Is tax season synonymous with sleepless nights and endless hours at your desk?"

For many accountants, it sure feels like it. The emails don’t stop. The deadlines pile up. And just when you think you’ve caught a break, another wave of client questions comes crashing in. If you’re stuck in the grind, you might be asking yourself, Is this the only way to do this?

This is exactly what Logan Graf tackled at WorkflowCon 2024. Logan, a CPA, tax expert, and founder of The Graf Tax Co., knows the stress of the busy season all too well. With a Master’s in Accounting from Texas Tech and a knack for productivity, Logan’s mission is simple: helping accountants like you reclaim your time without sacrificing quality.

In his WorkflowCon2024 session, Logan dove into the practical strategies he’s used to avoid those soul-crushing 80-hour workweeks—and they aren’t your typical “just delegate more” or “hire more people” tips. Let’s discuss the actionable steps to help you work smarter, especially when tax season tries to take over your life.

Why the Hustle Culture During Tax Season Needs to End

“Hustle harder.” “It’s just part of the job.” “Sleep is for April 16th.”

Tax season has become the poster child for hustle culture in accounting. You’re expected to put in grueling hours, meet impossible demands, and somehow survive on caffeine and stress. But this way of working isn’t just exhausting—it’s broken.

It’s not because you’re bad at time management. It’s because the system you’re working in is stacked against you. Think about it:

- Outdated workflows: Are you stuck inputting data manually into your tax returns?

- Unrealistic client demands: Do your clients think you’re on call 24/7 because it’s tax season?

- Poor boundaries: Do you feel guilty saying “no” to late-night requests, so you say “yes” to everything?

- Underpricing: Are you working triple overtime just to make fees that don’t reflect the true value of your expertise?

When you combine all these factors, it’s no wonder burnout is so common in our industry. The constant pressure leads to mistakes, missed opportunities, and most importantly, a serious hit to your quality of life. No family dinner, no weekends, no time to attend conferences that can improve your firm—it’s all work, all the time.

The problem isn’t you—it’s the system. The way you’re doing things currently. And the good news? Systems can be changed.

Creating capacity is creating more space to have a choice on what you want to work on and not what you have to work on"

Logan GrafSolution 1: Manage Your Client List

If you’re overwhelmed during tax season, one of the fastest ways to reclaim your sanity is by taking a hard look at your client list. Logan Graf calls it his “client nuking” process—and yes, it’s exactly what it sounds like. Twice a year, in April and September, Logan sits down and gets ruthless. He combs through his client list, identifies the ones who no longer fit, and… nukes them.

Why? Because all your work comes from your clients. If you’re overloaded, odds are your client list is bloated with people who drain your time, energy, and resources.

Maybe it’s the client who constantly misses information deadlines but expects miracles. Or the one who questions your fees like they’re haggling at a garage sale. Whatever the case, those clients are costing you more than they’re worth.

You don’t have to keep every contact, Logan says,

You need some clients to leave so you can free up capacity to improve your firm"

Letting go of bad-fit clients is one of the healthiest moves you can make for your accounting firm. When you clear out the clients who drain you, you create space for clients who respect your boundaries, value your expertise, and pay you what you’re worth.

Also, many of the wrong clients are wrong because their fees don’t reflect the time and energy they demand. Logan recommends adjusting your pricing as a way to nuke clients.

When pricing, consider that there’s a lot of opportunity cost when you work on projects that take a long time instead of completing multiple projects for more money in the same amount of time."

Logan GrafIf a client balks at paying what you’re worth, that’s a sign they’re not a fit.

Some pushback against pricing is good. No pushback means you need to bump up your pricing even more. You need some clients to leave so you can free up capacity to improve your firm"

Logan GrafFiring a client doesn’t have to be messy. You can use disengagement letters—clear, professional notes that let clients know you’re no longer a match or in Logan’s experience, use a tax return price increase template to inform clients of your new fees. He found that clients who took up most of his time replied to disengage from his services after being notified of the price increase.

Solution 2: Leverage Technology

If you’ve ever felt like your time is under attack during tax season, you’re not alone. Meetings, client questions, admin tasks—it’s never-ending. You don’t need to do everything. Instead, let technology take on the grunt work so you can focus on what matters.

That’s exactly what Logan Graf does. Logan thrives in the tax season—thanks to his tech stack, which includes project management, screen recording, calendar management, and form creation tools.

I try to use tech as much as possible to do admin tasks that take up my time. So that I don’t go crazy during the busy season."

Logan GrafTo implement these tools, you need to create an operational system for your firm. Look at your business through a lens of scalability and identify what challenges limit your firm’s capacity. Are client documents lost between emails and Google Docs? Do your teammates have the latest information on a client? Do clients need to be conferenced in to get updates?

Once you do that, ask your team what specific challenges they face and brainstorm ideas on how to solve them with your tech stack. To give you an idea, let’s look at some of Logan’s favorite tools.

Logan’s Go-To Tools (and How They Can Work for You)

1. Calendly for Scheduling

Hate the endless back-and-forth of finding a meeting time? Calendly solves that. You set your availability, clients pick a slot, and your schedule runs itself. Logan even blocks Mondays and Fridays entirely, so no one can book during his “focus days.” With tools like this, you’re not just saving time but protecting it.

As a business owner, your time is getting attacked by everything. Use a scheduling app to allow when you’re available to meet with anyone"

Logan Graf2. Typeform + Airtable + Zapier for Streamlined Intake

Logan takes client onboarding to the next level using Typeform, Airtable, and Zapier. Use Typeform to collect client details, connect it to Airtable for tracking, and let Zapier handle repetitive tasks like data entry or email follow-ups.

3. Loom for Client Communication

Instead of spending hours in live meetings, Logan records quick video walkthroughs of clients’ tax returns using Loom. These videos let clients get the answers they need—on their time, not yours.

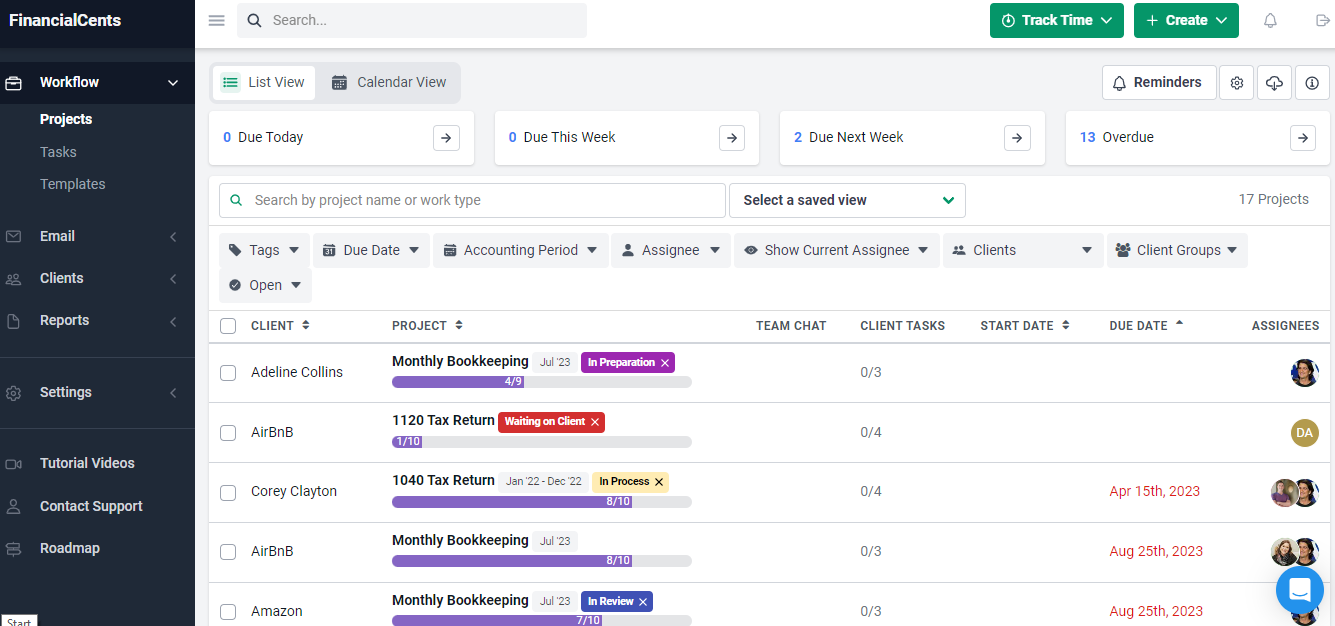

Beyond these tools, there are many more that you can add to your tech stack, one of which is Financial Cents. With it, you can manage your workflows, assign tasks to your team, and use automated reminders to keep everything moving without micromanaging.

Logan calls technology one of the best forms of leverage—and he’s right. These tools don’t just save time; they create space. Space to breathe, to think, to plan. Instead of drowning in admin tasks, you can focus on high-value work.

Solution 3: Establish and Enforce Boundaries

You want to help, you want to serve, and saying “no” feels like you’re letting people down. But without boundaries, your time, energy, and sanity will disappear.

Logan is unapologetic about setting boundaries—and sticking to them. He knows that saying “yes” to everything means saying “no” to his peace of mind. And for Logan, clear policies and service terms are the secrets to staying in control, even when the chaos of tax season hits.

Know What You Won’t Do

One of the quickest ways to create capacity is to decide what’s off the table. Logan calls this getting crystal clear on what you’re not going to work on.

For example, Logan avoids diving into unfamiliar tax laws outside his area of practice. Why? Because learning those laws might take hours—time he could spend completing five tax returns instead. The same goes for services outside your core expertise. Just because a client asks doesn’t mean you have to say yes.

Create Policies That Set Expectations

Policies aren’t about being strict—they’re about being clear. Think of them as your “rules of the road” for working together. They help accounting clients understand how you operate, so there’s less room for confusion.

Here’s an example from Logan: If clients don’t submit their documents by the information deadline, he can’t guarantee their return will be filed on time. Simple. Fair. Effective.

Setting these types of boundaries protects you from last-minute scrambles and puts the responsibility back on the client to meet your deadlines.

Limit When (and How) You’re Available

Controlling your schedule is another way to set boundaries. Logan protects his time by restricting when clients can book meetings. He blocks out Mondays and Fridays entirely and doesn’t take calls before 9 a.m. This gives him uninterrupted time to catch up, focus, or just breathe.

You can also set boundaries around how clients communicate with you. For example, let them know email is your preferred method and discourage texts or calls unless it’s urgent. The clearer you are, the more control you’ll have over your day.

Boundaries aren’t just good for you—they’re good for your clients too. When you’re not stretched thin, you’ll deliver better service, meet deadlines, and show up as your best self.

So, the next time you feel guilty about saying “no,” remember this: boundaries aren’t about being difficult. They’re about protecting your time so you can focus on doing great work—and keeping your sanity intact.

Mindset Shifts for Long-Term Change

If you’ve been stuck in the tax-season grind year after year, it’s easy to believe this is just how it has to be. Logan learned success isn’t about doing more. It’s about doing the right things – and you can too.

1. Saying No is a Strength

Accountants often feel like they have to take on everything. But here’s the thing: every time you say yes to something that doesn’t align with your goals, you’re saying no to something that does.

Saying no isn’t about letting people down—it’s about protecting your energy for what matters most. Start by asking yourself: Does this task move me closer to my personal or business goals? If the answer is no, let it go.

2. Delegation Isn’t a Weakness

As a business owner, it’s tempting to feel like you have to do everything yourself. But here’s the unconventional truth: delegating doesn’t make you less capable. It makes you more effective.

Logan uses both human capital and technology to lighten his load. Whether it’s automating admin tasks or delegating routine work to his team, he focuses on what only he can do—like strategic planning or high-valLearn how to avoid burnout during tax season with Logan Graf’s expert tips on managing clients, leveraging technology, and setting boundaries.ue client interactions.

What’s one thing on your plate that someone else could handle? Start there. Hand it off, and use that freed-up time for tasks that align with your strengths and goals.

3. Prioritize What Aligns with Your Vision

Tax season can feel like a never-ending to-do list, but not all tasks are created equal. Logan prioritizes focusing on work that aligns with his personal and business goals. That means knowing his limits, prioritizing high-value clients, and keeping his long-term vision front and center.

Here’s a quick exercise: Write down your top three goals (both personal and professional). Now, look at your task list. Are your daily actions helping you move toward those goals—or pulling you further away?

Conclusion

Tax season doesn’t have to feel like a never-ending grind. You’ve seen the toll it takes: late nights, burnout, and a constant sense of playing catch-up. But what if 2025 could be different?

The key is working smarter, not harder. And tools like Financial Cents make that possible. It’s more than just a tax workflow management tool—it’s a system designed to simplify your work, organize your team, and keep everything on track, even during the busiest times.

You’ve got the expertise. You’ve got the clients. Now, it’s time to give yourself the freedom to thrive. Take the first step. Start reclaiming your time today. Tax season won’t know what hit it.