Retaining your accounting clients shouldn’t be so hard. When a client chooses your firm, it’s because they believe you’re the best fit for their needs.

If they start considering a switch, it usually signals something deeper: a gap between what you promised and what you’re delivering. After all, no satisfied client goes about searching for another accountant.

If you’ve ever lost a great client despite doing your best, it might not be for lack of effort. It’s likely your tools.

Managing projects, client information, and communication with manual or disconnected systems creates information silos, missed follow-ups, and inconsistent service experiences.

That’s why more accounting firms are turning to Accounting CRM, which centralizes client data, communication, and workflows in one place.

By unifying these different aspects of accounting client engagements, accounting CRM software helps firms deliver consistent service, strengthen client relationships, and turn satisfied clients into loyal advocates.

This article shows how every firm can use CRM for accounting to take care of its clients to drive steady revenue, word-of-mouth referrals, and growth.

What is an Accounting CRM?

An Accounting CRM is a dedicated solution for managing client relationships across the entire client lifecycle, from lead tracking and onboarding to document requests and advisory meetings.

It is a centralized hub that brings together all the resources your team needs to efficiently serve clients. By automating routine workflows and consolidating client data, accounting CRM system helps your staff stay organized, reduce manual work, and deliver personalized service without overlooking individual client needs.

A well-implemented CRM enables your firm to maintain and grow relationships through consistent communication, transparency, and quality service.

Unlike generic sales CRMs, which are built to manage leads and close deals, accounting CRMs are designed to support the ongoing delivery of client services. While they still facilitate lead tracking and conversion, their core functionality revolves around client engagement, project tracking, and compliance.

Why Client Retention Matters for Accounting Firms

A good client retention rate shows how well you’re serving and making your clients happy, which makes your firm more attractive and marketable.

Other financial benefits of accounting client retention include:

a. Stable revenue and predictable growth

Recurring clients are a source of predictable revenues, which is important for cash flow planning and the overall business health. When you can count on a steady inflow of income from long-term engagements, you gain the financial insight to make informed business decisions.

The baseline income enables you to plan effectively, hire more staff, and reinvest in technology where necessary.

b. Stronger client relationships lead to referrals

Satisfied clients are usually eager to tell their friends and associates about your services, and this type of referral is organic and builds on the trust that exists between your client and their friends and associates.

This gives your brand social proof, and clients acquired this way are more likely to enter the relationship with a long-term expectation in mind.

c. Higher lifetime value of clients

A retained client doesn’t just bring one year of business; they result in years of recurring work. As their businesses grow, new service opportunities will arise, helping you to upsell them on your other services.

This enables you to get more financial value for the services rendered to a single client over the lifetime of the relationship, rather than constantly chasing new leads.

d. Less time and money spent on marketing

When your firm is at capacity and your client pipeline is full, you’ll devote more of your time to meeting client deliverables, instead of seeking new clients.

Your client acquisition costs also drop. Assuming you spend $800 each to get two new clients, and one stays for two years and the other stays for five years. Getting more of the five-year clients will provide a better return on client acquisition costs while reducing your overall expenses.

7 Ways Accounting Firms Can Retain Clients Using CRM

Accounting firms are using CRM to drive loyalty and sustainable growth due to the ability to:

1. Personalize Client Communication

Success in your client retention effort begins when your clients are confident that you understand their unique business goals and financial situation. Personalized communication helps you to demonstrate that.

Take regulatory updates, for instance, they will apply slightly differently to your clients, depending on their size, industry, and entity type. Your team will need to tailor each email message or call to their specific situations.

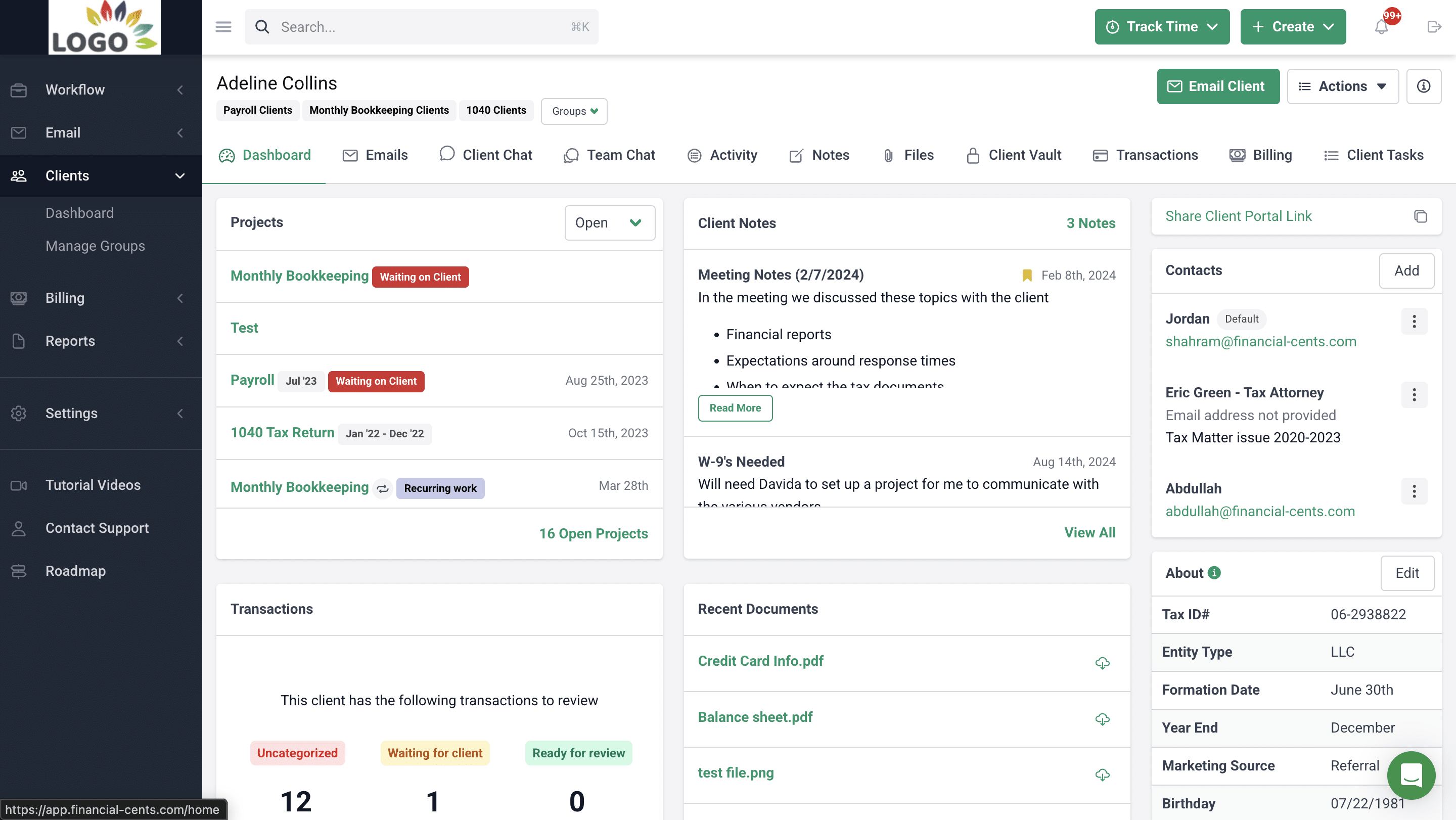

Financial Cents makes it easy to understand and communicate your clients’ specific business needs. The Client Group feature enables you to organize your clients by common attributes, such as tax clients, monthly bookkeeping clients, and payroll clients. This lets you take bulk actions on the clients with similar needs.

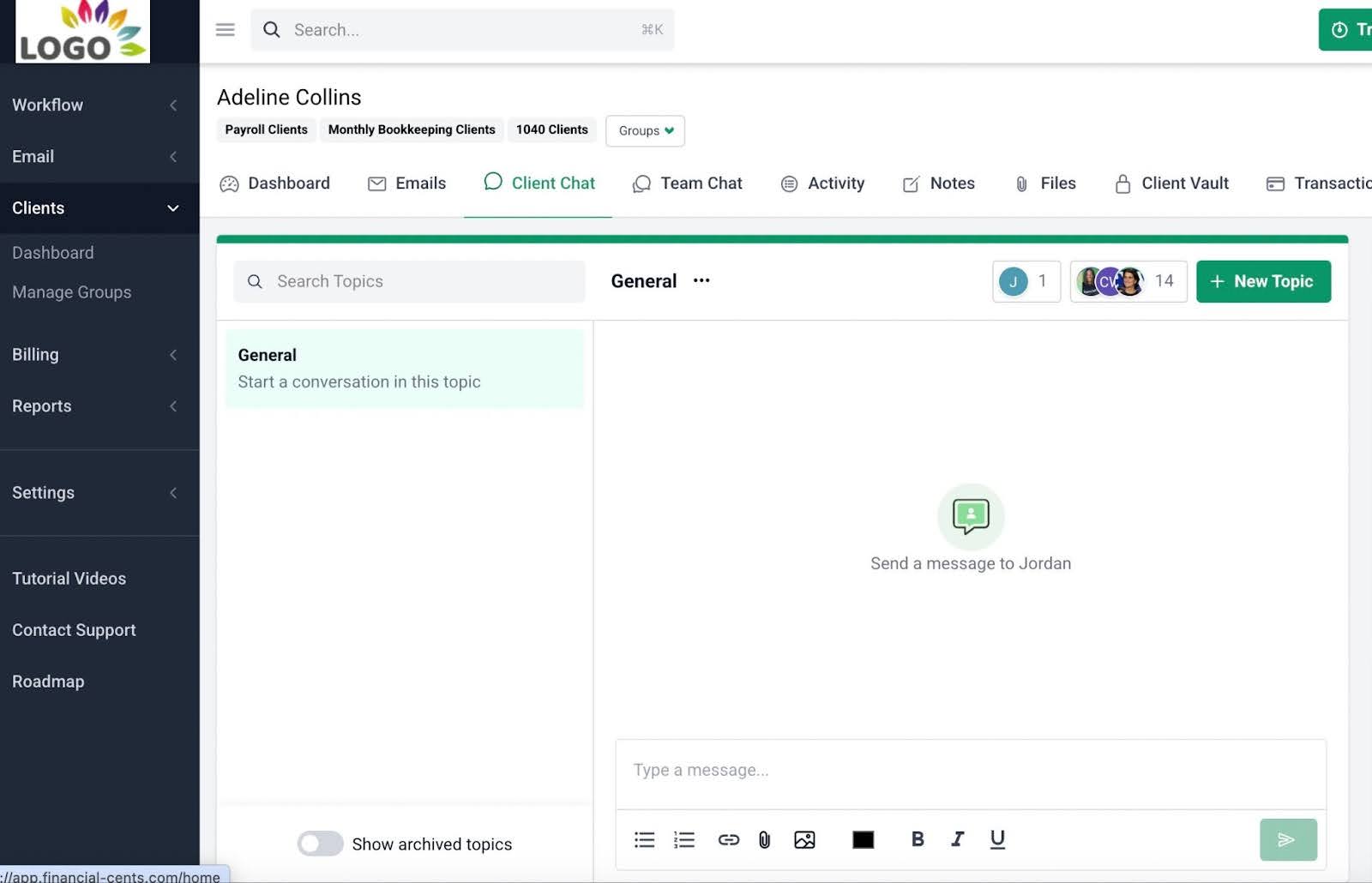

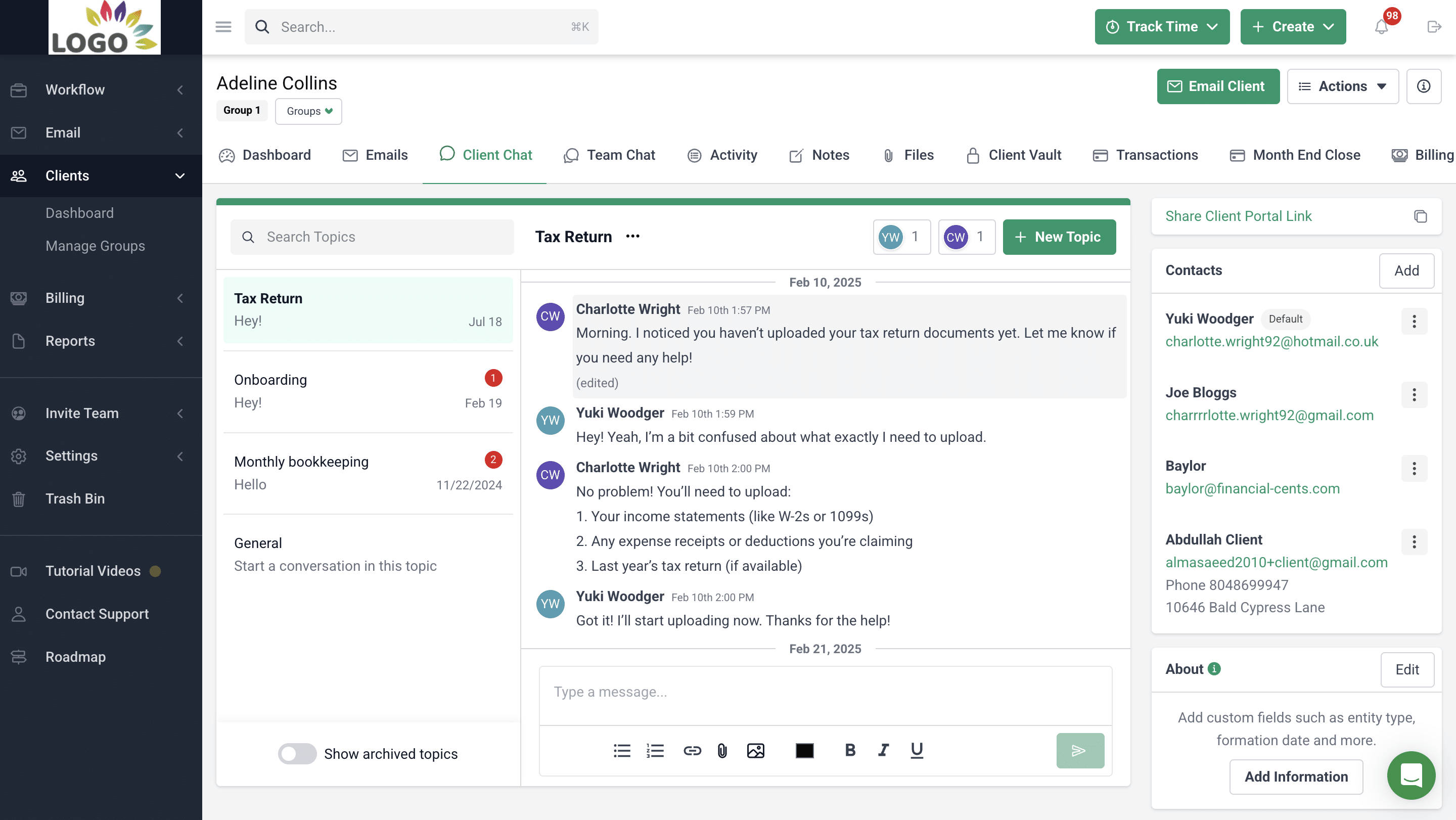

The Client Chat feature allows you to share in-app communication with each client. Conversations can be referenced and grouped into topics to provide adequate context. Relevant staff members from both the client’s company and the accounting team can also be added to these conversations to ensure the right information gets to the right person.

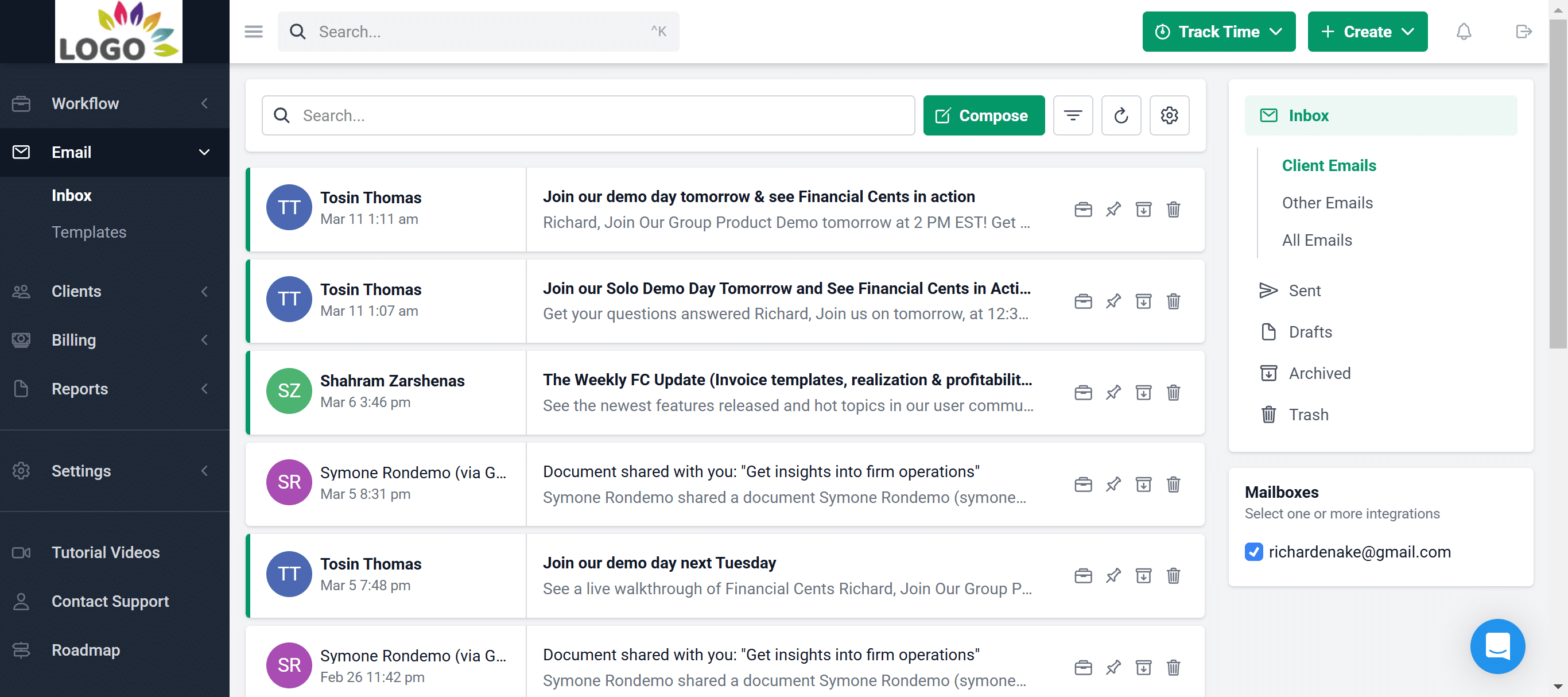

With Email integration, which pulls client emails into the client profile, you need less time and energy to track client emails, and the ability to compose and send client emails from the dedicated inbox in Financial Cents reduces your response time.

2. Centralized Client Information

Access to time and up-to-date client data is key to satisfactory client service. When your client’s information is scattered in multiple places, productive resources are spent retrieving it, and that can compromise service quality.

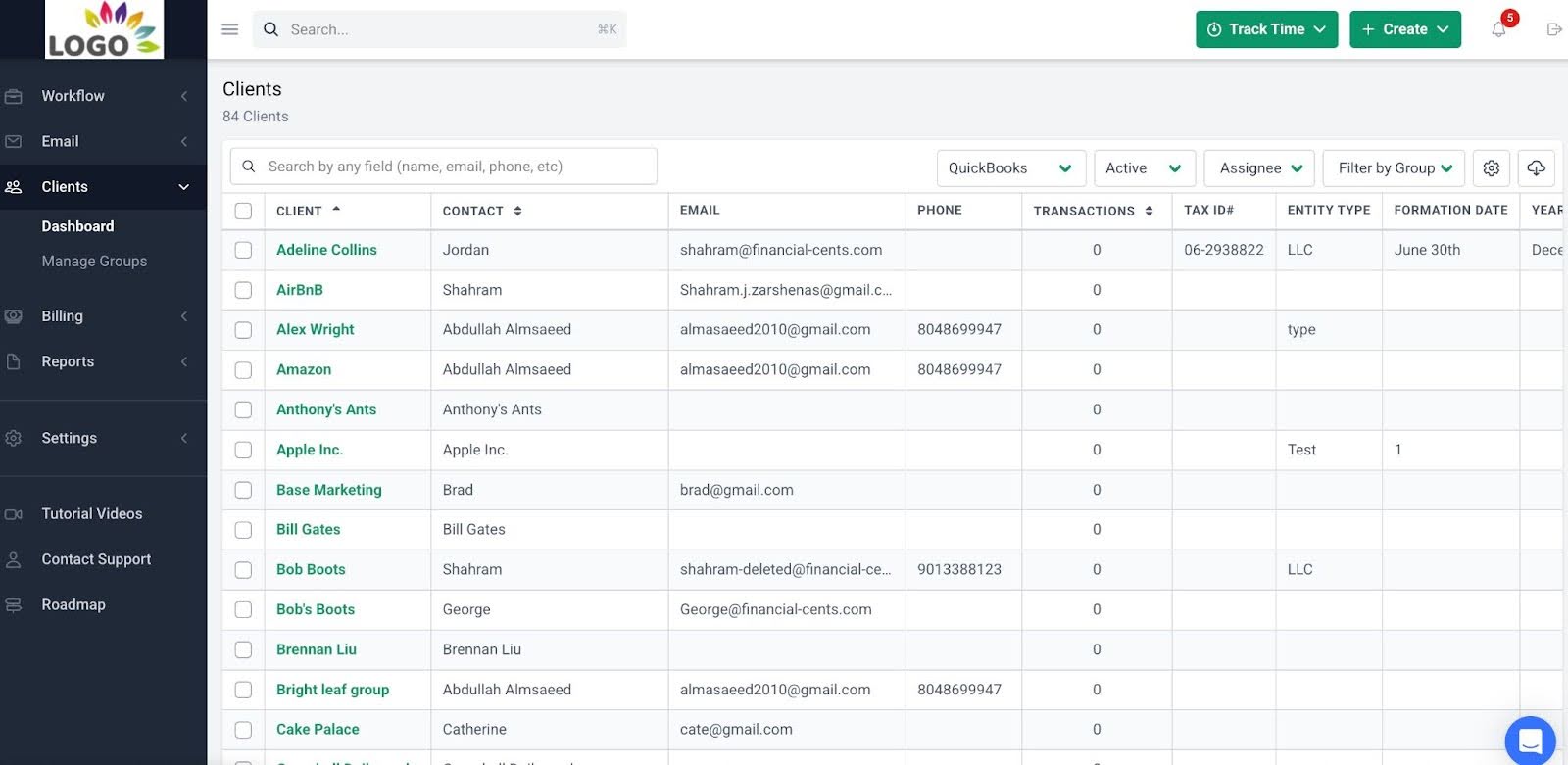

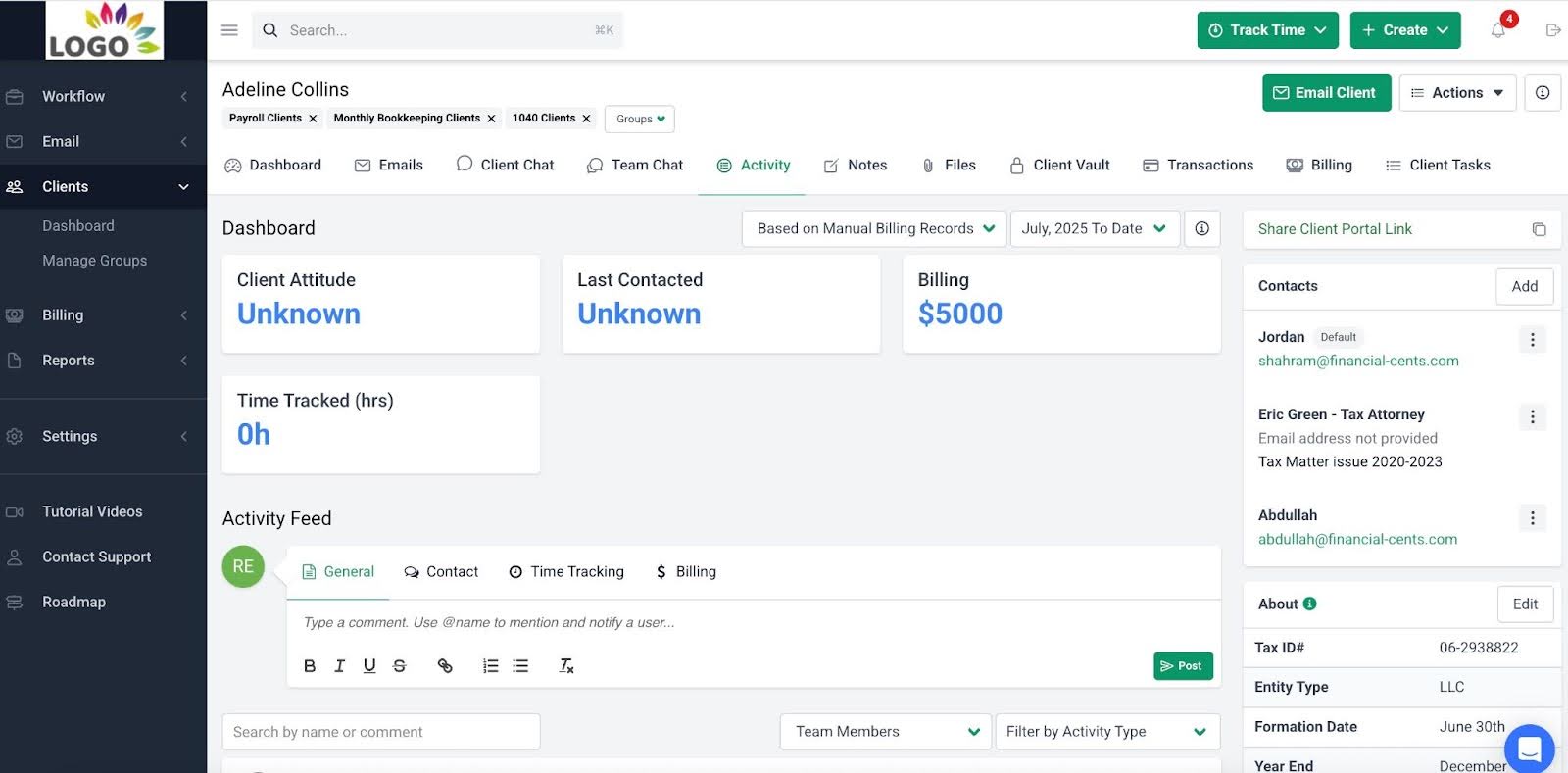

That’s why the Financial Cents client database and client profile come in.

The client database is a register of all your firm’s clients. It contains their essential information, which you can customize to show the high-level information you need your team members to see at a glance.

You can click on a client’s name to see more detailed information about them.

The client profile contains all the information about a client, from contact details to emails, tasks, files, chats, billing history, notes, usernames, passwords, uncategorized transactions, and custom fields (for information that is unique to each client).

This provides a single source of truth to everyone in the firm, saving them the time and effort of digging through spreadsheets, emails, or disconnected tools.

It shows every team member where things stand with any client, which helps them to deliver faster responses, consistent communication, and a smoother client experience.

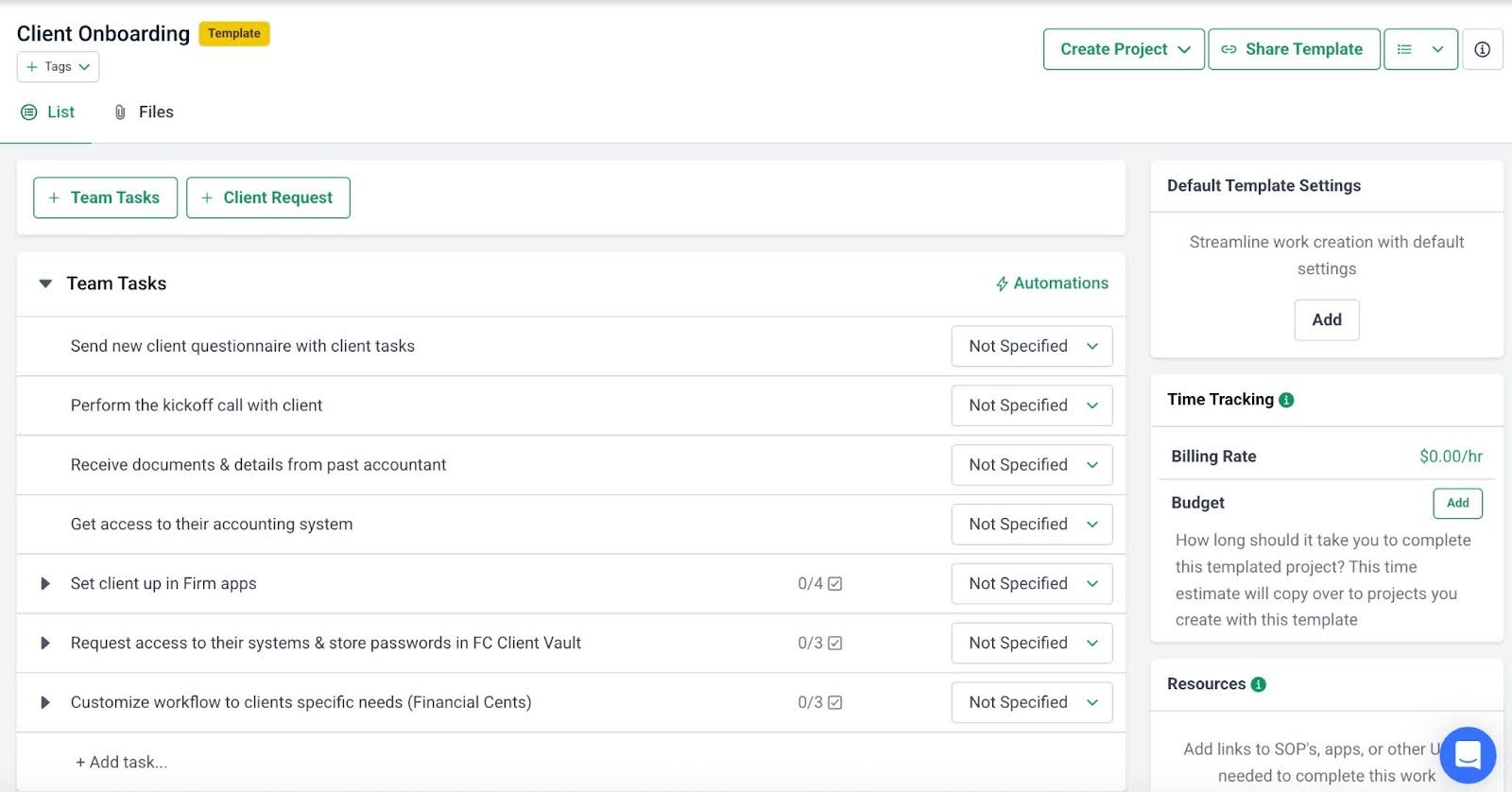

3. Automated Reminders & Follow-ups

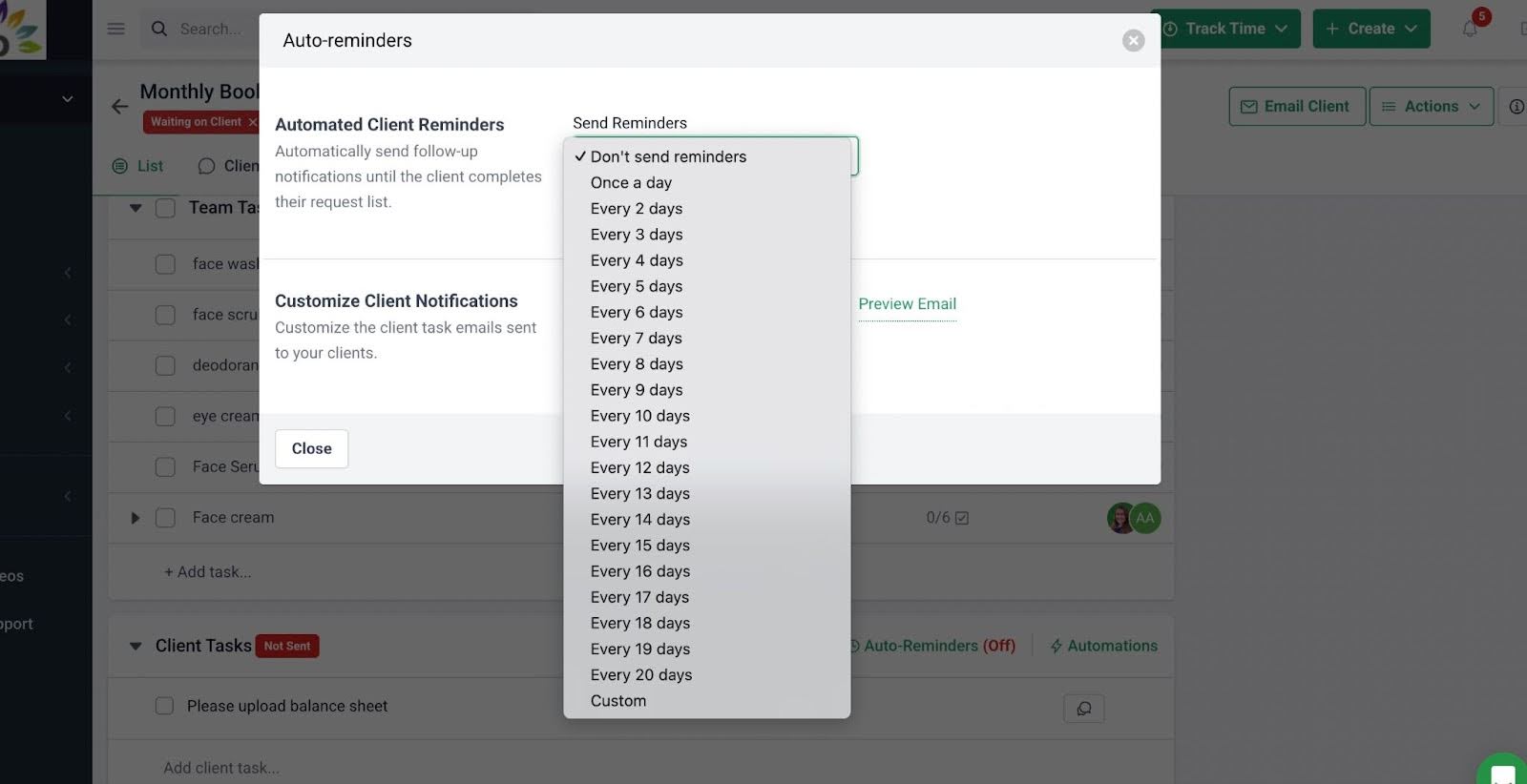

Since the timeliness and accuracy of accounting engagements depend on the client’s response to requests for additional information, finding a way to get their response will help your team to meet clients’ deadlines more consistently.

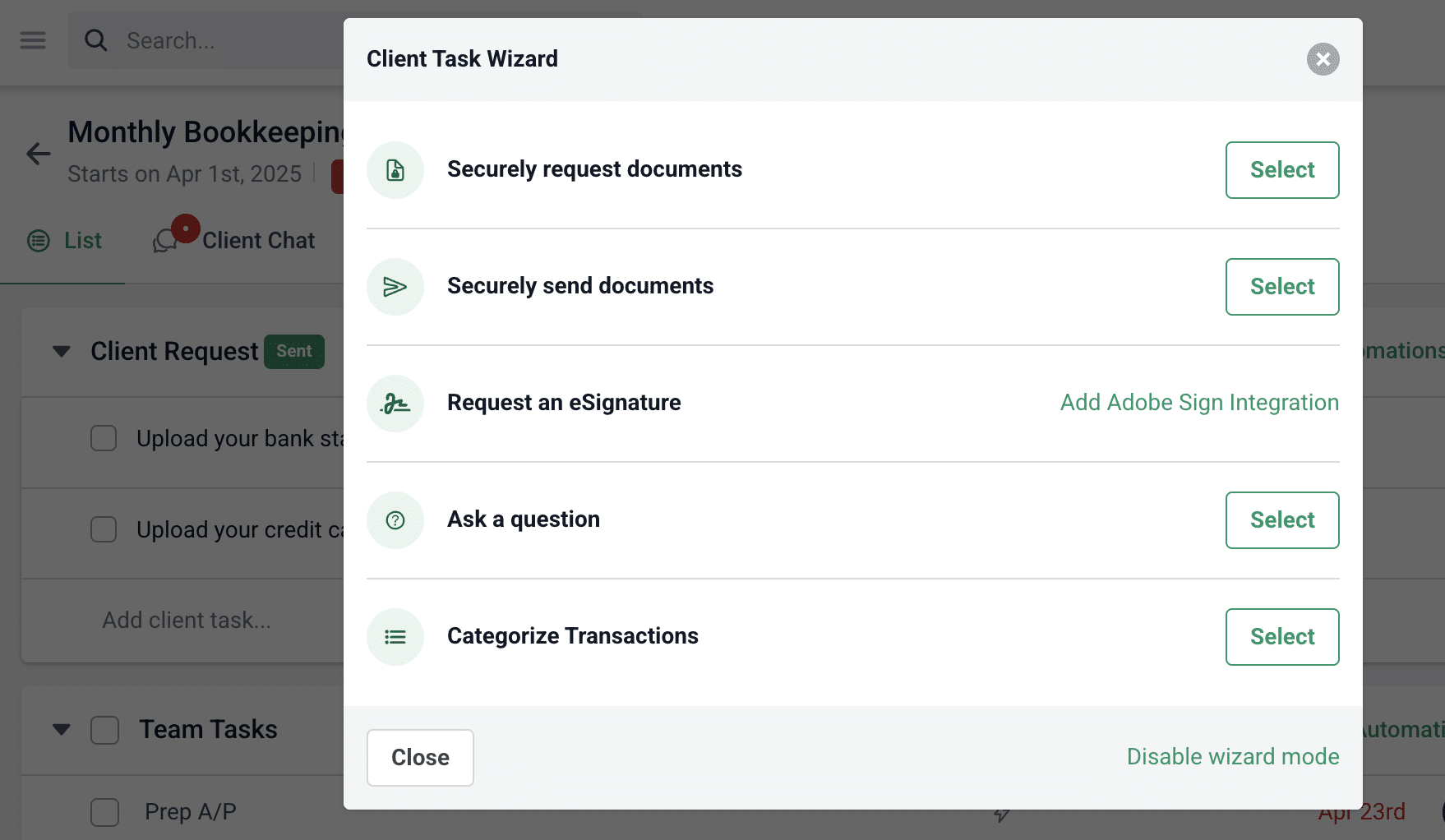

One of the ways Financial Cents helps with this is through the automated reminder and follow-up feature. Combined with the Client Task feature, this allows you to determine how frequently a client should be reminded about your request for information.

When used well, this feature ensures that your clients upload necessary tax documents, review returns, or approve filings with an E-signature on time.

You can even increase response rate using the SMS notification option in Financial Cents to remind them on their mobile phones.

Automated reminders ensure client deadlines are met without your team chasing clients manually.

The client task feature (and the new ReCats) is a time saver. Going out of our project management system to communicate with a client creates too many steps and variables. Automating the recurring reminders to clients helps us save our staff time on drafting emails and following up manually"

Stacey Feldman, CPA, Chief Operating Officer at Full Send Finance4. Proactive Service Delivery

When you’re always a step ahead of your clients’ needs, correcting their mistakes and explaining the impact of recent regulatory changes on their businesses, it’ll be hard for them to consider leaving your firm because they’ll grow to trust you.

It is easier to monitor changes in applicable regulations when you’re not worried about where a client’s file is stored or the quality and timeliness of your services. That‘s where Financial Cents’ CRM features come in, again.

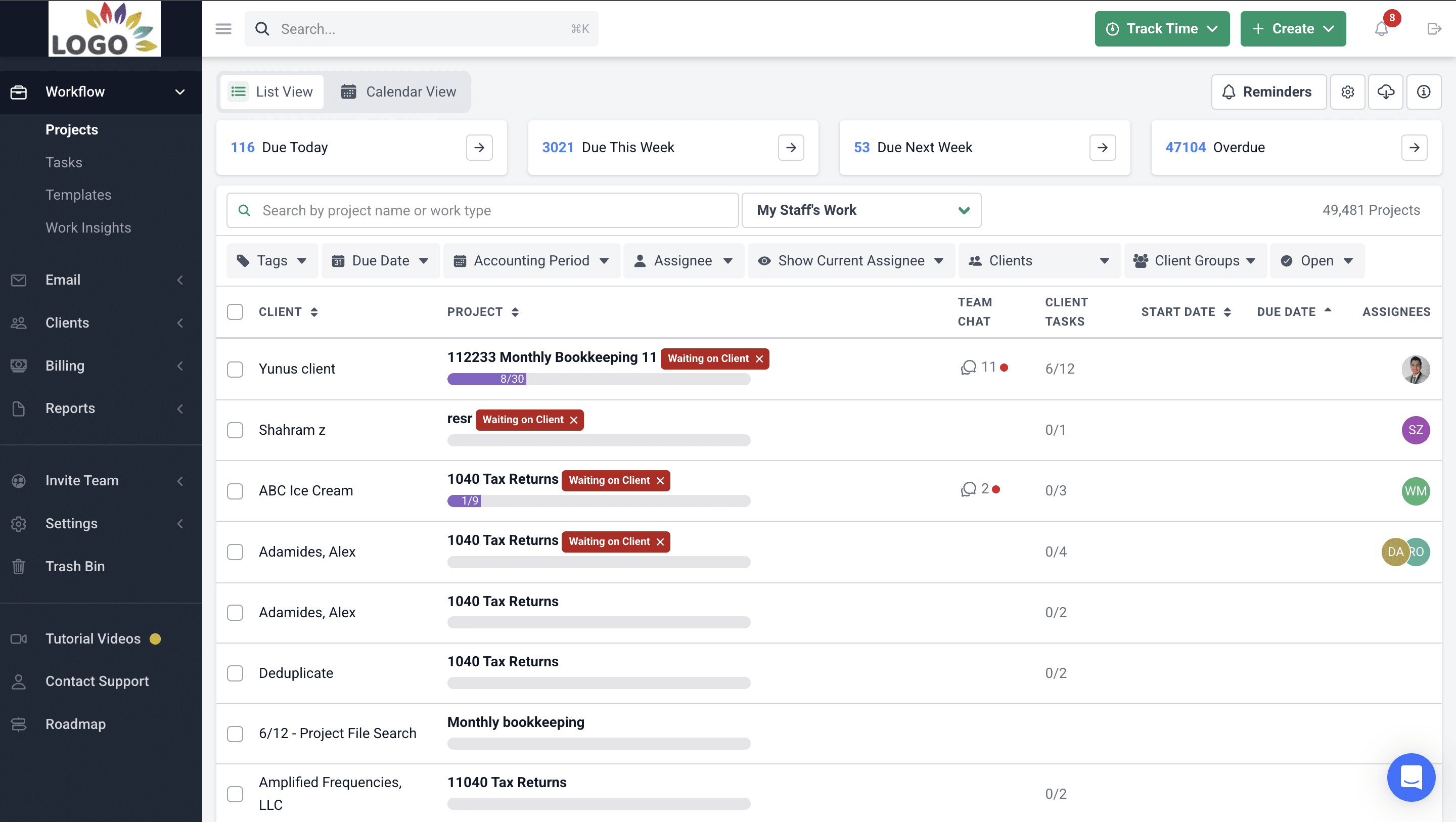

Financial Cents provides you with visibility into current, past, and upcoming client projects, helping you to manage your resources, prevent overwhelm, and keep projects on schedule.

The workflow dashboard shows (in real time) projects that are at risk of missed deadlines and why, helping you to follow up with unresponsive clients, balanced team workload, or any of the other thing that helps to prevent missed deadlines.

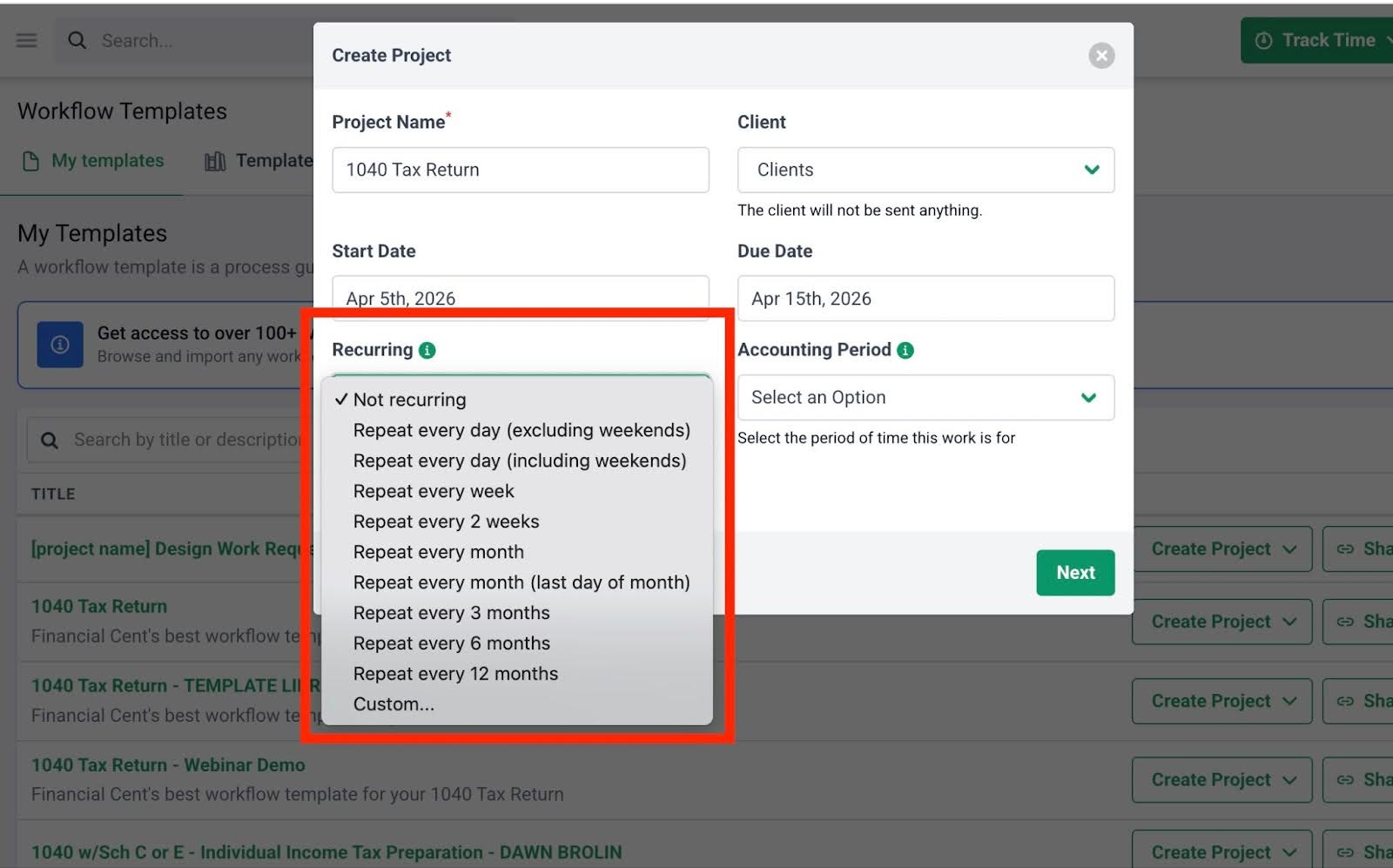

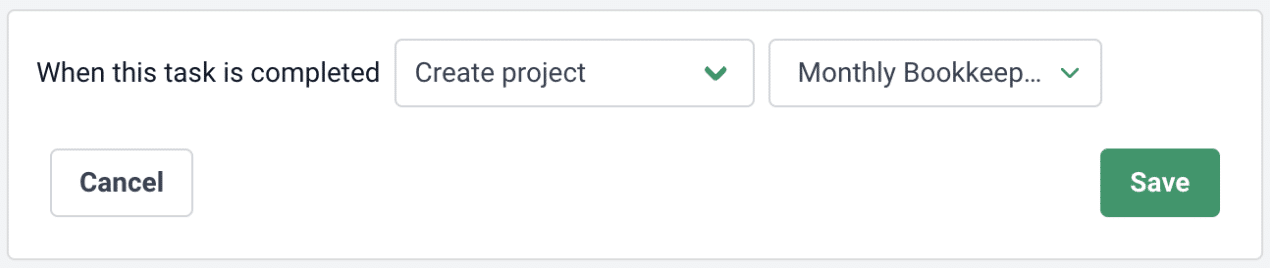

The recurring projects feature also auto-creates the next copy of projects, saving your team the stress of remembering and recreating them from scratch.

These, and other, features in Financial Cents help to ensure that you’re not reactive, but proactive, in your client service.

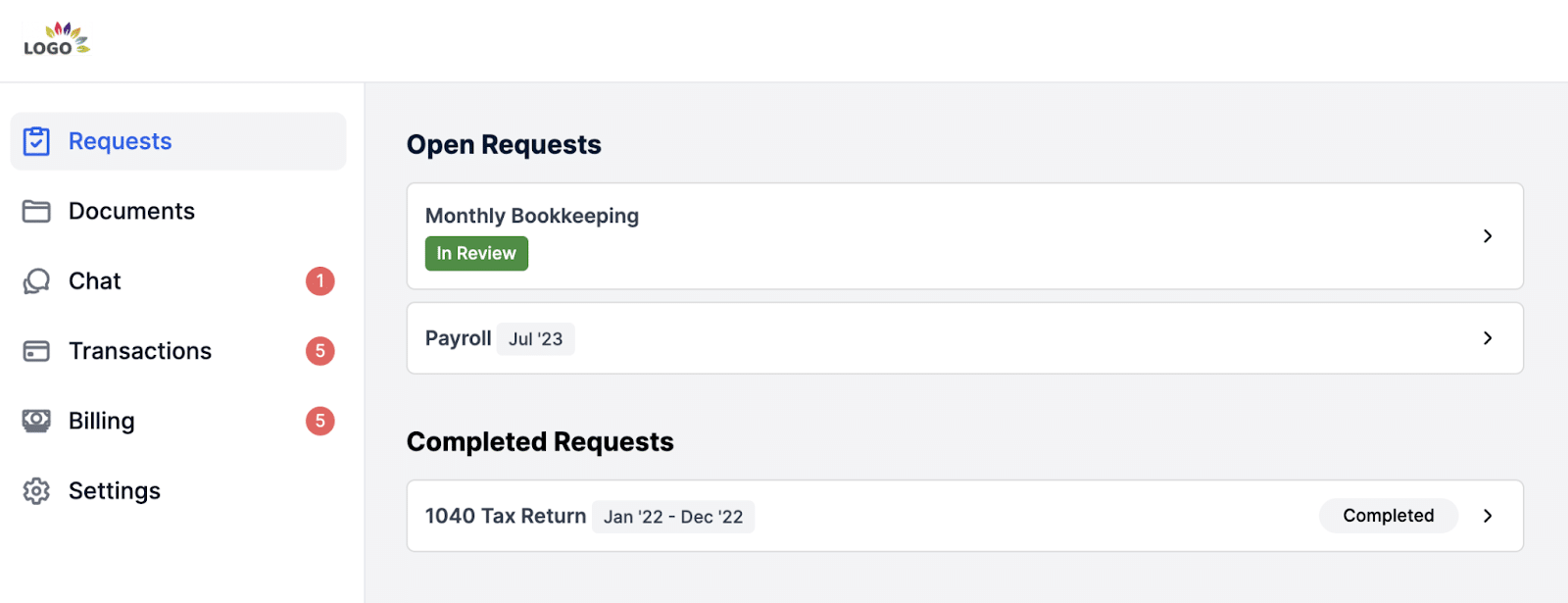

5. Client Self-service & Transparency

As the demand for client self-service and access to their financial data grows, Financial Cents empowers your clients with a secure, user-friendly client portal to upload documents and communicate with your team.

Apart from document upload, the client portal enables clients to view and approve documents and monitor their payment history independently.

The Financial Cents tag feature also helps you to make the status of projects client-facing. That allows your clients to see where their work stands without needing to ask your team members.

Its folder-sharing feature enables clients to share documents that do not necessarily relate to any project with your team.

Even better, the Financial Cents client portal does not require a password. Clients do not have to struggle to create or maintain another set of login information, and that makes it more convenient for them.

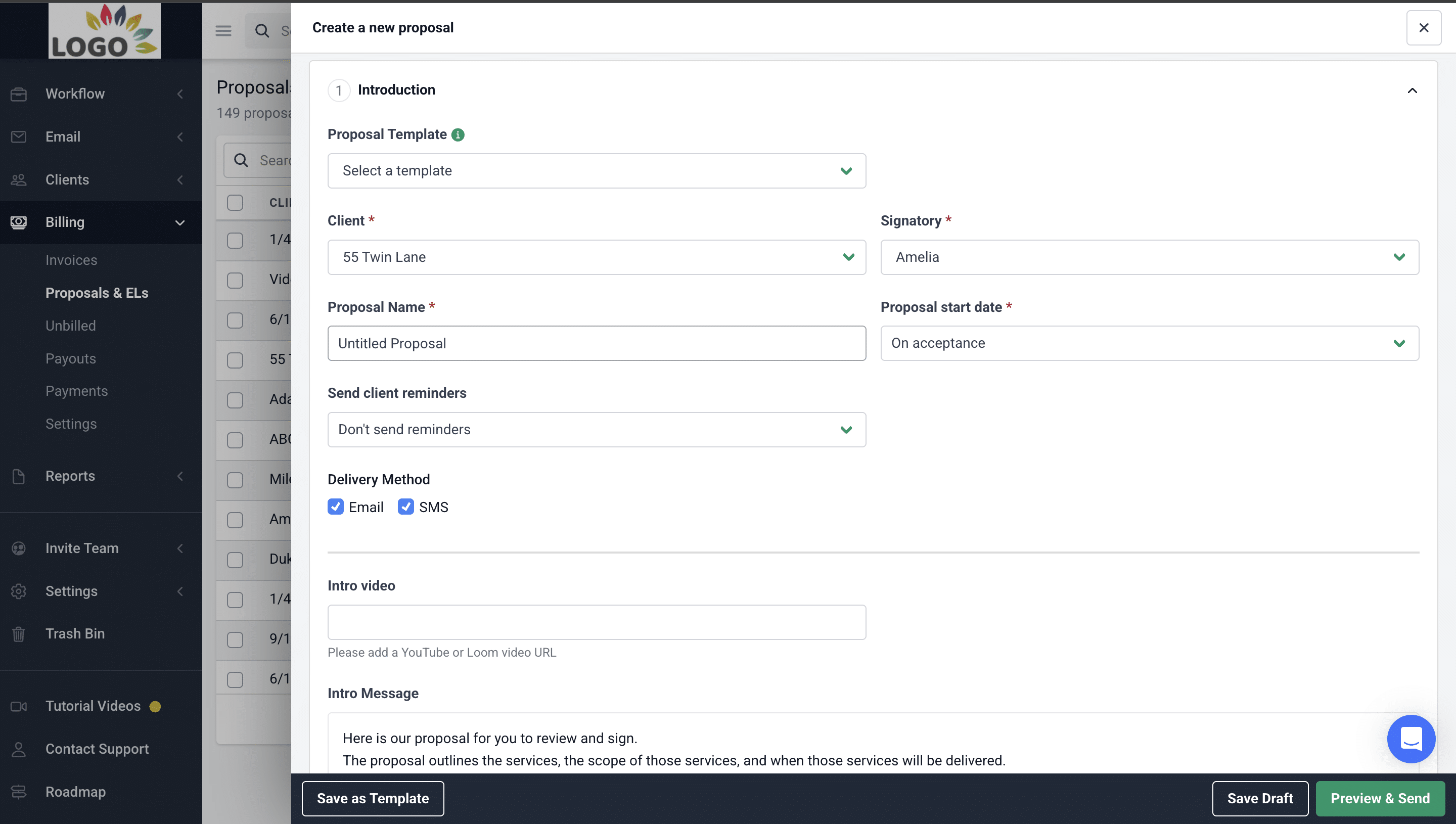

6. Streamlining the Client Onboarding Experience

A smooth onboarding process helps clients understand your services and sets them up in your systems, which is the foundation of a successful client relationship.

In Financial Cents, the onboarding process begins with the ability to create modern proposals, complete with E-signatures. The proposal and engagement letter feature enables you to define project scopes and align expectations with your clients, helping you to prevent instances of unmet needs that can harm the quality of the client relationship sooner rather than later.

Financial Cents accounting client onboarding templates help your staff collect and provide every necessary information that helps new clients to settle into your firm as seamlessly as possible.

Some firm owners use the Saved Payment Method feature to store the client’s payment information on file, saving them the stress of providing this information each time, which can negatively impact their experience.

The integrated Client CRM auto-populates the client’s profile with signed details and projects in the accounting workflow management solution.

The Optional Upsell feature enables you to sell complementary services to new clients, increasing your revenues.

These onboarding features demonstrate organization, enhance client conversions, and impress the new clients from day one.

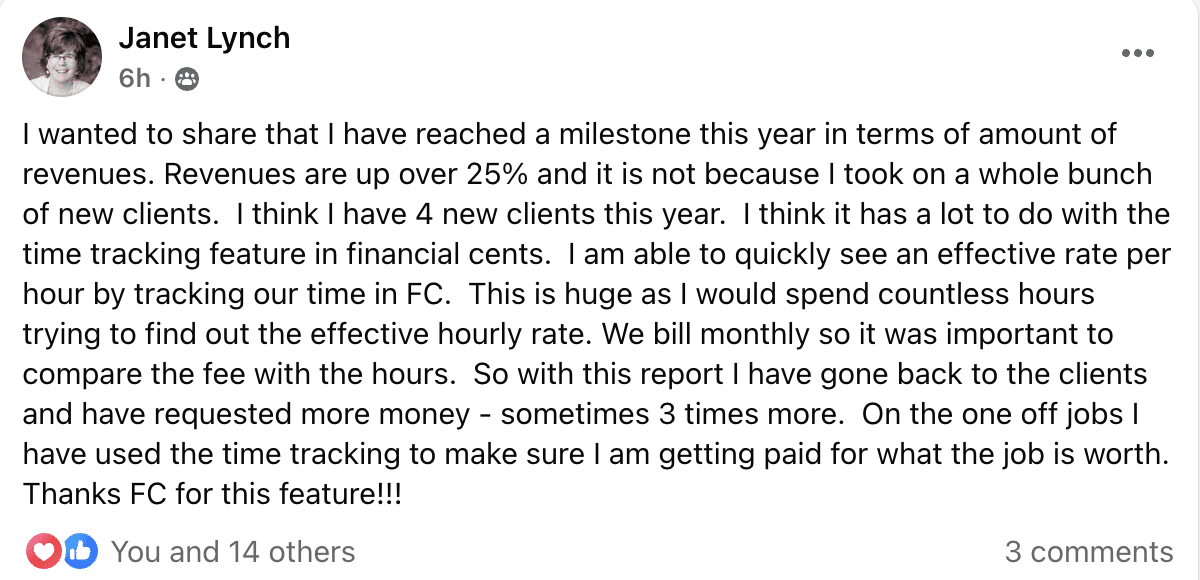

7. Data-driven Insights

Financial Cents helps us figure out capacity planning and when we need to hire another person. Because we set our capacity to 32 hours a week for all of our full-time staff, and if everybody is hitting 32 or more hours of scheduled projects every week, then we know that we're late in hiring. Ideally, we would bring in another person when everybody is consistently at about 28 hours of productive time."

Shannon Ballman Theis, Founder of Payroll RestorationTracking and analyzing your client engagement data shows you where clients are not getting sufficient value from your firm.

Your ability to identify these areas and make necessary adjustments communicates your commitment to your clients, making them feel seen, heard, and valued.

That is why accounting firm owners use Financial Cents’ reporting features to remove guesswork from their client engagement.

For example, the Effective Hourly Rate Report compares the revenue generated from each of your clients with the resources invested in their projects. This helps you increase your pricing and profitability, making it easier to go the extra mile for your clients.

Similarly, the Capacity report helps you see which team members are already overworking so that you can lighten their workload and enable them to support your clients effectively.

Best Practices for Using Accounting CRM Software to Improve Retention

The best client retention strategies combine a suitable CRM tool with the right processes and consistent execution to strengthen client relationships, simplify operations, and deliver proactive service.

Here’s how to achieve that:

-

Standardize communication templates

My top productivity and efficiency tip is, ‘do not write the same email twice.’ Start creating templates for these repetitive emails that you always send to clients, so that with time, that email that always takes you about two minutes is now only going to take a few seconds and clicks to send, and those minutes that you save will amount to hours by the end of the year."

Jessica Fox, Owner of Florida Virtual Bookkeeping LLCApart from saving time, standard communication templates enable your team to interact with clients with a consistent tone of voice. That is how you distinguish your messages in the multitude of other messages your clients receive every day, making it easier for your clients to identify and connect with your emails.

You can achieve this by building accounting email templates in Financial Cents for your team members to tailor to each client when needed. This allows your team members to communicate in one voice, instead of speaking with their unique voices, which will distort your firm’s messaging.

One of the time-saving benefits of these templates is simplicity, which makes it easier for your staff to communicate with clients as needed.

-

Train staff on CRM usage

Client retention efforts fail when every staff member uses the accounting CRM software differently. For example, everyone needs to understand how to pin client emails to a project, log client interaction, and send automated email updates to clients.

Otherwise, someone somewhere will skip these steps, and it will reflect negatively on the quality of the client’s experience.

That’s why firm owners who train their staff members stand a better chance of achieving 100% team adoption, preventing the bottlenecks and information silos that cause most accounting team members to abandon software solutions.

-

Automate recurring touchpoints

Lack of adequate client communication makes your clients feel undervalued, but keeping in regular touch is also a time-consuming task.

That is why automating recurring touch points is so helpful. It makes your clients feel supported even without manual efforts from your team.

Identify all tasks that require client communication, such as reviews, document reminders, and tax season updates, and create a reminder to auto-notify clients at a predefined time.

This will keep clients connected to your firm while reinforcing your reliability.

-

Regularly review CRM reports to measure engagement and satisfaction

Without data, your client management efforts may be worse than they seem, and vice versa. So, regardless of your feelings about your performance, analyze the data in your CRM tool to be certain.

With the Financial Cents reporting feature, you can track client engagements and client task reports in real time, enabling you to make informed decisions.

Data, they say, don’t lie, so if you see that a client hasn’t been contracted for some time (through the Activity Timeline feature), you can take steps to engage with them.

Failure to review these data regularly will result in reactive client retention efforts, when you should be steps ahead of their business needs.

How Financial Cents Helps Firms Retain Clients

Financial Cents is designed to help accounting firms consistently meet client deliverables through:

i. Centralized client info & documents

Financial Cents stores all files and information related to each client in the client profile. Here are some of them and what they organize:

- About Section: Custom fields for storing all the important information about a client, such as their Tax ID, birthday, and industry-specific tax updates.

- Activity Timeline: Shows who on your team last spoke to the client, when, and what was discussed.

- Client Groups: Put clients into categories for visibility and automation.

- Client Tasks: Displays all requests your team expects the client to grant.

- Client Notes: Important updates that help to meet client deliverables effectively.

- Client Vault: This service stores the client’s passwords and usernames in a secure vault and allows you to open the apps from Financial Cents.

- Contacts: Store all your client contact information.

- Upcoming Projects: All the services your team is scheduled to provide for a client.

- Recent Documents: All the documents related to each client and their projects are organized in one place.

- Relationships: Link related clients for better visibility.

This centralization eliminates the confusion of scattered spreadsheets, email threads, and non-accounting CRMs. It allows your team to retrieve the information they need to complete tasks and respond to client requests quickly and confidently.

ii. Automated client requests & reminders

Financial Cents automates client data collection and reminders to save you the stress of chasing clients by phone and email.

These automated requests can be pre-set in the workflow templates to automatically go to the client whenever a project is created from that template.

All things being equal, your team will have the necessary files and information waiting inside the project when they are ready to complete their tasks.

This prevents delay and enables the team to serve clients to the best of their abilities.

iii. Client communication tracking

Financial Cents enables you to track client communication in several ways: the dedicated client folder, client chat, Activity Timeline, etc.

Financial Cents integrates with Gmail and Outlook to pull all emails your clients send to your firm (any of your team members) into their client profile. This gives your team a single place to track and respond to client emails. Emails can also be pinned to relevant projects to improve the quality of client service.

The Client Chat feature also centralizes your team’s conversations with clients inside the app. This saves your team and clients the stress of dealing with emails and repeating the same questions several times.

The Client Audit Trail feature allows accounting teams to log client interactions, facilitating effective and continuous client communication.

iv. Secure client portal

Financial Cents’ Client Portal balances clients’ convenience with data security. It saves clients the burden of maintaining login information while using a unique combination of codes to provide secure access with magic link technology.

Its data encryption technology renders information in the client portal useless and inaccessible to unauthorized persons.

This enables clients to share information and track their projects and payments on demand.

Overall, clients can manage requests, chats, uncategorized transactions, shared folders, billing, and proposals in the client portal.

V. Workflows that prevent client tasks from falling through the cracks

Financial Cents’ workflow dashboard ensures real-time project tracking, making it easier to identify and attend to projects that are approaching their deadlines.

The task assignment feature shows who to hold responsible for delays, and the tag automation feature displays the cause of the delay, helping you eliminate bottlenecks on time.

Additionally, the workflow automation feature enables you to automatically create a project when a task or section is complete in a client’s work. This prevents tasks from being forgotten.

Build Client Retention Through Consistency and Care with Financial Cents All-In-One Client Management Features

While any firm can occasionally deliver great client services, the true test of its client retention efforts is whether it can keep its clients engaged and satisfied in and out of season.

Doing this takes more than guts and guesswork. It requires automation, structured workflows, and real-time visibility into the status of each client relationship. That is why accounting firm owners, like Dawn Brolin and Lori Hawkins, have built scalable accounting client management systems using Financial Cents’ client relationship management (CRM) solution.

Financial Cents organizes every client touchpoint (onboarding, communication, service delivery, regulatory notices, etc.), making it more transparent and proactive.

It prevents context-switching and enables you to focus on tasks that truly improve client relationships. The result? Happier clients, higher retention rates, and a more predictable way to grow your firm.

Manage and retain clients effectively with Financial Cents CRM. Click here to start a Free Trial.