Managing your accounting firm today often feels like spinning plates. You are tracking multiple clients, juggling recurring tasks, and trying to keep up with compliance deadlines while coordinating a stretched team. As you grow, every new client adds more moving parts, and the margin for error gets smaller.

Our State of Accounting Workflow Report shows how common this is. For instance, more than half of firms rated their team collaboration as only “moderate,” meaning updates get lost, and people are not always aligned. Another 47.6 percent said their client and staff onboarding felt clunky before adopting automation.The good news is that you do not have to work this way. Accounting workflow software brings structure and consistency to your processes. 50.8 percent of those firms from our report now use automation to track work, nearly half automate document collection, and 49.3 percent reported major improvements after implementing workflow management software. With the right features, you can standardise your workflows, remove blind spots, and keep your team operating with clarity and control. Let’s show you how in detail.

What Is Accounting Workflow Management Software?

Accounting workflow management software is the system you use to organise, automate, and track all the work happening across your firm. Instead of juggling spreadsheets, emails, or mental notes, you have one place to manage projects, assign tasks, monitor deadlines, and keep client work moving without constant follow-ups.

It helps you automate repetitive steps, standardise your processes, and keep your team running smoothly. You always know who is doing what, what is due next, and where bottlenecks are forming.

At a glance through our Financial Cents dashboard, you can see the status of a client and what part of the lead generation process they're in."

Jenna Rodriguez, CPAFor many firms, this becomes the operational backbone. It connects tasks, time tracking, client communication, document management, and reporting so you can see everything in one organised system. Tools like Financial Cents make this even stronger with workflow templates, automation, real-time dashboards, and simple collaboration features that keep your team aligned.

Get insights from The 2025 Accounting workflow and Automation Report

Why Accounting Firms Need Workflow Management Software

1. Missed deadlines and disorganised processes

You know how quickly things fall apart when work lives in too many places. One deadline sits in a spreadsheet, another lives in an email, and a third is something a client mentioned on a call. Before you know it, you are digging through ten different sources just to figure out what needs to be done today.

Accounting workflow management addresses this by consolidating everything into a single, organized view. You can see every task, every due date, and every status update without chasing information.

2. Lack of visibility into who is doing what

It is hard to run a smooth operation when you cannot see what your team is working on. You might think a task is in progress, only to find out no one actually picked it up. Or you assign something to a team member who is already overloaded without realising it.

This software gives you the visibility you are missing. You can instantly see who owns each task, what is moving, what is stuck, and where capacity is stretched.

3. Manual task tracking across spreadsheets or emails

If you are still tracking work in spreadsheets or email threads, you can relate to why they’re no longer a sustainable model if you’re reading this article. Spreadsheets get outdated the moment someone forgets to update a cell. Emails get buried under newer messages. And you are left piecing together tasks from different places, hoping nothing important gets lost.

Instead of relying on scattered tools, an accounting workflow management software gives you automated reminders, recurring task creation, and one central list that updates in real time.

4. Difficulty scaling operations

You can get by with manual systems when you have a small roster, but the moment your client list grows, things start to crack. More clients mean more recurring work, more deadlines, and more team members to coordinate.

If you are still relying on spreadsheets or ad hoc processes, everything becomes harder to manage, and your firm feels like it is constantly playing catch-up.

5. Client deliverables slipping through the cracks

Nothing is more stressful than realising a deliverable was missed, or a key document never made it into the file. It is rarely intentional. It usually happens because the information was scattered, the task lived in someone’s inbox, or the reminder was buried under other work. But to your clients, it looks like your firm is disorganised.

Accounting workflow management software helps you prevent those slip-ups. Every task, document request, and deadline lives inside the project, not across five different tools.

Essential Features to Look for in a Workflow Management System for Accounting Firms

If you’re ready to make a purchase but still unsure which features you actually need in an accounting workflow software, let’s break it down using insights from real accountants who have faced the same challenges you’re tackling.

Workflow Management & Automation

When evaluating software options, start with the workflow management and automation features. Why? Because this is the engine of your accounting firm’s digital operations. It influences collaboration, turnaround time, and the overall quality of your services.

With the right system, you can:

- Build clear workflows for every tax season, advisory services, or bookkeeping

- Trigger recurring tasks automatically, including document requests and reminders

- Assign work without unnecessary back and forth

- Ensure every step follows the right sequence

- Reduce errors caused by assumptions or missed steps

When we finish the first section of our internal tasks in Financial Cents, it’ll trigger the client requests, which is a customised email sent automatically to the client. They’ll get a notification and can go in to upload and share documents."

Jenna Rodriguez, CPA.In Financial Cents, workflow management includes several moving parts that work together to keep your firm organised, and these moving parts are supported by automation.

Each component removes a layer of admin work, reduces unnecessary follow-ups, and helps your team stay consistent.

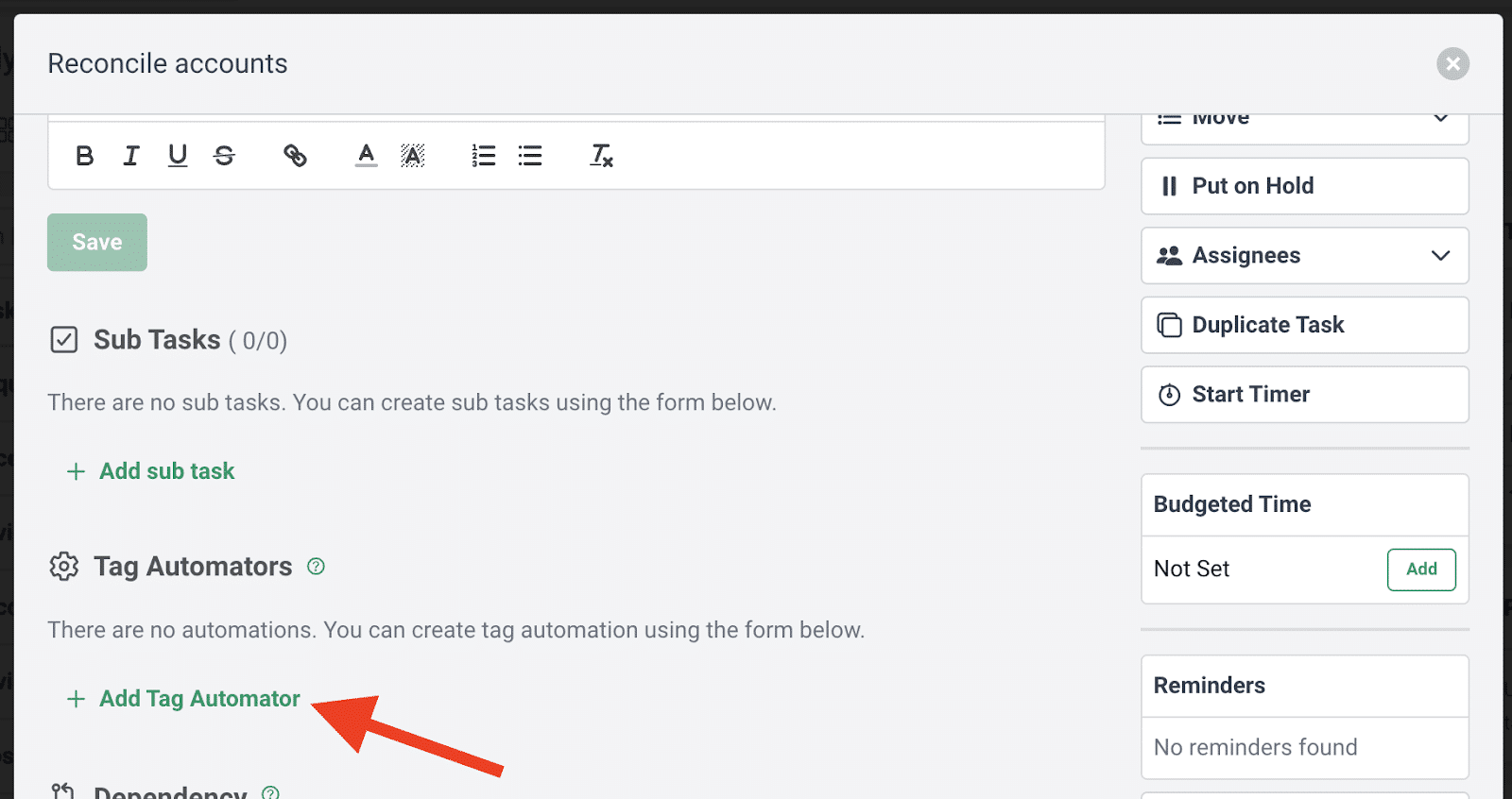

For example, Financial Cents offers document collection features that let you request tax returns or financial statements directly from a client’s profile.

You can take this even further by automating those requests so they trigger when a task in your workflow is completed. This is made possible with a feature called ‘Tag Automator’, which means you no longer have to return to your dashboard to manually request documents from a client.

You can read more about how Tag Automator works or watch Jenna and George’s AI automation demo to see how Jenna implements this at her firm.

Document management is just one part of managing workflows. You should also evaluate whether your software handles recurring work, task assignment, due date tracking, team capacity, and client communication, but that’s only the start. Look for features that directly address the pain points you experience every day.

Your workflow software should also support:

- Real-time project status tracking so you always know what’s in progress, what’s blocked, and what’s at risk

- Automated reminders and notifications that keep both your team and clients accountable

- A clear capacity and workload view to prevent burnout and balance assignments across staff

- Client requests automation to reduce back and forth and avoid chasing documents

- A client portal where clients can upload documents, view updates, and avoid email clutter

- Time tracking and budgets so you can measure profitability and spot scope creep early

- Workflow templates that standardise how work is done across every client and service

- Task dependencies so your team follows the process in the right order

- Internal notes and collaboration tools to eliminate scattered comments across emails or chat apps

- Reporting and insights that show bottlenecks, overdue work, and team productivity

- Strong integrations with the tools you already use (QuickBooks, Xero, SmartVault, Anchor, Zapier, etc.)

As a semi-new user, we’ve gone through two busy tax seasons using Financial Cents with the workflow and really enjoyed it."

Jenna Rodriguez, CPAWorkflow Templates

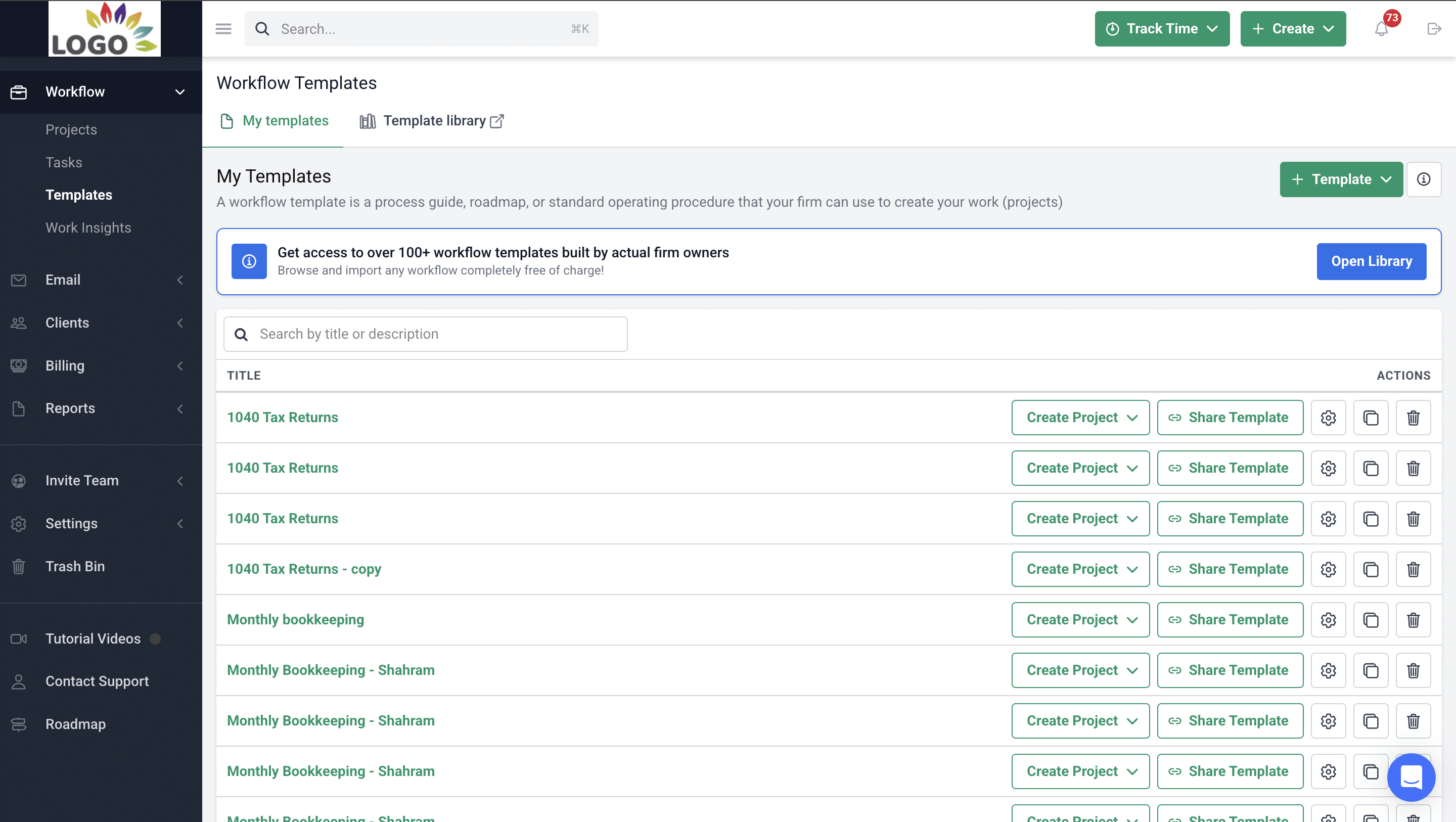

The next essential feature to look for in an accounting workflow management tool is the Workflow Template.

Most of the work you do follows predictable steps. Bookkeeping, payroll, month-end close, sales tax filings, and tax preparation rarely change month to month. Instead of rebuilding the same checklist every time, workflow templates let you set the process once and apply it across every client who needs it.

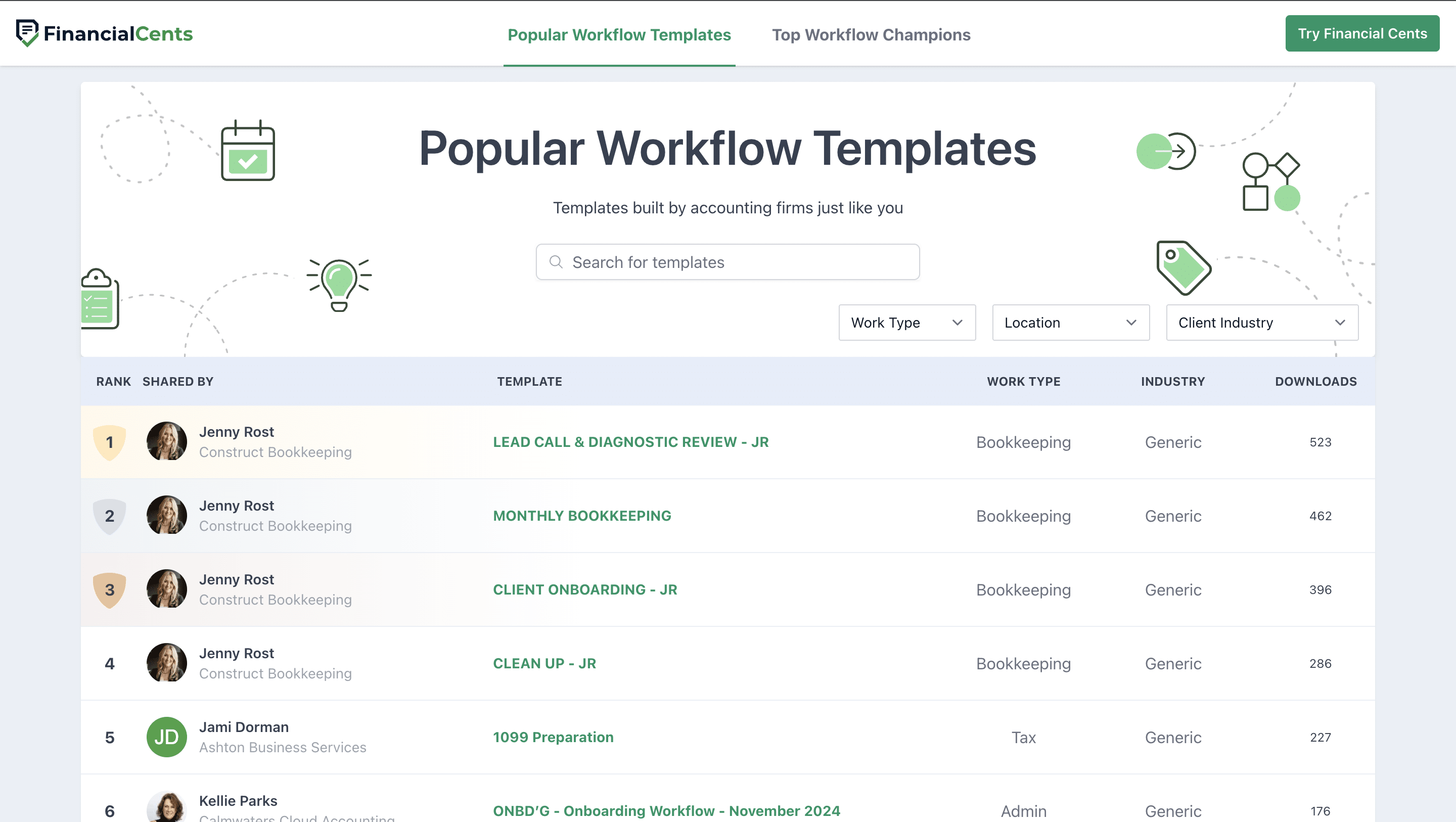

Financial Cents offers a library of free workflow templates that make this incredibly simple. You can use prebuilt templates for common accounting and tax workflows or create your own based on how your firm operates. Each template can include task lists, instructions, due dates, dependencies, document requests, and even quality checks. This gives your team a clear roadmap to follow so the work gets done the same way every time.

If you want even more workflow templates, Financial Cents also provides a community template library with templates created by other accounting, bookkeeping and tax firm owners within the Financial Cents community. These real-world templates come from firms facing the same challenges you do, and you can quickly import them into your account and start using them immediately.

Financial Cents provides you with predefined templates. They also have a library of user-shared templates that gives you a quick starting point for setting up your own templates and workflows."

Jenna Rodriguez, CPA.Deadline and Task Tracking

Of the many features you can find in an accounting workflow management system, this is one of the most important. In a firm where deadlines never stop, you need a system that helps you stay ahead of every due date, deliverable, and recurring task without scrambling or relying on memory.

A good software will let you track due dates and tasks in one central place, but a great software makes those due dates flexible based on when a client’s work actually begins. It goes without saying that you should choose a system with powerful automation, especially for deadline tracking.

For example, with tax returns, bookkeeping cleanups, and year-end work, you often cannot start until your client sends in their documents. Without workflow management software like Financial Cents, you are left guessing the start date, which makes it difficult to set accurate deadlines in advance.

In Financial Cents, you can build workflows that only begin once the client submits their documents, and the software will automatically calculate all due dates from that start date. It works like this:

- You create a workflow or template

- You send an automated document request to the client

- You wait for the client to upload everything

- Your team reviews the documents and confirms everything is correct

- You set the start date

- The system automatically generates all due dates and task timelines from that point

This is powerful because you can send requests early, and once the documents arrive, you simply set the start date.

Team Collaboration Tools

The accounting workflow tool you choose for your firm should have team collaboration features that make collaboration happen inside the work itself.

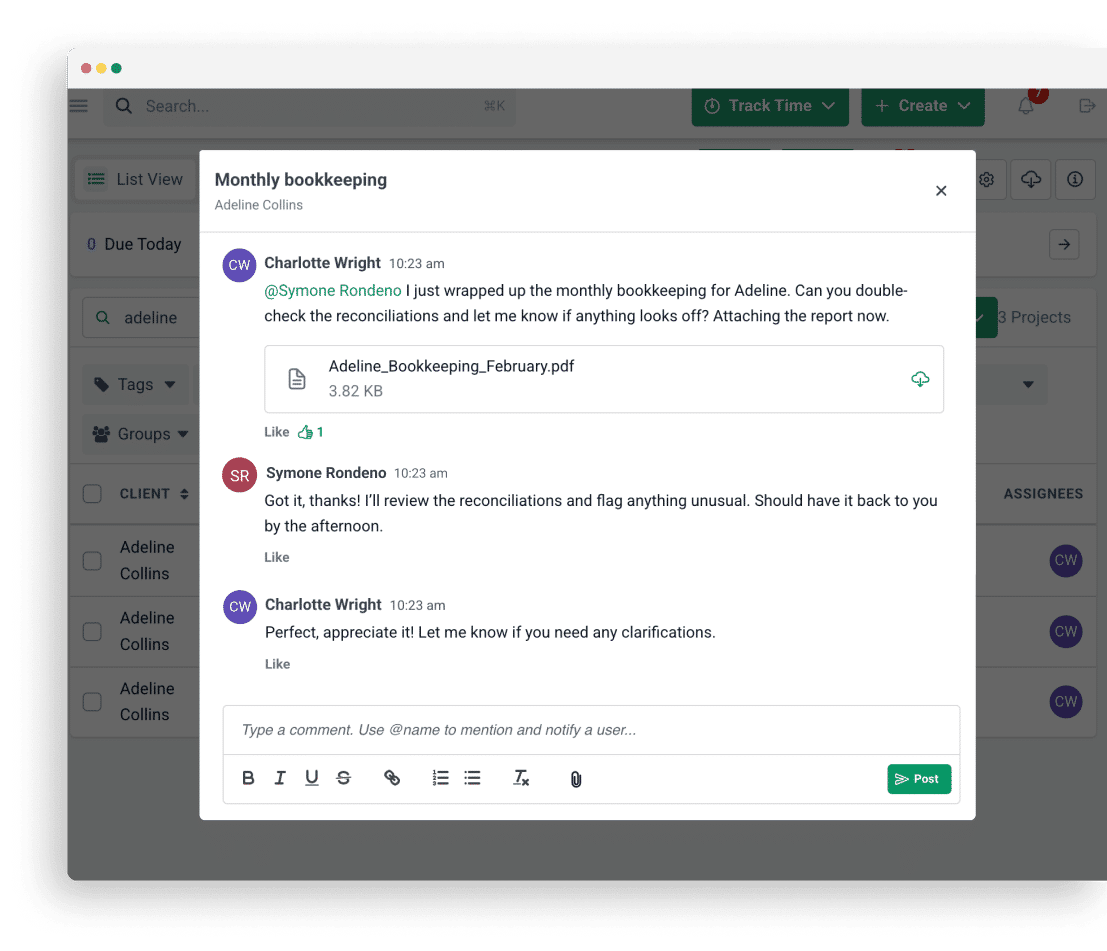

In Financial Cents, for instance, you can leave comments on tasks, tag team members, share files, and track every update in a single timeline. This removes guesswork and also cuts down on back and forth, since all context lives inside the project.

Client Management

The right workflow software for any accountant is one that helps you stay organised and deliver a consistent client experience. Instead of searching through emails or spreadsheets to find basic information, you have one dashboard that shows everything related to each client.

I love universal search in the dashboard; it gives you everything you possibly need about a client and takes you directly to it. That is a huge time-saver."

Kellie Parks, CPB.In Financial Cents, you can store client details, notes, documents, services, deadlines, and communication history in one profile. This makes onboarding smoother because your team can instantly understand the client’s needs and open tasks. It also reduces delays, since all requests and documents live in the same place.

Time Tracking and Billing

Time tracking and billing features help you understand how profitable your work really is. Without a clear picture of where your team’s time goes, it is hard to price services accurately or spot clients who consistently go out of scope.

In Financial Cents, time tracking is built directly into your workflows. Your team can log time inside each task, making it easy to see how long services actually take. You can analyse billable versus non-billable hours, track efficiency, and review profitability by client or service.

The billing features also help you streamline recurring invoices so nothing gets missed. With accurate time data, you can price confidently, improve margins, and ensure your team is working at a sustainable pace.

Reporting

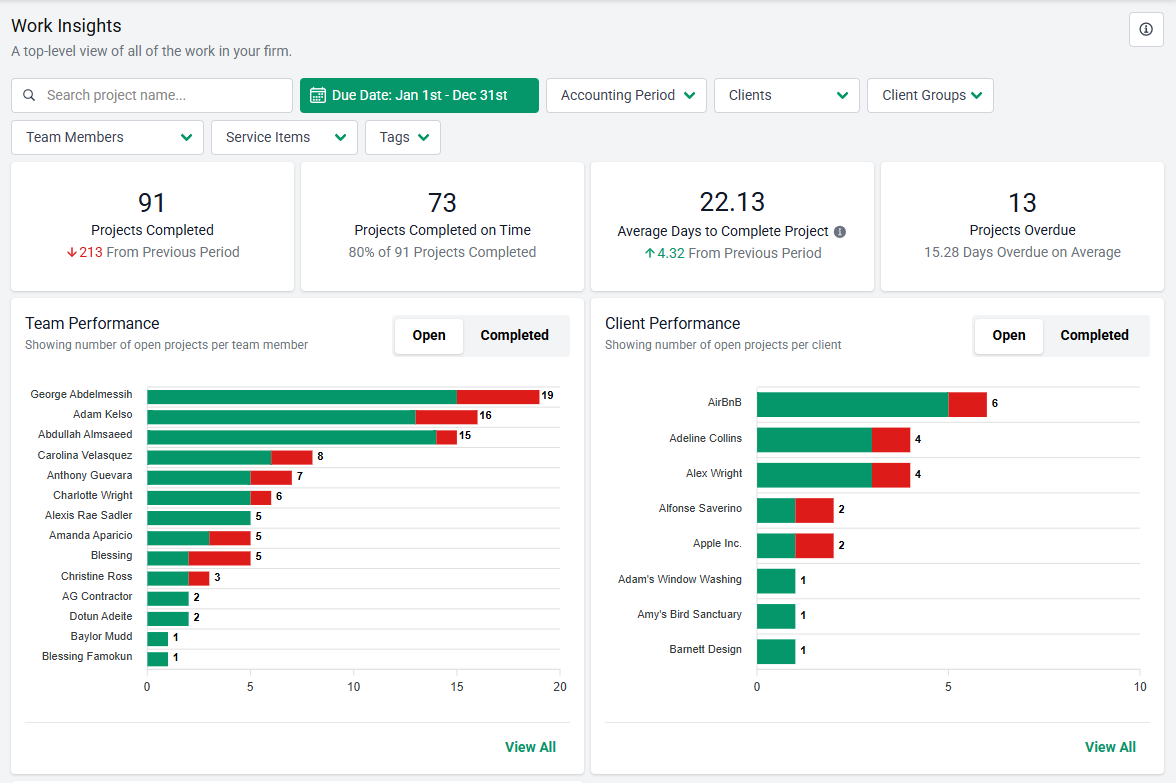

You cannot improve what you cannot see, and strong reporting helps you understand how your firm is truly performing.

Inside your Financial Cents dashboard, you can access clear reports on workload, productivity, and task completion trends. There are so many reports you can generate to better understand performance in your firm.

This helps you spot issues early, such as recurring delays, overworked team members, or clients who consistently require extra time. You can also review performance by service and identify areas where processes need improvement.

Capacity Management

Capacity management helps you understand how much work your team can realistically handle. Without this visibility, it is easy to overload certain staff, underestimate deadlines, or take on new clients when your team is already stretched.

In Financial Cents, you can see exactly who is working on what, how busy each team member is, and which projects are at risk. This makes it easier to reassign tasks, balance workloads, and plan more accurately during peak periods. Capacity management turns guesswork into confident decision making and helps you grow your firm without losing control.

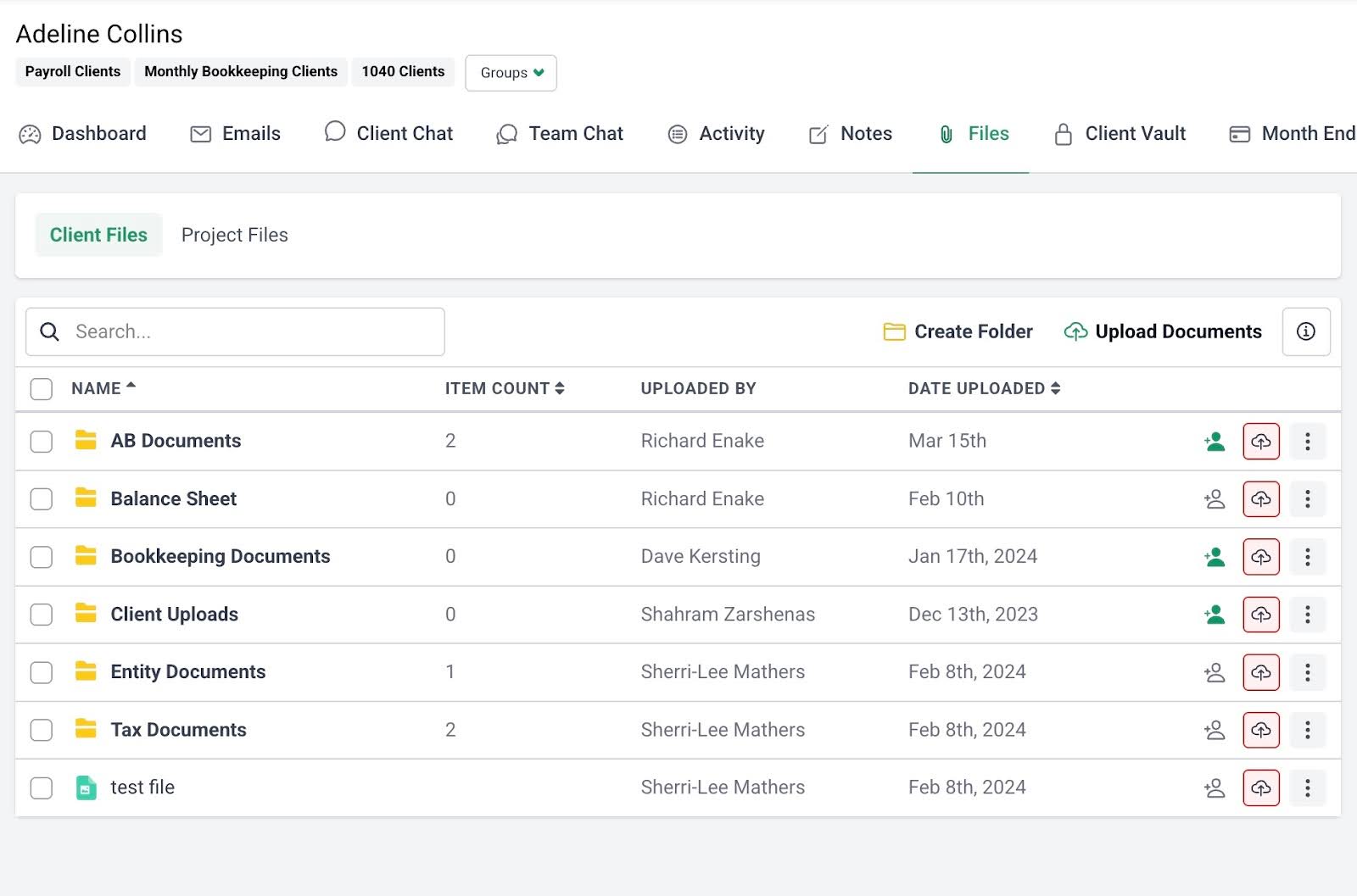

Document Management

Document management is a critical feature for any accounting workflow system because missing files and scattered documents slow everything down.

In Financial Cents, you can store client files directly inside their profile or attach documents to specific tasks. This gives you instant access to everything you need without digging through email threads or shared drives. You can also request documents from clients through automated reminders, which reduces back and forth and speeds up reviews. With all files in one place, your team stays organised, and you reduce the risk of errors or missing information. Strong document management keeps your workflows smooth, your audits cleaner, and your client communication simple and efficient.

Even if you’re not planning on growing, you have only so much capacity in your brain. And trying to keep everything in your brain: client deadlines, keeping track of ad-hoc requests, getting paid, and onboarding new clients, before we know it, our brain is full of stuff and we are at the mercy of accidentally forgetting something. And if you’re planning on growing your team, this becomes critical because a key component of quality service is that it doesn’t matter who does the books, they should all be of the same quality, the same standard, and done the same way. And the way you accomplish this is by having standard operating procedures."

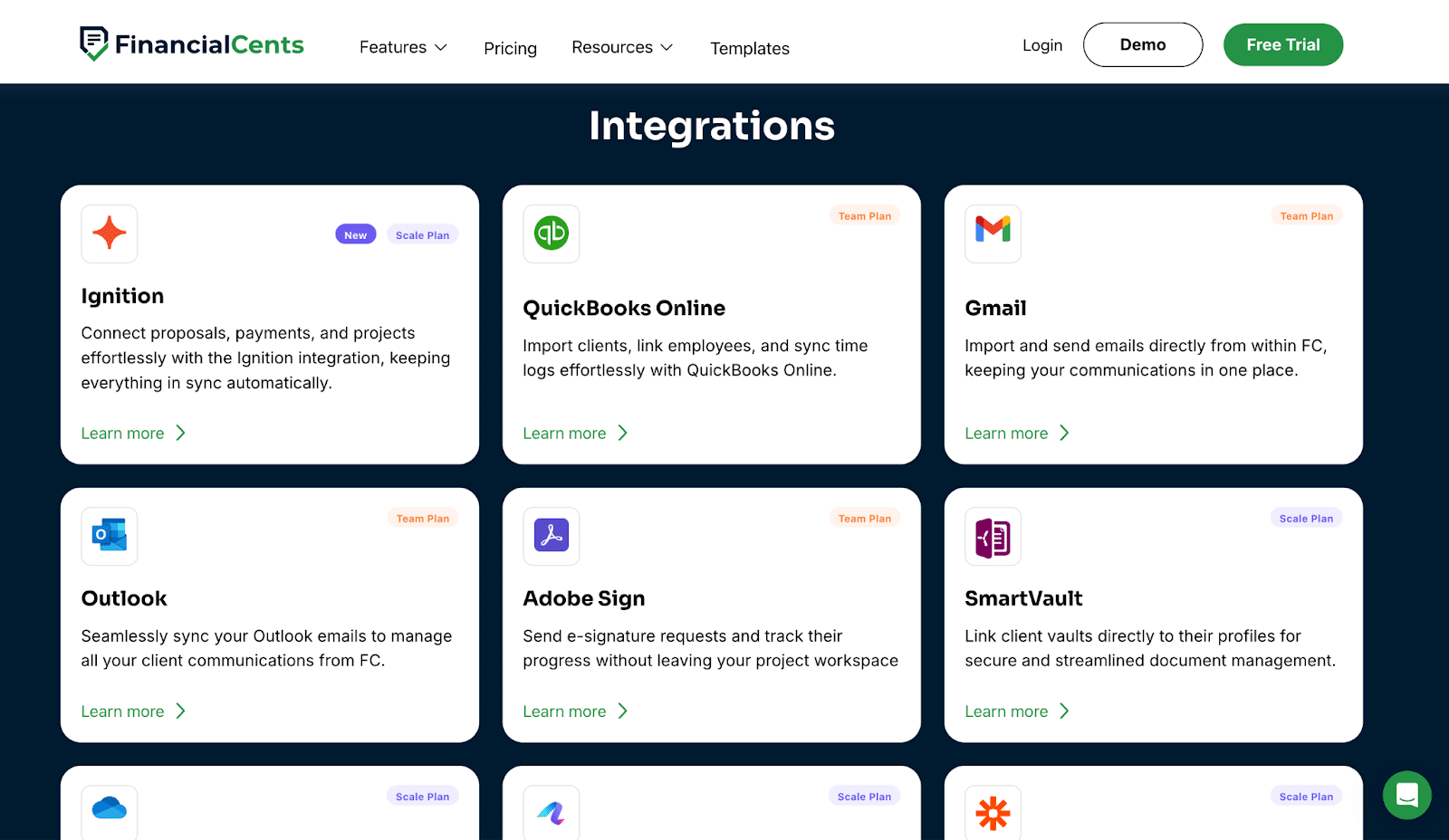

Jessica Fox, Florida Virtual Bookkeeping LLCIntegration Capabilities

Integration capabilities help your workflow software fit naturally into the rest of your tech stack. When your tools do not talk to each other, you end up entering the same information in multiple places, which wastes time and increases the chance of mistakes.

In Financial Cents, integrations connect your workflows to tools like QuickBooks, SmartVault, Zapier, and more. This means client details, documents, and project data can sync automatically instead of being managed manually. You can automate onboarding, streamline billing, pull in client information, and centralise key documents without extra effort.

How Workflow Management Software Transforms Accounting Operations

Task transparency and accountability

When everything is tracked in one place, you always know who is responsible for what. Your team can see the full task list, update progress in real time, and follow a clear sequence of steps.

Deadline compliance and workload balance

A shared system makes it easier to stay ahead of due dates. You can see upcoming deadlines, overdue work, and how busy each team member is. This helps you balance workloads, prevent burnout, and keep projects moving even during peak periods.

Collaboration across remote teams

When your staff works remotely or in a hybrid setup, communication gaps can slow everything down. Workflow software centralises comments, files, and updates so your team collaborates on the work itself. Everyone sees the same information, which keeps tasks flowing smoothly.

Client experience and communication

Clear workflows lead to clearer communication. Automated reminders, document requests, and status updates help clients stay accountable and informed. This reduces delays and builds a more consistent, supportive client experience.

How to Make the Most of Accounting Workflow Software

Getting workflow software is only half the win. To get real results, you need the right habits and standards in place.

Standardise workflows across clients

Create clear workflows for your core services and apply them consistently. When every client follows the same steps, you reduce errors, speed up delivery, and make it easier for your team to collaborate.

Review and optimise processes quarterly

Your workflows should evolve. Set aside time each quarter to review what is working, where delays show up, and what tasks feel repetitive or unclear. Use your workflow reports to identify bottlenecks and update your templates so your processes stay efficient as your firm grows.

Train staff effectively

A workflow system only works when everyone uses it properly. Train your team to update task statuses, leave comments in the platform, attach documents, and follow the workflows exactly. Clear expectations create smoother handoffs and reduce confusion.

Automate document and task requests

Automating client requests saves hours during month-end and tax season. Use your software to send document reminders, recurring requests, and progress updates automatically. This keeps clients accountable and helps your projects move forward without constant follow-ups.

Streamline Your Accounting Workflows with Financial Cents

The right workflow management software helps you save time, stay organised, and deliver consistent results across every client. When your processes are standardised, and your team has clear visibility, you reduce stress and keep work moving without constant follow-ups.

Financial Cents is built specifically for accounting firms and gives you all the tools you need in one place. You get strong workflow management and automation, workflow templates, deadline tracking, client communication, time tracking, reporting, and a client portal. Everything works together to help you stay on top of recurring work and keep your team aligned.

If you are ready to streamline your operations and improve accuracy across your firm, Financial Cents gives you a simple, powerful way to manage all your workflows in one organised system.

Book a Free Demo to see how you can gain visibility, save time and make work quality more consistent in your firm or Start a Free Trial to explore yourself.