Running a company can be a struggle, especially for small business owners. Between managing projects, handling finances, and sourcing for clients, there’s a lot to juggle. Add tax-related matters to the mix and it becomes overwhelming.

That’s why many business owners take the easy option of delegating a certified accountant like you to handle their taxes.

However, federal laws require the IRS to keep taxpayers’ information private. So how do you access your client’s tax records?

That’s where IRS Form 2848, Power of Attorney and Declaration of Representative come in. It shares almost a similar purpose with IRS Form 8821 tax information authorization, because 8821 also gives you access to your client’s tax records. However, you can’t perform certain acts or take decisions for your clients using form 8821.

The Power of Attorney is a legally binding document that authorizes individuals such as attorneys, enrolled agents, or CPAs to represent taxpayers before the IRS and make decisions on their behalf.

How do you file IRS Form 2848 to be granted power of attorney rights for your clients? That’s what you’ll learn in this step-by-step guide.

You may be interested in:

Purpose of IRS Form 2848

Not all taxpayers require representation before the IRS. But sometimes your clients may need you to stand in for them.

For instance, when dealing with an auditor during tax audits or negotiating with the IRS to pay off tax debts.

Also, in cases where clients are suffering from a chronic illness, are injured, or have traveled out of the country, filing Form 2848 makes you eligible to represent them and handle other tax matters such as:

- Receive confidential tax information

- Review tax transcripts

- Track tax refunds

- Dispute tax returns

- Appeal and negotiate tax payments

If after understanding the purpose of filing form 2848 and you fill 8821 is best suited for your client. Read our detailed form 8821 instructions for filing instead.

Filing IRS Form 2848 Instructions

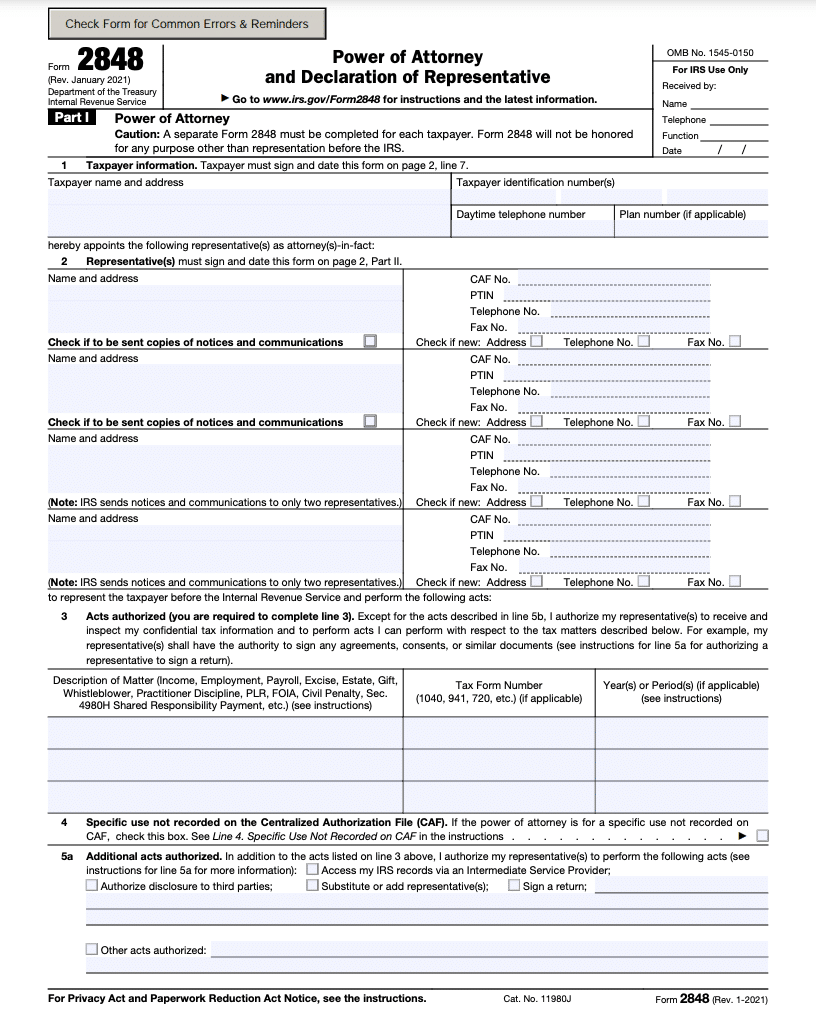

Form 2848 is divided into two parts and two pages. Part I is the Power of Attorney page while Part II is the Declaration of Representative page.

Let’s look at how to complete both parts starting with Part I

Part I – Power of Attorney

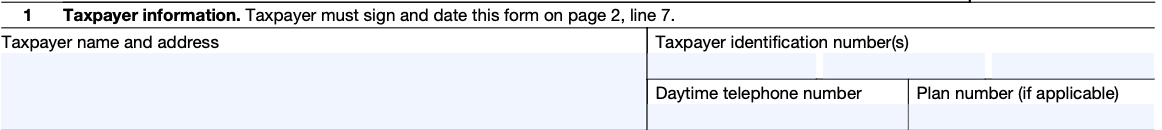

1. Taxpayer Information: In this section, enter your client’s basic information such as name, address, taxpayer identification number(s) (TIN), and daytime telephone number.

You can use your client’s SSN, ITIN, or employer identification number (EIN) as a means of identification.

Note: this section only applies to taxpayers, not their representatives or any other person.

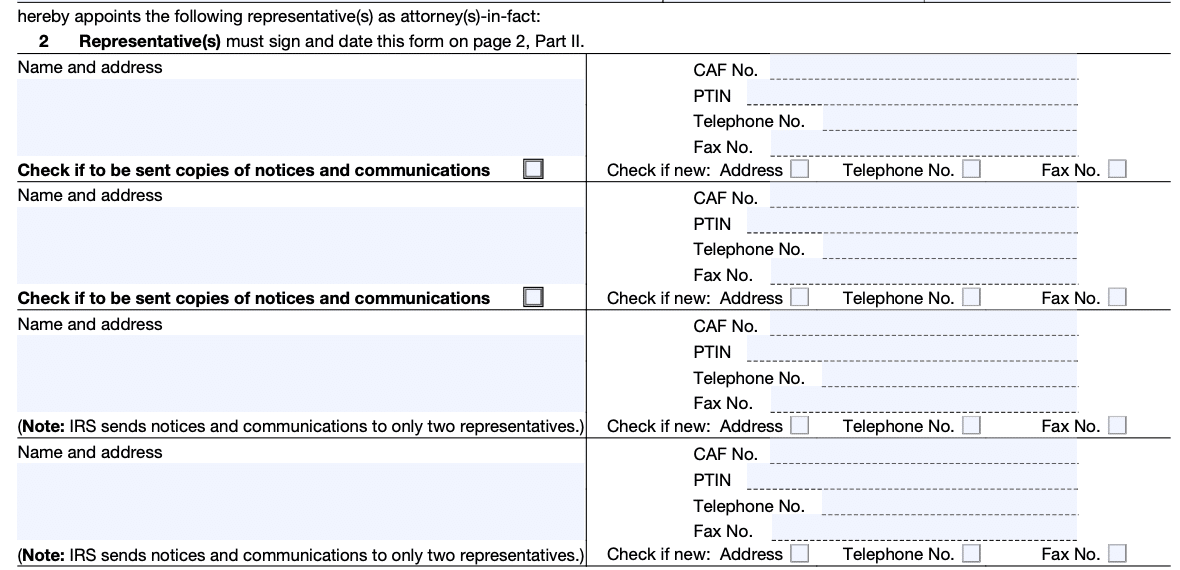

2. Representative(s) Information: This section applies to your client’s representative(s). You can enter up to four representatives including their names, addresses, phone and fax numbers.

Note: Only individuals eligible to practice before the IRS can be named as representatives. Since you’re representing your client, simply fill in your details.

Next, enter your CAF No. and PTIN. If you don’t have a CAF No., enter None. The IRS will issue you one directly or you can check our blog post for how to get a CAF number. And if you’ve applied for a PTIN, enter “applied for” otherwise, leave it blank.

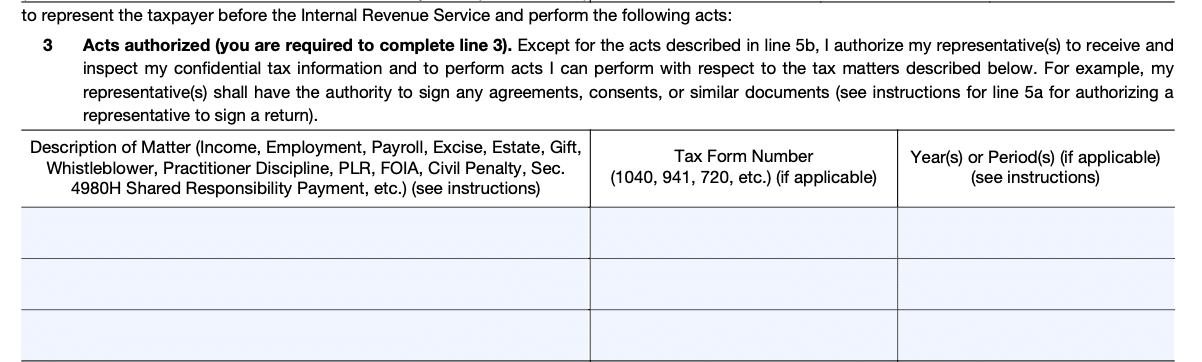

3. Acts authorized: this section is divided into three parts. The first part is where you list the matters your clients authorize you to represent them based on your engagement agreement.

The second part is the tax form number while the last part is the number of years as agreed upon.

For example, you can list income under Description of Matter, 1040 under tax form number, and 2023 under years.

Don’t use general wordings such as “all years” or “all periods” to prevent the IRS from rejecting the form. But you can list multiple years to cover longer periods using ‘thru,’ ‘through,’ or hyphen (-). For instance, 2023 – 2025.

Note: You cannot list future periods exceeding three years from December 31 of the current year you filed Form 2848.

4. Specific use not recorded on the Centralized Authorization File (CAF): The CAF is a system where the IRS stores all its power of attorney documents. However, there are specific cases where filing Form 2848 is one-time and does not relate to a specific tax period.

This is known as a specific-use power of attorney and wouldn’t be stored in the CAF. If such cases apply to your client, mark the checkbox in line 4.

Here’s are examples of specific uses not recorded listed by the IRS:

- “Requests for a private letter ruling or technical advice (see Rev. Proc. 2021-1, or the latest annual update, available on IRS.gov);

- Applications for an EIN;

- Claims filed on Form 843, Claim for Refund and Request for Abatement;

- Corporate dissolutions;

- Circular 230 Disciplinary Investigations and Proceedings;

- Requests to change accounting methods or periods;

- Applications for recognition of exemption under sections 501(c)(3), 501(a), or 521 (Forms 1023, 1024, or 1028);

- Request for a determination of the qualified status of an employee benefit plan (Forms 5300, 5307, 5316, or 5310);

- Applications for an ITIN filed on Form W-7, Application for IRS Individual Taxpayer Identification Number;

- Applications for an exemption from self-employment tax filed on Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners;

- Application for Award for Original Information under section 7623;

- Voluntary submissions under the Employee Plans Compliance Resolution System (EPCRS); and

- Freedom of Information Act (FOIA) requests.”

[Source]

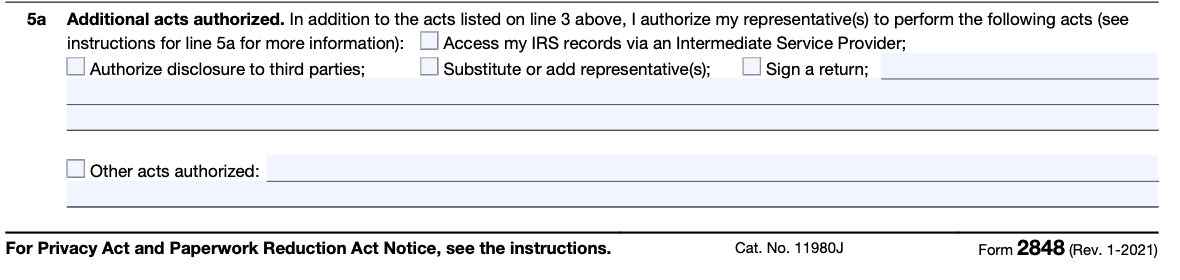

5a. Additional acts authorized: In this section, you’re to check the appropriate box for any additional matters that your clients authorize you to perform.

- Access my IRS records via an Intermediate Service Provider: You can obtain your client’s tax information directly by using the IRS e-Services Transcript Delivery System. However, checking this box grants you access to obtain tax records through third-party services.

- Authorize disclosure to third parties: Checking this box permits you to disclose your client’s tax return to third parties.

- Substitute or add representative(s): Without checking this box, you cannot add or remove other representatives on your client’s behalf.

- Sign a return: Permits you to sign an income tax return on your client’s behalf in cases of injury, disease, or absence from the U.S. for at least 60 days.

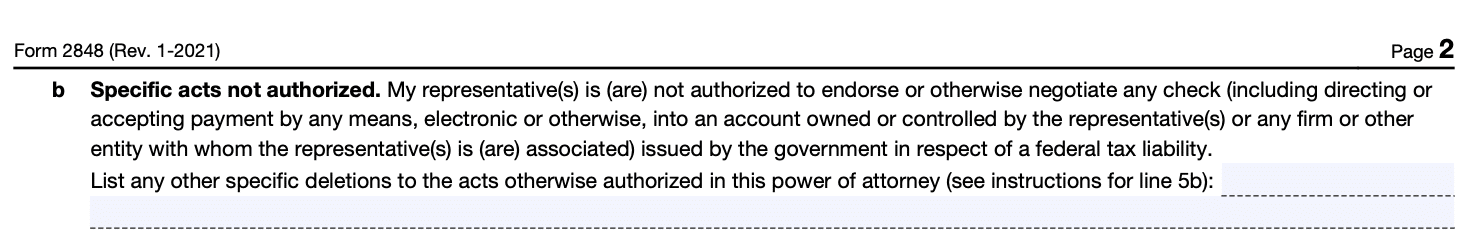

5b. Specific Acts not Authorized: There may be acts your clients wouldn’t want you to perform on their behalf such as signing waivers or accessing tax transcripts. If this applies to you, enter those acts in this line. Otherwise, skip it.

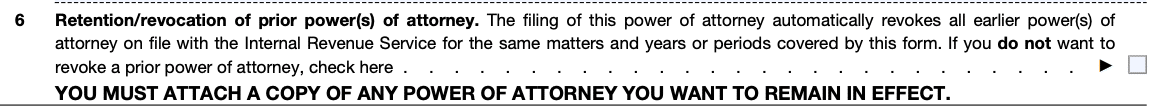

6. Retention/revocation of prior power of attorney: filing a form 2848 automatically revokes any previous POA stored in the CAF for the same matter and period. Checking this box prevents such from happening.

For example, if your client had previously filed a Form 2848 authorizing another CPA to represent him in income matters, filing another form for the same matter as the new representative revokes the earlier form.

To retain an existing POA, simply check the box on line 6 and include a copy of the POA.

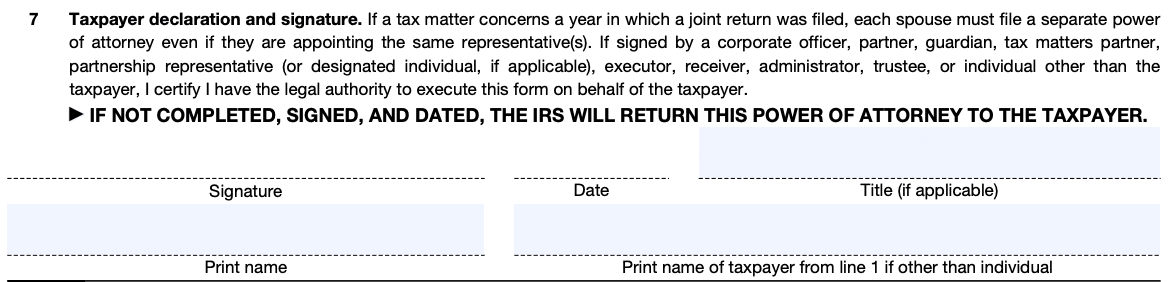

7. Taxpayer declaration and signature: if you’re filing Form 2848 via mail or fax, taxpayers must physically sign the form. But if it’s online, they can use a digital signature.

According to the IRS, individuals, corporations, partnerships, estates, and employee plans are all eligible to sign Form 2848.

- For individuals, your client must sign and include a date.

- For corporations, an officer with the power to make decisions on behalf of the corporation must sign and enter his exact title.

- For partnerships, all partners must sign and include their exact titles. In cases where a partner acts on behalf of others, only that partner should sign and add his title.

- For estates, only one co-executor with the power to make decisions on the estate’s behalf should sign.

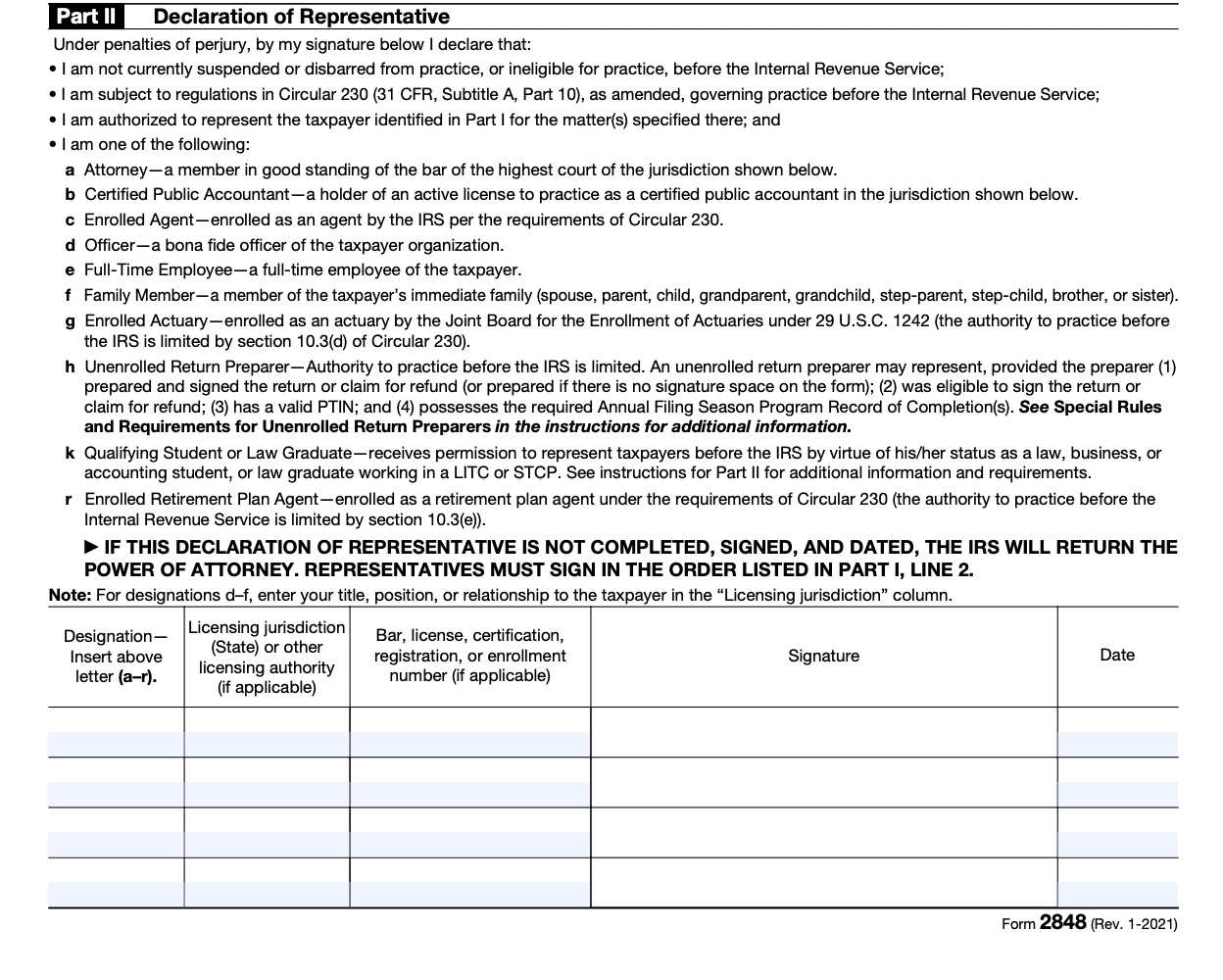

Part II. Declaration of Representative

In part II, you officially declare to represent your client before the IRS. It’s divided into five parts.

The first part is the designation. Enter b as a CPA. Next, enter your licensing jurisdiction/authority. Then add your license number, signature, and date.

If there is more than one representative, they must sign in the order listed in Part I, line 2.

How to File Form 2848 Power of Attorney Electronically

Before you e-file Form 2848 for your clients, here are a few things to keep in mind.

- Create a Secure Access account on the IRS website.

- Be sure to authenticate your client’s identity.

- Ensure both you and your client sign the form either electronically or with an ink signature.

Once all these are in place, follow the steps below to file Form 2848:

Step 1: Log in to the IRS online platform

Step 2: Enter your username, password, and authentication code

Step 3: Provide answers to a few questions about the form. You’re permitted to file only one at a time.

Step 4: Upload a completed and signed Form 2848.

Click on “submit another form” to file multiple forms.

Note: You must not submit a form online if you’ve already submitted it via mail or fax.

Once you’ve submitted the form, you will get a confirmation email.

According to the IRS, the CAF unit will process online forms on a first come, first served basis.

How to File Form 2848 Power of Attorney Via Mail

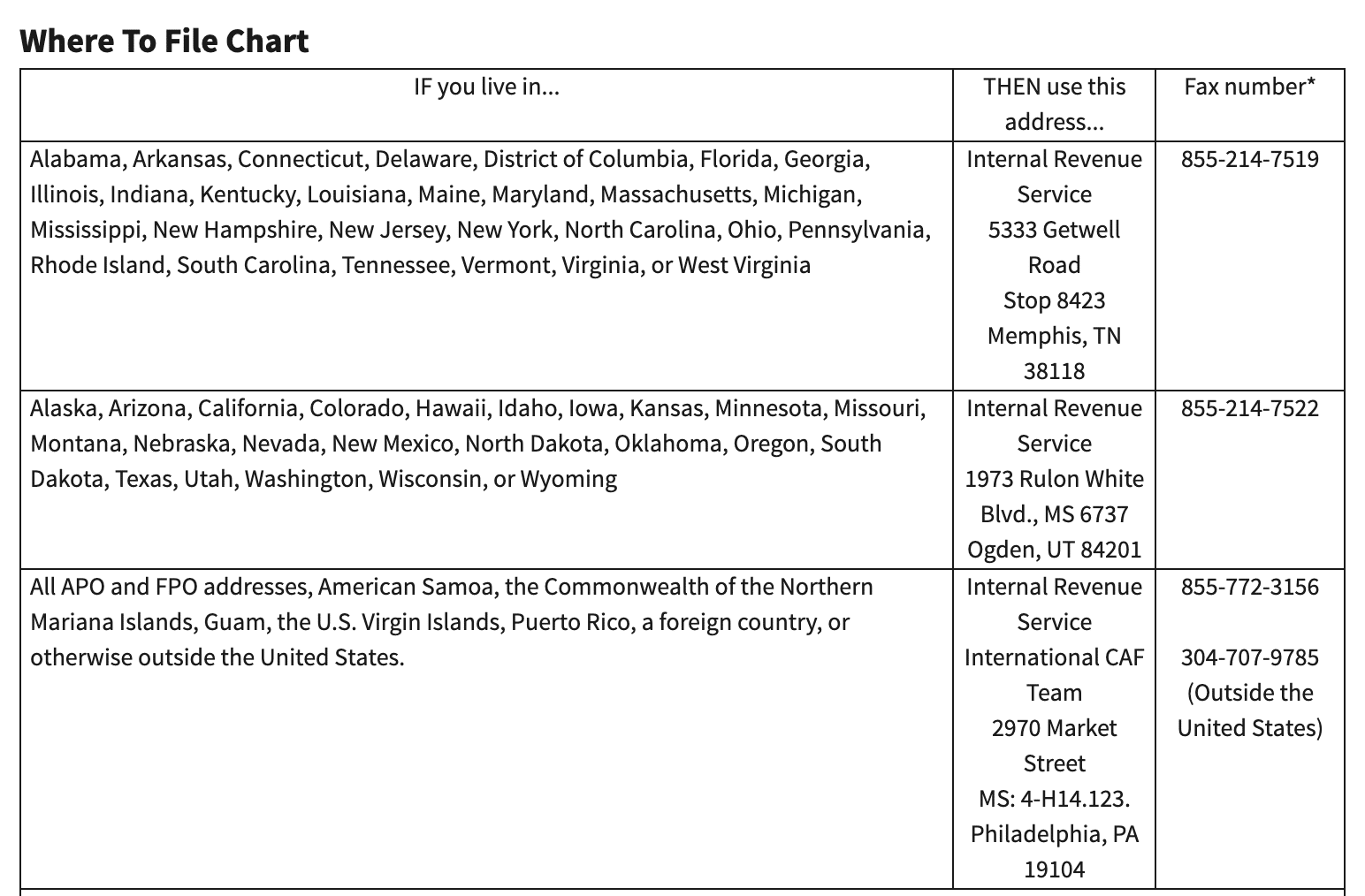

If your clients prefer to file Form 2848 via mail or fax, they should download and complete the form. Then check for mistakes before sending it to the mailing or fax address in the where to file chart below:

[Source]

Streamline Your Firm’s Operations With Financial Cents

Filing Form 2848 for your clients is a pretty straightforward process. All you have to do is complete and submit the form online or via mail. It doesn’t get any easier than this.

But as an accountant or bookkeeper, filing forms is one of the many tasks you handle. And as your firm grows, so will the need to work more efficiently and increase productivity to avoid burnout or missing deadlines.

That’s where accounting software like Financial Cents comes in. It helps you manage clients, automate workflows, and collaborate with your staff all in one app. Ready to take it for a spin?

Use Financial Cents to manage your accounting practice.