Starting prices rarely tell the true cost of accounting practice management software. It’s common for two firms on the same pricing tier to pay very different amounts (or for two tools with the same prices to result in different total costs).

Another common scenario is platforms advertising low monthly fees while separating core features and functionalities into paid add-ons that only become clear after you have committed too many resources to the platform, and switching tools now feels too expensive.

That is why we recommend knowing your estimated ROI by modelling your firm’s size, workflows, automation needs, and growth plans using the practice management pricing calculator.

In this guide, we’ll show you how to do your estimates today, what accounting practice management software realistically costs in 2026, and the factors driving those costs, so you can choose a tool that supports your firm now and in the future.

How Practice Management Software Is Typically Priced

Every practice management software vendor uses one of the following pricing strategies:

1. Per-User Subscription

Under a per-user pricing model, firms pay a recurring monthly or annual fee for each team member using the software.

Prices range from $19 to $100/month per user, depending on the vendor and the factors mentioned earlier (team size, growth stage, and usage pattern).

Pros

- Simple to understand and easy to budget for.

- Costs increase predictably as headcount grows.

- Pricing generally aligns with the number of people actively using the system.

Cons

- Total cost can rise quickly as the firm adds staff.

- Firms may limit licenses to control costs, which can reduce workflow visibility and team collaboration.

- Part-time, seasonal, and administrative users are often priced the same as full-time staff.

3. Per-Client Pricing

This model charges based on the number of clients you’re serving in the system, rather than the number of team members using it.

While it favors firms with numerous higher-value clients, prices can be too high for bookkeeping and payroll firms providing standardized services to a high volume of clients.

Pros

- Adding users does not increase cost, which supports firm-wide adoption.

- Works well for firms with relatively low client counts and higher-value engagements.

- Easier to forecast expenses when client volume is stable and clearly defined.

Cons

- It can become expensive for firms with many clients and low fees per client.

- Client definitions vary by vendor (active, archived, prospects), which can inflate costs.

- Costs increase quickly when growth comes from adding clients rather than revenue per client.

4. Flat-Rate Tiered Plans

The flat-rate model uses tiered plans that charge accounting firms a fixed monthly or annual fee for all features.

Each tier bundles a specific level of features and functionality within a predictable cost structure, while placing limits on users, clients, or usage.

This has proven to work best for firms with a stable team structure and clearly defined workflow needs, while forcing firms growing unevenly across users, clients, or services to upgrade their tiers earlier than planned.

Pros

- Predictable, fixed pricing with fewer variable cost factors.

- Encourages full team adoption, visibility, and collaboration within tier limits.

- It can be cost-efficient for firms that fit cleanly within a tier’s user and feature caps.

Cons

- Feature gating may force upgrades before the firm is operationally ready.

- Large price jumps between tiers can lead to paying for unused capacity.

- Less flexible for mid-sized firms that outgrow lower tiers quickly but don’t need the next tier’s full feature set.

5. Add-Ons & Modules

Under the add-ons or modular pricing model, the base platform usually comes at a modest price. Advanced features and functionalities are sold separately as optional modules, which allows firms to pay for the additional features they truly need.

Modular pricing can work well for niche accounting firms with narrow needs, but can become expensive quickly as the firm scales and needs advanced functionality.

Pros

- Lower initial cost makes it accessible for small and mid-sized firms.

- Flexibility to enable only the features required at a given stage.

- Easier to tailor the system to specific workflows or service lines.

Cons

- Total cost can escalate quickly as the firm’s needs expand.

- Core practice management features (automation, reporting, client portals) may not be included by default.

- Vendors may shift previously included features into paid add-ons over time, which will increase costs.

6. Custom Quotes/Enterprise Pricing

Software providers use enterprise pricing to tailor pricing to each accounting firm based on several factors, like team size, client volume, service complexity, and required features.

This model is most common among larger or more complex firms and is often used along with per-user or per-client pricing structures.

Pros

- It can be cost-effective for large or complex firms with high usage and specific requirements.

- Allows firms to negotiate pricing, terms, and feature access based on their needs.

- Often includes premium onboarding, dedicated support, and service-level agreements (SLAs).

Cons

- Lack of transparent pricing makes it difficult to compare tools objectively.

- Smaller or less complex firms may overpay for enterprise-level features they don’t fully use.

- Typically involves longer sales cycles, contract commitments, and more hands-on implementations.

Typical Price Ranges for Accounting Practice Management Software [2026]

| Category | Price Range | Typical Features Overview | Best Suited for Firm Size/Needs |

| Solo User Firms | $19– $60+/month per client | Basics: Task management, client portal, limited integrations | Single firm owners/practitioners |

| Entry Level/Small Firms | $49– $80/month per client | Team collaboration, basic automations, standard integrations | Small teams (2–10 users) getting organized |

| Mid-Tier Firms | $69– $90+/month per client | Advanced automation, analytics, and deep integrations | Growing/mid-sized firms (10–30+ users) |

| Enterprise/Large Teams | $89–$100+ (or custom) | Custom features, premium support, scalability | Large and complex firms (25+ users) |

| Per-Client Model | $10–$50/month per client | Scales by client volume, portals, and basic tools | Firms with high-value clients |

| Flat Fee Pricing | Varies | Access to all core features, predictable costs | Firms seeking unlimited users |

The following categorization is meant to provide clarity. Firms of all sizes can (and do) subscribe to higher or lower tiers that satisfy their practice management needs.

For example, a solo firm owner may choose a tier designed for teams of 10-30 members if that plan is where they find the features and functionalities needed to operate efficiently.

a. Solo User Firms (single user)

Typical Price Range: $19 – $60+ per month

This pricing range is designed for solo firm owners who are moving away from manual practice management methods, such as spreadsheets and email, to enjoy greater organization, visibility, and automation.

Many new firm owners use tools in this range to document their workflows and systematize their firms before hiring their first team member.

This tier is not ideal for multi-user firms that require advanced automation, collaboration, and reporting.

Typical Features Include:

- Basic task and deadline tracking.

- Client lists and simple workflow templates.

- Limited document management.

- Email notifications and reminders.

- Basic or minimal reporting.

Most platforms at this level offer limited integrations with third-party tools such as email, calendar applications, accounting software, and tax systems, while reserving deeper integrations and automations for higher-tier plans.

b. Entry Level/Small Firms

Typical Price Range: $50 – $80/month per user

This range is most common among small accounting teams moving from manual processes to organized, collaborative workflows. Firms at this stage are starting to share visibility across tasks, deadlines, and client work for the first time.

It introduces structure and collaboration to small accounting firms, but firms with growing client volumes or more complex workflows may require more advanced automation, reporting, and customization available in higher tiers.

Typical Features Include:

- Team collaboration tools (such as task assignment, shared workflows, and visibility into work in progress).

- Client requests, secure client portals, and basic workflow automation.

- Document management with limited organization and permissions.

- Time tracking and billing.

- Standard reporting.

- Integrations with accounting, tax, email, calendar, and automation tools, like Zapier.

c. Mid-Tier Firms

Typical Price Range: $69 – $90+/month per user

Designed for established accounting practices that are actively scaling and looking to improve efficiency, consistency, and profitability across teams, firms at this stage manage higher client volumes, multiple service lines, and recurring work that requires complex coordination.

These firms prioritize the reduction of manual work and improvement of profit margins through deeper automation, analytics, firm-wide visibility, and other benefits that help them grow without adding headcount at the same pace.

Typical Features Include:

- Advanced workflow automation (recurring work, client tasks, task dependencies, etc.).

- CRM and document management.

- Time, billing, and payment processing.

- Customer support and guided onboarding.

- Profitability and realization reporting, capacity planning, and utilization insights.

- Integrations with multiple accounting and tax platforms.

d. Enterprise/Large Teams

Typical Price Range: often custom-quoted for 25+ users

This pricing tier is created for large or highly complex accounting firms that manage high client volumes, multiple service lines, and often operate across multiple locations.

These firms value customizability, consistency, and scalability to tailor client experiences to specialized teams.

Typical Features Include:

- Enterprise-grade security, compliance controls, and dedicated support with service-level agreements (SLAs).

- Unlimited document storage and historical records, branded client experiences, and seasonal or flexible user licensing.

- Advanced analytics, AI-driven reporting, and scalability.

- Advanced integrations, including custom applications and native enterprise APIs.

Other Pricing Models

- Per-Client Model

Typical Price Range: $10 – $50/month per client

Firms are charged based on the number of clients managed in the system rather than the number of users, so costs increase as client count grows and features are focused on client relationship management.

Per-client pricing can be cost-effective for firms with a relatively small number of high-value clients and small teams. This allows firms to add users without increasing software costs, encouraging firm-wide adoption and collaboration.

- Flat Fee Pricing

Price Range: Varies widely

Flat-fee pricing provides a single, predictable cost regardless of team size. The plans often cover a set number of users and a defined set of core features.

Vendors may offer modular add-ons or comprehensive plans to expand functionality as needed.

This model appeals to firms seeking predictable, all-in-one pricing that allows them to add users and clients without worrying about per-user or per-client charges.

Pricing Examples

The examples below are based on Financial Cents’ per-user pricing model and assume annual billing, which is the most common option among accounting firms due to cost savings (compared to monthly plans).

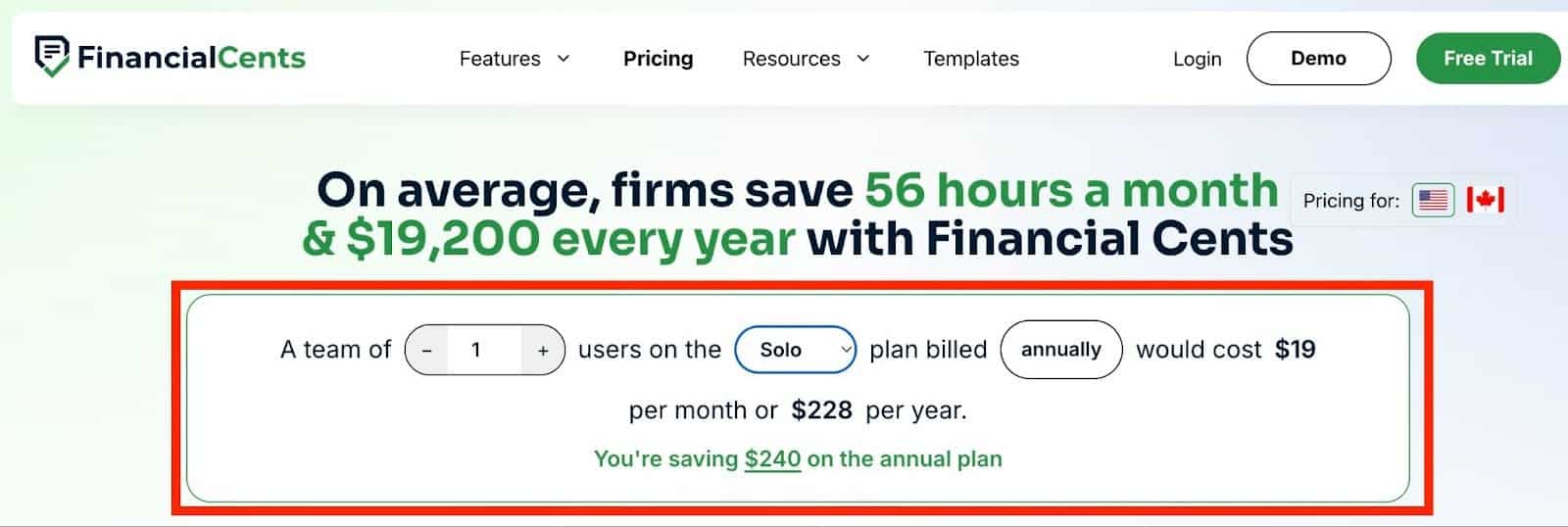

Solo Practitioner (1 User)

Estimated Cost: $19/month (billed annually at $228/year)

This plan is for solo CPAs, bookkeepers, etc., who need structured workflows and deadline management to replace spreadsheets and email.

The Solo Plan in Financial Cents includes

- Workflow and automations

- Client tasks & requests

- Client portal

- Document management

- Client CRM & database

- Time tracking

- Invoicing & billing

- Proposals & engagement letters

- QuickBooks Online Integration

- Budgeting & reporting

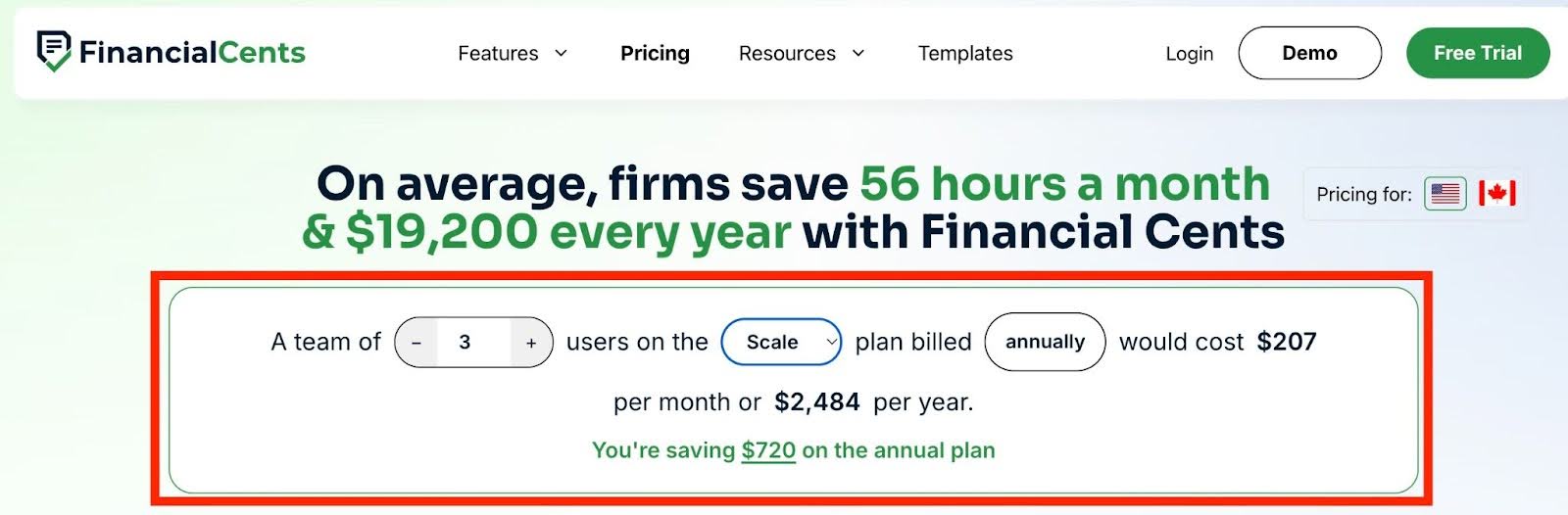

Small Firm (3–10 Users)

Small firms often start on a lower tier (Team plan of between $1,764/year for three users and $5,880/year for ten users).

The Team plan usually focuses on workflow consistency and collaboration. The feature includes:

- Integrated email

- E-signature

- Unlimited tags, client groups, and custom fields

As their workflow, automation, and reporting needs evolve, they upgrade to the Scale plan (between $2,484/year for three users and $8,280/year for ten users).

The Scale plan adds deeper automation, more reporting, and better firm-wide visibility. The features include:

- Auto-follow-ups for client tasks

- Customize client task emails

- Auto-send email updates

- Auto-create work

- Optional upsell services in proposals

- SmartVault Integration

- OneDrive & Google Drive Integration

- Open API

- Branded client portal

- Profitability reports

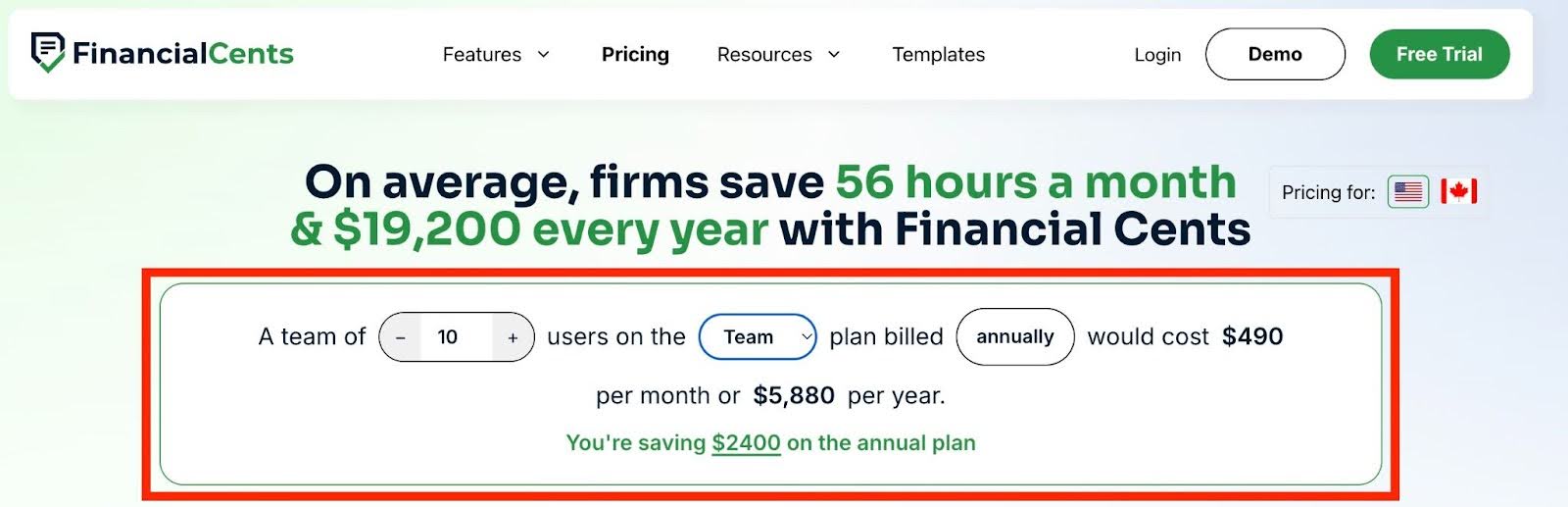

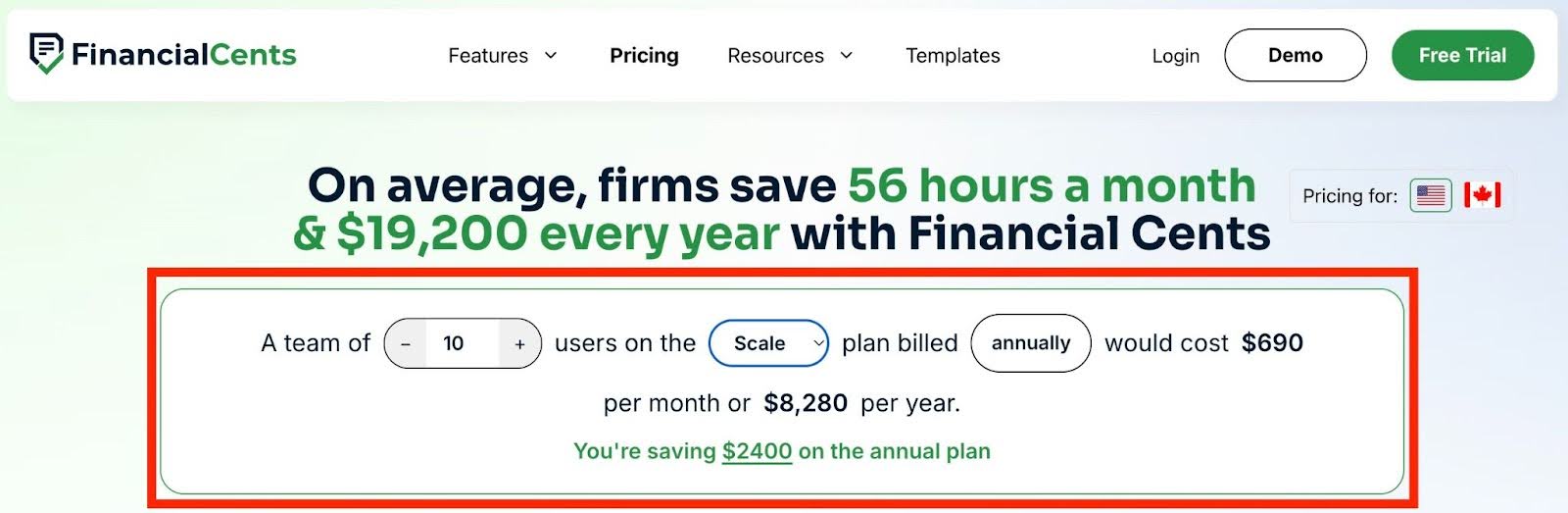

Mid-Sized Firm (10–30 users):

At this stage, practice management software is an operational command center, and the firm is willing to pay more for advanced features that replace manual coordination, reduce missed deadlines, and avoid additional hires.

Estimated Monthly Cost Range:

Team plan costs $490 (5,880 yearly) for 10 users and $1,470 (1740 yearly) for 30 users.

To use the branded, secure, and passwordless client portal, and other advanced features and integration, the firm can upgrade to the Scale plan at $690 ($8,280 yearly) for 10 users and $2,070+ ($24840 yearly) for 30 users.

Enterprise/Multi-Service Firm:

This tier is built for large firms that don’t find per-user costs or per-client models appealing. They prefer price customization that enables them to achieve control, standardization, and firm-wide visibility.

Beyond headcounts, their pricing reflects the complexity of multi-office (or multi-service) accounting operations, and they enjoy advanced features like robust reporting and native integrations.

Estimated Monthly Cost Range: customized to the needs of individual firms

This tier (in Financial Cents) includes

- Everything in the Scale Plan, plus

- IP Fencing/IP Whitelisting

- Mandatory 2FA Option

- Custom user permissions

- Webhooks

- Priority support

- Premium training & onboarding

- Dedicated customer success manager

Note:

The most accurate way to estimate the cost of practice management software is to model your own firm based on your team size, feature needs, and growth plans.

Running your numbers through an accounting practice management pricing calculator like Financial Cents’ will show you the actual amount you’ll have to pay. This will help you compare the expected efficiency and capacity gains with the investment before you commit your resources.

Feel free to go ahead and model your own firm’s size and growth plans using the Financial Cents pricing calculator today. Adjust users and features to see how pricing changes as your firm scales.

2026 Top Accounting Practice Management Software Options Prices Compared

The following prices are typical ranges, not exact figures, because software providers often bundle features, charge add-ons, or adjust plans frequently.

We have noted features that are commonly sold as add-ons, especially for platforms like Canopy.

One more thing, a tool can technically support a feature, but the depth of that feature (automation, reporting, scalability) may vary widely, so this information is not meant to replace your detailed evaluation.

See a review of the best accounting practice management software options in 2026.

| Software | Financial Cents | Karbon | Canopy | Jetpack Workflow | Pixie | TaxDome |

| Pricing Model | Per user | Per user | Modular | Per user | Per client | Per user |

| Price Range | $19–$69/month per user | $59–$89/month per user | $150–$175+/ per month (base price, plus add-ons) | $40–$49/month per user | $129–$329/month (depending on the number of clients) | $700–$1100/year per user (For a 3 year plan) |

| Workflow Automation | Advanced | Advanced | Add-on ($32/month per user) | Available | Available | Advanced |

| Workflow Management | Advanced | Advanced | Part of the workflow module | Available | Available | Advanced |

| Document Management | Available | Limited (relies on third-party integrations) | Add-on ($36/month per user) | Limited | Available | Available |

| CRM | Available | Available | Available | Very limited | Available | Available |

| Secure Client Portal | Available | Available | Available | Not available | Available | Available |

| Time Tracking | Available | Available | Add-on ($22/month per user) | Limited | Not available | Available |

| Native Billing & Invoicing | Available | Available | Part of the Time Tracking module | Not available | Not available | Available |

| Workflow Templates | Available (Over 300 templates) | Available | Part of the workflow module | Available | Available | Available |

| Proposals & Engagement Letters | Available | Available | Available | Not available | Not available | Available |

| Month-End Close | Available | Not available | Not available | Not available | Not available | Not available |

| Unlimited Storage | Available | Available | Available | Available | Not available | Available |

| Unlimited Clients | Available | Partially Available (depending on the plan) | 2,500 clients | Available | Not available | Available |

What Drives the Cost of Practice Management Software

The price of a practice management software solution increases with the size, complexity, and capacity of the following components:

I. Feature Set & Automations

Two main reasons explain why the depth of a platform’s feature set is a primary driver of practice management software for accounting costs.

Advanced features, such as AI-driven automations, custom workflow templates, real-time dashboards, and profitability analytics, require more resources to build and maintain. It only makes sense that such features are available at a higher price than others.

Advanced features reduce manual coordination and automate recurring work, which enables firms to handle greater client volume without adding staff. This added value attracts additional costs.

II. User Base & Team Size

Most accounting practice management platforms use per-user pricing, which means that costs increase as more team members need to use it. As firms grow, the number of users begins to determine how much you spend on the tool. That’s not all.

Team growth also introduces additional operational needs. Larger teams require more complex features and functionalities, such as role-based permissions, stronger access controls, and more advanced reporting. In many cases, this will necessitate an upgrade to a higher pricing tier.

III. Client Size

The number of active clients your firm manages also directly influences the costs of practice management software. Some vendors charge according to the number of clients, which increases your final payments as you add more clients.

The client base also has an indirect impact on costs. Many platforms may not charge per client, but they limit how many clients a firm can serve at a given tier. For example, you may realize that you can’t store more documents or use more automations once your client count reaches a certain point.

The idea is to force you to consider higher plans or purchase additional add-ons to enjoy certain features and functionalities at scale.

IV. Integrations

In many practice management software solutions, the lower the plan you’re on, the more limited your integrations will be. This can show up through one-way (versus a two-way or API access) integrations.

That is because building and maintaining secure, reliable integrations requires continuous development, testing, and compliance, especially when connecting to tax software, accounting platforms, and payment systems. As a result, vendors reserve advanced integrations for higher pricing tiers.

V. Document Management & Storage

The investment in infrastructure required to securely store, organize, and govern large volumes of client files makes the document management feature a major driver of practice management cost.

As if raw storage capacity is not costly enough, features like version control, role-based permissions, audit trails, document retention policies, etc., increase development costs and therefore, the price of the apps.

That is why many practice management software vendors limit storage by plan, charge for additional space, or restrict advanced document management capabilities to higher tiers. Only a few platforms, like Financial Cents, provide unlimited document storage in their plans.

VI. Onboarding and Migration

Although Financial Cents and some other tools offer self-service onboarding, practice management software solutions with more complex interfaces or feature sets require paid implementation services.

From migrating clients, workflows, templates, and historical data, as well as training teams to use the system effectively, these one-time fees can significantly increase software spend in the first year.

Platforms with steeper learning curves may even require ongoing implementation support to ensure teams adopt the system correctly and minimize disruption to client work.

How to Budget for Accounting Practice Management Software

-

Set a baseline budget (e.g., $X per user or $Y total)

Defining a realistic price range based on your firm’s size, expected usage, and prevailing market pricing will help you to evaluate practice management software with clarity and discipline.

Without one, every tool can appear like the right fit, which makes it harder to compare options objectively or make a confident decision.

It also protects you from overspending on features you don’t need now, while identifying tools that are too simple to grow with your firm.

-

Build cost into annual technology planning

The best managed accounting firms treat practice management software as part of their core infrastructure. Planning for team growth and workflow complexity enables them to budget accurately for possible tier upgrades and evolving needs.

Many practice management software providers also offer discounts for annual billing, which can significantly reduce long-term costs.

-

Use free trials and sandbox accounts before committing

The only reliable way to assess a tool’s ease of use, automation depth, and functionality gaps is to test it with real-world accounting projects.

Free trials and sandbox accounts allow you to import sample data, set up workflows, and manage projects, teams, and clients to evaluate how the software fits your firm’s day-to-day operations.

-

Involve your team in evaluating the tool

Since your team will use the system (maybe even more than you), it makes sense to include their feedback in your decision-making, and that is impossible if you evaluate tools all by yourself.

Involving your team helps with identifying adoption risks, clarifying training needs, and assessing the tool’s specific impact on day-to-day operations.

Why Financial Cents Is a Competitive Option

Financial Cents was built directly from feedback from accounting professionals, which shows in how closely its core features align with the realities of day-to-day accounting operations.

Its pricing model is transparent, predictable, and reduces the risk of discovering later that essential capabilities require costly upgrades.

-

An all-inclusive price for workflow automation, client portal, document management, billing, payments, etc.

Financial Cents uses a pricing model that includes all features (workflow, automation, client portals, document management, time tracking, billing, and payment processing) across all plans to save firms the financial and administrative cost of relying on multiple tools.

-

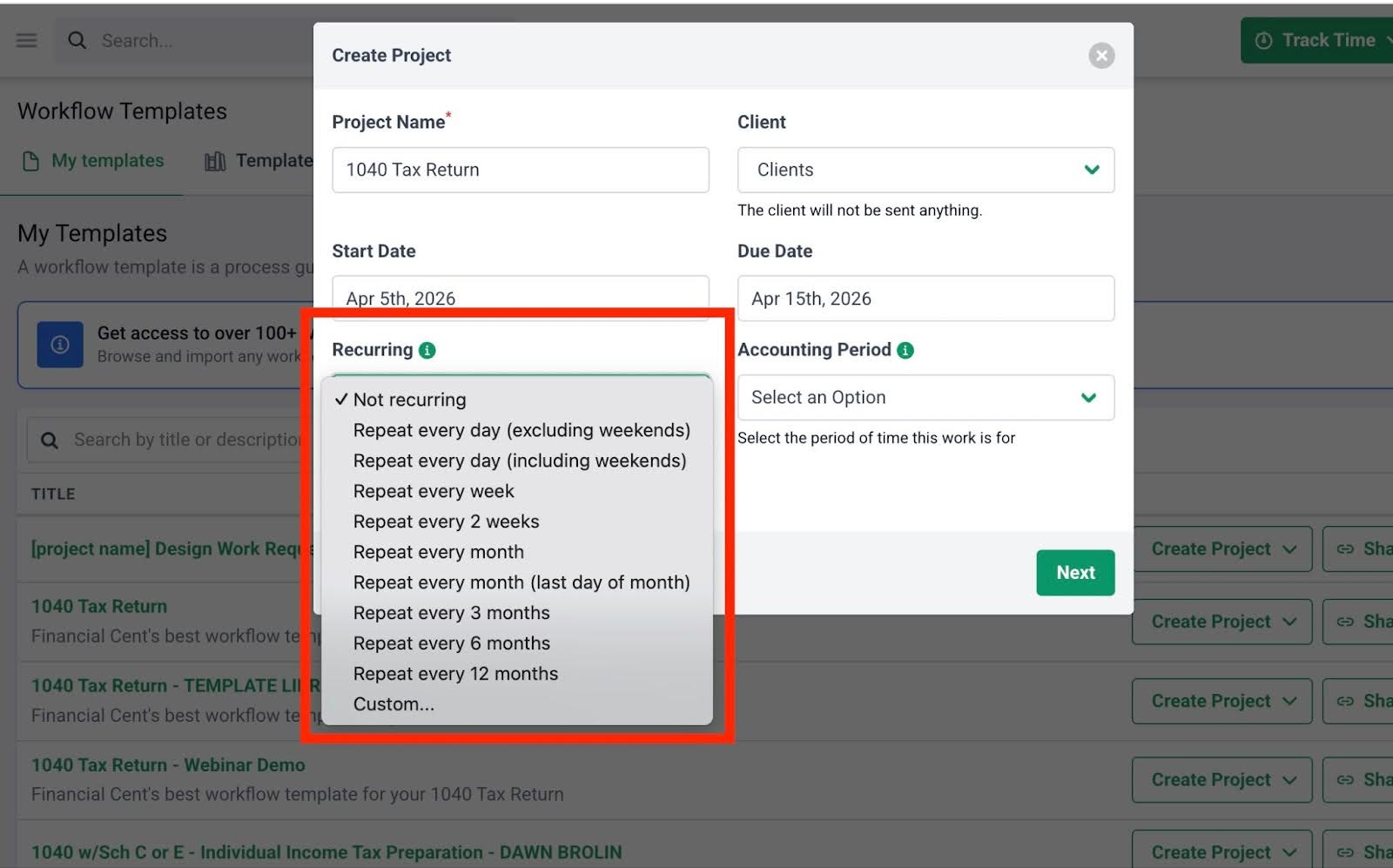

Recurring work, client reminders, and other automation that save time and increase team capacity

Financial Cents’ recurring work feature automatically recreates future projects, while built-in client reminders follow up until clients provide the required documents. Combined with other automation features, Financial Cents reduces manual coordination, improves deadline compliance, and frees staff to focus on higher-value work.

-

Supports scalability as firms grow without surprise add-ons

Financial Cents is also designed to scale without surprise costs. All plans include unlimited clients and storage, and firms can move from Solo to Team to Scale tiers as they grow, which activates advanced automation, collaboration, and reporting features without disrupting workflows and client deliverables.

-

Free trial & Demo available so firms can test before committing

A Free Demo to see a walkthrough of the system and a 14-day free trial with full feature access allows firms to test real workflows before committing. Financial Cents is rated 4.9/5 in terms of ease of use and overall efficiency on leading review platforms, like Capterra and GetApp.

Click here to Book a Free Demo

Why You Should Evaluate Practice Management Software Beyond Starting Price

The differences in pricing models, team size, feature depth, and growth trajectory (of each firm) have made choosing a tool based on its starting price a risky decision. What looks affordable upfront can become costly (or limiting) over time.

To get the most out of your decision, identify your priority features, compare pricing models using this guide, and test shortlisted tools through free trials to see how they perform in your workflows.

With Financial Cents, a free trial gives you access to all its accounting management features, which have enabled accounting firm owners to manage every aspect of their firm from one place, instead of jumping between multiple apps every day.

This has helped Infinite Accounting Solutions and Butler and Sanchez LLC to manage their clients better and coordinate multi-state offices, respectively.

If you’re ready to end your search for accounting practice management software today, start by using all Financial Cents features and functionalities for free.

Frequently Asked Questions (FAQs)

How much should an accounting firm expect to pay for practice management software?

Price varies based on firm size, pricing model, and feature depth. Generally, solo practitioners should expect to pay between $19–$60 per month for entry-level plans.

Small and mid-sized firms spend $50–$100+/month per user with annual billing, depending on automation, integrations, and reporting needs.

Larger or enterprise firms often move to custom pricing, which commonly starts around $100+/ month per user and increases with team size, workflow complexity, and support requirements.

Bear in mind that firms using per-client or flat-fee models may see different cost structures.

Why do some practice management software solutions for accountants increase costs quickly with add-ons?

Many vendors intentionally separate core functionality from advanced features to sell them as paid add-ons.

While this allows them to advertise low starting prices, users quickly realize that these add-ons are not as optional as they seemed, which ultimately results in sharp price increases as their needs expand.

What practice management features are worth paying more for?

Features that deliver measurable efficiency, scalability, and client satisfaction are generally worth a higher investment.

For most firms, these include:

- Robust workflow automation

- Branded client portals

- Deep integrations

- Advanced reporting and analytics

What’s the average monthly cost per employee for accounting firms?

For small to mid-sized accounting firms, practice management software typically costs $50–$90/month per user with annual billing. Larger or enterprise teams often use custom pricing that depends on their needs.

Is it cheaper to pay monthly or annually for practice management software?

It is cheaper to pay annually. Most accounting practice management tools offer discounts for annual billing compared with monthly payments. Plus, paying annually provides billing stability, which protects your firm from potential mid-year price increases.

At what firm size does practice management software become necessary?

Every accounting firm can benefit from practice management software, but the need becomes more urgent as the firm grows.

Solo practitioners benefit by organizing projects, client information, and recurring tasks. It helps them to maintain operational efficiency and prepare for future team growth. Small teams enjoy workflow visibility, team alignment, and deadline tracking. Mid-sized and larger firms benefit from greater automation, reporting, and workflow management to handle higher client volume, multiple service lines, and complex operations.

Can smaller firms get by with affordable plans?

Yes. Many practice management tools, including Financial Cents, offer entry-level plans for solo practitioners or small teams to manage tasks and track deadlines, and nurture client relationships without breaking the bank.

Do larger firms always need enterprise-level plans?

Not necessarily. Enterprise plans are designed for large teams with complex workflows, multi-office operations, or advanced reporting and automation requirements.

Some large firms with standardized processes and modest feature needs may find mid-tier plans sufficient for their operational needs, and that works just fine.

![blog cover image for How Much Does Accounting Practice Management Software Cost? [2026 Guide]](https://financial-cents.com/wp-content/uploads/2026/01/How-Much-Does-Accounting-Practice-Management-Software-Cost_-2026-Guide.jpg)