Accounting firms don’t miss deadlines because of a lack of effort. They miss deadlines when:

- A client wouldn’t send the required information on time.

- Team members fall behind on their tasks.

Both situations are more likely when projects, deadlines, and client information are scattered across email inboxes, spreadsheets, calendars, and, worst of all, memory.

Without a centralized project management system, accounting firms often struggle to get the right staff to do the right work at the right time.

We started looking for accounting project management software to when we missed payroll for a client. There were too many clients and staff to keep up with, and we were relying on Outlook reminders. It became clear we had outgrown that simple way of managing work."

Denise May, Founder of BookPro IncEven when deadlines are known, managing projects with the wrong tools makes it difficult to meet them at scale. Tools without automation, visibility, and accountability force firms to rely on manual project tracking and last-minute efforts, which can break down easily as the firm grows.

In the 2025 State of Accounting Workflow and Automation Report, firms that implemented project management systems in 2024 reported a reduction in administrative tasks to less than one hour per week and a 4% increase in the number of firms meeting their deadlines more quickly.

This article discusses the ways accounting project management software saves firms the stress of reacting to deadlines by enabling them to manage recurring workflows, client collaboration, and team capacity.

Why Accounting Firms Struggle with Deadlines

Missed deadlines are usually the result of small workflow issues that have compounded over time, such as:

-

Disorganized workflows

Show me an accounting firm without clear workflows, and I’ll show you a team that duplicates and skips important tasks in a project (because team members are not sure who’s assigned to what task and what the next step should be).

In such firms, work is often left to the last minute, and during peak accounting periods, errors multiply, rework takes valuable time, and the ability to meet deadlines is compromised.

Without consistent workflows, firms also struggle to estimate the time a project should take, making planning, scheduling, and capacity management unreliable and increasing the likelihood of missed deadlines.

-

No visibility into who is working on what

Accounting firms are juggling dozens of active projects, so the easier they can view work status or client information, the more likely they are to meet deadlines.

But most of them rely on project management systems that force their staff to check multiple tools just to understand where a project stands, who owns each task, and what may be causing delays.

This lack of visibility creates blind spots that make it difficult to identify bottlenecks early enough to correct them. As a result, some tasks fall through the cracks or miss deadlines.

-

Manual tracking in spreadsheets

Spreadsheets can be a problem, especially during busy periods, like tax season or month-end close. They require accounting teams to manually update work information as project scope, deadlines, task status, and deliverables change.

Apart from the time and effort this consumes, it also compromises the team’s ability to update the sheets quickly enough, which can lead team members and managers to make decisions based on inaccurate data. The resulting confusion can put deadlines at risk.

-

Lost client documents or unanswered requests

Since accounting engagements depend on timely client collaboration to move forward, relying on email and other manual systems scatters client documents and requests across individual inboxes, which makes files difficult to locate and organize.

The process of searching for files and information wastes the time that could have been spent completing billable work.

Manual data collection systems also tend to receive fewer client responses and require staff to spend hours manually following up for missing documents. By the time the client responds, deadlines might already be at risk, forcing teams into last-minute work.

-

Inefficient communication

When conversations are spread across email, chat tools, and meeting apps, there’s no single source of truth for client or team communication, making it easy to miss important details and decisions.

As a result, team members waste time searching for context, clarifying instructions, or unknowingly duplicating work that’s already been completed.

These inefficiencies slow down workflows and make accounting deadlines harder to meet.

-

Overbooked team members

It is difficult to plan capacity for your team when you can’t see how much work each team member already has on their plates. More often than not, high-performing team members are overloaded while others remain underutilized.

This imbalance creates bottlenecks and increases the risk of employee burnout, which you may notice only when several projects have exceeded due dates.

-

Lack of standardized processes

When accounting firms rely on manual and disconnected systems, creating and enforcing standard operating procedures (SOPs) is more difficult.

The lack of standardization increases task turnaround time for new staff and makes quality dependent on individual effort rather than established procedures.

As the firm grows, this inconsistency slows down workflows, increases rework, and makes it harder to meet client deliverables.

Key Project Management Features That Help Accounting Firms Hit Deadlines

Accounting project management tool is built specifically for accounting workflows, with features that directly address the most common reasons accounting deadlines are missed.

These include:

-

Deadline & Task Tracking

The system assigns each task to a specific team member, creating clear accountability for accuracy and timeliness.

The Task Assignment feature combines this with due dates, dependencies, and real-time progress tracking features to help teams monitor every task and address workflow bottlenecks before they snowball.

The workflow dashboard shows upcoming deadlines and the status of each project, giving firm owners and managers a firm-wide visibility to keep work on schedule.

-

Recurring Workflow Automation

Recurring workflow automation automatically creates repetitive projects on a weekly, monthly, quarterly, and annual basis.

Automating these recurring tasks allows teams to focus on completing the work itself (rather than remembering and recreating it all the time), which reduces the risk of missed deadlines.

-

Workflow Templates

Workflow templates define the standard steps for your client engagements, like payroll processing, a tax return, a month-end close, or an advisory project.

These standard operating procedures (SOPs) minimize missed steps, expedite workflows, and enable teams to deliver timely and consistent services to all clients.

-

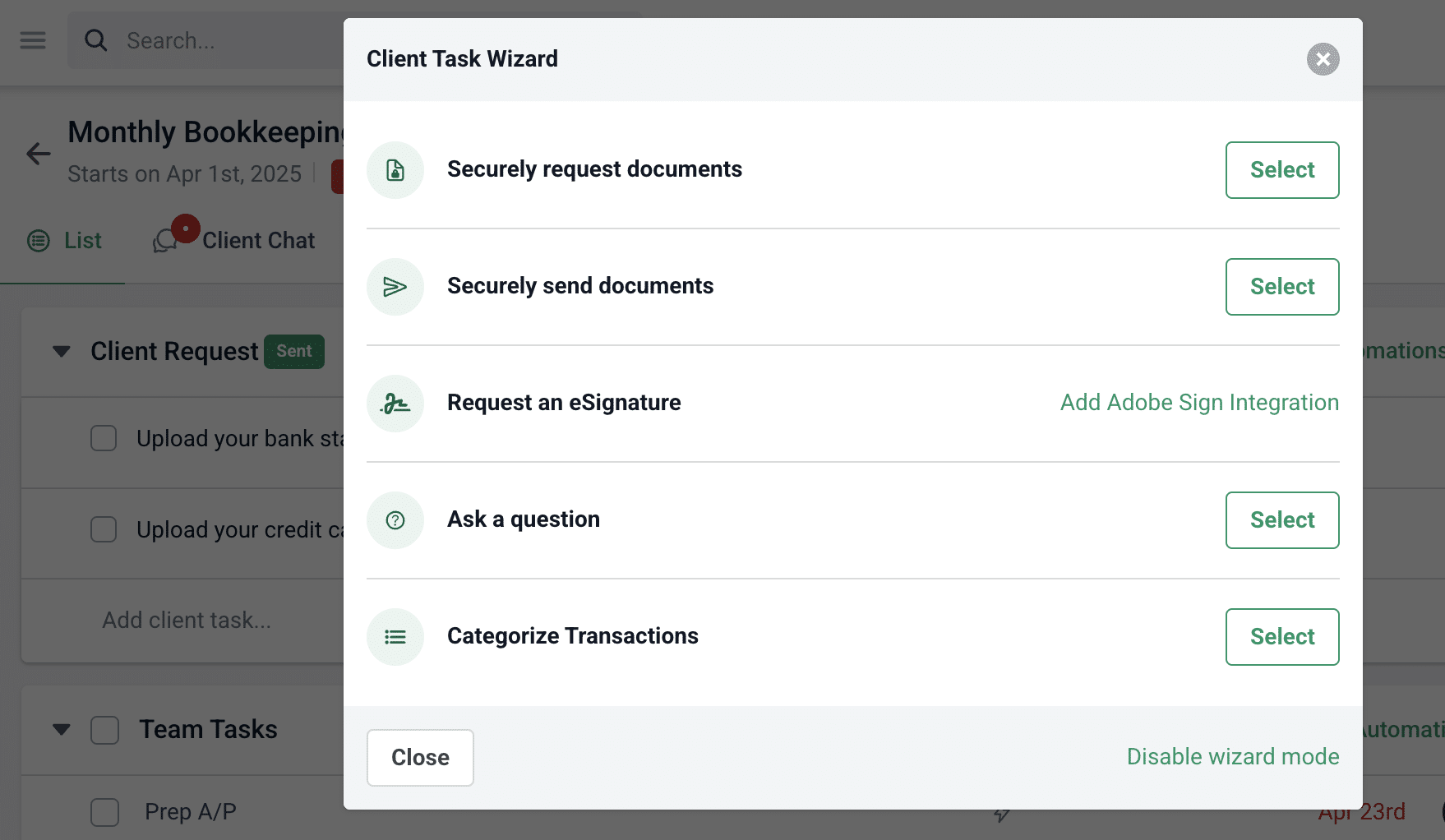

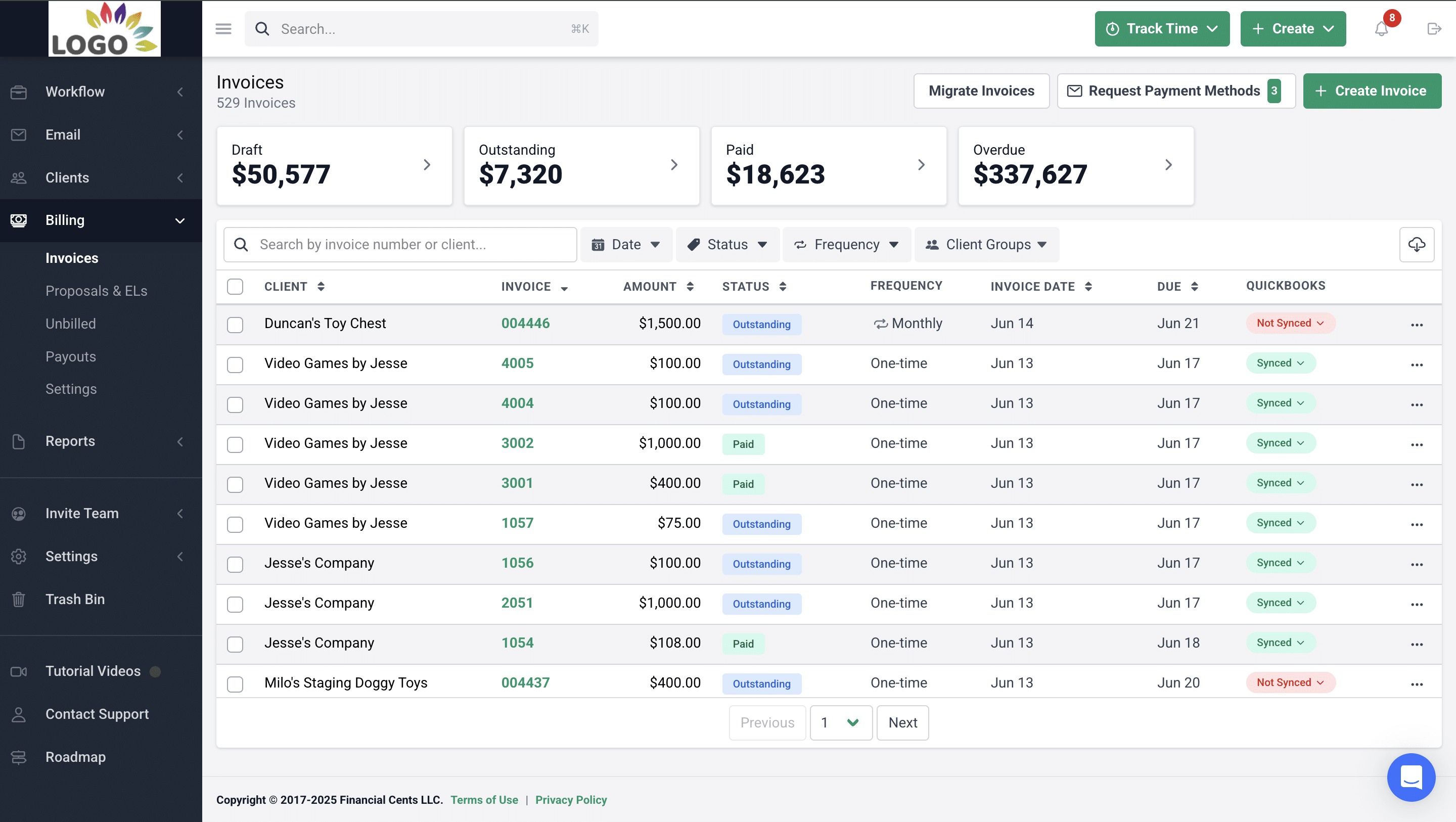

Client Document Request Automation

The document request feature automatically sends document request checklists to clients when needed. These checklists show clients what is required and make it easy for them to submit documents on time.

The software also follows up with automated reminders until the documents are provided, saving your staff the stress of following up by email and phone calls.

All requests are tracked, and documents are organized centrally, ensuring visibility for everyone on the team to increase productivity.

-

Team Capacity & Workload Visibility

Project management software shows the tasks assigned to team members, so that firm owners can manage team capacity effectively.

This includes the ability to reassign work from overloaded team members to prevent burnout and reduce the risk of missed deadlines caused by uneven workloads.

-

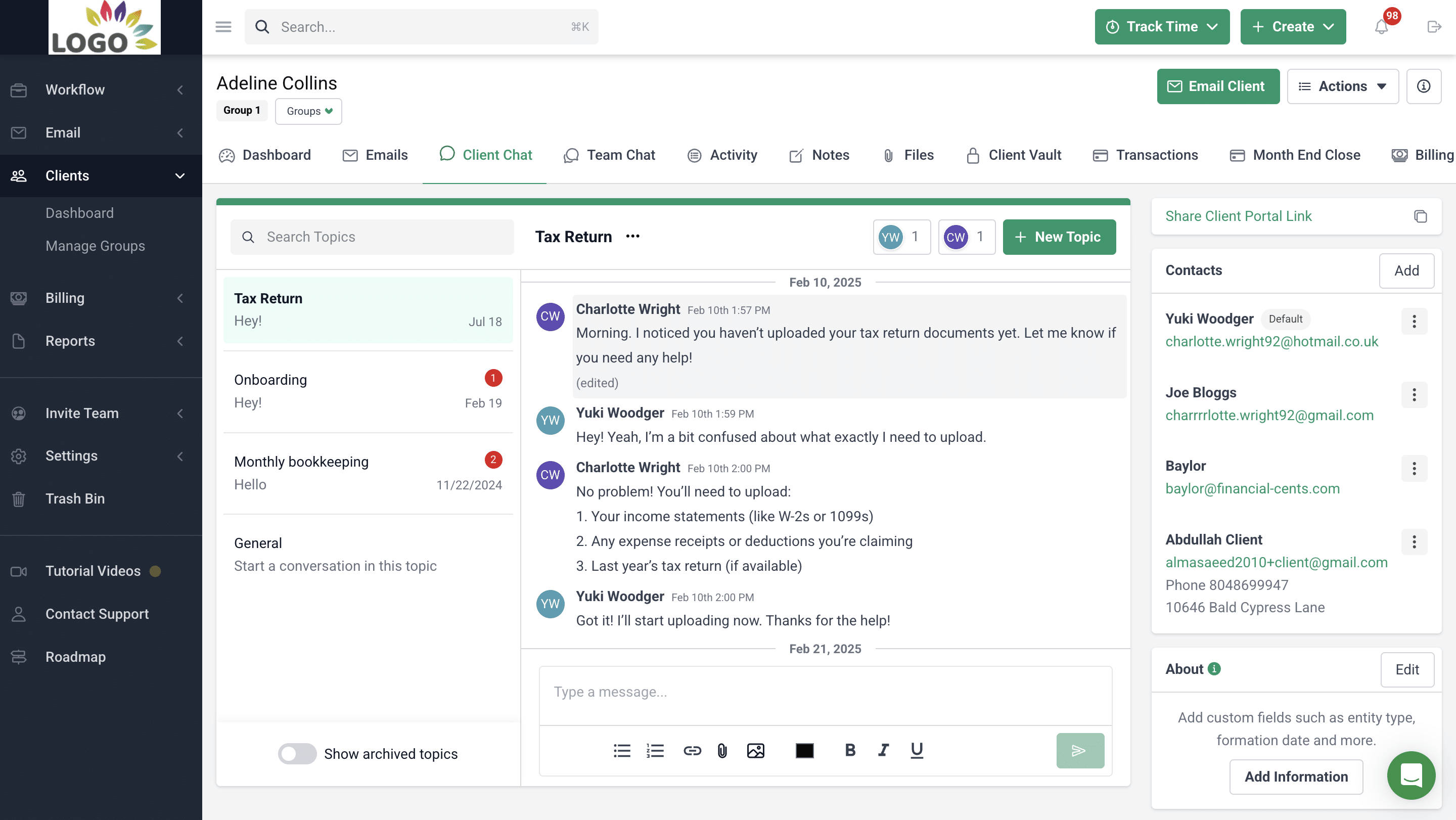

Centralized Communication

Project manage software for accounting tasks stores all task-related conversations in a single, centralized location where every team member can view them.

In that location, team members can use comments and tags to communicate, keeping everyone in the loop and ensuring context is clear.

This reduces miscommunication and the stress of searching through multiple email threads to understand client work.

-

Real-Time Dashboard & Reporting

Dashboards provide real-time visibility into task progress, upcoming deadlines, and at-risk projects.

These insights enable accounting teams to identify workflow challenges early and take timely action to keep projects on schedule to meet deadlines.

How These Features Directly Prevent Missed Deadlines

Together, the features of accounting project management actively address the root causes of delays and turn chaotic processes into reliable service delivery by:

-

Eliminating forgotten tasks

Relying on memory to manage client work can lead to tasks being forgotten, created too late, or tracked inadequately.

Accounting project management software removes this risk by automatically creating tasks and recurring workflows at the right time for your repetitive engagements.

With clear due dates in place, firms can see when each project and task is expected to be completed, allowing them to plan and allocate resources effectively to meet deliverables on time.

Every one of my team members can easily see what they need to do because they can create a view that shows all the projects they're assigned to. They can see what they're doing, when they're the next assignee on a project, and we can get an overall view of who's working on what."

Shannon Ballman Theis, Founder of Payroll Restoration-

Reducing delays caused by missing client documents

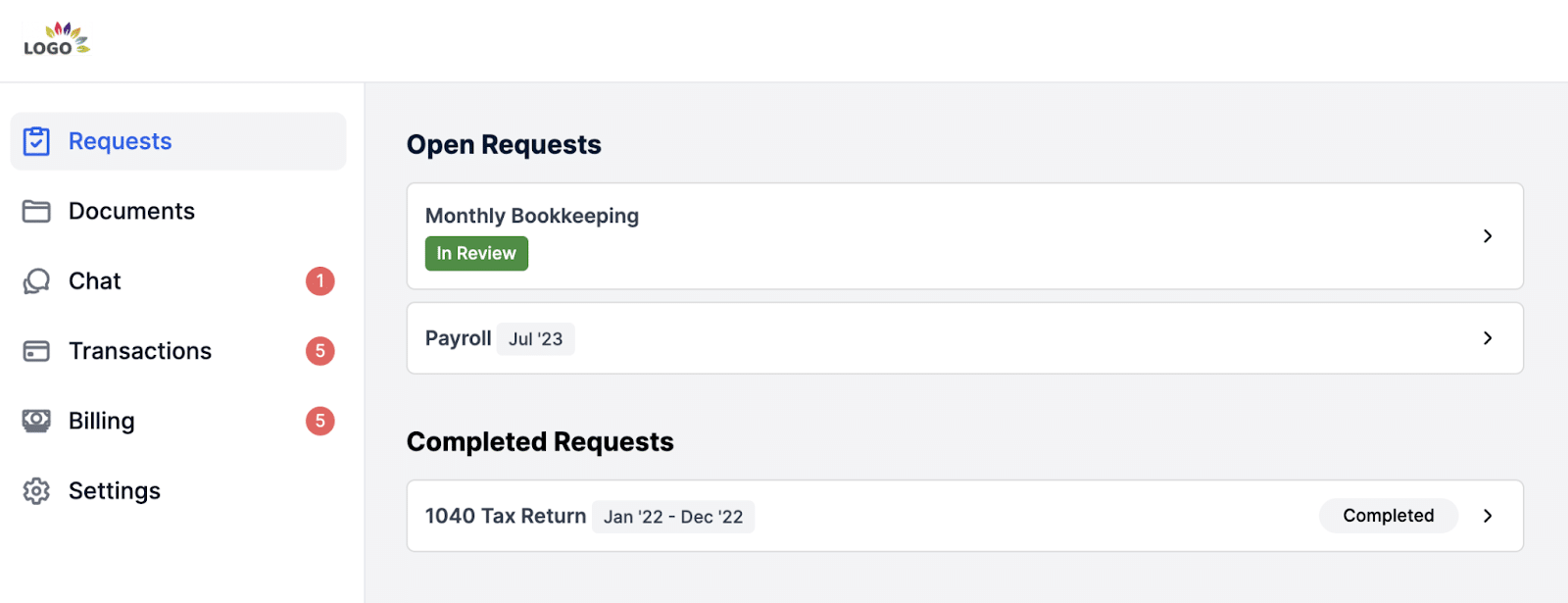

Accounting project management tool with inbuilt accounting crm automate client document requests by sending an email with a link that takes clients to a secure portal where they can easily upload required files.

While these structured checklists clearly communicate what information is needed, the accompanying automated reminders follow up with clients until the documents are received, which reduces email back-and-forth and minimizes incomplete submissions.

All uploaded documents are automatically organized and stored in the appropriate folders to centralize client information for easy retrieval.

-

Improving team collaboration

Clear task ownership, centralized communication, and automated task and project updates ensure every team member has access to the same client and work information.

The system ties comments, emails, and notes directly to projects and clients.

This enables teams to collaborate more smoothly, hand work off with confidence, and avoid searching for context or duplicating effort. The result is faster execution, less friction, and fewer reasons to miss deadlines.

-

Increasing accountability

Task assignments, due dates, and status tracking make task ownership and expectations visible across the entire team.

Each task has a clear owner who can track progress against deadlines, and managers gain the visibility needed to follow up early, address delays, and provide support to help team members complete their tasks on schedule.

-

Helping managers see timeline risks early

Workflow and capacity dashboards give firm owners real-time visibility into the status of client work and the hours of work each team member has on their plate.

This visibility helps managers identify early warning signs, such as delayed client responses and overextended staff, all of which can push deadlines off track if left unaddressed.

With these insights, managers can take action before problems worsen, either by redistributing work from overbooked team members, adjusting timelines, or proactively following up on outstanding client requests. The result is fewer surprises and more timely deliverables.

Practical Steps to Hit More Deadlines Using Project Management Tools for Accounting Firms

Step 1: Document your recurring workflows

The first step to hitting deadlines is to clearly document the steps required to complete your processes, especially the complex and recurring ones.

Well-documented workflows show the steps that should be taken at every stage of a project to eliminate guesswork and keep projects on schedule.

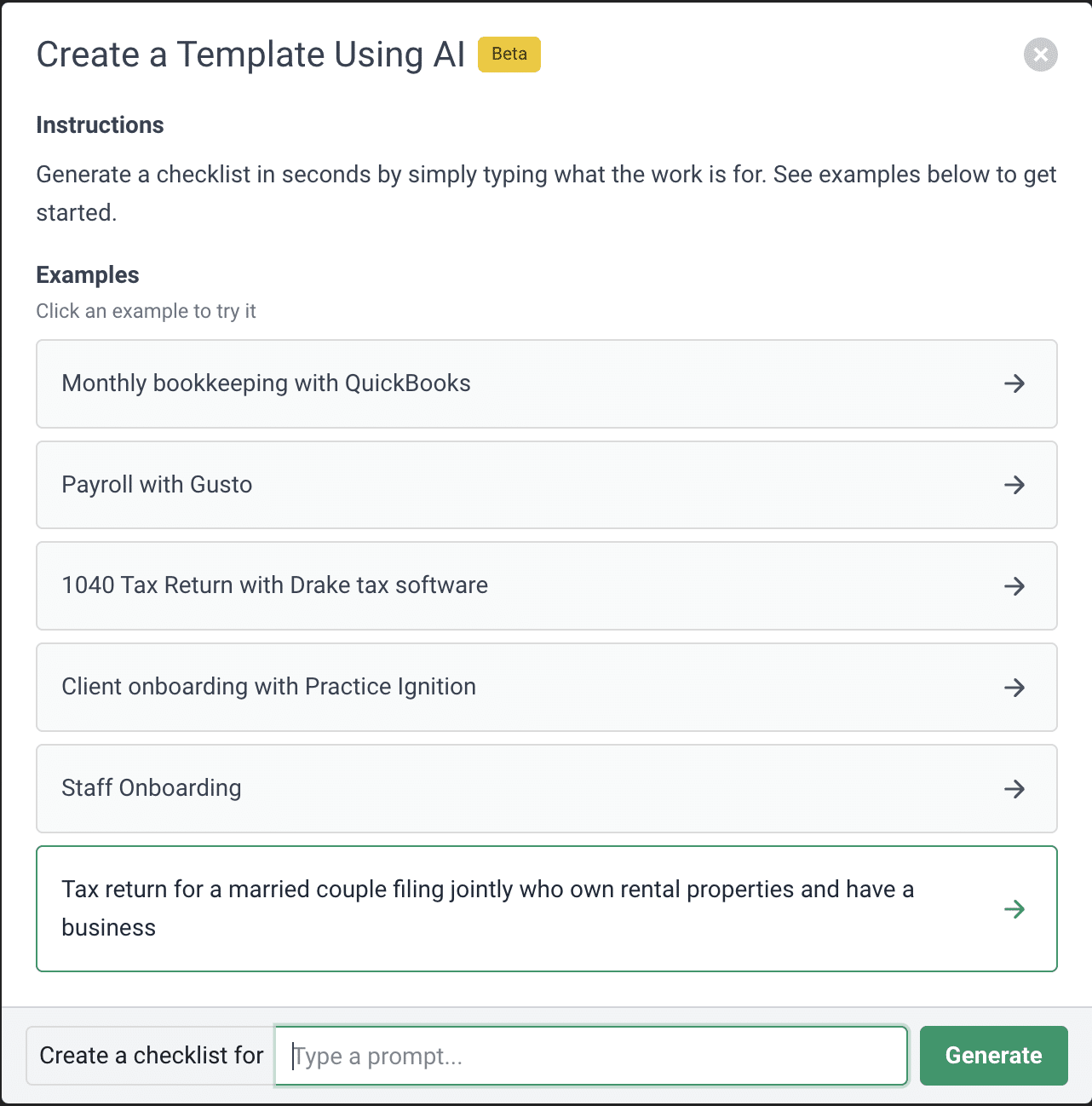

Financial Cents’ Workflow Templates feature provides pre-built checklists for your common accounting processes, like month-end close, client onboarding, and tax preparation. You can customize them to suit your preferences by adding the steps that are relevant to your team and removing those that aren’t.

You can also document your processes using the AI inside feature Financial Cents. You simply enter the process you want to document, and it will generate a list of tasks that make up that process in seconds.

For solo firm owners, documented workflows make onboarding new staff faster and position them to complete their tasks more quickly and hit their deadlines more consistently.

Step 2: Set up templates for common services

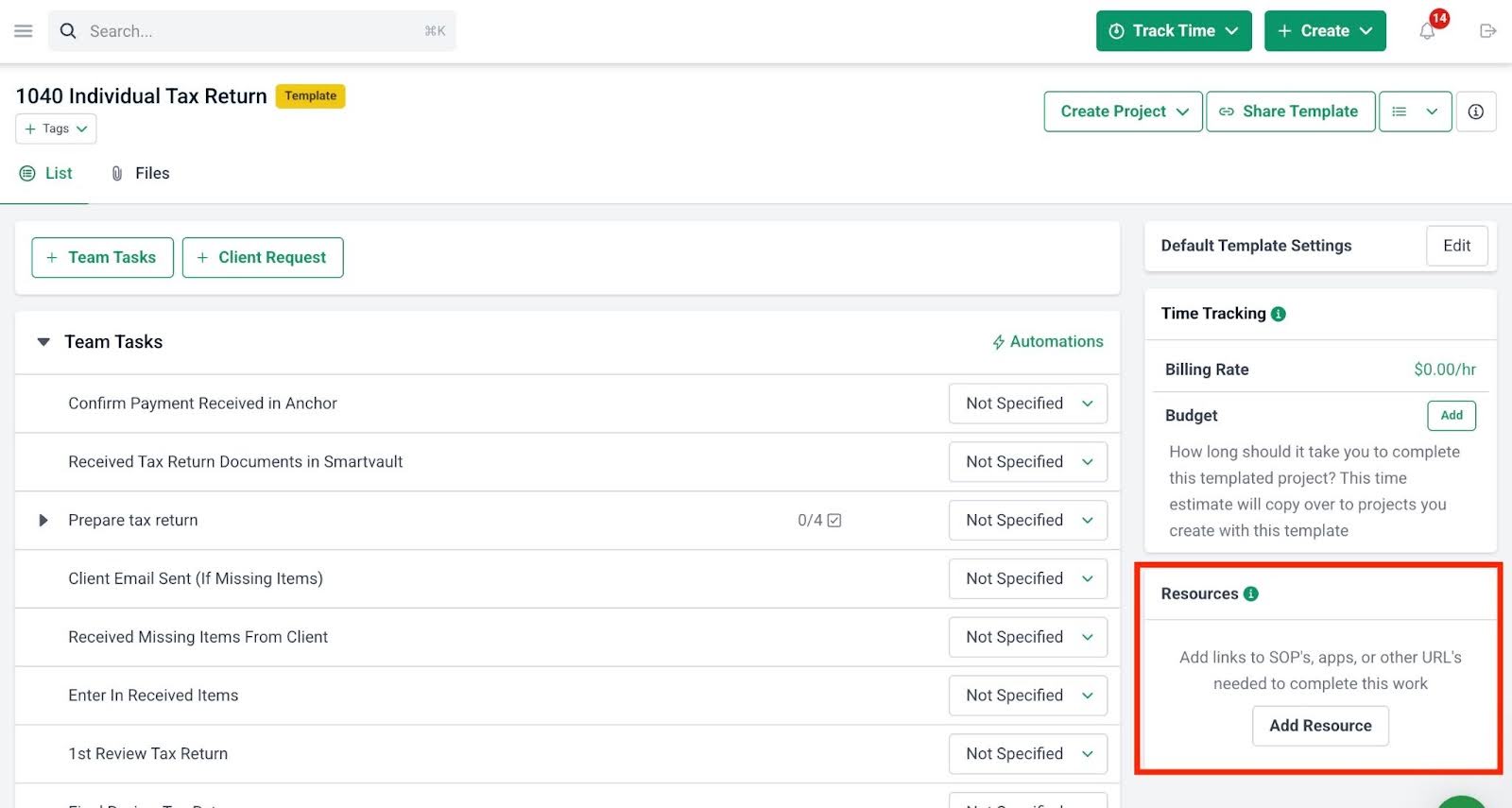

Once your workflows are documented, the next step is to convert them into reusable templates for your common services.

Financial Cents templates allow you to instantly create projects (whether it’s monthly bookkeeping, payroll, or advisory work) for multiple clients without rebuilding tasks from scratch.

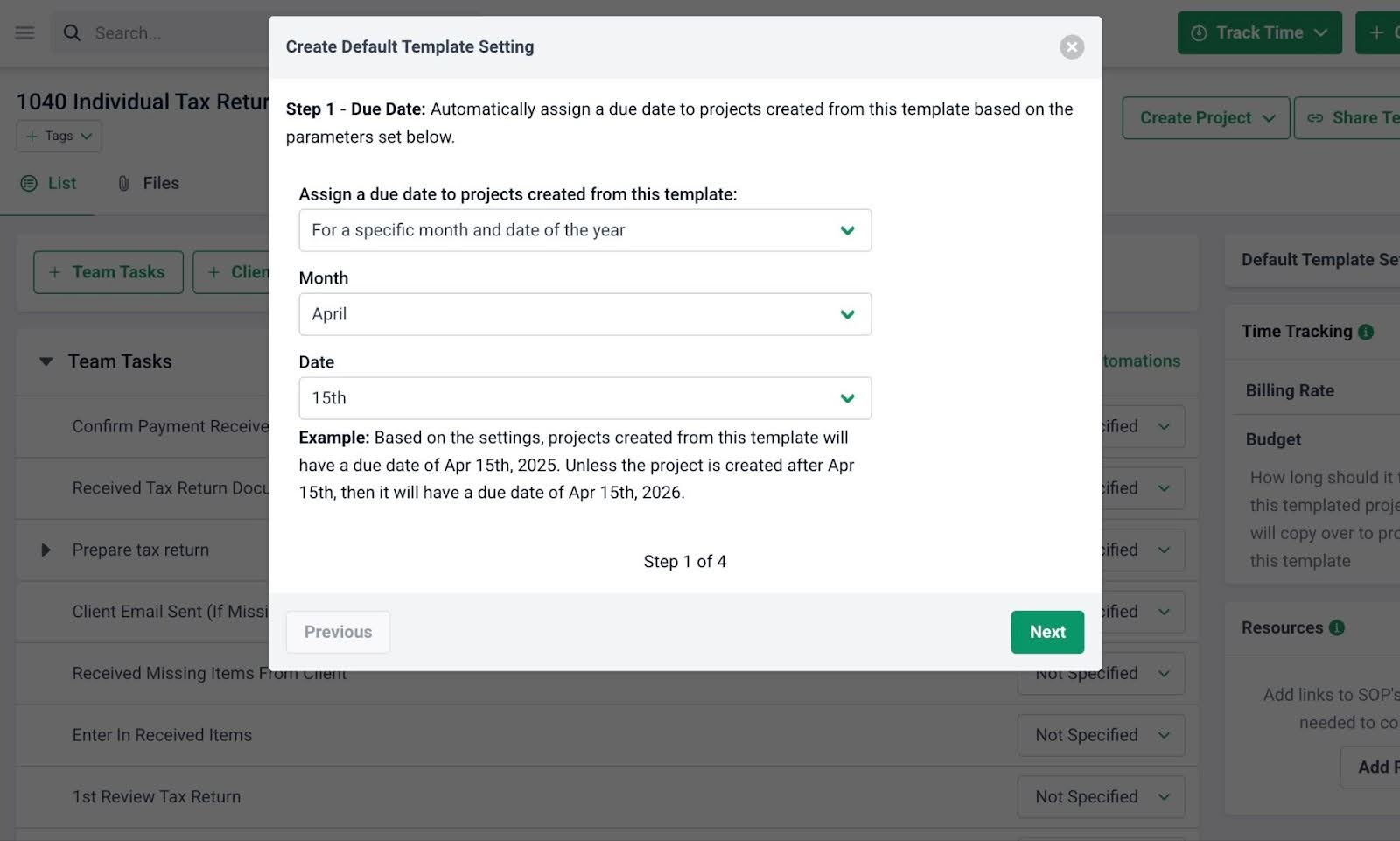

The Default Template Settings enable you to convert workflow checklists into templates, complete with built-in rules that automatically:

- Set due-date constraints that determine when work should start and when it should be completed.

- Define recurring frequencies so projects automatically follow a weekly, monthly, quarterly, or annual cycle.

- Pre-assign tasks using role-based placeholders to ensure responsibilities are assigned to the right team members when projects are created from the template.

With the Template Resources feature, you can add the workflow information to your templates:

- Links to the apps used to complete the work.

- SOP documentation stored in Google Docs, OneDrive, etc.

- Training videos.

- Links to your firm’s third-party document storage systems.

By embedding this information directly into templates, your team avoids recreating setups, searching for instructions, or guessing how work should be done, which saves their time, reduces errors, and keeps every project on track.

Step 3: Create Projects and Assign Tasks to Your Team

This step helps you to organize the client’s work and establish ownership to reduce confusion and increase team alignment.

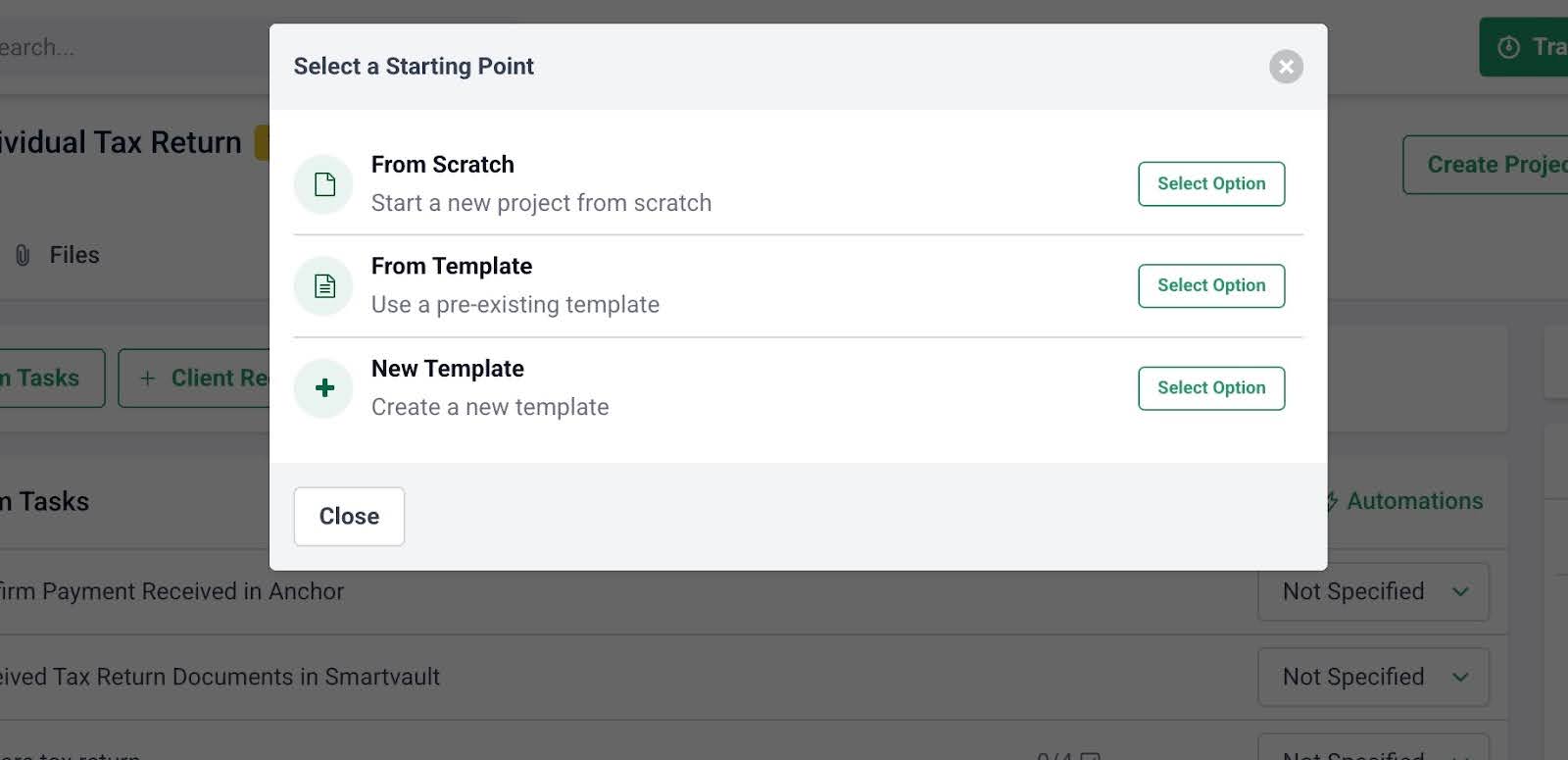

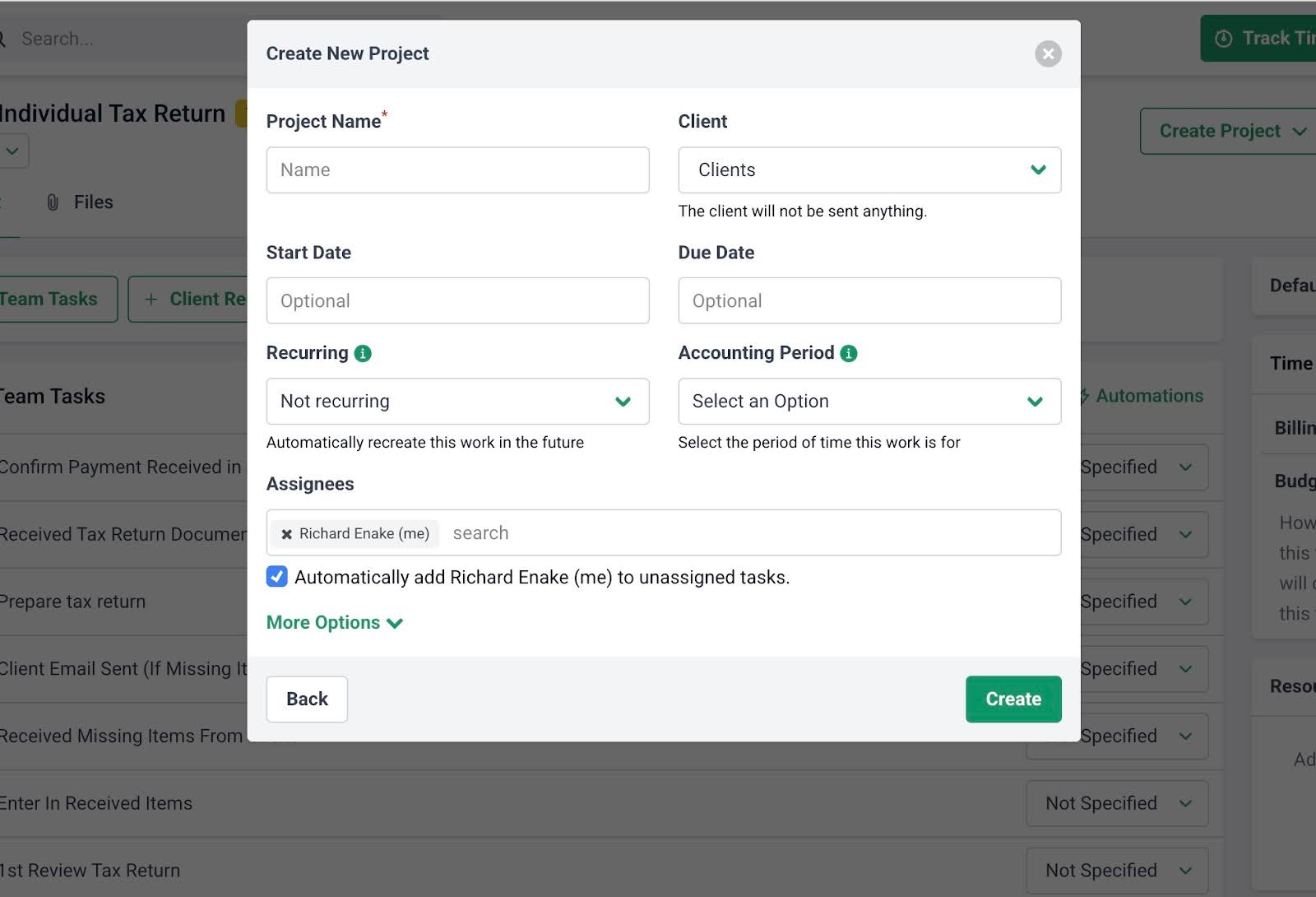

In Financial Cents, projects can be created either from scratch or from templates.

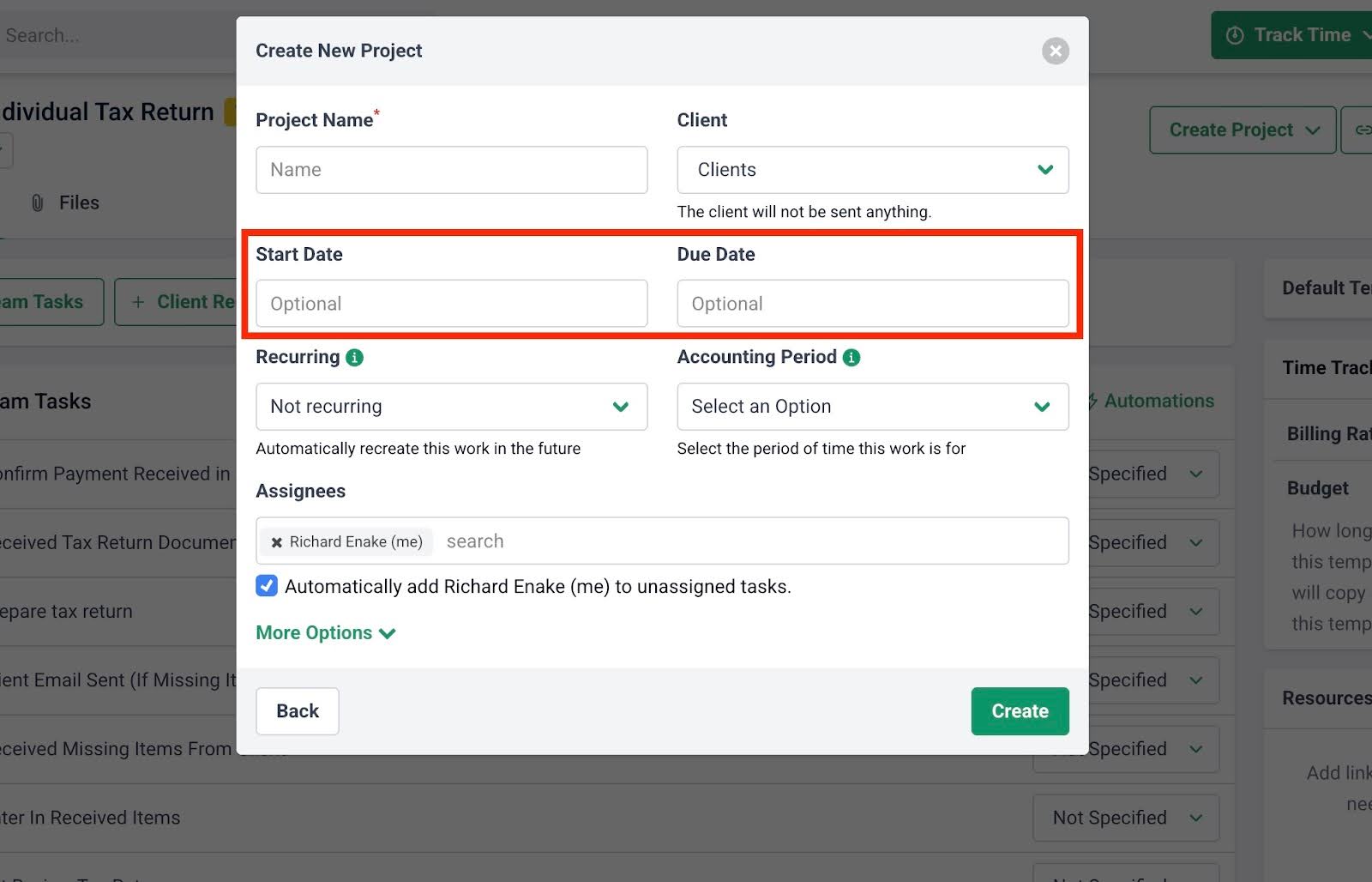

When creating a project from scratch, you simply have to enter key details such as the project name, client, due dates, and recurring frequency.

When creating a project from a template, most of this information is already preconfigured to save your time and ensure consistency. You only need to adjust any client-specific details.

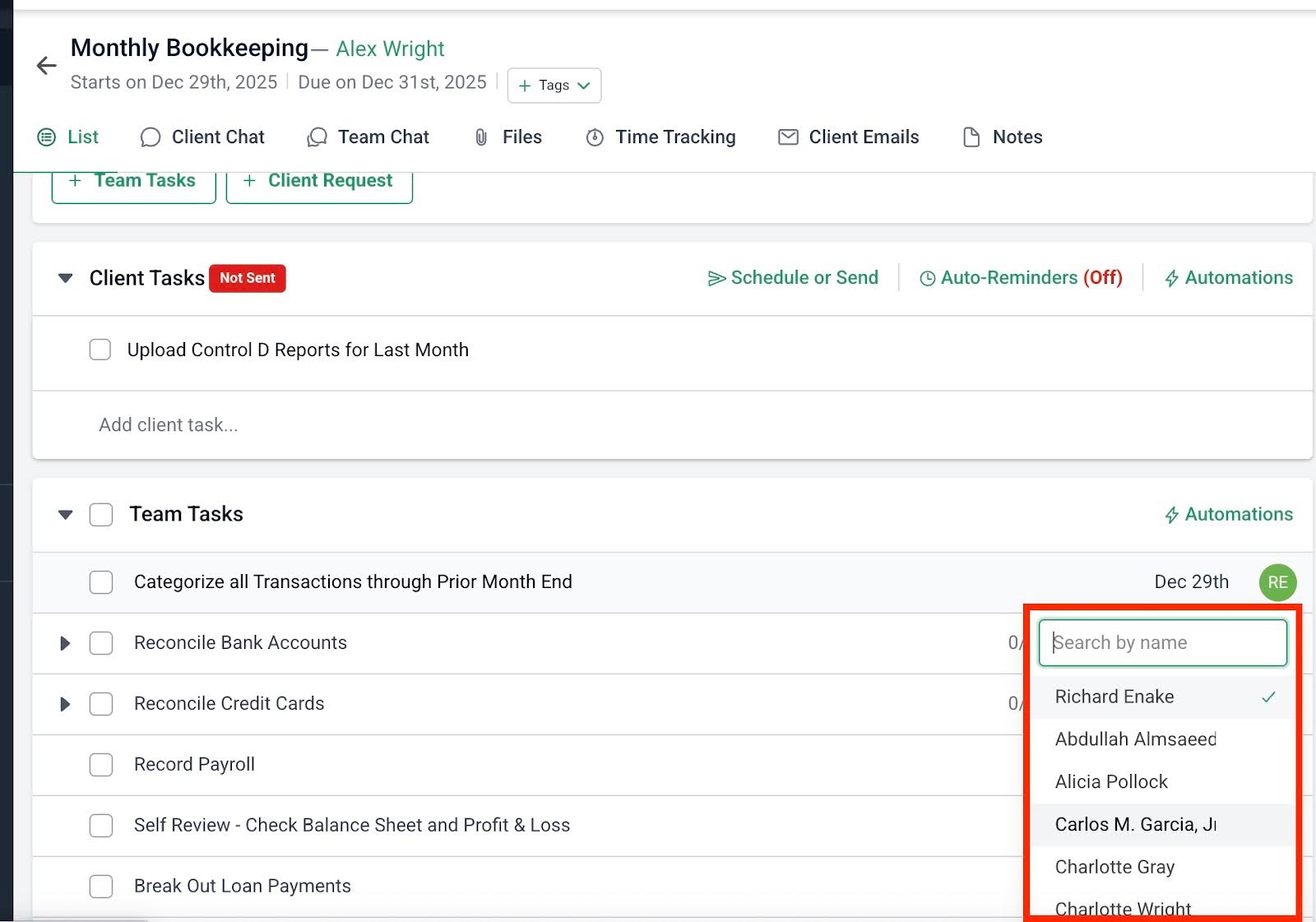

Once a project is created, tasks must be assigned to specific team members. By default, tasks created from scratch are assigned to you, the project creator, but you can easily reassign them to the appropriate team member.

Step 4: Set up Due Dates (internal and client deadlines)

Due dates can’t live only in people’s heads or scattered notes if you want to meet client deadlines consistently.

That is why Financial Cents enables you to build them directly into your project workflows.

You can set client-facing and internal due dates when creating projects. Client-facing due dates are the deadlines you promised your clients, while the internal due dates are set (to an earlier date than the client deadline) to give your team enough room for reviews, corrections, and unforeseen delays.

In the project creation window, you can add:

- A client due date that aligns with regulatory or client expectations

- Set an internal due date that gives the team a clear target for completing the work ahead of time.

You can add these due-date rules to templates to automatically apply them to every project created from them.

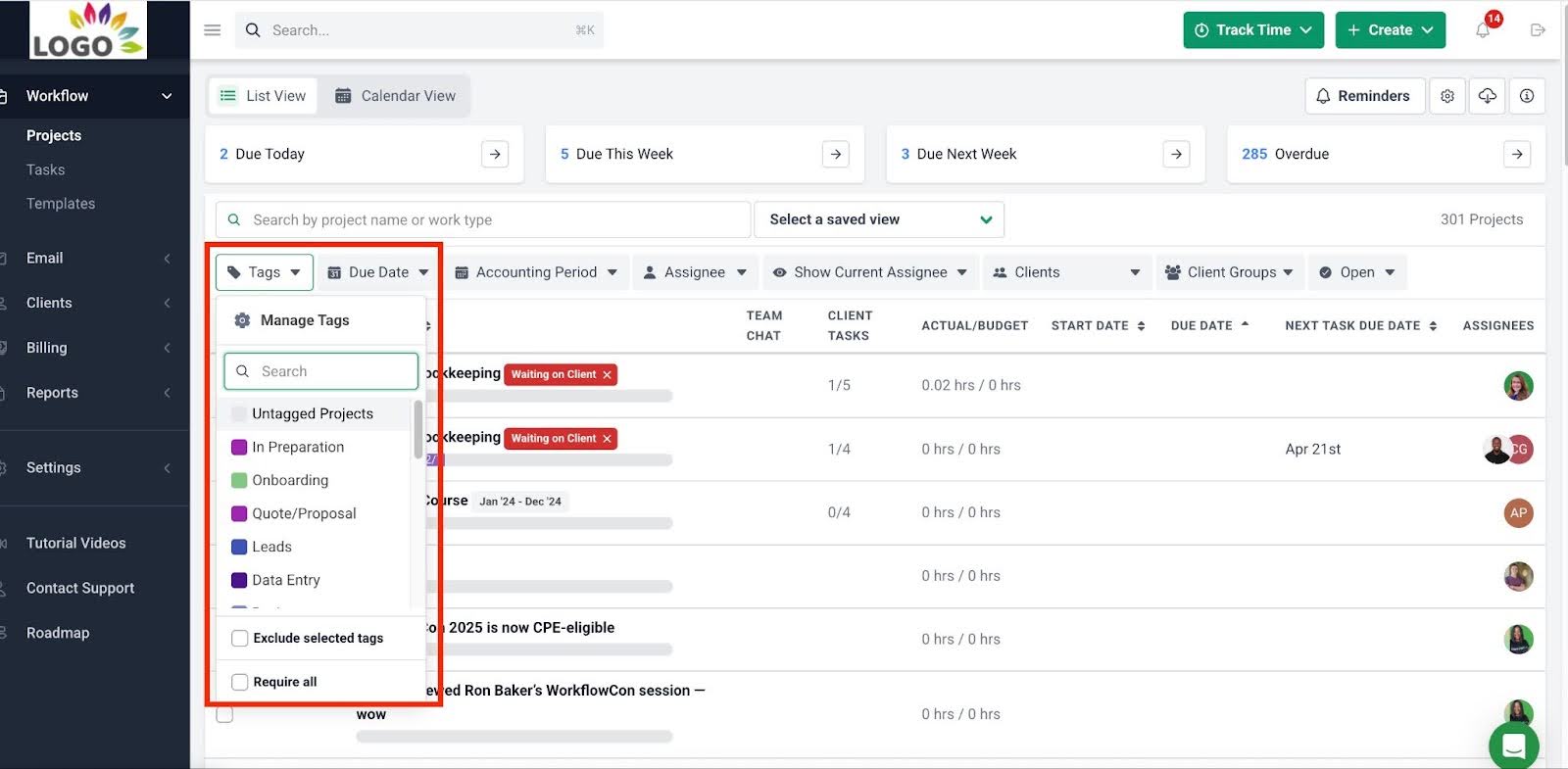

Step 5: Use tags or categorization for urgent, high-value, or complex tasks

As your client list grows, your workflow dashboard could get overwhelming, and quickly identifying what needs attention becomes just as important as knowing what’s due.

Financial Cents allows firms to apply tags to projects to indicate their current status or priority, which has made it easier for firms to track projects at a glance.

Common tags include

- Waiting on Client

- In Progress

- In Review

- Ready to Submit

- Etc.

Firms can also create tags that categorize the type of work being performed. For example, a Recurring Work tag can identify projects that repeat monthly, quarterly, or annually.

In Financial Cents, Tags work hand-in-hand with Workflow Filters to allow teams and firm owners to sort projects by specific criteria, such as:

- Accounting period

- Assignee

- Client group

- Due Date

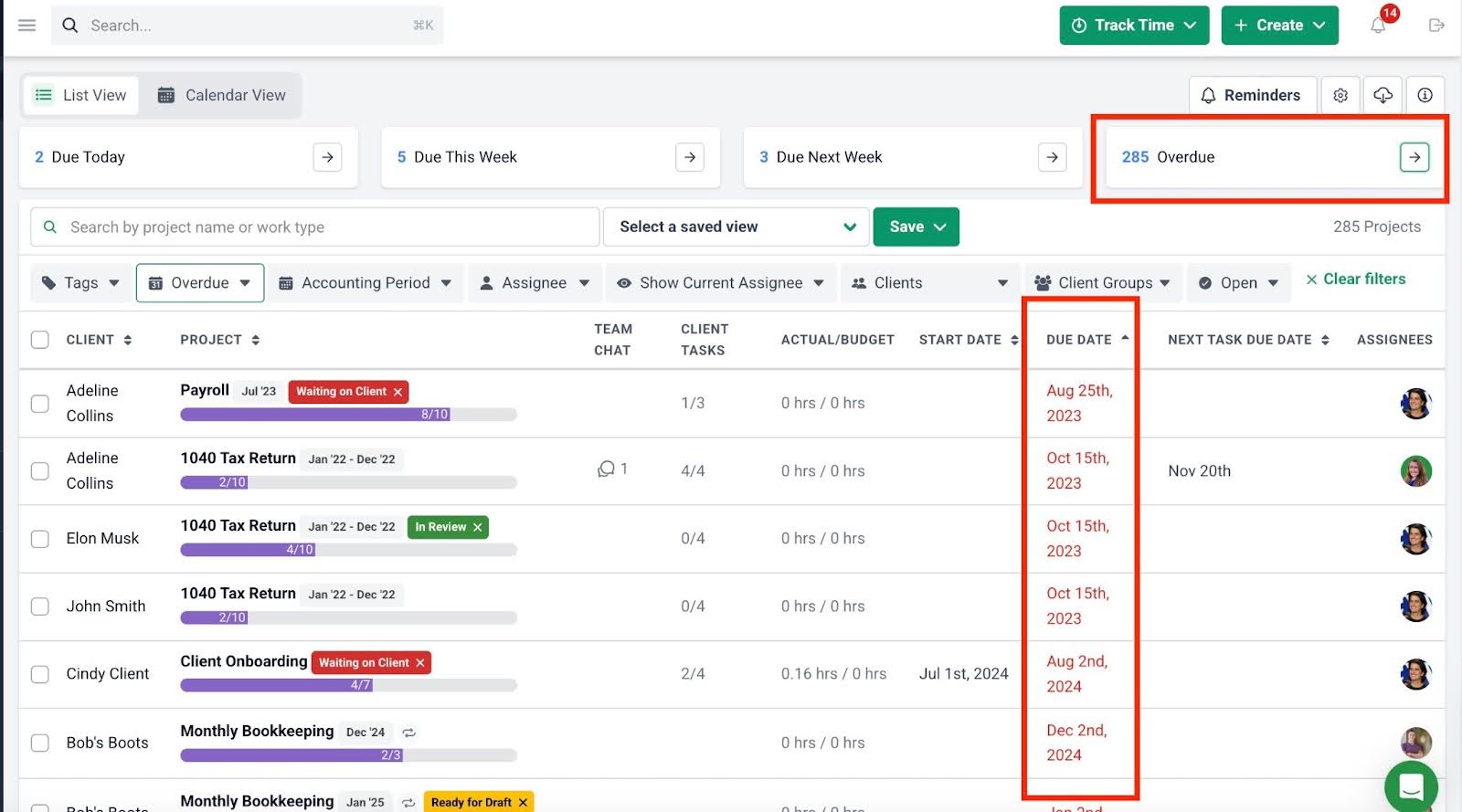

In Financial Cents, I can see all of the projects that everybody is working on. I can see how many are overdue and how many are due this week, this month, and next month.

That is helpful because we sometimes have to restructure project due dates. After all, we'll have a lot due. We have 427 projects open right now, and they are due in the next couple of months."

This level of filtering helps firm owners to prioritize the right work at the right time and reduce the risk of important tasks falling behind schedule.

Step 6: Automate client document reminders

With Financial Cents, you don’t have to wait until a project is close to the deadline to chase clients for necessary documents.

Document requests can be sent automatically as soon as a project is created. Clients receive the request by email and are directed to the secure client portal, where they can upload files, send messages, e-sign documents, or complete other required tasks.

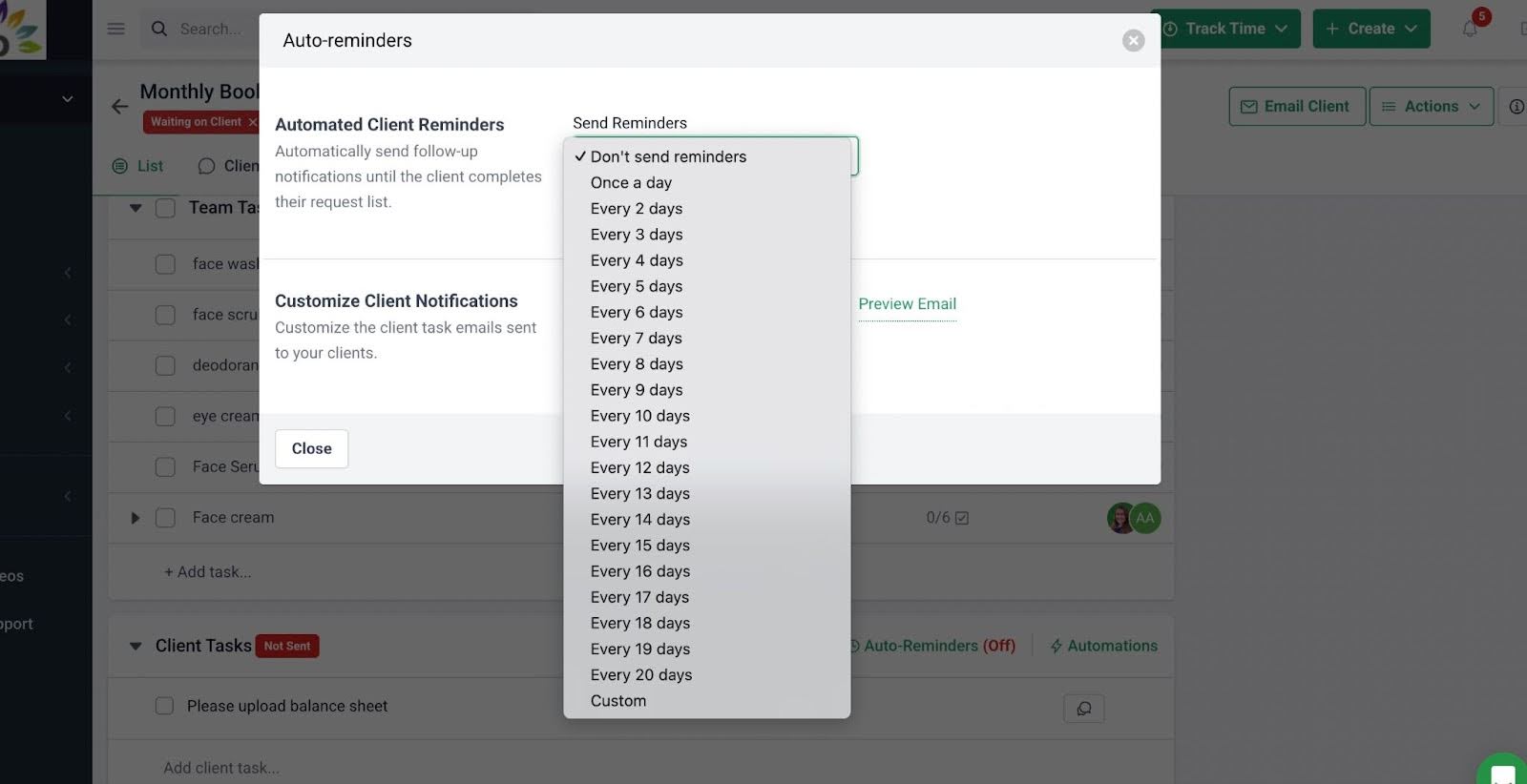

With the automated reminder feature, Financial Cents reminds clients at the frequency you set until the documents are submitted.

This removes manual follow-ups and allows your team to focus on completing client work instead of tracking down missing information.

Step 7: Track progress daily or weekly using workflow dashboards

Financial Cents’ workflow dashboards provide full visibility into all projects to help teams deliver client work on schedule.

The dashboard highlights key information, including projects that are Due Today, Due This Week, Due Next Week, and Overdue.

Using Workflow Filters, you can quickly see which projects are at risk of missing deadlines. You can also save filtered views for quick access in the future.

Moreover, each project in the Financial Cents workflow dashboard displays progress with a color-coded progress bar, making it simple to spot tasks or projects that are falling behind.

Regularly reviewing the dashboard keeps your team proactive, instead of reactive, with your deadline tracking and management.

Step 8: Review overdue tasks and adjust your process regularly

While overdue tasks are never good news, they can provide valuable insight into workflow inefficiencies.

Overdue tasks indicate where your team is underestimating the time or capacity required to complete tasks, facing delays in client data collection, or overloading high performers.

Reviewing these tasks helps you to identify patterns (like the type of projects most overdue in a certain period) to adjust workflows in a way that prevents similar issues in the future.

Financial Cents highlights overdue tasks on your workflow dashboard, making it easy to spot where delays occur. This allows you to drill into specific project details (to see which tasks are behind schedule), reassign work, adjust due dates, or refine recurring templates.

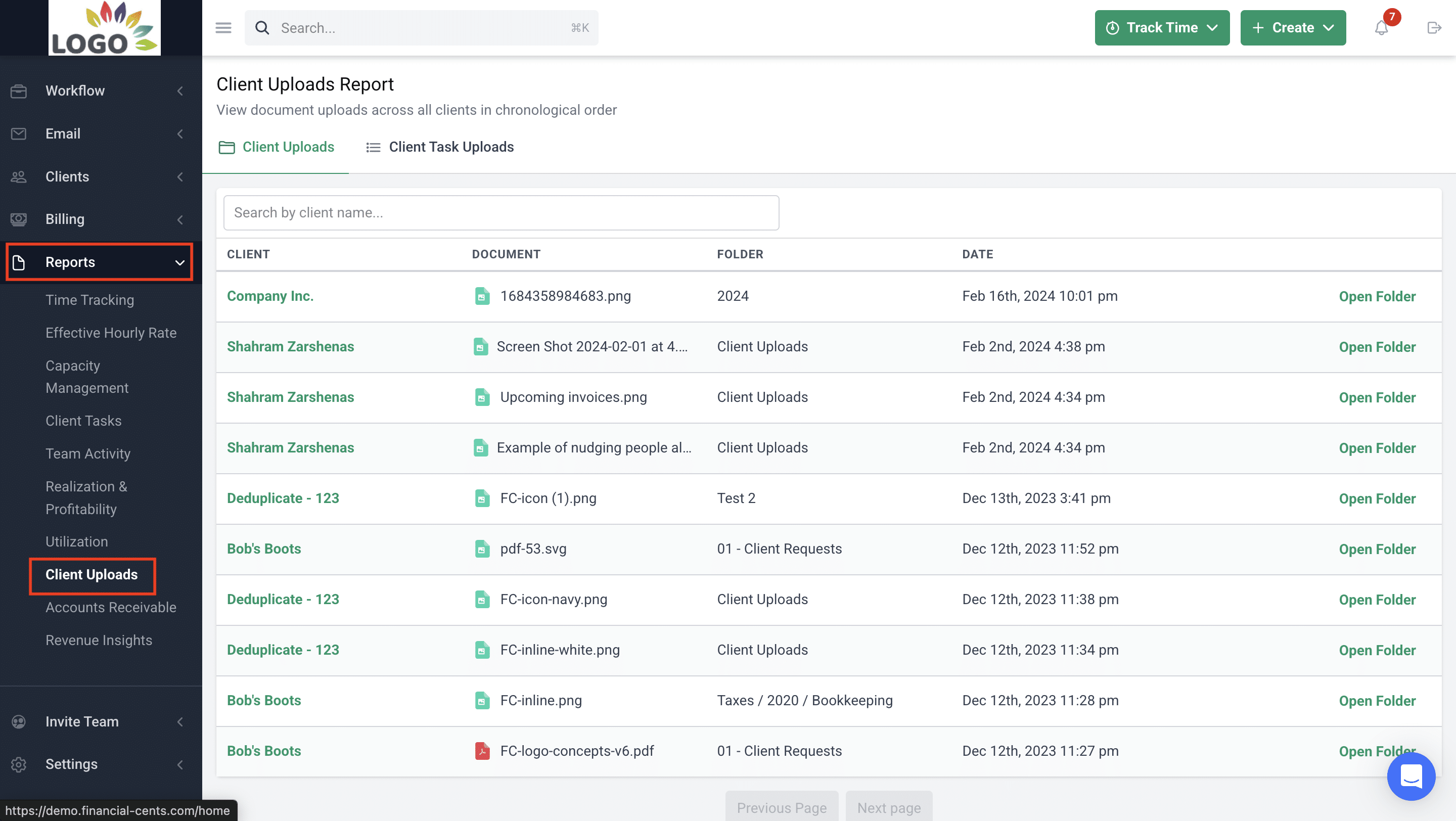

Step 9: Reporting

Financial Cents’ reporting feature provides real-time insights that not only help firms manage deadlines but also optimize team performance and improve client profitability.

Here are some of the reporting features and the information they provide:

- Budget reports: The clients that are over and under budget.

- Capacity management: Your firm’s capacity to enable you to reassign work to team members with available capacity.

- Client uploads report: A view of all client uploads across the firm.

- Realization reports: Snapshot of your most profitable clients, work items, and team members.

- Revenue Insights: The services driving the most revenue in your firm.

- Time tracking reports: Real-time view of where your team members are spending their time.

- Utilization reports: Team and client utilization to ensure you are maximizing your firm’s time.

- Work Insights report: Work efficiency insights and issues causing delays.

Such insights help firms like the JNW Group to proactively address potential delays, rebalance workloads, and ensure projects stay on schedule.

Why Financial Cents is the Right Project Management Software for Your Firm

Financial Cents is designed for the deadline-driven and recurring project management needs of accounting firms.

It helps them to organize work information, collaborate with their team members (and clients), and automate repetitive tasks to reclaim their time.

1. Recurring workflow automation

Financial Cents automates recurring client projects, like monthly bookkeeping, payroll processing, and quarterly reviews.

It enables firms to recur projects on standard (daily, weekly, monthly, or quarterly) or custom schedules (for more complex timelines specific to a client or service).

The custom recurrence enables you to recreate projects based on specific calendar events. Kellie Parks, CPB, uses it to set project start dates on the first Monday of the month, rather than on the first of the month.

Once set up, recurring projects are automatically generated on schedule, ensuring nothing is overlooked.

2. Deadline tracking dashboard

Financial Cents’ Workflow Dashboard is the tool’s home screen. It provides real-time visibility into all projects, upcoming deadlines, and overdue tasks.

With Workflow Filters, firm owners and managers can quickly find specific projects or tasks on the workflow dashboard.

This clear and centralized view of all deadlines enables firms to identify workflow issues early, make timely adjustments, and complete projects on time.

3. Client requests and auto reminders

Financial Cents automates client data collection using request checklists that make it easy for clients to understand and provide what you need.

Its email and SMS auto-reminders improve clients’ responses, and that keeps workflows moving forward.

Financial Cents' automation allows me to request documents (bank statements, credit card statements, invoices) without lifting a finger. I don't have to call, email, and text over again. I set it up so that if they don't respond, they'll get email reminders every three days until I get what I want."

Kathy Nash, Founder of Nash Financial Solutions, LLC4. Team capacity management

Financial Cents provides real-time visibility into team workloads to show firm owners and managers who is overbooked and who has capacity for additional work.

Its capacity management features include the ability to:

- View Team Capacity to see how many hours of work each team member has on their plate using the dashboard.

- Set Capacity Limits to define maximum hours for each staff member.

- Filter Custom Workloads to view workloads by team member, project, or deadlines to identify potential bottlenecks.

- Reassign Tasks by moving tasks from overburdened or unavailable team members to those with available capacity, keeping projects on track.

This enables proactive rebalancing during peak periods, reducing the risk of missed deadlines caused by uneven workloads.

5. Workflow templates for bookkeeping, tax, payroll, and more

Financial Cents provides a library of customizable accounting workflow templates, so that accounting teams won’t have to create projects from scratch each time.

These templates establish standard procedures for completing work, ensuring consistency and efficiency across all client engagements.

If these are not enough, the Financial Cents Templates Library provides firms with accounting workflow templates created by other firm owners and managers for different work types, industries, and jurisdictions.

All you have to do is download them or add them to your Financial Cents workflow tool and customize them to fit your operating procedures.

6. Time tracking and billing

Financial Cents’ built-in accounting tracking and billing tool shows how much time is spent on client work and how long certain types of projects actually take.

These insights help firms to plan capacity more accurately and set realistic deadlines. Adequate time tracking also supports accurate pricing, effective project scoping, and efficient resource allocation.

The billing component automates invoicing to help firms receive payments faster. By linking time spent with the work done and revenue generated, Financial Cents helps teams turn sufficient profits to keep their teams motivated to complete work on time.

7. Centralized communication and client notes

Financial Cents centralizes all task-related communication and client notes within each project, where teams can share comments, tag teammates, and build the right context.

This centralization reduces email clutter and helps teams to complete tasks and meet deadlines more consistently.

8. Secure client portal

Financial Cents’ passwordless client portal allows accounting firms to collaborate with clients by sharing documents, e-signing proposals and tax forms, managing billing information, and communicating about ongoing projects in one place.

The portal relies on secure magic link authentication, so clients do not need to create an account or remember passwords to access it.

By simplifying client interactions, the portal ensures documents are submitted on time and requests are responded to promptly.

See how Financial Cents can keep your firm organized to meet deadlines consistently. Try It Today for Free.

Use the Right System to Replace Hustle with Structure

The lesson here is clear: consistently hitting client deadlines is not about working longer hours or hiring more staff. It is about putting the right systems in place to manage your accounting workflows confidently.

Without workflow automation, visibility, and accountability, even the most experienced teams struggle to stay ahead of deadlines.

While generic project management tools may seem like an upgrade from spreadsheets and sticky notes, they often fall short of addressing the recurring and deadline-driven nature of accounting projects.

We tried to make Asana work for the main problem we were trying to solve (recurring work), but Asana only helps you through all the steps of a project. It's hard to get it to remind you to do those same steps every month, quarter, or year."

Tonya Schulte, Founder of The Profit ConstructorsAccounting project management software replaces spreadsheets, human memory, and sticky notes with an all-in-one system that automates manual work, standardizes processes, and makes ownership and deadlines clear.

Financial Cents helps accounting firms to centralize client work, automate recurring tasks, improve accountability, and gain complete visibility into firm-wide operations.

The result is a more organized practice, calmer staff members, and sustainable completion of all tasks before their deadlines.