The accounting profession has never felt more competitive, and it’s not simply because there are more firms in the mix. Competition is tightening, pricing pressure keeps edging in, and staffing shortages continue to stretch teams thin. Clients now expect clarity, speed, and meaningful insight, not just tidy reports. Layer in the steady stream of new technology shaping how work gets done, and it becomes clear that the ground is shifting for firms of every size.

Private equity is adding another layer of complexity. Investor interest in accounting firms continues to rise, with reports showing sustained growth in PE-backed acquisitions across the profession, a sign that the market sees long-term opportunity in firms that operate efficiently and scale well.

Growth in 2026 requires more than new clients. It takes smarter operations, modern software, and systems that can actually keep up. To help you navigate this shifting landscape, this guide outlines 15 practical strategies designed to foster your firm’s growth with confidence and profitability.

Why Growth Requires a New Approach

Growth used to mean adding more clients and hiring a few extra hands. Today, the formula looks very different. Why, you may ask?

Increasing demand for advisory services

Clients no longer want you only for year-end cleanups. They want guidance, clarity, and someone who can translate financial data into decisions. Firms that expand advisory capabilities are meeting a growing expectation, not creating a luxury add-on.

Automation and AI are reshaping workflows.

Repetitive tasks are disappearing into the background thanks to smarter cloud-native software such as Financial Cents. This frees up capacity but also forces firms to rethink how people, processes, and technology fit together. In other words, growth now depends on workflows that run efficiently even when no one is “pushing buttons.”

Remote teams are becoming more common.

Talent shortages have made geographical hiring optional. Remote and hybrid teams open doors to stronger hiring, but they also require better systems for collaboration, oversight, and accountability. Firms that build for flexibility are the ones keeping their teams engaged and productive.

Clients expect faster turnaround, transparency, and digital communication

Patience is no longer part of the standard engagement letter. Clients want status updates, clear communication, and work delivered quickly. Meeting these expectations requires streamlined processes and tools that reduce back-and-forth friction.

Firms must adapt or risk falling behind

The firms thriving today aren’t simply “working harder.” They are working smarter, modernizing operations, investing in systems that scale, and managing their accounting firms better. Standing still in 2026 isn’t neutral; it’s falling behind, and forward-thinking firms know it.

With these factors in mind, how do you set your firm up for success in 2026?

15 Growth Strategies for Accounting Firms

Niche down to stand out

The fastest way to cut through the competition is to stop serving everyone. Specializing in an industry or service area helps you price confidently, market more effectively, and become the obvious choice for clients who want someone who already understands their world. As Jamie Finfrock puts it in How to Identify and Dominate Your Niche,

find what you love and lean into it. Build your tech stack and expertise around the problems you want to solve.

Expand into advisory services

Compliance may keep the lights on, but accounting advisory strengthens your client relationships and your margins. Businesses want insights, not just reports. Take it from Brandon Hall, who shared his playbook for building a 7-figure firm through advisory services by leaning into strategic guidance. Offering services like cash flow forecasting, budgeting support, and long-term planning positions your firm as a true partner in your clients’ success, not just a once-a-year necessity.

Enhance client onboarding and experience with technology

First impressions set the tone for the entire engagement. A smooth onboarding process supported by automation and clear communication tools reduces friction and increases client confidence. From client onboarding checklists to accounting client portals, modernizing the experience makes your firm feel organized, responsive, and easy to work with.

Develop a strong referral system

Referrals are often your highest-converting leads, yet many firms rely on them “hoping” rather than planning. Create a structured system that includes partner networks, satisfied clients, and complementary service providers. Consistency turns referrals from a pleasant surprise into a predictable acquisition channel.

Optimize your pricing model

Growth often stalls not because firms lack clients, but because their pricing no longer reflects the value they deliver. Revisiting how you price your work can make everything else run more smoothly. Whether you’re exploring value-based pricing, building tiered packages, or simply tightening your scope, a modern pricing model helps you protect margins while giving clients a clearer sense of what they’re paying for. If you’re thinking about updating your approach, this playbook on pricing accounting and bookkeeping services offers a helpful place to start.

Improve your online presence

In a world where clients Google before they call, your digital footprint matters. A clear message, relevant content, and active profiles help prospects understand who you serve and why you’re a good fit before you ever speak. And when you layer in accounting SEO strategies, your online presence becomes more than a digital storefront. It becomes a steady source of qualified clients who can actually find you.

Standardize processes across the firm

Inconsistent workflows create bottlenecks, confusion, and eventually burnout. Standardizing tasks, workflow templates, and review steps gives your team a predictable way to work, which reduces errors and keeps projects moving. It also makes onboarding new hires far easier since they can step into clear processes instead of piecing things together on their own. As your firm grows or experiences turnover, that level of consistency becomes one of your biggest operational advantages.

Invest in a high-converting website

Your website shouldn’t be a digital brochure. It should lead visitors toward taking action, whether that’s booking a consultation or downloading a resource. From the first interaction, your site needs to deliver clear value and show prospects that you understand their challenges and are ready to support them. When you combine clear messaging, simple navigation, strong social proof, and a visible call to action, your website becomes a reliable source of new business instead of something clients skim and forget.

Automate recurring work and administrative tasks

Many firms still lose hours each week to tasks that software could handle effortlessly. Automating reminders, client tasks, data collection, and recurring workflows frees up your team’s time for higher-value work. The more your systems handle, the more capacity your firm has to grow.

Launch a targeted content marketing strategy

Prospective clients want proof that you understand their challenges. Publishing helpful, niche-specific content builds trust long before a sales call. Think practical guides, industry insights, or short educational videos. A great example is our own website, where we’ve created a library of free accounting tools, accounting articles, playbooks, community driven accounting workflow templates, webinars, videos, and industry reports. Each resource is designed to offer actionable insights that accountants such as yourself are navigating today.

Invest in talent development and retention

Your people are your firm’s growth engine. Ongoing training, clear career paths, and supportive leadership help your team stay engaged and perform at a higher level. Firms that invest in development don’t just keep their best people. They attract talent that wants to grow with them.

Leverage automation and AI tools

Automation and AI aren’t replacing firms. They’re empowering them. From document collection to forecasting, smart tools reduce manual work and give your team back the time they need for advisory. When used intentionally, AI automation becomes a capacity multiplier that supports smarter, faster decision-making.

Build strategic partnerships

Partnerships with law firms, financial advisors, SaaS providers, or industry associations expand your reach and strengthen your referral pipeline. The right partner introduces you to new clients and new opportunities while positioning your firm as part of a broader ecosystem of trusted experts.

Acquire or merge with smaller firms

Mergers and acquisitions aren’t just for the biggest players anymore. Firms of all sizes are using M&A to expand capacity, enter new markets, and strengthen their bench. Amanda Birch is a great example. After acquiring another firm, she found that the long-term client relationships spoke for themselves. “We were able to look at the records, and they’ve had clients with them for like 20 years. So my thought is that the clients are happy because they’re coming back.” When executed thoughtfully, M&A can accelerate growth far faster than organic efforts alone and give your firm a strong foundation of loyal clients from day one.

Host webinars, workshops, and community events

Hosting online or in-person events helps you showcase expertise, answer real client questions, and build trust at scale. These sessions often become a steady source of leads, since attendees already see your firm as helpful and knowledgeable before the first consultation.

As your firm grows through strategies like niching, advisory expansion, stronger marketing, or even acquisitions, the next challenge is managing that growth without overwhelming your team. That’s where the right systems make all the difference.

How Practice Management Software Supports Firm Growth

Practice management software for accounting becomes especially valuable as your firm grows because it brings order, clarity, and consistency to the work that keeps everything running.

Workflow automation helps you stay ahead of deadlines and recurring tasks, so your team isn’t relying on memory or scattered notes. Collaboration tools give everyone a shared place to communicate and move work forward, which is increasingly important as remote and hybrid teams become the norm. Capacity management shows who has room to take on more and who’s stretched thin, helping you make smarter staffing and scheduling decisions.

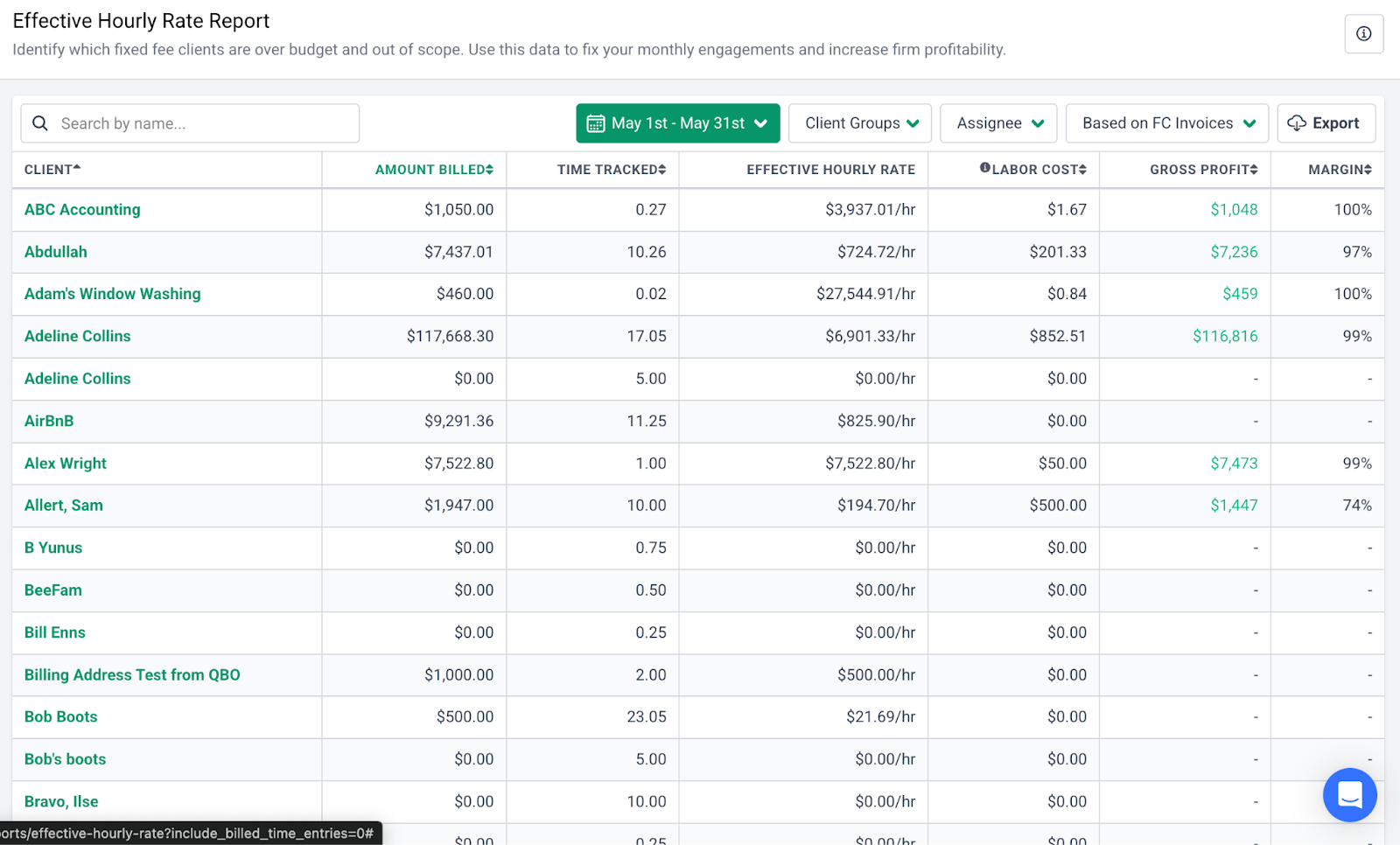

Reporting adds another layer of insight by showing how your team is performing, which clients are most profitable, and where bottlenecks tend to appear.

These benefits are part of what helped Full Send Finance scale more confidently as they added new team members and shifted from generic project management tools to workflows built specifically for accounting. And for Butler & Sanchez LLC, having everything centralized in an all-in-one platform made it possible to run a more organized firm, collaborate remotely, and stay in control of client work, reminders, tasks, and team capacity.

With smoother client communication layered in, your firm delivers a more transparent, reliable experience. All of this supports healthier revenue because you can operate with consistency, manage growth intelligently, and deliver work without unnecessary friction.

How Financial Cents Fits Into Your Firm’s Growth Plan

Streamline workflow management

Financial Cents centralizes all your work in one place, so tasks, deadlines, and recurring projects run smoothly without manual effort slowing you down.

Scale service delivery efficiently

Whether you’re adding new clients or expanding services, automated workflows in Financial Cents and capacity insights help you grow without overwhelming your team.

Enhance client experience

Client tasks, reminders, and a shared communication history create a smoother, more transparent client journey that builds trust and reduces back-and-forth with the crm accounting feature.

Improve profitability tracking

Time tracking and reporting tools show which clients and services drive profits, helping you make smarter pricing and resource decisions.

Boost team productivity and collaboration

With everyone working from the same platform, your team stays aligned, informed, and accountable no matter where they’re located.

Standardize processes for growth

Templates and documented workflows ensure consistent, high-quality work as your firm expands.

Support hiring and onboarding

Clear systems, defined roles, and easy visibility into work make onboarding new staff faster and more reliable, setting them up for success from day one.

Conclusion

Growth in 2026 won’t happen by accident. It requires clear decisions, intentional strategy, and systems that support you as client expectations, technology, and competition continue to evolve. The good news is that you don’t have to implement all fifteen strategies at once. Choose a few that fit your firm’s priorities today, put them into practice, and build from there. Small, consistent improvements often create the biggest momentum.

If you’re ready to strengthen your operations and scale with confidence, Financial Cents can support every step of your growth journey. Explore the platform, book a demo, or start a free trial to see how it can help your firm work more efficiently, serve clients better, and grow sustainably in the year ahead.