New businesses often make two Accounts Receivable (AR) mistakes that cost them their hard-earned money down the road.

1. They prioritize making difficult sales over collecting money owed, which harms their ability to get the cash they need.

The accountant, as a trusted advisor, should help these businesses understand how crucial it is to manage accounts receivable for their financial health.

2. They often overlook managing the process of collecting money owed until important information slips through, leading to bad debt.

Managing accounts receivable is not simple. Most companies, including your clients, have several projects with different payment schedules happening at the same time.

Besides, a repeat customer can remain in your client’s AR ledger for years. Creating a system that helps your team view your multiple AR projects in one place is essential to consistently meeting your Additionally, a returning customer might have outstanding payments for years. It’s crucial to create a system that allows your team to see all ongoing projects in one place to meet your clients’ clients’ deliverables consistently.

This guide shows how you can continuously improve your Accounts Receivable process so that your clients’ day sales outstanding (DSO) will reduce month-over-month.

What is Accounts Receivable Workflow?

Accounts Receivable workflow is the series of steps a firm takes to collect and record payments for the products or services it provided within the last 12 months.

The AR workflow begins when a product or service is purchased and ends when the customer completes payment for the product or service.

Is there a Difference between Accounts Receivable Process and Accounts Receivable Workflow?

Although we use process and workflow to mean the same thing here, they mean slightly different things.

A workflow is a series of steps that make up a task, while a process is a set of activities involved in achieving a goal. A process can consist of several interconnected workflows.

For the sake of this guide, we will use both concepts interchangeably because they both help to clarify how accounting firms get Accounts Receivable work done for clients.

A Breakdown of the Accounts Receivable Process

A typical accounts receivable workflow takes the following steps:

a. Design and Establish Credit Application Policies

Before extending credit to customers, every company needs to determine the conditions under which they can allow credit.

When done well, the credit application policies will help the company extract the information necessary to know which customer is eligible for credit. This helps to prevent giving credit to customers who wouldn’t pay back on time.

The policy should state:

- The company’s ideal debtor: some companies prefer to provide goods and services on credit to business customers alone.

- How the company determines a customer’s creditworthiness.

- The interest rate for late payments.

The credit application policy helps both parties understand what they are getting into ahead of time.

The application will be approved once the customer meets the company’s requirements.

b. Create and Send Invoice

Once the order has been received and the products delivered, the company needs to send an invoice quickly to enable them to make payment.

The invoice information has to correspond with the Purchase Order and note confirming the goods or services received information. Any discrepancy is a potential cause for delay.

The invoice should include the name and address of both businesses, issued date, payment terms, quantity, and prices of products provided.

c. Collection Management

An average business organization has customers that never pay on time. An effective collection management system reduces the time it takes to receive payments from these customers while making it easier for the other customers to complete their payments.

Sometimes, invoicing errors can cause your punctual customers to pay late. That’s why checking for invoicing errors is a key part of the collection management stage.

When there is no discrepancy, the rest of this stage revolves around sending payment reminders to prompt forgetful customers to complete their payments.

Depending on the amount and the customer’s payment history, your follow-up could look like this:

- 5 days past due: remind the customer that payment is due.

- 7 days past due: send another reminder.

- 14 days past due: remind the customer about the application of a late fee should payment be delayed further.

- 30 days past due: notify the customer that late payment is not active on the debt.

- By day 90, the creditor can enlist the help of a collection agency or take legal steps to address it.

Customer’s creditworthiness should be reviewed regularly to determine when the company can stop extending credit to them.

d. Payment Processing and Reconciliation

Once the information on the invoice corresponds with the Purchase Order (PO) and the note confirming goods or services received, the customer has all the information they need to make payment.

They can pay with a wire transfer, check, automated clearing house (ACH), or debit/Credit Card.

Upon payment, the books are reconciled by deducting the amount from the Accounts Receivable balance and adding it to cash at bank.

e. Track and Monitor Accounts Receivable

This is where the creditor creates a plan to track unpaid invoices to avoid bad debt.

One way to do that is by conducting invoice age analysis. This shows all your invoices by how late they are (usually 0-30 days, 31-60 days, 61-90 days, and 90+ days overdue).

When done well, tracking and monitoring your accounts receivable enables you to understand important AR metrics like day sales outstanding (DSO). This empowers you to make informed decisions on Account Receivable collection.

f. Keep a Report

Like most reports, an up-to-date AR report helps with the month-end close process, trial balance, and financial planning.

AR report helps firms to understand their company’s accounts receivable performance with metrics like staff productivity and collection effectiveness index.

Best Practices for Streamlining Accounts Receivable Process

I. Document Your Collection Process

Defining the cash collection process eases the process of completing AR tasks and makes results more accurate, making debt collections more successful and the business financially healthier.

A well-documented collection process looks like this:

- Order is received

- Credit is approved

- Deliver products or services

- Create and send an invoice

- If payment is received by the due date, it should be processed and applied (marking the end of the project).

- If payment is delayed, investigate for internal error (maybe due to the wrong amount or invoice sent to the wrong person)

- If there’s an internal error, correct and resend the invoice.

- If there’s no error, remind the customer of the due payment

- The reminder process continues until payment is received.

PRO TIP: You can present this flow of work in a flow chart by adding directional arrows and symbols. Your team will find the visual representation of the process more engaging to follow.

II. Use AR Automation Software

Automation will save you time, cost, and errors on Account Receivable projects. With account receivables management software, you will be able to automatically:

- Send form emails to your customers

- Send “thank you” emails upon payment.

- Follow-up with customers when payments are overdue.

- Generate AR reports

Automating as many low-value tasks as possible will enable your team to focus on resolving invoicing disputes and make the quality of your account receivable work more consistent. This can determine how quickly customers pay a company.

III. Record All Charges and Expenses

Accounts Receivable comes at a cost, and these costs have to be accounted for. They include:

- Carrying Costs that prevent the company from investing the money into growing the business.

- Administrative Costs that result from collection management efforts, such as follow-up emails, phone calls, and payment for a collection agency.

- Bad Debt results when a company considers debt irrecoverable and writes it off.

Be sure to keep proper records of such expenses that affect a company’s liquidity.

IV. Build and Maintain Relationships with Clients

Poor communication (resulting from the absence of a good relationship) between the AR team and customers has led to the nonpayment of many debts.

Here’s how a good relationship helps to resolve many accounts receivable challenges:

- A good relationship relies on effective communication. Effective communication between AR teams and customers helps resolve invoicing and payment challenges between a company and its debtor.

- Every touchpoint a customer has with a business serves as a potential payment reminder for forgetful customers.

V. Optimize Your Accounts Receivable Process

Cash flow is the lifeblood of any business. Creating a clear plan to get paid promptly helps to prevent many of the Accounts Receivable problems.

Businesses should prioritize Accounts Receivable by discussing their credit and payment policies with potential debtors before extending credit to avoid bad debt.

Here are some of the ways you can optimize your Accounts Receivable Process:

- Use electronic payment systems to centralize invoicing and payments.

- Offer several payment methods to enable your customers to choose the most convenient.

- Outline the steps a customer should take to make the payment.

You may be interested in:

How to optimize your Accounts Payable Workflow: A Step-by-Step Guide

Use an Accounting Workflow Software to Manage your AR Process

Accounting workflow management software makes Accounts Receivable projects more efficient. They help accounting teams to:

a. Gain Visibility into the Status of AR Tasks with Workflow Dashboard

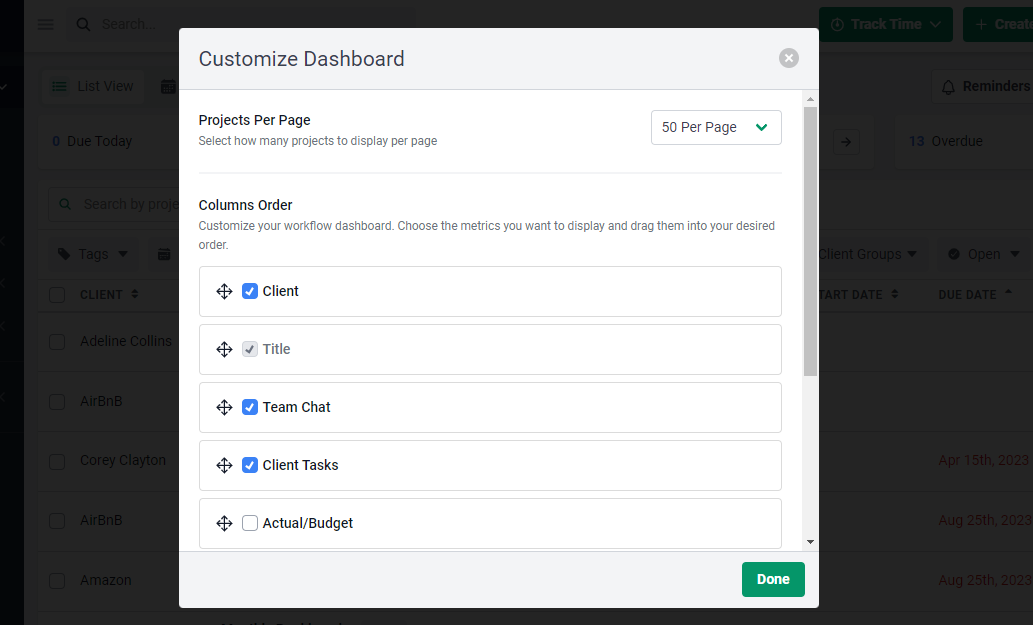

A successful AR project relies on the team’s ability to track work in the workflow dashboard. It helps them see important project information at a glance.

Each Accounts Receivable project on your dashboard shows the due date, assignee, and the client it’s for. With a workflow tool like Financial Cents, you can customize your dashboard to display the project information that is most important to you.

Other features of the workflow dashboard that will give you visibility into your AR work include:

- Workflow Filters: It allows you to see all your Accounts Receivable work by clients in one view.

- Tag automation: It shows the status of each AR project on your dashboard, allowing you to see what might be holding the work back.

The workflow dashboard keeps you from getting overwhelmed with the multiple AR projects your firm has to do for clients.

b. Standardize Your Accounts Receivable Process Using Workflow Templates

You have to lay out the steps you take to complete AR tasks for your team members. Knowing how you get those tasks done helps you achieve organizational consistency in your firm.

Workflow templates help you make sure of it. By documenting and sharing the step-by-step procedures for getting AR work done, you empower them to complete AR projects to your standard.

In Financial Cents, you can customize pre-existing accounts receivable workflow templates or create new ones to help everyone in your firm know what to do at each stage of their accounts receivable reconciliation work.

c. Automate Manual Tasks

The real value of an accountant’s work lies in the ability to separate high-value work (like analysis and problem-solving) from low-value work like chasing clients for documents.

Accounting workflow software empowers you to automate these manual AR tasks to free up time for the work that makes the most impact in your firm.

For example, Financial Cents’ Client Task feature saves your team the stress of chasing your clients for additional documents. It allows you to set up a list of things you need from them and auto-reminds them until they complete it.

Similarly, the E-Signature feature saves your clients the stress of printing and scanning documents to sign. So, if you need a client to sign documents, they will go to your accounting client portal and sign it anytime and from anywhere.

d. Set Recurring AR Tasks to Automatically Recur

When you have to complete an AR project every week, month, or quarter, you’ll lose valuable time and energy to create it from scratch each of those times.

Thanks to the Recurrences feature, you can create such work once, and the system will ensure the project is created anytime you need to do it in the future. This also spares you the struggle of forgetting to create such tasks in the future.

e. Assign and Delegate Tasks Effectively

With multiple Accounts Receivable tasks (for several clients) breathing down your neck, you need a system that lets you assign work effectively.

This is where the capacity management feature of your accounting workflow software comes in handy.

It gives you real-time insights into your team members’ workload, enabling you to determine who best to assign a particular AR task to.

f. Use Due Dates

The Due Dates feature in accounting workflow software displays the due dates of each project in your workflow dashboard. This helps your team to know which project is closest to the deadline at a glance.

In Financial Cents, this feature comes with a reminder that notifies your team about upcoming deadlines. This improves your chances of completing your AR projects on time.

g. Communicate with Team Members

Communication issues are a major cause of late payments, non-payment, and short payments (short payment being where a customer pays for part of the items on the invoice).

By enabling your team members to share timely information, you eliminate the bottlenecks that delay the collection process. Accounting workflow software makes these communications easy.

In Financial Cents, your team members can share information with:

- The Comments feature to ask questions and gain clarity on account receivable tasks.

- The @mention feature, to tag teammates to comments in AR projects.

Using these features to share information inside the Accounts Receivable projects enables your team to communicate without losing the context.

Improve Your Account Receivable Processes with Financial Cents’ Workflow Management Features

Account Receivable transactions are rarely a quick task. The last thing you want to do is give your clients’ customers a reason to delay further.

Using accounting workflow software is particularly beneficial to the AR processes because it centralizes all your AR projects. You can see where each project stands and make decisions that enable you to meet client deliverables consistently.

Accounting workflow software like Financial Cents makes managing the cash collection process easier and more organized for your team, which potentially helps to save your clients -money, and prevent having to write off bad debts.

Use Financial Cents for your accounting firm’s AR workflow needs.

Start a Free Trial Today!!!