Accounting workflow management is about reducing the time you spend working on what to work on (in Jason Staat’s voice):

- What do I do next?

- Where did I store which client’s information?

- Or whether the client ever sent the file I requested, to begin with.

An increase in these tasks is directly proportional to the time wasted on non-billable work, which reduces your work quality and profitability.

Accounting workflow software automates manual tasks and puts files and information at your fingertips, unburdening your staff, reducing errors, and freeing you to focus on the work that matters most, like 63.2% of the firm owners in the 2025 State of Accounting Workflow Automation.

In this article, we review the eleven (11) best workflow software solutions for accounting in 2026 to save you endless searches.

(You may be interested in our review of the best accounting practice management software.)

What is Accounting Workflow Software?

Accounting workflow software is a solution that centralizes and automates accounting processes like task tracking, team collaboration, document exchange, and client communication.

By taking care of these manual processes, accounting teams can reduce manual errors, enhance team (and client) collaboration, and get work done more quickly.

Key Features to Look Out for in Workflow Tools

-

Workflow Dashboard

The workflow dashboard provides a centralized, real-time view of projects and tasks with their progress reports, giving you real-time visibility into project timelines to hold your team accountable.

That is why 73.9% of firm owners and managers prioritize access to workflow dashboards in their workflow management solutions.

-

Due Date and Deadline Tracking

How can you tell your team’s chances of meeting deadlines if you can’t see when a project is due at a moment’s notice?

The due date and deadline tracking feature shows the date every project and task in your firm is due.

-

Workflow Automation

Automation is the cure for time-wasting repetitive work that overwhelms your ability to deliver error-free work.

From data entry to document requests, project creation, and client follow-up, workflow automation processes tasks and information between team members (and clients) based on predefined rules, saving your team the need to perform repetitive tasks manually.

-

Workflow Templates

Workflow templates make it easy to show your team members how to get work done to your standard by outlining every step on a checklist.

Templates are easy to edit to your preference, saving you the time to create them from scratch.

With Financial Cents, you get both the built-in templates and the templates library, a hub of over 200 workflow templates created by other accounting firms on an ongoing basis.

-

Recurring Projects

This feature automatically creates future versions of your repetitive projects. This saves you:

- The mental load of remembering to create them.

- The stress of leaving every other thing to create them daily, weekly, monthly, quarterly, or yearly.

If you’re like 50.7% of firm owners, the recurring projects feature will be one of the most important features in workflow software.

-

Time Tracking and Billing

The time tracking feature keeps your team working on tasks that make your firm profitable by showing you where your team members spend their time and which projects take too much of your time.

When combined with the billing solution, your invoicing data will become more accurate, helping to prevent invoicing disputes and late payments.

-

Client Portal

The client portal is a secure platform for client collaboration. There, your clients can upload documents, view the documents you’ve shared, and communicate with your team.

The best and most secure accounting client portals are passwordless. They use magic link technology to ensure security while saving clients the trouble of creating and managing login information.

-

Document Management

With deadlines and evolving financial reporting standards to comply with, finding up-to-date documents for work shouldn’t add to that stress.

The document management feature puts documents at your team members’ fingertips by letting you store and organize files in one central location.

-

Integrations

All-in-one practice management solutions are crucial, but no matter how extensive a tool is, it won’t meet all your needs.

That’s why integration with your other mission-critical tools is key. It will reduce the number of apps your team logs into daily, enhancing their productivity and focus.

11 Top Accounting Workflow Management Software in 2026

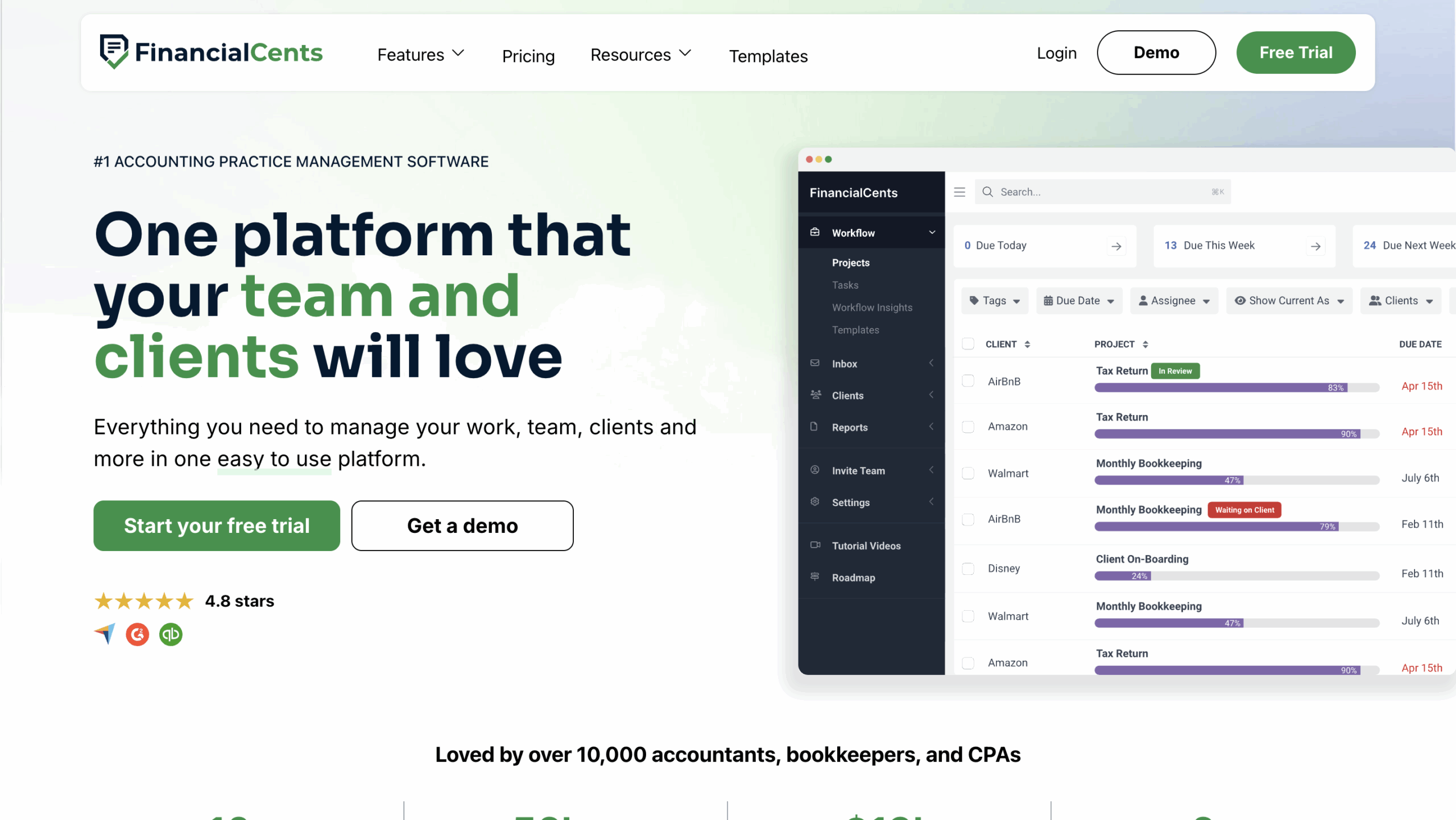

1. Financial Cents

Financial Cents is an all-in-one accounting practice management software that helps you manage every aspect of your firm (workflows, clients, and team members) in one place.

Its workflow solution features are designed to give accounting teams the ease and simplicity they need to work quickly and the sophistication to accommodate future growth.

Its workflow feature includes:

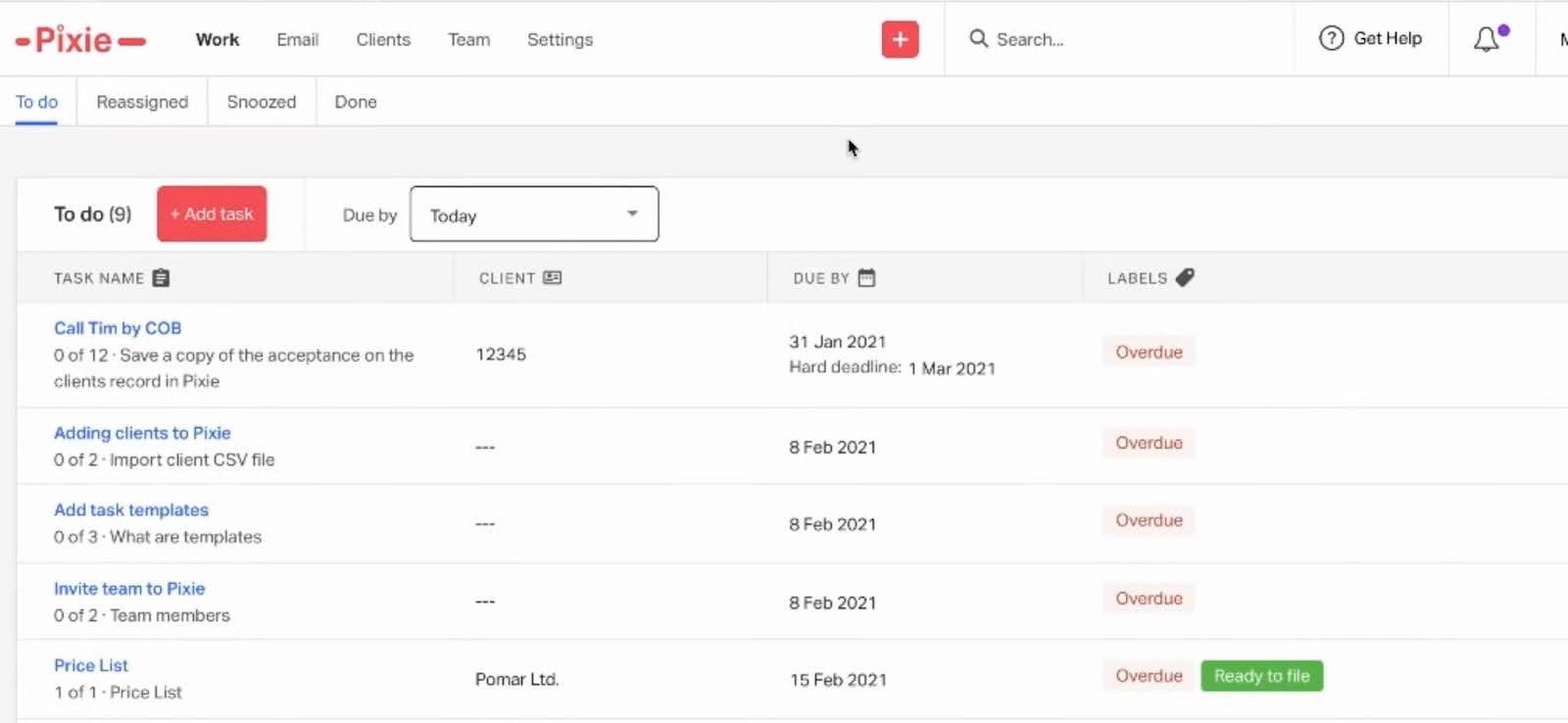

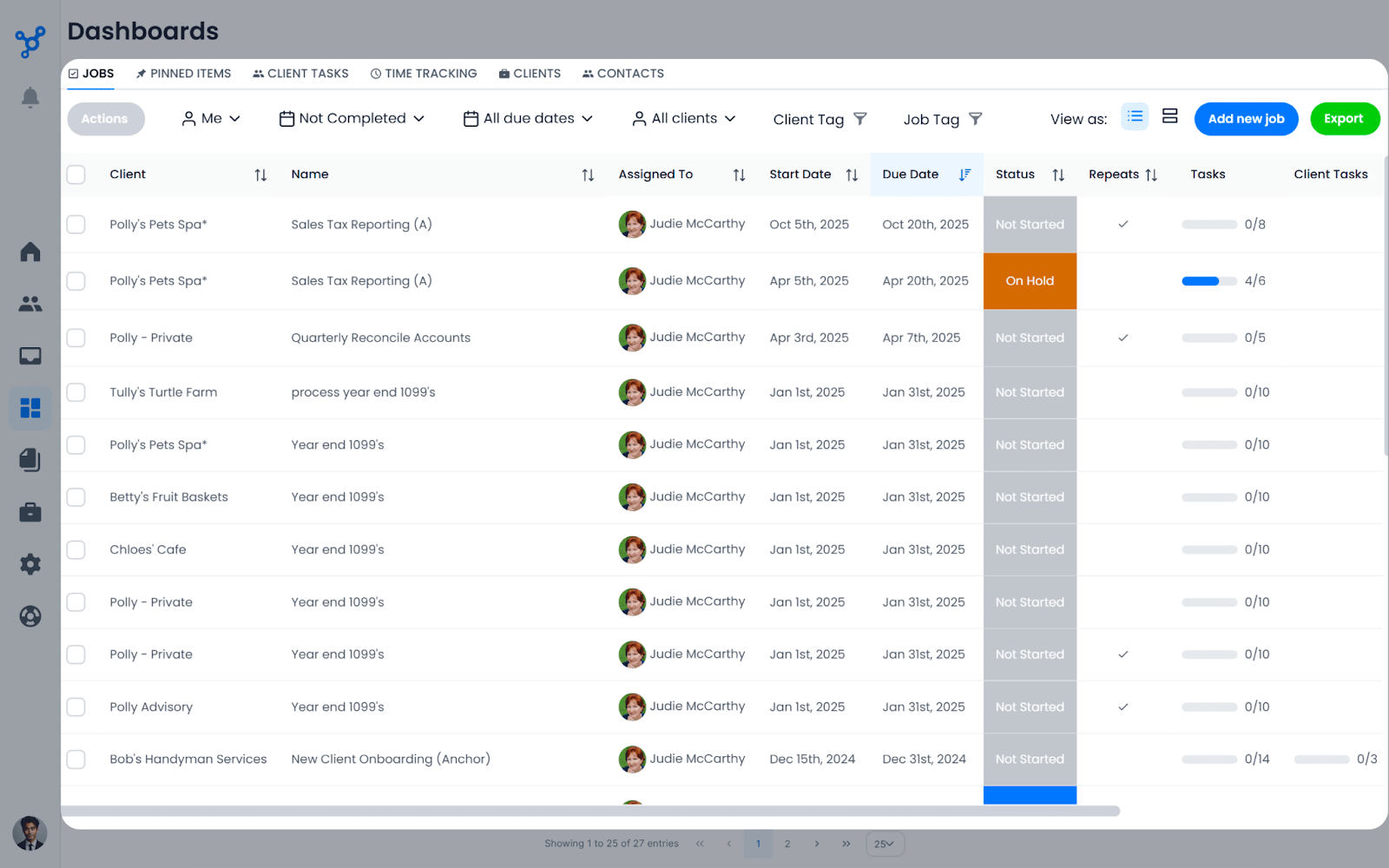

Workflow Management

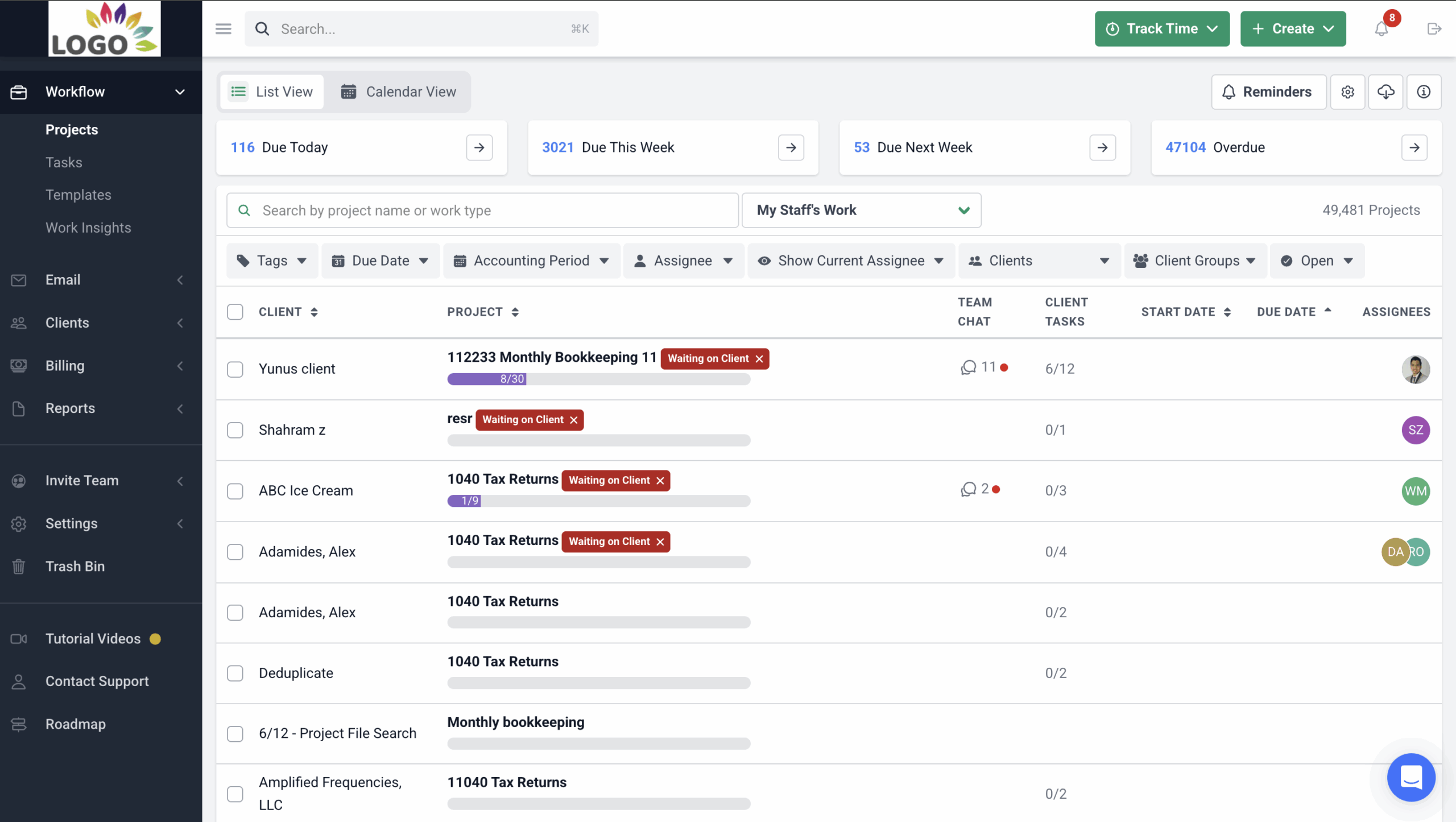

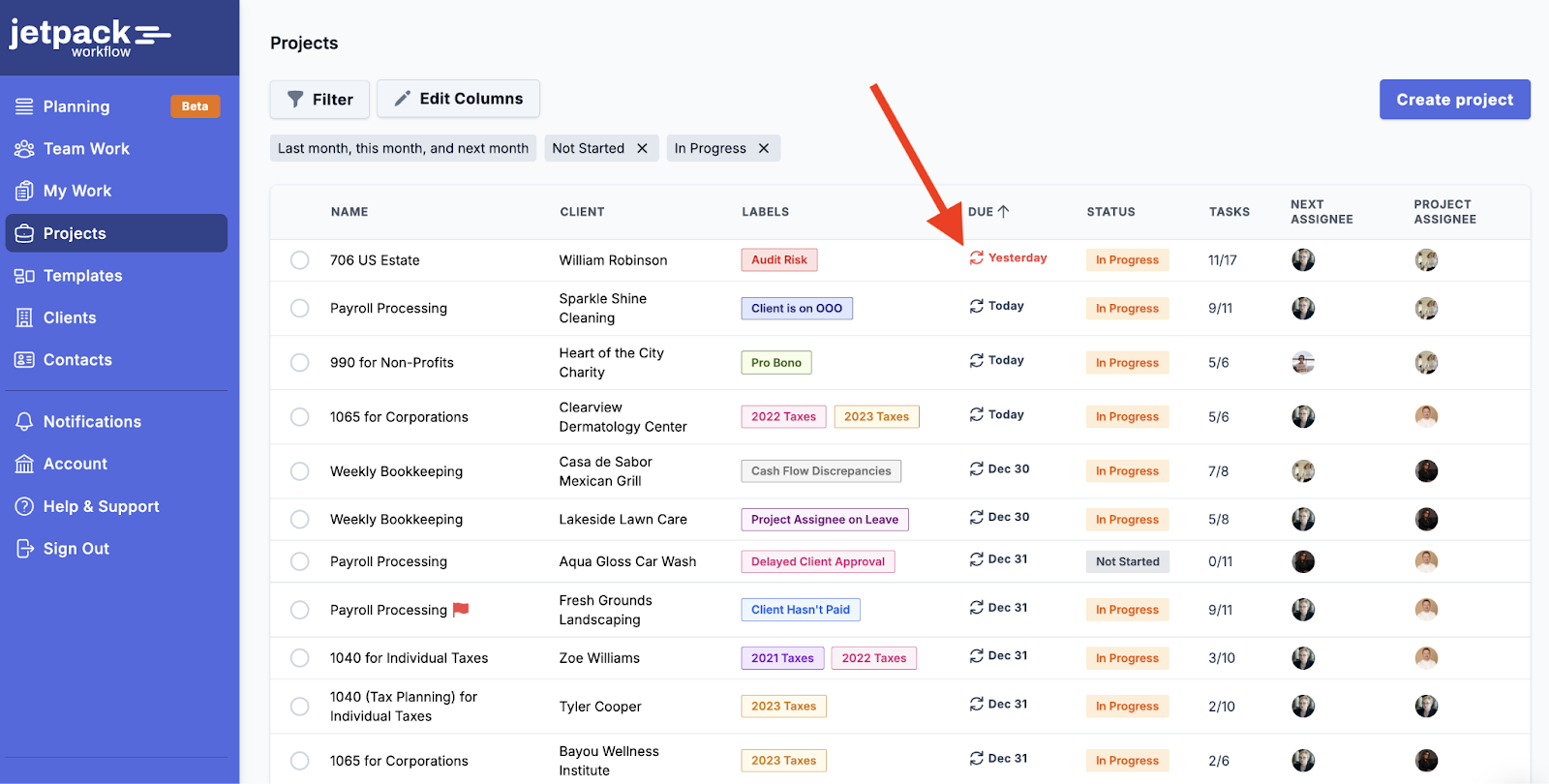

- Dashboard: the home page in Financial Cents, where all the projects in your firm (with their due dates, status, progress report, assignees, etc.) are displayed, giving you complete visibility.

- Workflow Filters: allows you to view only the work or information that matters to you at a particular time.

Here are some of the filters and what they display:

-

- Search Bar: type of work, assignee, or status.

- Tags: Custom labels that indicate the different stages of your projects.

- Assignees: specific team members’ work.

- Clients: projects done for a particular client.

- Due Date: work due by date (today, this week, next week, this month, etc.).

- Current Assignee: The team member is currently working on the project.

- Templates: pre-built workflow checklists (SOPs) that show your team members how to complete their work. You also get access to over 200 templates built by other accounting, tax and bookkeeping professionals like yourself through the template library.

- AI Workflow: AI-generated workflow checklists that make documenting your workflow processes easier and faster.

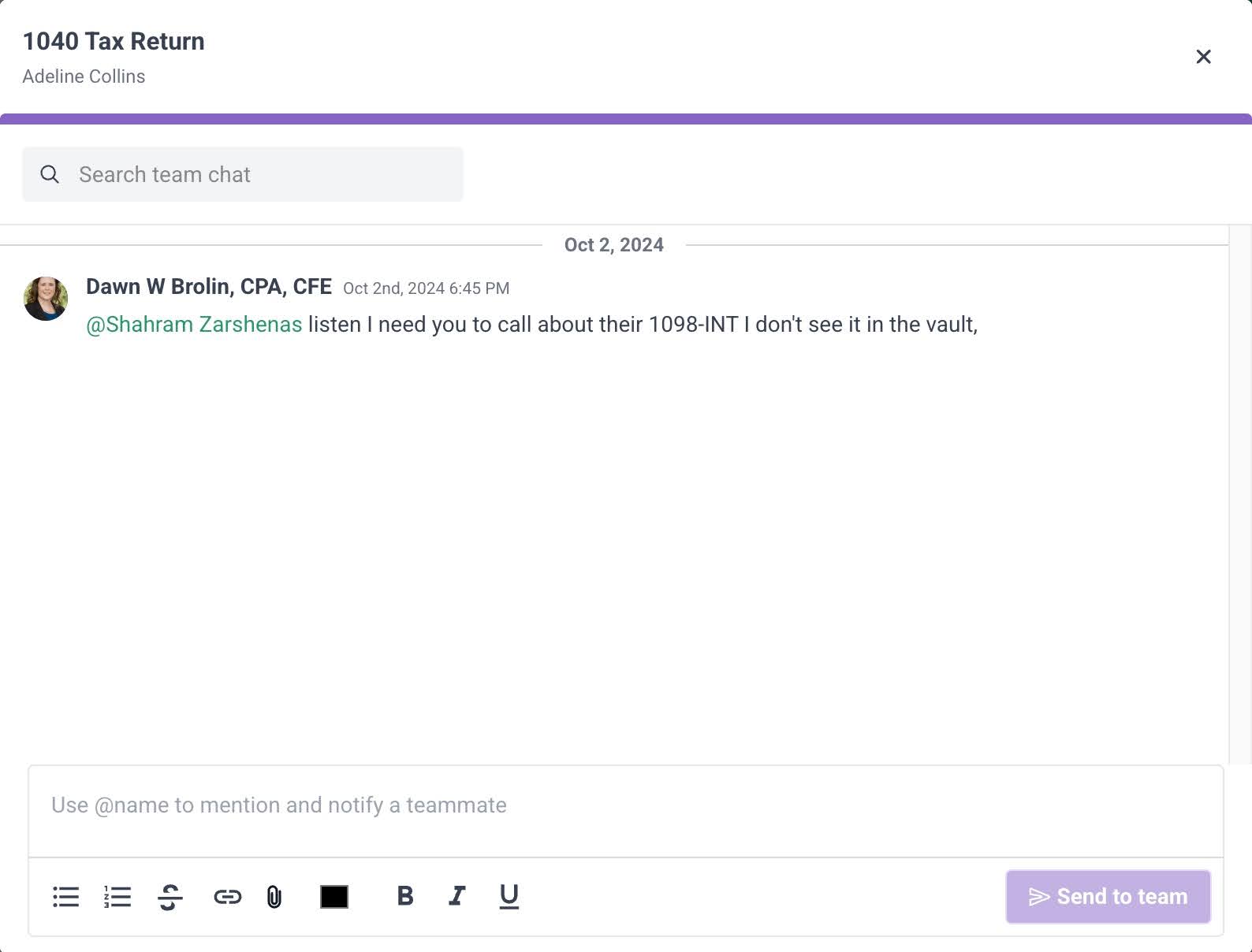

- Comments: Team members can share comments to ask questions and build clarity.

- Team Chat: All project-related team communication is stored inside the project.

- @Mention: This feature lets you pull specific team members into your conversations.

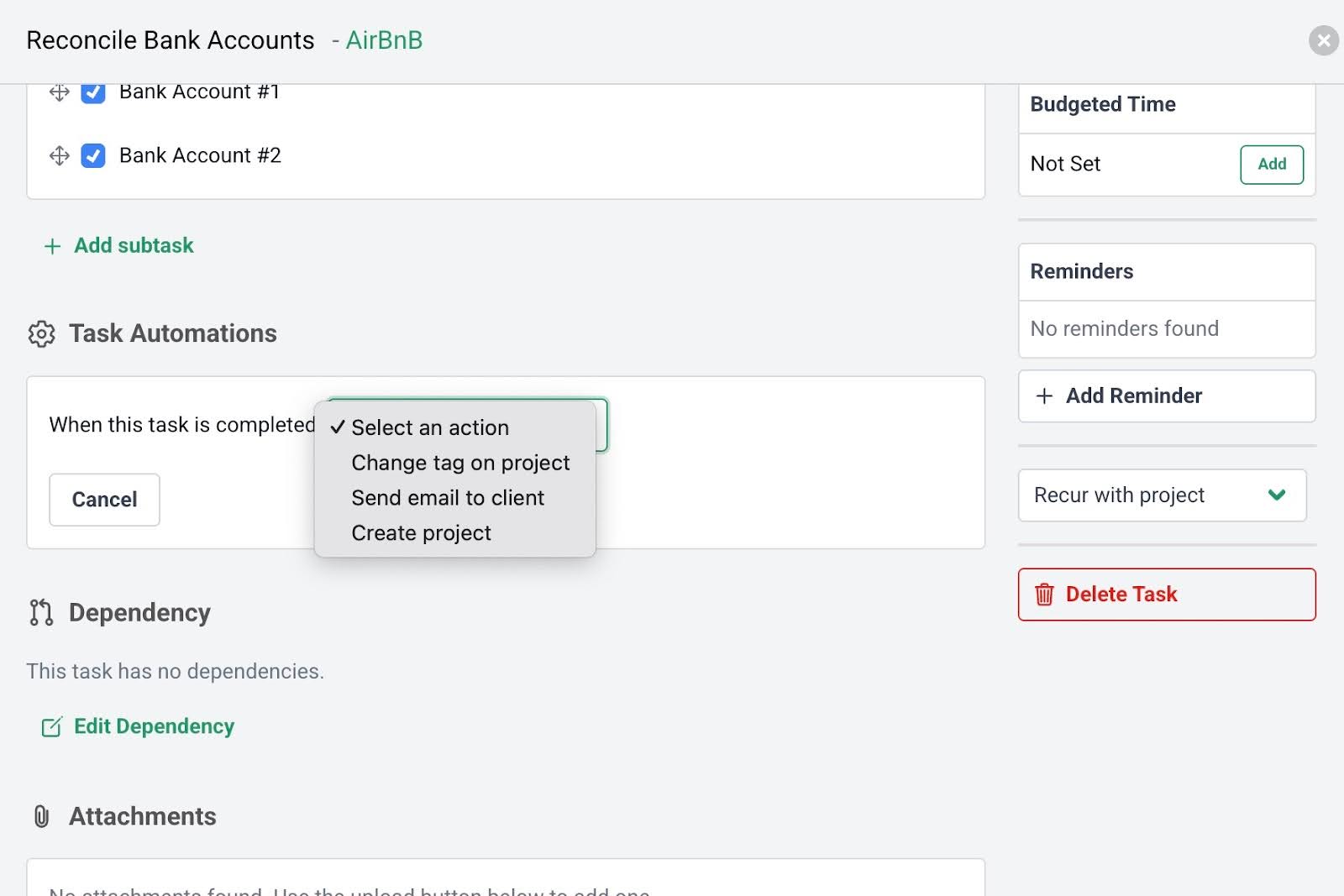

Workflow Automation

- Tag Automation: automate work status as a project moves through the states by applying predefined labels (In Preparation, In Review, Waiting on Client Info) to the project.

- Automatic Client Update: send an email to your client when your team completes a task or section, telling them what to do next.

- Auto-create Projects: create a project when your team completes a task or section without manual input.

- Dependencies: prevent team members from starting work until the previous task is done to enhance coordination.

- Client Tasks and Reminders: remind clients about the file or information (or E-Signature) you need to get their jobs done.

- Passwordless Client Portal: a secure hub to store requests and share documents and tax forms with your clients.

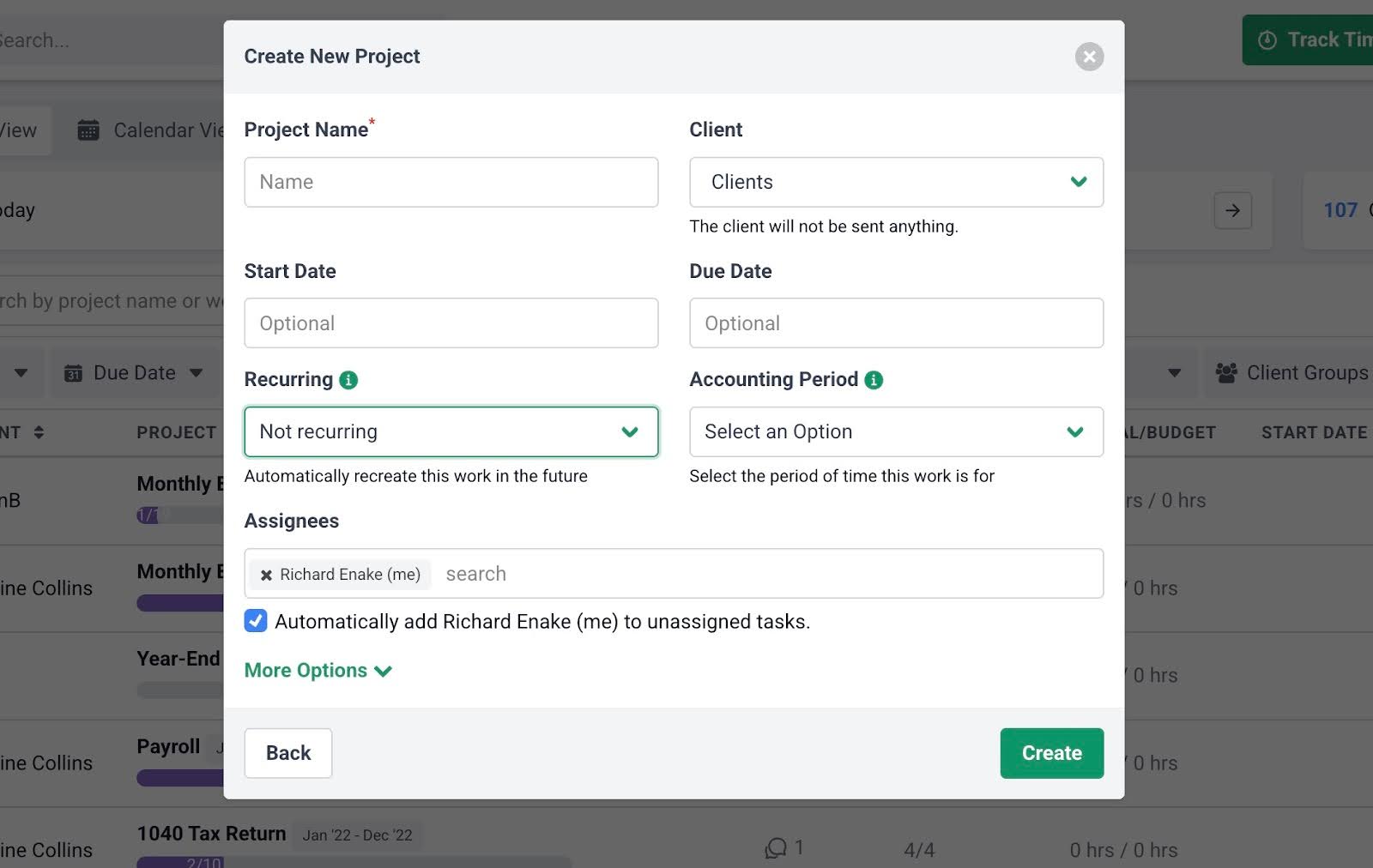

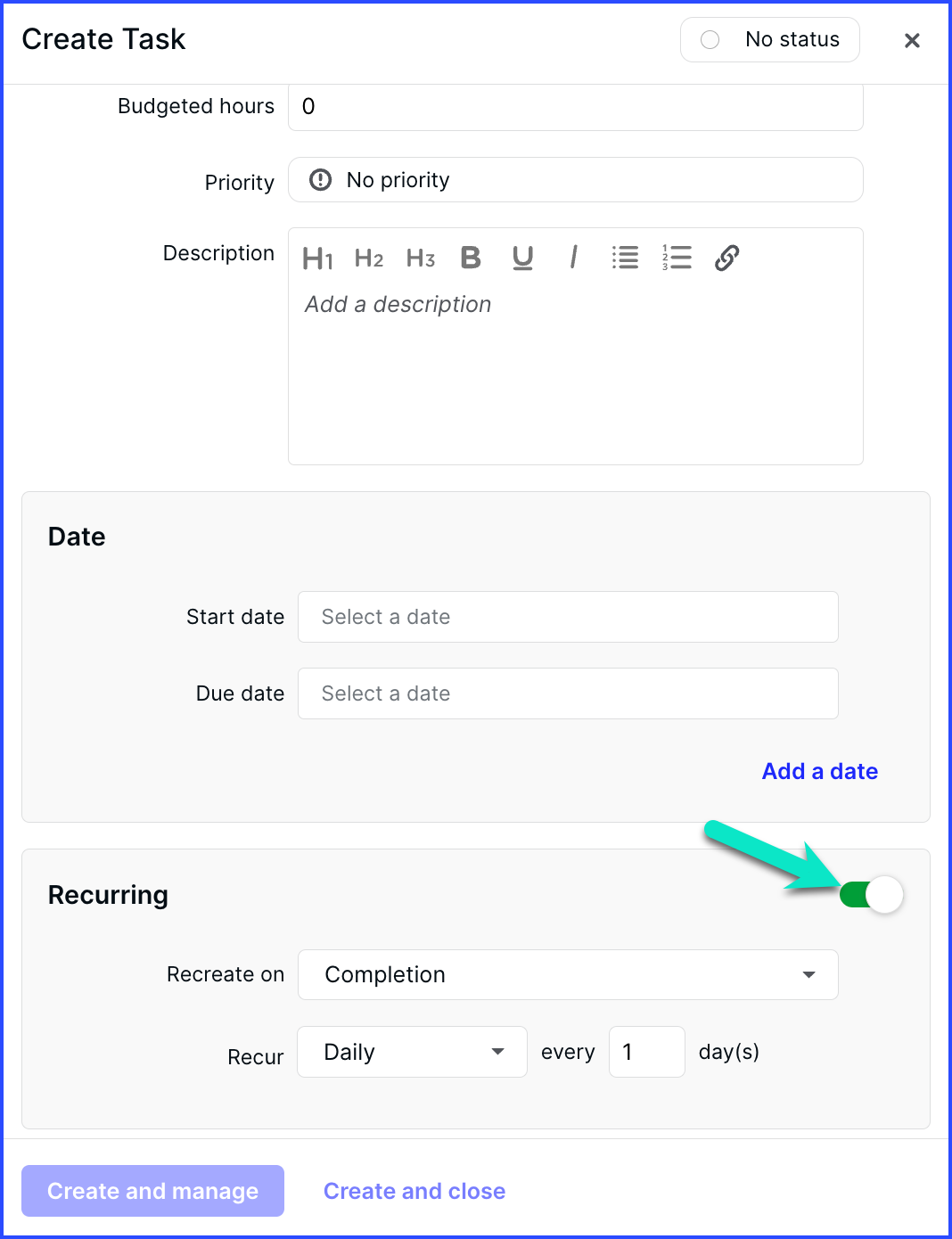

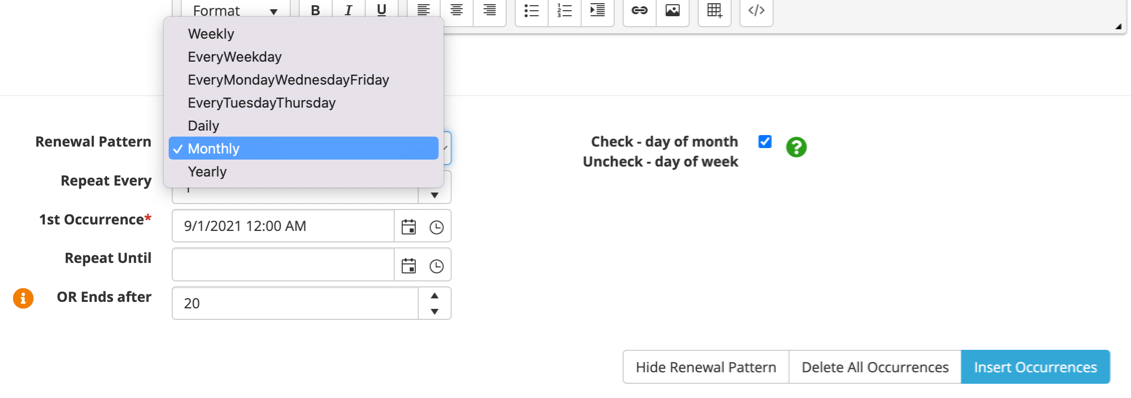

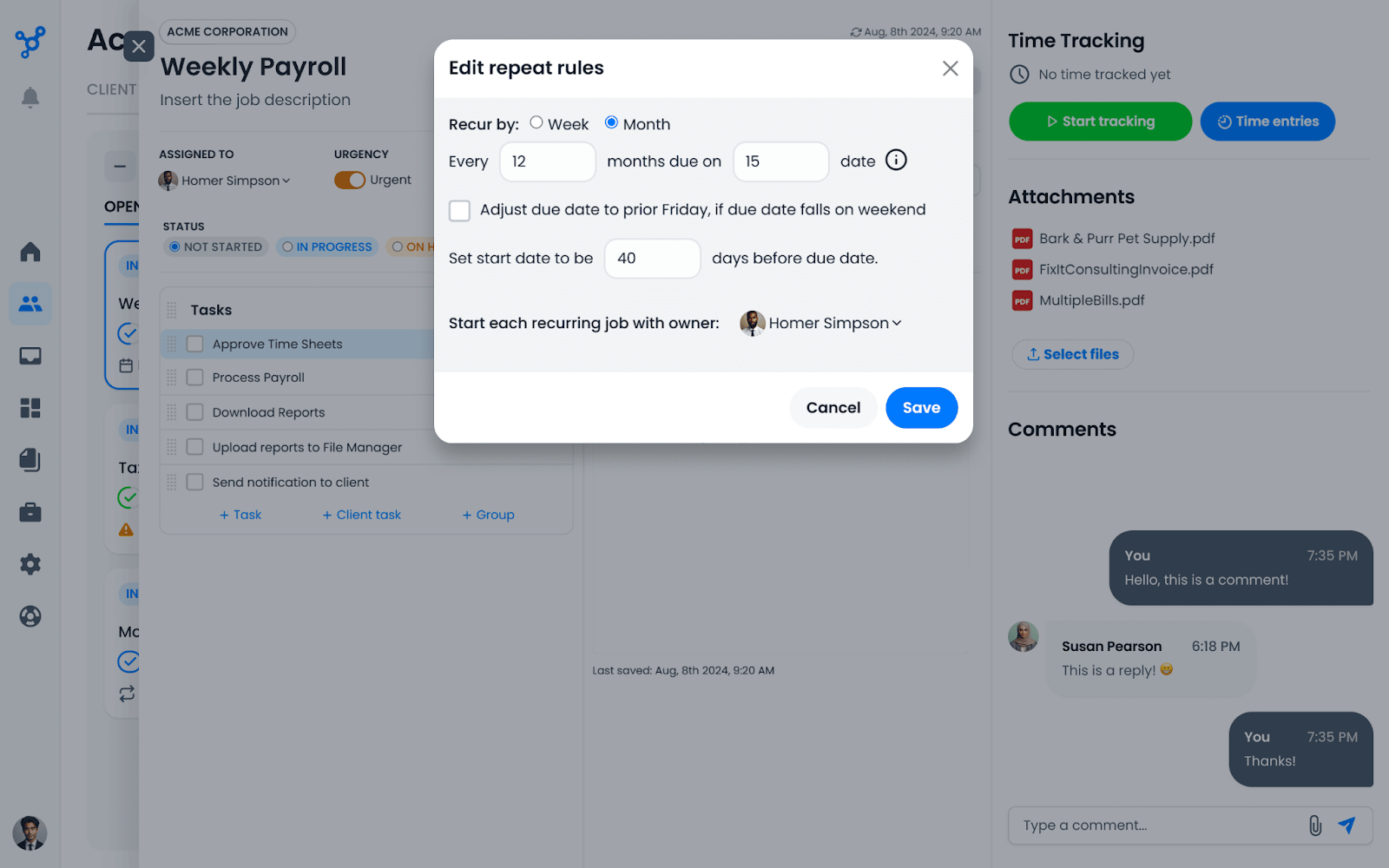

Recurring Projects

Financial Cents enables you to create future copies of your repetitive projects, saving you the stress of creating them manually (or the embarrassment of forgetting them) in the future.

You can create two kinds of Recurrences:

- Default Recurrences: You can create repetitive work for regular schedules (like Daily, Weekly, Monthly, Quarterly, or annually).

- Custom Recurrences: You can also create projects for more dynamic schedules (on the last day of the month, on the first Friday of the month, every Tuesday of the Second Week of the Month, etc.).

Time Tracking and Billing

Financial Cents has a built-in time tracking feature that provides:

- Define Billing Rates: You can add your hourly rates on individual projects, for individual team members, or on a service item.

- Automated Timer: allows you to track time in the background.

- Manual Entries: You can also add time entries manually.

- Time Budgets: Estimate the time a client’s work should take to identify when you are running over budget.

- Billable Vs Non-Billable: Track the time you can bill for and the administration work you can’t bill for to keep your firm profitable.

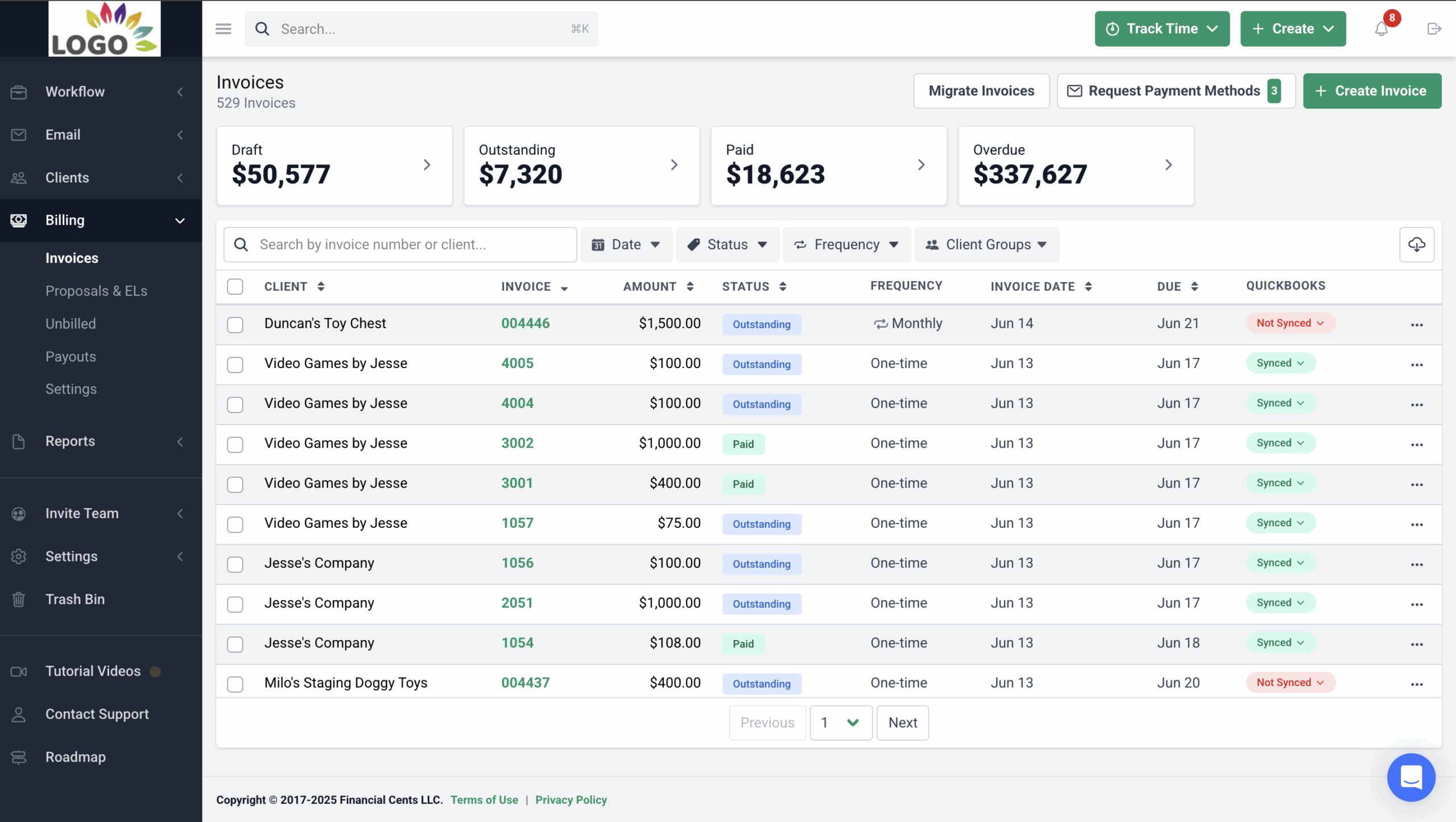

Its Billing Features include:

- Multiple Payment Methods: conveniently receive payments from your clients using ACH & Credit Cards.

- Recurring invoices: Apart from one-time invoices, you can also use templates to create recurring invoices to bill clients when due.

- Saved Payment Methods: add your client’s payment method to their file to save clients the time of entering the information repeatedly.

- Automatic Payments & Authorized Payments: clients can automatically pay you as and when due.

- Invoice Off Billable Time: generates invoices from billable time in WIP that have not been billed for.

- Pass CC Fees on to Clients: This enables you to transfer credit card fees to clients.

- Lock Time Entries Once Invoiced: You can prevent time entries from being edited once the invoice has been sent.

- Automated Client Reminders: Financial Cents follows up with clients to send your payment.

- Sync Invoices and Payments with QuickBooks Online: prevents double entry by showing invoices sent from Financial Cents inside QBO.

Reporting

- Time-Tracking Reports: provide insights into the time your team spends on a client’s work to make informed pricing decisions.

- Effective Hourly Rate Report: understand which clients are sucking up your time and keeping you from making maximum profits.

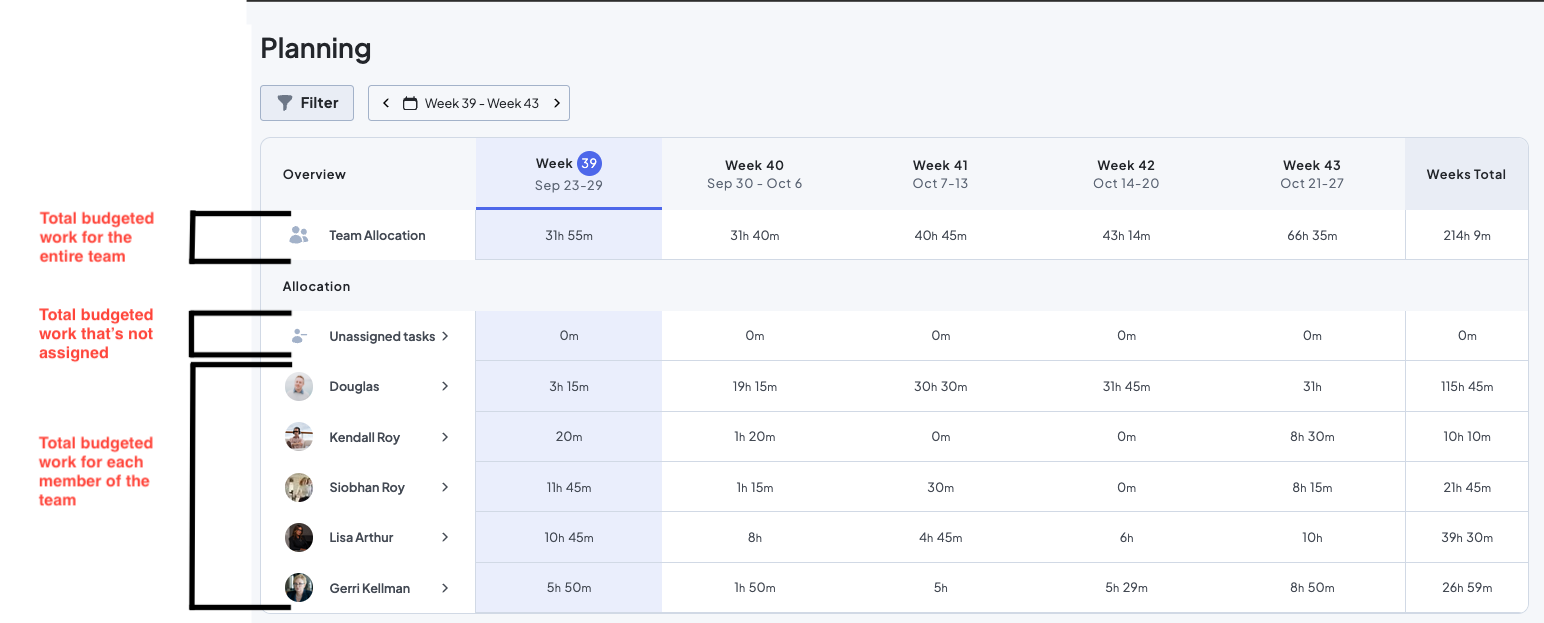

- Capacity Management: See how much work your team members are doing, who is overworking, and who has room for more work.

- Team Activity Report: See the work your team members are currently doing, what they’ve done previously, and the time they tracked on a particular day.

- Realization & Profitability Report: see how much profit a project, client, or team member is generating for your firm.

- Utilization Report: Track how much time your team is spending on billable versus non-billable work to make necessary adjustments.

- Client Tasks Report: see which requests our client has granted and what is outstanding in real-time.

- Client Uploads Report: View the documents a client uploads by the time they upload them on one screen.

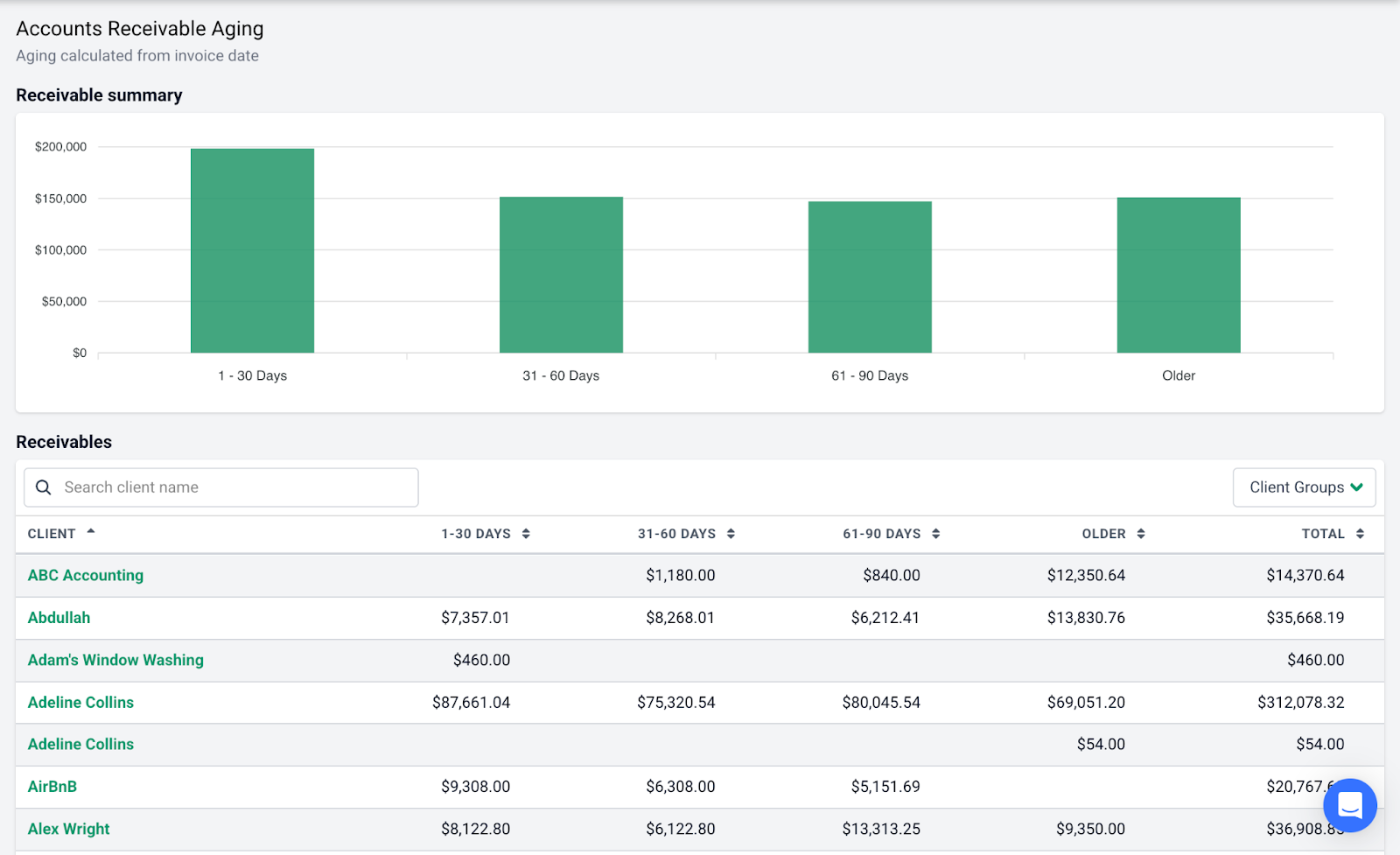

- Accounts Receivable Aging Report: Monitor your receivables to manage collections more confidently.

- Revenue Insights Report: see your firm’s total and average revenue by clients and projects to measure your growth.

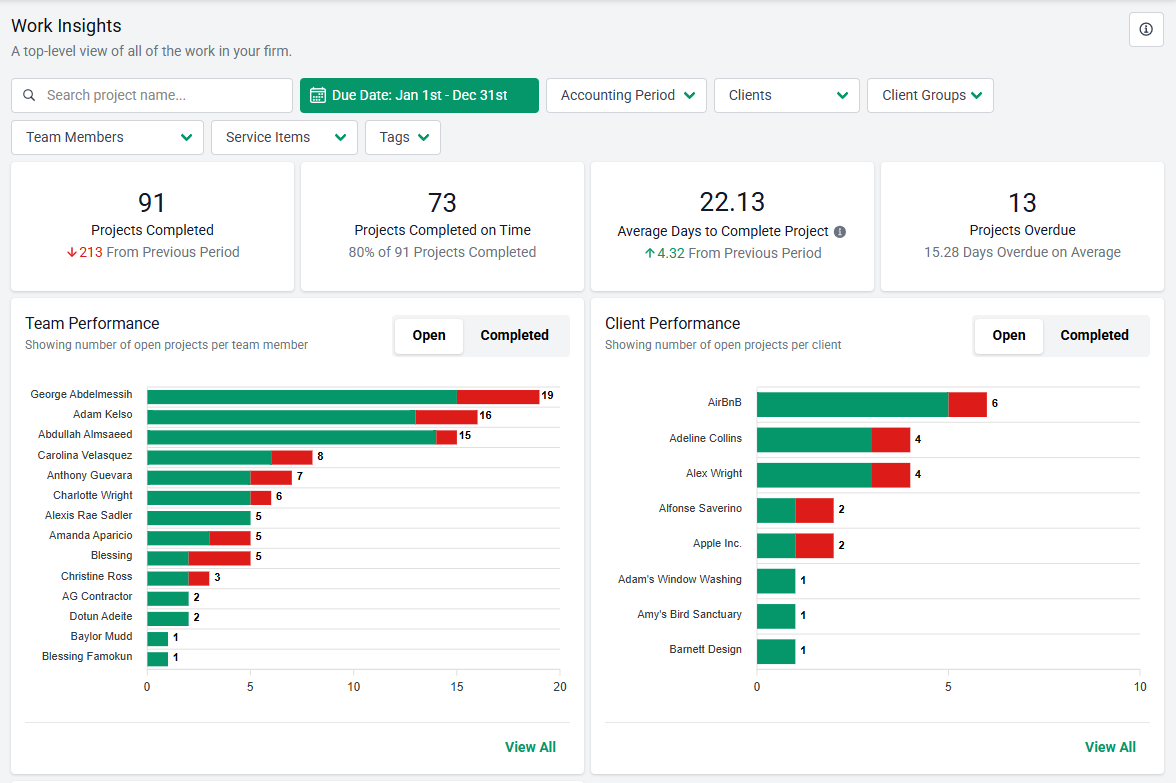

- Work Insights Report: This shows your firm’s efficiency gains by the number of projects completed, the number of days spent on projects, the number of overdue projects, etc.

Rating

Financial Cents is rated:

Free Trial

14 days free trial available

Pricing

- Solo Plan – $19/month (paid annually). For single user firms.

- Team plan – $49/month per team member (paid annually) or $69/month per team member (paid monthly),

- Scale plan – $69/month per team member (paid annually) or $89/month per team member (paid monthly).

- Enterprise – custom prices for advanced support, security & customization needs.

Pros

|

Cons

|

Start streamlining and automating work in your firm with Financial Cents. Start a 14 day FREE trial or Book a Free Demo today.

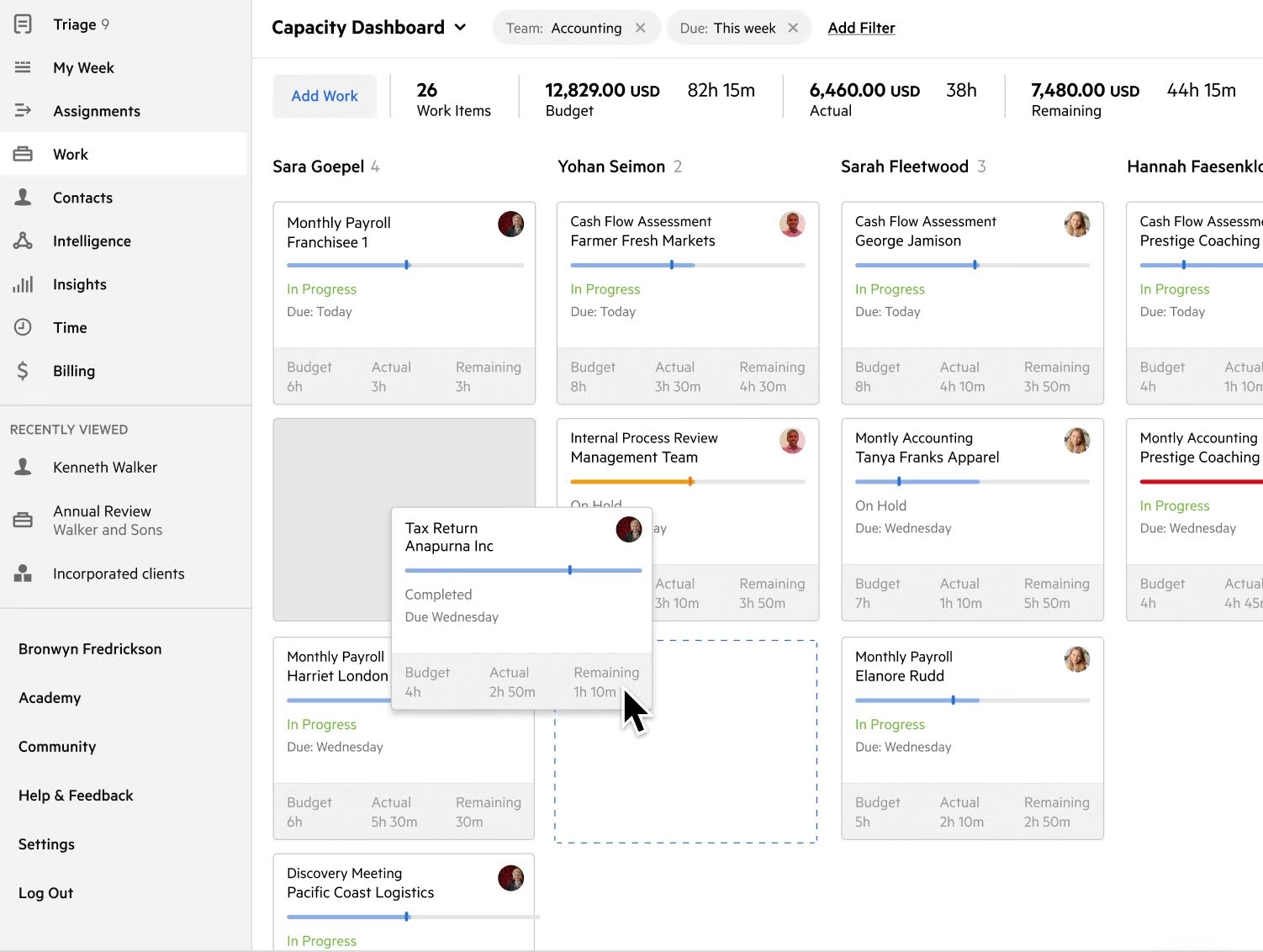

2. Karbon

Karbon’s collaborative platform unifies workflow management, client communication, and payment processing for accounting firms.

Its automation enables teams to understand work status and improve efficiency at scale.

Its workflow feature includes:

Workflow Management

- Dashboard: Displays tasks, emails, and calendar events in Kanban or list format.

- My Week: Organize each team member’s tasks into a manageable weekly action plan.

- Calendar: Syncs tasks and deadlines in a visual timeline.

- Templates: Library of 250+ accounting workflow templates that you can customize for your firm.

- Notifications: Keeps teams aligned with real-time updates.

- @mentions: allows teams to share comments for internal collaboration.

Workflow Automation

- Task Automators: Creates logical relationships and dependencies between the tasks in a workflow.

- Auto-reminders: remind clients of missing information automatically.

- Task Assignment: Automates task delegation based on job roles and work history.

- Automatic Communication Updates: make team communication more accessible by sending summaries of conversations to team members.

Recurring Projects

Karbon’s work scheduler sets recurring work to repeat automatically. Karbons shows you an outline of when the next job in a series will be created.

Time Tracking and Billing

- Inbuilt Time Tracking: Tracks the time employees spend on tasks. You can also enter time entries manually.

- Time Estimates: budget your time for projects to understand when you’re running over budget and plan more effectively.

- One-time and Recurring Billing: Bill clients for a one-time or recurring project.

- Saved Payments Details: Save clients the need to enter their payment information afresh to make receivables faster.

- Automatic Payments: enable clients to be automatically charged in the future.

- WIP: tracks unbilled work to show you what’s not billed for.

Reporting

- Work Status: Identify the bottlenecks in your process to address them on time.

- Work Outstanding: shows all projects currently being worked on.

- Client Communication: shows how well you’re handling client communication.

- Time: shows the client projects each team member is handling.

- Billing: shows your revenue growth month over month.

Rating

Karbon is rated:

Free Trial

A 7-day free trial is available

Pricing

- Team Plan: $59/month per user (paid annually) or $79/month per user, paid monthly

- Business Plan: $89/month per user (paid annually) or $99/month per user, paid monthly

- Enterprise: Custom Pricing

Pros

|

Cons

|

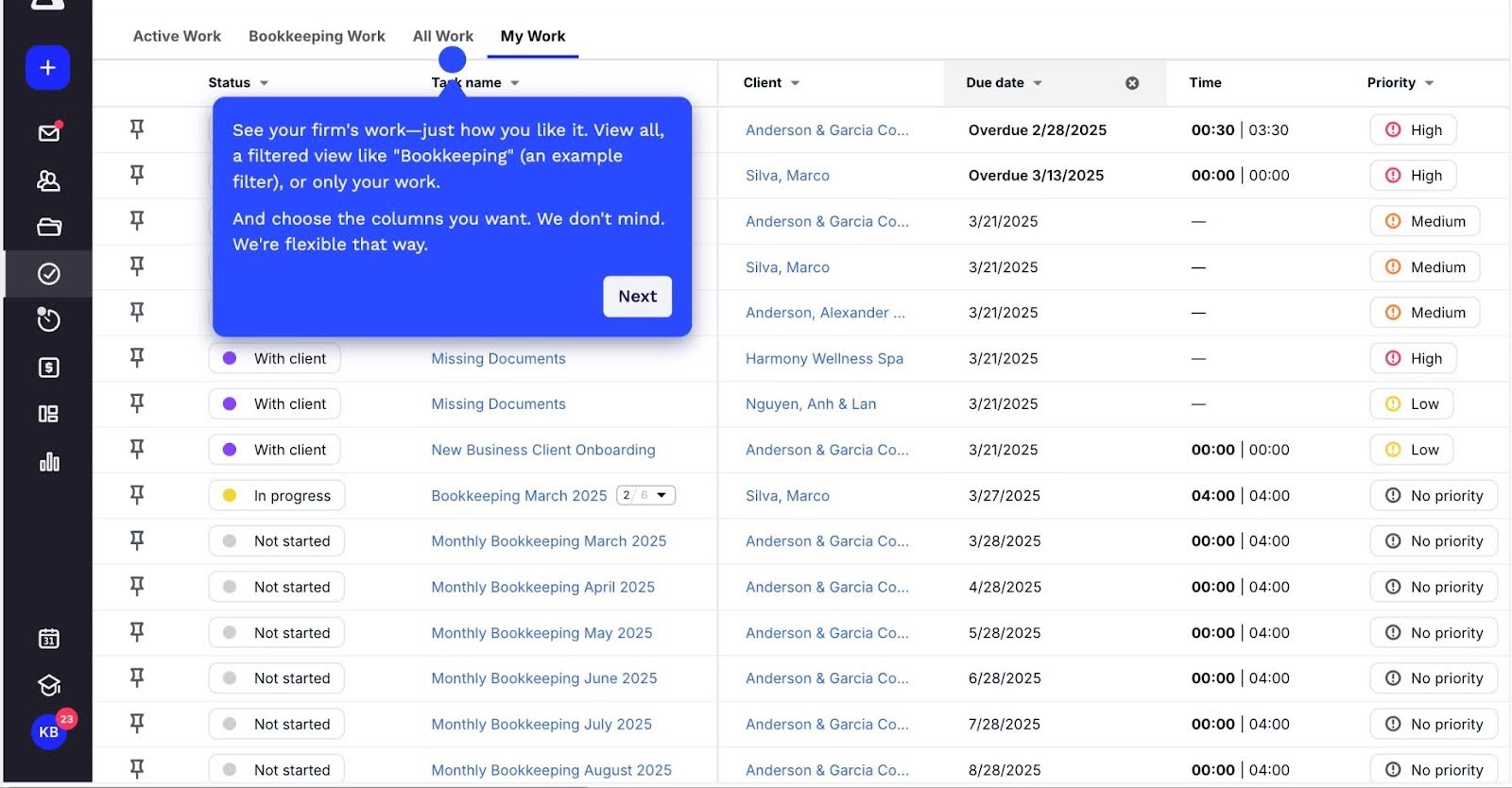

3. Canopy

Canopy is a client-focused workflow management software with advanced automation, billing, and communication features. It is most notable for its tax resolution features like IRS integration and transcript analysis.

Its workflow features include

Workflow Management

- Global Dashboard: A customizable dashboard that gives a firm-wide view of project attributes (assignee, client name, due date, status).

- Tax Organizers: enable your team to gather and organize tax information from business and individual filers in a simple step.

- IRS Transcripts: Canopy allows you to request summaries of your client’s return information on demand.

- Task Templates: document your processes to show your team how to complete their assigned tasks.

- Comments: Discuss projects with your team by adding comments to tasks.

- Files: add relevant documents to your projects in Canopy to help assignees retrieve them more easily.

Workflow Automation

- Automation Rule: Set up tasks and subtasks with custom automation rules to reduce tedious tasks.

- Automatic Notification: Canopy sends assignees an automated notification when their tasks are due.

- Automatic Tags: tags projects when tasks get to predefined stages.

- Automatic Client Emails: sends emails to acknowledge receipt of client documents or completion of client tasks.

- Automatic Workflow: creates a project for a client when that client has been onboarded.

Recurring Projects:

Canopy lets you create recurring logic that automatically recreates ongoing projects.

Time Tracking and Billing

- Timer: run the Canopy timer to track time in the background.

- Budget Hours: Add an estimate of the time you expect tasks to be completed.

- Locked Time Entries: Lock time entries to protect the accuracy of billing information

- Recurring Payments: Apart from one-time payments, you can also schedule payments against a client’s recurring invoice.

- Multiple Payment Methods: accept ACH and credit card payments.

- Late Fees: sets up automated late fees to encourage prompt payment.

- Saved Payments: make subsequent payments easier by saving your client’s payment details.

Reporting

- Hours by Service Item: shows the hours your team spends on client work.

- Hours by Client: displays the hours spent on your client’s projects.

- Revenue by Service Item: shows how much profit projects generate.

- Aged Receivable Detail: gives granular information about your client’s outstanding payments.

- Utilization by Team Member Report: Shows how well your team members are using their billable hours.

Rating

Canopy is rated:

Free Trial

A 15-day free trial is available.

Pricing

Canopy uses a modular pricing model:

- Standard:

Client Engagement: $150 per month (unlimited users)

Document Management: $36/month per user

Workflow: $32/month per user

Time & Billing: $22/month per user

- Pro:

Client Engagement: $175/month (unlimited users).

Document Management: $36/month per user

Workflow: $40/month per user

Time & Billing: $31/month per user

Pros

|

Cons

|

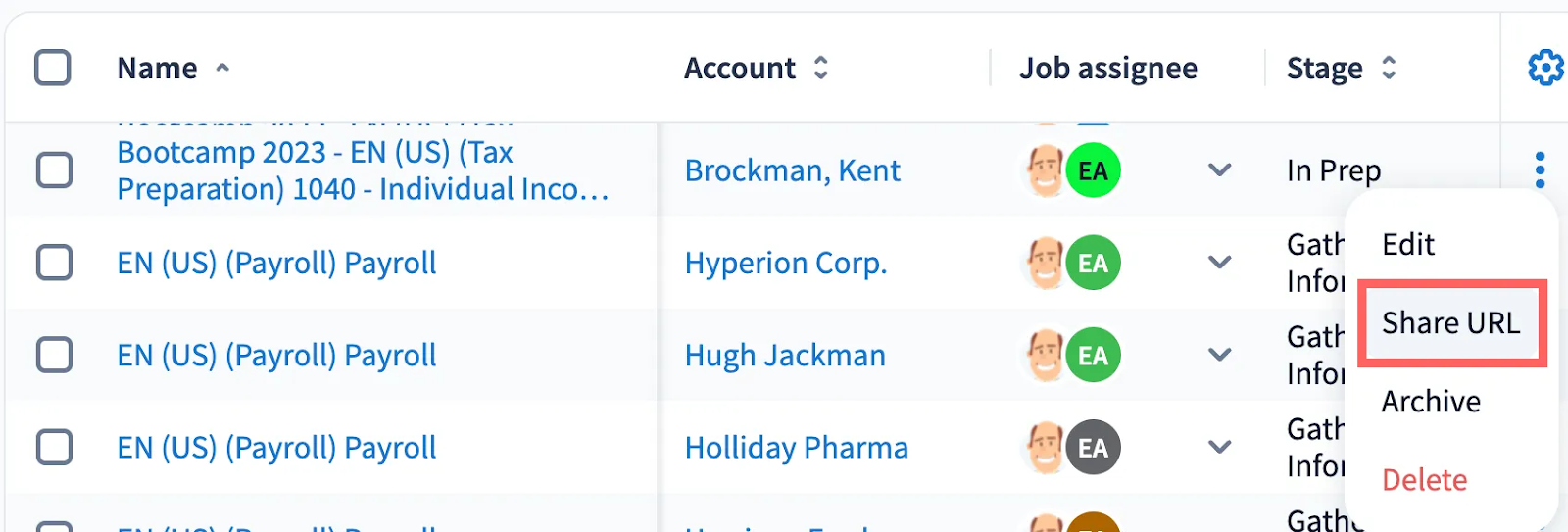

3. TaxDome

TaxDome promises to help you save time and drive firm-wide efficiency by enabling you to oversee both strategic planning and day-to-day task management. Its comprehensive features make it relevant to firms of all sizes.

Its workflow feature includes:

Workflow Management

- Dashboard: a customizable calendar that lets you visualize your work in a timeline format.

- Templates: customizable SOPs that help you document your processes.

- TaxDome Wiki: add detailed instructions to tasks to standardize your operating procedures.

- Notifications: keep you informed on relevant emails, messages, tasks, and work-related activities.

Workflow Automation

- Automove: moves work through its various stages and assignees without manual input.

- Pipelines: automate the steps in a process to ease coordination.

- Automatic Communication Updates: update clients on their project status automatically.

- Automated Reminders: keep clients accountable for your requests for information, documents, signatures, invoices, and organizers.

Recurring Projects

TaxDome allows you to automatically generate repetitive jobs in your pipelines on a predefined schedule–daily, weekly, bi-weekly, monthly, etc.

Time Tracking and Billing

- Inbuilt Time Tracking: track time in the background when your team is working.

- WIP: track unbilled work and ensure adequate client billing.

- Payment Processing: TaxDome’s payment processing system accepts multiple payment methods.

- Recurring Invoices and Payments: You can also send invoices regularly to reduce admin work.

Reporting

- Job Assignment Report: analyzes your team’s output over a period.

- AI-driven Search: You can find data more quickly by typing a keyword.

- Revenue Monitor: tracks revenue using received and expected payments.

- Time Utilization: monitors your team’s profit by comparing workloads to revenue generated.

- Team capacity: compares the time tracked by employees to the balance of workloads.

Rating

TaxDome is rated 4.7/5 on both Capterra and G2.

Free Trial

A 14-day free trial is available.

Pricing

- Solo: $700/year, per user (3 year subscription plan)

- Pro: $900/year, per user (3 year subscription plan)

- Business: $1,100/year, per user (3 year subscription plan)

Pros

|

Cons

|

5. Jetpack Workflow

Jetpack is workflow management software for accounting firms to organize client work, automate repetitive tasks, and hit deadlines consistently.

It is built specifically for workflow management. It doesn’t have the other features (like client management and billing) that make practice management solutions more comprehensive.

Its workflow feature includes:

Workflow Management

- Workflow Dashboard: one place to monitor client work and coordinate the team.

- Workflow Templates: checklists of accounting to-dos that help to standardize work quality across the firm.

- Labels: tags that you can apply to projects to monitor them as they go through the stages.

- Planning Tab: allows you to compare your work with available human resources to balance workloads.

Workflow Automation

- Task Dependencies: This feature ensures your tasks are completed as and when due by making succeeding tasks inactive until preceding tasks have been completed.

- Triggers and Actions: These let you automate tasks and information based on predefined rules.

- Recurring Projects: Jetpack allows you to set tasks and jobs to automatically repeat daily, weekly, monthly, or yearly.

Time Tracking and Billing

While you can track time and set time budgets in Jetpack Workflow, you have to integrate with QBO to bill your clients for the time tracked in Jetpack.

Reporting

- Progress Reports: show your project stages compared with their deadlines.

- Dashboard Insights: monitor overdue projects and upcoming deadlines to allocate your resources more effectively.

Rating

Jetpack Workflow is rated:

Pricing

- Starter Annual: $40/month per user (paid annually)

- Starter Monthly: $49/month per user (paid monthly)

Free Trial

14-day free trial is available.

Pros

|

Cons

|

6. Aero Workflow

Created by actual accountants, Aero Workflow helps small to midsize firms organize their firms to improve efficiency and productivity across the board.

Like Jetpack Workflow, Aero Workflow is ideal for firms that want to prioritize simplicity over comprehensive practice management features.

Its workflow features include:

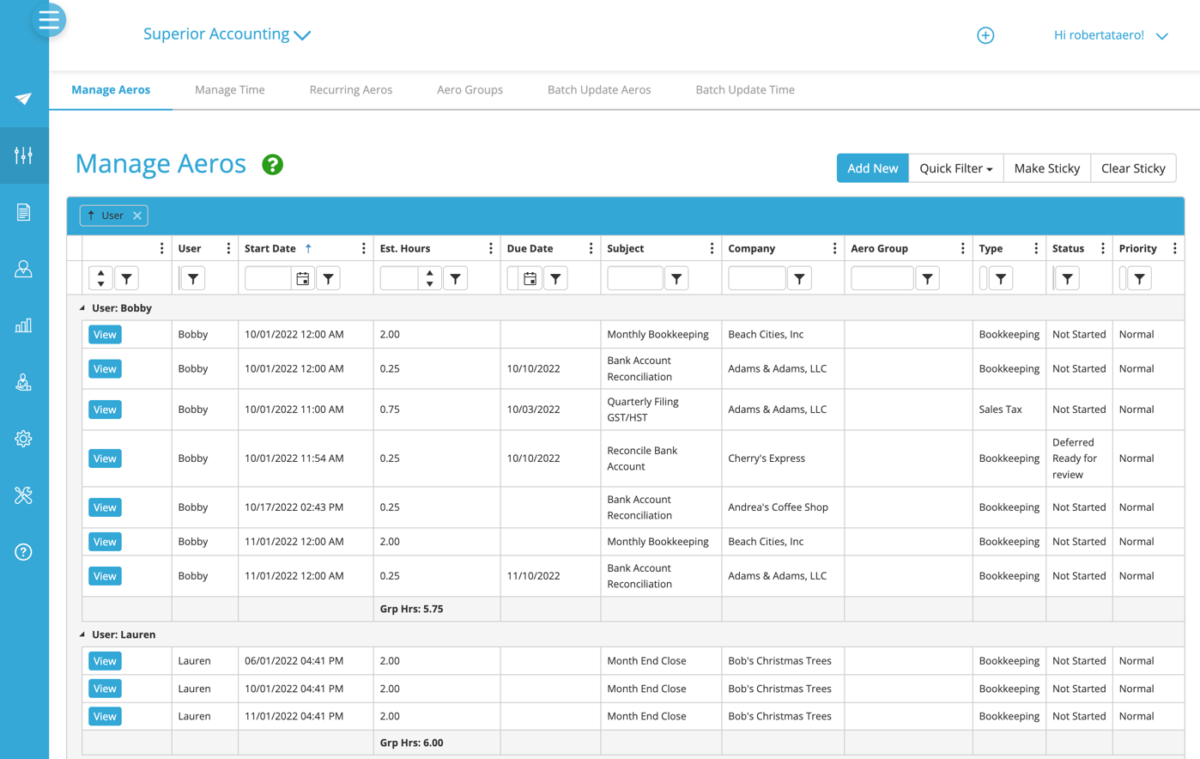

Workflow Management

- Manage Tab: shows firm owners and managers an overview of all work in the firm.

- My Work: contains all tasks assigned to each team member.

- Workflow Templates: over 60 prebuilt workflow templates that help firm standardize their processes.

- Status: the progress your team has made on a project.

- Task Deference: the ability for team members to hand work off between themselves.

- Priority: the urgency level of each project in a firm.

Recurring Projects

You can auto-repeat ongoing projects so you can focus on meeting deadlines.

Time Tracking & Billing

Aero automatically syncs the time you tracked with your QBO or QuickBooks Time for billing.

Reporting

- Actual vs Estimate by Team Member: the time your team members spent on a task compared with the budgeted hours.

- Daily Activity by Team Members: monitors how much time your team members spend on an Aero project.

- Client Last Activity Date: the most recent time entry for your clients.

Rating

Aero Workflow is rated:

Free Trial

A 30-day free trial is available.

Pricing

- Startup: $108/month for 1-5 users (paid annually)

or $135/month (paid monthly)

- Growth: $200/month for 6-25 users (paid annually)

or $250/month (paid monthly)

- Scale: $295/month for 26-50 users (paid annually)

or $365/month (paid monthly)

Pros

|

Cons

|

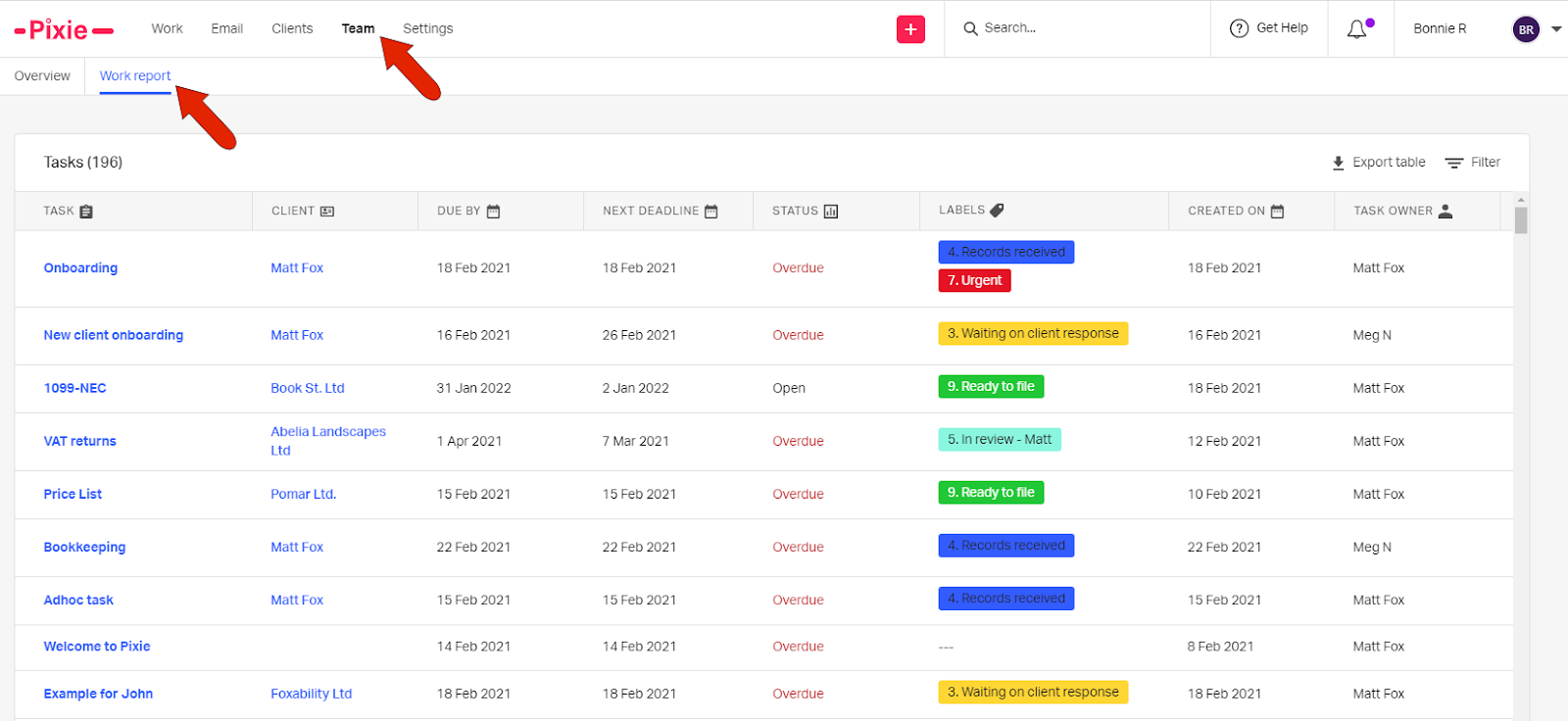

7. Pixie

Pixie enables busy accountants to simplify their workflows, automate their tasks, and enhance client management.

It is notable for its integration with Companies House, which enhances client data collection.

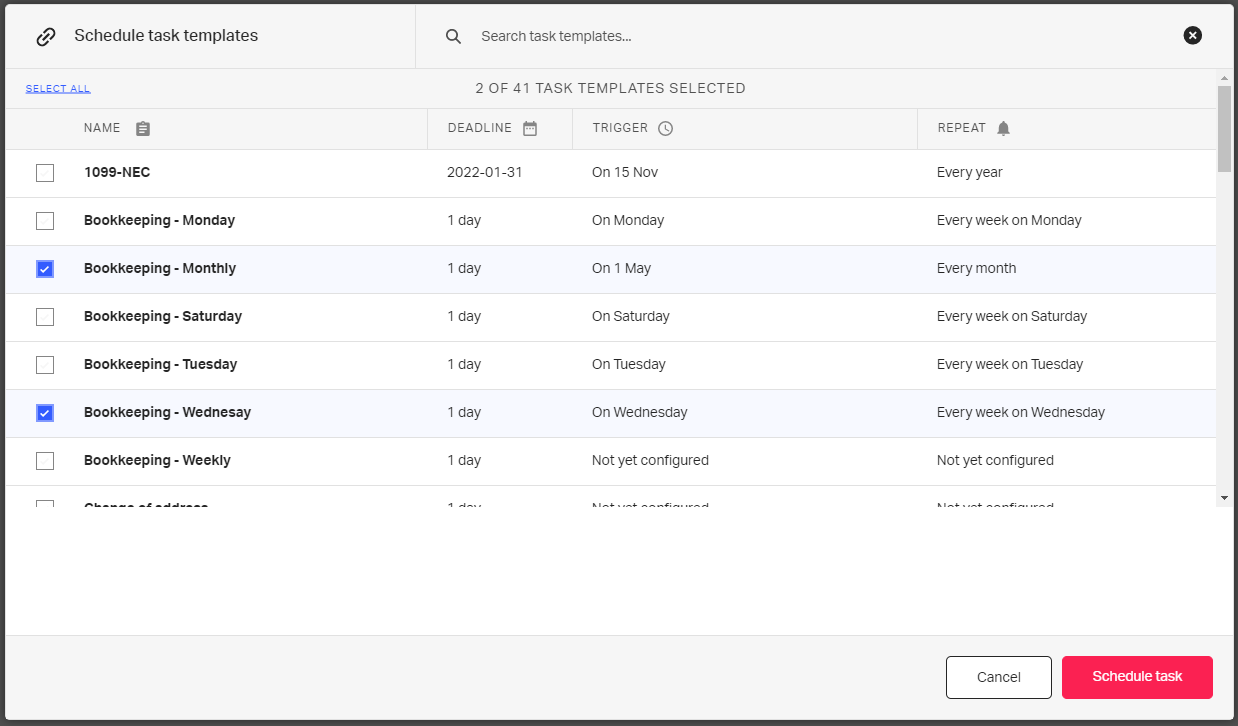

Its workflow management features include:

Workflow Management

- Custom Workflow Templates: Create templates that outline each step of a service with specific tasks.

- Task Assignments & Team Visibility: Assign tasks to team members or roles to clarify responsibilities.

- Built-in Email and Notes: Add emails and notes to tasks to build better context.

- Workflow Dashboard & Filters: How it works: Use filters (by client, team member, deadline, status) to view what’s overdue, in progress, or completed.

Workflow Automation

- Automated Client Requests: Tasks that request files or information from clients

- Conditional Logic (Smart Workflows): Show relevant tasks in a workflow based on the client’s responses.

- Automatic Client Records: Add client emails and files to their records.

- Companies House: UK accountants or those serving UK clients can integrate their accounts with Companies House to import data into client records.

Recurring Task Automation

Pixie’s recurring feature automatically regenerates your repetitive projects on a schedule without manual setup.

Time-Tracking and Billing

Pixie has limited time-tracking features that include:

- Manual Time Logs: Log time against tasks and projects.

- Team-Level Insights: shows which tasks your team members are spending their time on.

- Export Data: Send time logs to a third-party billing solution.

Reporting

- Work Report: shows all the tasks for your entire team.

- Email Report: The Emails section gives you insights into your client communication metrics.

- Productivity Report: The productivity section provides widgets to visualize the number of tasks completed in a specific time frame and the number of clients assigned to team members

- Operational Report: The Operational section provides widgets to track the number of jobs created in your firm.

Rating

Pixie is rated 4.8/5 on both Capterra and G2.

Pricing

Pixie’s uses a client count pricing model:

- $129 per month for teams with less than 250 clients

- $199 per month for Teams with 251-500 clients

- $329 per month for teams with 501-1000 clients

Free Trial

A 30-day free trial is available.

Pros

|

Cons

|

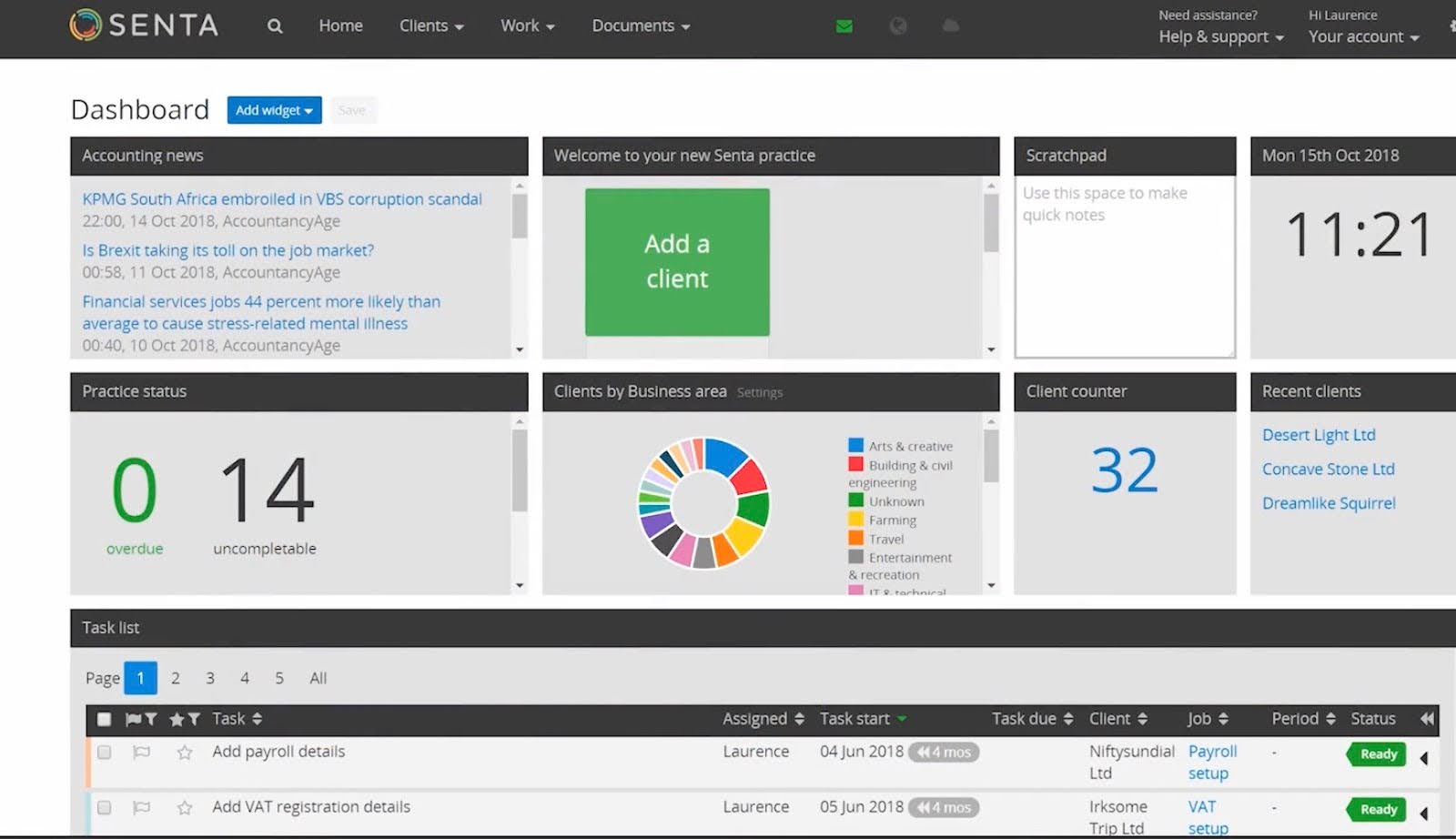

8. Senta

Senta is a workflow and task system for managing client relationships, workflow, and operations.

Built with UK accountants in mind, takes the hassle out of managing your firm so that you can focus on quality service delivery.

Its workflow management features include:

Workflow Management

- Templates: pre-built task templates that standardize recurring tasks or projects

- Prioritization: helps your team meet urgent deadlines by prioritizing the right tasks.

- Work Tracking: Monitor task status and progress against project deadlines.

- Comments: Add comments to tasks to enhance team collaboration and discussion.

- Document Management: Upload relevant documents to tasks to reduce the document retrieval process.

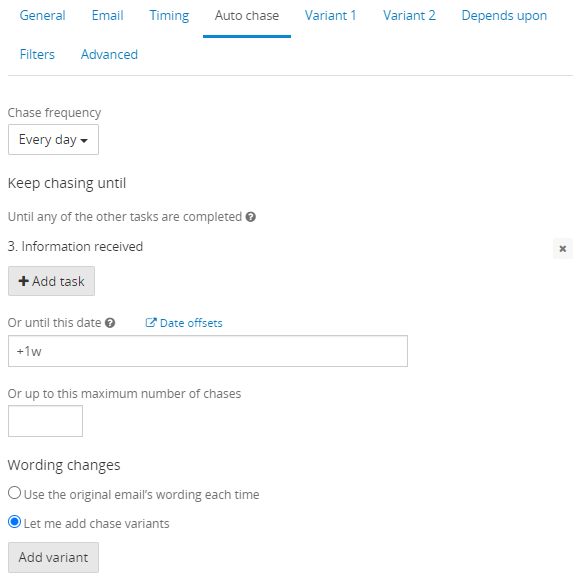

Workflow Automation

- Workflow Triggers: Dates or client actions can automatically trigger the creation of projects.

- Automatic Task Assignment: Assigns tasks automatically based on roles or workload.

- Pre-filled Templates: Senta automatically enters client data into fill forms.

- Email Notifications & Reminders: Reminds clients of outstanding requests. It also reminds team members of upcoming deadlines.

- Auto Chase: chases your clients for requests until they grant it.

Recurring Projects

Senta’s Recurring projects feature recreates your repetitive projects on a regular schedule, such as weekly, monthly, and yearly.

Time Tracking

- Time Entry: Your team members can log the time spent on tasks manually.

- Custom Rates: define your billable rates by the staff member, task, or client involved.

Reporting

- Time Reports: displays hours spent on a client, task, or project (or by team member).

- Customizable Reports: reports that track work status, client activity, and deadlines.

- KPI Tracking: Monitors metrics like turnaround times and client responsiveness to help you adjust your process effectively.

Rating

Senta is rated:

Free Trial

30-day free trial available

Pricing

- Monthly: $29/month per user (depending on the number of users)

- Annual: $23.20/month per user (depending on the number of users)

Pros

|

Cons

|

9. Firm360

Firm360 unifies your workflows so that your team can work smart, breathe easy, and maintain client satisfaction.

As an all-in-one solution, it brings your workflows, client communication, and billing features into a single platform.

Its workflow features include:

Workflow Management

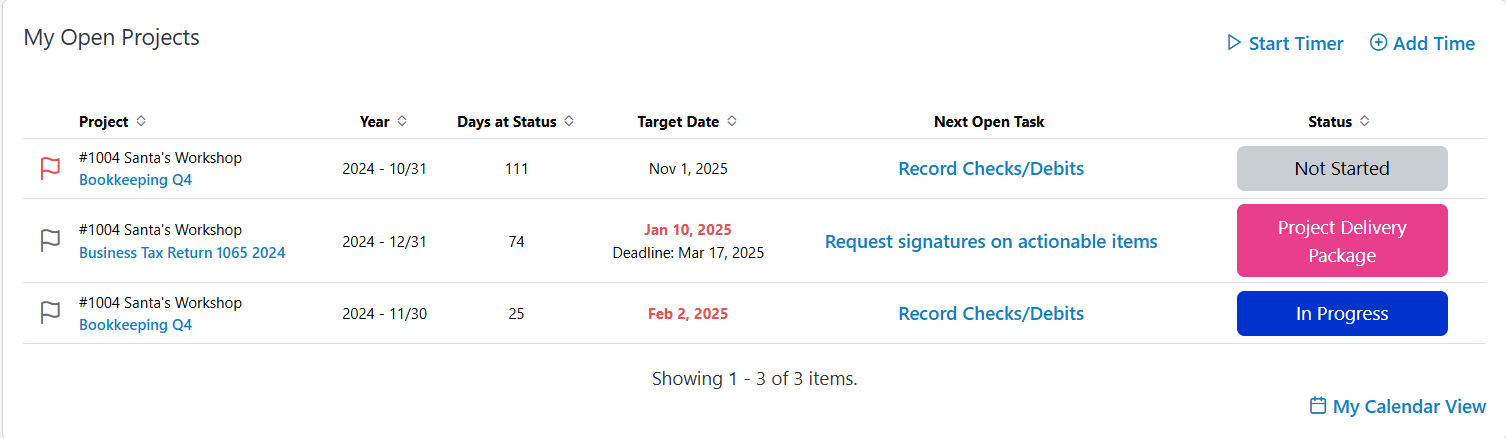

- Dashboard: a comprehensive dashboard that shows your team’s task lineup to enable you to set clear priorities.

- My Open Projects: displays all tasks assigned to a team member.

- Following: all assignees to a project are added as followers.

- Comments: Leave comments on projects for your team members.

- Tagging: add your team members as followers in a project by adding their names with the @mention feature.

- Notification: Firm360 notifies anyone tagged to a comment.

Workflow Automation

- Bulk Action: perform the same action on multiple clients simultaneously, such as bulk messaging, document requests, and setting recurring projects.

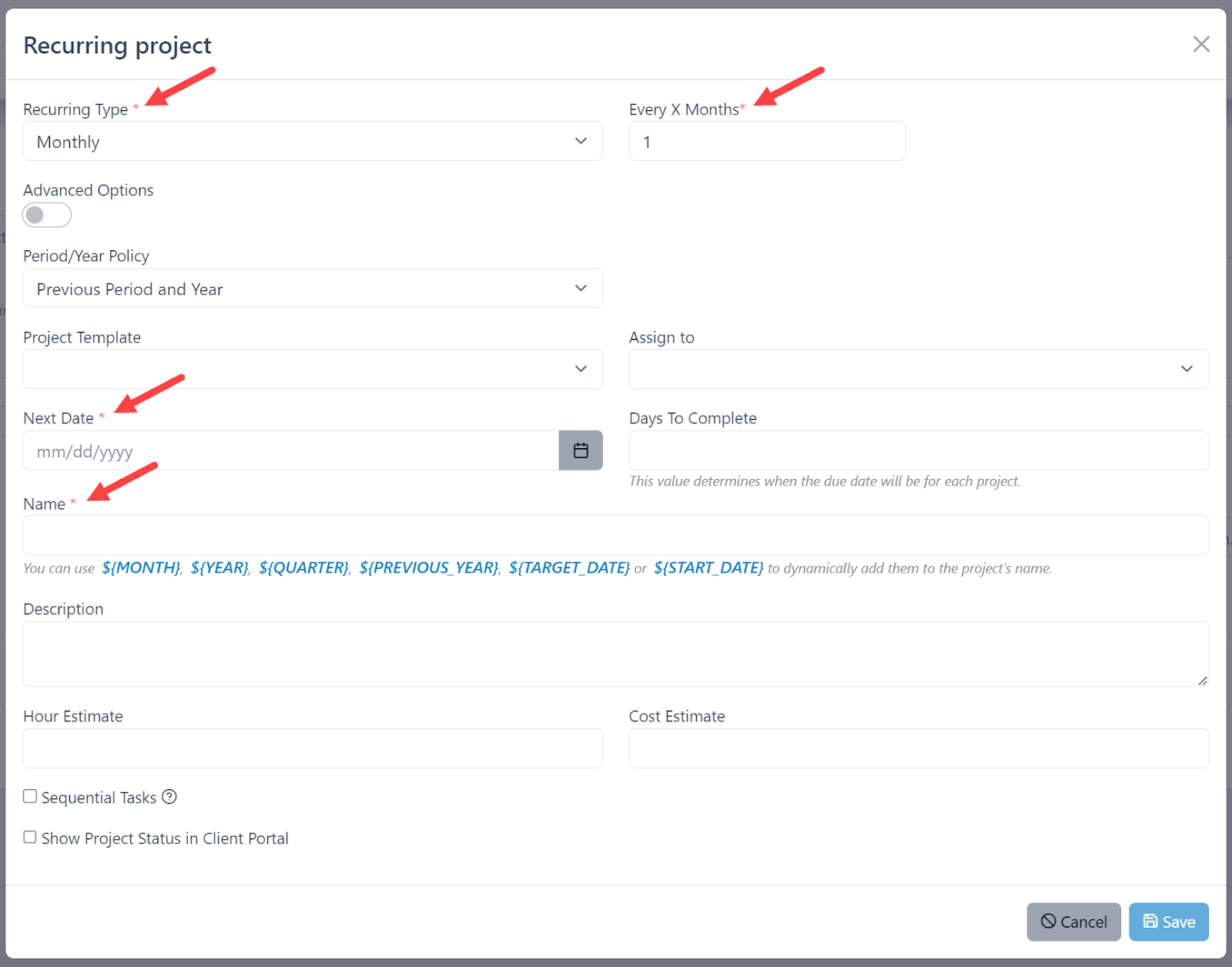

Recurring Project

Firm360 automates the creation of your repetitive projects on a predefined schedule.

You can set projects to recur daily, weekly, monthly, etc., or use advanced recurring options like a particular day of the week or month.

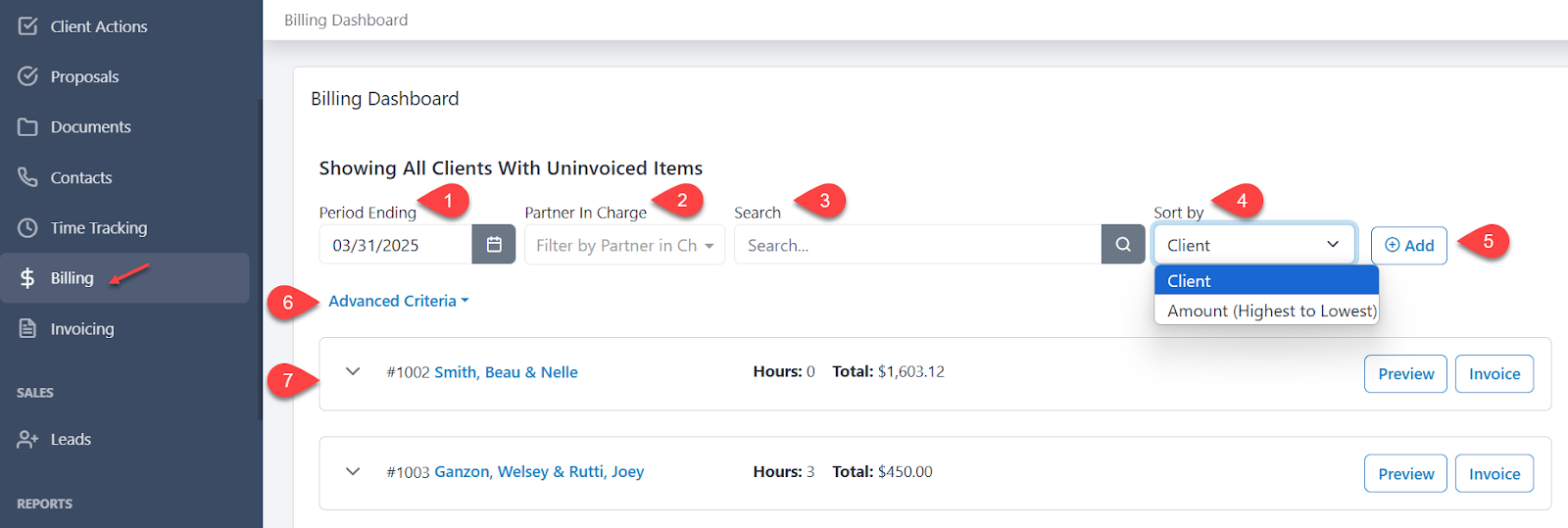

Time and Billing

- Built-in Timers: start, pause, and resume timers that help you track time effectively.

- Recurring Billing: invoices your clients on a regular schedule.

- Progress Billing: invoices your clients according to the work done in a project.

- Real-Time Invoice Adjustment: You can edit the time entry and billing amount in the invoice.

- Automatic Payment: charge your client’s card automatically according to agreed payment terms and conditions.

- Automatic Receivables: Automatically receive payments and reconcile accounts receivable.

Reporting

- Recurring Projects Reports: a comprehensive view of the recurring projects for each client.

- Client Project Status Report: displays how long projects have been in a particular stage.

- Project Budget to Actual: compares each project’s status by the time allocated to it.

- Client Revenue Analysis Report: breaks down your revenues by category to show you how revenue was invoiced and what you earned based on work done.

- Client Project Hours Report: detailed information about the hours of work that can be billed to the client and the amount the project generated.

Rating

Firm360 is rated:

Free Trial

A 30-day free trial is available.

Pricing

- Basic: $49/month per user (annual billing)

- Standard: $79/month per user (3 users minimum – annual billing)

- Premium: $99/month per user (3 users minimum – annual billing)

Pros

|

Cons

|

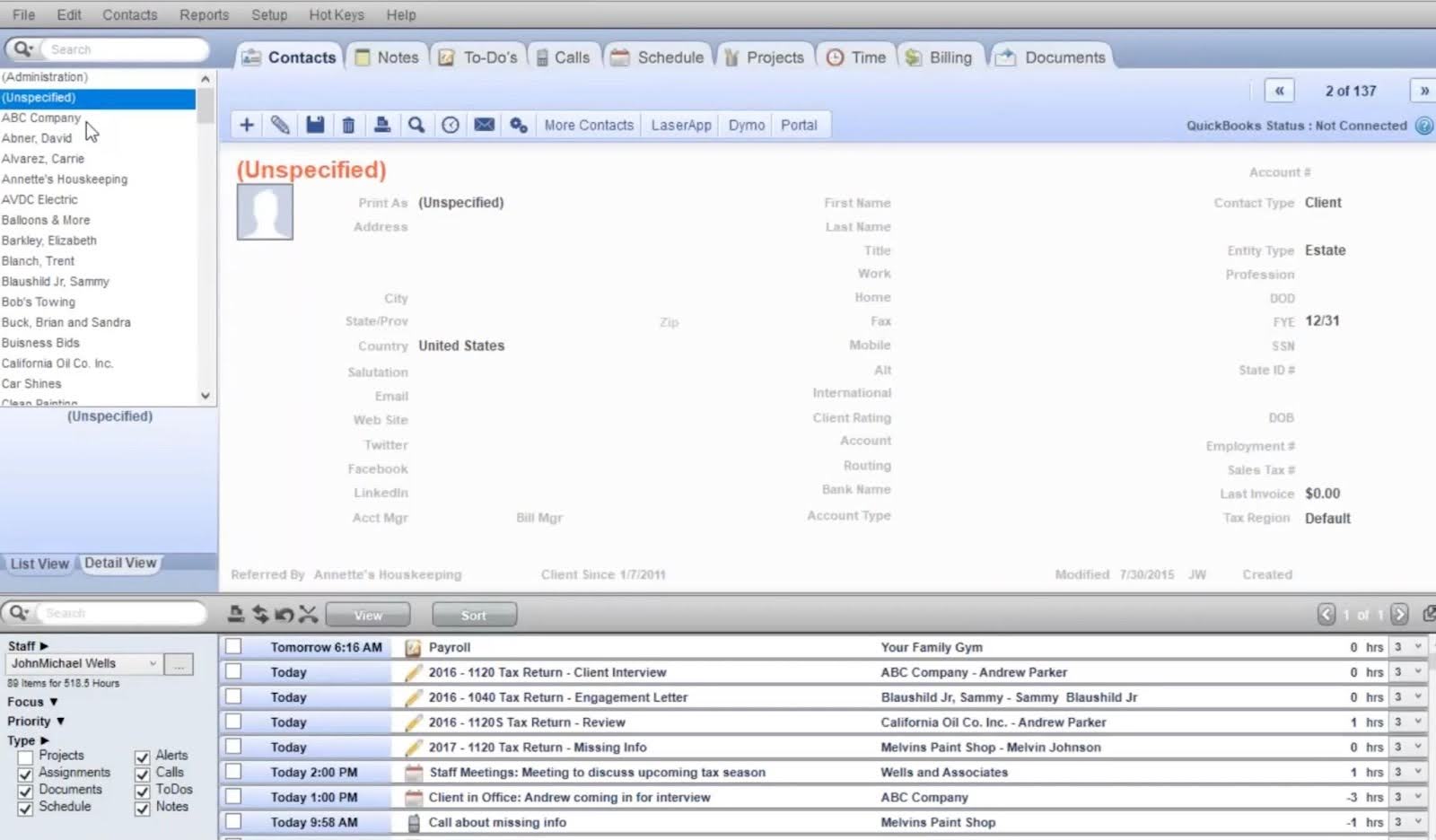

10. OfficeTools

OfficeTools combines multiple management functions into one to help accounting professionals align their teams and keep their clients happy.

Its workflow features include:

Workflow Management

- Dashboard: a central view of projects and high-level information that helps to eliminate bottlenecks.

- Linked Items: Connect your tasks, documents, and clients to improve visibility.

- Due Date Monitoring: shows your team’s tasks versus their deadlines.

- Progress Tracking: color-coded labels that show job status and bottlenecks.

- Task Notes: Add a description of the assigned work to improve clarity.

- Schedule Tab: keeps the team on the same page by centralizing appointments, availability, and what other staff are up to.

Workflow Automation

- Document Routing: Client documents are automatically added to their files.

- Reminders: keep your team from forgetting urgent work information.

- Job Dependencies: defines the order in which tasks should be performed.

Recurring Projects

You can set your To-Dos in OfficeTools to repeat weekly, monthly, etc. on your calendar.

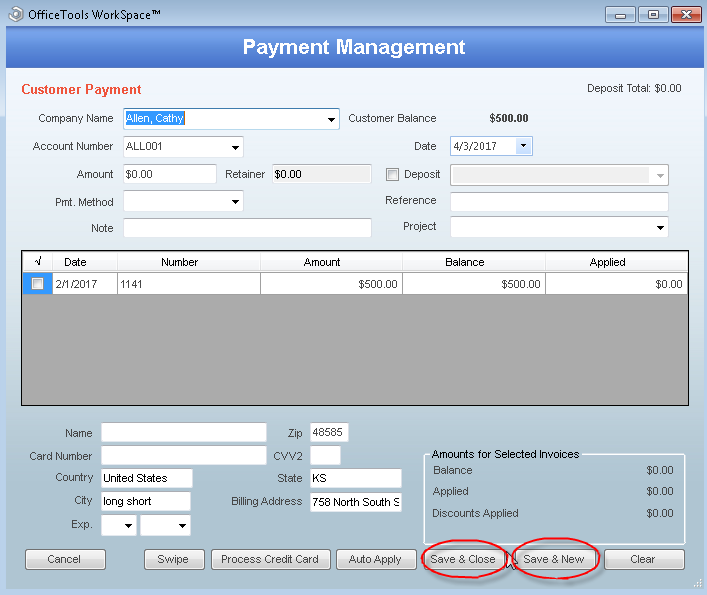

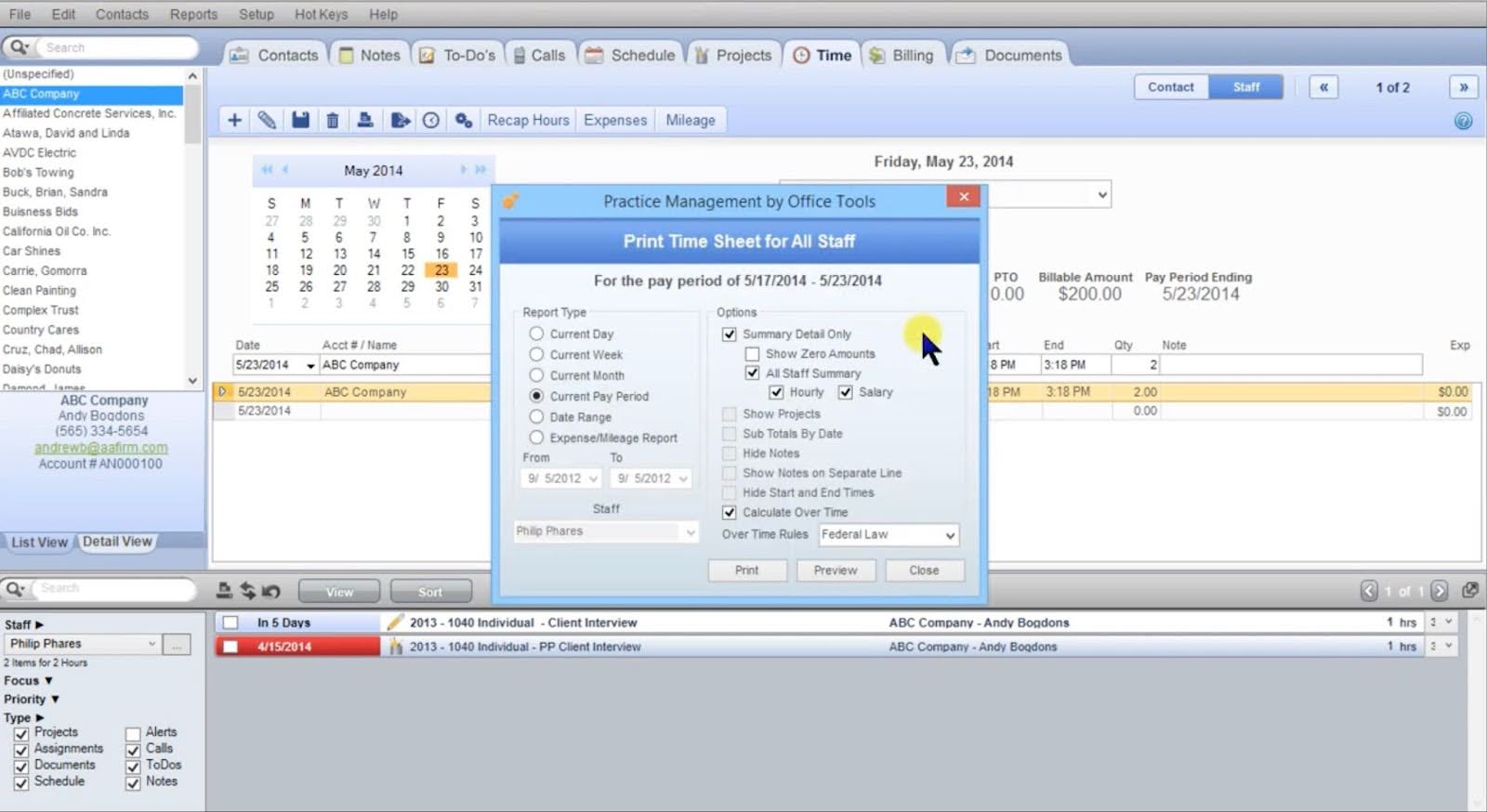

Time Tracking and Billing

- Inbuilt Timer: track and budget time for tasks in the background.

- Payment Collection: Collect payments using Abacus Payments Exchange (APX).

- Billing Status: Monitors your invoices to ensure effective receivable management.

Reporting

- AR Aging: shows how much unpaid clients owe you.

- Staff Utilization: Show how much of your staff’s total working hours they used.

- Staff Budget and Revenue: the resources (time) allocated to an employee and the amount they generated.

- WIP Reconciliation: tells you how much completed and uncompleted tasks are worth.

Rating

OfficeTools is rated:

Pricing

Custom pricing

Free Trial

A Free Trial of OfficeTools may be available. Contact their sales team to confirm.

Pros

|

Cons

|

11. Client Hub

Client Hub is a workflow management software with client management at its core, helping firms collect client data faster and categorize uncategorized data more efficiently.

It is designed with bookkeeping and controller services firms in mind.

Its workflow features include

Workflow Management

Jobs Dashboard: an overview of all jobs by their deadlines and status

- Job Templates: gives accountants and bookkeepers access to prebuilt checklists for their projects.

- File Manager: Allows you to organize, share, and store files for your team.

- Jobs Panel & Task Checklists: Organize your client work into structured projects.

- Communications Dashboard: Client Hub brings all your communications into a central location for all relevant team members to access.

Workflow Automation

- Magic Workflow: automatically generates checklists, client requests, and email replies to save time and improve efficiency.

- Automatic Jobs: Client Hub creates jobs from client messages.

- Auto-Reminders: encourage clients to respond to your requests sooner rather than later.

Recurring Jobs

Create recurring jobs for ongoing tasks, which will be automatically scheduled once the last copy is marked complete.

Reporting

- Time Tracking Dashboard: a central view of time entries that helps you monitor time spent on various tasks and clients.

Rating

Client Hub is rated:

Free Trial

A 14-day free trial is available

Pricing

- Solopreneur: $49/month per user (annual billing)

- Practice Manager: $59/month per user (annual billing)

- Practice Manager plus: $66/month per user (annual billing)

Pros

|

Cons

|

How to Choose the Right Workflow System for Your Accounting Firm

a. Evaluate firm size and complexity

If you’re a team of three accountants (for example), you likely don’t need a bloated solution built for firms with hundreds of employees. Your collaboration, work assignment, and capacity management requirements are different.

Your team will struggle to navigate the numerous features of such a robust tool, which will harm your productivity. The reverse is the case for large firms.

b. Ease of Use

There’s a problem if you have to call your software provider’s support team every time you want to change something.

Apart from ease of setup and adoption, an easy-to-use solution will have a library of content (short videos or articles) addressing specific use cases.

This helps your team to quickly address any challenge you may encounter as you use the tool daily, without paying for a course that feels like software engineering.

Usually, you can’t tell how easy or difficult a tool’s interface is until you use it. That’s why we encourage free trials. It allows you to see the tool in action beyond what anyone tells you about it.

c. What industry is it built for?

A tool created for your specific industry is more specific to your needs. That’s why tools like Financial Cents have features (like accounting period, templates, e-signature, etc.) that suit the exact workflow needs of the accounting community.

A generic tool might work for your firm in its early days, but as you grow and your clients’ needs become more complex, you’ll get frustrated working around it.

d. Consider integrations with your existing tech stack

If too many cooks spoil the broth, too many apps can kill productivity. How well does a workflow tool integrate with the other programs your firm runs on?

The more of your existing tools it integrates with, the more money you’ll save and the tasks your team can perform from one single platform.

e. Level of automation needed

Consider the number of repetitive tasks in your firm and how many of those tasks you can potentially automate with your prospective tool.

For example, you can centralize and automate client information (like client interactions and billing) in Financial Cents that you can’t do in Jetpack Workflow.

If your workflow management software does not automate as many tasks as you need to automate, you’ll be left to stitch together so many apps that require more time and energy to coordinate.

f. Support, training, and ease of onboarding

No matter how simple a tool is, you may forget (or simply don’t know) how to perform a task. In such instances, you need to be able to easily reach the support team, and if you can’t access them (or they are not helpful), your team can get stuck at critical times.

The best workflow software solutions provide accessible live support, detailed documentation, one-on-one onboarding, live demos, and training resources (such as walkthrough videos, webinars, or one-on-one onboarding.

Standardize & Scale: Why Workflow Automation in Accounting Matters

- Standardize Processes

Workflow software for accounting firms is effective because while most accounting tasks are predictable, the humans who operate them can be unpredictable.

Software solutions process tasks and information based on predefined workflow rules, enabling everyone in your firm to follow the same steps to arrive at the same outcome. This keeps your processes uniform and client results consistent.

- Burnout Reduction

Between the pressure of regulatory deadlines, client demands, and unending repetitive tasks, burnout is more likely in the accounting industry.

Accounting workflow management tool relieves your staff of this pressure by automating manual tasks, helping your team work faster, and freeing them up to rest between tasks.

- Team Collaboration

Team collaboration is critical for all teams, but more so for remote teams, who can’t easily go over to their colleagues’ desks to ask questions and gain clarity.

Accounting firm workflow software mitigates this by centralizing work information to give everyone a single source of truth.

Tools like Financial Cents also provide the Team Chat feature to help all assignees see what’s been said about a project. Team members can also tag each other in comments to pull people into conversations.

- Meet Deadlines

Regulatory and client deadlines are second nature to the accounting industry, and accounting workflow software empowers you to manage them better with the due date tracking feature, among others.

The due date tracking feature ensures that no deadline takes you unawares. It allows you to see them ahead of time and make the necessary decisions to meet them.

Similarly, the workflow dashboard ensures that you see which work is taking longer than expected, helping you to eliminate bottlenecks ahead of time, so that your team can complete their projects on time.

Start Tackling Your Firm’s Workflow Issues Today with Financial Cents

Despite running her firm, Kellie Parks (owner of Calmwaters Cloud Accounting), has found a good system to organize work information and resources, which has given her time for things outside of her firm:

- Speaking at accounting conferences regularly.

- Partnering with leading productivity apps (Financial Cents, 17hats, Ignition, PandaDoc, etc.).

- Enjoying her favorite sport (Snow and water skiing).

- Raising two Australian Shepherds (dogs).

How does Kellie manage it all? Short answer: A good workflow management software.

After years of using systems where she struggled to assign tasks, recur projects, and engage clients, Kellie switched to Financial Cents.

Since then, she has unified work information, team (and client) communication, and other resources in one place, improving consistency and efficiency across the firm.

Financial Cents creates insane effectiveness, efficiency, and consistency in work, communications, and collaboration. Its intuitive interface and automation features improve efficiency"

Kellie Parks CPB, Owner, Calmwaters Cloud AccountingYour story can be better than Kellie’s. Start streamlining your processes with Financial Cents.