Many accounting firms grow by doing what feels natural at the time: hiring another person when work piles up. A bookkeeper here, a tax preparer there, maybe an admin to keep things moving. What often gets skipped is defining who owns what. Over time, that gap shows up as confusion, duplicated work, and bottlenecks. Eventually, the firm owner becomes the default answer for every question, no matter how big the team gets.

Accounting firm organizational charts tend to get dismissed at this point. They sound corporate. Overkill. Something meant for large firms, not growing ones. But a good organizational chart is not about hierarchy or control. It is about clarity. It makes responsibility visible. It shows how work should flow and who is accountable at each step.

In this guide, you will learn how to structure an accounting firm at every stage of growth. We will break down practical organizational charts and role structures for small, mid-sized, and growing firms, so you can build a team that scales without burning you out.

Why Organizational Structure Matters in Accounting Firms

- Improves accountability and ownership

When roles are clearly defined, everyone knows what they are responsible for and where their work begins and ends. This reduces finger-pointing and makes it easier to spot issues early.

- Prevents role overlap and burnout

Without structure, the same work gets done twice or falls on the same few people. Clear roles spread responsibility more evenly and protect high performers from carrying too much of the load.

- Makes onboarding and delegation easier

New hires ramp up faster when responsibilities are documented and visible. Delegation becomes simpler because tasks are tied to roles, not individuals.

- Supports consistent service delivery

Clients get a more predictable experience when work follows a defined structure instead of depending on who happens to be available.

- Enables scalable growth

As the firm grows, roles can expand or be duplicated without reinventing how work gets done each time.

Accounting Firm Organizational Chart by Firm Size

There is no single correct organizational chart for accounting firms. Structure should reflect firm size, service mix, and growth strategies. What matters most is clarity.

Below are practical organizational chart examples by firm size, including common responsibilities for each role. Use these as starting points, not rigid rules.

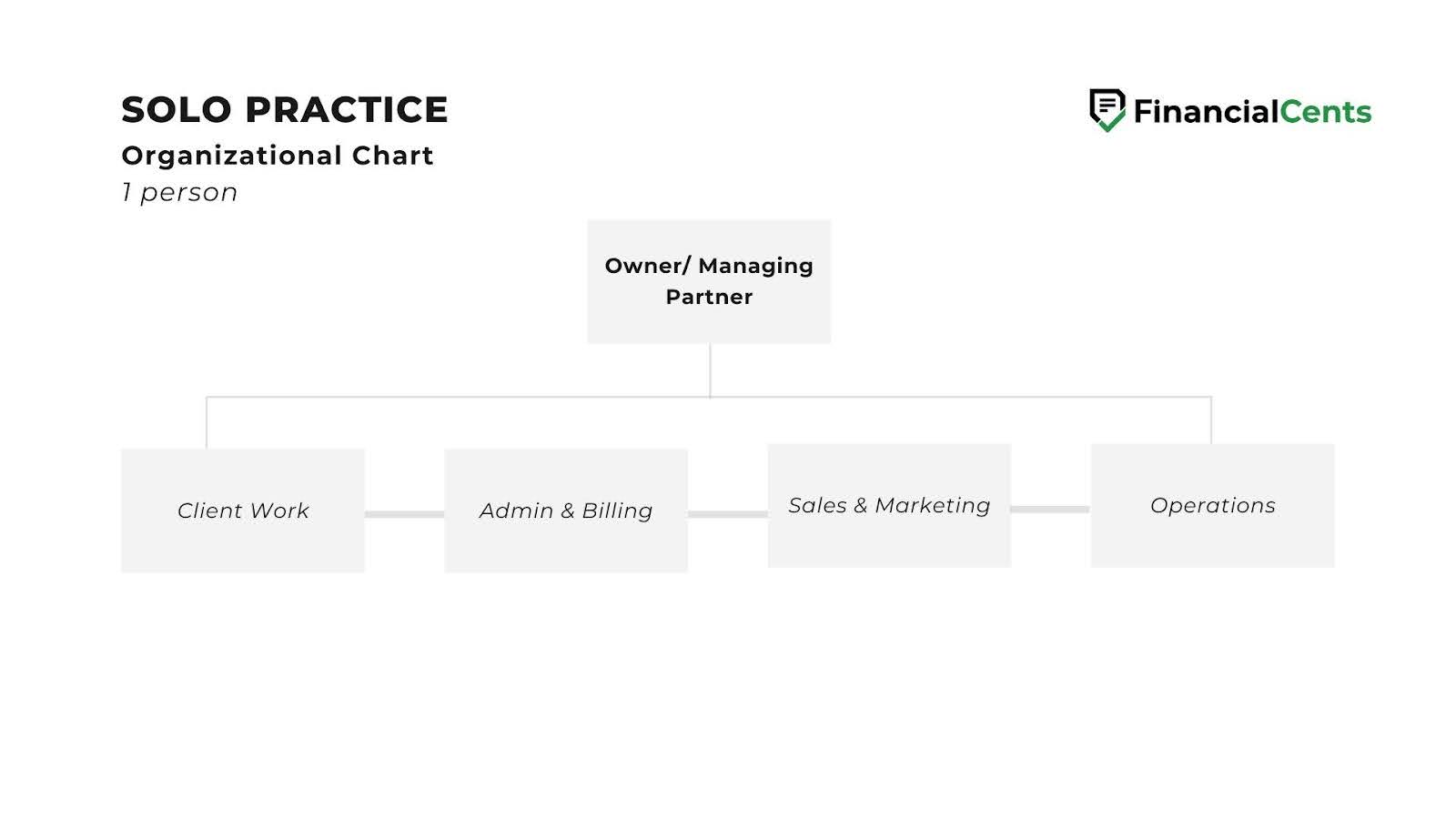

Solo Practitioner (1 Person)

At the solo stage, the firm and the owner are effectively the same thing. The solo practitioner handles client delivery, admin, billing, sales, follow-ups, and decision-making. There is no separation between roles because there is no one else to separate them from. Everything flows through the owner, which keeps things simple, but also fragile.

Typical roles and responsibilities

Owner / Accountant

Delivers all client work, manages deadlines, handles billing and collections, responds to client communication, and drives sales and growth. Every role in the firm sits with one person.

Common challenges

Burnout from wearing every hat

Switching constantly between delivery, admin, and sales drains focus and energy. There is no real separation between work types.

No role separation

Time spent invoicing, scheduling, or chasing documents directly reduces billable capacity.

Limited scalability

The firm can only grow as fast as the owner can work. More clients usually mean longer hours, not leverage.

This stage works because it has to. But it is also where light structure begins to matter. Documenting responsibilities early makes the first hire far easier and prevents chaos later.

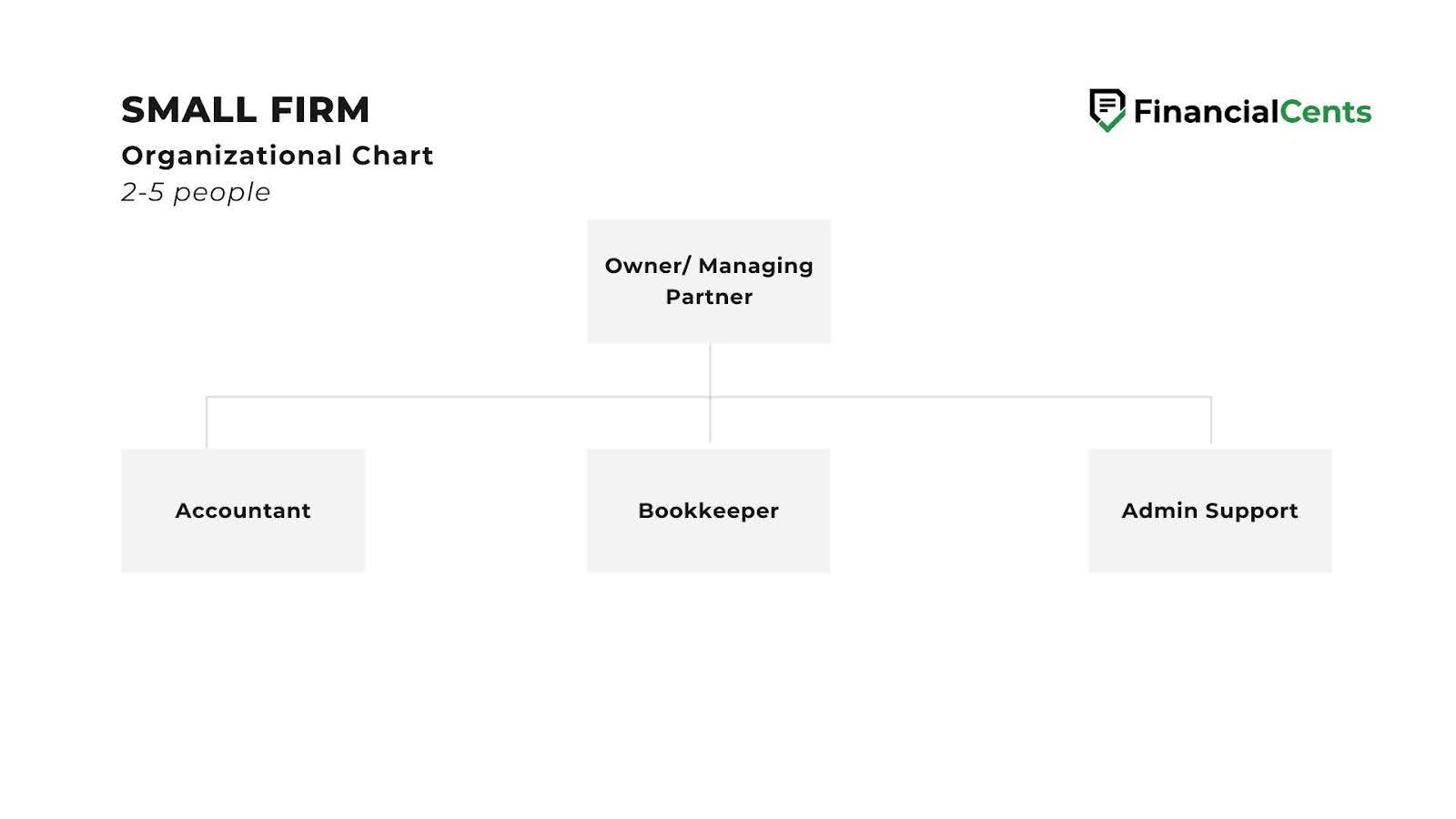

Small Accounting Firm Organizational Chart (2–5 People)

This is the stage where the firm starts to feel like a team, but the structure is still informal. The owner is no longer doing everything alone, yet most decisions, reviews, and priorities still funnel through one person. Roles exist, but boundaries are often loose.

Typical roles and responsibilities

- Owner / Managing Partner

Owns client relationships, reviews work, sets priorities, and drives growth. Still heavily involved in delivery and decision-making.

- Staff Accountants / Bookkeepers

Handle day-to-day client work such as bookkeeping, tax prep, reconciliations, and reporting. Often juggle multiple clients with varying expectations.

- Accounting Admin

Supports the firm behind the scenes by handling scheduling, document collection, billing coordination, and basic client communication. This role reduces friction and protects billable time.

At this size, roles may overlap, but defining responsibilities early helps prevent work from drifting back to the owner.

Common challenges

- The owner becomes the bottleneck

Even with help, work still stacks up at the top. Reviews, approvals, and decisions wait on the owner’s availability.

- Blurred roles and overlapping responsibilities

Staff help “where needed,” which sounds flexible but often leads to duplicated effort or missed handoffs.

- Admin work still competes with billable work

Without clear admin ownership, non-billable tasks continue to interrupt client delivery.

- Delegation feels risky

Because processes are not fully documented, delegation depends on constant checking instead of confidence.

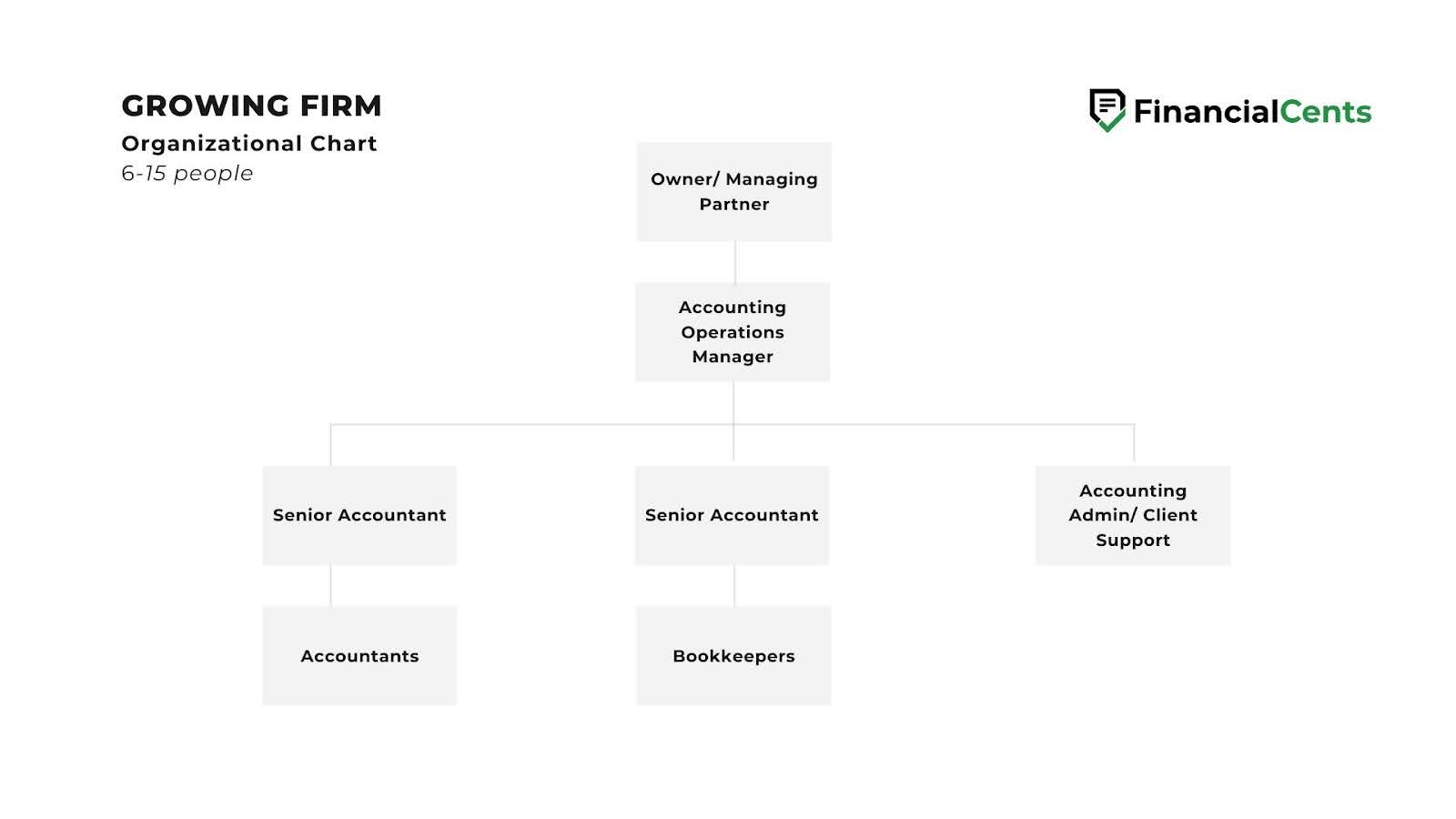

Growing Accounting Firm Chart (6–15 People)

This is the stage where the informal structure starts to break. The firm has enough people, clients, and moving parts that relying on “everyone just knows” no longer works. Without clearer roles and ownership, too much work and decision-making start piling up with the owner and senior staff.

Typical roles and responsibilities

- Owner / Managing Partner

Focuses more on strategy, key client relationships, and firm direction. Still reviews work, but should no longer be the default fixer for daily issues.

- Accounting Operations Manager

Owns workflows, deadlines, capacity, and internal coordination. This role ensures work moves smoothly across the firm and protects leadership from constant interruptions.

- Senior Accountants

Review staff work, handle more complex client issues, and provide guidance and training. They act as the bridge between leadership and delivery.

- Staff Accountants / Bookkeepers

Manage day-to-day client work across bookkeeping, tax, payroll, or reporting, following defined workflows instead of ad-hoc processes.

- Accounting Admin / Client Support

Coordinates client communication, document requests, onboarding, and billing support. This role keeps work flowing and reduces friction for both clients and staff.

Common challenges

- Leadership still gets pulled into the weeds

Without strong operational ownership, the owner and seniors are still solving workflow problems instead of leading.

- Workflow ownership is unclear

Tasks move, but no one is clearly responsible for keeping work on track end-to-end.

- Inconsistent client experience

Without standardized processes, service quality varies depending on who is handling the work.

- Capacity issues surface

Some team members are overloaded while others have room, but there is no clear visibility to rebalance work.

This is often the stage where firms feel busy but not efficient. Adding structure here is less about control and more about creating leverage.

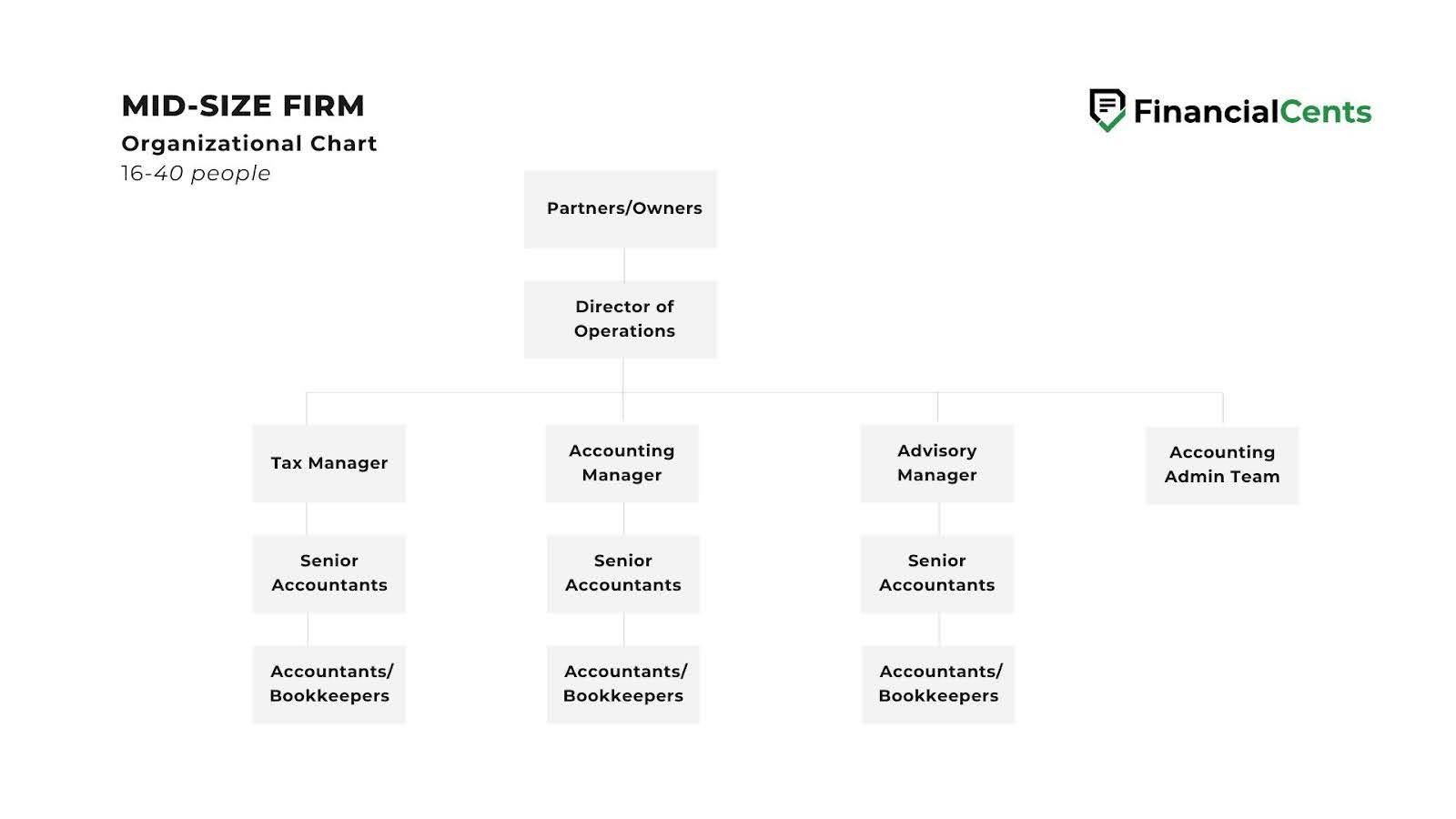

Mid-Sized Accounting Firl Organizationa; Structure (16–40 People)

At this stage, the firm is no longer a single team. It is a collection of teams. Structure is no longer about keeping things organized. It is about making sure the firm can operate consistently without leadership being involved in every decision.

Typical roles and responsibilities

- Owner / Partners

Set firm strategy, oversee major client relationships, and make high-level decisions. Day-to-day operations should no longer run through them.

- Director of Operations

Owns firm-wide execution. This role is responsible for workflows, capacity planning, systems, and making sure departments stay aligned. It is one of the most critical roles at this size.

- Department Managers (Tax, Accounting, Advisory)

Lead service lines, manage team performance, and ensure work is delivered consistently within their department.

- Senior Accountants

Handle complex work, review staff output, and support department managers with training and quality control.

- Staff Accountants / Bookkeepers

Focus on delivery within a defined service line, following standardized workflows.

- Accounting Admin Team

Manages onboarding, document requests, billing coordination, scheduling, and client support across departments.

Common challenges

- Silos begin to form

Departments operate well individually but lose visibility into what other teams are doing.

- Inconsistent processes across departments

Each team develops its own way of working, making firm-wide reporting and planning harder.

- Leadership overload shifts, not disappears

As partners step back, department heads often absorb the pressure, carrying more responsibility than the role was designed for.

- Coordination becomes harder

Without strong operations oversight, handoffs between teams slow work down.

At this size, structure protects consistency. It ensures the firm delivers the same quality of service regardless of which team handles the work.

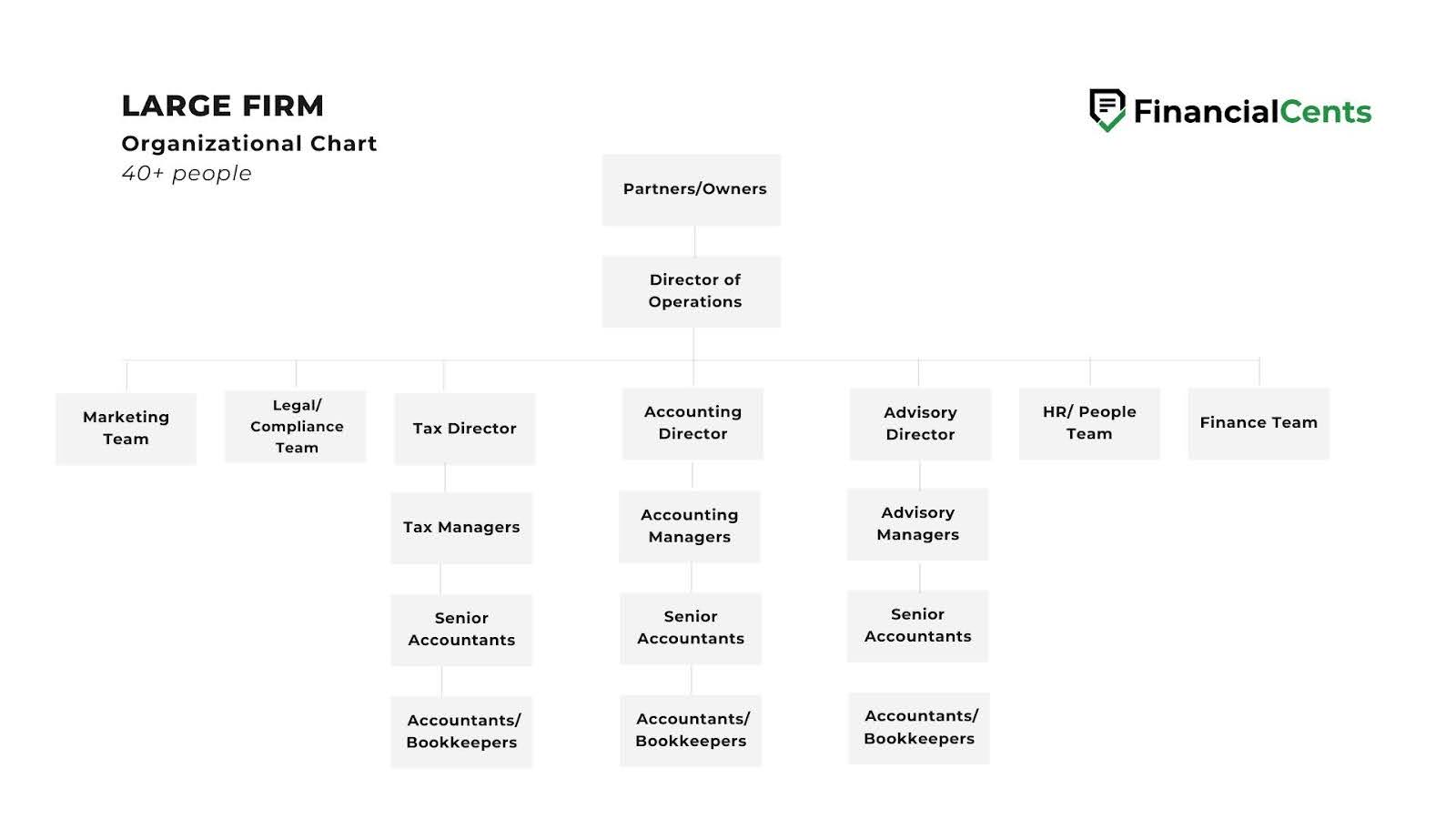

Large or Enterprise Accounting Firm Organizational Chart

At this stage, the firm operates more like an organization than a single practice. Leadership is focused on strategy, growth, and governance, while execution is handled through clearly defined teams and systems. Structure is no longer just helpful. It is essential.

Typical roles and responsibilities

- Managing Partners / Executive Team

Set firm vision, long-term strategy, and performance goals. Focus on major client relationships, mergers, and firm-wide decisions rather than day-to-day operations.

- COO / Operations Director

Oversees firm operations end-to-end. Owns execution, capacity planning, systems, and cross-department coordination to ensure the firm runs smoothly at scale.

- Department Directors (Tax, Accounting, Advisory, CAS)

Lead service lines, manage department performance, and ensure consistent delivery across large teams.

- Accounting Operations Managers

Support department directors by owning workflows, deadlines, quality control, and capacity within their teams.

- Accounting Admin Teams

Handle onboarding, document collection, billing coordination, scheduling, and client support at scale. These teams are critical to maintaining efficiency and client experience.

- HR, IT, Finance, Marketing

Specialized teams support hiring, training, systems, internal finance, and firm growth.

Common challenges

- Maintaining consistency at scale

As teams grow, ensuring every client receives the same level of service becomes harder without strong systems.

- Cross-department coordination

Work often spans multiple teams, increasing the need for clear ownership and communication.

- Decision-making drag

Without clear authority and reporting lines, decisions can slow down as more stakeholders get involved.

At this level, structure is what keeps the firm agile instead of bureaucratic. The best enterprise firms use structure to move faster, not slower.

Common Accounting Firm Organizational Structure Mistakes to Avoid

Most structural issues don’t come from bad decisions. They happen when you grow quickly without stopping to define how your firm should actually operate.

i. Too many direct reports to partners

If too many people report directly to you or your partners, everything slows down. Decisions take longer, feedback gets delayed, and leadership time disappears into day-to-day management instead of moving the firm forward.

ii. No clear workflow ownership

When everyone touches a process, no one truly owns it. Without clear ownership, issues linger, accountability blurs, and small problems turn into recurring headaches.

iii. Promoting without leadership training

Being a strong accountant does not automatically make someone a strong manager. Promoting based on tenure or technical skill alone often creates frustration for both you and the person stepping into the role.

iv. Growing headcount without structure

Hiring more people without adjusting roles or reporting lines adds complexity, not leverage. Your firm gets bigger, but the work does not get easier.

v. Not documenting roles and responsibilities

If responsibilities are not written down, expectations stay unclear. Your team fills the gaps with assumptions, and work quietly drifts back to the same few people.

How to Design the Right Structure for Your Firm

The goal of structure is not to look impressive on paper. It is to make work flow smoothly, decisions happen faster, and growth feels manageable instead of chaotic.

a. Start with services, not titles

Before you think about job titles, get clear on what your firm actually delivers. Tax, bookkeeping, payroll, advisory, and client support. Structure should follow the work, not the other way around.

b. Define responsibilities before hiring

Hiring without clarity usually creates overlap and confusion. Define what the role owns, what it supports, and how success is measured before you bring someone in.

c. Design for where the firm is going, not just where it is

Your structure should support the next stage of growth. Even if roles are combined today, the organizational chart should show how responsibilities will be split as volume increases.

d. Review and adjust structure annually

Firm structure is not set-and-forget. As services, team size, and clients change, roles and reporting lines should be revisited regularly.

e. Align structure with workflows and capacity

Roles should match how work actually moves through the firm. When structure supports workflows and capacity planning, growth becomes far easier to manage.

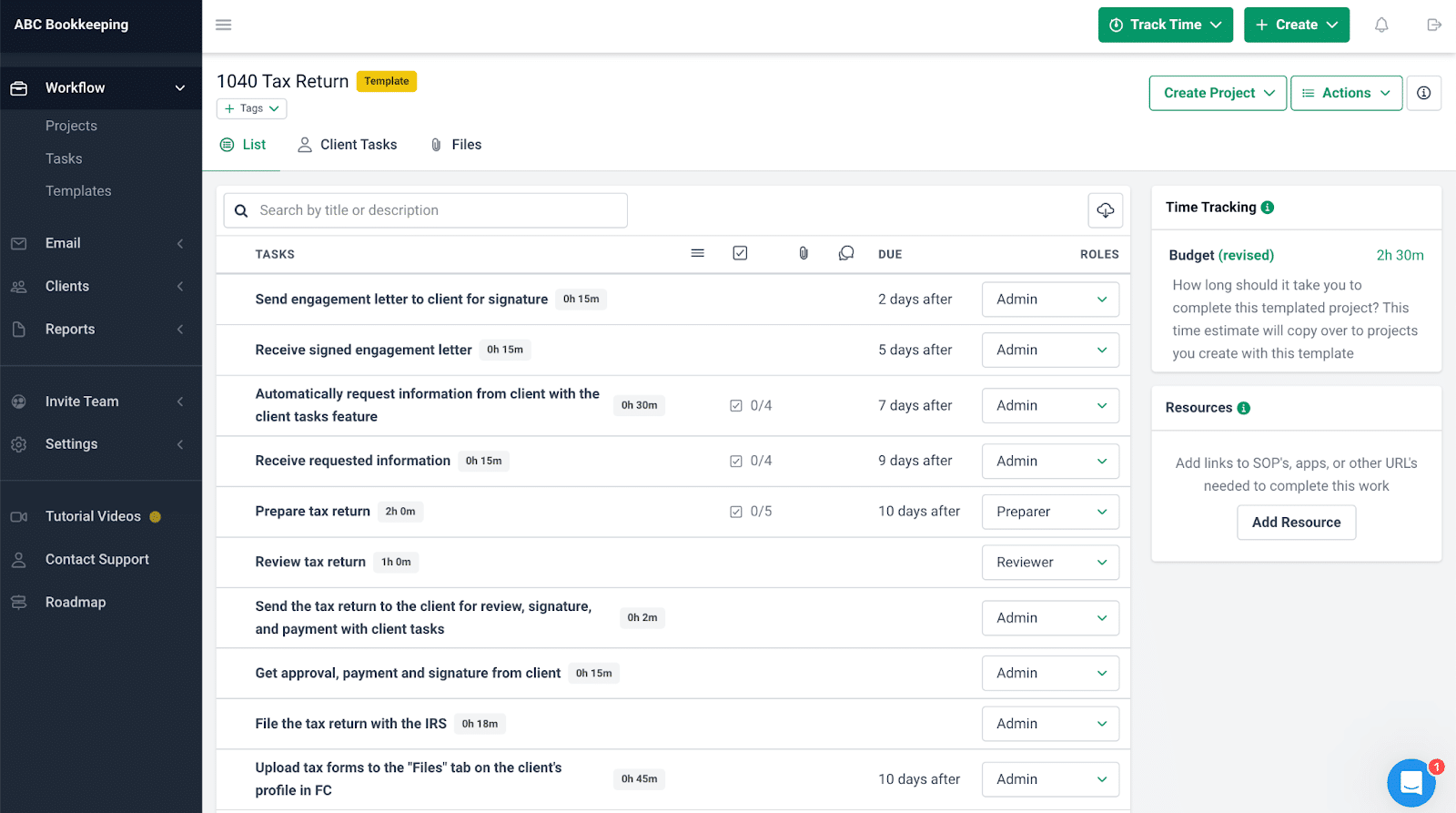

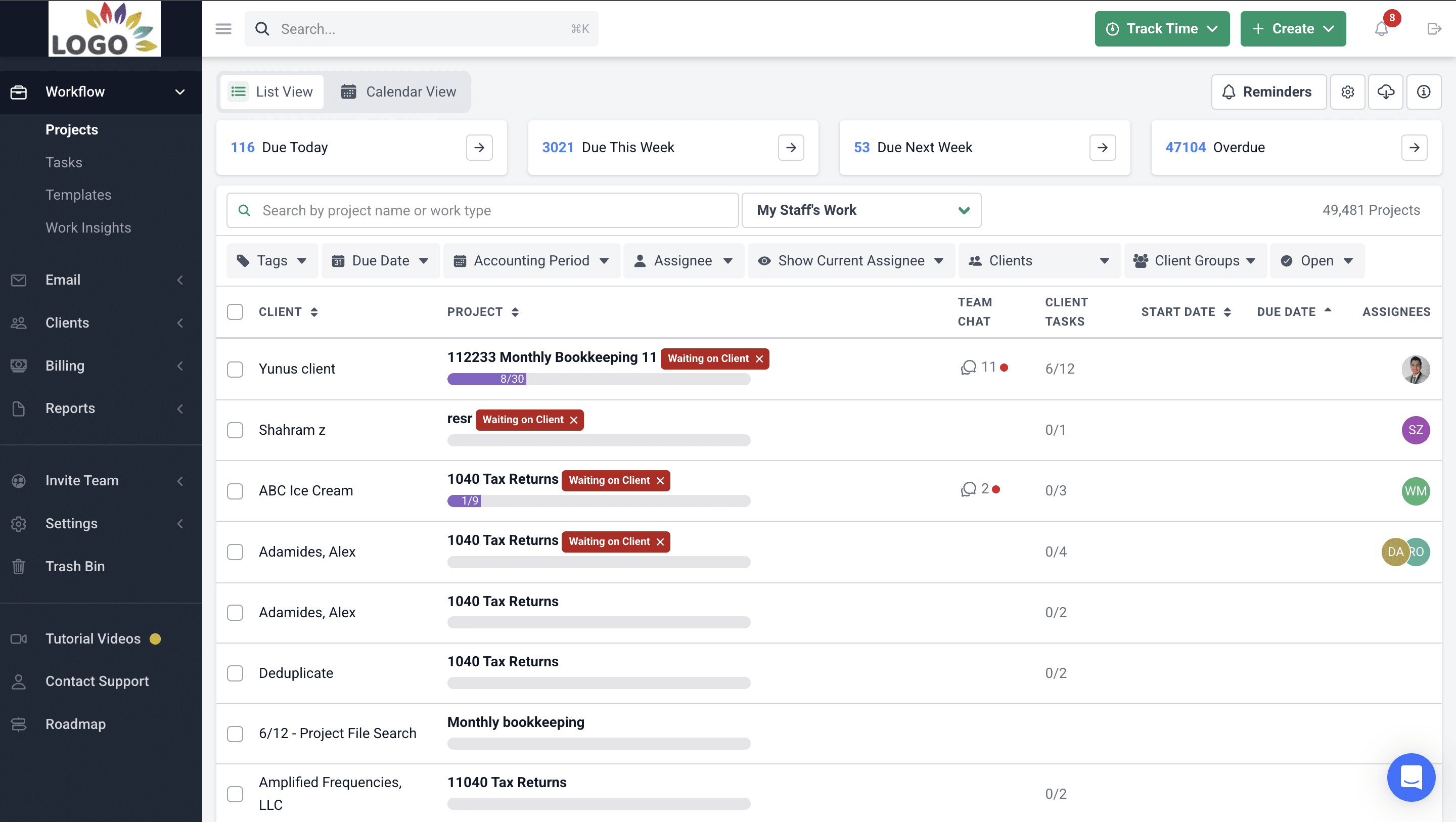

How Practice Management Software Supports Firm Structure

A clear organizational chart only works if your systems reinforce it. Practice management software turns structure from a diagram into something your team actually uses day to day. Here’s how to do it:

Assign workflows by role

When workflows are assigned by role instead of by individual memory, work moves more predictably. In tools like Financial Cents, tasks and projects can be tied to specific roles, making it easier to delegate work consistently as the team grows.

Visibility into who owns what

Practice management software gives everyone visibility into who is responsible for each task, reducing handoffs, confusion, and duplicated work.

Capacity and workload tracking

As firms grow, intuition stops working. You need to see who is overloaded and who has room to take on more. Financial Cents provides real-time workload visibility so managers can rebalance work before bottlenecks form.

Centralized communication tied to tasks and clients

With practice management software, client messages, requests, and updates stay connected to tasks and projects, reinforcing accountability and role clarity.

Conclusion

There is no single accounting organizational chart that works for every accounting firm. Structure should evolve as your firm grows, your services change, and your team expands. What matters most is not getting it perfect on day one, but starting simple and refining as you go. Even a basic structure is better than none if it creates clarity and reduces friction.

That said, structure alone is not enough. Organizational charts need to be supported by documented roles, standardized workflows, and clear visibility into who owns what work. When your structure, processes, and systems are aligned, work flows more smoothly, accountability improves, and growth becomes far easier to manage.

If you want to see how the right systems can support your firm’s structure as it scales, it’s worth exploring Financial Cents. You can book a demo or start a free trial to see how it fits your firm and supports your team before complexity sets in.