As an accountant or bookkeeper, one of the forms you’ll need at some point is IRS form 8821, Tax Information Authorization. This form grants you access to your client’s tax records for tax planning, advisory, auditing, or resolving IRS issues.

But it also does the opposite. Aside from granting authorizations, you can use Form 8821 to revoke previous tax information authorizations.

With how useful this form is, you must know how to file it correctly if you wish to serve your clients well.

And so, in this article, we show you form 8821 instructions for filing without making mistakes. For a general overview of this form, check out this piece.

Understanding the Purpose of Form 8821

Form 2848, Power of Attorney and Declaration of Representative, is another form that performs a similar function. It also allows taxpayers to authorize third parties to inspect and receive confidential tax information.

But don’t confuse the two; there’s one key difference between them.

Form 8821 doesn’t permit you to represent the client before the IRS. You can only view and receive their tax information. However, form 2848 gives you access to client records and the power to act on their behalf.

It’s like you’re given the password to a friend’s Netflix account. You can watch all the shows (see all the tax information) but can’t change the account settings (make changes or representations to the IRS). While both forms allow you to do the former, only form 2848 permits you to do the latter, i.e., make changes or represent the client.

There are certain instances where clients prefer form 8821 to its counterpart. For example,

- When they only want you to access their information, not represent them: They may only need advice or basic accounting services from you or have no extensive issues requiring your representation.

- When they want to maintain control: Form 8821 allows taxpayers to limit the authority they give. With it, they can specify the type of tax information (income, employment, payroll, civil penalty, etc) and the year they want to disclose. They can even state a validity period, after which the IRS revokes your access to their records. These features allow them to control any interactions or negotiations with the IRS.

- When they have privacy concerns: Some clients are more security-conscious than others. While this form allows you to view their personal records, it’s less invasive than form 2848. It provides a way for them to share information on a need-to-know basis. They can get the accounting assistance they need without granting broad authority over their tax matters — a win-win.

- When they don’t want to go through a complicated process to revoke authority: Canceling form 8821 access is easy. You either submit another form or wait for the IRS to withdraw access after seven years automatically. There is no long process involved.

If form 2848 power of attorney is more suited for your needs, check out detailed step-by-step IRS Form 2848 Filing Instructions for Power of Attorney.

Preparing to File IRS Form 8821 for Clients

Before filing this form, there are three steps to take.

- Receive essential client information and documentation: First, collect certain information from your client. This includes their name, address, Taxpayer Identification Number (TIN), and phone number. Verify these details to ensure they are accurate and up-to-date.

- Understand the client’s tax history and existing tax issues: Second, review their tax history, including previous returns, notices, and ongoing or unresolved tax matters. Doing this helps you understand their tax situation to ascertain if, indeed, this is the form to file rather than form 2848.

- Determine the scope of authorization: Finally, discuss with the client to learn their boundaries. Find out the type (and years) of information they want to disclose and agree on a validity period.

Once you’ve done these, it’s time to complete the form.

You may be interested in:

Step-by-step Form 8821 Instructions

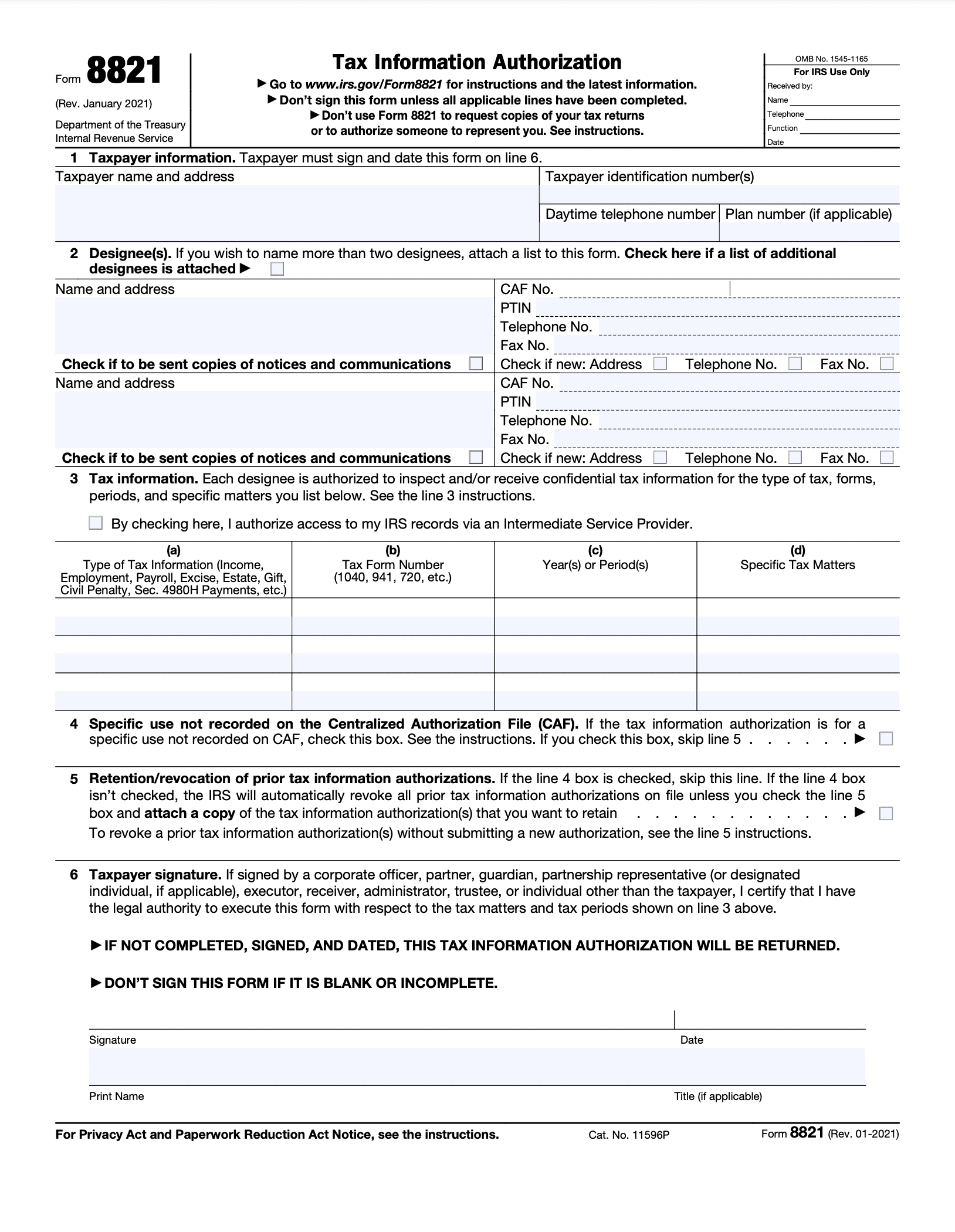

This is a one-page form with six sections or lines, and here’s how to fill out each.

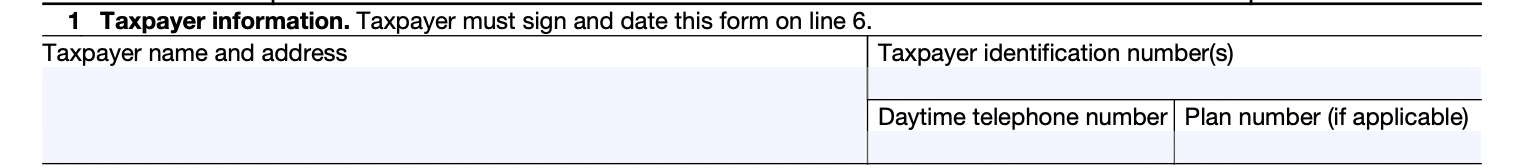

1. Taxpayer information

Line 1 includes your client’s name, address, TIN, daytime phone number, and plan number (if applicable). If you’re filing a joint return, your client’s current or former spouse must file a separate form to release their tax information. Form 8821 is individual.

- If you’re dealing with a corporation, partnership, or association, enter an EIN (instead of a TIN) and a business address.

- If it’s an employee plan or exempt organization, use the EIN or SSN of the plan sponsor/plan name, exempt organization, or bond issuer. Also, enter the three-digit plan number when necessary.

- For a trust, fill out the name, title, and address of the trustee and the name and EIN of the trust.

- For an estate, enter the name and address of the estate. If it doesn’t have a separate taxpayer identification number, enter the decedent’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- And for tax-advantaged bonds, enter the bond issuer’s name and address.

You can send this tax preparer checklist for clients to get the required info you need.

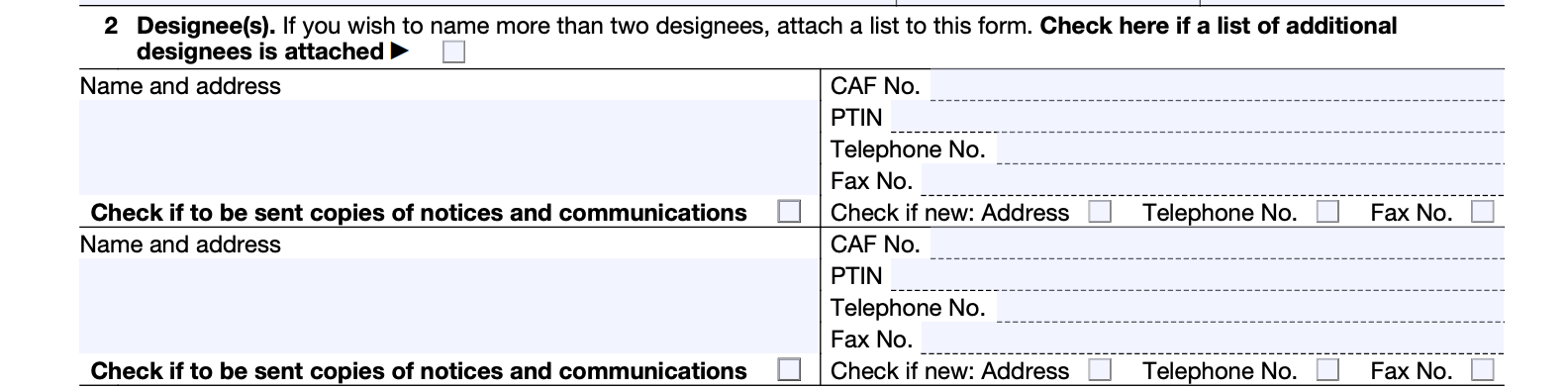

2. Designee(s)

The designee or appointee is the person the taxpayer is granting access to. In this case, yourself. There’s another field for a second designee. You can use this for your team or another party the client desires.

Input your name, address, Centralized Authorization File (CAF) number, Preparer Tax Identification Number (PTIN), Telephone number, and Fax number. If you have a CAF number from filing form 8821 or 2848 in the past, use it. But if you don’t have one, write “none” in the field, and you’ll get one within weeks. You can also check this guide for getting a CAF number.

Also, indicate if you’ve changed your address, telephone number, or fax number since the IRS issued a CAF number. Check the appropriate box to receive IRS notices and communications copies. Do the same for the second designee if you’re using one.

P.S. The IRS won’t grant a CAF number if it’s an employee plan status determination or exempt organization application request.

If you wish to add more than the two designees allocated on the form, check the appropriate box and attach a list of their names and other necessary details. However, these additional designees can’t receive correspondences because the IRS limits the number of people receiving notices on the same matter to two.

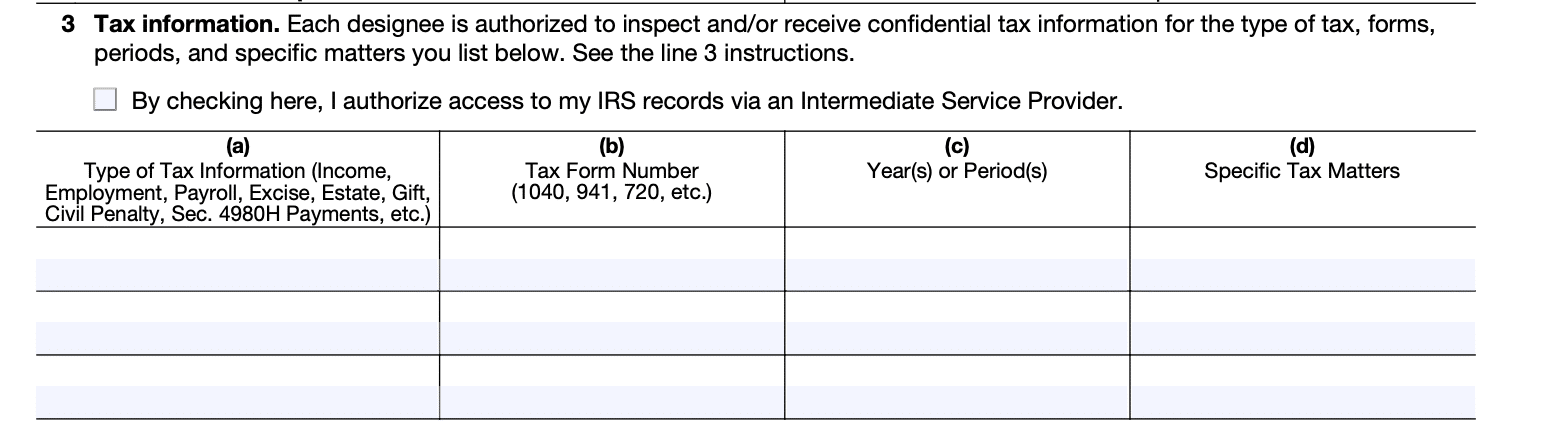

3. Tax information

This section is where you state the type of tax information, tax form number (1040, 941, 720, etc.), validity years, and specific tax matters (e.g., balance due amount, a specific tax schedule, or tax liability) the taxpayer is authorizing. You can put multiple tax types, form numbers, and years.

Some things to note.

- You can specify multiple years on the form. For example, to gain access to records from 2019 to 2021, enter “2019 thru 2021” in the field. Or for quarterly periods, say the third quarter of 2020 to the second quarter of 2023, input “3rd 2020–2nd 2023. For fiscal years, use the “YYYYMM” format to enter the ending year and month.

- In addition to past or current years, you can include future years on the form. However, the IRS won’t release information for periods more than three years from December 31 of the year you file. e.g., If you file for future years in September 2022, you won’t receive tax records from January 1, 2026 onward.

- DO NOT enter blanket references like “all years,” “all form numbers,” or “all tax matters’. The IRS will return any form with such general reference.

- If it’s estate tax, enter the decedent’s date of death in place of the year or period. If the matter concerns an employee plan, include the plan number in the “type of tax information” column.

- If the client is not limiting your authority to review all their tax information, put “not applicable” in the “Specific Tax Matters” column.

Check the appropriate box if you use an Intermediate Service Provider (ISP) to retrieve, store, and display tax return data (and if your client is on board with this). Otherwise, you’ll have to obtain the records from the IRS e-Services Transcript Delivery System.

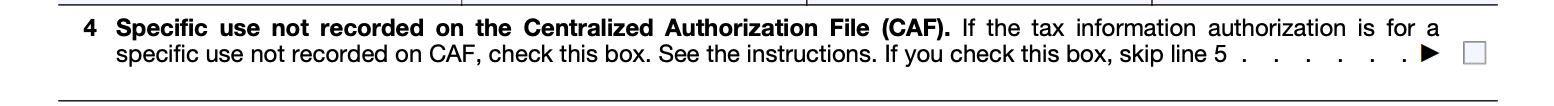

4. Specific use not recorded on the CAF

The IRS stores most, but not all, tax information on the CAF. If the form 8821 you’re filing is for a one time use or for a specific use you do not want the IRS to store, check the relevant box (leave blank if not). Then, either mail, fax, or go to the concerned IRS office (with a copy of form 8821) to receive the information.

According to their website, the use cases not recorded include:

- Requests to disclose information to loan companies or educational institutions.

- Requests to disclose information to federal or state agency investigators for background checks.

- Requests for information regarding the following forms:

- Form SS-4, Application for Employer Identification Number;

- Form W-2 Series;

- Form W-4, Employee’s Withholding Certificate;

- Form W-7, Application for IRS Individual Taxpayer Identification Number;

- Form 843, Claim for Refund and Request for Abatement;

- Form 966, Corporate Dissolution or Liquidation;

- Form 1096, Annual Summary and Transmittal of U.S. Information Returns;

- Form 1098, Mortgage Interest Statement;

- Form 1099 Series;

- Form 1128, Application To Adopt, Change, or Retain a Tax Year;

- Form 2553, Election by a Small Business Corporation, or

- Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners.

P.S. A specific use authorization form 8821 doesn’t revoke prior authorizations automatically like the regular form does.

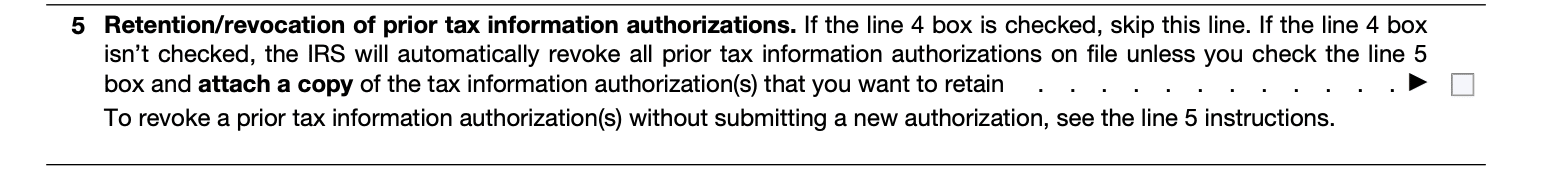

5. Retention/revocation of prior tax information authorizations

Retention: If you checked the previous box (line 4), skip this section.

If not, check the box in this section and attach a copy of the tax information authorization you want to retain. A new form supersedes previous ones, so if you’d like previous designees to maintain access, attach their form(s) to the new one.

Revocation: The IRS automatically revokes all prior authorizations when you file a new form unless you choose to retain it. If you want to revoke without submitting a new form, write “REVOKE” across the top of the authorization you want to withdraw. Then, add the current taxpayer signature and date under the original signature. However, if you don’t have a copy of the tax information authorization you want to revoke, and it isn’t a specific-use authorization, contact the IRS with these details. In your message,

- State that the authority of the designee is revoked,

- List the name and address of each designee whose authority is being revoked,

- List the tax matters and tax periods, and

- Sign and date the notification.

If you want to revoke all access for an appointee, state “revoke all years/periods” on the form.

And if you want to revoke a specific-use tax information authorization, send the tax information authorization or notification of revocation to the appropriate IRS office with the same instructions as above.

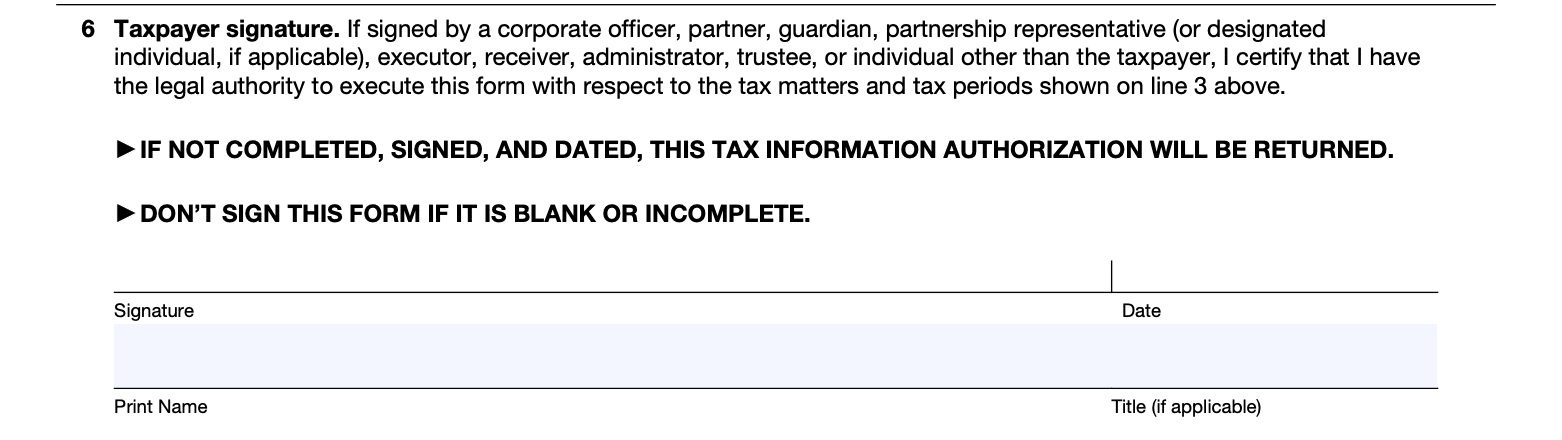

6. Taxpayer signature

Finally, sign the form and enter the date, your name, and title. This is very important, as the IRS will send it back if you don’t do this. If you’re mailing or faxing the form, handwrite your signature. But if submitting online, you can use an electronic signature.

How to File

After completing and signing the form, you must submit it within 120 days (this timeframe doesn’t apply when the form’s purpose is to resolve tax issues). There are three ways to do this.

- Online: You can submit your form on the IRS portal from any browser here.

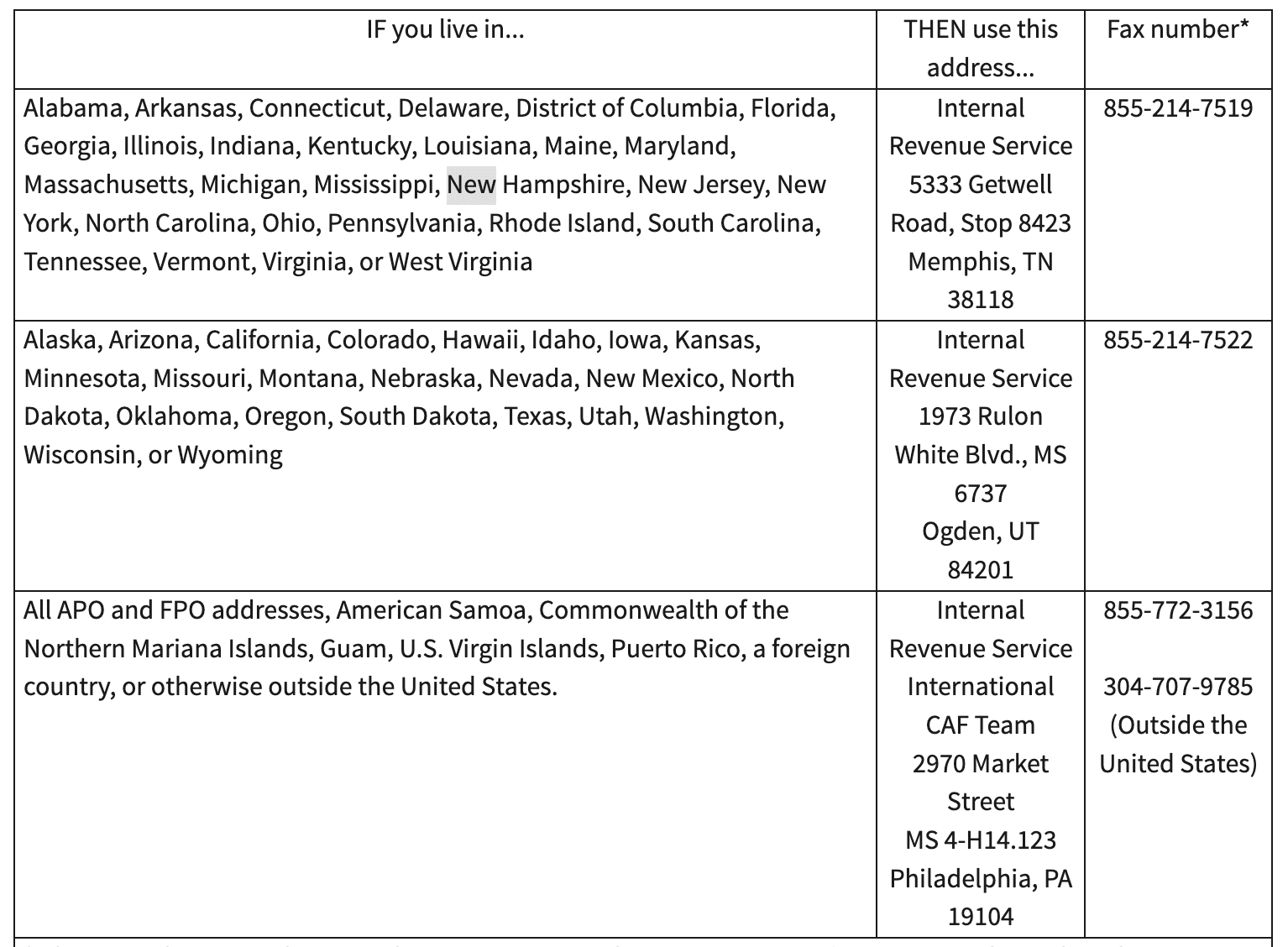

- Mail & Fax: Alternatively, you can mail or send it via fax to the right address/fax number based on your client’s location.

What Next?

Now, you wait for the IRS to accept or reject your request. They might reject yours if you:

- Enter the wrong TIN, EIN, or SSN.

- Use general references like “all years” or “all future periods” instead of being specific.

- Don’t sign the form or include a date.

If you didn’t make any of the above mistakes and follow the form 8821 instructions outlined here, you stand a good chance. If rejected, review the rejection notice, rectify the issues highlighted, and resubmit.

If you’re ever in doubt while filling out the form, go over the full 8821 instructions on the IRS Website or contact the IRS for guidance.

Keep Clients’ Information Confidential and Stay Organized

Giving you access to personal records shows your client trusts you. They trust you to use their sensitive information responsibly. Don’t betray this trust. Put measures in place to ensure the safety of these data.

If you have multiple clients, it’s easy to get disorganized, leading to data leaks. To be more efficient, use a practice management software like Financial Cents. We help firm owners organize their work and keep everything tidy. And this significantly reduces the chance of losing information or having it fall into the wrong hands.

Use Financial Cents to manage your accounting practice.