It is frustrating to struggle with your tax processes for so long and spend your resources researching (and buying the most promising solution) only to find that it can’t address your tax workflow challenges.

That is why an understanding of the feature set of a tax workflow software is critical. It helps you know how the tool can meet your current (and future) tax workflow needs.

In this article, we discuss the features a tax workflow management software must have to make your tax season more organized and productive.

Essential Features Your Tax Workflow Software Should Have

1. Workflow Management and Automation

All tax teams need a smooth flow of tasks to achieve maximum productivity, accuracy, and efficiency. Workflow management facilitates that.

The workflow management and automation feature shows what’s most urgent, helps you monitor tax projects as they go through the stages, and automates manual tasks.

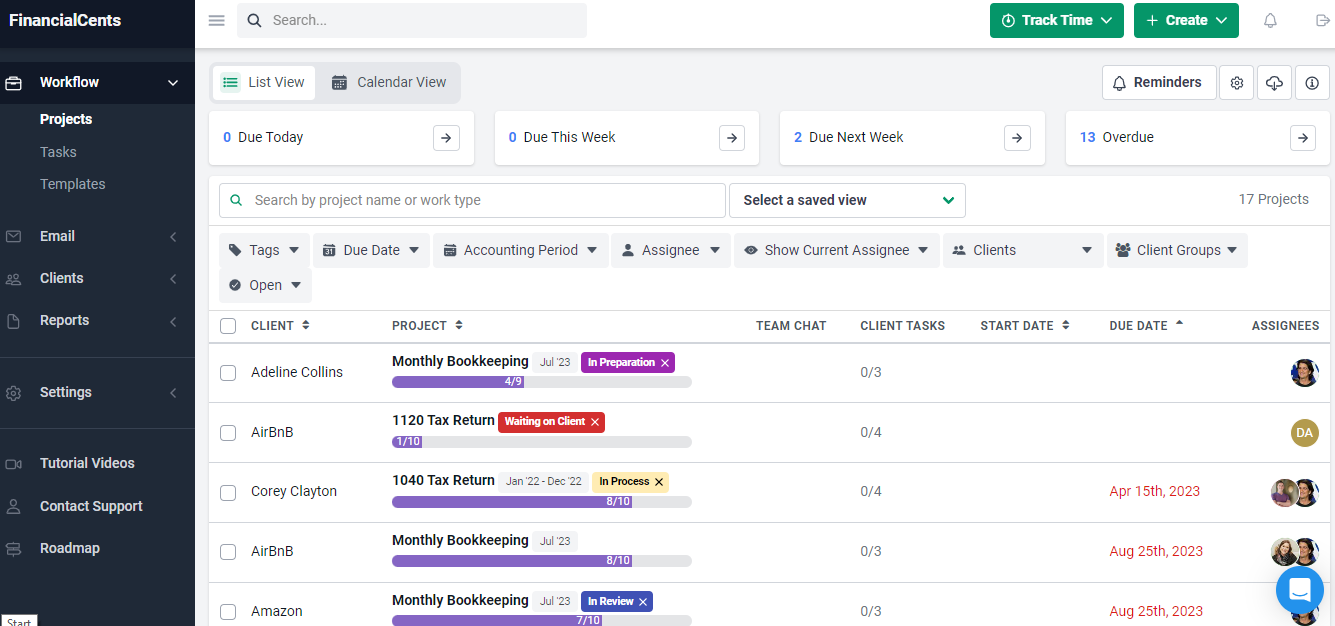

The workflow management and automation feature in Financial Cents provides you with the following:

- Workflow Dashboard: a firmwide view of all your tax projects and their status. The dashboard ensures nothing slips through the cracks.

- Workflow Filters: sifts through your dashboard to show you the specific project information you want.

- Workflow Templates: prebuilt process checklists that you can customize to suit your tax procedures.

- Recurring Project: recreates repetitive tax projects as and when due to save you the time and energy of creating it from scratch each time.

- Client Tasks and Auto-Reminders: the ability to request tax information beforehand.

- Team and Client Notification: Financial Cents informs you when your clients or team members provide relevant files or information, so you don’t waste time waiting for files and information already provided.

- Task Dependencies: stops assignees from doing a task until previous steps have been completed. It also declutters their dashboard to help them focus on the tasks that are due.

- Tags: assigns status to tax projects to show you where they are in the workflow.

- Pin Client Emails to Tax Projects: your client’s ad-hoc email requests can be added to their respective projects instead of getting lost in email inboxes.

2. Due Date and Deadline Tracking

Financial Cents has kept us more organized. Sometimes we get so busy that we forget things. For example, important information may be buried in an email, but if we put it as a project with the due date in Financial Cents, it'll bring it right back up."

Kim Ritter, Ritter’s Tax and Accounting ServicesConsistently meeting tax client deliverables can seem elusive, but a strong due date tracking feature helps to achieve that consistently.

The due date feature in your tax workflow software shows your most urgent projects whenever you look at your dashboard. This will help you manage employee workload and allocate resources to meet all client deadlines.

Every project in Financial Cents has its due date, which is shown alongside the other project information like assignee and team chat. This lets you see your most urgent projects in your dashboard.

The due date tracking features in Financial Cents include:

- Due Date Filter: displays your tax projects by their due dates.

- Due Date Reminders: your team members can set Financial Cents up to remind them about all projects or tasks due on a certain date.

- Extension Due Date: allows you to extend the due date you have set for tax projects in Financial Cents.

- Internal Due Dates: enables you to set deadlines for your team to complete tax projects earlier than the due dates you gave to clients.

3. Client Relationship Management (CRM) and Portal

The accuracy of a tax return depends on the amount of client information you have to work with. That’s where a client relationship management feature shines.

The CRM solution helps you collect, store and aggregate client information along with tracking client interactions to improve the quality of your client relationships.

The Ritter’s Tax and Accounting team is one firm that has benefited from a good CRM solution (particularly the ability to track client notes).

With Financial Cents, keeping track of client updates just became easier. It allows us to put new updates in the client’s notes. This allows you to access it faster whether they are in the office or not. You don't have to dig through files."

Kim Ritter , Ritter’s Tax and Accounting ServicesHere’s how you can manage your clients in Financial Cents:

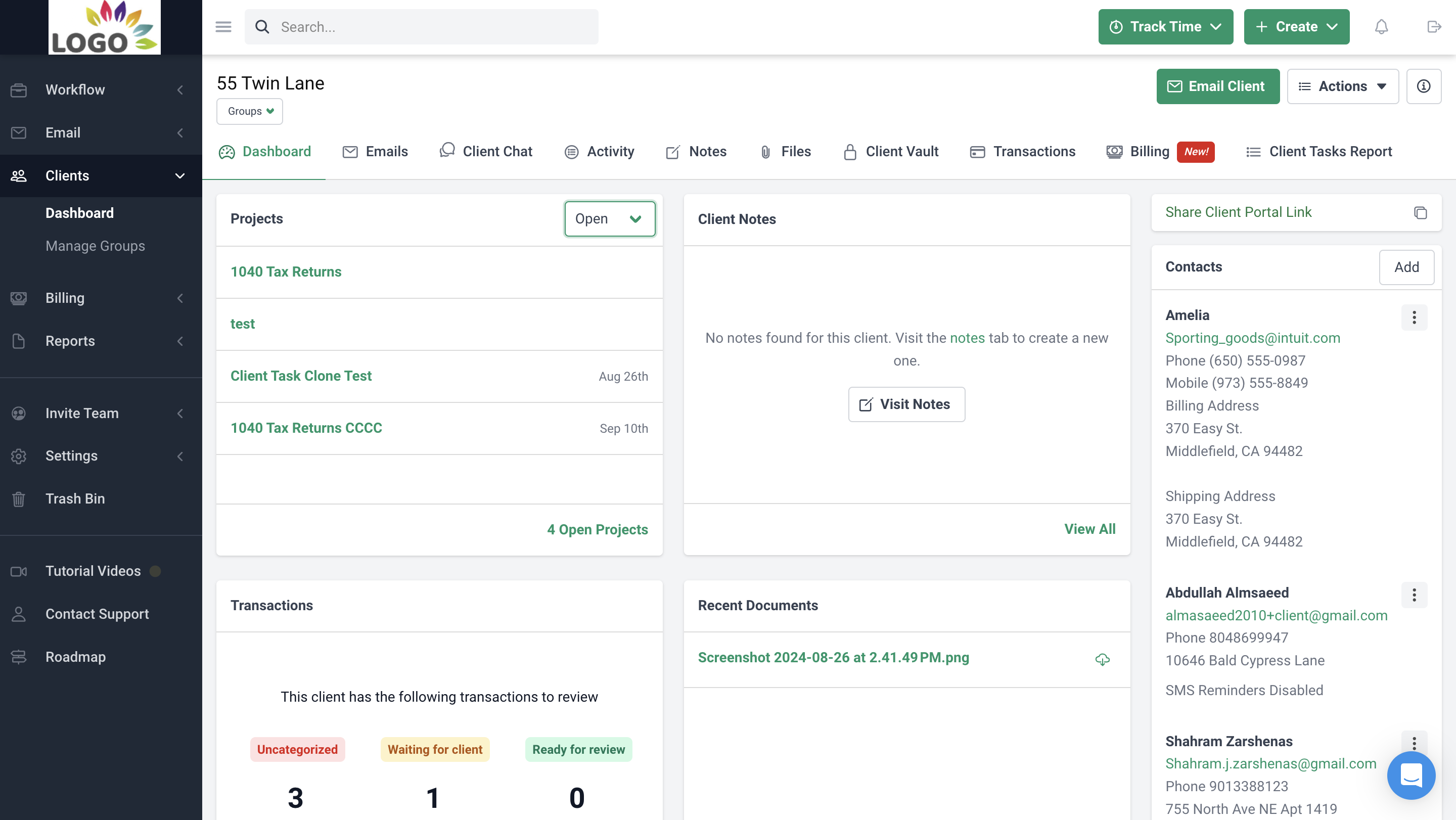

The Client Profile: each client has a profile that contains every information your team needs to do their taxes and maintain quality client relationships.

The client profile is divided into:

- Contacts: contains your client’s contact information

- Upcoming Projects: all the tax returns (and other projects) your team is doing for the client.

- Client Notes: contains all important client updates and information specific to that client.

- Documents: all documents from a client are securely stored here.

- Client Tasks: stores all document requests made to the client.

- Activity Timeline: tracks all client interactions with your firm, including who last contacted the client, what they discussed, and their attitude.

- Client Vault: a secure vault to store the usernames and passwords for your client’s business-critical applications. You can open these apps directly from Financial Cents.

- About Section: custom fields allow you to store your client’s unique information, such as tax ID, entity type, and formation date. This is information that you may need to know for every client.

- Relationships: establish relationships between clients and quickly navigate between the related clients in one click.

- Client Groups: put your clients into groups to easily navigate your client database and find their information. Grouping all your 1040 clients allows you to perform uniform action on them.

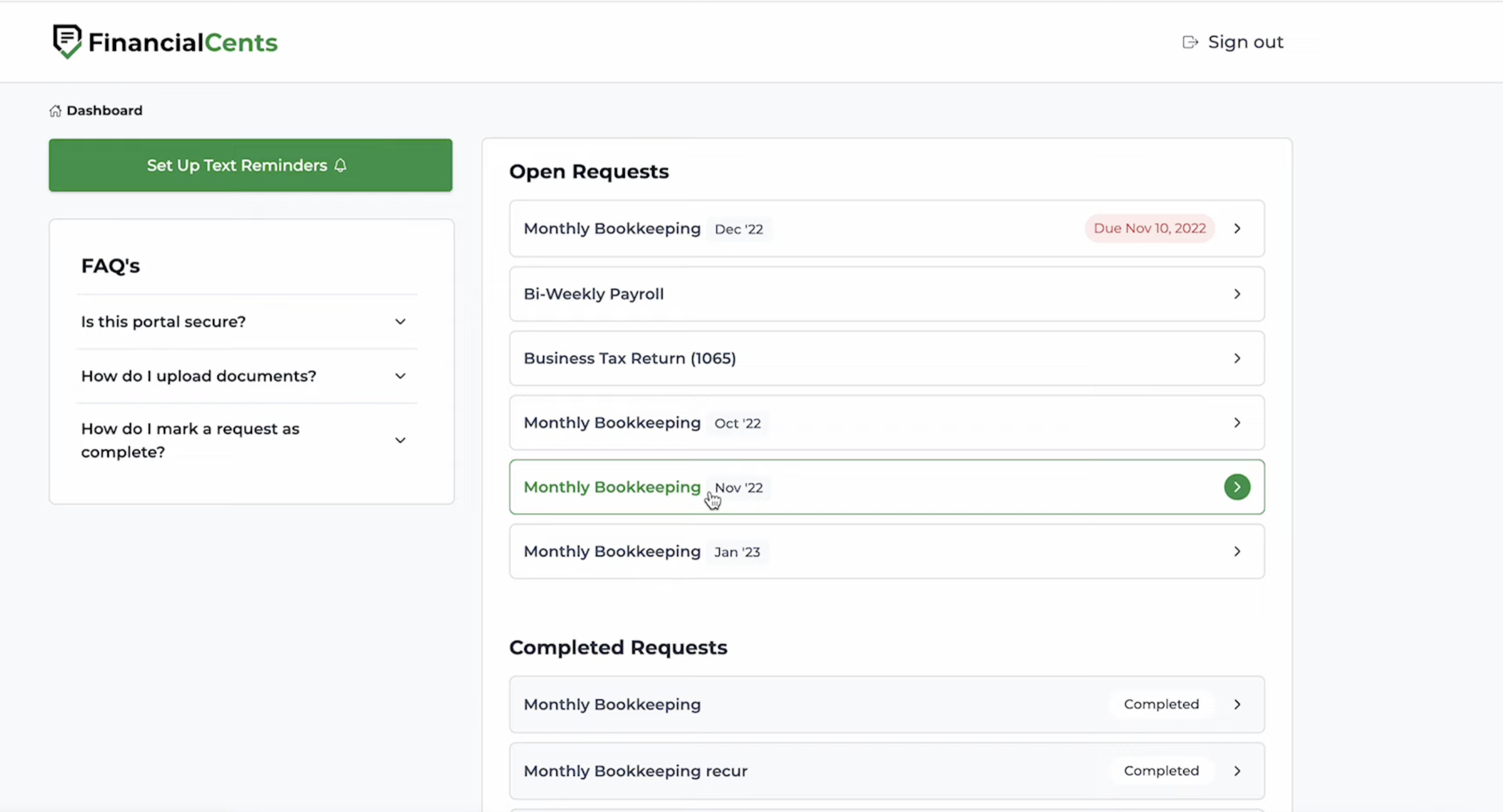

Client Portal

The accounting client portal is a one-stop shop for all client communication and collaboration.

In Financial Cents, the client portal is divided into:

- Client Tasks & Requests: the files, information, and E-Signatures you need from your clients. It allows clients to view all pending requests and respond to them by uploading the relevant document with a few clicks.

- Billing: this shows clients their paid and outstanding invoices and stores their payment methods.

- Client Chat: this feature allows clients to discuss tax projects and documents with you. You can also group conversations into topics to streamline communication and improve continuity.

- Folder Sharing: this helps you share complete document folders with clients.

- ReCats: it allows you to ask clients about uncategorized transactions. Once the client clarifies the transactions, you can update them inside QuickBooks Online from your Financial Cents account.

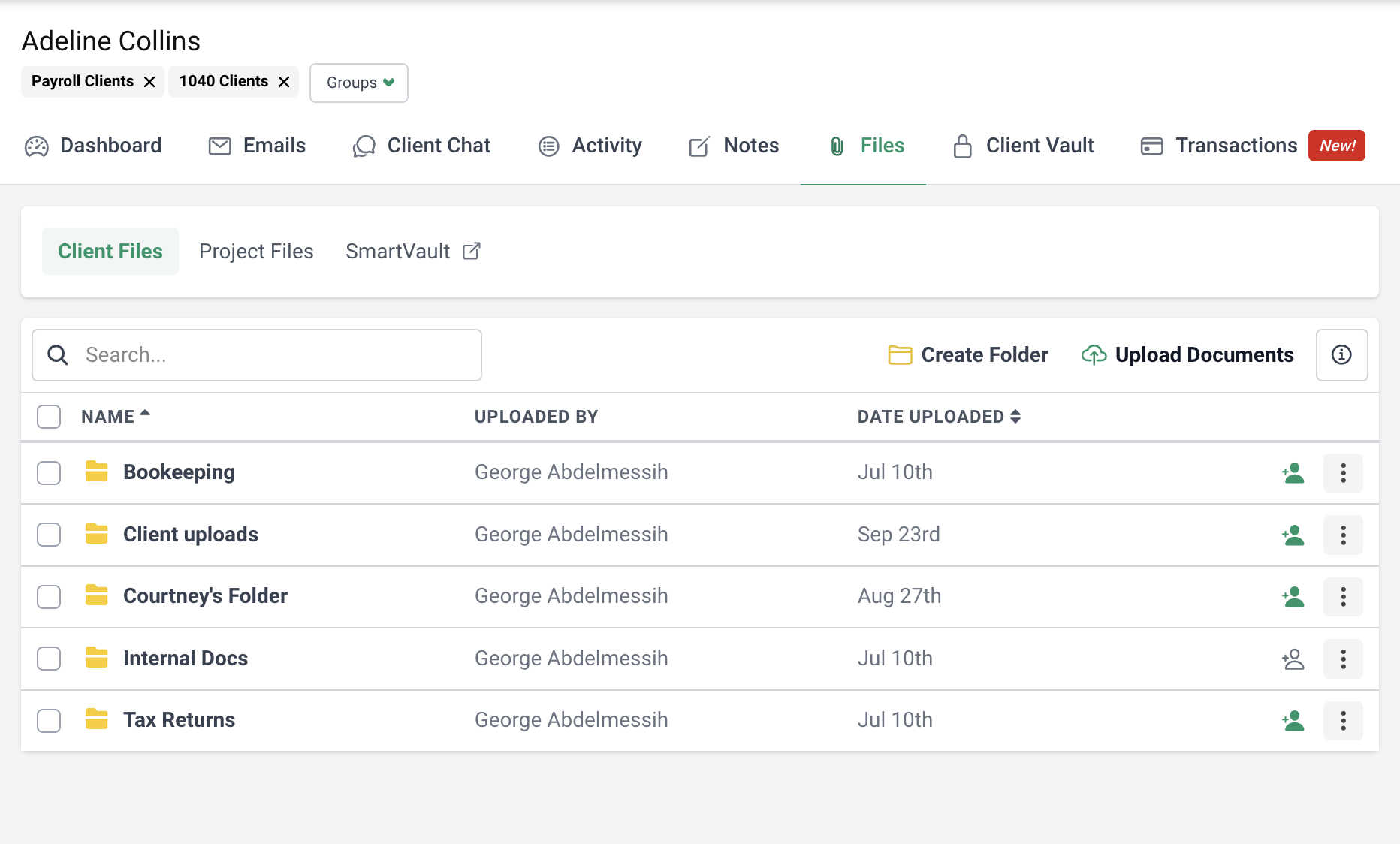

4. Document Management and Secure Storage

The document management and secure storage feature centralizes all the documents in your accounting firm in one secure location, allowing your staff to organize and access work documents from anywhere.

This protects your firm’s (and client’s) sensitive information from unauthorized access while automating your manual document processing.

In Financial Cents, you can manage your documents in two main ways:

- Client Files: the client file route applies to the document folders you and your team members create for your internal workflows and for sharing with clients when necessary.

The documents in such folders include financial statements, client agreement letters, and reports relating to a particular client.

- Project Files: the project files are automatically added to projects when clients upload them in response to your requests. This organizes all work-related documents inside the project, giving your team one source of truth.

These documents are organized according to their project names and accounting periods.

The document management feature in Financial Cents empowers you to:

- Create Document Folders: groups your documents into your preferred categories.

- Search: makes documents more accessible by using keywords to search the document management system.

- Customize Documents: you can rename, preview, and download documents on demand.

- Move Documents: re-organize documents to store documents where they belong for easy access.

Security:

Your firm’s documents in Financial Cents are protected with:

- Data encryption technology: renders files and information unusable by unauthorized persons.

- Magic link technology: ensures secure access to files and information.

- Multi-factor authentication: verifies users’ identity using multiple means of identification.

5. Team Communication and Collaboration

Financial Cents does help with communication. When our admin is unavailable, we can easily see the date a tax return was mailed, so we don't have to worry about it."

Kim Ritter, Ritter’s Tax and Accounting ServicesEvery tax firm with two or more staff members needs a collaboration solution to get the most out of their unique blend of accounting talents and expertise to keep everyone aligned and productive.

Effective collaboration ensures that the team members can find the information they need to get work done confidently.

Team collaboration in Financial Cents is possible with the following features:

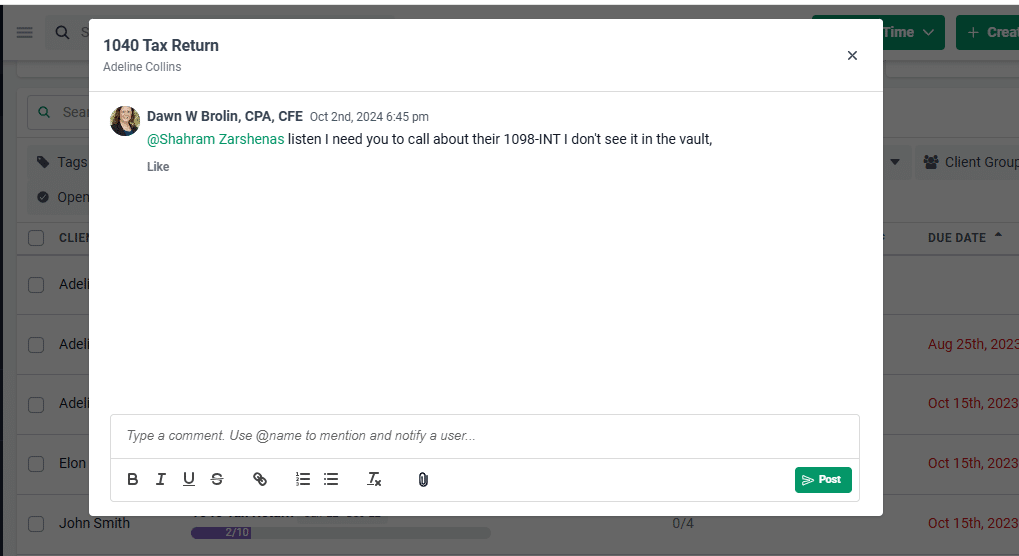

- Comments: these help your team to share ideas and discuss tax projects inside the tax projects.

- Notes: clarify client work by allowing team members to add updates to the client’s profile.

- Emails: client emails can be added to tax projects to improve visibility into client communication.

- Files: with all files stored in the project and client profile, your tax professionals can easily find the documents they need to complete your client’s tax returns on time.

- Client Vault: securely store your client’s login information (with live links) to their third-party apps in the client vault for your staff members to use when needed.

- Activity Feed: your team members can understand the status of each client relationship in the Activity Feed that tracks all client interactions.

- Automated Notification: informs your team members when they are assigned work, mentioned in comments, sent the documents they requested, etc.

6. Automated Client Requests (with Signatures)

Financial Cents’ Client Task feature allows us to follow up with clients to send the required documentation. These automated emails prevent us from forgetting about it. And we don't have to worry about the client forgetting it. Automated emails continue to go out to them (at the frequency we set) until they send in the required information.""

Kim Ritter, Ritter’s Tax and Accounting ServicesThe Client Tasks feature helps tax professionals to request additional information to complete tax returns on schedule.

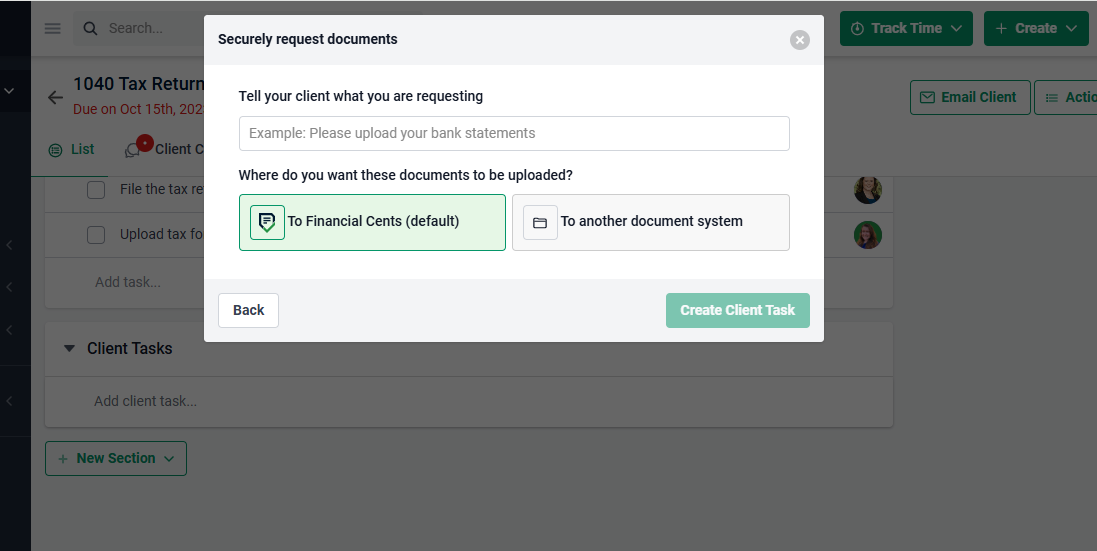

This feature also allows you to describe what you want your clients to do so that they can grant your request. It also has a chat feature that allows your clients to ask for further clarification on your requests.

In Financial Cents, the client task feature saves tax and accounting firms hours of non-billable work every week by automatically chasing after clients for information.

Client Task features include:

- Auto-Reminders: the ability to automate client chase. The auto-reminder feature sends clients Email and SMS notifications at predefined times.

- Securely Send Documents: allows you to send your clients deliverables for their review and reporting requirements.

- Ask a Question: helps you gain clarity by holding project-related conversations in one secure place.

- Categorize Transactions: direct your clients to provide information that helps to categorize uncategorized transactions.

- Custom Uploads: gives you the options of storing your files directly to your preferred document management system.

NB: Client Tasks in Recurring Tax Projects: With Financial Cents, your client requests inside recurring projects will be sent automatically. You wouldn’t need to activate them in the future.

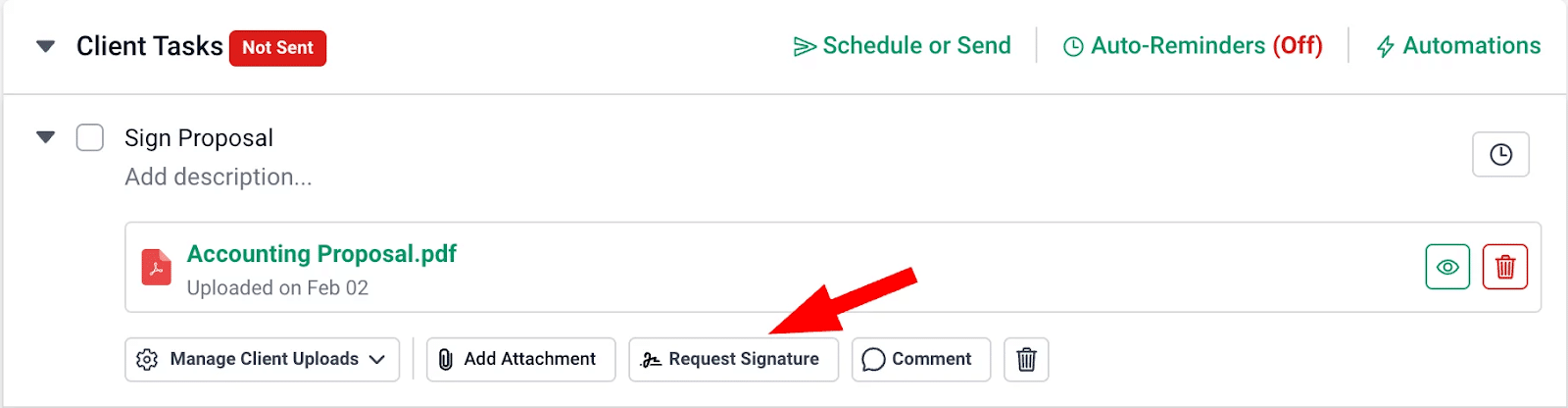

E-Signature Request in Financial Cents

You can also request an E-Signature inside Financial Cents. This will save your clients the time and hassle of printing and scanning tax documents before signing.

This enables clients to sign their tax returns, proposals, and other documents inside Financial Cents, where they are already working and collaborating with your firm.

Once an E-Signature is sent, the document will be tagged “pending.” Upon the signature, the document will be added to the Client Task Files in the client’s profile.

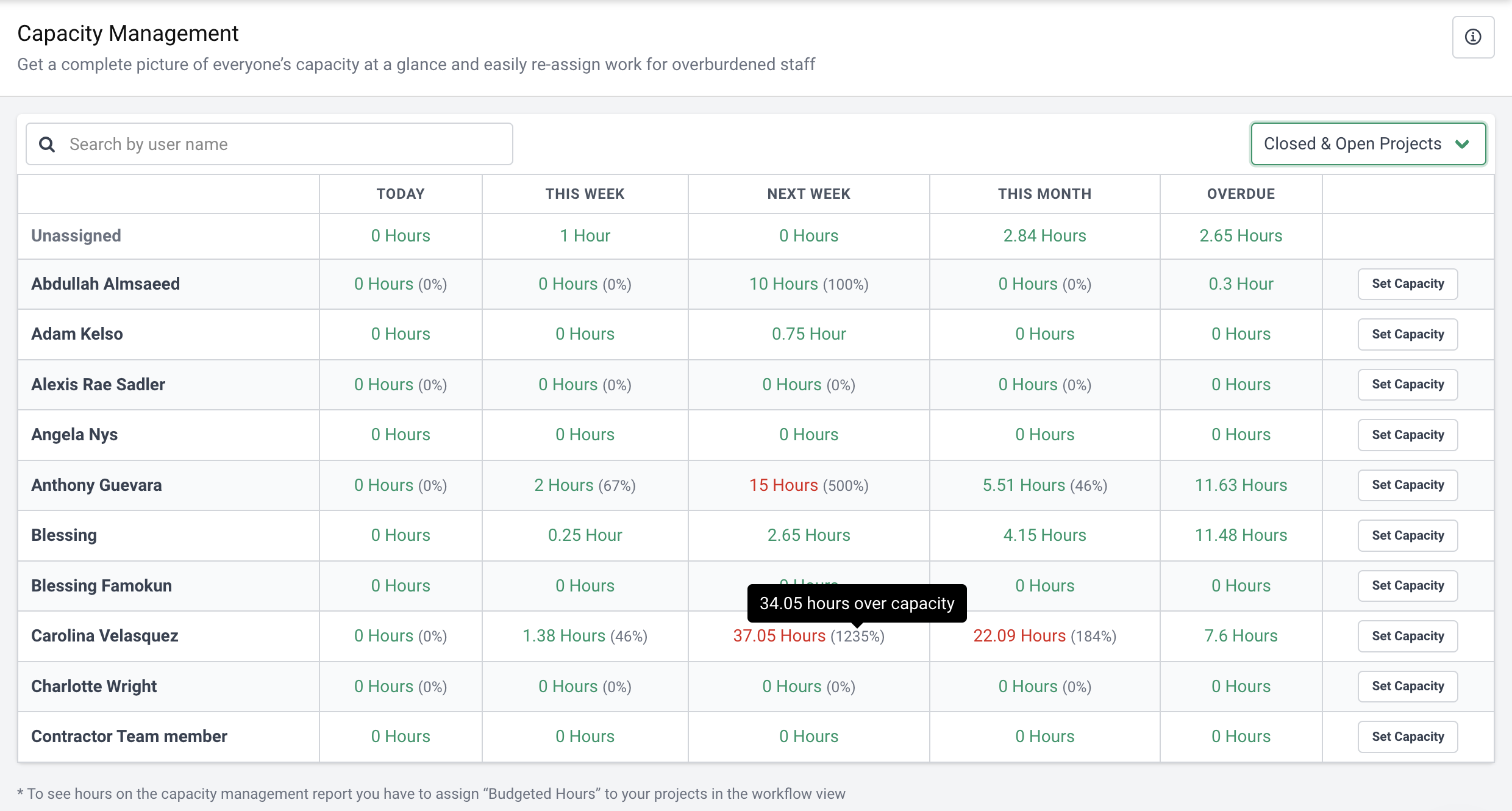

7. Capacity Management

The capacity management feature helps to address the lack of visibility into employee workload and assigning tax work.

By showing the hours of work your team members have on their plate, this feature helps you see which team member is overworking and who has enough room for more work while ensuring that your team members are working on the tasks they are most qualified to handle.

With the Financial Cents Capacity Management Reports, you have a dashboard that shows you how much work each of your staff members has on their plate.

- The Capacity Limit: enables you to determine the maximum hours your team can work to manage your team’s work-life balance.

- Reassigning Tasks: reallocates between team members through a drag-and-drop functionality.

8. Time Tracking and Billing

Time tracking helps you to monitor your firm’s time usage. The billing feature ensures swift and adequate payment.

Most tax workflow software solutions have built-in time-tracking features that can be turned on and off as you start and finish work on a client’s tax project.

Financial Cents’ time tracking features include :

- Actual VS Budgeted Time: this shows how much time it took to complete a project compared with how much time was budgeted. This allows you to optimize your process and rates when tax projects take too long.

- Time Budgets: Financial Cents help you understand the number of hours your tax projects take.

- Billable Rates: define your rates and track how much you’re expecting from each client.

- Seamlessly Switch Between Timers: your team members can easily pause time for a client project when they have to stop to attend to another project.

- Billable/Non-Billable Time: helps your team to separate billable rates from non-billable for more accurate invoices.

- Time Tracking Reports: helps you monitor your productivity and profitability by clients, projects, and staff.

The Financial Cents Billing feature helps you get paid inside your tax workflow application, giving you the ability to:

- Create One-off & Recurring Invoice: Financial Cents allows billing for one-time and recurring tax projects.

- Sync Invoices and Payments with QuickBooks Online: this optional feature allows you to import your service items from QuickBooks for invoicing. Paid invoices in Financial Cents will also be reflected in QBO to prevent duplicate data.

- Accept ACH & Credit Card Payment Options: your clients can pay you via ACH (bank transfers) or credit card.

- Save Payment Methods: Financial Cents can save your client’s payment after their first payment to save them the stress of manually entering their payment information subsequently.

- Automate Client Payments: use a client’s saved payment information to charge their account automatically.

- Automated Client Reminders: payment reminders are sent to your clients to help them pay you on time.

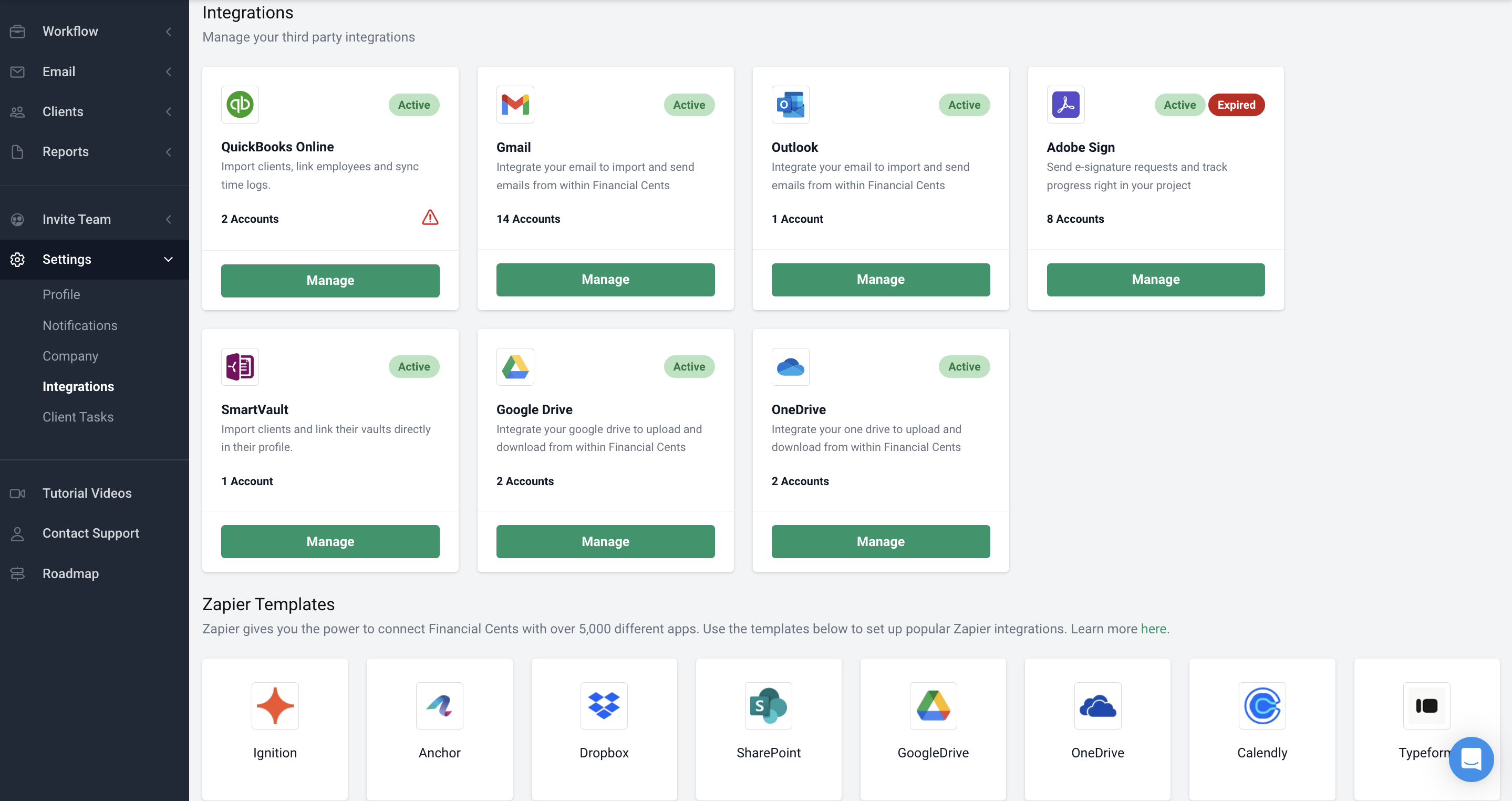

9. Integrations

Any software solution that does not integrate with the other tools in your tech stack is a potential source of bottleneck—no matter how good it is.

Such apps will require you to manually enter client data and create login information, which increases manual labor and chances of error.

Software integration syncs data and automates tasks (like tax calculation), saving your team the stress and mental load of learning multiple software solutions.

For example, Financial Cents integrates with QuickBooks Online to enable you to:

- Import and auto-sync your clients between both apps: automatically imports clients added to QBO to Financial Cents.

- Import and auto-sync service items for invoicing: create invoices in Financial Cents from your QBO service items.

- Sync invoices and online payments from Financial Cents to QuickBooks Online: any invoicing action you create in Financial Cents reflects in QBO to prevent duplicate data.

Other Financial Cents integrations are:

i. Gmail & Outlook Integration

This keeps you on top of client communication by creating a dedicated folder for client emails inside Financial Cents. This removes the need to constantly switch between your email app and tax workflow software to track client communication.

Other actions you can perform with this integration include:

- Pinning important client emails to projects.

- Turning ad hoc client requests into projects you can track in your workflow dashboard.

- Reading and sending emails from within Financial Cents.

- Track the email conversations between your staff and clients.

- Save draft emails.

ii. SmartVault Integration

This integration allows you to import clients from SmartVault, link clients between SmartVault and Financial Cents, create a client in SmartVault when their profile is created in Financial Cents, and route documents uploaded to the Financial Cents client task portal to the client’s folder in SmartVault.

iii. Adobe Sign (E-Signatures)

An integration that lets you request client signatures on tax returns, proposals, and other documents, saving clients the stress of traditional signatures.

iv. Zapier

Zapier connects Financial Cents users with 5000+ apps that may help tax professionals do their work more efficiently and profitably. These apps include accounting software (Xero), your form builders (TypeForm, Google Form, Incognito Forms, etc.), Document management software (Dropbox, Google Drive, ShareFile, etc.), and others.

Benefits of Tax Workflow Management Software for Firms

- Consistently Meet Deadlines

Tax workflow software streamlines and automates most tasks, which frees up resources to complete tax work more quickly.

For example, these tools synchronize data with other project-critical systems, eliminating human errors, which can result in rework and missed deadlines.

- Spend Less Time on Manual Tasks

The pressure of meeting client deliverables during tax season is overwhelming, and adding manual tasks like data entry and client follow-up will worsen it.

By automating data entry, client follow-up, and other manual tasks, tax workflow software allows tax preparers to focus on calculating liabilities in compliance with relevant tax laws.

- Reduce Staff Burnout

When your tax preparers are occupied with tasks machines can handle, it drains their physical, emotional, and mental strength—especially during the busy season.

With features like workflow dashboard (that gives a firmwide view of all tax projects), recurring projects (that saves you the mental load of remembering your recurring tax projects), and task dependencies (that ensures your staff members complete their tasks), your tax specialists have fewer things to worry about to meet tax client deliverables.

- Improved Client Experience

Tax workflow software streamlines client communication and collaboration, making it easy for clients to work with you.

The email integration brings all client emails into your workflow solution and prevents client requests from slipping through the cracks.

The client portal and E-Signature features facilitate the exchange of files (and information) and enable clients to review and sign tax returns in one place instead of going into multiple apps for files, information, and E-Signature.

You’re a Financial Cents Subscription Away from A Calm and Organized Tax Season

A major cause of bottlenecks in accounting operations is the lack of visibility into your tax projects, which prevents you from tracking the work you’ve done and what’s left.

Kim Ritter and Ritter’s tax and accounting services team were once in this situation.

They could not see what they’d done in a tax project, and the client notes assignees needed to work effectively because they used notebooks, to-do lists, and Google Sheets.

We noticed that we were taking notes but deleting them. We also couldn't see what we've done throughout the tax work. We needed something more to keep track of all the tax returns we were doing and the notes we were taking. That's when we started looking for a program and finally found Financial Cents."

Kim Ritter, Ritter’s Tax and Accounting ServicesIt’s time to put your current tax workflow challenges behind you for good.

Take advantage of our 14-day free trial to understand how well our feature set will suit your firm. Click here to start trying Financial Cents today.