Starting a firm is a joyous moment for many accounting professionals. The thrill of landing clients, generating revenue, and scaling the business is second to none.

But this joy is often short-lived when you spend hours on boring, repetitive tasks that should take a few minutes to complete. This leads to increased work lengths, lower productivity, and difficulty focusing on money-making tasks.

The good news is, automation is becoming more important to businesses these days. Automating your accounting or bookkeeping firm saves time, reduces errors, and improves efficiency.

In a 2022 survey of accounting and bookkeeping firm owners, 24.2% said getting work done faster was the biggest impact of using accounting automation software in their companies. This is closely followed by:

- Better systems and processes (22%)

- Becoming more collaborative (18.9%)

- Meeting deadlines faster (11.4%)

- Getting documents from clients faster (8.3%)

Judging by the above stats, it’s safe to say automation is no longer a nice to have. Accountants should prioritize automation to help streamline operations and foster company growth.

So if you’re yet to embrace automation, it’s not too late. Here’s a guide on how to get started with accounting automation.

And if you are ready to automate your accounting firm but unsure where to start? This article walks you through seven areas to automate in your accounting firm.

7 Areas You Should Automate in Your Accounting Firm

There are various areas you can automate in your accounting firm. However, not all may apply to you depending on factors such as company size, budget, and immediate needs. As such, it’s essential to evaluate your current accounting processes and identify areas where automation can bring the most significant benefits.

With that said, here are seven aspects of your accounting processes you should consider automating for a start.

1. General Ledger Accounting

As the central repository for all the financial transactions in your firm, automating your general ledger should be a no-brainer.

Imagine spending hours digging through files just to find a single transaction record. Or even worse, incorrectly recording transactions. For example, entering a sales invoice as a purchase — a financial catastrophe.

Automation cuts out such costly errors and makes the entire process a breeze. With a single click, you can organize, record, and retrieve financial data.

Think of it as having a competent assistant who not only eliminates the headache of manual searching but also manages your company’s financial records accurately and efficiently.

Furthermore, automating the general ledger ensures:

- Quick and simpler reconciliation of accounts

- Reduced errors that may occur from manual data entry

- Swift access to a summary of financial reports

Quickbooks and Xero are great software options to automate your general ledger.

2. Payroll

Manually calculating employee payments for a few staff members may be light work. But as your firm grows and staff increases, it becomes a stressful, time-consuming task. It’s at this point the need for automation arises.

Automating the payroll process enables you to seamlessly compute and disburse employee compensation, salaries, tax, and deductions without delay. As a result, you maintain happier and more motivated staff. Remember, happy staff equals happy customers.

Embracing payroll automation streamlines operations further by:

- Eliminating errors associated with manual calculations

- Automatically keeping track of employee work hours and overtime

- Saving money on administrative costs

- Granting employees access to payment records

- Allowing scalability without sacrificing speed, efficiency, and accuracy

- Compliance with labor and tax laws requirements

- Increased security on payroll data

- Less burden on HR and account teams

You can use software like Wagepoint and Gusto to automate the payroll process for your firm. If you are interested in a checklist template instead, you can check our Payroll checklist template.

3. Expense management

It’s 4.45 PM on a Friday. You’re about to close for the week when suddenly an employee rushes in with a truckload of incurred expense receipts for reimbursement.

Though this shouldn’t be a big deal, manually auditing and processing these receipts in a spreadsheet can take hours. This is stressful and frustrating.

Also, manually recording expenses doesn’t just sap your time. It’s fraught with issues like missing receipts, reimbursement delays, and fraudulent practices. And if care isn’t taken, all these can cause problems between your employees and the accounting department.

Automating expense management reduces these challenges. It simplifies the entire expense reporting process for both you and your staff.

Using expense management software like Ramp and Expensify significantly reduces the need for forms, spreadsheets, and receipts. Other benefits include:

- Allows employees to upload receipts online

- Tracks expenses in real-time

- Verifies and validates receipt’s authenticity

- Spots unauthorized expenses

- Approves payments

- Fastens reimbursements

- Gain easy access to expense records

4. Accounts Payable

In any organization, owing suppliers or vendors money for goods or services received is a norm. But delaying their payments way past the due date is where the problem lies.

One major reason for this is an inefficient accounts payable process. From paperwork clutter and lost invoices to missed payment deadlines, this tedious process can strain your relationships with suppliers. And, in worse cases, attract late payment charges.

However, implementing accounting software removes this bottleneck by keeping tabs on all the outgoing payments and ensuring suppliers get paid promptly. It also ensures employees can focus on high-value tasks rather than waste time chasing invoice details.

Here are some other benefits of automating your accounts payable process:

- Reduces the need for manual data entry thus saving time and minimizing errors.

- Speeds up the approval process as invoices are automatically sent to supervisors or managers for approval.

- Ensures only approved payments are processed, adding a layer of control to the payment process.

- Helps in capturing early payment discounts as well as averting any payment penalties.

- Schedules payments to avoid missing due dates

- Keeps track of important vendor details, such as contact information and payment terms, making it easier to stay organized.

You may be interested in our free accounts payable checklist template.

5. Accounts Receivable

A typical traditional accounts receivable process goes like this: create invoices, print, and mail to clients, wait for clients to make payments, track payments, confirm receipt, and record payment on spreadsheets. Then rinse and repeat.

You’d agree that this process is monotonous, time-consuming, and prone to human errors. And in cases where you have to chase after clients, it could result in late payments, negatively impacting your cash flow. At worst, it may also lead to unpaid invoices.

So what should companies seeking prompt payments from their clients do?

Automate the entire process with accounting software. This will make it easy to quickly create and send out accurate invoices, track pending payments, and automatically remind clients of their due invoices.

Other reasons you should automate this aspect of your accounting firm include:

- Saves costs on paper invoices, printing, processing, and mailing

- Eliminates invoicing errors and double-entry issues

- Reduces manual tasks ranging from invoice generation to data input

- Encourages faster order-to-payment cycle which improves cash flow

- Improves customer satisfaction as clients enjoy a better invoicing experience

- Real-time view of pending payments and company cash flow

You may be interested in our free accounts receivable checklist template.

6. Accounting workflow

In 2022, 66.7% of accounting & bookkeeping firm owners attributed workflow as a major challenge they faced in their firms. Also, 58.3% said spending time on manual work was their biggest workflow issue.

What can we deduce from these two eye-opening stats?

Many firms still use traditional methods to perform repetitive tasks such as data entry, client onboarding, or filing tax returns. The result? Spending countless hours on tasks that could have been used wisely.

The CEO and Co-Founder of Financial Cents shares the same view. In his words:

Many accounting firms never realize the benefits of a smooth workflow process because they don’t document their processes well or automate manual steps in the process. This kills profitability, slows down work, and causes poor client deliverables, which ultimately slows overall growth. The #1 way to build a high-growth firm is by improving work quality, while simultaneously increasing productivity. You do this through workflow documentation & automation."

Automating your routine accounting workflows helps to save time, reduce errors, increase efficiency, and meet deadlines.

That’s why firms who use accounting workflow automation software like Financial Cents to automate tasks have better visibility and spend 50% less time on those tasks.

7. Document management

Documentation is an integral part of accounting.

But sifting through an overwhelming amount of files to access documents isn’t productive. Instead, it’s stressful, time-consuming, error-prone and inefficient. Also, cases of missing documents could lead to heavy fines during tax and audit season.

What’s more, the manual documentation struggle isn’t limited to internal workflows alone. In the aforementioned Workflow report, 53.8% of accounting and bookkeeping firm owners agreed that getting documents from clients was slow.

Why, you ask?

Because there’s no proper documentation process in place. As such, clients can send important documents whenever they deem fit. This leads to missed deadlines, causing bad rapport with clients.

But all these documentation issues can become a thing of the past with accounting software. Having a system that manages, processes, and distributes documents efficiently will save your firm a lot of time and resources, expedite document creation, and prevent information loss.

In addition, implementing workflow automation software results in a faster response from clients. Take Christian Grimm, Owner of CG Bookkeeping, for instance. Automating her client documentation process yielded faster communication with her clients.

Automating our client document gathering has significantly increased our client communication, almost too much. We are getting answers faster, more documents more often, and maintaining quality relationships with our clients. When we started to grow, we couldn’t keep up with the personalized communication. It was too much time on the phone and too many in-person meetings. But now we get chats, uploads, and thank you’s. In combination with a digital phone line that allows texting, our management software has significantly changed the landscape of our business."

Just starting your accounting firm? Check out this comprehensive guide to building your accounting form tech stack.

Using AI and ChatGPT to Automate Your Accounting Firm

The emergence of AI and ChatGPT in particular, has sparked mixed reactions among accounting professionals.

Some fear AI could take over their jobs. In reality, it has made life simpler for accountants and bookkeepers like you by automating repetitive tasks that used to take hours to complete.

Frankie Chia, Managing Partner & International Liaison Partner, BDO LLP also corroborates this point:

We live in an age of disruptive technology and breakthrough innovation practices. Instead of shying away from these newfangled force multipliers, we should embrace them as opportunities to add value for our clients. The enhanced interconnectivity of our services will enable us to take a multidisciplinary approach and deliver a full spectrum of client solutions."

So rather than shy away from using ChatGPT, your best bet is to embrace it so you can enjoy benefits such as:

- Minimized human errors

- Faster, accurate accounting & bookkeeping processes

- Improved efficiency and productivity leading to business growth

- More time to focus on other strategic high-value tasks

You may be interested in:

How to Automate Your Accounting Firm With ChatGPT

Integrating AI software like ChatGPT with your accounting software makes access to important data rapid and efficient, thus enhancing your firm’s productivity.

Here are a few ways to automate your accounting and bookkeeping firm with ChatGPT:

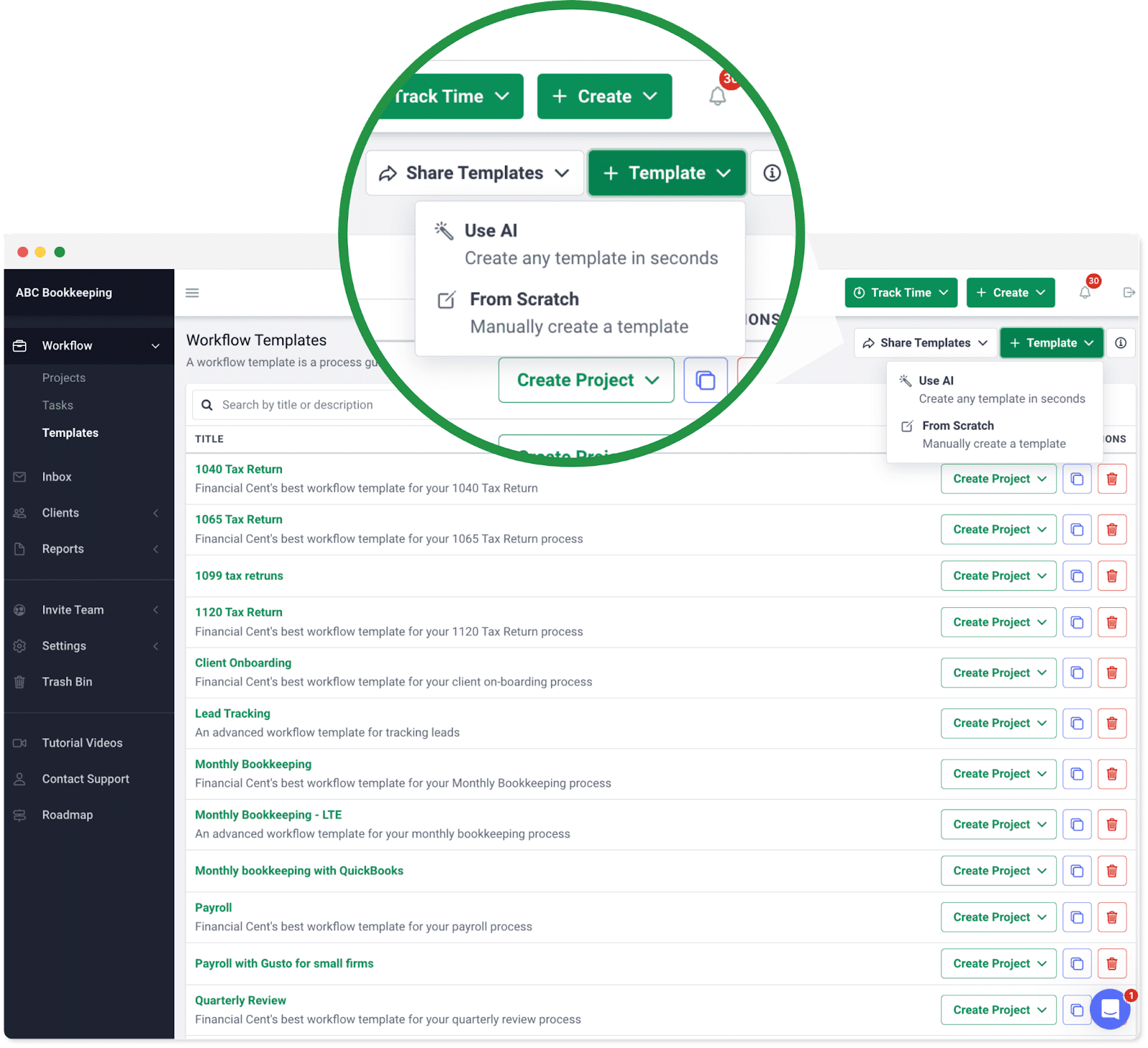

1. Accounting Workflow: Using ChatGPT integrated with accounting software like Financial Cents reduces the time spent on recurring tasks. For instance, you can create workflow checklist templates in seconds such as Monthly Bookkeeping or client onboarding in Financial Cents.

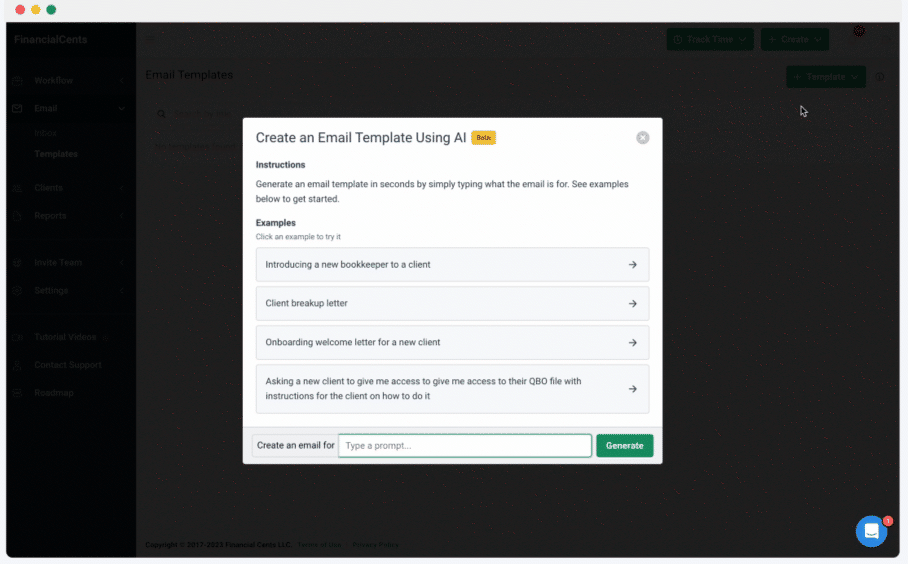

2. Client communication: the key to any successful client relationship is efficient and timely communication. But writing client emails isn’t exactly your forte. That’s where ChatGPT comes in. Integrating it with accounting software like Financial Cents allows you to craft emails in seconds. The best part is it allows you to save those email templates for future use.

Automate Your Accounting Workflow Processes with Financial Cents

We’ve said a lot about automating your accounting firm, AI, and ChatGPT.

While this may seem like a lot, automation is a necessary step your company needs to save costs, improve productivity, increase efficiency, and achieve growth.

And the simplest way to get started is by automating your accounting workflow processes using Financial Cents.

Financial Cents is a cloud-based accounting software designed with firm owners like you in mind to help:

- Automate recurring tasks

- Manage client work

- Collaborate with team members

- Meet client deadlines

- Create workflow checklist templates

In our recent survey, firms reduced manual work from an average of 1-10 hours to 0-5 hours after implementing workflow automation software. Want to achieve the same result?

Start your journey into accounting automation by automating your workflow with Financial Cents.