Whether you’re a beginner looking to gain some skills to start your bookkeeping business or an experienced bookkeeper looking to up-skill, this roundup is for you.

You’re one bookkeeping course away from unlocking your next phase of accounting success. Whatever your skill level may be.

But there are more bookkeeping courses than your schedule can take. On a bad day, you may even end up spending the time you don’t have on a course you don’t need.

We want to help you prevent that.

This list of bookkeeping courses will improve your bookkeeping performance. Whether you’re a job seeker or an experienced bookkeeper.

Need a list for the best free accounting courses with certificates instead? Check out the list here.

First Thing; What to Look for In Bookkeeping Courses

Here are some factors to consider when deciding on bookkeeping courses or course to take.

Coverage

Your choice of a bookkeeping course will depend on your goal. But every bookkeeping course should make you better in some, if not all, of the following:

- Journal entry

- Financial statements

- How to scale your firm

- Bookkeeping software solutions

- And more

The Instructor

Would you allow an unqualified pilot to teach you how to fly a plane? I don’t think so. The instructor’s qualification says a lot about their ability to teach you bookkeeping.

Instruction Software

Learning and practicing a skill with a software solution quicken your ability to apply the skills in a real-world situation. Most of the courses use QuickBooks Online for their instruction. So, it’s a plus if the course’s instruction software is relevant to your goal.

Country

To ensure bookkeeping and accounting standards, countries approach their bookkeeping standards differently. Knowing where the course creator lives will help you put things in perspective.

Who It’s Best Suited For

I mentioned time-wasting earlier. This is what helps you prevent that. Taking an advanced course when you need something foundational will waste your time and money. The reverse is true also.

Accreditation

This shows professional or academic recognition. Accredited bookkeeping courses are usually more valuable for the participants.

Duration

The length of the course determines whether you can complete it. It also determines the level of changes you need to make to your current routine, and for how long.

Start Date

Many of these courses do not have start and end dates. The course starts when you are ready and ends when you complete it. But for those with official start and end dates, you need to be sure it falls at the right time for you. So, you don’t put your life on hold to complete them.

Price

Paid courses are generally better than free ones. But it’s not always the case. The price of a training program will determine whether you can go for it.

With that in mind, let’s see the 15 bookkeeping courses you can take to improve your practice and business, starting today.

List of the Best Free and Paid Bookkeeping Courses

- The Pure Bookkeeping System

- NACPB Accounting Fundamentals

- ICS Canada’s Bookkeeper Online Training

- The Bookkeeping Business Accelerator

- Introduction to Bookkeeping By ACCA

- Penn Foster’s Bookkeeping Training Program

- So, You Want to Learn Bookkeeping

- Tax Savvy Pros

- Kninja90 Training

- The Basics of Debits and Credit

- Bulletproof Bookkeeping with Quickbooks Online

- Debits and Credits

- Xero UK – Accounting & Bookkeeping Essentials Course

- Fast and Easy QBO ProAdvisor (Basic and Advanced)

- Bookkeeping for Personal and Business Accounting

- Understanding Debits and Credits

- Financial Accounting

- Intuit Bookkeeping Basics

- Bookkeeper Launch

- Accounting Basics: A Complete Study

1. The Pure Bookkeeping System

This course focuses on training bookkeepers to build systems that make them more organized and efficient. This course helps you standardize your firm’s operations. It includes using SOPs in QBO, Sage, and your practice management software.

The course’s modules cover

- Full suite bookkeeping procedures.

- Bookkeeping start-up marketing.

- Standardized bookkeeping checklists.

Additional Information

| Instructor | Debbie Roberts, with 20+ years of bookkeeping experience |

| Instruction Software | QBO, Sage, and Hubdoc. |

| Country | Australia, with a presence in the US and Canada. |

| Best Suited For | Bookkeeping entrepreneurs. Those with just a few clients, and those with many clients. |

| Accreditation | None |

| Duration | It requires you to use its strategies for about 12 months for the most results. |

| Start Date | Start date: You can start the course at any time. But it doesn’t run like the other courses. |

| Price | The practice plan is $295/month, the Business plan is $495/month and the Enterprise plan is $695/month. |

2. NACPB Accounting Fundamentals

This course explains basic bookkeeping principles, procedures, and processes you need to succeed. It requires you to take a pre-assessment test, watch video presentations, and read book chapters. The exercises and problems help you test your knowledge before completing the examination.

The topics include

- Analyzing Business Transactions.

- The General Journal and General Ledger.

- Accruals, Deferrals, and the Worksheet.

Additional Information

| Instructor | NACPB instructors. |

| Instruction Software | the course uses QuickBooks online for instruction. |

| Country | The United States of America. |

| Best Suited For | Job seekers and entrepreneurs interested in the fundamentals of bookkeeping. |

| Accreditation | The course enables you to sit for the NACPB Certificate examination. |

| Duration | the course has thirteen sessions, and each session lasts a week. Because it is self-paced, you can decide to complete it sooner or later. But you have access to the course for six months. |

| Start Date | you can start the course any day you choose. Once you buy the program, you will receive the course access code. |

| Price | The course costs members of the NACPB $369 and non-members $449. |

3. ICS Canada’s Bookkeeper Online Training

ICS Canada’s bookkeeping courses will take you from beginner to advanced learning fast. Unlike the other items on this list, this is not a course.

It is a complete program. its courses range from end-of-month accounting, to payroll, and wholesale accounting. The program is structured to help you learn from one level to the next.

For example, Course Three (3) of the program aims to enable you to understand

- Payroll procedures for Canadian bookkeeping.

- Merchandise inventory.

- Methods of calculating wholesale accounting.

Additional Information

| Instructor | ICS Canada staff. |

| Instruction Software | None |

| Country | Canada. |

| Best Suited For | Anyone looking to learn bookkeeping at a beginner or advanced level. |

| Accreditation | All courses in the program are DEAC-Accredited |

| Duration | It can take as short as six months to complete a course. But usually a year on average. |

| Start Date | Since it’s a distance learning course, you can start when you’re ready. And it is Self-Paced. |

| Price | $1,299. |

4. The Bookkeeping Business Accelerator

The BBA helps professional bookkeepers overcome the fear of starting their practice. the course teaches strategies to set up a profitable bookkeeping business. It also connects participants with other bookkeeping professionals in their members-only Facebook group.

The course modules empower participants to

- Attract their ideal clients.

- Structure their services, prices, and strategies to stay profitable.

- Improve their work systems to meet client deliverables at scale.

Additional Information

| Instructor | Serena Shoup is a certified CPA. She owns a virtual accounting firm.. |

| Instruction Software | Xero |

| Country | The United States of America. |

| Best Suited For | Entrepreneurs with bookkeeping experience looking to start their practice. |

| Accreditation | None |

| Duration | six (6) weeks. |

| Start Date | The course is self-paced. You can start whenever you are ready and pace it according to your availability. |

| Price | Pay in full $1497 or Three-part Payments of $525. |

5. Introduction to Bookkeeping By ACCA

This introductory course helps with understanding the double-entry bookkeeping system and business transactions. You can start it with ACCA’s quizzes to gauge your accounting skills. Completing the introductory course prepares you for advanced topics like cashbook reconciliation.

Its topics include

- Ledger accounts.

- Reconciliation.

- Trial balance

Additional Information

| Instructor | James Patrick is ACCA’s Head of Professional Education. Krutika Adatia is ACCA’s Digital Learning Lead. And Isobel Wroath is ACCA’s Digital Community Manager. |

| Instruction Software | QBO |

| Country | Worldwide but with headquarters in the United Kingdom. |

| Best Suited For | job seekers and entrepreneurs interested in bookkeeping. |

| Accreditation | you must become an ACCA member at $150 a year to be eligible. |

| Duration | The course lasts six weeks at 5-8 hours per week. It has a total of 30-48 hours. It’s flexible and allows you to go at your own pace for at least six months. |

| Start Date | you can start the course anytime. |

| Price | Free |

6. Penn Foster’s Bookkeeping Training Program

Penn Foster’s program teaches job seekers all they need to thrive in bookkeeping. The course is interactive and connects participants to a network of community online. It also has self-check quizzes to test your knowledge.

Its modules include

- Payroll management.

- Financial Reporting.

- Accounts payable and receivable

Additional Information

| Instructor | Penn Foster’s staff |

| Instruction Software | QBO |

| Country | United States of America |

| Best Suited For | Job seekers looking to improve their CV and career prospect. |

| Accreditation | DEAC-Accredited |

| Duration | Six (6) months. |

| Start Date | It is in-demand and self-paced. |

| Price | $989. |

7. So, You Want to Learn Bookkeeping

Bean Counter’s So You Want to Learn Bookkeeping is a beginner training on bookkeeping. It explains the relationship between business activities, financial information, and bookkeeping. The course includes a handful of quizzes for your self-evaluation.

Its modules include

- Bookkeeping systems (single and double entry methods).

- How credits and debits affect accounting.

- General ledger and journal

Additional Information

| Instructor | Dave Marshall |

| Instruction Software | None |

| Country | United States of America |

| Best Suited For | individuals and business owners that do not have a background in accounting and bookkeeping. |

| Accreditation | None |

| Duration | The course has six lessons, each taking roughly an hour to complete. |

| Start Date | you can start the course anytime. |

| Price | Free. But $14.95 to buy the E-Book for offline study. |

8. Bookkeeping Method – Tax Savvy Pros

The Tax Savvy Bookkeeper helps bookkeepers and entrepreneurs “know their numbers.” The course helps them identify areas of possible tax deductions to make their businesses more profitable.

Its lessons focus on helping participants:

- Set-up and their businesses to ensure tax compliance.

- Understand payment collections rules & guidelines.

- Know how to read & understand reports to make informed decisions.

Additional Information

| Instructor | Meagan Hernandez, founder of a 6-figure virtual bookkeeping business. |

| Instruction Software | Meagan teaches attendants on QuickBooks Online, Xero, Wave, and QuickBooks Desktop. |

| Country | United States of America |

| Best Suited For | job seekers without prior knowledge or education in bookkeeping. And entrepreneurs interested in launching their businesses. |

| Accreditation | None |

| Duration | the course has eight modules, and a module has 3-5 lessons. A lesson lasts for about 15 minutes. |

| Start Date | The course starts when you are ready to start. It is self-paced |

| Price | $1,297 |

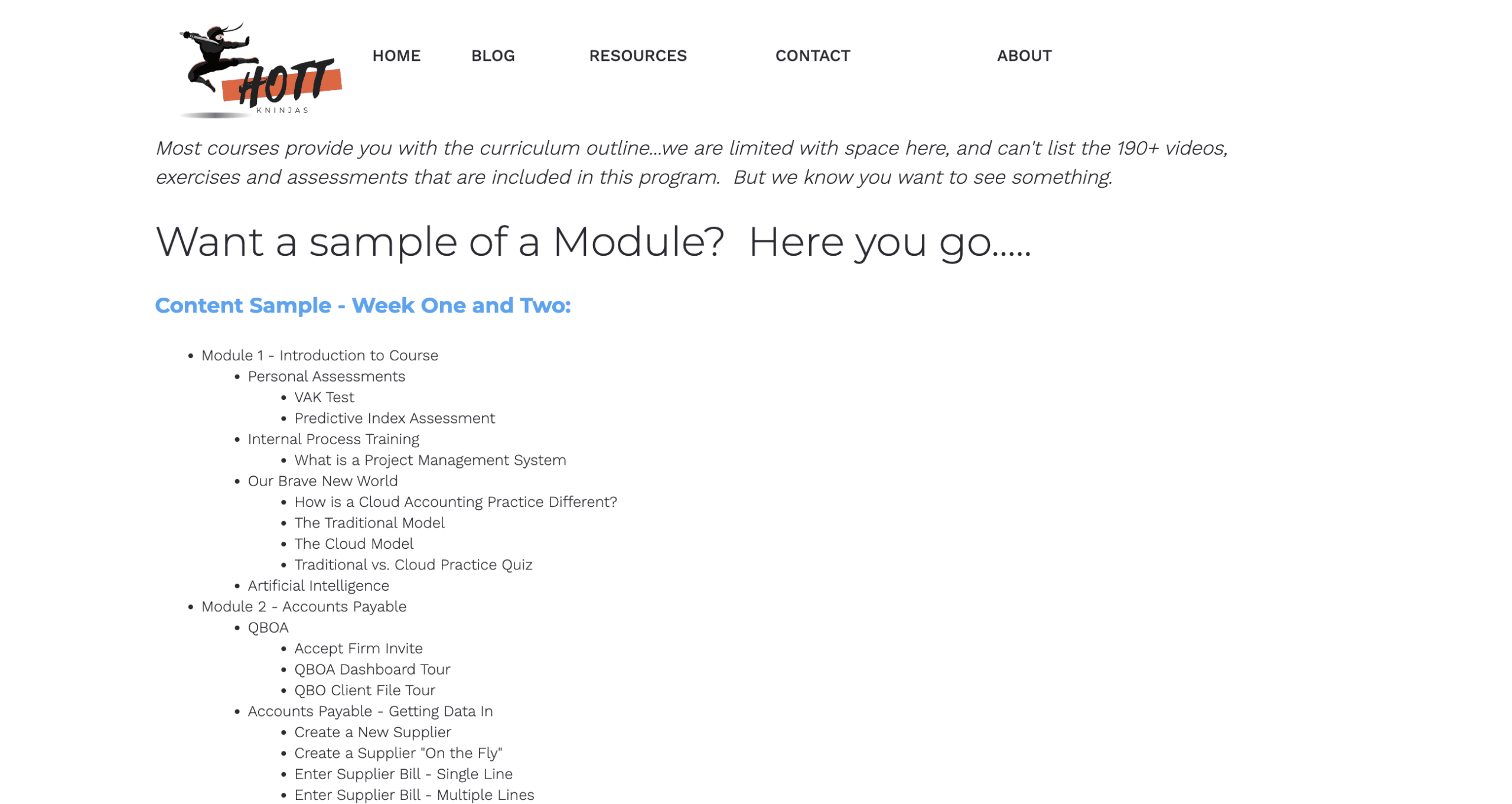

9. Kninja90 Training

Kninja90 Is a three-month training program for employees. It helps firms to train their employees to be more productive with cloud bookkeeping. With its step-by-step approach, your employees will go from knowing so little to so much. Especially about bookkeeping technology like QBO.

As their employer, you can track your employees’ progress and test scores.

The course covers

- Sales and Receivables.

- Payroll (wagepoint) and sales tax filing.

- Bank feeds and rules

Additional Information

| Instructor | Juliet Aurora, who has been named in the Top 50 Women in Accounting and Top 50 Cloud Accountants. |

| Instruction Software | the course is delivered around QBO. It also covers Plooto, Hubdoc, and Wagepoint, which will make your employees proficient in them. |

| Country | Canada |

| Best Suited For | Experienced bookkeepers needing to be more productive with cloud technology. |

| Accreditation | None |

| Duration | The course runs for three months (90 days/13 weeks). |

| Start Date | It is self-paced, but since your employees will still need to complete client work at your firm, they can take it for 2-4 hours a day. |

| Price | CAD 9980 |

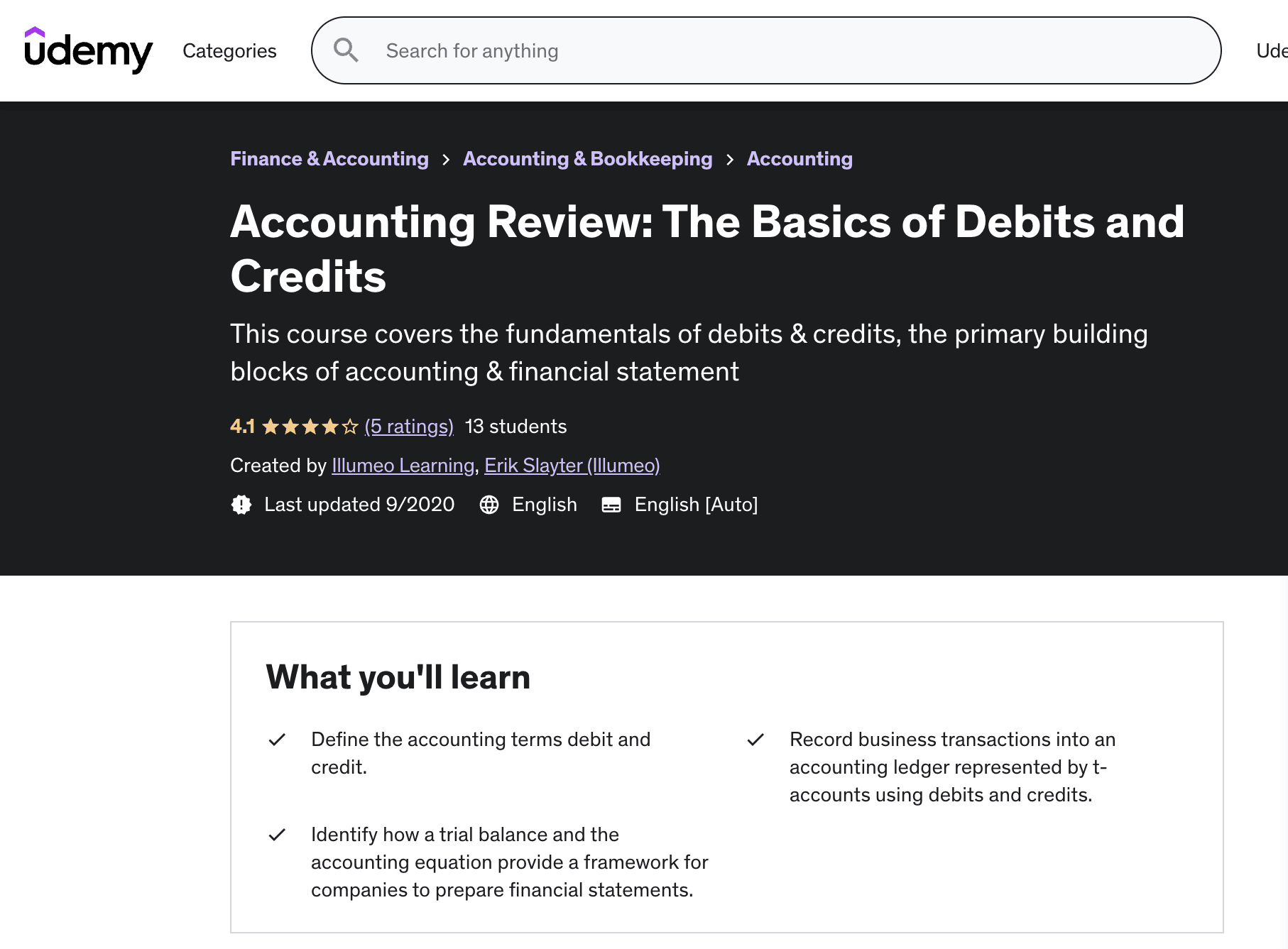

10. The Basics of Debits and Credit

This course breaks down credits and debits for individuals interested in bookkeeping. This is done in a way that equips the participant with a solid foundation in bookkeeping. For experienced bookkeepers, the course refreshes their understanding of core bookkeeping concepts.

Its modules will improve your ability to:

- Understand the concepts of credit and credit.

- Use your understanding of credit and debit to record transactions into t-accounts.

- Prepare financial statements using the trial balance and the accounting.

Additional Information

| Instructor | INSTRUCTOR: Erik Slayter, Accounting Professor at California Polytechnic State University |

| Instruction Software | None |

| Country | United States of America |

| Best Suited For | Anyone interested in accounting and bookkeeping. |

| Accreditation | None |

| Duration | The course is an hour-long video with articles and other resources you can study to understand it. |

| Start Date | The course is self-paced. You can take it whenever you buy it and go as fast as you see fit. |

| Price | Around $8 (contact Udemy to be sure of the specific price in your region) |

11. Bulletproof Bookkeeping with Quickbooks Online

The Bulletproof bookkeeping course teaches professionals how to keep impeccable books. The program is so rich in insights that you can always return to it as a refresher if you encounter difficulty on the job. If you follow Seth David’s strategies in this course, you’ll see dramatic improvements in your bookkeeping career.

The course will teach you how to:

- Automate the bookkeeping process with detailed bank feed rules.

- Maximize recurring transactions to improve the accuracy of your books.

- Master the expense and sales cycle.

Additional Information

| Instructor | Seth David, an auditor with over 20+ years of experience. |

| Instruction Software | QBO |

| Country | United States of America |

| Best Suited For | Job seekers and experienced bookkeeping professionals. |

| Accreditation | None |

| Duration | The course lasts about 16 hours. |

| Start Date | You can start anytime you are ready and go at your own pace. |

| Price | $1997 |

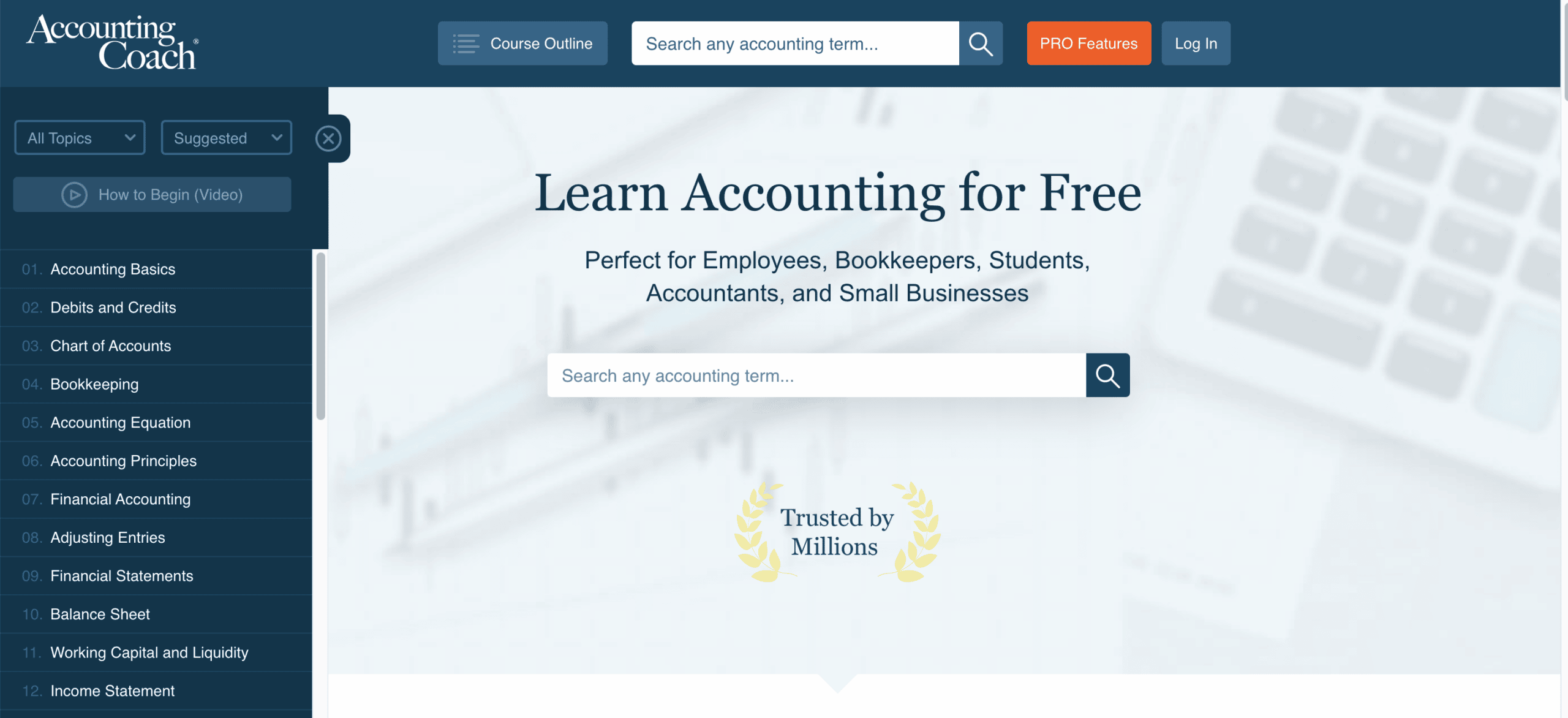

12. Debits and Credits

AccountingCoach.com has a library of accounting courses. But we’re focusing on the Debits and Credits course. The bookkeeping course explains how individual and business accountants are credited and debited. It teaches those interested in bookkeeping foundational aspects of bookkeeping for free.

The course includes modules on

- Balance sheets, income, and cash flow statements.

- Double-Entry Accounting, Debits & Credits.

- T-accounts and journal entries.

Additional Information

| Instructor | Harold Averkamp, CPA |

| Instruction Software | QBO |

| Country | United States of America |

| Best Suited For | Everyone interested in learning bookkeeping at any level. |

| Accreditation | You can earn a certificate of achievement when you buy the Pro plan. |

| Duration | The course is self-paced. |

| Start Date | You can start whenever you’re ready. |

| Price | The course is free but you can upgrade to any of the two paid plans (at $49 and $99) to get more value, including assessments and business forms. |

13. Xero UK – Accounting & Bookkeeping Essentials Course

This Xero course teaches business owners how to master Xero software to keep their books. It takes participants through the VAT tax rate, email set, and bank account settings in Xero UK.

Its topics cover

- Payroll according to UK standards.

- Products and Services (Inventory).

- Fixed assets.

Additional Information

| Instructor | Mark Cunningham, Accountant, bookkeeper, entrepreneur |

| Instruction Software | Xero UK |

| Country | New Zealand. But uses Xero UK |

| Best Suited For | INSTRUCTION SOFTWARE: Xero UK

Business owners who want to learn Xero UK and bookkeepers that serve UK clients. |

| Accreditation | Certificate of completion |

| Duration | Six hours of video lessons. |

| Start Date | You can start any time. |

| Price | $25 (contact creator for current price) |

14. Fast and Easy QBO ProAdvisor (Basic and Advanced)

This one is not bookkeeping per se. It is a course that helps participants complete their Intuit Pro Adviser certification. It focuses on the United States edition of QuickBooks Online and the ProAdvisor test.

To make learning easier, faster, and more fun, the course has

- 50 short video lessons.

- Hands-on exercises.

- Summary guides.

Additional Information

| Instructor | Margie Remmers-Davis |

| Instruction Software | QBO |

| Country | United States of America |

| Best Suited For | Bookkeepers, tax advisors, and enrolled agents. |

| Accreditation | Certificate of completion |

| Duration | You have lifetime access. So, you can take it as fast or slow as you can. |

| Start Date | The course is available when the 2023 version of intuit test is released. December 2023 (tentatively). |

| Price | $99 (Basic) or $495 (Advanced) |

15. Bookkeeping for Personal and Business Accounting

Bookkeeping for Personal and Business Accounting teaches participants how money flows in business. That allows them to understand how profit and loss make or break businesses. It helps you build the skills you need to keep books in any company.

Its topics include

- Double entry and the Balance sheet.

- Numerical skills.

- Financial accounting and reporting.

Additional Information

| Instructor | Devendra Kodwani is a Professor of Financial Management and Corporate Governance. |

| Instruction Software | Microsoft Excel or Google spreadsheet. |

| Country | United Kingdom |

| Best Suited For | Job seekers and entrepreneurs looking for an introductory bookkeeping course. |

| Accreditation | Available upon completion of 90% of course steps and all assessments. |

| Duration | The courses last for 4 weeks, and you can study for 3hrs per week. |

| Start Date | You can start and learn at your pace. |

| Price | Free |

16. Understanding Debits and Credits

This course is an in-depth examination of strategies to manage credit and debit in a business. You’ll be sure of the OHSC team’s support whether you registered for the free or paid version.

Its topics include:

- Working with Debits and Credits.

- Reading Annual Reports.

- Identifying High and Low-Risk Companies.

Additional Information

| Instructor | Oxford Home Study Centre team |

| Instruction Software | None |

| Country | United Kingdom |

| Best Suited For | The course is suitable for all who want to learn bookkeeping. |

| Accreditation | The course is CPD-approved. You can also get a course completion certificate upon passing the assessments. |

| Duration | The course lasts for 20 hours. |

| Start Date | The course is always ongoing. You can start whenever you like. |

| Price | Completely free, with the option to pay a small fee if you want the certificate. CPD accreditation is £30. |

17. Financial Accounting

This Harvard Business School course explains accounting concepts and principles. It helps you understand how to interpret financial data for business decision-making.

The course covers:

- The methods of developing balance sheets, income statements, and cash flow statements

- Using financial statements to test the financial health of a business.

- Understand generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS).

Additional Information

| Instructor | Professor V.G. Narayanan, Professor of Business Administration at Harvard Business School. |

| Instruction Software | None |

| Country | United States of America |

| Best Suited For | Job seekers, individuals, or bookkeeping professionals. |

| Accreditation | you must complete all 7 modules and relevant quizzes. |

| Duration | 8 weeks |

| Start Date | January 2023, January 18, 2023, to March 15, 2023 |

| Price | $1,750 |

18. Intuit Academy Bookkeeping Professional Certificate

This certification course prepares anyone interested to understand the foundation of bookkeeping. It allows participants to build their competence by working on projects.

The course topics include

- Accounting Concepts and Measurement.

- Accounting cycle.

- Accounting principles and practices

Additional Information

| Instructor | Intuit, Coursera and Certiport/PearsonVUE teams |

| Instruction Software | QuickBooks Online |

| Country | United States of America |

| Best Suited For | Job seekers and entrepreneurs looking to learn bookkeeping. |

| Accreditation/ Certification | Available for participants in the US. |

| Duration | Can be completed in 16 hours and paced as you see fit. |

| Start Date | You can start anytime. |

| Price | Free |

19. Bookkeeper Launch

This course is for bookkeepers who want to speed up their bookkeeping business. It helps them set up their business by focusing on three key areas: Skills, Clients, and systems.

The syllabus revolves around:

- 21st-century bookkeeping skills you need to produce quality work consistently.

- 21st-century business systems that you need to work efficiently and productively.

- Inbound marketing and sales systems.

Additional Information

| Instructor | Ben Robinson |

| Instruction Software | QuickBooks Online |

| Country | United States of America |

| Best Suited For | Entrepreneurs looking to scale their bookkeeping business. |

| Accreditation/ Certification | Available for participants in the US. |

| Duration | The course has three main videos, and the Bookkeeper Launch System includes 64 hours of coursework. |

| Start Date | Any day you are ready. |

| Price |

|

20. Accounting Basics: A Complete Study

This introductory course teaches bookkeeping, accounting cycles, journal entry, and accounts preparation. It concludes with case studies that make the lessons more relatable.

The modules cover

- Double entry system.

- Rules of debit and credit.

- Bank reconciliation.

Additional Information

| Instructor | Raja Natarajan, B.Com., PGDBA, FCA |

| Instruction Software | None |

| Country | India |

| Best Suited For | Best suited for beginners who do not have the barest understanding of bookkeeping. And entrepreneurs looking to understand bookkeeping to be able to keep their books. |

| Accreditation | Certificate of completion |

| Duration | 35 hours of video. |

| Start Date | You can start any time. It is self-paced. |

| Price | $25 (contact course creator to be sure) |

Frequently Asked Questions About Bookkeeping Courses

1. Should I take a free or paid bookkeeping course?

Both free and paid courses are valuable. But if you want higher quality content, greater flexibility, and support, go for a paid course.

Free courses are cheap and easier to complete, and you only get what you’re given. Since you’re not paying for it.

2. Should I take an online or in-person bookkeeping course?

In-person training encourages face-to-face interaction, which can make learning easier and better. But most of these courses do not need physical interaction to be efficient.

Moreover, technology has made connecting over distances easier with improved online engagement.

3. Are bookkeeping courses worth it (or can I just learn on the job?

You can always learn anything on the job. You may fail many times but you’ll adjust. But some failures can be fatal. You do not need to fail when you can learn beforehand.

4. Are these bookkeeping courses beginner-friendly?

A good number of the courses are strictly for beginners.

5. I have some work experience; do I still need to take a bookkeeping course?

Bookkeeping is constantly evolving. Opportunities arise each day, if you don’t upgrade your knowledge and skills, you wouldn’t be able to take advantage of them.

To Get the Most of Bookkeeping Courses

You can begin to apply some of these courses to your practice or business right away. For some others, you may need to take the next one to build depth.

In any case, don’t allow learning to distract you from the application. Look for opportunities to apply the lessons you’re learning.

And should you need help organizing your bookkeeping practice, feel free to reach out to me. We’ll be happy to help you scale your bookkeeping practice with—lightning—speed.