Most accounting clients won’t ask for a client portal. They may even be reluctant to use one.

They’re often comfortable communicating and collaborating in email, instant messaging apps, and other fragmented tools.

For them, client portals translate to extra work, more passwords to maintain, and another system to learn.

That is why you need to choose a client portal that impresses your clients and team members from day one, knowing that once implemented, switching to another one will require another round of training, which could disrupt the client experience.

In this article, we review the 15 client portals for accountants that can make your client collaboration easier, more secure, and accessible in 2026.

What is an Accounting Client Portal?

It is a cloud-based platform that allows accounting firms to collaborate with their clients by exchanging files and information.

Unlike email, generic file-sharing tools, and other fragmented tools, the client portal centralizes interactions between accounting firms and their clients, making it easier and faster for clients to respond to you.

The accounting client portal incorporates compliance-ready features to handle sensitive data like tax returns, payroll records, bank statements, and audit trails, while complying with relevant regulations (SOC 2, GDPR, or IRS e-file requirements).

The top portals allow you to customize their interface to suit your brand, making it a client-facing extension of your firm.

Key features to look out for in a client portal software for accountants

a. Security and Compliance

Adherence to data security protocols helps to protect your clients’ sensitive financial data, from payroll records to tax returns.

That’s why your client portal solution must have security systems, like encryption, multi-factor authentication, granular permissions, and secure file storage.

The top client portals for accountants also provide a full audit trail of actions and backup data, enabling you to see who’s accessing or modifying documents.

This facilitates compliance with global security and compliance standards, like SOC 2 Type II and GDPR.

b. Ease of use for clients

The average accounting client is too busy with their core business operations to spend much time and energy learning how apps work.

That is why your client portal solution has to be easy for them to access and navigate as they collaborate with your team.

Otherwise, they’ll be forced to resort to the good old email, and sending sensitive financial information by email compromises the security of the data.

That means your clients wouldn’t need a username or password to use your portal, reducing client resistance and encouraging adoption.

For example, passwordless authentication reduces login frustration. Users won’t need to create, forget, or reset passwords.

c. Centralized document management

Centralization helps to ensure access to the latest versions of the multiple documents accountants share with their clients across several engagements.

That is why a client portal for accountants must provide one place for accountants to organize all their documents.

The best portals support folder structures, version control, tagging, and advanced search, enabling team members to locate the document they need without digging through email threads.

Options like Financial Cents automatically sync documents to client profiles and relevant projects, which helps accounting teams to maintain focus at work.

d. Client access management

While your client portal should allow on-demand access, document upload, and progress tracking, no two people from your client’s company should have equal access to information and conversations.

Your client portal should enable your clients to regulate access levels to control what each staff member can see or do.

This feature empowers them to set permissions at the client, project, or file level, among other use cases.

e. Automated reminders and notifications

Accounting teams spend hours chasing clients for documents and signatures, which negatively affects their productivity and efficiency.

A reliable client portal addresses this by allowing accounting firms to automate reminders that follow up with the clients until they grant their requests.

Tools like Financial Cents also provide SMS reminders that send text messages at set times. This improves response and deadline management.

f. Reports

You’ll need your portal’s reporting dashboards for real-time visibility into client status, deadlines, and analytics to improve client communication and collaboration.

For example, Financial Cents provides:

- Client Task Report that shows how well clients are responding to your requests.

- Client Upload Report to track all documents uploaded by clients.

g. Integrations

The best of disconnected tools will still drain time and energy. They require accounting teams to open apps individually and manually transfer data. This leads to human errors and material misstatements.

That is why client portals that integrate with your general ledger and practice management software are more helpful than those that require manual workarounds to integrate.

For example, Financial Cents’ integration with QuickBooks enables accountants to clarify uncategorized transactions inside the client portal. This also helps accounting firms to categorize transactions in QBO without leaving Financial Cents or entering data manually.

h. Communication and Collaboration

Client communication and collaboration are more effective when firms use built-in messaging features.

Otherwise, clients and team members will have to shuttle between email threads, Slack channels, and Microsoft Teams rooms to get the full picture.

A suitable client portal for accountants should have a space for threaded conversations between teams and clients.

This makes it easier for teams to tie conversations to tasks and client engagements for maximum clarity and context.

i. Branding customization

The branding customization feature ensures your client portal doesn’t look and feel different from your other client touchpoints.

With custom branding, you can add your logo, firm colors, and even a custom domain to make it an extension of your firm. This increases client trust and communicates your professionalism.

The 15 Top Client Portals for Accounting Firms in 2026

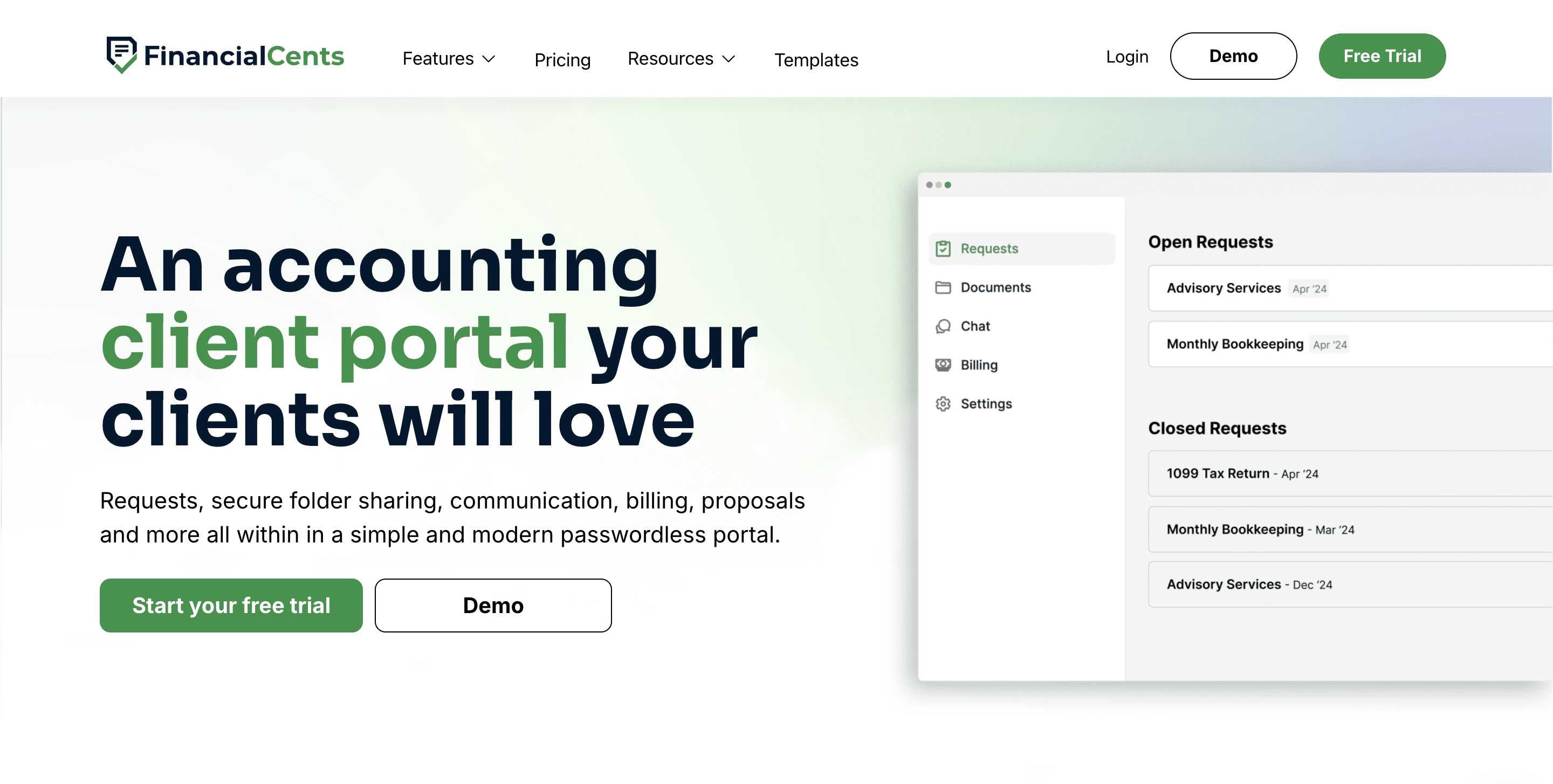

1. Financial Cents

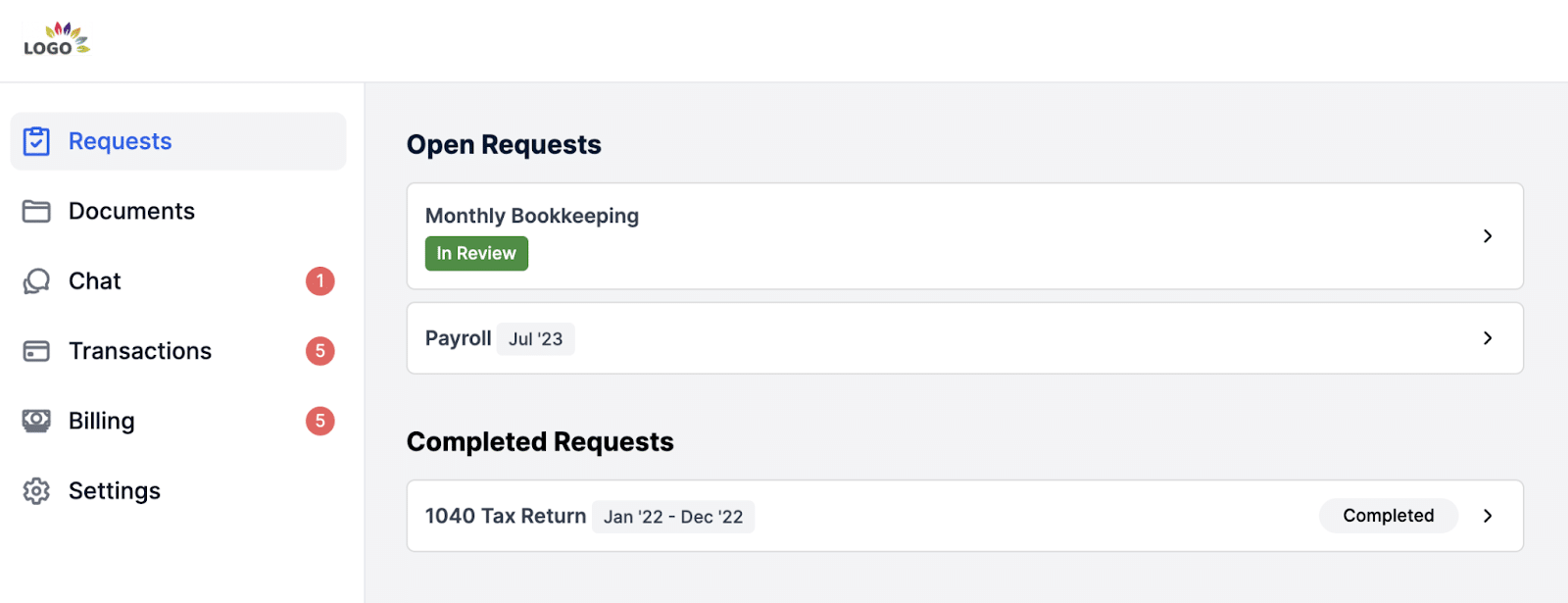

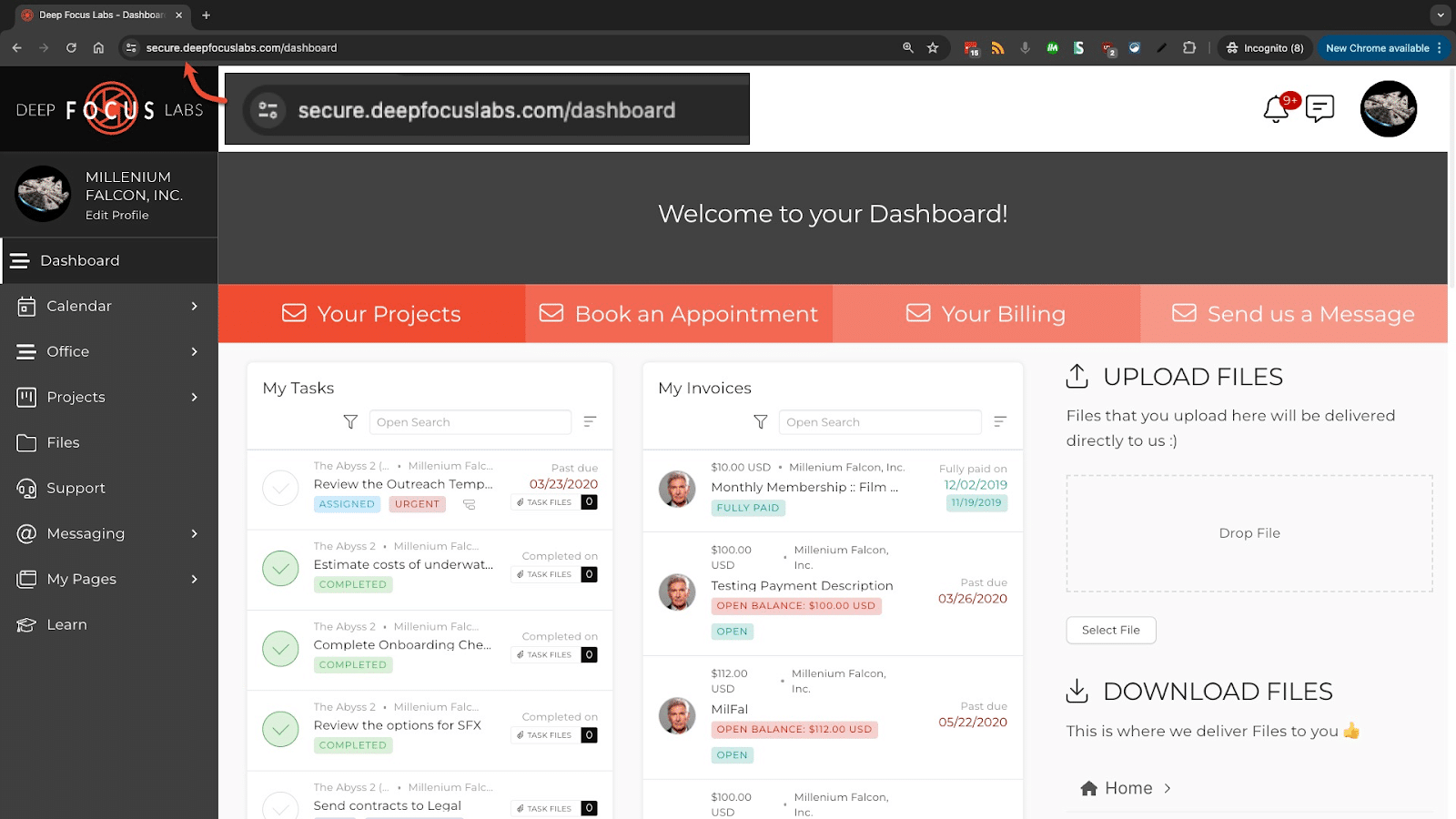

Financial Cents is an all-in-one accounting practice management software with a client portal that centralizes all client communication and collaboration, enabling your clients to access your requests, share documents, sign proposals, view reports, manage invoices, and communicate with your team on demand.

The combination of its client portal with other practice management features enables your team to manage clients alongside your workflows and team capacity.

Financial Cents’ Client Portal Features and Benefits include:

Security and compliance

Financial Cents’ general security protocols include bi-annual security assessments conducted by third-party cybersecurity experts, regular penetration testing, code vulnerability scanning, and data encryption at rest and during transit to prevent unauthorized access.

Financial Cents’ cloud services are SOC II, SOC III, GDPR, and HIPAA compliant, showing that independent auditors have verified that it follows strict data protection practices, such as encryption, access controls, system monitoring, and employee training.

Ease of use

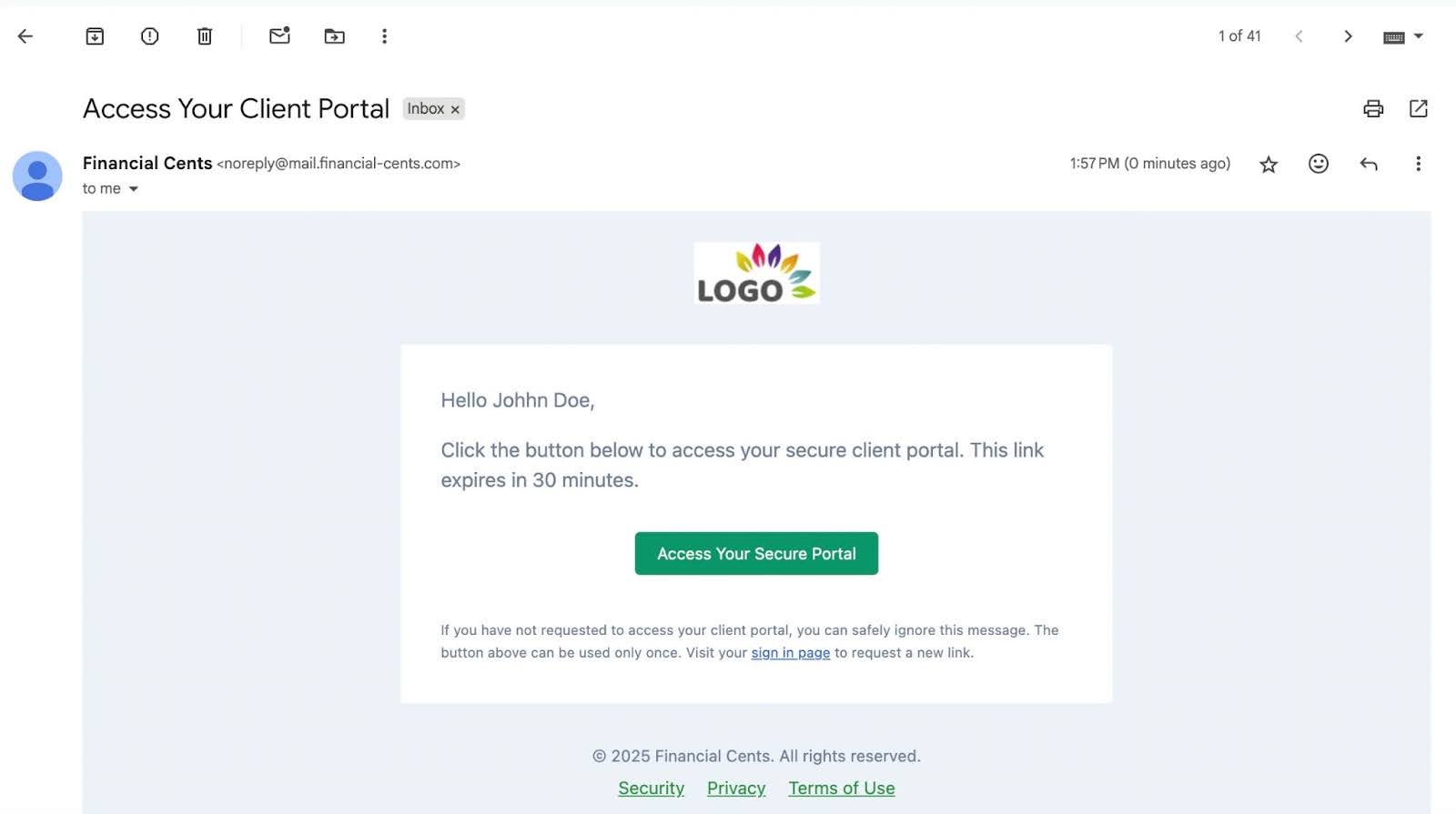

Your clients don’t need to create or remember passwords to access the portal. Financial Cents uses secure magic link technology to give clients instant and on-demand access, making clients more responsive to your requests.

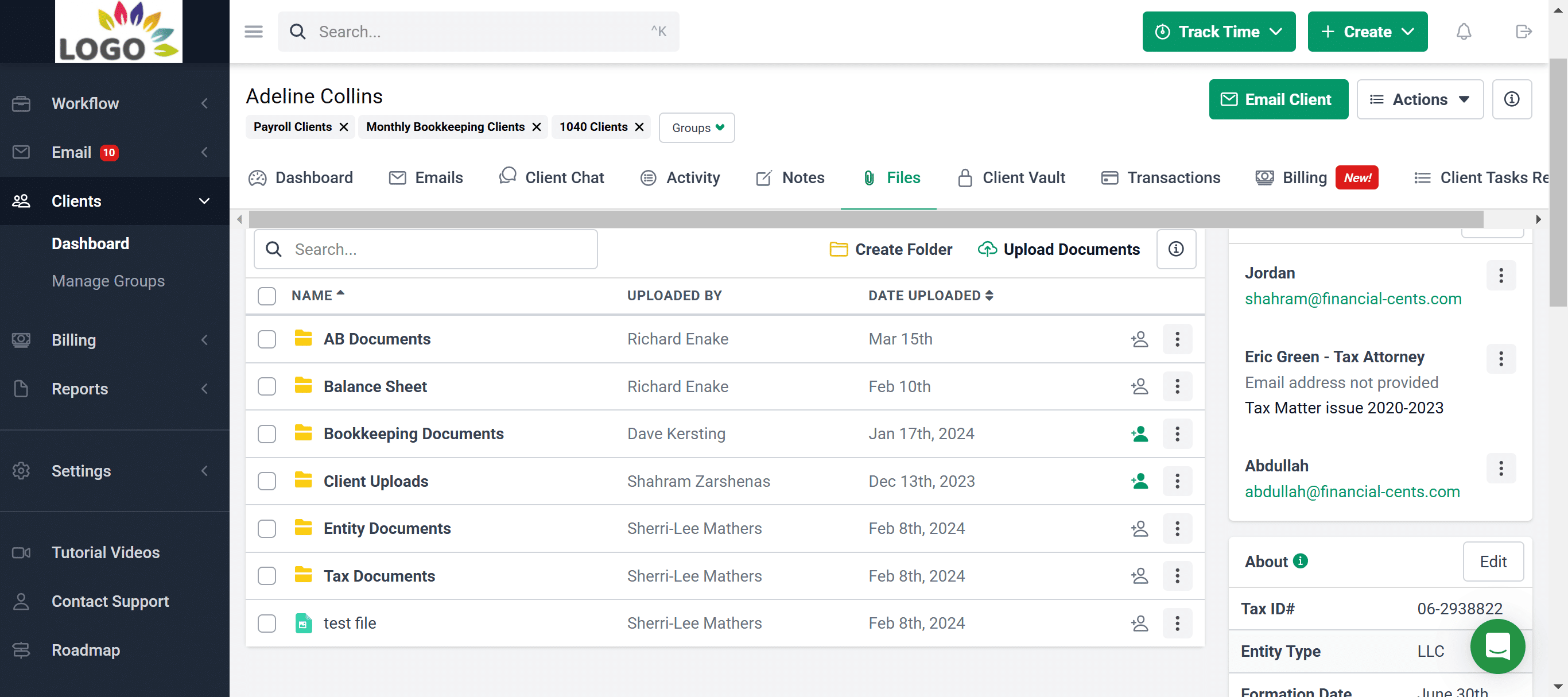

Document Management

- Document Requests: Request documents and information from clients by sending them a checklist.

- Folder sharing: Shares folders with clients in the portal to enable them to upload documents on demand

- Document organization: Financial Cents allows you to organize your files into custom folders and sub-folders for easy access and retrieval.

- Search functionality: Filters documents by typing relevant keywords.

- Real-time notifications: Financial Cents alerts your team when clients or team members upload or modify a document.

- DMS integrations: Financial Cents reroutes documents to your existing accounting document management system.

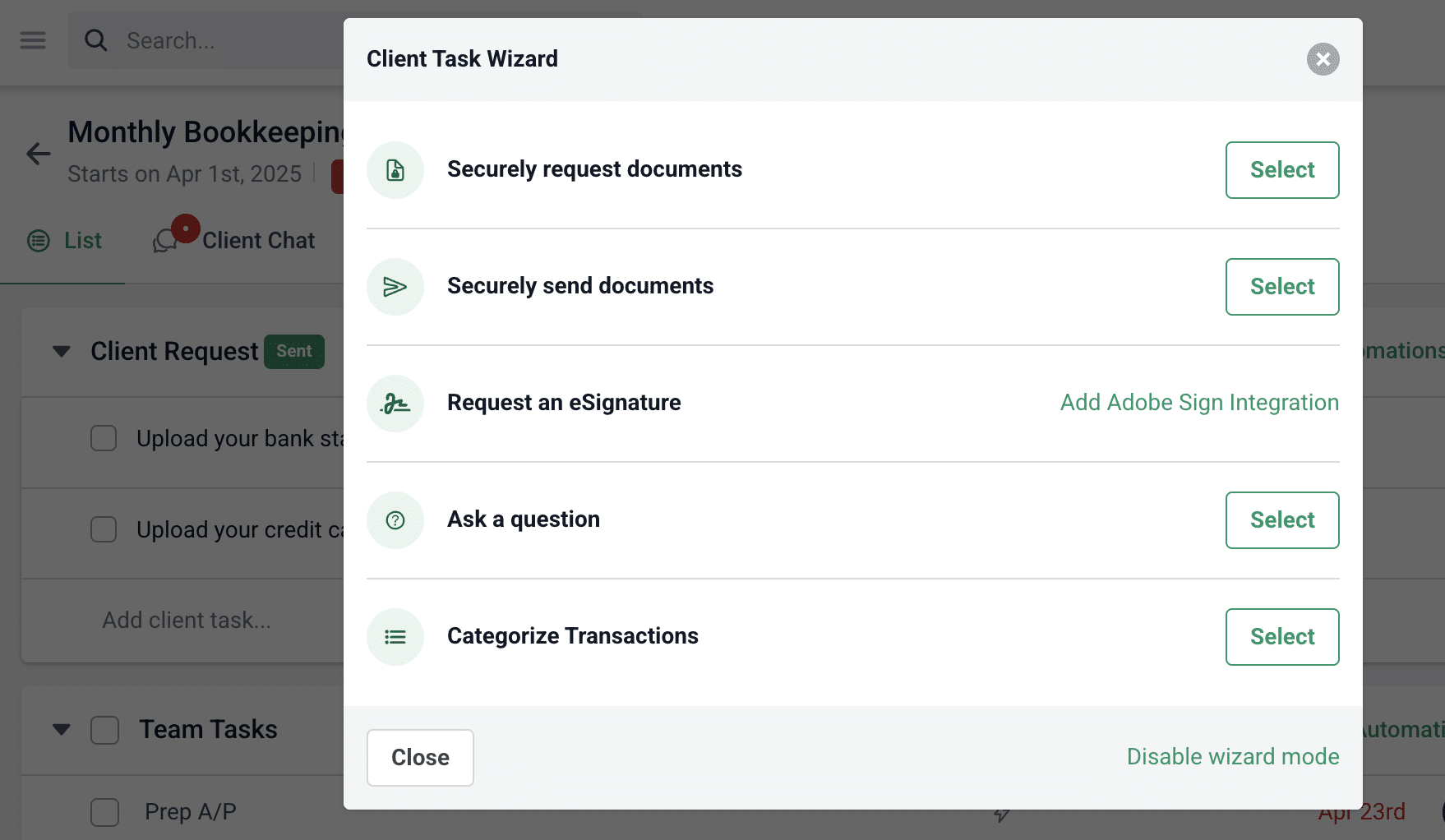

Automated Requests, reminders, and notifications

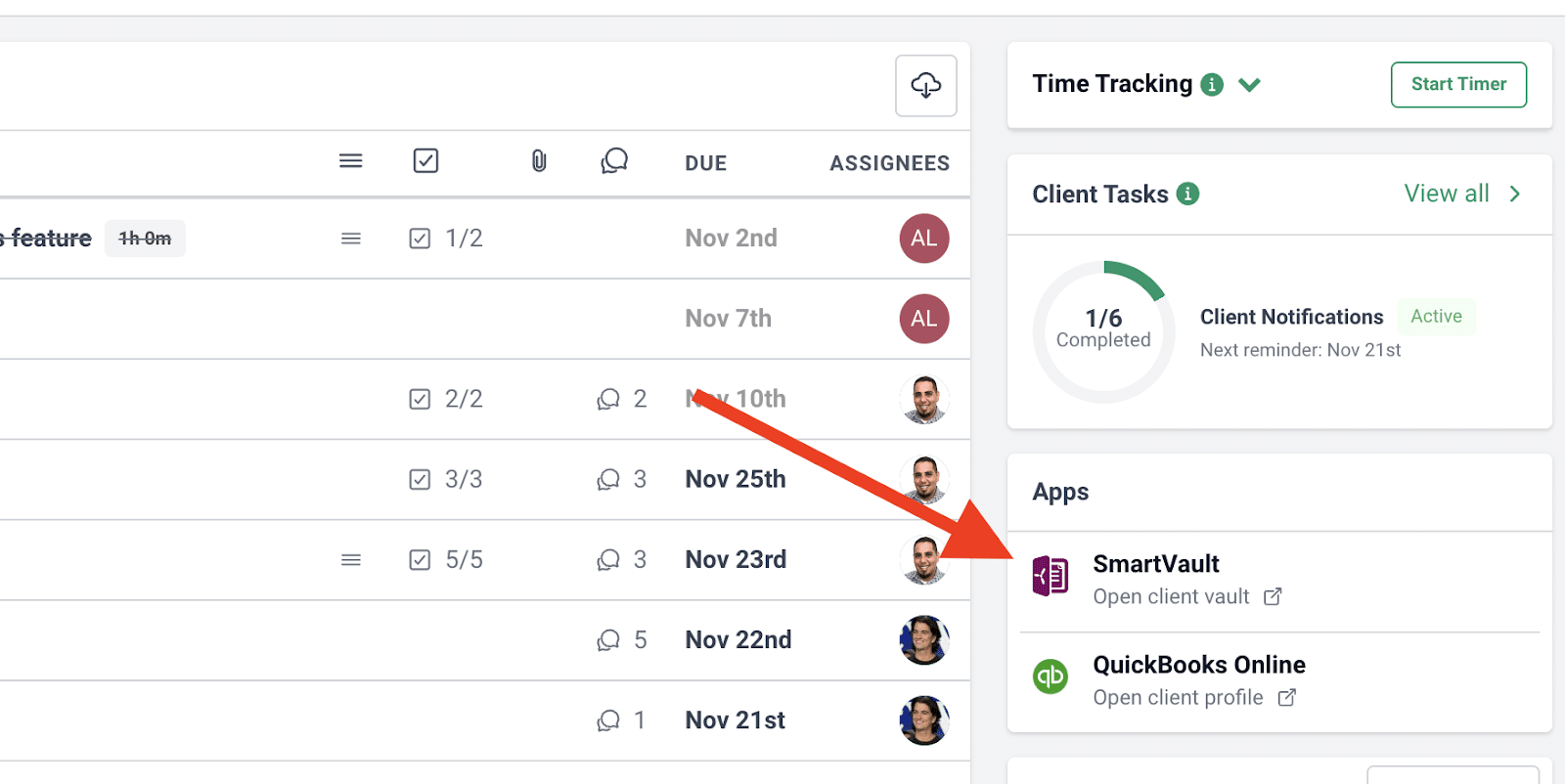

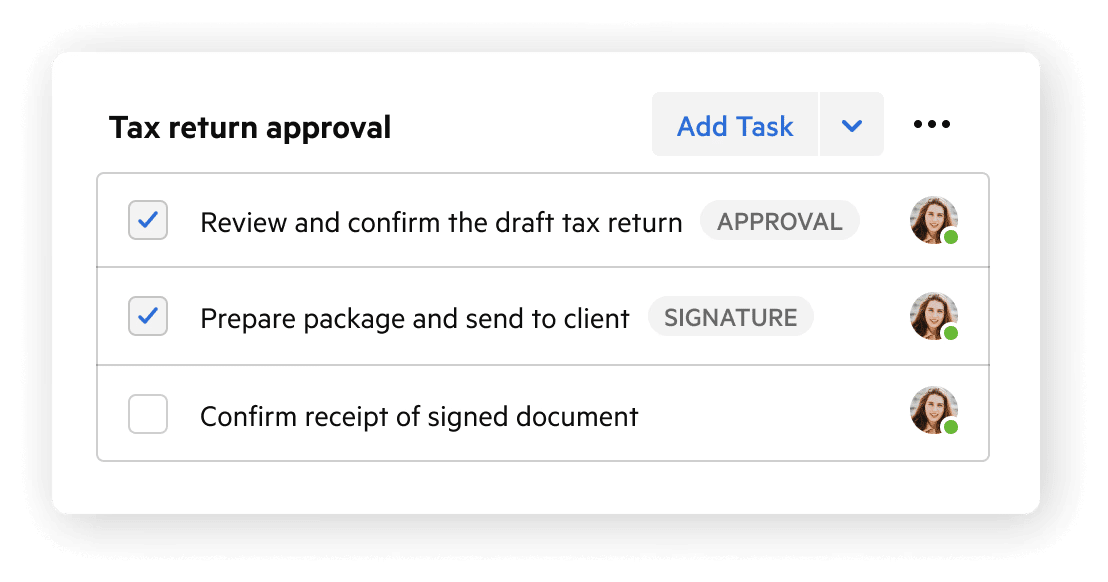

The Client Task Feature enables you to request the files, information, and approvals you need to complete projects (in advance).

The Auto-reminders notify your clients to send documents, E-sign documents, make payments, and provide additional information about uncategorized transactions to get their responses quickly.

Email and SMS alerts: For faster results, Financial Cents allows you to combine SMS notifications with emails.

Integrations

Financial Cents integrates with other accounting tools that enhance client collaboration in the following ways:

- SmartVault: creates a client folder in SmartVault when the client profile is created in Financial Cents, syncs client information between Financial Cents and SmartVault for two-way access.

- E-Signatures: Enable clients to tax returns and other important documents online, eliminating the need to print and scan paper documents.

- QuickBooks Online: Financial Cents client portal facilitates the clarification of uncategorized transactions, enabling firms to update the transactions in QBO without leaving Financial Cents.

Communication and Collaboration

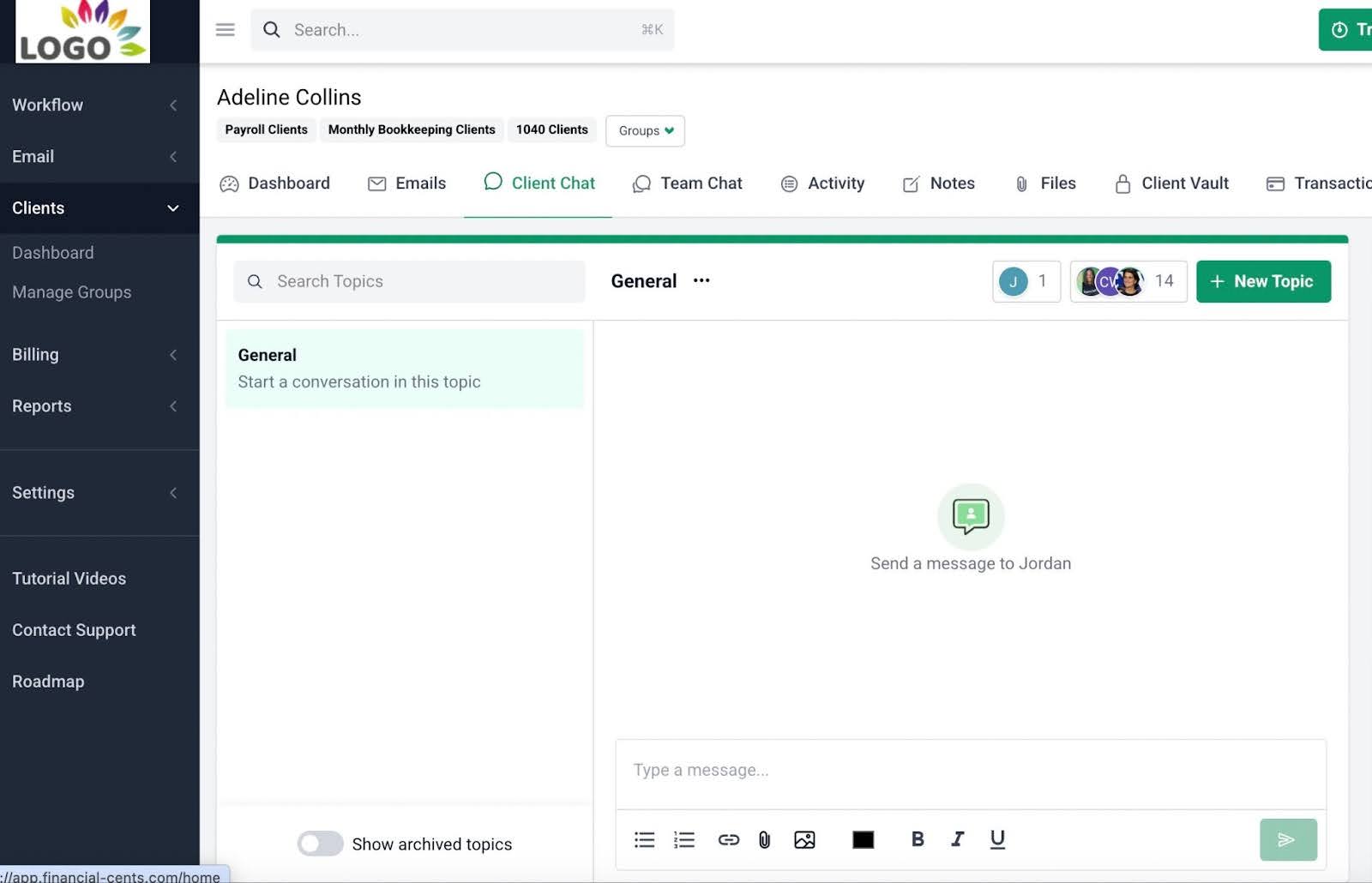

The Financial Cents client portal centralizes all client communication and collaboration using the Client Chat feature.

The client chat allows accounting teams and clients to discuss progress and deliverables inside the project or client profile using:

- Topics: the various categories of conversations held with a client. It improves the context of messages sent.

- Participants: You can add the staff members you and your client need to be part of the conversations.

- Search: filters for specific conversations in the client portal.

Branding customization

Financial Cents allows you to white-label and brand your client portal and all client communication to make it look and feel like your other client touchpoints.

This allows you to:

- Add your firm’s logo.

- Edit the client portal URL.

- Use your preferred colors in the links and buttons inside the portal.

Client Access Management

Your clients do not need to create usernames and passwords to use the Financial Cents client portal.

They can access it using the “View and manage tasks” button in the email sent to them following your request for file, signature, or additional information.

Once they click on the button, they’ll be asked to enter their email. This will trigger an email or SMS verification code, which will grant them access to the portal.

For the next 30 days, they’ll access the portal without providing their email or entering a code. The code is rotated every 30 days to maintain the security of the portal.

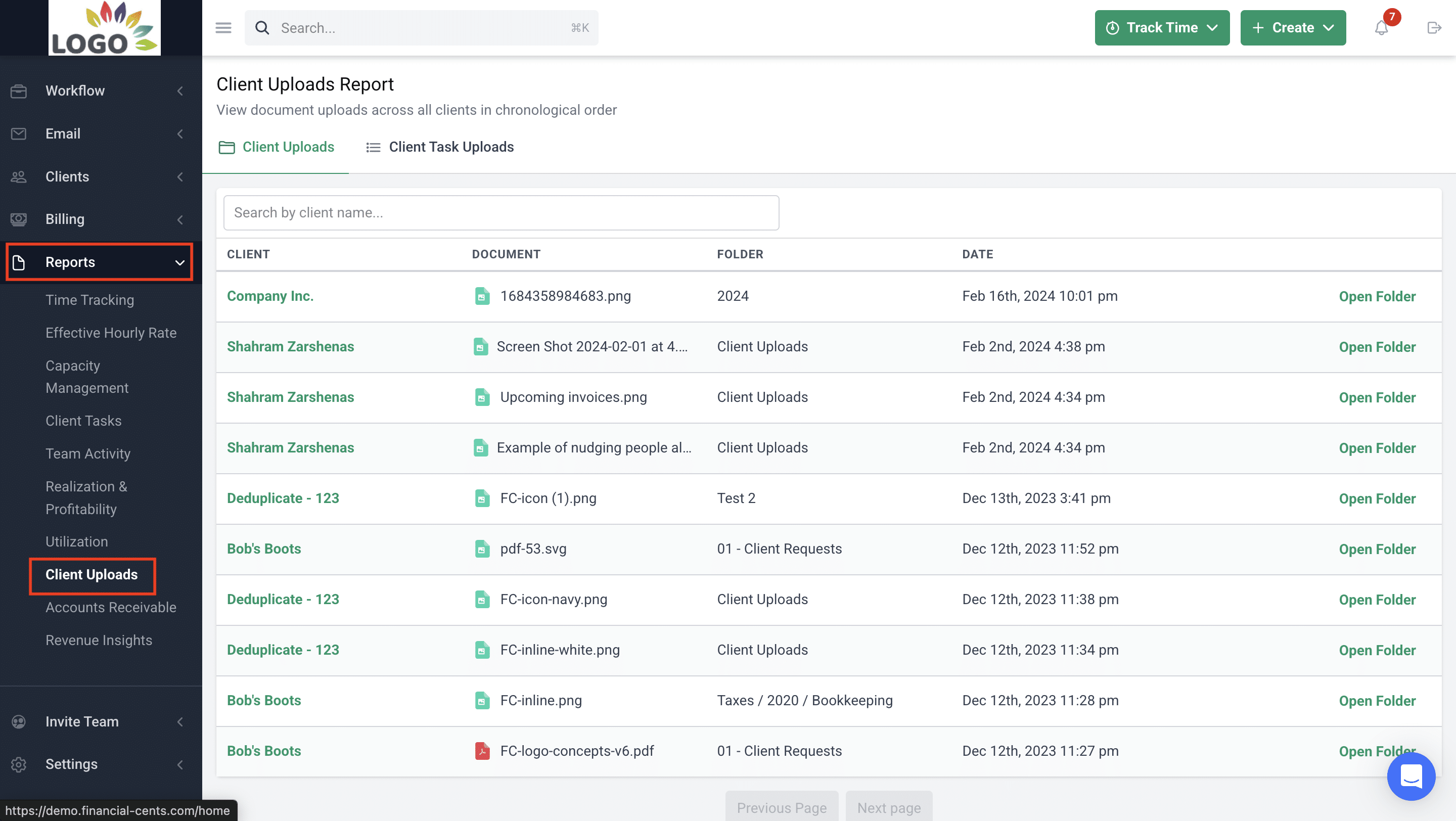

Reports

Financial Cents client portal-related reports include:

- Client Tasks Report: This report tracks all outstanding and recently completed client requests to ensure that your clients are sending in the information your team needs to complete their work.

- Client Uploads Report: Displays all files uploaded by a client in their chronological order.

| Pros

Simple and intuitive design SMS notification In-project client chat Client-facing task status Automated reminders |

Cons

No mobile app for clients |

Pricing

- Solo: $19/month per user

- Team: $49/month per user

- Scale $69/month per user

- Enterprise: Custom

Rating

Financial Cents is rated

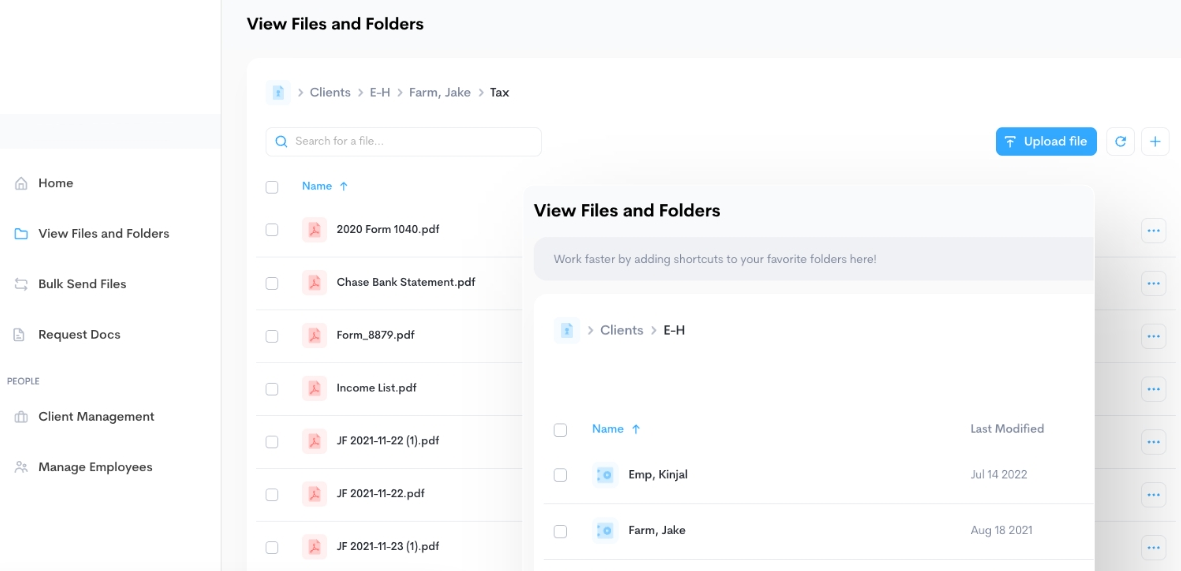

2. SmartVault

SmartVault is a document management and client portal software built specifically for the accounting industry.

It enables accounting firms to work with their clients by sharing files, filling forms, and signing documents wherever and whenever.

SmartVault’s Client Portal Features and Benefits include:

- E-signature: Built-in E-signature tool that speeds up workflows and improves client responses.

- Data Security: Enterprise-grade security and compliance with relevant security standards like SOC 2 Type 2 compliance.

- Version Control: Visibility into version history to prevent data loss.

- Collaboration: Comment threads that enable contextual conversations.

- File-locking: SmartVault allows you to lock documents to prevent modifications.

- Branding Customization: Ability to customize your client portal to feel like an extension of your firm.

| Pros

Advanced document management Built for the accounting industry Mobile App |

Cons

Has a steep learning curve |

Pricing

- Business Pro: $50/month per user

- Accounting Pro: $55/month per user

- Accounting Unlimited: $75/month per user

Rating

SmartVault is rated 4.3 on both Capterra and G2.

3. Canopy

Canopy‘s client portal provides the tools accounting clients need to access and complete their tasks faster, which increases client satisfaction and upselling.

Firms love it for its modular pricing model, which allows firms to subscribe to only the features they need.

Canopy’s Client Portal Features and Benefits include:

- Client Communication: Links your clients’ communication via phone, website, and email.

- E-signatures: Send clients a link to the document they need to sign.

- Payment Processing: Clients can view their outstanding balance, invoices, and payment history.

- Files Request and Reminders: detailed to-do lists that help clients understand what you need. The automated reminders also do the follow-up for you.

- Custom Questionnaires: Collect all necessary client information to improve your client onboarding process and experience.

- Data Security: Canopy uses multi-factor authentication, web encryption, and face ID to allow secure access to data from anywhere.

- Custom Branding: customizable firm branding that allows you to use your colors and logos.

| Pros

Built-in signature Mobile app for clients |

Cons

Price increases with additional modules Has a learning for clients who are not tech-savvy. |

Pricing

- Client Engagement module: $150/month per user.

Other features are available at various prices, such as:

- Document Management: $36/month per user

- Workflow management: $32/month per user

Rating

Canopy has:

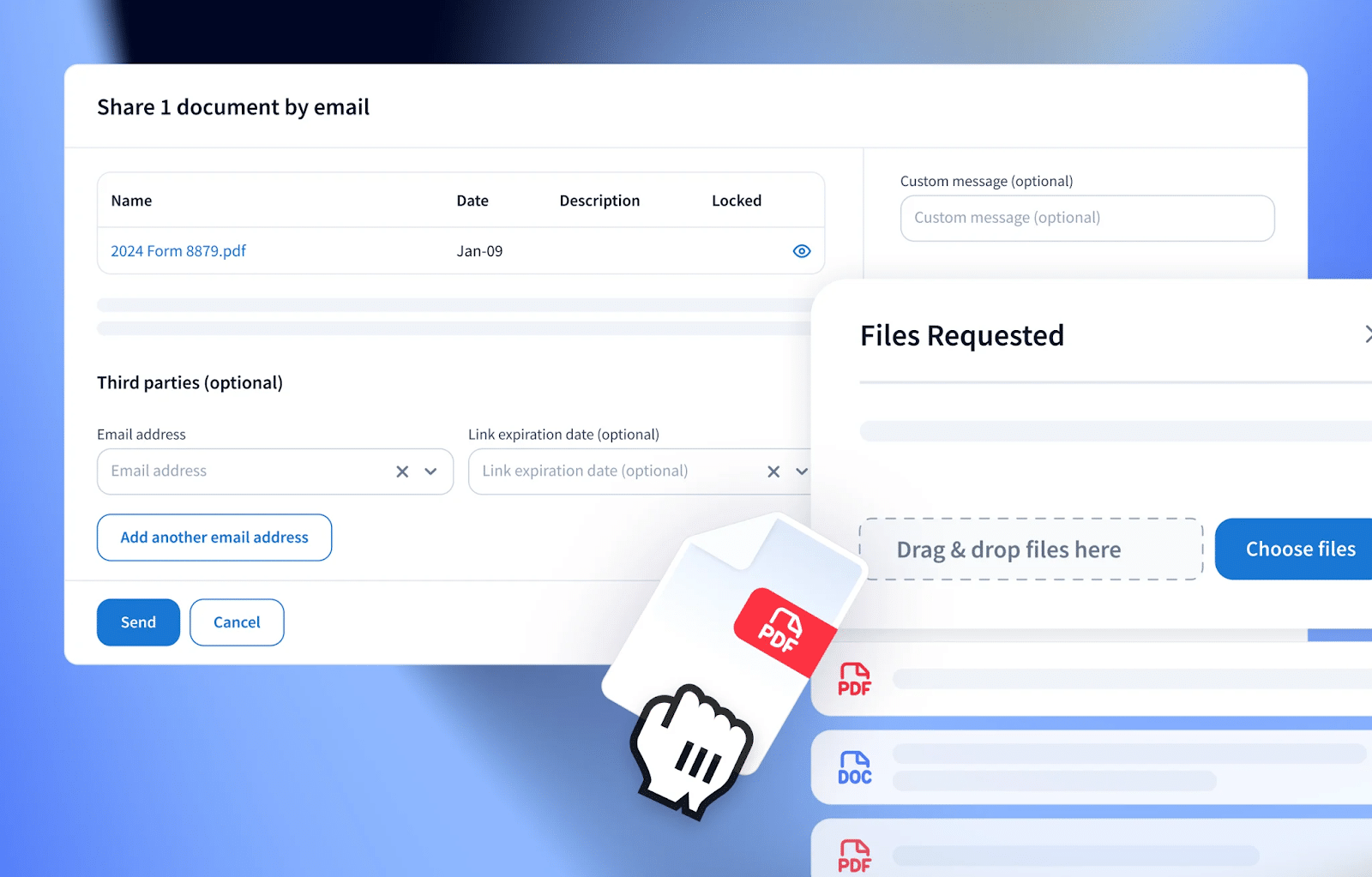

4. TaxDome

Taxdome is an accounting firm management software with a client portal feature that centralizes everything your clients need in one unified place.

From messaging to signing signatures to messaging to accepting proposals, TaxDome keeps your clients informed about everything going on with their projects.

Client Portal Features and Benefits include:

- Chats: Share real-time messages in the cloud with your clients.

- Client To-Dos and Reminders: User-friendly to-do list and automated reminders that gently nudge your clients to act faster.

- Forms and Organizers: Easy-to-fill forms that make data collection faster.

- Security: TaxDome protects your clients’ data using two-factor, biometric authentication.

- Document management: Unlimited document storage space that your clients can access to share files anytime and from anywhere.

- Branding customization: TaxDome allows teams to modify their client portal with their preferred login URL, email, and theme.

- Mobile app: Allows clients to scan documents to improve the quality of PDF source documents.

| Pros

E-signature and Approval workflows Mobile app |

Cons

Has a steep pricing structure Has a learning curve |

Pricing

- Essentials: $800/year

- Pro: $1000/year per seat

- Business: $1200/year per seat

Rating

TaxDome has 4.7/5 stars on both Capterra and G2.

5. Karbon

Karbon‘s client portal offers a single, branded hub for clients to securely collaborate and stay informed, helping accounting firms to deliver memorable client experiences.

It centralizes everything clients need, from personalized task lists and project timelines to secure document sharing, e-signature collection, and billing dashboards.

Karbon’s Client Portal Features and Benefits include

- Client To-Dos and Reminders: User-friendly to-do lists and automated reminders that gently nudge clients to act faster and keep projects moving without manual follow-up.

- Centralized Visibility: Every client task, document, and interaction is stored in one place, giving your entire team full visibility into project status and responsibilities.

- Real-time Collaboration: Allow clients and team members to comment directly on specific tasks or files, ensuring adequate context.

- Enterprise-Grade Security: Two-factor authentication and end-to-end encryption safeguard sensitive client data, ensuring full compliance with professional and regulatory standards.

- Real-Time Updates and Alerts: Clients receive instant notifications on project progress or requests for action, helping them stay informed without constant check-ins.

- File Sharing and Document Management: Share, collect, and organize files securely through the portal, reducing the risk of misplaced documents.

- E-signatures: Simplify client approvals with a built-in E-signature tool that eliminates the need for external apps.

- Custom Branding: Personalize your client portal with your firm’s logo, colors, and domain name to create a consistent, professional brand experience.

- Mobile Accessibility: Clients can access their portal anywhere.

| Pros

Email Integration Robust team collaboration |

Cons

Has a steep learning curve Limited document management Contact types are limited depending on the price plan. |

Pricing

- Team: $59/month, per user

- Business: $89/month, per use

- Enterprise: Custom Pricing

Rating

Karbon is rated:

6. Liscio

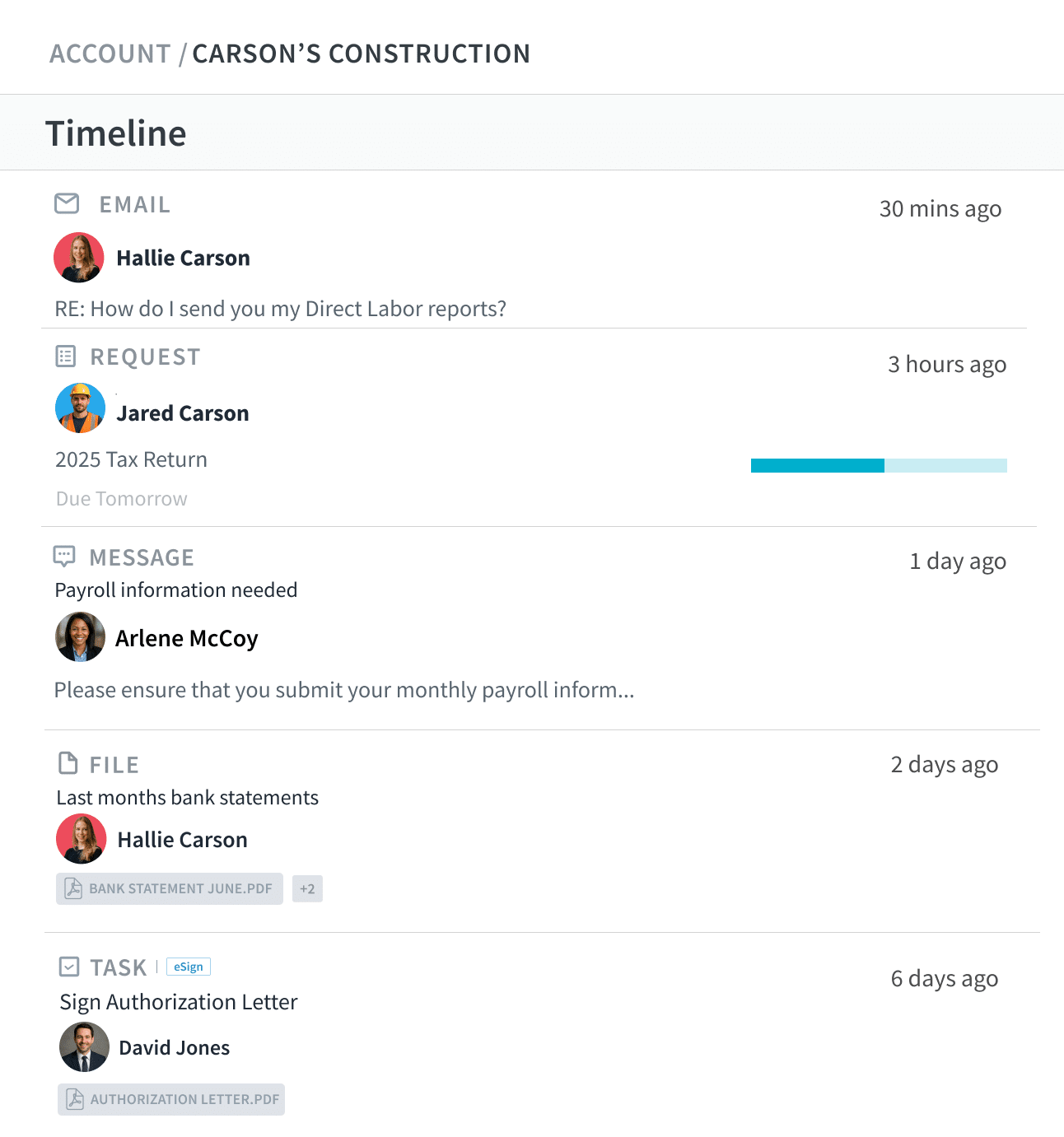

Liscio’s client portal provides a central location for secure communication, file sharing, and e-signatures between accounting firms and their clients. Every message, file, and signature is in a secure, easy-to-use space, ensuring smooth collaboration and a better client experience.

It replaces scattered tools, keeping accounting firms and their clients focused on tasks that move their engagements forward.

Liscio’s Client Portal Features and Benefits include:

- Unified Client Timeline: Every client message, document, task, and signature in one organized timeline, giving your team complete visibility into what’s been done, what’s pending, and what’s next.

- Smart Requests: Simplify the document collection process with intelligent requests that automatically remind clients.

- Secure Messaging: Communicate confidently through compliant messaging that keeps conversations organized.

- Integrated Email: Connect Gmail or Outlook to unify client communication in one secure view.

- E-Signatures: Collect signatures on engagement letters, authorizations, and tax forms instantly within Liscio.

- File Sharing & Storage: Securely share and receive files from any device.

| Pros

Dedicated client communication and collaboration Mobile app for staff and clients |

Cons

Limited workflow automation Branding limitation |

Pricing

- Tax Solo: $49/month per user

- Tax Team: $99/month per user

- Tax Enterprise: Custom

Rating

Liscio has 4.6/5 stars on both Capterra and G2

7. OneHub

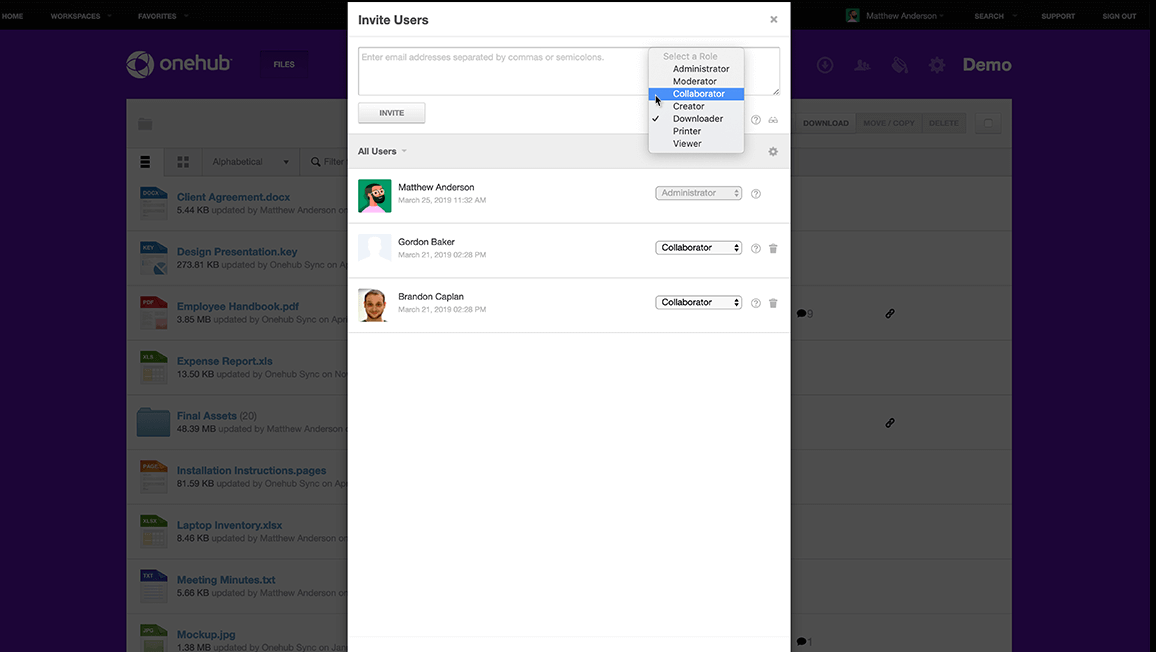

Onehub is a standalone file management and client portal solution for storing, sharing, and collaborating on business files. While it is designed for professional firms across multiple industries, it provides the bank-level encryption, role-based permissions, and audit trails that accounting firms need to protect sensitive client data.

Its cloud-based workspaces make it easy for clients to upload, preview, and share files from any device, and allow firms to manage documents and control who has access.

Onehub’s Client Portal Features and Benefits include:

- Data Rooms: Set up virtual data rooms for confidential projects like audits or deals, with document watermarking, NDAs, and audit trails.

- Upload: Easily upload files and folders via drag-and-drop, automatic versioning, or secure FTP, which speeds up bulk uploads.

- Branding Customization: Create a branded client experience by customizing your workspace with your firm’s logo and colors.

- Secure: Protect sensitive information with enterprise-grade security, including role-based permissions and two-factor authentication.

- Preview: Preview files instantly within your browser or mobile device.

- Share: Grant precise access to folders or files using customizable permissions or secure links with expiry dates and passwords.

- Index: Automatically organize files with numerical indexing in data rooms.

- Secure Cloud Storage & Sharing: Store, organize, and share client files securely in the cloud with role-based permissions.

| Pros

Granular permissions and activity tracking Virtual data rooms |

Cons

Lacks built-in messenger Limited accounting integrations |

Pricing

- Standard: $12.50/month per user

- Advanced: $20/month per user

- Data Room Edition: $300/month per user

- Custom Quote: Priced by Usage

Rating

Onehub is rated:

8. Assembly

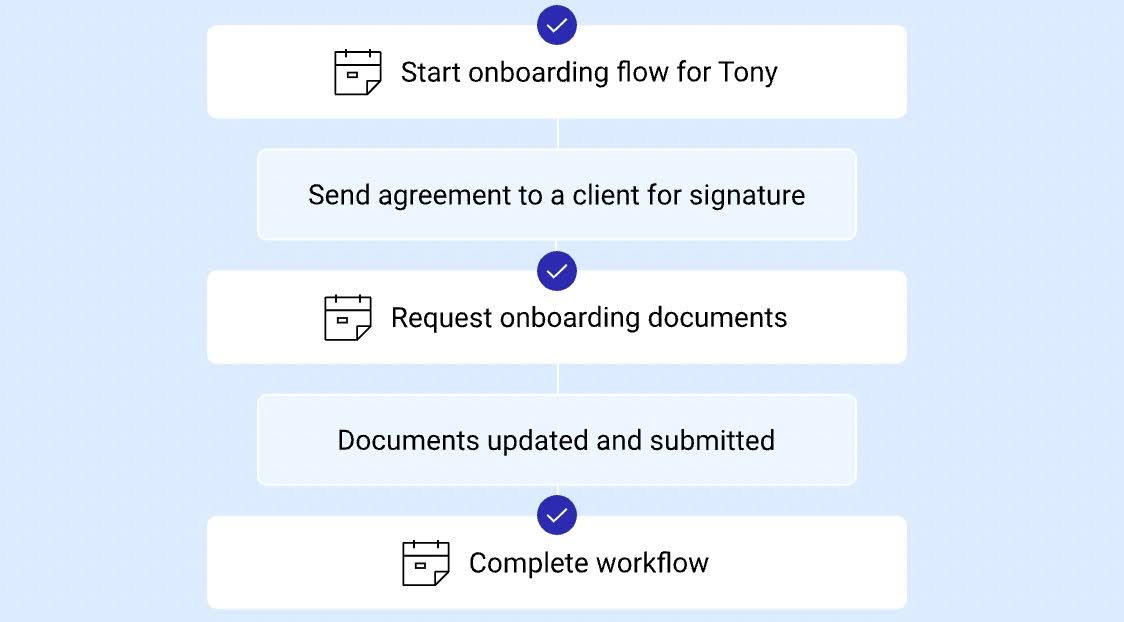

Assembly’s (formerly co-pilot) customer portal helps firms deliver a unified, modern client experience from onboarding to ongoing collaboration.

It combines communication, file sharing, and payments in one secure, branded space to eliminate information silos. Clients can easily connect, access documents, and complete payments, while firms maintain full visibility and control.

Assembly’s Client Portal Features and Benefits include:

- Branded Client Portals: A fully branded portal that delivers a professional experience with customizable themes, layouts, and branding that reflect your firm’s identity.

- Secure Access: Google SSO & magic links protect and simplify client access with secure single sign-on or password-free magic links.

- File Sharing: Share documents securely and grant controlled access permissions so clients can easily view or download files without risking data exposure.

- Tasks: Assign and track client and team tasks in one shared workspace, improving accountability and ensuring nothing slips through the cracks.

- Security: Protect sensitive client data with SOC 2 and HIPAA-compliant, enterprise-grade encryption.

- CRM Integration: Manage all client relationships and interactions from one central hub, keeping your communications, contracts, and billing in perfect sync.

- Forms: Collect key client information through customizable intake forms that automatically organize responses and reduce back-and-forth emails.

- Contracts: Send professional agreements for quick, secure E-signatures to speed up approvals.

| Pros

CRM integration Accounting integrations |

Cons

Initial setup has a learning curve Limited reporting features |

Pricing

- Starter: $39/month

- Professional: $149/month

- Advanced: $399/month

- Enterprise: Custom

Rating

Assembly is rated 4.8/5 stars on Capterra and G2

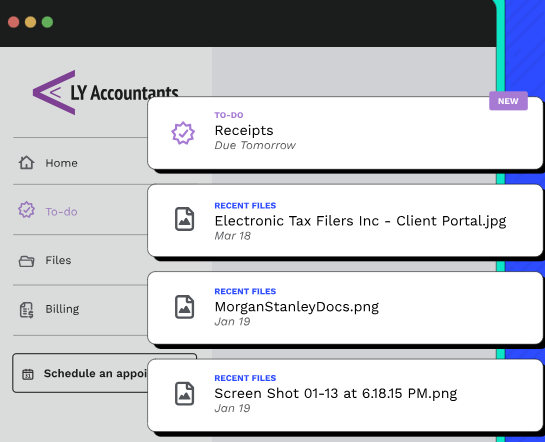

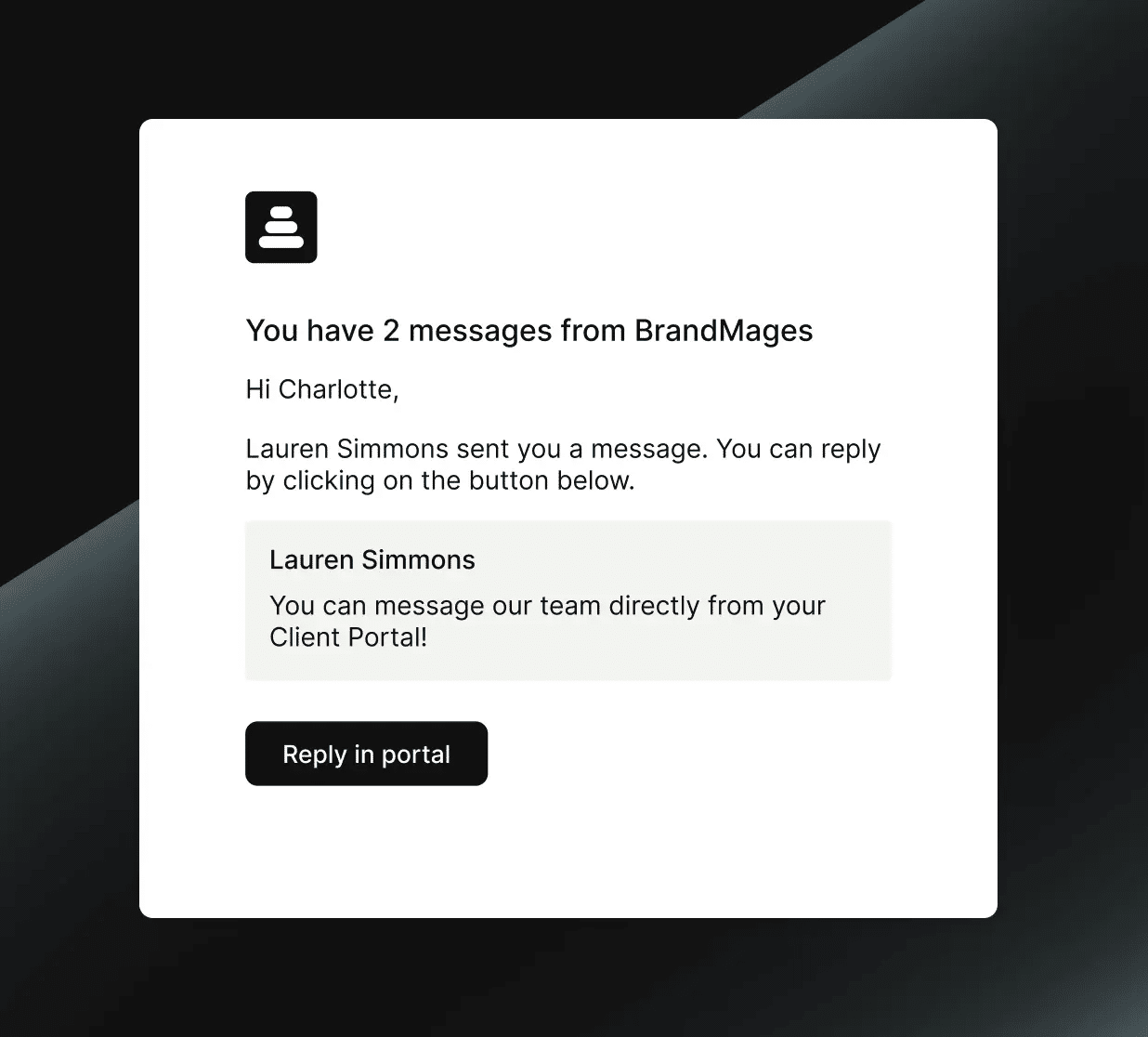

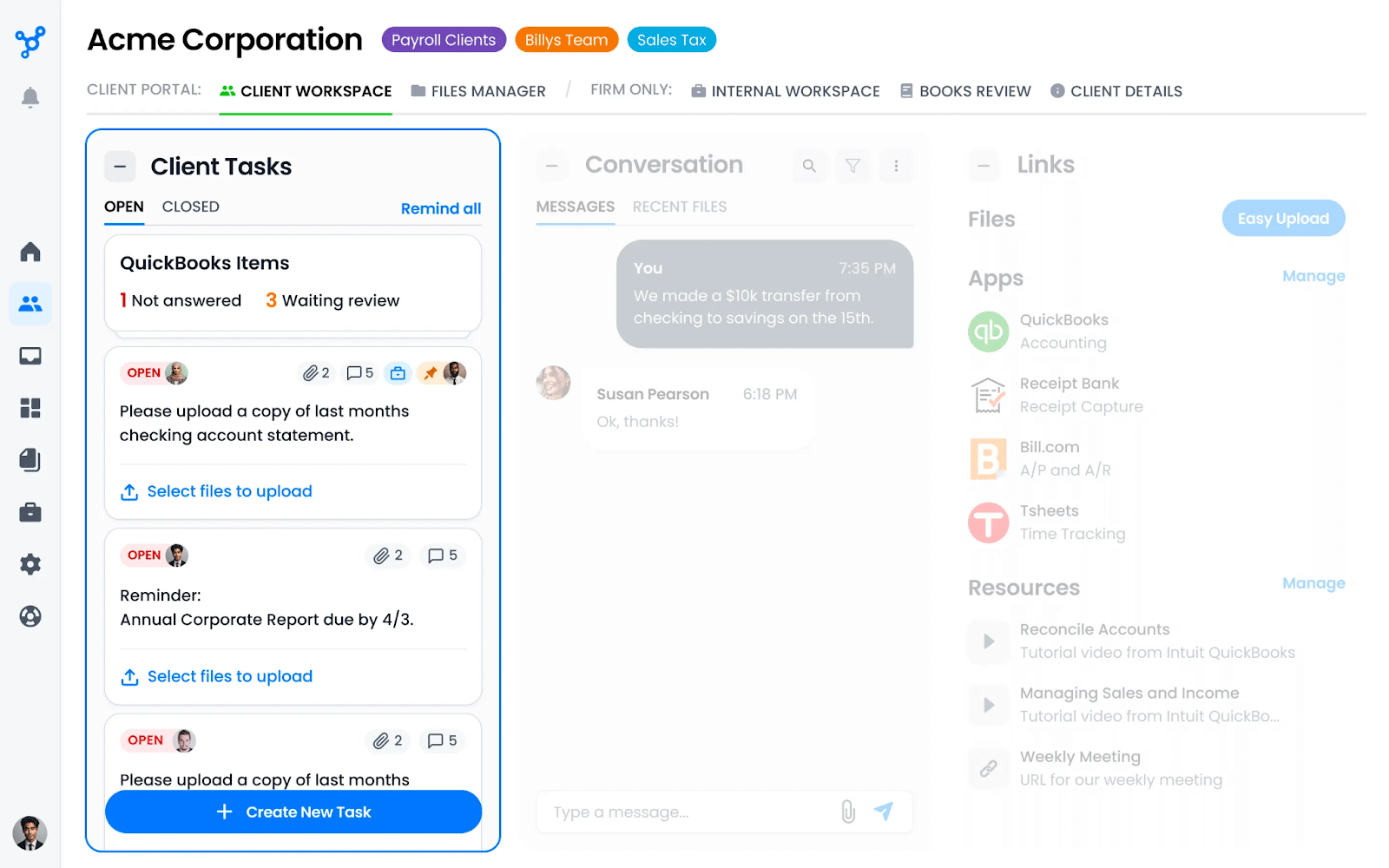

9. Client Hub

Client Hub is a client portal software that makes collaboration effortless. It centralizes communication, improves visibility, and strengthens client relationships by making every interaction seamless, efficient, and professional.

It allows accounting clients to access documents, communicate with your team, and manage tasks from anywhere.

Client Hub’s Liscio’s Client Portal Features and Benefits include:

- Client Tasks: Easy-to-complete tasks that help clients respond faster and keep projects moving without confusion.

- Document Management: Centralize document sharing in one secure location where clients and accountants can upload, view, and manage financial files.

- Client Workspace: Provide clients with a dedicated space to collaborate with your firm, view tasks, access apps, and stay connected with your team in real time.

- Conversations: Enable clients to communicate instantly in a quick, text-like way. Conversations are easy to follow for both sides.

- QuickBooks Integration: Client Hub connects with QuickBooks Online so clients can instantly resolve unclassified expenses and keep their bookkeeping accurate and up to date.

- Recent Files: Allow clients to quickly access recently added files with one click, saving time and improving transparency.

- Client Shared Folders: Provide clients with secure shared folders for organized document exchange, ensuring everything stays in one safe, easy-to-navigate space.

- Mobile App: Deliver a modern, mobile-friendly experience where clients can communicate, upload files, and complete tasks from anywhere.

- Notifications and Alerts: Keep clients informed through timely notifications that minimize the need to log in while ensuring they never miss an important update.

- Deep Links: Use deep links to take clients directly into their workspace or specific tasks without needing to log in again.

| Pros

Seamless QBO integration Built-in client chat |

Cons

Limited reporting features No mobile app |

Pricing

- Premium: $69/month per user

Rating

Client Hub has:

10. Progress ShareFile

Progress ShareFile (formerly ShareFile) helps accounting firms and their clients share documents, manage requests, and communicate in one simple, secure platform to speed up client responses and maintain full visibility across engagements.

It brings all client interactions (file uploads, approvals, and messages) into a single workspace that you can access via web and mobile.

Progress Sharefile’s Client Portal Features and Benefits include:

- Document Request Lists: Keep client submissions organized and on time with structured document request lists that clearly outline what’s needed.

- Client Dashboards: Clients can instantly view active items, pending tasks, and shared documents in one intuitive dashboard.

- Automated Notification: Automated notifications and mobile-friendly access keep clients engaged and responsive.

- Unlimited Client Users: Easily create and manage portals for all clients and team members without extra user fees.

- Mobile App for Clients: Let clients securely access, upload, and manage documents anytime with ShareFile’s dedicated mobile app.

- Custom Branding: Personalize your portal with your company’s logo and brand colors for a consistent, professional look.

| Pros

Deep Microsoft integrations Mobile app |

Cons

Has an initial learning curve Dated interface |

Pricing

- Advanced: $16.00/month per user

- Premium: $25.00/month per user

- Industry Advantage: $41.67/month per user

- Virtual Data Room: $67.50/month per user

Rating

Progress Sharefile has:

11. Clinked

Clinked is a secure platform that brings teams and clients together by centralizing file sharing, communication, and task management to ensure team and client alignment.

It is designed to help businesses across industries (especially professional services firms like accounting, legal, and consulting firms) to increase productivity and strengthen client relationships.

Clinked’s Client Portal Features and Benefits include:

- Branding and customization: Fully customize your client portal with your logo, colors, and domain to create a branded experience.

- Task Management: Organize projects efficiently by creating tasks and sub-tasks, assigning responsibilities, and tracking progress with intuitive Kanban boards.

- Custom Access Permissions: Maintain data security by controlling who can view, download, share, or edit specific files.

- Google Workspace and Microsoft Integration: Collaborate seamlessly by syncing with Google Workspace and Microsoft 365.

- E-signatures: Simplify approvals by integrating e-signature tools like Adobe Acrobat and DocuSign.

- Audit Trail: Gain full visibility with detailed activity logs tracking file views, downloads, updates, and logins.

- Mobile App: Stay connected wherever you are. Communicate, share updates, and manage client work directly from Clinked’s secure mobile app.

| Pros

Version control Mobile access |

Cons

Basic user interface Lacks a built-in E-signature |

Pricing

- Lite: $ 95/month

- Standard: $ 239/month

- Premium: $ 479/month

- Enterprise: Contact us

Rating

Clinked is rated 4.9/5 stars on both Capterra and G2

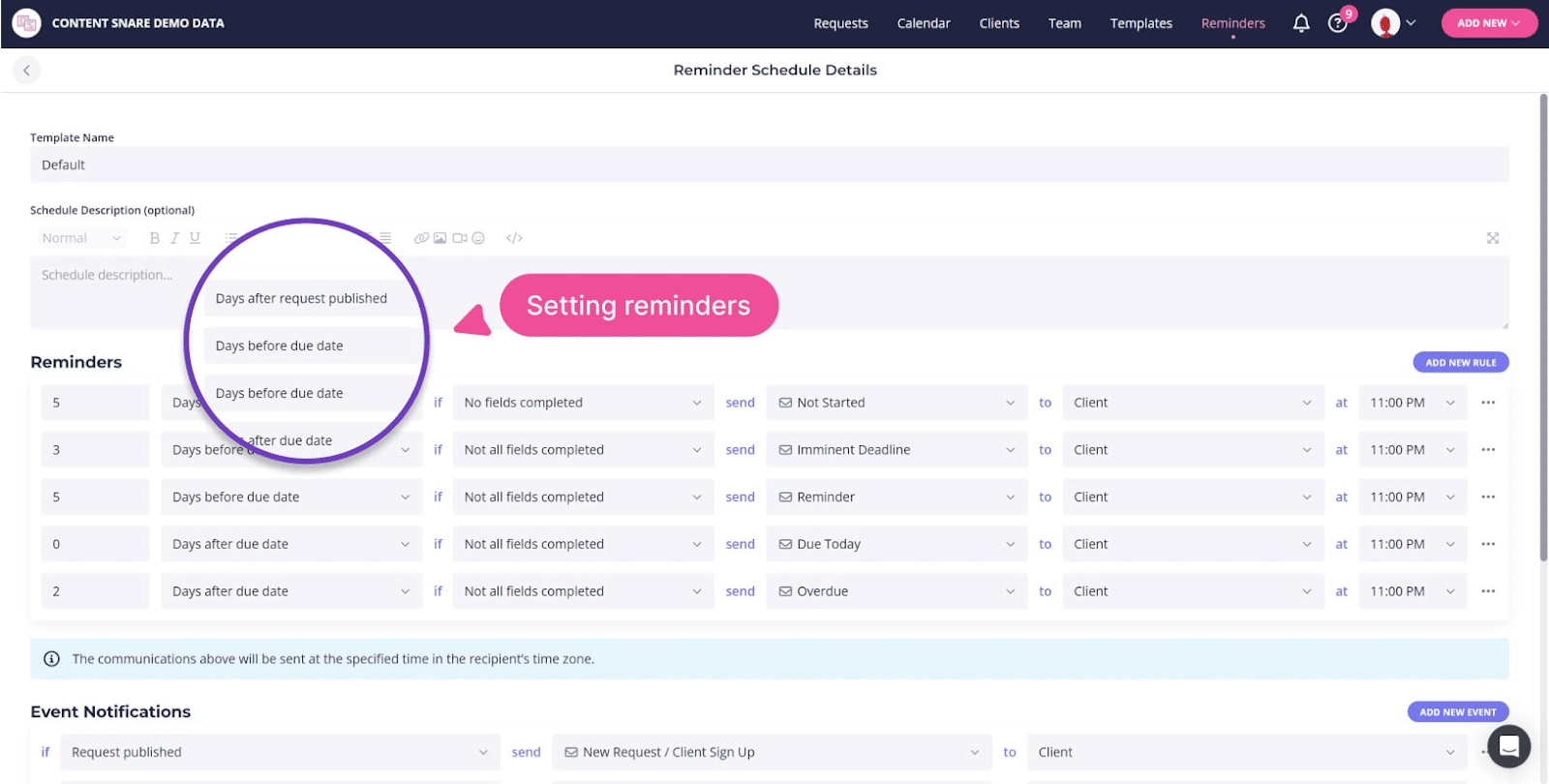

12. Content Snare

Content Snare simplifies the way firms collect information from clients by eliminating endless email follow-ups.

It provides a secure and centralized space for clients to upload documents, fill out forms, and respond to requests. With Content Snare, accountants, bookkeepers, and consultants can streamline document collection, reduce admin time, and deliver a smoother client experience.

Content Snare’s Client Portal Features and Benefits include:

- Client Checklists: Clear, organized checklists that guide clients on exactly what to submit.

- Automated Client Reminders: Let Content Snare send automated follow-ups to clients for missing items.

- Easy Review and Approvals: Approve client submissions instantly or request revisions for specific fields.

- Centralized Data Downloads: When clients finish their submissions, download all files and responses or automatically sync them to Google Drive, Dropbox, or OneDrive.

- Reusable Templates: Save time by turning frequent requests into templates that your whole team can reuse.

- Contextual Communication: Eliminate messy email chains by discussing clarifications and feedback directly within client checklists.

- Security Controls: Protect client data with enterprise-grade encryption, access restrictions, and compliance with global privacy standards.

| Pros

Automated reminders Built-in approvals and comments |

Cons

Lacks accounting-specific integrations Limited file organization |

Pricing

- Basic: $35/month

- Plus: $71/month

- Pro: $119/month

- Custom: $215+/month

Rating

Content Snare is rated:

13. Revver

Revver simplifies how firms share, organize, and collaborate on client documents, reducing administrative burdens and empowering professionals across industries to focus on client service and firm growth.

With intelligent features that streamline document management and eliminate manual effort, Revver helps teams maintain accuracy, transparency, and speed.

Revver’s Client Portal Features and Benefits include:

- Document Templates: Create document templates that automatically sort and store client files in a consistent structure. This ensures easy access, faster retrieval, and improved collaboration between your team and clients.

- Automated Document Key Requests: Eliminate messy email chains with automated document collection. Request, receive, and store specific client files in the correct location automatically.

- Secure Sharing with Client Portals: Provide clients with secure, shared spaces to upload, download, and search for documents.

- Governance and Compliance: Protect sensitive client data with customizable access permissions.

| Pros

Built-in compliance and governance features Intelligent search capabilities |

Cons

Primarily for document management Limited real-time collaboration |

Pricing

Contact sales

Rating

Revver is rated:

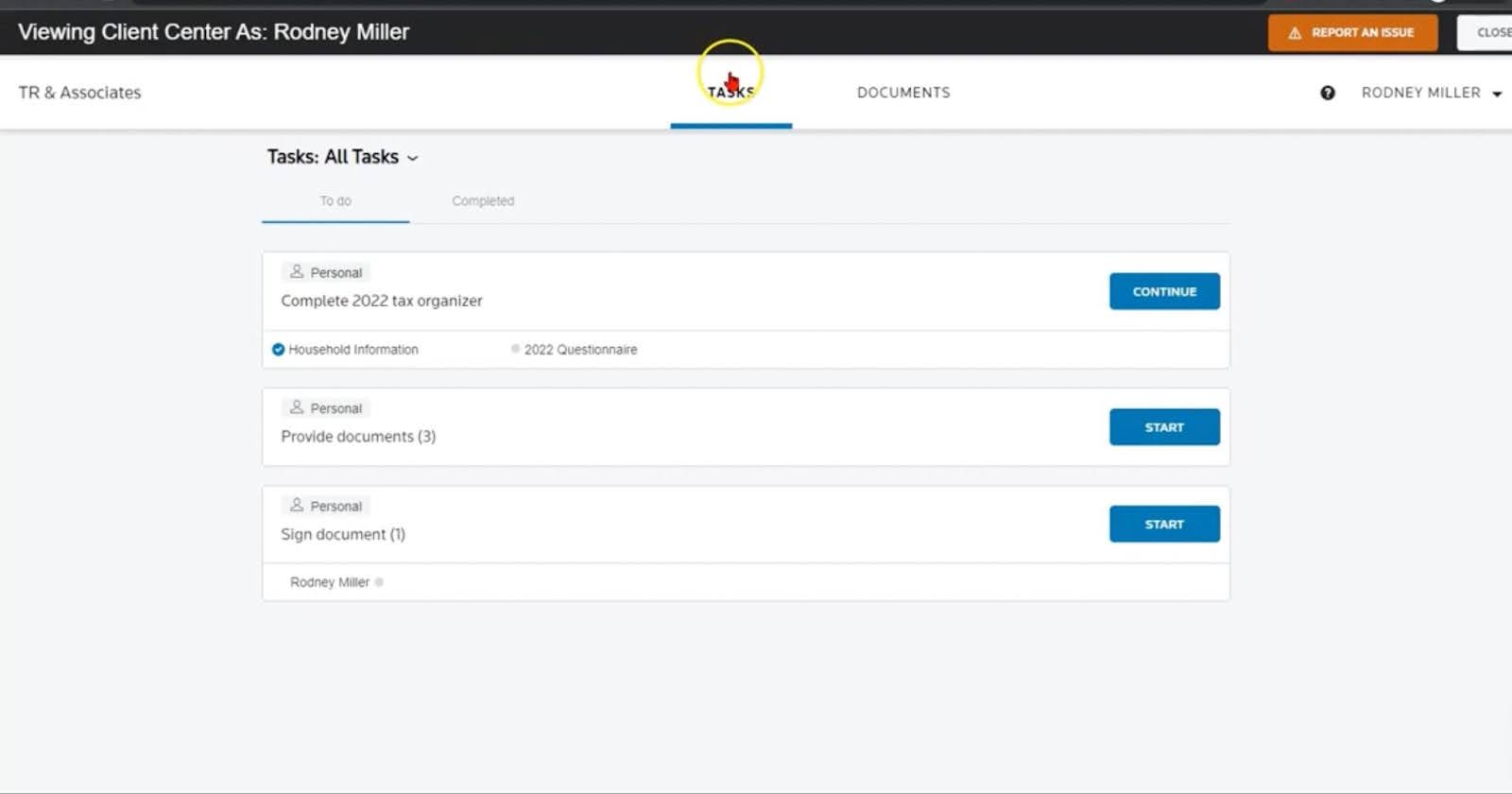

14. Onvio

Onvio provides accountants with a secure client portal that allows 24/7 online access to essential tax and accounting services.

It allows clients to securely exchange files, view documents, and access financial data from any device, which enhances collaboration, reduces administrative back-and-forth, and improves client satisfaction.

Onvio Client Portal Features and Benefits include:

- Cloud-based Access: Strengthen relationships with clients through cloud technology that enables seamless collaboration, instant updates, and personalized service without sacrificing the human touch.

- File-sharing: Enable clients to securely send, receive, and review personal financial documents, returns, and reports.

- E-signature: securely sign documents when it’s most convenient and automate agreement workflows to suit your processes

- Create Portals Easily: Set up client portals in minutes. Clients gain instant access to shared files, messages, and services, improving their experience and making your firm’s delivery more efficient.

- Virtual Client Office: Provide clients with secure, 24/7 access to essential accounting software and Microsoft Office tools.

- Data Security: Protect sensitive financial data with enterprise-grade encryption and remote-access safeguards.

| Pros

Deep integration with Thomson Reuters apps Integrated virtual office |

Cons

Dated interface Limited integration with tools outside of Thomson Reuters |

Pricing

Contact Sales

Rating

Onvio has 3.5/5 stars on G2

15. SuiteDash

SuiteDash transforms how businesses manage client relationships by combining CRM, project management, and communication tools in one secure platform.

This enables each client to view a personalized dashboard that displays their unique data, project status, and shared files in real time, helping your firm to maintain transparency and professionalism.

SuiteDash’s Client Portal Features and Benefits include:

- Customizable Client & Staff Portals: SuiteDash enables firms to tailor their portal to their firm’s needs by controlling what clients and staff can see.

- Advanced Access Control: Assign role-based permissions so each client can only access the pages, files, and documents relevant to them, ensuring security and efficiency.

- Custom Branding: Deliver a polished, branded experience by applying your firm’s logo, colors, and custom domain. The portal is translation-ready for multilingual clients.

- Smart Form Builder: Create embeddable or standalone forms to collect client data, streamline onboarding, or update contact profiles with ease.

- Automated Workflows: Trigger automations the moment a client completes a form, such as assigning tasks or sending notifications.

- Multilingual Support: Offer seamless experiences in your clients’ preferred languages using built-in translation sets, including Spanish, French, and more.

| Pros

Highly customizable client portal Client and staff portals |

Cons

Steep learning curve Not accounting-specific |

Pricing

- Start: $19/month

- Thrive: $49/month

- Pinnacle: $99/month

Rating

SuiteDash is rated:

How to Choose the Right Portal for Your Firm

You don’t have the luxury of experimenting with your client portal. The wrong choice won’t just be a waste of time and money; it could also trigger client dissatisfaction and churn.

Here’s how you can make a decision you’ll be glad to be proud of:

i. Consider Your Firm Size

While more features can be better, they can become overwhelming for many small firms, which is why they should opt for simpler tools that are easier to implement and use.

Meanwhile, larger firms cannot afford to use a client portal solution that doesn’t allow everyone in the firm without extra charges.

Some client portals also limit the number of team members firms can add. When the features of a client portal are not robust enough, large firms often resort to manual workarounds that consume time and drain energy.

ii. User & Client Experience

You obviously understand the importance of your client portal, but your clients likely don’t. They need to use it to see its value, and choosing an easy-to-use client portal is the best incentive you can give your clients to adopt it.

Otherwise, they’ll be opposed to your client portal and resort to collaborating with your firm anyway they know how.

Your client portal will create memorable user experiences if the interface is clean and easy to navigate. This enables clients to upload documents and sign forms without assistance, reducing your team’s workload.

iii. Document & Workflow Features

Beyond communication and file sharing, your client portal should enhance your document and workflow management system.

That is why firms prioritize tools like Financial Cents that organize the files your clients upload into the relevant projects, enabling your team to access them for their assigned tasks.

This enables your team to manage client collaboration, document management, and workflows in one place, reducing admin work.

iv. Pricing and Scalability

The general idea is to prioritize a pricing system that fits your current needs and budget. That includes determining whether a per-user, per-client, or per-feature model is best for your firm.

However, the final cost may change as you add more clients and team members, and you need to understand what that will look like as your firm grows.

Some vendors offer discounts based on the number of clients, while others include additional fees that can limit scalability.

v. Support & Reliability

Bugs and service downtime are part of the reality of using a software solution, but the frequency and duration vary from firm to firm.

The fewer downtimes your client portal experiences, the fewer disruptions your client communication and collaboration will experience.

Similarly, your software provider’s implementation resources, responsiveness of the customer support team, and onboarding resources can help you minimize individual and general downtime.

Software solutions like Financial Cents provide clear documentation and training materials that enable users to navigate the product for all intents and purposes.

Our 24/7 technical support and live chat provide ongoing support to users. These measures keep service downtime to a bare minimum, enabling users to deliver uninterrupted client services.

v. Data Security Needs

Managing the security of a client portal software (on an ongoing basis) is a full-time job. You won’t want to add it to your already busy accounting schedule.

That is why you need to consider the data security practices of a software provider before committing your time and money.

Top solutions provide data security features, like encryption, multifactor authentication, and role-based user permissions.

Beyond these, Financial Cents enables firms to choose which country to store their clients’ data. That allows you to store your clients’ data in the U.S., U.K., Canada, or Australia in compliance with data residency laws.

These features not only help comply with the strict and numerous data security requirements of the accounting industry, but they also build client trust and provide greater transparency.

Use Financial Cents to Manage and Streamline Clients’ Work

Getting the accounting client portal of your dreams doesn’t matter so much when you’re struggling to manage other aspects of your firm, like workflows, CRM, team capacity, and billing.

That’s why we recommend prioritizing an all-in-one accounting practice management software solution over standalone client portals.

They provide accounting firms with everything they need to facilitate secure client collaboration and manage their firms in one single tool, often at the same price.

With Financial Cents, you’ll get an all-in-one tool to manage all your firm’s needs in one place:

- Workflow Management and Automation: Track tasks and automate routine processes to free up time for more revenue.

- Team Collaboration: Centralize team discussions and file-sharing to ensure clarity and alignment.

- Email Integration: Brings all client emails into the client’s profile to improve visibility and response time.

- CRM: Organizes client information in one central location.

- Capacity Management: Balances team workload at all times and prevents burnout.

- Time Tracking: Shows where your time is spent to improve profitability and efficiency.

- Document Management: Automates document handling for maximum efficiency.

- Proposal and Engagement Letters: Modern proposals that automate client agreements, billing, and payments.

- E-signature: Quick and easy electronic signature collection that improves client experience.

- Month-End Close: track and clarify errors in your client’s books, including uncategorized transactions in the client portal and push the changes to QBO without leaving Financial Cents.

- Billing and Payments: Timely client billing that saves you the stress of data entry and third-party integration.

- Budgets and Reports: Provide real-time reports to grow and scale your firm.

This centralizes team collaboration, automates repetitive tasks, and provides visibility into project status to help you identify and address bottlenecks before they become problems that negatively affect deadlines and revenues.

Use Financial Cents free for the next 14 days and see the improvement in your client collaboration.