Imagine walking into your accounting firm at the crack of dawn, not to a pile of paperwork and pressing deadlines, but to a smooth-running firm where systems operate easily and your role transitions from micro-manager to strategic overseer.

Pure bliss

This isn’t just a pipe dream—it’s the promise of a self-operating accounting firm. Building a firm that virtually runs itself in a space where automation and technology redefine traditional roles should be your next strategic move.

A self-operating accounting firm offers remarkable benefits—flexibility to work on strategic tasks, independence from routine data entries, improved client relationships, and optimum time for yourself.

How do you want to see yourself in the next three years? How many hours per day do you want to work, and how many months in a year? This process gives you timeout, time to go on vacation with family, no work, just you in your own space"

Ryan Lazanis, CPA, Founder of Future FirmBut the path to automation has its challenges. You might find yourself juggling multiple roles—from IT support to customer service and strategic planning—especially in the early stages. Managing an ever-increasing workload and acquiring new clients while ensuring the seamless integration of new technologies can seem daunting.

This comprehensive guide is crafted to navigate you through the complexities of establishing a self-operating accounting firm.

Foundations of a Self-Operating Accounting Firm

The key to success in building a self-operating accounting firm begins with thorough planning and smart groundwork.

By carefully organizing your initial steps and setting clear objectives, you create a strong foundation that supports not just the startup phase but also sustainable growth in the future.

Create a good deal flow. Let potential & existing clients know what you do or can offer. A firm shouldn't be idle"

Ryan Lazanis, CPA, Founder of Future FirmPlanning and Preparation

Think of this as plotting your course before setting sail. It’s about getting a clear picture of where you want your firm to go and mapping out the path to get there. Start by understanding your market—what do clients need that they’re not getting? What can you offer that’s different? Drafting a detailed plan isn’t just a formal requirement; your roadmap outlines your vision, goals, and strategies to streamline operations and delight clients.

Business Formation & Legal Considerations

Here’s where you lay the cornerstone of your firm. Choosing the right structure—be it as a sole proprietor or a more protected setup like an LLC—shapes everything from your taxes to how much personal liability you’ll shoulder:

Build Your Tech Stack

Choosing the right tech stack is like assembling your crew—it needs to be strong, reliable, and ready to handle whatever comes your way:

- Automate with the right software: Identify repetitive and time-consuming tasks, such as data entry, invoice generation, and payroll processing. Automate these processes to free up your team’s time for more strategic activities, such as providing valuable insights to clients. In this case, cloud-based accounting software is your best bet for flexibility and access.

As the Journal of Accountancy puts it, Investing in technologies that automate core processes and streamline user experience will be paramount to building — and retaining — a skilled and agile finance team.

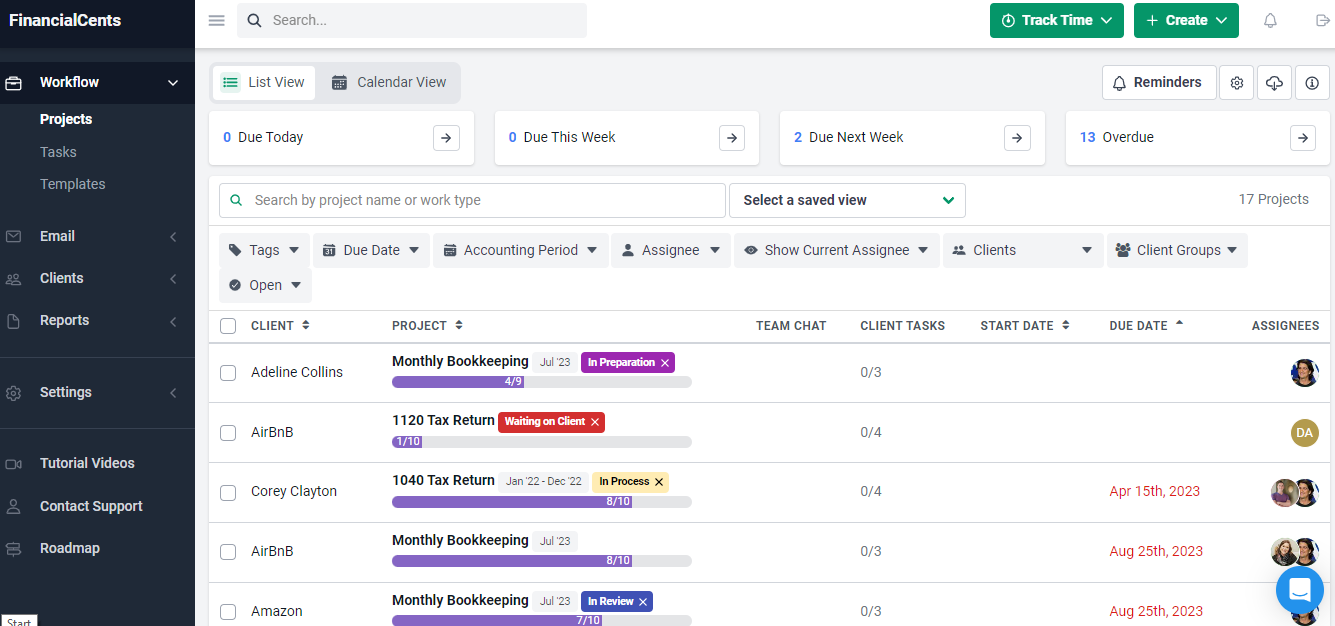

- Keep work on track: A great accounting-focused work management software like Financial Cents can give you visibility into the status of work by helping you:

- See where client work stands compared with their deadlines and move things around when needed.

- Delegate tasks to team mates.

- Centralize information so your team has what they need to do client work.

- Find information to give clients updates and build successful client relationships.

- Spot and address bottlenecks to help your team do more in less time.

Financial Cents’ workflow view gives me a great summary of the status of all of my projects, while capacity management allows me to ensure that I don’t overcommit when taking on new projects. Customizing projects is quick and easy."

Jessica B.F, Firm Owner- Stay connected: Tools such as Slack or Microsoft Teams ensure that your communication lines are always open, whether your team is across the hall or scattered around the globe.

- Safeguard your data: In the accounting space, cybersecurity can’t be an afterthought. Investing in strong security measures protects not just your firm’s data but also your clients’ trust.

By putting together each foundational piece with care, you’re shaping a strong accounting firm that will operate efficiently, grow steadily, and adapt quickly to new trends in accounting.

Operating Your Accounting Firm

a. Streamlining workflows

According to the 2024 State of Accounting Workflow Automation Report, 63% of the overall challenges firms faced came from their workflow. These challenges stemmed from outdated processes, a lack of integration between systems, and manual data entry errors, which slowed down operations and increased the likelihood of mistakes that had significant implications.

As your firm transitions into a self-operating one, the importance of efficient workflow management cannot be dismissed.

I wanted to help small businesses succeed, but I found myself very overwhelmed, not with the client work, but with the administrative stuff where I was either having to hire an admin or systematize. I found systematizing to be a lot more efficient and rewarding. Now, I guide and mentor new and growing bookkeepers to implement systems in their businesses to become efficient and organized, which is a solid foundation for scaling"

Jessica Fox, Florida Virtual Bookkeeping LLC.You may be interested in

b. Building a Scalable Client Management System

When building a self-operating firm, managing an increasing number of client relationships without sacrificing quality can be challenging if certain systems are not in place. A scalable client management system is essential to handle this growth efficiently and effectively.

i. Client Onboarding: Smooth and systematic onboarding is critical for setting the tone of client relationships. It ensures that clients understand what to expect from your services and what steps they need to take.

ii. Sending new client questionnaires: The client onboarding questionnaire helps you learn more about the needs of your new clients and find ways to meet them. The key to an effective client questionnaire is knowing what to ask at the moment or leave for later to avoid overwhelming them. You can start with getting their contact information (phone numbers, email addresses), login information (to third-party apps), the preferred channel of communication, and their goals and expectations.

During onboarding, we build trust, and we have to be highly communicative. The client needs to remember what they signed. They don’t understand a lot of times because it’s their first time outsourcing. So they’re learning, and you need to be good at it "

Nikole MacKenzie, CEO & Founder of Momentum Accounting, Inc.iii. Organizing Client Info: Develop a checklist or a standard protocol for gathering initial client data, setting up accounts, and scheduling initial consultations. Accounting CRM systems like Financial Cents can automate these steps, ensuring consistency and thoroughness.

iv. Efficient Client Communication: Clear, consistent communication is vital to maintaining strong client relationships even when you are not in the picture. Leveraging technology here can improve interaction and satisfaction.

- Client Portals: Implement a secure portal where clients can log in to view their documents, track the progress of their filings, and communicate directly with your team. Client portals for accountants like Financial Cents offer these functionalities with added security measures.

- Regular Updates: Your client may need more time to track all information affecting their business. As their trusted advisor, you can help them with that. Did you find an opportunity or a potential threat to their business? Let them know so they can prepare for it as soon as possible.

v. Document Management and Security

Your client’s data is only as secure as the weakest tool in your tech stack. If either your workflow or document management system is not secure, it becomes the weak link by which fraudsters can access your client’s information. This can be prevented by putting specific measures in place, including:

- Cloud Storage Solutions: By integrating a workflow tool like Financial Cents and a DMS like SmartVault that are bank-level secure, your client data is safe from unauthorized access during transfer, processing, and storage. Both tools give you access and control capability, which enables you to restrict access to documents and track the activities of your team members on client information.

- Encryption and Security Protocols: Ensure all stored documents are encrypted and accessible only to authorized personnel. Regular security audits and compliance checks should be performed to maintain high-security standards.

c. Team Building and Delegation

Building a strong team and mastering the art of delegation are essential to sustaining growth and ensuring your firm remains efficient and responsive. Here’s how to effectively manage team dynamics and task distribution.

As the owner of the firm, you are the bottleneck of your firm; the task you wish to delegate could either be a task you don’t like to do or a task you feel takes time taking, like answering the phone, document management or creating proposals "

Nicole Davis, CEO Butler-Davis Tax & Accounting LLCHiring New Staff

You need to ask yourself, who do I need to hire? Why do I need to hire them? What are they going to contribute daily to move the firm forward?"

Nicole Davis, CEO of Butler-Davis Tax & Accounting LLCHiring the right people is foundational to your firm’s success. Here’s how to attract and retain top talent:

- Skill-Based Hiring: Focus on candidates who not only have the necessary technical skills but are also proficient in using the latest accounting technologies. For instance, familiarity with cloud-based accounting platforms, data analysis tools, and accounting automation software is important.

- Culture Fit: Ensure that candidates align with your firm’s culture and values. Employees who share your firm’s vision and ethos are more likely to be engaged and committed in the long term.

- Diverse Talents: Look for diverse skills and backgrounds to enrich your team’s capabilities. This diversity can lead to more innovative solutions and better problem-solving. Implement a diversity recruiting strategy by broadening your recruitment channels and partnering with organizations that serve underrepresented communities.

Always be on guard to make your firm the best opportunity for candidates right from the start, from when they’re being interviewed to getting hired and the whole time they’re working there. Once you recognize a “rockstar employee” you’d like to retain, show them that your firm can provide whatever it is they’re looking for."

Jeremy Calhoon, Assistant Vice President of Recruitment, RobertHalfTeam Training

Continuous training is key to keeping your team updated and ready to handle the challenges of a modern accounting environment.

Each applicant should always go through a trial period, a two-week test, or a training course before they start dealing with clients"

Nicole Davis, CPA- Ongoing Education: Provide opportunities for your team to attend workshops, seminars, accounting conferences or online accounting courses that can enhance their professional skills and knowledge.

- Certification Support: Encourage and support staff in obtaining further qualifications such as CPA or specialized certifications in areas like forensic accounting or tax law.

- Technology Training: Since your firm relies heavily on technology, regular training sessions on new software and tools are essential.

Dedicate learning time, share knowledge within the team, and encourage attendance at conferences and seminars for continuous skills upgrading."

Nayo Carter-Gray, Owner of 1st Step Accountingd. Implementing Standard Operating Procedures (SOPs)

Standard Operating Procedures (SOPs) are essential for creating a structured and efficient workflow within your accounting firm. They ensure that every team member understands their tasks and the standards to which they are held, which is important for building a self-operating accounting firm.

Developing Effective SOPs

Creating effective SOPs involves several key steps:

- Identify Key Processes: Start by identifying the processes that are critical to your firm’s operations. This might include client onboarding, data entry, financial reporting, and compliance checks.

- Documentation: Clearly document each step of these processes. This documentation should include the tools needed, the person responsible, and the expected outcome. Make sure the instructions are clear and straightforward to minimize the risk of errors.

Stop struggling to document your processes with 30-page-long SOP documents. Use videos instead! Just record yourself as you do the work and add the video link to your checklists so your team can view it. Wouldn't cost you any extra time."

Shahram Zarshenas, Founder & CEO, Financial Cents- Review and Approval: Once the SOPs are drafted, they should be reviewed by senior team members within the firm. This helps ensure that all procedures are accurate and comprehensive.

- Training: Implement training sessions for your team to familiarize them with the new or updated SOPs. Everyone must understand how to follow the procedures before they are fully integrated into daily operations.

- Continuous Improvement: SOPs should not be static; they need regular review and updating to reflect technological changes, regulations, and business operations. Set a schedule for reviewing and updating SOPs to ensure they align with current best practices.

Task Delegation

Effective delegation is not just about assigning tasks; it’s about empowering your team members to take responsibility and make decisions.

- Define Roles Clearly: Ensure that every team member knows their responsibilities and how their role fits into the larger goals of the firm. This clarity can increase efficiency and reduce overlap.

Establish a method for accountability by clearly assigning tasks, responsibilities, and deadlines. This method, often expressed as 'who will do what by when,' ensures clarity and accountability within the workflow"

Terrell Turner, CPA (CEO, TL Turner Group)- Empowerment through Trust: Trust your team with not just tasks but also the authority to make decisions within defined limits. This empowers them and can lead to increased job satisfaction and productivity

When you give instructions to your employees, you must ensure they process them as given so the results won’t differ from what you said"

Nicole Davis, CPA.- Feedback Systems: Implement a robust feedback system where team members can give and receive constructive feedback. Regular reviews and discussions about job performance can motivate team members and help them grow.

Use Financial Cents to Manage Your Self-Operating Accounting Firm

Building a self-operating accounting firm may seem ambitious but it’s an attainable goal.

One of the easiest ways to get this done is to automate certain areas and tasks in your firm. This is where Financial Cents comes in.

Free accounting workflow checklist templates are available to help you streamline your process. Also, onboarding your clients and team to the software is seamless. Most firms get set up in a matter of a few hours to a few days (depending on how streamlined their processes are).

Start using Financial Cents today and enjoy a 14-day free trial.