Managing finances is one of the biggest challenges for business owners. Every sale, expense, and payment adds up quickly, and without a reliable system, it’s easy for important details to slip through the cracks.

That’s where a general ledger (GL) comes in.

It’s the primary hub for all financial activity and provides a single, organized source of truth for tracking every dollar flowing in and out of a business. By capturing all transactions in one place, the GL helps avoid costly errors and simplifies the preparation of essential financial statements, like the balance sheet and income statement.

With the rising trend of outsourcing finance and accounting, more businesses are relying on firms like yours for crucial tasks like maintaining their GL. According to Grand View Research, the finance and accounting outsourcing market has been on a steady rise since 2018, reaching over $60 billion in 2023, with projections to nearly double to $110.7 billion by 2030.

To save time and ensure accuracy for your clients, you need a well-designed GL template.

In this guide, we’ll explore the essential components of a GL, share tips for maintaining it efficiently, and provide a free template to get you started.

What is an Accounting General Ledger?

The accounting GL is the central record in a double-entry bookkeeping system, organizing, classifying, and summarizing all financial transactions. It serves as the main database that consolidates every financial activity—whether related to sales, expenses, or assets—into distinct accounts for easy tracking and analysis.

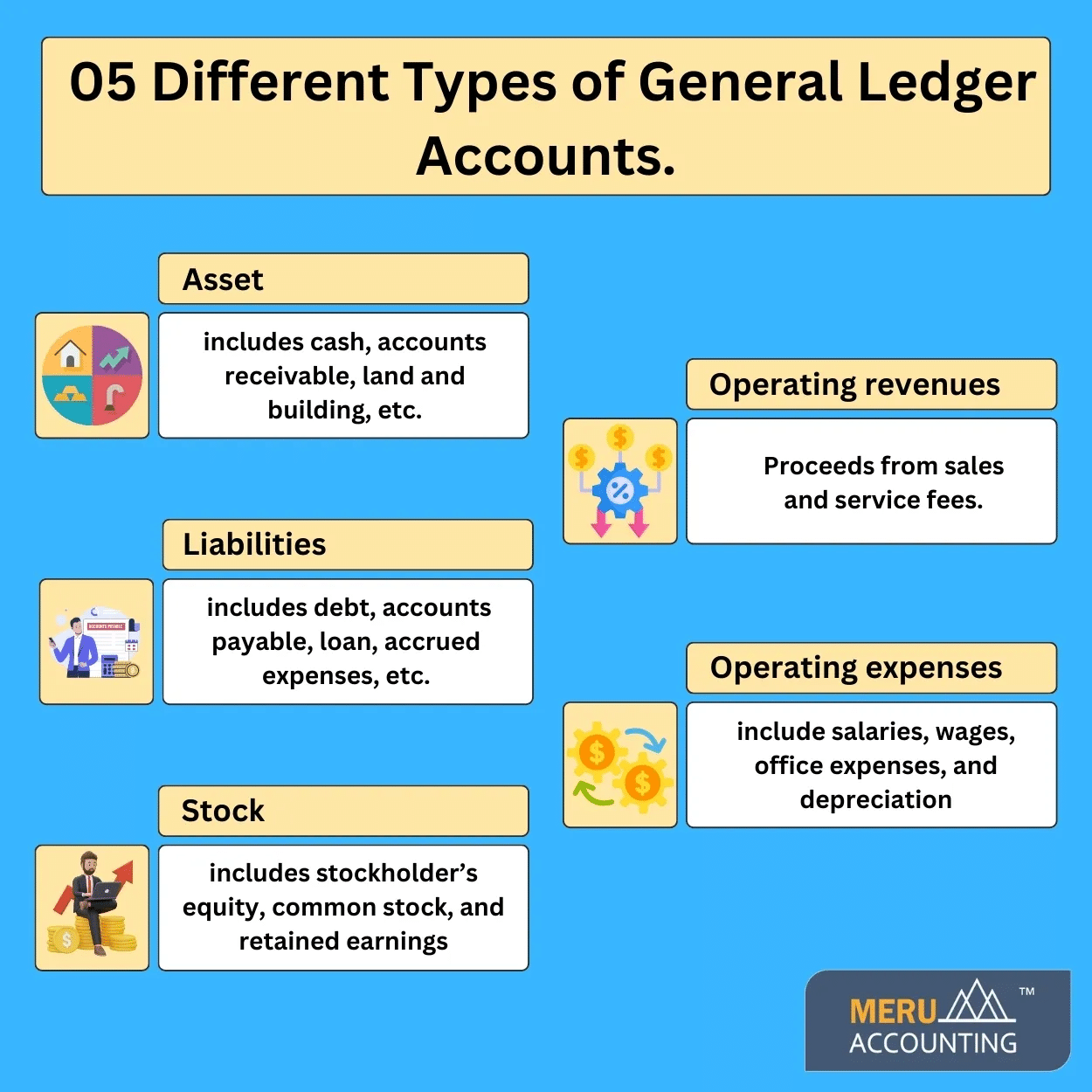

There are five major types of GL accounts:

Source: Meru Accounting

- Assets – Resources owned by the business, such as cash, equipment, and inventory.

- Liabilities – Obligations or debts, including loans, accounts payable, and accrued expenses.

- Equity or Stock – Owner’s interest in the business, encompassing retained earnings and capital.

- Revenue (Income) – Income generated from primary business activities, like sales or services rendered.

- Expenses – Costs incurred in the process of earning revenue, such as rent, utilities, and wages.

You have to record each transaction in at least two of these accounts to maintain the balance in the books so that the accounting equation (liabilities + equity = assets) holds true.

The GL simplifies the process of preparing financial statements like balance sheets and income statements. It also allows businesses to maintain accurate and transparent records for decision-making and compliance purposes.

Key Components of An Accounting General Ledger

Every accounting ledger should have the following components:

Account Name

This is the title of each account in your client’s ledger. It tells you exactly what the account is about—like cash, accounts receivable, revenue, or utility expense.” These names help keep everything organized and easy to find, especially when you’re looking through the ledger to track specific transactions.

Account Number

Account numbers are unique identifiers for each account. These numbers make it easy to sort, filter, and categorize your client’s transactions without mixing things up, especially if you have similar accounts (e.g., different types of revenue or expense accounts). Plus, it makes data entry quicker when you’re updating your records.

Period of the Journal

Each GL entry ties to a specific accounting period, such as a month, quarter, or year. This setup is essential because it lets you organize and review financial activity within each period, making it easy to analyze trends or prepare monthly and annual reports.

Date of Transaction

Dates clarify the timeline of the transactions. Recording each transaction on the day it actually happens provides a clear, accurate picture of when every financial event took place. This accuracy is invaluable when you need to review records or resolve discrepancies.

Description of Transaction

The description gives you context—a quick note explaining what each transaction was for. It can save you from confusion later and makes it easier to explain things to others down the line.

Debit and Credit Columns

In the double-entry system, every transaction has two sides: a debit and a credit. The debit column is for increases in assets or expenses and decreases in liabilities, equity, or revenue. While the credit column does the opposite. By entering each transaction in both columns, you keep the books balanced.

Learn more about Double-entry accounting.

Account Balances

This shows you where each account stands at any given time, reflecting the cumulative total of transactions in that account. It’s like a running total that updates with each new entry, so you can always see how much cash the business has, what its liabilities are, and whether it’s making a profit or loss.

Account Codes or Categories

Similar to account numbers, account codes are additional identifiers to help classify accounts into broader categories, such as current assets or operating expenses. This extra layer of organization helps you analyze financial data at a higher level and can simplify the process of preparing financial reports by grouping similar accounts together.

Journal Reference

The journal reference links directly to the original journal entry where you recorded the first transaction. It’s like a bookmark that makes it easy to trace each GL entry back to its source, ensuring transparency and accuracy. This is especially helpful if you need to check the details of a transaction, as you can go straight to the journal for a full breakdown.

Each of these components works together to keep your general ledger clear, accurate, and insightful, helping you manage your finances with confidence.

Download the Free Accounting General Ledger Template

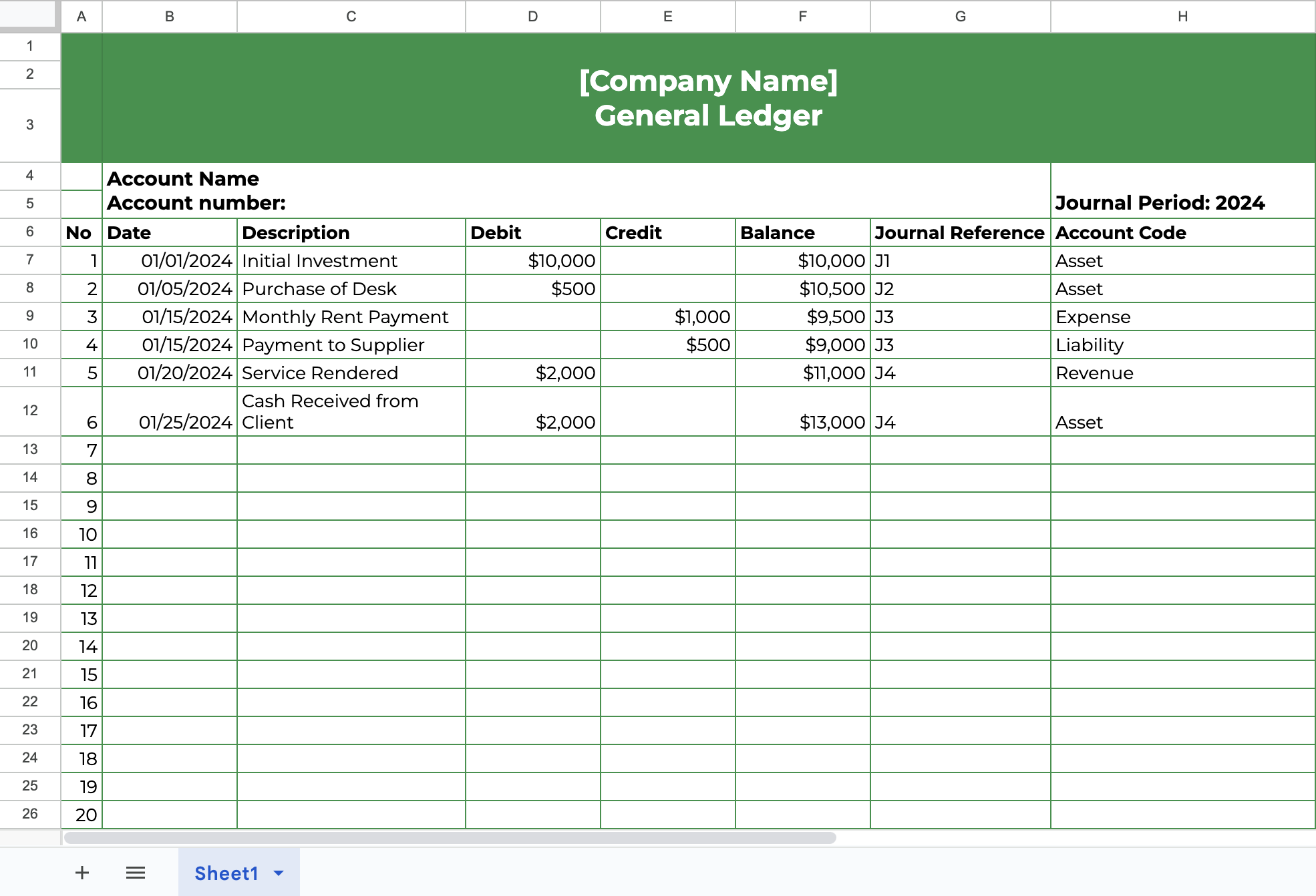

Here’s what our free GL template looks like:

You can download it here and customize it to your firm’s and client’s needs.

Accounting General Ledger

Importance of a General Ledger

Every business needs a GL. Here’s why it’s so important:

Transparency and Financial Clarity

The general ledger is the story of a business’s financial journey. It captures every sale, expense, and payment and gives a real-time view of where the money’s coming from and where it’s going. This transparency helps the business, and investors see the full picture.

Instead of a blur of numbers, the ledger organizes everything in a way that’s easy to understand, making it simple to identify trends, spot any issues, and make smarter decisions.

Tax Preparation and Compliance

Tax season can be stressful, but a good ledger makes the process easier. With everything organized throughout the year, it’s straightforward to pull together information for taxes.

When you already have clean, clear records, it’s a lot easier to file accurately and avoid the risk of penalties or audits. Plus, it can serve as proof of compliance with tax laws and standards.

Budgeting and Forecasting

A GL allows a business plan for the future instead of making decisions based on gut feeling. It tells you where you stand today and lets you look back at previous months or years to spot patterns and trends. With that insight, you can create realistic budgets, set financial goals, and even make cash flow predictions based on actual data.

So, instead of just hoping things go well, you’re making informed, data-driven plans that help steer your business toward growth.

Best Practices for Maintaining General Ledger for Clients

Maintaining a clean, organized general ledger can make a huge difference for your clients. It’s all about keeping things clear, accurate, and easy to manage.

Here are some best practices that make it easier to do just that:

- Consistency Record-Keeping

- Perform regular reconciliation

- Include detailed Descriptions for Transactions

- Perform periodic reviews

- Use a General Ledger Accounting Software

Keep Records Consistently

Make it a habit to record transactions on a set schedule, whether it’s daily, weekly, or monthly. That way, you’re less likely to miss a transaction or have to scramble to get things in order later. This routine keeps everything neat, organized, and ready whenever you need it.

Perform regular reconciliation

Compare the ledger with bank statements, receipts, and other records to make sure everything aligns. This helps you catch any mistakes, duplicates, or mismatches early on, before they turn into bigger issues. Reconciling regularly keeps things balanced and gives you and your clients confidence that everything’s on track. Here’s a bank reconciliation sample.

Include detailed Descriptions for Transactions

Every transaction has a story, so take a few extra seconds to add a clear description for each one. Write out what the transaction was for, like payment from client x or office supplies purchase. These little notes make it so much easier to understand entries at a glance, saving time during reviews and making audits a lot less stressful especially for uncategorized transactions.

Do Periodic Reviews

Even with regular entries and reconciliations, it’s smart to take a step back now and then to do a full review. This could be every quarter or month, depending on the volume. Reviewing helps you spot any trends, double-check data accuracy, and see if there are any unusual transactions that need attention. These periodic reviews are like a financial check-up that helps catch anything unusual before it grows into a bigger issue.

Use a General Ledger Accounting Software

Software like Sage Intacct, QuickBooks Online, and Xero streamlines the process of maintaining a ledger. It can automate data entry, categorization, and reconciliation, making it faster and reducing manual errors.

Plus, most accounting software comes with handy features like reporting, data backup, and even integration with other tools, like payroll or invoicing systems. It’s a big help for keeping everything organized and accessible.

Manage Your Firm and Clients With Financial Cents

Managing clients’ GLs allows you to provide accurate reports, track trends, and make informed decisions that benefit your clients and your own business.

But if you have multiple clients, it’s difficult to stay on top of all tasks efficiently. That’s where Financial Cents comes in.

Our software makes managing client work and tasks (like the general ledger) simpler and more efficient, so you can focus on serving clients.

With Financial Cents, you can organize and manage your general ledger tasks, streamline your workflows, and keep your team on track.

It’s great for firms that want to stay on top of client work and remain efficient.