Always look to leverage integrated systems. As you see the progression of things in the industry, you're going to need to make changes to your systems and processes.

One of the key reasons we switched to Financial Cents was the connection with SmartVault.

We could have remained in our previous workflow tool and used workarounds, but when you can leverage a system that is already integrated, you're going to be able to manage your tasks, your data, and documents more profitably."

As the bar for what constitutes satisfactory client services continues to rise in the accounting industry, the cost of operating in manual systems or disconnected apps is getting too high.

Successful firm owners are quick to spot the signs:

- Lack of visibility into the status of client work.

“I asked, ‘Where is Client X at?’ and no one could answer me.”

- Missing deadlines

“Things were falling through the cracks, and clients and staff were getting annoyed.”

- Spending more time on admin tasks, instead of clients’ work.

Responding to these signs with the right accounting technology is why 67% of firm owners in this survey are now experiencing smoother and more organized processes.

This is not just about buying accounting apps that can solve individual challenges. It’s about creating a connected system of apps, which allows data to flow and tasks to be automated across the board.

This article shows the categories of apps you need for a smooth-running tech stack and explains how to align them so every tool serves its purpose within a unified system.

What Is an Accounting Firm Tech Stack?

An accounting firm’s tech stack is the collection of software applications and digital tools the firm uses to manage its projects, clients, team, and every other aspect of its operations.

These tools are carefully selected for their ability to integrate and communicate with other relevant apps in the stack, which enables the accounting team to perform most of its tasks from one tool.

This is how, for example, invoices (in the billing tool) can be automatically generated from the time (in the time tracking software) spent on projects (in the workflow management software).

With that, the team wouldn’t have to manually enter this data, saving time, minimizing errors, and creating consistency across the firm’s processes.

So, it’s not just about having software. It’s about how the tools work together to support every part of your workflow. The accounting tech stack uses the hub-and-spoke model, where individual apps (spokes) connect to the central app (the hub) from which financial processes can be tracked.

A disconnected set of tools creates silos: staff waste time switching between applications, re-entering data, or chasing files that don’t sync properly, leading to inefficiency, errors, and client frustration.

Why Your Firm Needs a Strong Tech Stack

A. Improved efficiency and automation

A well-integrated tech stack keeps you from spending valuable time on manual tasks.

It minimizes, if not eliminates, tasks like manual data entry, bank feeds, and client reminders to enable your team to focus on understanding and applying their accounting expertise to clients’ financial situations.

B. Better client experience

Rising client expectations require accountants to be more available to help their clients navigate market opportunities with expert advice.

Your team can only make time for such services when it delegates time-consuming work, like scheduling tasks, tracking client emails, and chasing clients for outstanding documents, to the software.

C. Easier compliance and audit readiness

Top accounting tools are built with compliance in mind. They ensure secure and adequate process documentation in line with relevant security standards.

Software also uses validation rules and automation to reduce human errors. For example, solutions like QBO make financial records accessible in a centralized system, where they can be audited.

D. Scalability and growth

Automating your processes using the right blend of technology solutions gives you time to serve more clients without increasing operational costs.

It also enables collaboration when firms grow into multi-location entities by centralizing key information and allowing teams to tag each other.

What Should Be in Your Accounting Tech Stack?

1. General ledger accounting software

The general ledger accounting serves two main purposes: (1) the recording, classifying, and organizing of clients’ financial activities, and (2) generating financial reports from the financial records.

It centralizes financial information to enable accountants to collaborate with clients in the cloud and automates manual tasks, like data entry, invoicing, and reporting. This frees accountants up to focus on analyzing and advising clients based on the financial reports.

Top general ledger software includes accounts payable and cash receivable features, but they are not the primary purpose.

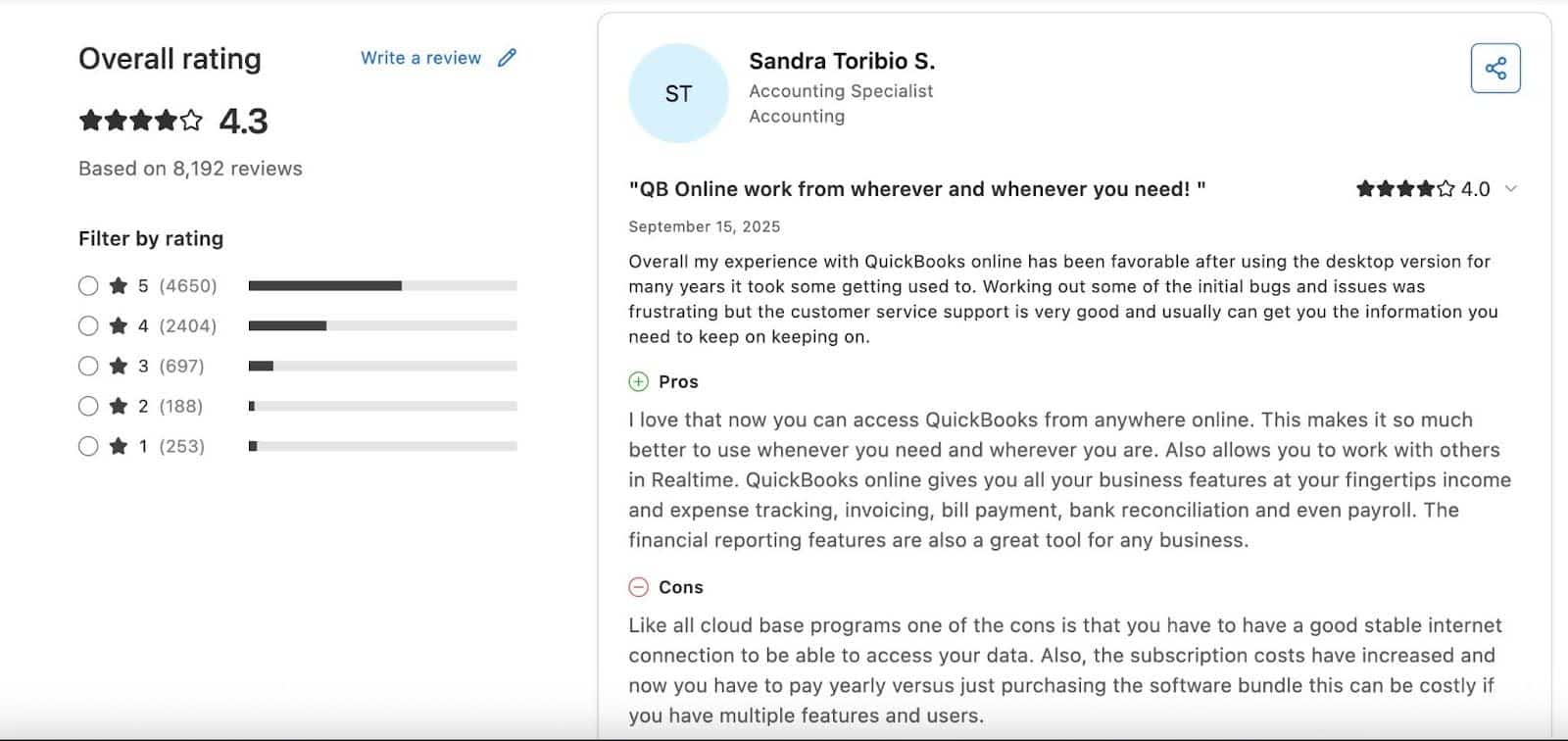

QuickBooks Online

QuickBooks Online provides a centralized platform for accounting firms to manage their clients’ financial activities, from generating invoices to tracking expenses, to performing reconciliations and running financial reporting.

Clients can access their financial records to provide information about invoices, receipts, and payments, increasing collaboration and transparency.

Notable QBO features include:

- Income and expenses tracking

- Recurring invoices

- Inventory tracking

- Payment matching

- Late-payment reminders

- Scheduled reporting

Pros:

|

Cons:

|

- Pricing: QuickBooks Online starts from $19/month.

- Free Trial: Yes

Featured Customer Review

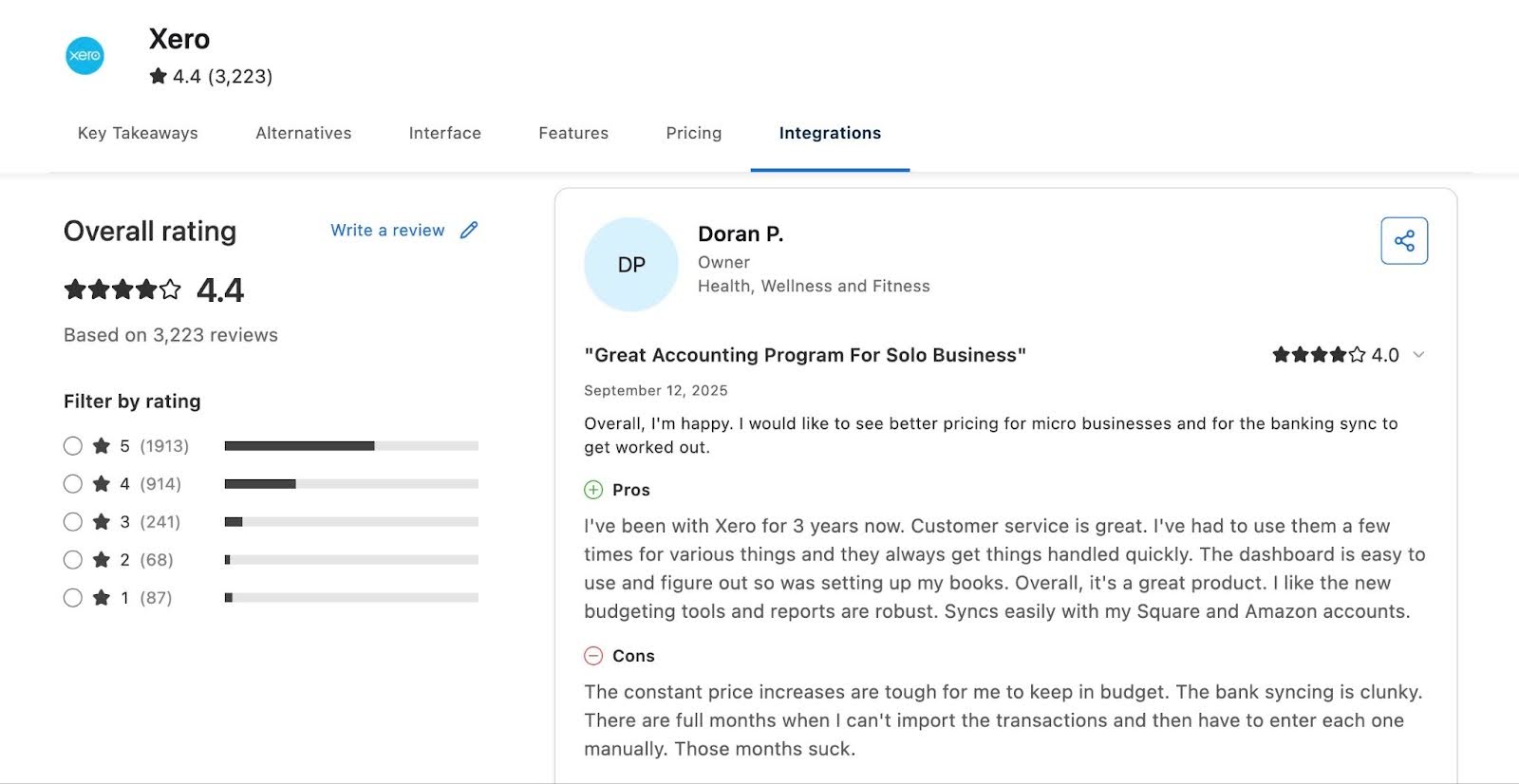

Xero

Xero is a general ledger software that simplifies bookkeeping and enhances collaboration between accountants and their clients by automating invoicing, bank feeds, and reconciliations.

Its unlimited users and multi-currency support make it ideal for accounting firms that have multiple shareholders involved in financial operations.

Notable Xero features include:

- Online Invoicing

- Bank Connections

- Bank reconciliations

- Payment processing

- Payroll processing

Pros:

|

Cons:

|

- Pricing: Xero starts from $29 per month.

- Free Trial: Yes

Featured Customer Review

- Pricing: Xero starts from $29 per month.

- Free Trial: Yes

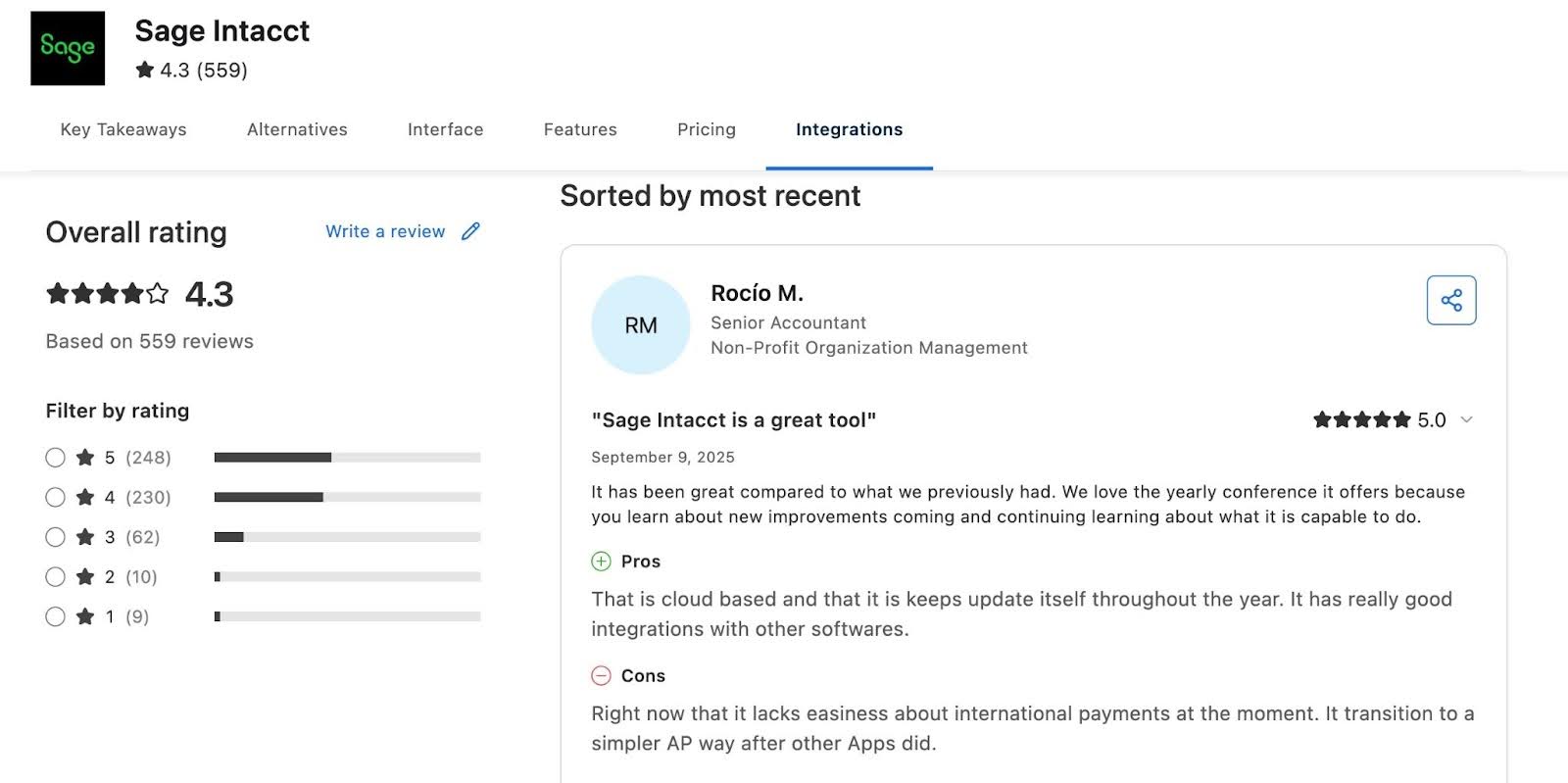

Sage Intacct

Sage Intacct is an accounting software that streamlines consolidations, automates intercompany eliminations, and manages complex compliance requirements for growing mid-sized firms and enterprises.

It provides advanced features like multi-entity accounting, revenue recognition, and industry-specific reporting, which enable accounting teams to build tailored dashboards and track key performance indicators (KPIs).

Notable Sage features include:

- Project accounting

- Subscription management

- Intuitive budgeting

- Dashboards and reporting

Pros:

|

Cons:

|

- Pricing: Sage Intacct has a custom pricing

- Free Trial: Yes

Featured Customer Review

2. Expense management

Expense management software helps businesses and the accounting firms that serve them to track, approve, and reimburse business expenses efficiently.

Instead of relying on paper receipts or messy spreadsheets, these tools automate expense capture, categorize transactions, enforce policies, and integrate directly with general ledger software.

That way, it reduces manual data entry, improves visibility into client spending, and simplifies reporting.

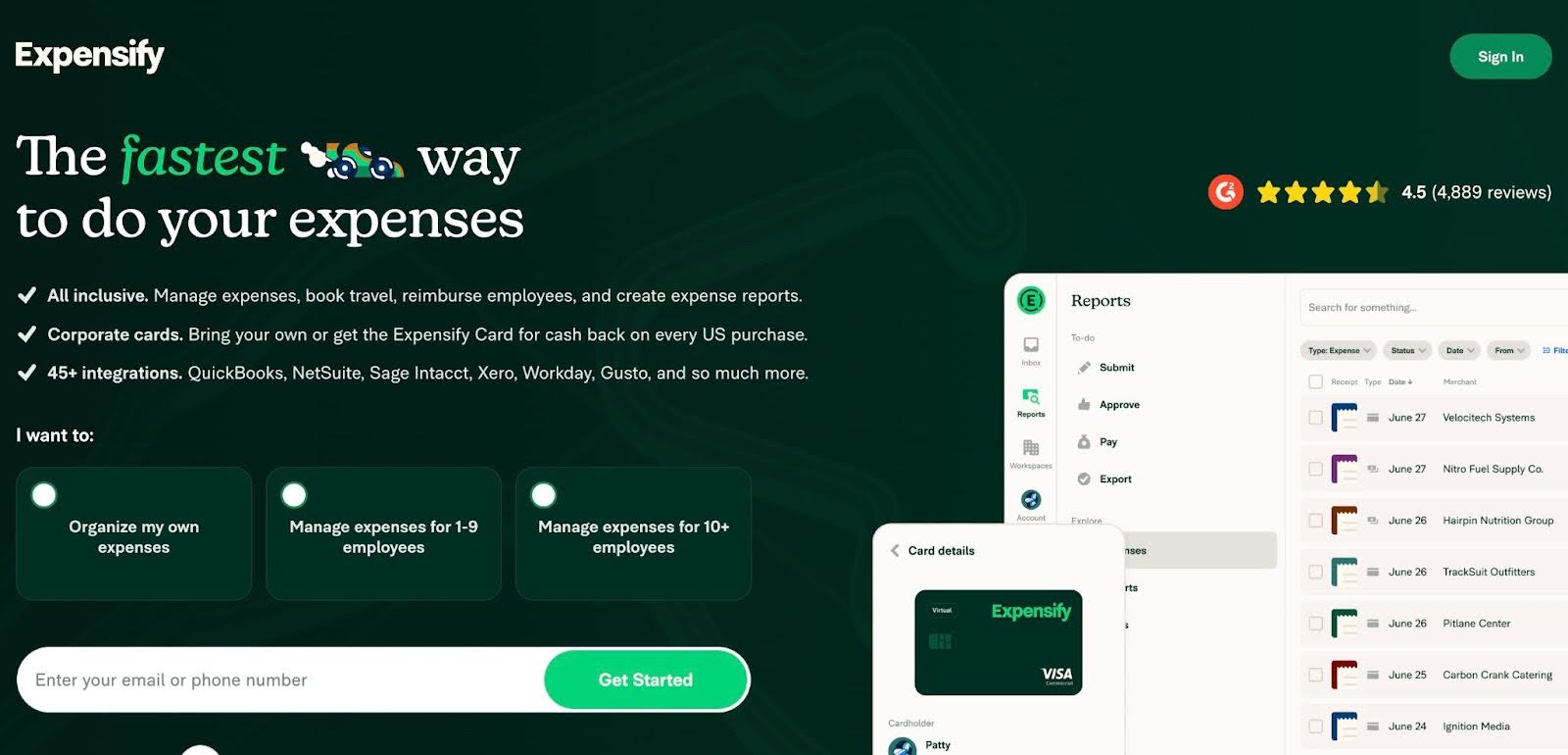

Expensify

Expensify automates expense reporting by enabling users to snap receipts while optical character recognition (OCR) technology reads and categorizes them.

This increases the speed and accuracy of expense capture, spend management, and reimbursements.

Notable Expensify features include:

- Expense management

- Travel

- Receipt scanning

- Corporate card imports

- Expense reports

Pros:

|

Cons:

|

- Pricing: starts from $5 per member/month

- Free Trial: Yes

Featured Customer Review

Bill Spend and Expense (Formerly Divvy)

Bill Spend and Expense helps accounting firms and businesses to combine corporate credit cards with automated expense management to tighten their control over expenses.

It minimizes the delay between expenses and reporting by providing cards for staff and departments and syncing transactions to the expenses management solution in real-time. This improves visibility into finances.

Notable Bill Spend and Expense features include:

- Business credit

- Expense management

- Budget management

- Virtual cards

- Reimbursements

Pros

|

Cons

|

- Pricing: Free

- Free Trial: Yes

Featured Customer Review

3. Practice management

Practice management software helps accounting firms manage every aspect of their firms: projects, workflows, deadlines, team capacity, client information, etc.

It centralizes information to keep everyone on the same page and automates manual tasks to help accounting teams regain time. Generic practice management software caters to all industries, and accounting practice management tools are built for the needs of the accounting industry.

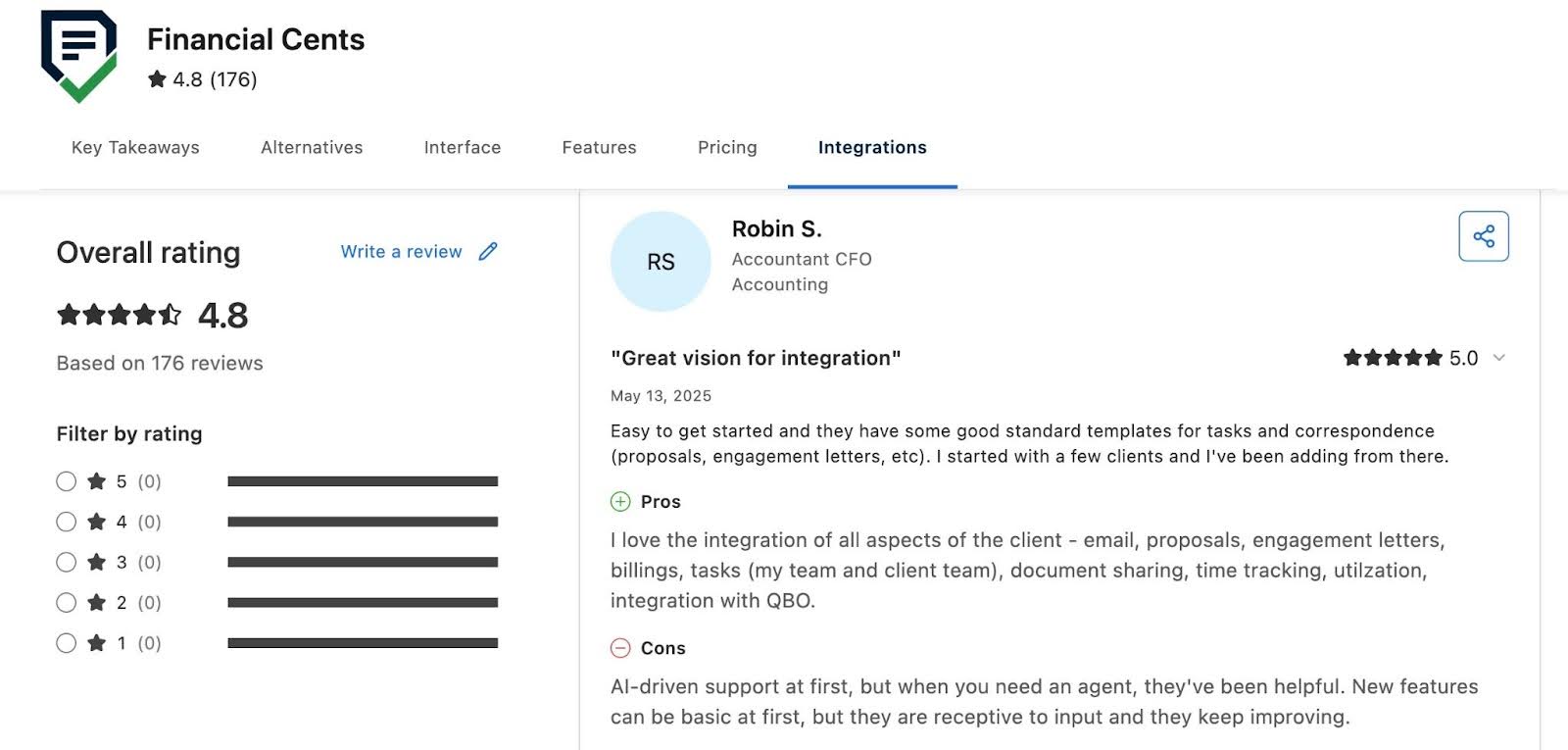

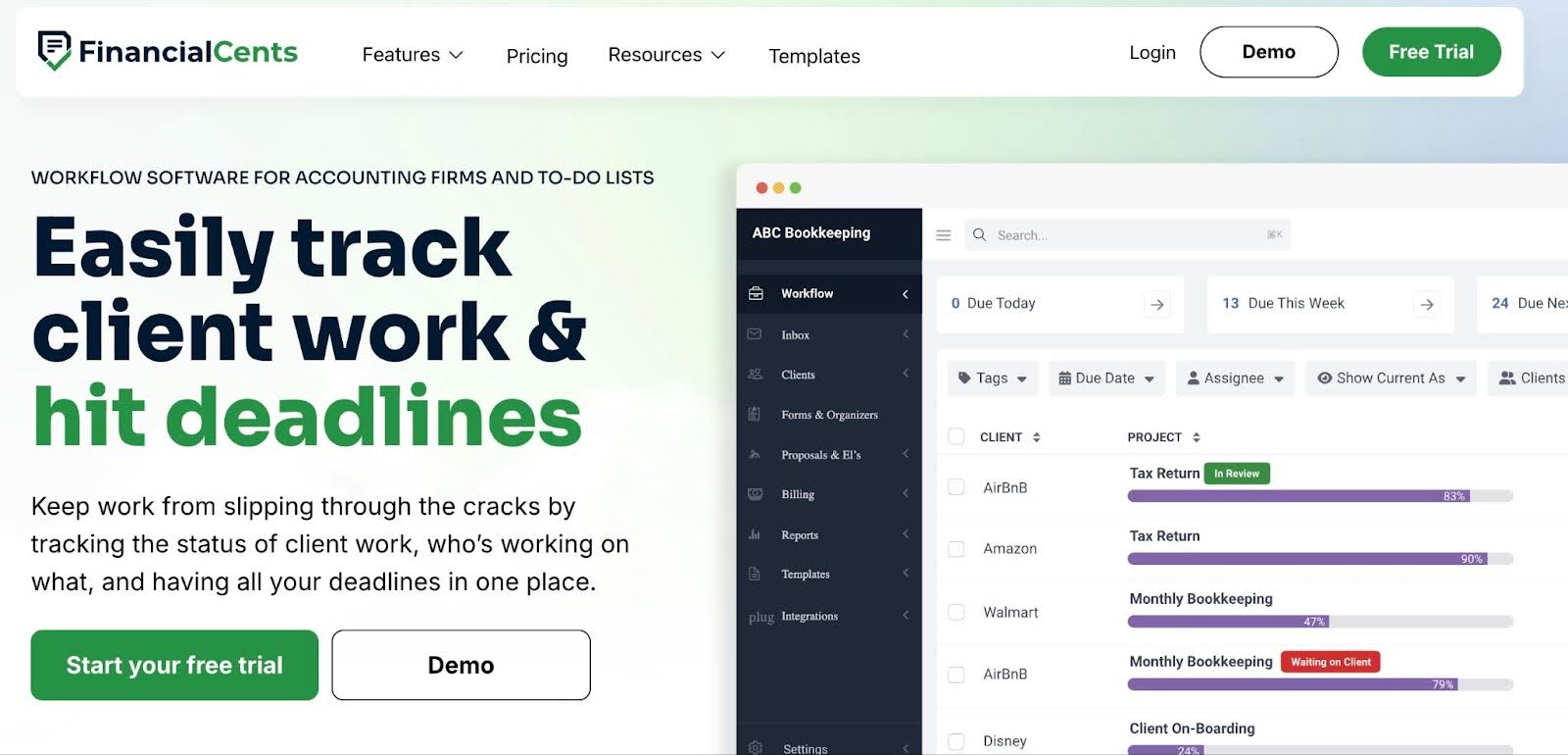

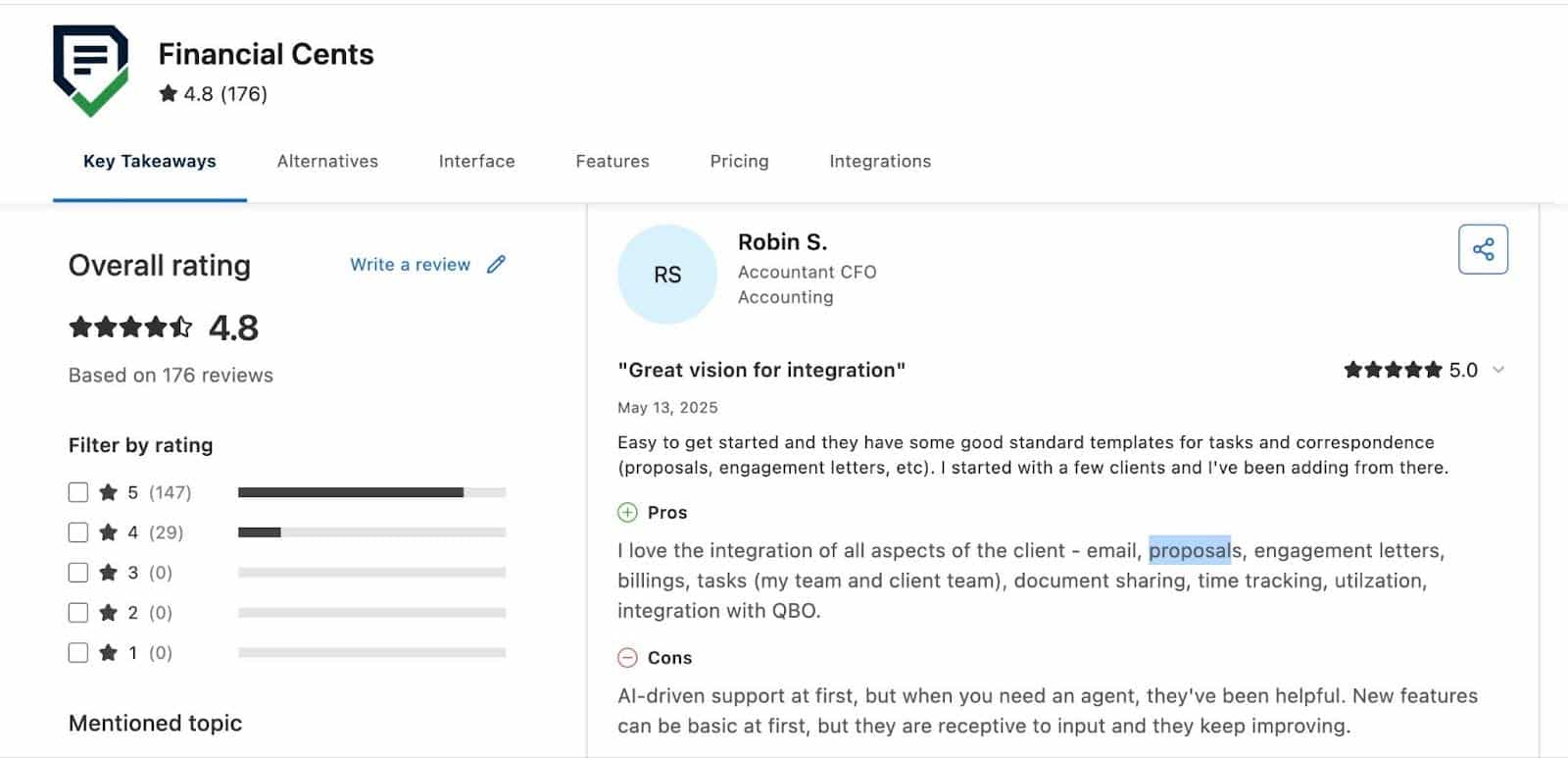

Financial Cents

Financial Cents is an accounting practice management software that helps firms organize their projects, teams, and client information in one central place to improve collaboration while automating manual tasks to hit deadlines faster.

Its blend of a clean and simple interface with advanced, all-in-one features makes it suitable for both small and large firms.

Notable Financial Cents features include:

- Workflow management

- Workflow automation

- Time and Billing

- Accounting CRM

- Capacity management

- Document management

- Proposal and engagement letter

Pro

|

Cons

|

- Pricing: Starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free Trial: Yes

Featured Customer Review

4. Client relationship management (CRM)

A CRM tool manages accounting firms’ client relationships by centralizing client data, tracking communications, and automating client management tasks to improve the quality of client engagements.

It provides a single source of truth for all the information that accounting firms need to personalize client services and communication.

Liscio

Liscio is a client communication and document sharing tool that allows accounting firms to send sensitive documents and respond to client requests to ensure satisfactory client service.

By providing one secure platform to manage client engagements, Liscio eliminates the back-and-forth in client interactions, saving firms the time of chasing after clients’ documents and reducing the security risks associated with sharing confidential information by email.

Notable Liscio features include:

- Timeline

- Secure messaging

- Client tasks

- File sharing

- Smart tax gathering

Pros

|

Cons

|

- Pricing: Starts from $49/month per user

- Free Trial: Yes

Featured Customer Review

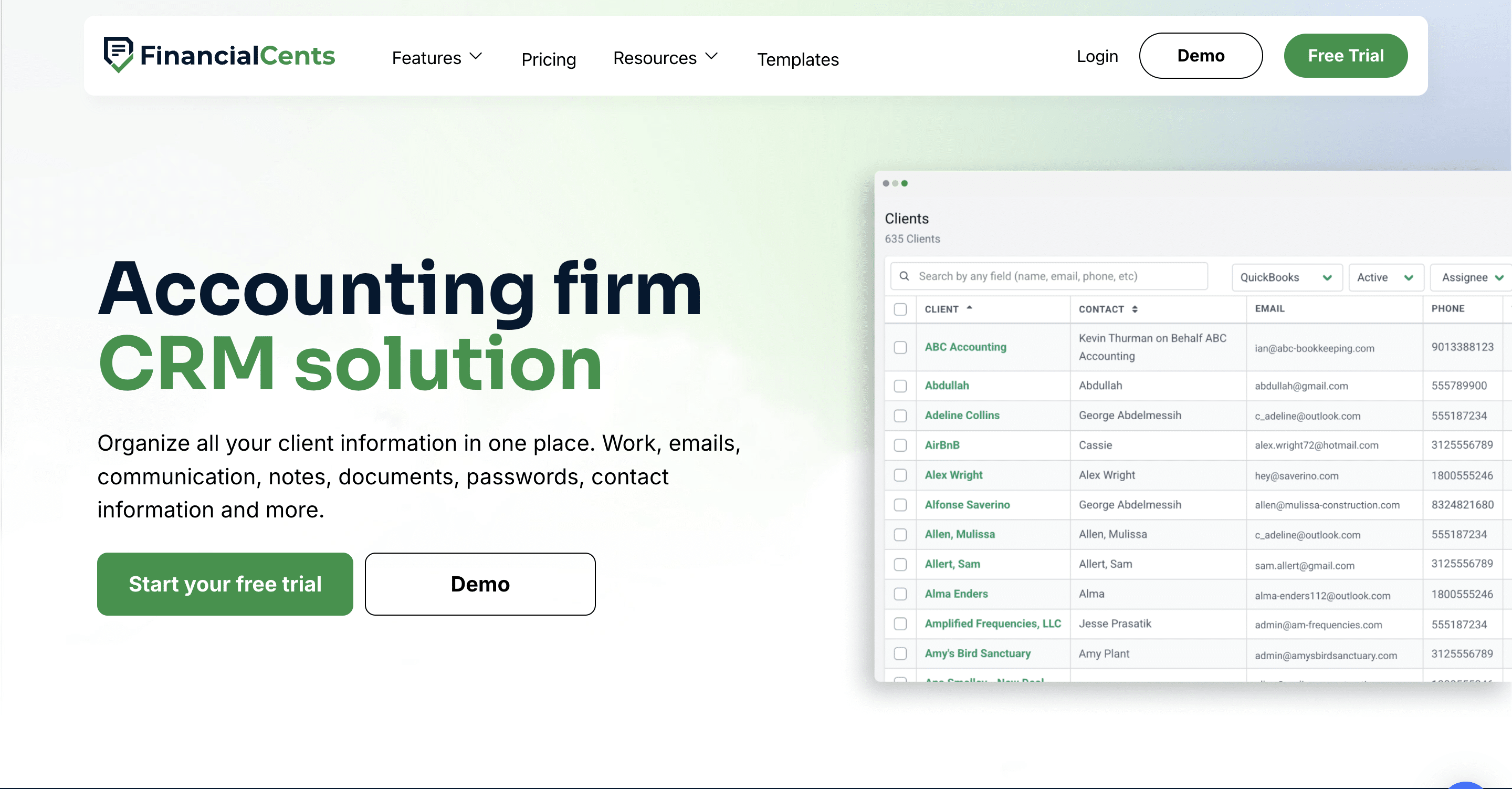

Financial Cents

Financial Cents accounting CRM System provides accounting firms the advantage of managing client relationships alongside their projects, instead of switching between a separate project management and CRM tool.

The client profile contains all information relating to each client an accounting firm is serving, such as contact details, client emails, client notes, interaction history, entity type, formation data, EIN, SSN, and passwords. This gives the team one place to access all the information they need to deliver satisfactory client service.

Notable Financial Cents CRM features include

- Contact information

- Client chat

- Client projects

- Files

- Client vault

- Client group

- Custom fields

- Billing

- Uncategorized transaction

Pros

|

Cons

|

- Pricing: starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free trial: Yes

Featured Customer Review

6. Payroll

Payroll software uses automation to reduce your reliance on manual data input in the process of paying your clients’ employees and contractors, calculating taxes, and filing payroll tax forms.

Because human input is minimal, these tools ensure greater accuracy of payroll output, helping you to keep your clients compliant with relevant labor laws.

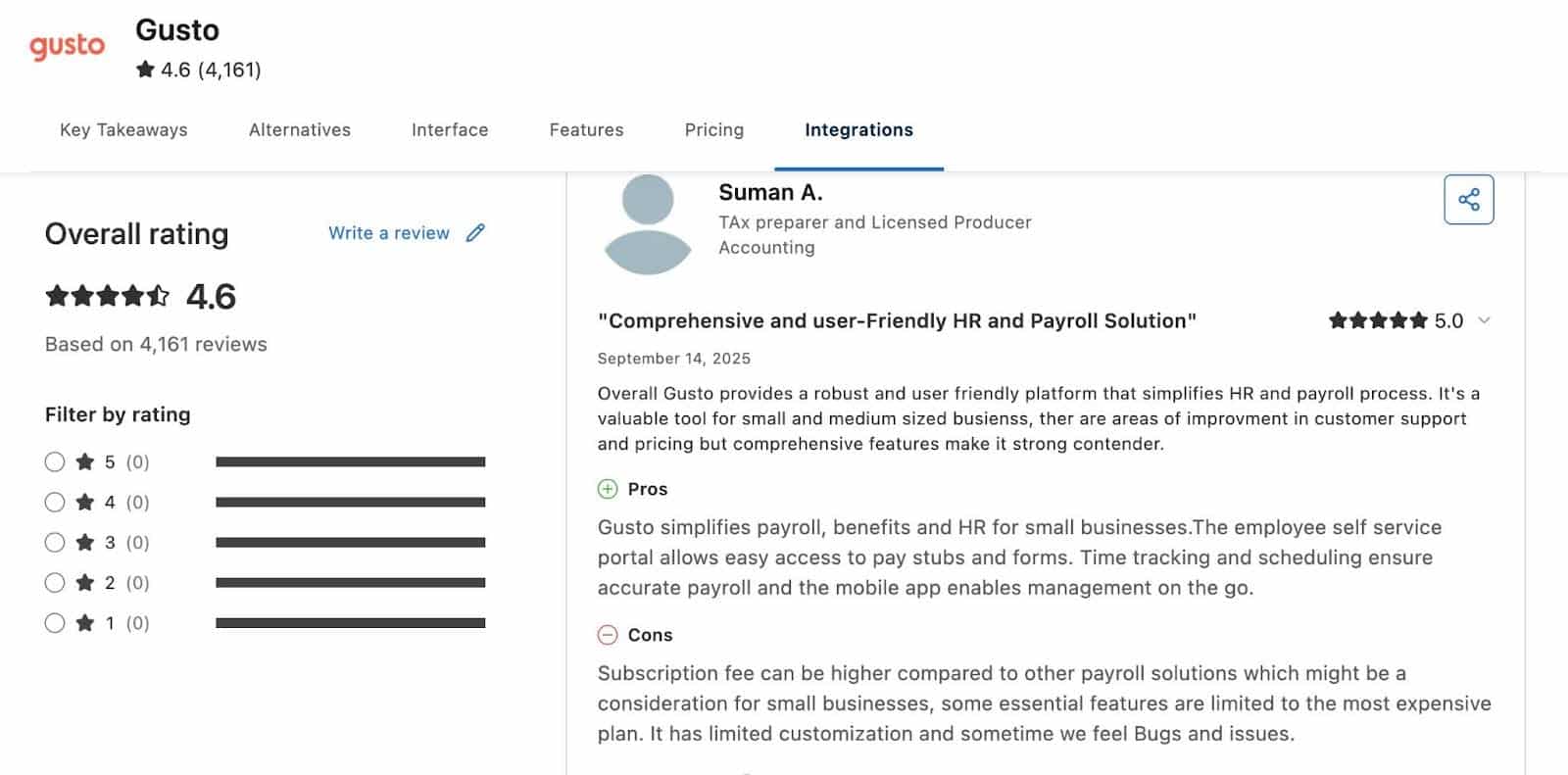

Gusto

Gusto is a payroll and HR software for small and mid-sized businesses that want to automatically run payroll, file payroll taxes, and manage employee benefits effectively.

The tool provides an accountant dashboard that makes it easy to manage payroll for multiple clients in one place.

Gusto’s notable features include:

- Time and attendance

- Hiring and onboarding

- Talent management

- Insights and reporting

Pros

|

Cons

|

- Pricing: Starts from $49/month

- Free Trial: Yes

Featured Customer Review

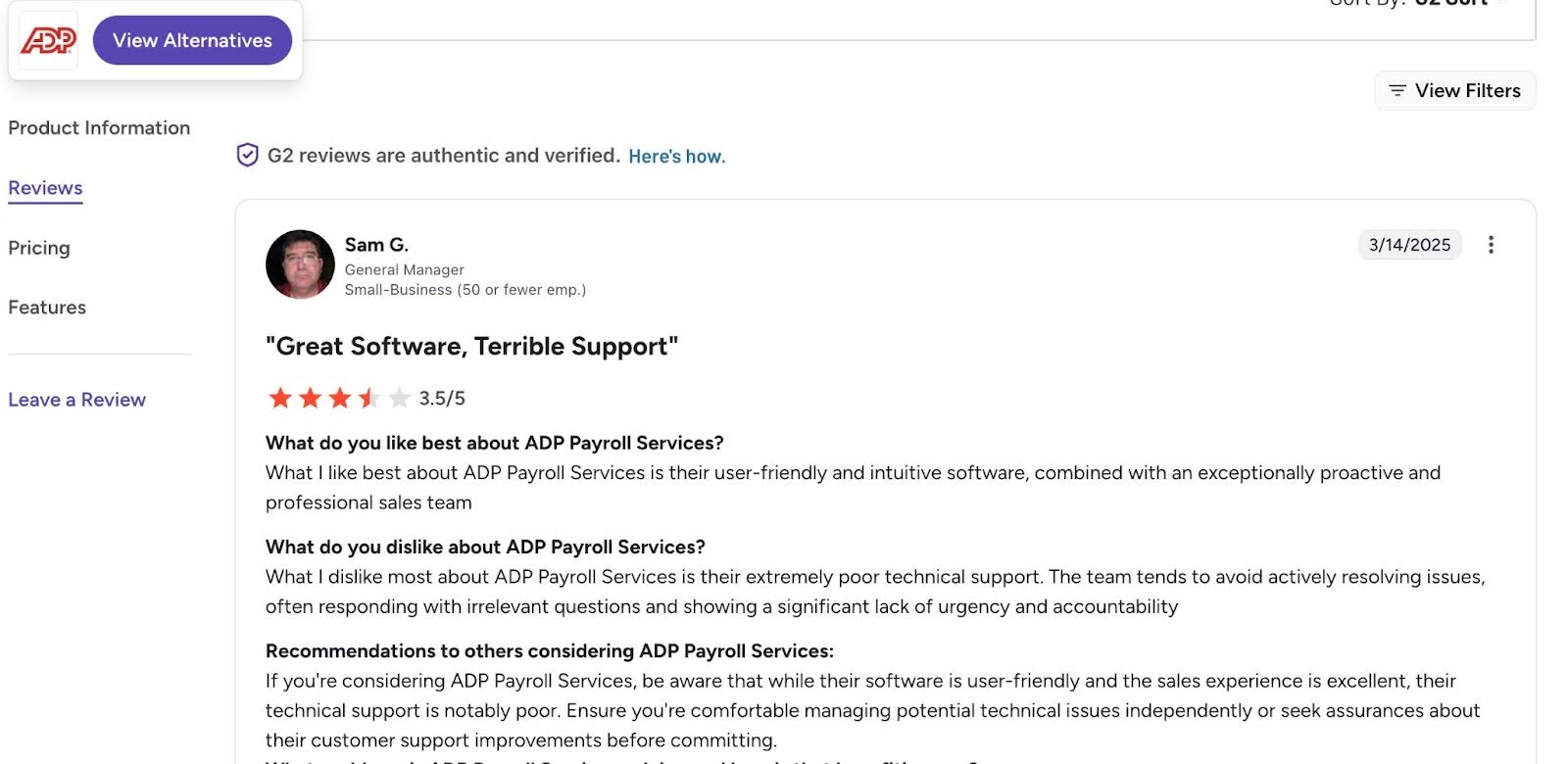

ADP Run

ADP provides payroll solutions for businesses of all sizes. It uses advanced features to handle payroll processes, tax compliance, and HR management for enterprise businesses.

It is suited for accounting firms serving businesses with operations in multiple locations.

Notable ADP features include:

- Time and Attendance

- Talent

- Benefits and Insurance

- PEO and HR Outsourcing

- Compliance services

Pros

|

Cons

|

- Pricing: Custom pricing

- Free Trial: Yes

Featured Customer Review

6. Taxes

Tax software simplifies tax preparation, filing, and compliance by automating data entry, calculating tax liabilities, and keeping firms compliant with changing regulations.

This helps to speed up the filing processes and increase productivity while maintaining accuracy during tax seasons.

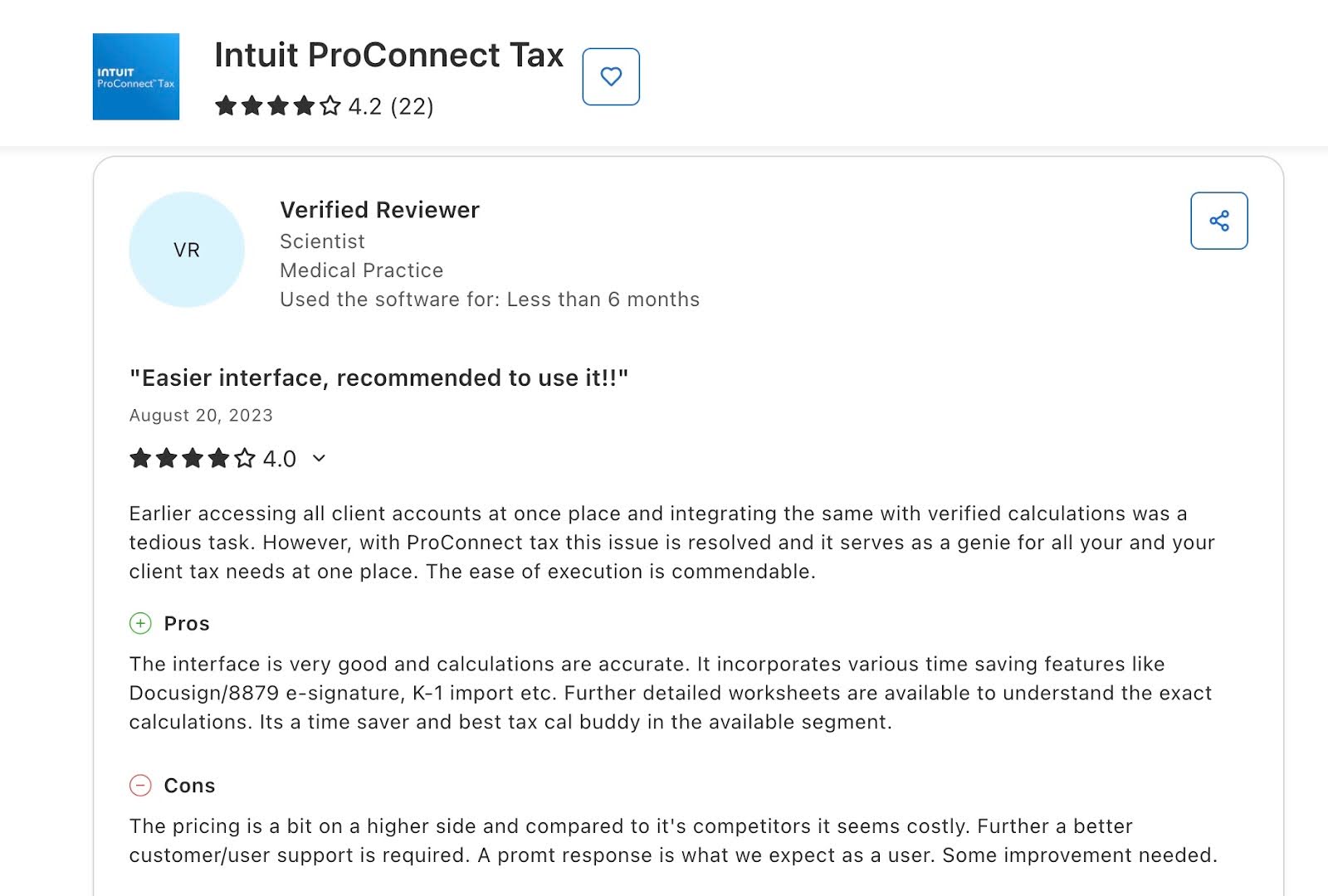

Intuit ProConnect

Intuit ProConnect is a tax preparation software that integrates with QuickBooks Online to enable accounting and CPA firms to pull client data directly into tax returns to reduce manual entry.

It is suitable for individual and business tax returns because it supports a wide range of forms and e-filing methods.

Notable ProConnect’s features include:

- QuickBooks integration

- IRS transcripts

- Advisory and planning

- Client portal import

- AI-powered client briefing

Pros

|

Cons

|

- Pricing: Starts from $3,463/year

- Free Trial: Yes

Featured Customer Review

Drake Tax

Drake Tax is a cloud and desktop-based tax preparation tool with a broad library of tax forms and compliance tools.

Its depth of features enables tax accountants to file both simple and complex tax returns, offering huge value to accounting professionals across the board.

Notable Drake features include:

- Comprehensive forms and schedules

- Guided tax preparation process

- Multi-user collaboration

- Switch between online and desktop versions

- E-signature

Pros

|

Cons

|

- Pricing: Starts from $359.99 pay per return and $1,825 for the bundled plans

- Free trial: Yes

Featured Customer Review

7.Project management

Project management software helps accounting firms to plan, organize, and execute projects in the most efficient way possible. This means the timeliness and accuracy (compliance) of the project.

These tools enable firm owners and managers to allocate resources, centralize collaboration, and track progress to ensure all deadlines are met.

Financial Cents

Project management is a major feature of Financial Cents’ all-in-one practice management solution software. It enables accounting firms to create projects, assign tasks to team members, centralize work-related information inside the project, and track deadlines in the workflow dashboard.

Financial Cents’ built-in workflow templates and task automation features reduce admin tasks and ensure team members have enough time to focus on billable work, while the capacity management feature facilitates even distribution of workload to prevent team burnout.

Notable Financial Cents project management features include:

- Workflow templates

- Due Date

- Task Assignment

- Team Chat

- Files

- Recurrences

- Task Dependencies

- Task automations

Pros

|

Cons

|

- Pricing: starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free trial: Yes

Featured Customer Review

8. Time tracking

Time tracking allows accounting teams to record the time spent on billable and non-billable tasks to improve billing accuracy and profitability.

Regardless of the firm’s pricing model, time tracking provides the reports that ensure bottlenecks are identified on time before they become major problems.

Toggl Track

Toggl Track is a dedicated time tracking tool that helps professionals (including accountants) to record their work hours to ensure accurate billing.

It integrates with third-party project management tools so that users can connect time entries to specific clients or tasks, and its reporting features allow partners to identify inefficiencies and improve resource allocation.

Notable Toggl features include

- Automated timer

- Online worker timer

- Invoicing

- Reporting

- Timesheet reports

Pros

|

Cons

|

- Pricing: There’s a free plan. Paid plan starts from $9/month per user

- Free trial: Yes

Featured Customer Review

Financial Cents

Financial Cents’ all-in-one accounting practice management software provides a time tracking feature that enables accountants to track time against clients and projects automatically.

It combines with other Financial Cents features (like project and client management) to provide your team with an integrated system that doesn’t need third-party integration to connect time entries to projects or clients. Time sheets are automatically used to generate client invoices to receive payments, all without leaving Financial Cents.

Notable Financial Cents’ time-tracking features include:

- Automatic timer

- Billable vs non-billable

- Time budgets

- Billable rates

- Invoicing

- Reports

Pros

|

Cons

|

- Pricing: starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free trial: Yes

Featured Customer Review

8. Communication

Communication tools centralize an accounting firm’s team and client communications to save them hours of chasing clients and teammates.

They differ from general communication tools like emails in terms of their emphasis on data security, among other unique features.

Microsoft Teams

Microsoft Teams is a chat, video meeting, and file-sharing tool that enables accounting teams to share information that helps everyone stay on the same page.

It has an external access feature that allows accounting teams to invite their clients to discuss their projects.

Notable Teams features include;

- Online meetings

- Screen sharing

- Custom backgrounds

- Video conferencing

- Chat

- File sharing

Pros

|

Cons

|

- Pricing: starts from $4/month per user

- Free trial: No

Featured Customer Review

Slack

Slack’s messaging-first platform centralizes team conversations to enhance internal collaboration and decision-making.

It categorizes team discussions into channels to keep conversations in proper context. The Slack Connect feature allows accounting teams to invite their clients as external collaborators.

Notable Slack features include:

- Channels

- Slack Connect

- Messaging

- Huddles

- Clips

- Canvas

- File sharing

Pros

|

Cons

|

- Pricing: Slack has a free plan. The paid plan starts from $7.25/month per user.

- Free trial: Yes

Featured Customer Review

Financial Cents

Financial Cents’ accounting team and client communication features enable accounting teams to send and receive files and information where they are doing client work.

It organizes team and client interactions inside the client profile and projects to ensure all communication is tied to the work being done and the client being served.

Notable Financial Cents Communication Features include:

- Team chat

- Client chat

- Client Notes

- Gmail and Outlook integration

- Document and folder-sharing

Pros

|

Cons

|

- Pricing: starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free trial: Yes

Featured Customer Review

10. Client Proposals

Client proposal software enables accounting firms to create branded proposals that outline the services, prices, and terms of engagement clearly.

Usually, this includes E-signature and payment processing, which makes it convenient for clients to sign agreements and encourages early payments.

Ignition

Ignition enables accountants to send proposals and automate engagement letters for clients to sign online without printing.

It has an integrated billing and payments solution that makes it easier to collect client payments.

Notable Ignition features include:

- Proposal templates

- Smart upselling

- Bulk create and send

- Integrated payment collection

Pros

|

Cons

|

- Pricing: starts from $39/month.

- Free trial: Yes

Featured Customer Review

GoProposal

GoProposal helps accounting firms to price their services adequately and generate proposals and engagement letters while you’re still in the meeting.

Its pricing engine keeps firms from undervaluing their services and undercharging themselves.

Notable GoProposal’s features include:

- Line items

- E-signature

- Engagement letters

- Professional proposals

Pros

|

Cons

|

- Pricing: starts from $75/month.

- Free trial: Yes

Featured Customer Review

Financial Cents

Financial Cents’ accounting proposal features enable firms to create proposals and engagement letters that trigger the creation of a profile and projects once the client signs.

This enables accounting firms to immediately start the engagement, reducing onboarding time and service delivery time.

Notable Financial Cents proposal features include:

- Proposals

- Engagement letters

- Proposal packages

- Billing

- Payments

- Optional upsells

- Welcome videos

- Auto-reminders

- Pricing: starts from $19/month per user for solo firm owners and $49/month per user for the team plans.

- Free trial: Yes

Featured Customer Review

How to Build Your Firm’s Tech Stack Step by Step

-

Assess firm needs and pain points

If every aspect of your firm is going as seamlessly as it could, you wouldn’t need any tool, but it never does. The idea is to buy a software solution only because it will serve a definite purpose, not just because you’re supposed to use one.

That is why you have to understand the problem a tool will solve for your team. This is a good place to ask your team members where they are struggling and where client complaints are coming from.

Sometimes, you don’t need to buy a tool for a problem. Maybe a task needs to be eliminated or delegated to someone with better capacity to handle it.

-

Map out processes that can be automated

Mapping out your processes opens your eyes to the bottlenecks in your processes. You can start seeing where you're inefficient, where you're wasting your resources, and throwing money out of the window."

Nayo Carter-Gray, Owner of 1st Step AccountingThe fact that your team is struggling in an area doesn’t mean that automation is the solution. To understand your opportunities for automation, map out each process in your firm from client onboarding to service delivery. You can use a checklist or diagram for this.

With the steps in each process laid out, it is easier to understand what can be, as Nayo puts it, “ delegated, automated, or eliminated.”

Repetitive tasks lend themselves more to automation to save time and energy. You can also find tasks that are duplicated. Those need to be eliminated.

In Nayo’s tax preparation checklist, she realized that the task of handling client calls and scheduling client appointments could be delegated, so she hired an answering service to answer such calls and schedule appointments on her behalf.

For the task of enabling clients to sign an engagement letter, pay deposits, and fill out a tax organizer, Nayo’s team automated it by creating an online form that has all three of those steps in one.

This prevents friction and gives their clients one place to sign the engagement letter, pay a deposit, and fill out tax organizers, so the team can take it up from there.

-

Choose scalable, easy-to-use tools

Features are important, but ease of use is critical, given that your team’s ability to implement and use any tool depends on it.

Your software solutions need to have an intuitive interface and helpful resources that your team can rely on to maximize every feature.

Demos and free trials are other helpful resources. They show you how tools solve real-world problems to help you make informed decisions.

The tool’s roadmap can also tell how useful it will be to your firm when you add more clients and team members, and your needs become more complex.

-

Ensure integrations between tools

Using integrated systems and streamlining processes is going to help you serve your clients better and make your team more productive and profitable."

Dawn Brolin, CPA, CFE, CEO of Powerful AccountingRunning an accounting requires managing many moving parts. While disconnected tools may be excellent on their own, they can create more problems than they solve.

When the moving parts of a firm work in isolation, you’ll need more time to transfer data between them or risk having different sets of data in the different tools, which will compromise work quality.

With the right Integrations, your tech stack provides a single source of truth, ensuring all team members are working with up-to-date information.

When evaluating an app, check its compatibility with the other apps you already use. If it doesn’t integrate, your team will struggle to manage data and coordinate activities across several systems.

-

Train team members for adoption

Most accounting tools are feature-rich and can be overwhelming for the average accounting professional. Initial and ongoing training can help your team understand all relevant features and functionalities to get a better return on investment.

Otherwise, they might find the tools frustrating, which can result in an unused subscription while their workflow struggles continue.

Top accounting firms rely on walkthrough videos, office hours, and standard operating procedures (SOPs) to enable their teams to understand their software solutions, making technology a part of their everyday work.

Best Practices for Managing Your Tech Stack

-

Regularly review and update tools

Regular review of your tech stack is necessary for understanding if your existing tools are still relevant to your needs or if there are new tasks that warrant the addition of more tools to the stack.

A change in an application’s features or user interface can also affect how it serves your team.

Perhaps you didn’t need so many reporting features when you started using a practice management tool. Now that you need a lot of it, reviewing your tech stack will show if your current practice manager has added enough reporting features to support your current needs.

-

Avoid tool overload by sticking to essentials

If you build your tech stack by judging by the number of apps available, you will end up with too many accounting apps that you neither have the time nor the money to maintain.

Your team will spend more time and effort managing the tools that are supposed to make your team more productive and efficient.

Moreover, the more apps you use, the more login information you have to manage, the more data storage points you have to maintain. This not only makes it more difficult to maintain and protect your data, but it also makes your firm a bigger target for cybercriminals.

For many firms, a general ledger, tax, practice management, and one or two other apps should suffice.

That’s especially because accounting practice management software, like Financial Cents, provides an all-in-one solution for your workflow, client, capacity, document, communication, time tracking, and billing management needs, as you can see in most of the app categories above.

-

Standardize workflows across the team

Automation features thrive on repeatability and consistency. When your workflows are not standardized and each team member works in a way that differs from the next person, it’ll be hard to trigger the apps in your tech stack to perform tasks on their own.

Plus, documenting your accounting processes makes it easier to train your team to understand not just the processes, but also how to use your tech stack to complete their assigned tasks without skipping important steps.

With Financial Cents Workflow Templates, documenting your processes doesn’t have to take a lot of brainstorming. It gives you prebuilt templates that you only need to customize to suit your unique procedures.

-

Prioritize security and compliance

Due to the sensitivity of financial information, data security is critically important in the accounting industry.

That’s why most of them have security features, like data encryption, multi-factor authentication, role-based access control, and certifications like ISO, SOC, and GDPR.

Any tool that doesn’t have them is a potential source of data breach and other security challenges, which can damage your firm’s reputation.

Common Mistakes Firms Make with Tech Stacks

-

Adding too many tools without integration

Throwing an app (especially if they don’t integrate with others) at every challenge you have in your firm will result in a bloated tech stack.

This usually lays the foundation for:

- Information silos ( every tool stores separate data)

- Increased errors (due to manual data entry and version control issues)

- Lack of productivity ( time is wasted managing the tools individually).

The tech stack is effective because individually brilliant apps are working and sharing information between themselves, reducing the time and effort needed to manage each one on its own.

-

Not training staff properly

Lack of adequate training can result in incorrect data entry, a lack of confidence that can lead to resistance to change, and time wasted when they do not know the quickest ways to complete tasks.

Plus, a lack of adequate training can result in your staff using just a fraction of your accounting tools’ capabilities, which reduces your overall return on investment in your tech stack.

-

Choosing tools based only on price

Everyone wants to get the best deal, but that can come at the expense of important features, functionality, and integrations needed to make the apps in your tech stack work in harmony.

When a tool is too pricy, evaluate further to see if the value of its features corresponds to the cost and vice versa. If your mind is made up against tools that are above or below a certain price point, you might miss out on the opportunity to get better value for your money.

-

Ignoring workflow standardization

Failure to standardize your accounting workflows can result in inconsistencies in client services, even with the best accounting tech stack.

That is because team members will be inclined to experiment with different approaches, use the tools differently, and ignore important steps, which may get different results each time.

This lack of predictability does not just affect the quality of work; it also damages branding and brand identity.

Financial Cents: Your Accounting Tech Stack Should Revolve Around Your Practice Management Software

If you don’t take anything away from this guide, remember that building a tech stack is less about buying the best tools and more about creating a connected system that can enable data to flow and tasks to be automated across the board.

This maintains data integrity, conserves your staff’s energy, and frees up time for core accounting functions.

For firm owners like Christi, the first tool they choose after their tax and general ledger software is Financial Cents, their practice management solution.

Financial Cents acts as the hub of the modern accounting tech stack. It helps firms to streamline workflows, automate repetitive tasks, and stay on top of client deadlines.

It forms the centre of the firm to which every other tool in the stack can connect to provide maximum visibility for the accounting team.

Are you ready to start building a future-forward accounting tech stack? Click here to start your Financial Cents free trial.