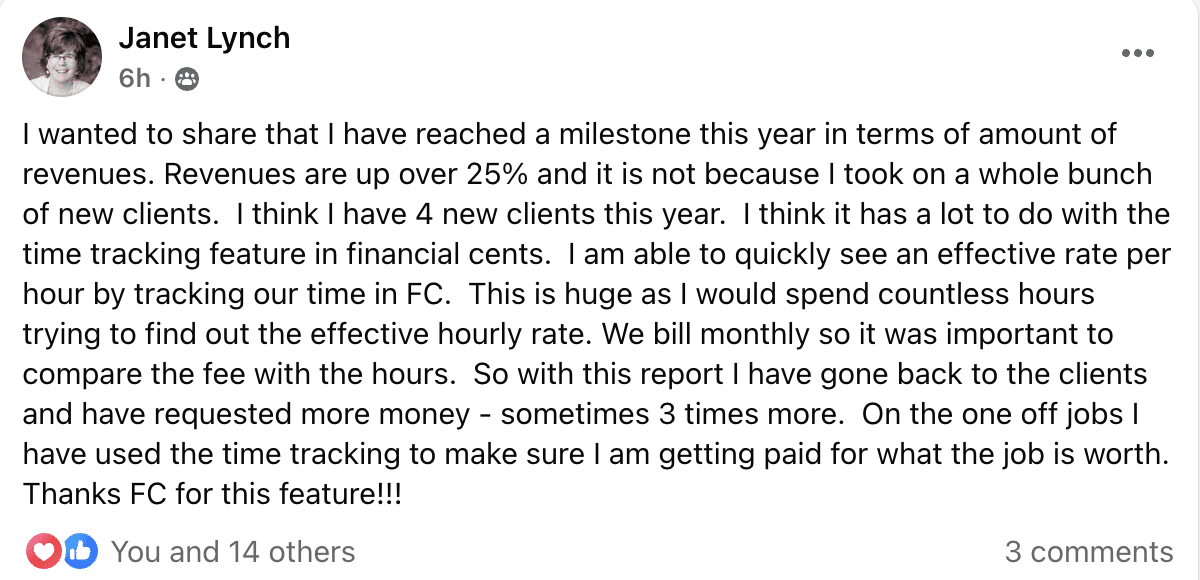

Here’s what a customer said about this feature:

Upsell or Cross-Sell Value-Added Services

Beyond your core services, you can increase profitability by offering related services that provide additional value to your clients. For example, a bookkeeping client may also benefit from advisory calls (which is the fourth service that drove the highest profits for firms in 2023), payroll support, or audit preparation.

If you’ve delivered strong results on their primary service, they’re far more likely to trust you with the next one. It’s a win-win: clients get more comprehensive support from someone they already trust, and your firm increases revenue without needing to acquire a new client.

Streamline Internal Workflows

Messy internal processes kill profitability. When your team spends too much time searching for documents, waiting for client replies, or manually tracking deadlines, your margins shrink.

Financial Cents helps you standardize your workflow with templates, automate task reminders and client follow-ups, track work in progress in one place, and reduce back-and-forth by centralizing communication.

A streamlined workflow means less wasted time, which improves profit margins.

Review Your Client Mix Regularly

A client who pays a high monthly fee but constantly requests extra work may be less profitable than a small client who follows processes and communicates well.

Review your client mix at least once or twice a year to identify low-margin clients and recurring scope creep, and either adjust pricing or scope, or offboard clients who consistently drain your resources.

Use Realization & Profitability Reports

Financial Cents gives you Realization and Profitability Reports that make it easy to see how efficiently your firm converts work into revenue.

These reports allow you to view billables vs. actual billed amounts, client profitability, service profitability, team profitability, gross profit, and gross margin.

This goes much deeper than basic time reports. You can immediately see which clients or services need price increases, where work is taking too long, and which team members are productive.

Improve Team Efficiency and Capacity Planning

Your team’s time is your firm’s most valuable resource. If you don’t manage capacity well, you’ll constantly fall behind in work. Financial Cents helps you improve team efficiency through simple automation. For example, you can automate client follow-ups for document requests and automatically generate recurring projects to save your team time.

Financial Cents also has a Capacity Management feature, which gives real-time visibility into your team’s availability and work so you can reassign work to balance workloads and prevent burnout.

Foster a Culture of Continuous Improvement

Adopt a routine of reviewing EHR monthly, checking profitability/realization each month or quarter, updating pricing regularly (e.g, annually), and giving the team feedback based on performance data. This ensures your firm remains productive and profitable.

All of these tips and strategies become significantly easier when you use a practice management software like Financial Cents. It gives you workflow automation, client management, centralized communication, built-in time tracking, client task reminders, EHR reports, realization & profitability insights, and capacity and utilization tracking in one tool. No need to switch between multiple apps.

Turn Pricing Conversations Into Growth Opportunities

Raising your rates is part of growing and running a healthy, sustainable firm. When you approach pricing changes with transparency, great communication, and proving your value, clients are far more likely to understand the update and continue working with you.

Financial Cents makes the entire process even easier. You can manage your workflows, automate client communication, track time, bill clients, and access insights into your firm’s productivity, realization, and profitability—all in one place. With better systems and clearer data, pricing conversations become simpler, smoother, and far more effective.

We also have additional template letters for free download: