Picture this: a new client signs with your accounting firm, excited to get started. But then, during onboarding, everything falls apart.

There’s so much back and forth while trying to gather the information you need and set expectations that the client becomes frustrated. Not exactly the positive first impression you were hoping for, right?

Unfortunately, this scenario is all too common, which is why you need automation. It makes the whole onboarding process more efficient, making it go off with little to no hitch. According to Financial Cent’s workflow automation report, 52.2% of accounting/bookkeeping/tax firm owners say automation has made the client onboarding process smoother.

A smooth onboarding process is key to building a long-lasting relationship with your clients. It sets the tone for their entire experience with your firm and directly impacts their satisfaction.

On the other hand, a slow and disorganized onboarding experience wastes your time and resources and negatively affects your relationship with your clients.

In this article, you’ll learn why you should use an accounting client onboarding software and how to choose one for your firm.

Negative Effects of Manually Onboarding Client

Traditionally, onboarding new accounting clients has been a manual process, but this has several problems, including:

Inefficient Data Collection and Document Management

The manual method of onboarding promotes inefficiency because it is clunky and chaotic.

Say you want to collect information about your client. Sure, you can use a form or just have them send it via email/chat/call. But what if you’re working with many clients at once or have a long email/chat chain with a client? It becomes difficult to grab the information you need quickly. Searching for data every time is inefficient, wastes time, and increases the risk of errors.

Lack of Clear Communication and Setting Expectations

In a chat, Nikole Mackenzie, CEO and founder of Momentum Accounting, said:

During the onboarding process, we’re building trust. The client often doesn’t trust us yet, so we have to be highly communicative. We need to set boundaries with clients, keep them on schedule, and remind them of the timeline and deliverables during the process."

Simply put, communication is important to ensure everyone is on the same page. But in a scenario where you don’t have a streamlined process, communication can become haphazard.

Important information may be overlooked or misunderstood in the shuffle of emails, phone calls, and meetings. Clients may also not receive consistent updates or clear instructions about what is required of them.

This lack of clarity breeds frustration and can damage trust right from the start.

Delays Due To Manual Tasks and Paperwork

Performing tasks like data entry, sending welcome emails, and chasing signatures manually is time-consuming.

It creates bottlenecks and slows down the entire onboarding process so much that clients lose their initial enthusiasm for partnering with your firm. They are left waiting, and your team’s valuable time is wasted on manual tasks that could be automated. A lose-lose situation for both parties.

How Accounting Client Onboarding Software Makes Clients Happy

Accounting client onboarding software can help you overcome these challenges and create a smoother, more efficient onboarding experience for your clients. Here are some of the ways it can do that:

Streamlined Data Collection Through Secure Client Portal

The client portal is a central hub for all communication and data collection during onboarding. It allows clients to upload their information (like tax forms, bank statements, and identification) at their convenience, and the software notifies them when they’ve completed each step.

No more round-and-round communication or manual data entry. This saves time chasing information, keeps everyone organized, and optimizes the whole process.

Furthermore, the secure nature of these portals protects clients’ information, demonstrating your commitment to data security.

Automated Workflows for Sending Welcome Packages, Engagement Letters, and Other Materials

Onboarding software can automate your workflows, taking the grunt work out of delivering essential materials to your new clients. It lets you pre-design and store digital templates for all your onboarding documents, from personalized welcome packages to standard engagement letters and service agreements.

You don’t have to manually create onboarding emails from scratch with client onboarding software. And most of them have templates you can customize if you are not feeling so creative. But, if you prefer, you can create one from scratch. Most of them offer the ability to brand what you send with your firm’s logo, colors, and any message you want to promote for future use. This enhances your efficiency, brand consistency, and professionalism.

Basically, the software takes care of your onboarding when getting a new client. It automatically sends out a customized welcome package containing relevant information about your firm, introductory materials explaining your services, and helpful resources to get them started. They also offer e-signing options for clients to sign your engagement letter. This reduces the number of tools you use and the time you spend onboarding a client.

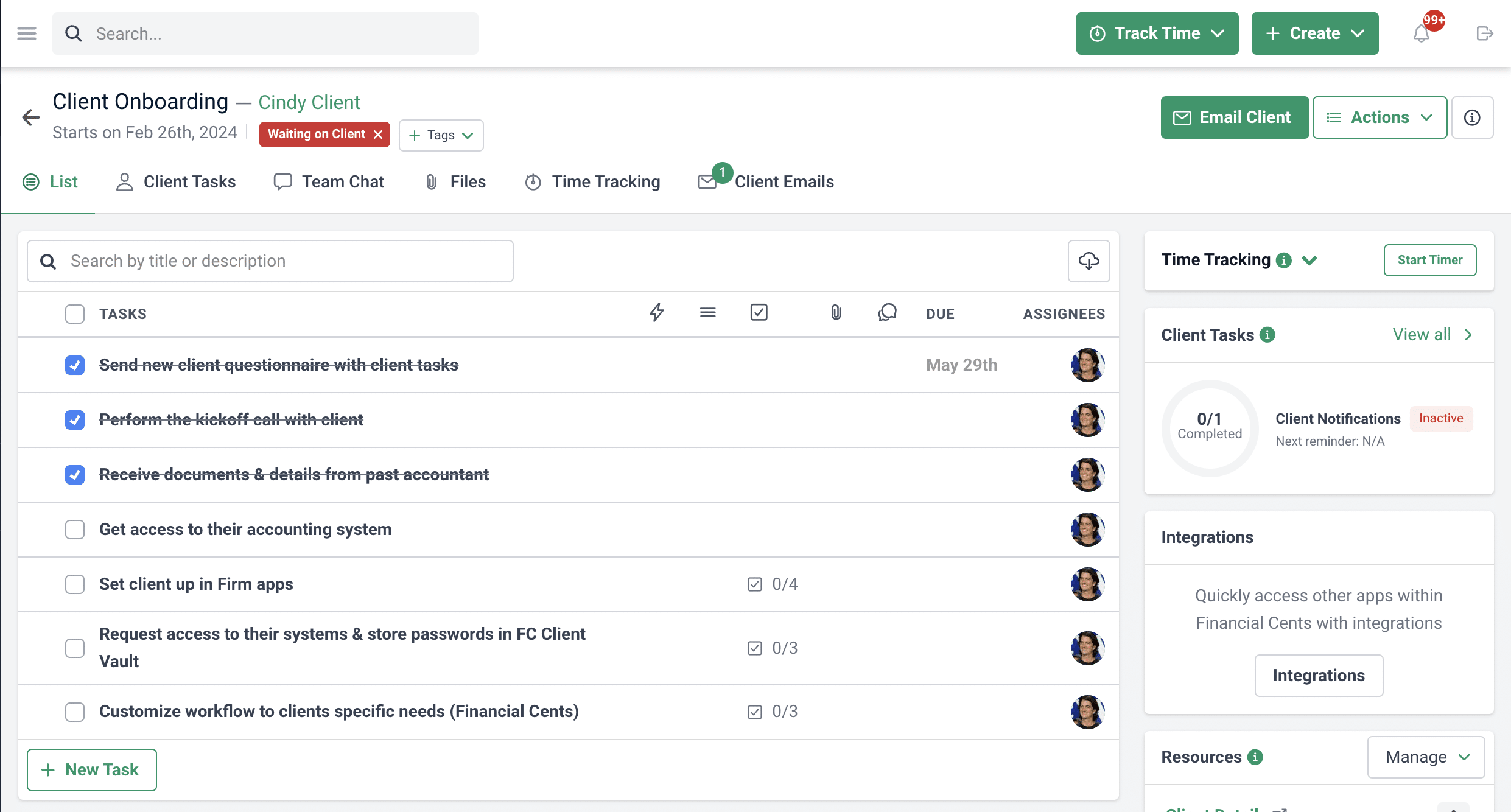

Interactive Onboarding Checklists and Task Management Tools

This duo: interactive onboarding checklists and task management tools work hand-in-hand to create a clear, collaborative roadmap for a smooth onboarding journey.

The checklists serve as a standardized guide for your firm, so every client is onboarded the same way regardless of whoever on your team is doing the onboarding. It lists all the necessary tasks and actions to carry out during the onboarding phase. With this, you guarantee the person in charge of onboarding doesn’t overlook any step, and they give every client the same high level of service.

Task management tools go one step further by allowing you to assign, track, and manage onboarding-related tasks. They have a centralized dashboard where you can monitor the progress of the client’s onboarding journey in real-time, set deadlines, and send reminders.

These tools provide a clear, organized view of everything, so nothing falls through the cracks and everything moves according to schedule.

Improved Communication Channels for Questions and Clarifications

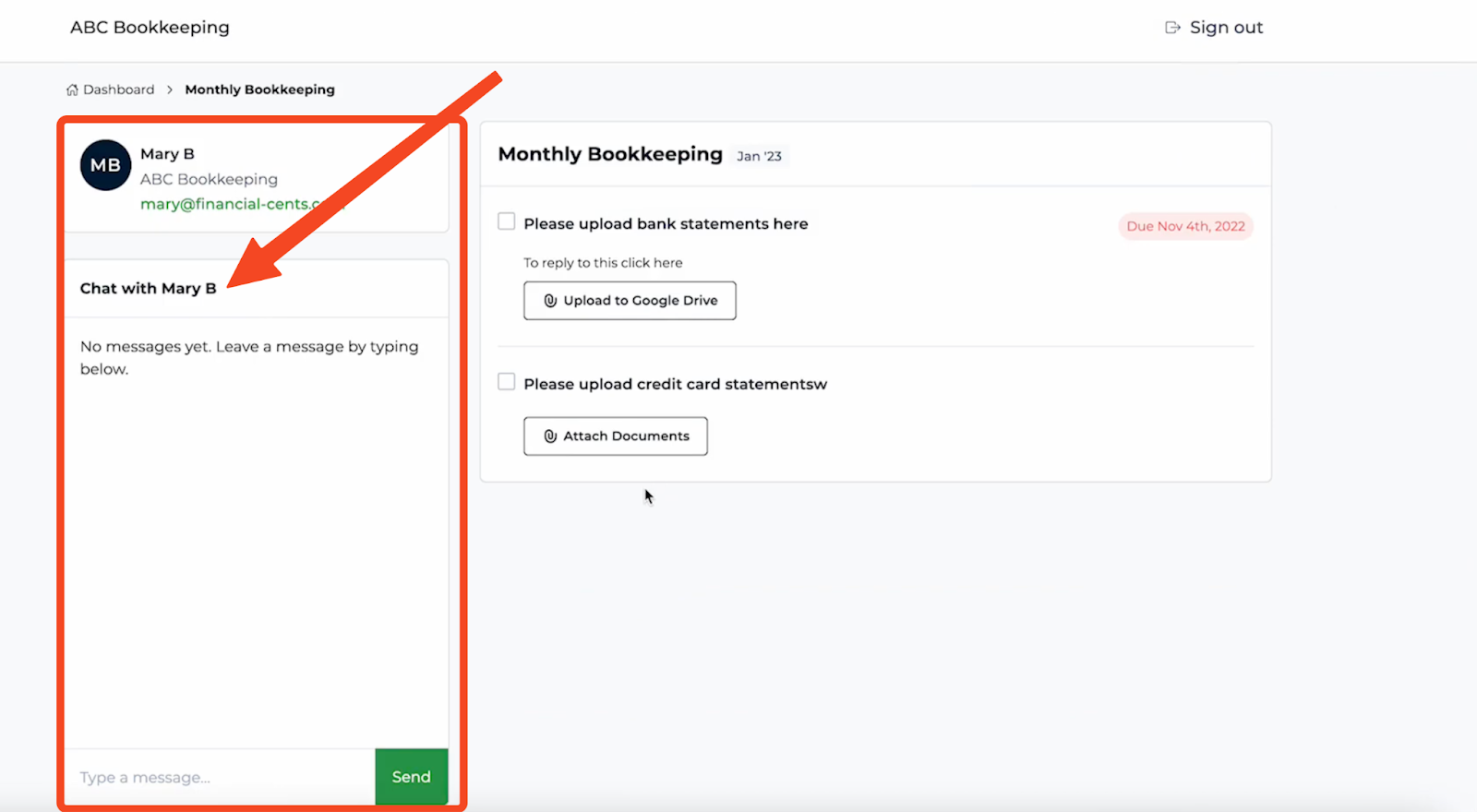

As mentioned earlier, accounting client onboarding software improves communication with clients. It often integrates a secure messaging system and chat functions directly within the client portal. This dedicated communication channel lets clients ask questions or seek clarifications in real time.

The immediate access to support helps address concerns promptly, preventing misunderstandings and keeping the onboarding process moving forward.

On your end, you can answer their inquiries directly within the portal, ensuring a clear and documented record of all communication. No more digging through email threads or relying on unreliable phone calls.

Accounting client onboarding software, like Financial Cents, sends automated email notifications and reminders. For instance, clients can receive automatic email alerts when a task is assigned to them or when a document requires their attention. These features ensure everyone stays on the same page and eliminate confusion from scattered communication channels.

Frees up Staff Time for More Valuable Tasks

Time savings is one of the major benefits of accounting client onboarding software. It eases your team’s life by taking over menial and repetitive tasks, allowing them to focus on more strategic and client-centric activities.

For example, the traditional onboarding of new clients often involves a mountain of administrative tasks. Manually chasing down signatures, entering data, and assembling welcome packages consume significant staff time. Onboarding software eliminates these tedious burdens through automation.

The software also helps clients to complete tasks independently. Interactive onboarding checklists guide them through the process, reducing the need for hand-holding and personalized explanations.

Your team can then dedicate their energy to what they do best: building relationships with clients, providing strategic financial advice, and being the best service providers they can be. This also frees up time to allow your team time to learn and grow into the best team member they can be.

This shift in focus ultimately leads to higher client satisfaction and a more profitable firm.

Creates a Professional Image From the Start

An accounting client onboarding software immediately helps firms establish a professional image by delivering a seamless and polished onboarding experience. It standardizes the onboarding process, ensuring every client receives consistent, high-quality service.

From the moment a new client engages with your firm, they encounter an organized, efficient system demonstrating you understand that their time is valuable, that you are a tech driven firm and your attention to detail is second to none. This reaffirms their decision to work with you and gives them confidence in not only you, but your team..

Features to Look for in a Client Onboarding Tool for Your Accounting Firm

When choosing an accounting client onboarding tool, there are a few key features to consider for the best results. They include:

Accounting Client Portal With Branding

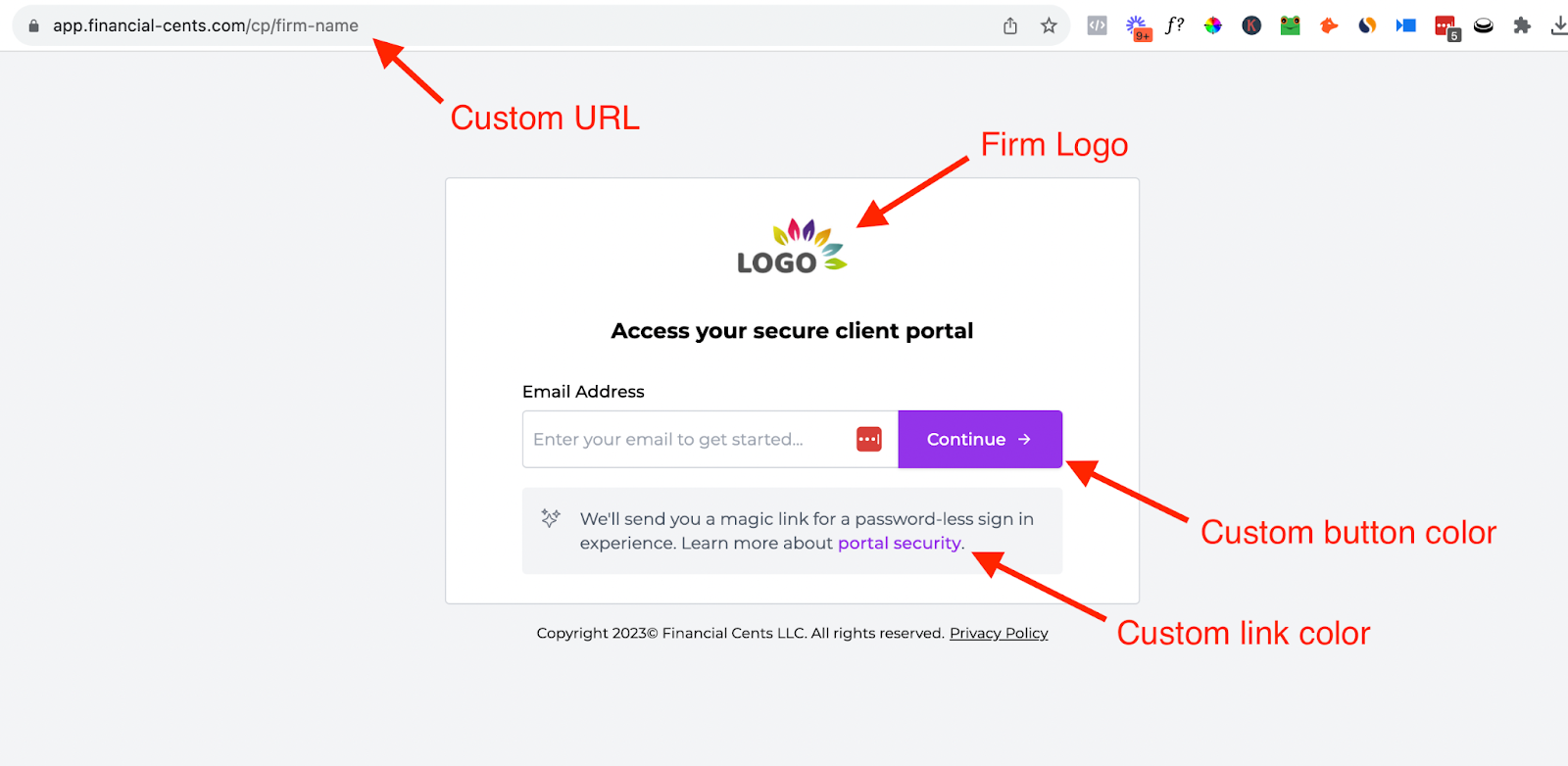

Look for software with a client portal for accountants and the option to customize it with your logo, colors, and branding elements. This personalized touch fosters trust and establishes a professional image from the very beginning.

Financial Cents offers this option. It’s designed specifically for accounting/bookkeeping firms — no forcing a generic tool to fit your needs. It has a secure portal where you can request for documents from your clients, and they can upload these documents and complete tasks.

You can also brand your portal by customizing the URL, color of the buttons and links and displaying your firm’s logo with Financial Cents.

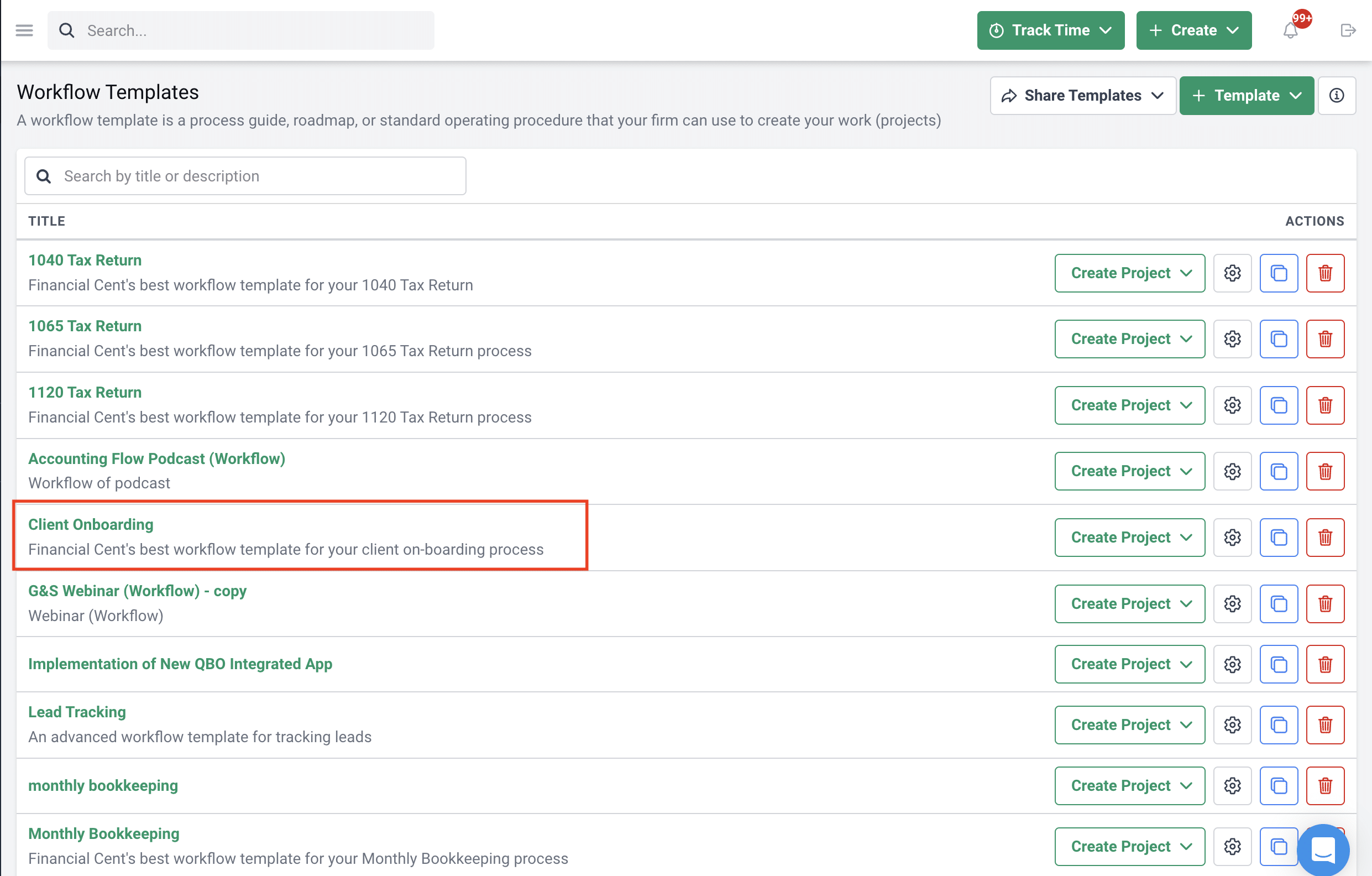

Customizable Onboarding Workflows and Checklists

A one-size-fits-all approach to onboarding won’t do because every client has different needs and problems.

So, go for a software that allows you to create customized onboarding workflows and checklists tailored to different client types. This ensures a pleasant experience by guiding each client through the specific steps relevant to their needs.

You can create templates and store them in Financial Cents for team use:

We also have 50+ free accounting checklists you can modify and use. Examples include:

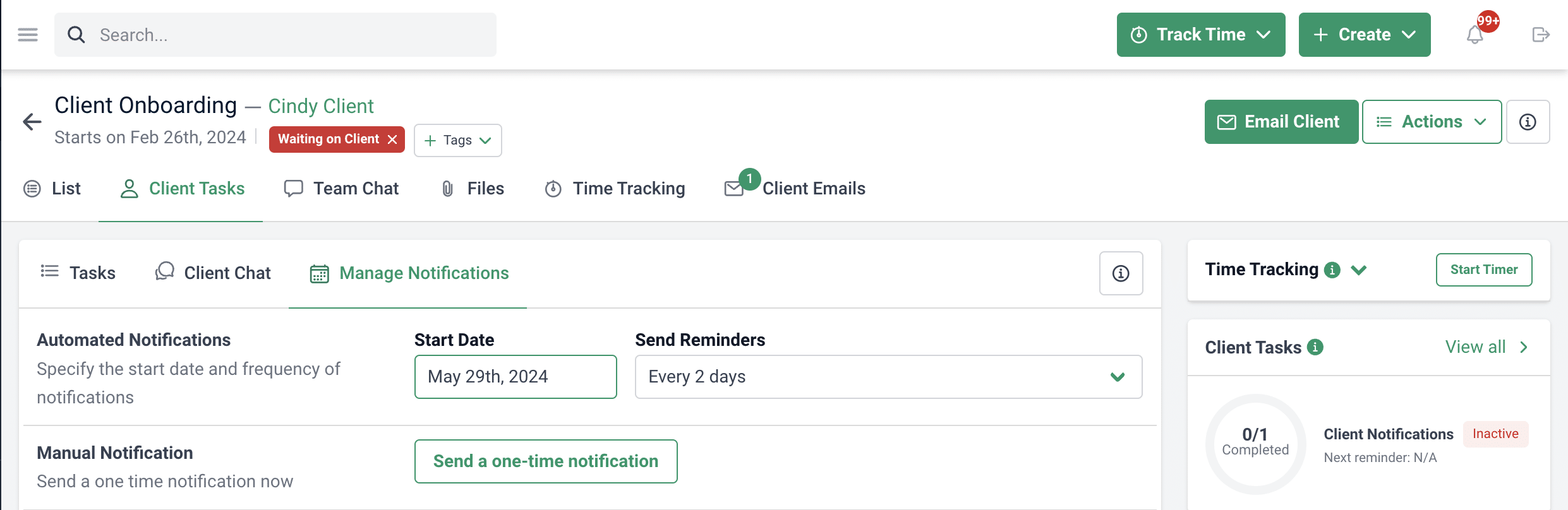

Automated Communication Tools and Task Reminders

To streamline communication between your firm and clients, look for a tool that can send automated notifications, updates, and reminders on your behalf. These can include reminders for document submissions, upcoming meetings, or status updates on the onboarding process.

Such automation keeps clients informed and engaged without requiring constant manual intervention from your staff.

Say you requested a document from your client with Financial Cents; you can set automated reminders at your preferred time intervals till the clients complete your request:

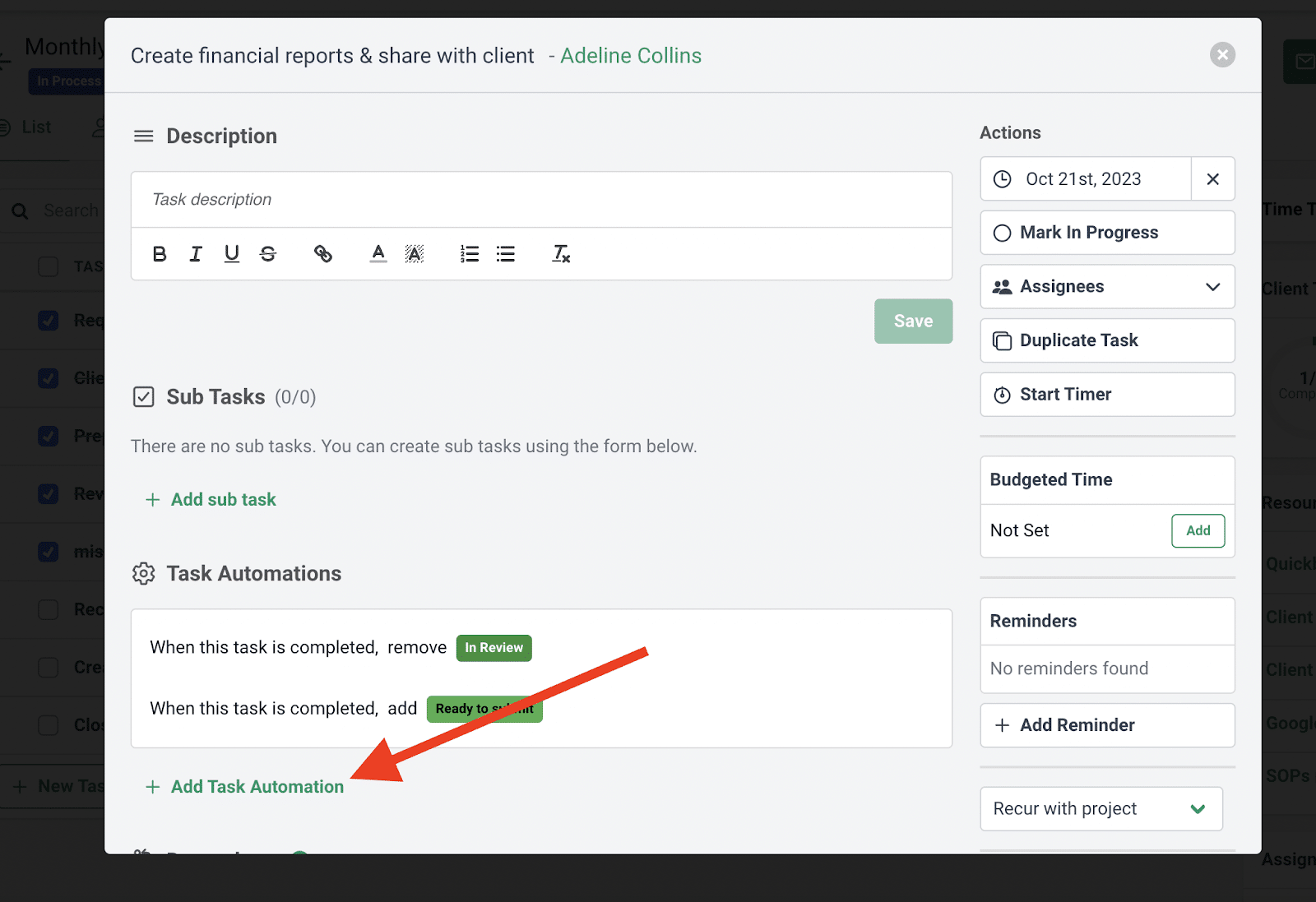

Another feature of the tool is “Task Automation” where it automatically sends customized emails to clients when triggered by the completion of certain tasks. For example, when your team finishes a task, Financial Cents can sends emails with either of the following:

- A calendar invite to schedule a meeting

- A survey to get feedback on the deliverables

- A link to the document management system for viewing the reports

- Or just a simple update on the status of the work so they are in the loop

To set up “Task Automation,” go to any task and click “Add Task Automation”:

Integration With Other Accounting Software

Seamless integration with your existing software is important for a streamlined workflow. Look for onboarding software that integrates with the tools you already use, such as tax preparation software or bookkeeping applications. This eliminates the need for manual data entry and double-handling of information, saving time and minimizing errors.

Financial Cents integrates with all your favorite apps like QuickBooks Online, Gmail, Outlook, SmartVault, Typeform, and Adobe Sign. It also integrates with Zapier, from which you can connect with over 5,000 different apps.

Security

Client data is sacred. So, choose software that prioritizes security with features like bank-grade encryption, access controls, and two-factor authentication. This guarantees the safety of your client’s financial information during and after your working relationship.

We take data security seriously at Financial Cents. That’s why we use OpenSSL encryption to provide AES-256 and AES-128 encryption. Also, all our encrypted values are signed using a message authentication code (MAC) so that their underlying value can not be modified once encrypted.

Dashboard for Clients

Finally, the client onboarding software you select should include a client dashboard where clients can access and manage their information.

They should be able to view uploaded documents, track the progress of their onboarding journey, and access important resources – all within one platform. This transparency increases trust and engagement. The client dashboard in Financial Cents allows clients to:

- Easily access requests, documents, reports, invoices and resources,

- Upload documents and other information,

- Communicate with your team.

This dashboard also provides you with the following:

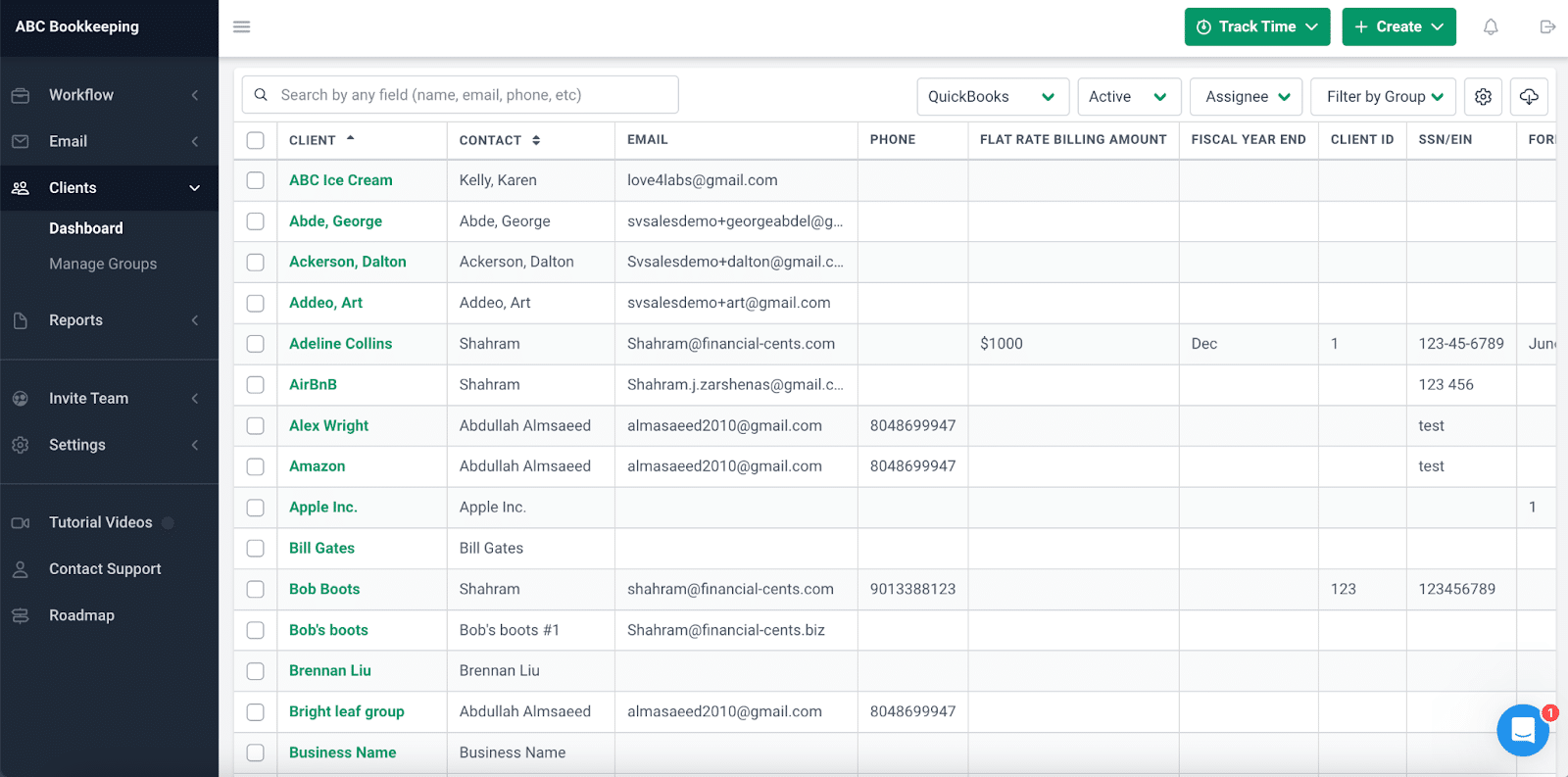

- An overview of all the clients you’re working with at a glance:

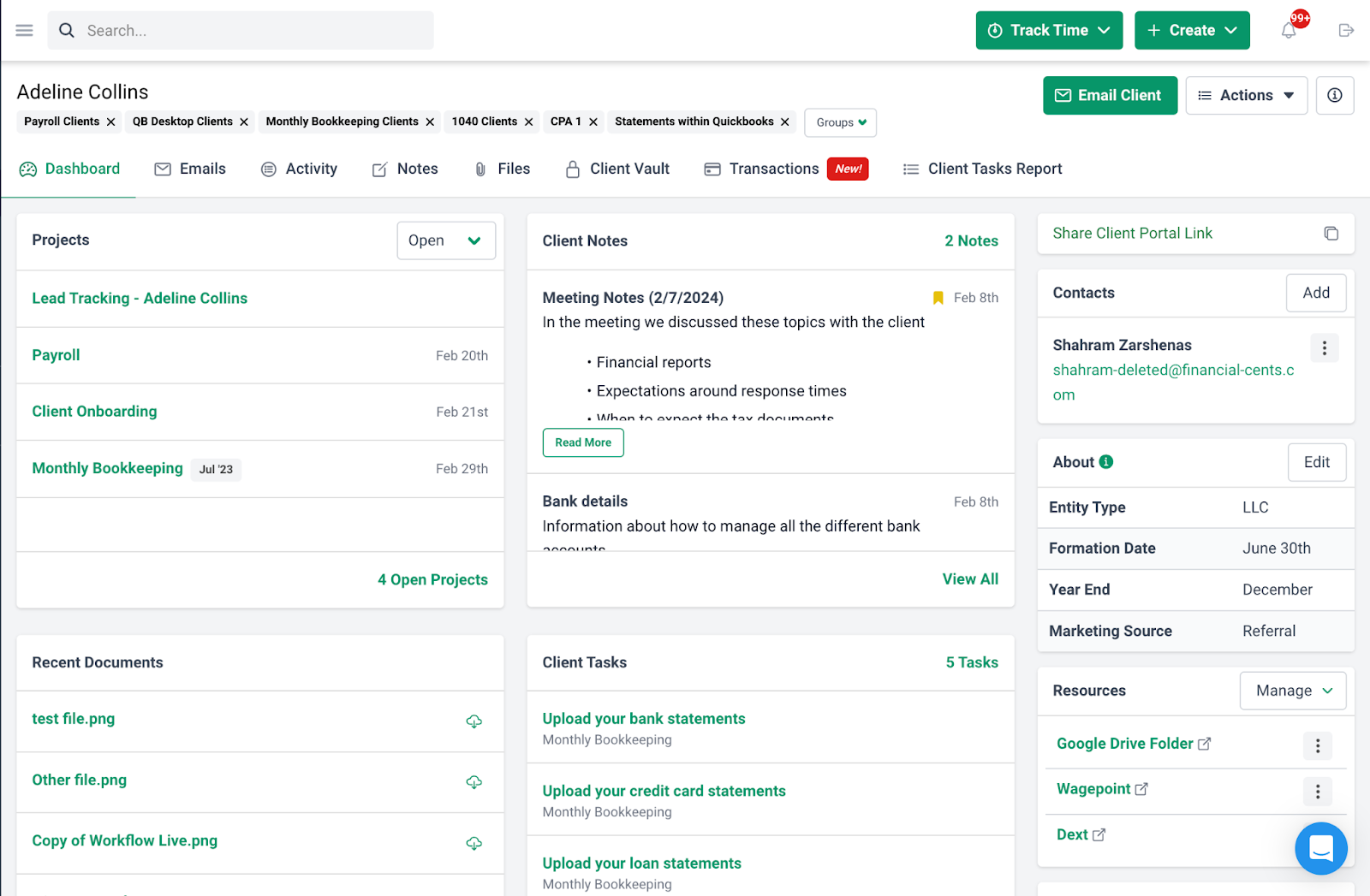

- Indepth information of each client (consisting of notes, documents shared, details about their business, ongoing projects, etc.):

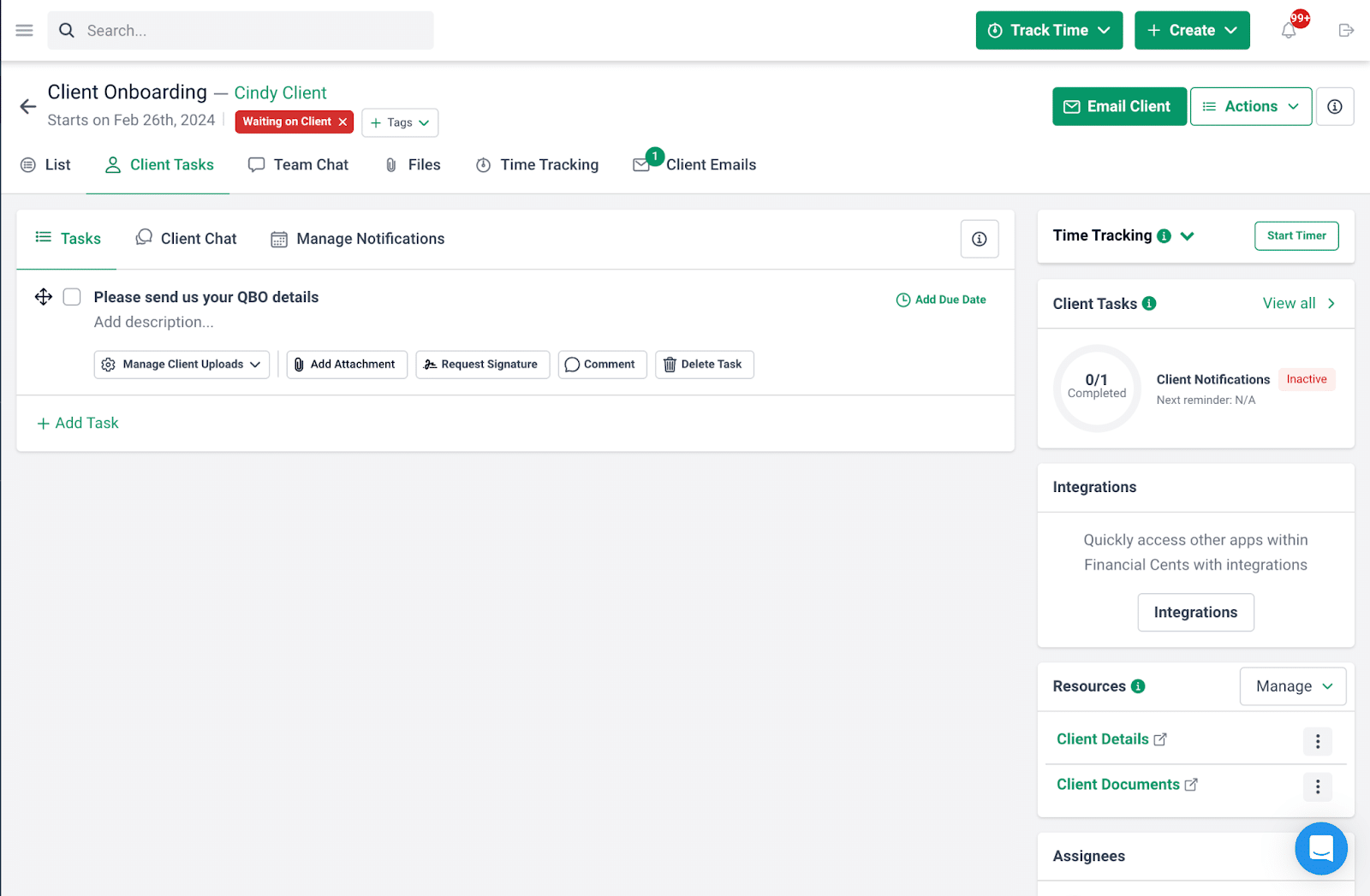

- Make requests:

- Chat with them:

- Categorize uncategorized transactions with ReCats, etc.

Clients don’t need a username and password to access this portal. It’s passwordless, meaning they can access it with a single click:

Always Leave a Good First Impression

Your first impression on a new client sets the tone for your entire relationship. A clunky process can quickly create frustration and cause clients to lose confidence in you.

To keep clients’ trust in you, use accounting client onboarding software. It streamlines data collection, automates workflows, and facilitates clear communication—all leading to a smoother, more efficient, and positive onboarding experience for your clients.

Remember, happy clients are loyal clients. They become your brand ambassadors, helping you bring in new leads. By investing in a good onboarding solution, you’re laying the foundation for long-term success.

Here at Financial Cents, we understand the importance of a seamless onboarding process. Our comprehensive client onboarding software offers all the above features and much more.

Beyond onboarding, Financial Cents is a practice management solution that helps you manage all aspects of your firm. This includes managing your workflows and tasks, tracking time, creating invoices, and generating detailed reports.

Use Financial Cents for your workflow management