There are many apps for any accounting task you can think of today. That’s why QuickBooks and Xero have 750 and 530 apps in their respective marketplaces.

With every one of these accounting apps promising to fill that void in your workflow, team management, and client relationships (which they do), the challenge becomes app fatigue.

Using and maintaining each app on your tech stack will require a lot of admin work, which makes sacrificing productivity and service quality a natural result.

This article shows why and how integrating your tech stack with your accounting practice management software cuts down the number of applications you need to open to complete your day-to-day accounting processes.

Why Integration Matters for Accountants

I. Reduces manual data entry and duplicate work

Integrated apps communicate with one another to synchronize information across the board, removing the need to manually enter the information.

When your emails are automatically pulled into your practice management software, you won’t have to move client emails from your email service provider into your practice management software.

II. Improves accuracy and reduces errors

Manually moving data between two software programs is bound to result in errors.

Distraction and tiredness (which are common with humans) could produce errors that impact the numbers in a financial statement, tax returns, or accounts payable work in a way that causes overpayment and erroneous financial reporting.

With integrated software solutions, such errors are nearly impossible, giving your team the correct data to produce accurate work.

III. Saves time by streamlining task handoffs

Integrated apps do not synchronize information alone. They also move tasks between apps and assignees without human intervention.

This saves you the time of manually notifying every assignee when they are due to work on a project, which could cause delays in your workflow process.

IV. Creates real-time visibility into work and deadlines

With integrated apps, your practice management software becomes a central hub for all client information and work.

This allows you to track deadlines and view updates while preventing information from slipping through the cracks.

V. Improves team collaboration and accountability

When all work and client information are in one place, team members can find crucial information without needing to ask each other, and when they need to ask, it’s easier to reference other information to build the right context.

Similarly, automated notifications ensure all team members are held accountable for work done and actions taken (or not taken) on a project.

VI. Enhances client communication and service

Integrated apps make it efficient for you to track and respond (on time) to client communication.

This makes your clients feel seen and valued. It also enables your team to see and complete your clients’ ad-hoc requests, improving your service quality.

What Types of Accounting Apps Should Integrate with Your Practice Management Software?

1. Bookkeeping/GL Software

Integrating general ledger (GL) software, such as QuickBooks, with your accounting practice solution syncs transactions and other information between both apps, enabling you to maintain uniform client information.

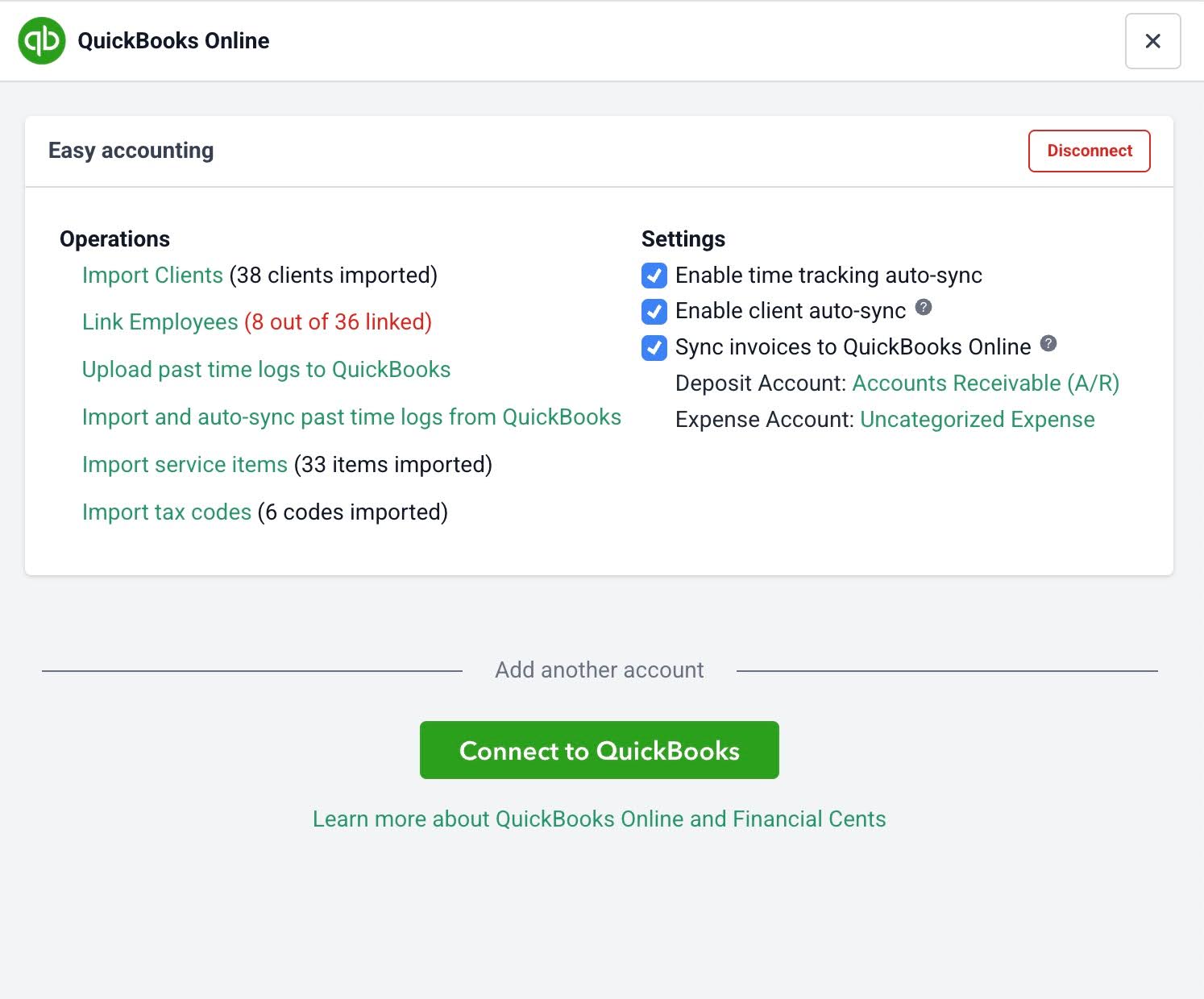

With Financial Cents and QuickBooks, this allows you to:

- Import your clients from QuickBooks Online into Financial Cents

This pulls your existing client information (email, phone number, address, and notes) into your Financial Cents account in seconds.

Every new client you add to QuickBooks Online will be automatically added to Financial Cents, and your edits in QBO will be reflected in Financial Cents.

- Sync Your Time Entries in Financial Cents with time logs in QuickBooks Online.

The time you tracked for a client’s work in Financial Cents is sent to the client’s records in QBO. If you log or edit a time entry in QBO, it also reflects in the client’s information in Financial Cents.

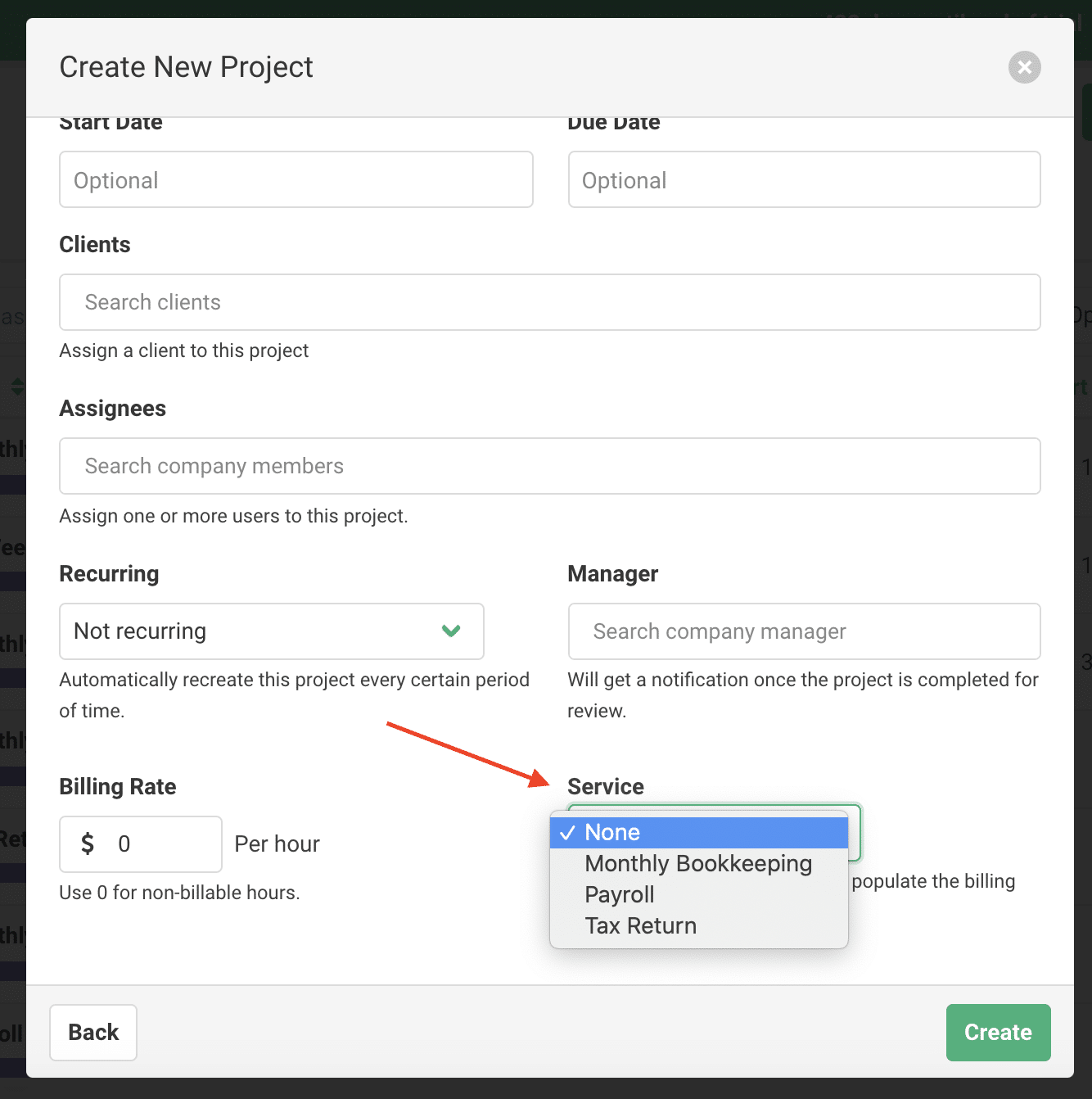

- Sync Your QuickBooks Online Service Items to Financial Cents

This updates your QBO time logs in Financial Cents, so that you can bill your clients inside Financial Cents.

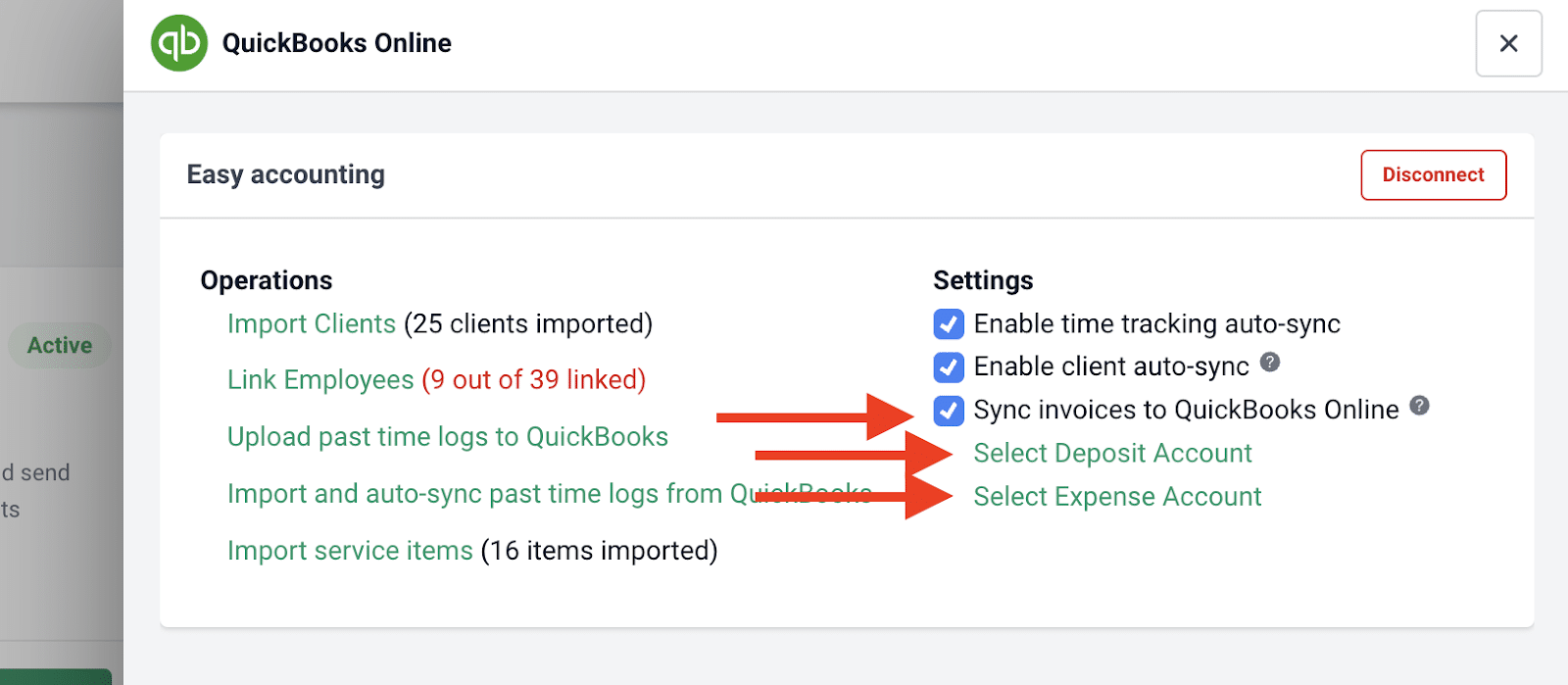

- Sync Invoices & Payments from Financial Cents to QuickBooks Online

This unifies your invoicing and payment information between both apps. That means the invoice you send in Financial Cents is automatically sent in QBO, and when you mark an invoice sent in QBO, it is reflected in Financial Cents.

- Pull QBO Transactions into Financial Cents to Categorize Uncategorized Transactions

The Financial Cents ReCats feature enables you to categorize uncategorized transactions in QuickBooks without exporting the data into a spreadsheet or manually chasing clients to clarify them.

The transactions automatically show up in the client’s profile in Financial Cents. All you need to do is send them to the client for clarification (using the Financial Cents Client Portal).

To get the client’s response faster, the Financial Cents automated reminder feature will notify the client at preset intervals, saving you hours of admin time.

In the Client Portal, the client can describe the transactions by providing notes and receipts, which you can push to QBO to add the transactions to their proper accounts.

2. Tax Software

Integrating your tax software with accounting practice management software allows you to access its information or features from your practice management software.

This reduces tax preparation errors, gives you better visibility into your tax workflows, and enhances client communication and collaboration, making your clients’ tax returns more compliant.

3. Document Management

Integrating your document management software (DMS) centralizes document storage and retrieval, making it easier to control versions and keep an audit trail of your documents.

With the right integration, you will be able to access your client’s documents from your practice management software.

Available DMS integrations in Financial Cents include:

SmartVault:

This integration allows you to:

- Import or link clients from SmartVault to Financial Cents.

- Create clients in SmartVault when a client is created in Financial Cents.

- Access SmartVault from your projects, documents, or the client’s profile in Financial Cents.

- Route the documents your client sends to you to their folder in SmartVault automatically.

Google Drive: This allows you to access your Google Drive files from Financial Cents.

OneDrive: You can also access and update your documents in OneDrive without leaving Financial Cents.

4. E-Signature Tools

E-Signature tools make document approvals easier, faster, and more convenient, enabling you to get client responses faster.

Instead of printing and scanning documents to add a signature and share with you, your clients can conveniently access your E-Signature app and add their signature to documents from your practice management software.

For example, Financial Cents integrates with Adobe Sign.

This enables Financial Cents users to send and receive proposals, tax returns, and other important documents for signature.

It also automatically organizes all signed copies of your documents in the Client Task Files in Financial Cents.

5. Time Tracking and Billing

Integrating an accounting time tracking and billing app with your practice management software ensures the time your team spends on client work is accurately recorded and billed for (without leaving your practice management software).

This reduces the administrative work and human errors associated with data migration from your workflow management and time tracking apps to your billing solution, improving transparency and profitability.

In Financial Cents, time tracking and billing are core features. You do not need an integration to use them.

Its time tracking features include:

- Automated timer for tracking time in the background.

- Billable rates are used to calculate the amount due.

- Manual time entries

- Reports that show your team’s productivity and profitability.

- Time budgets to flag projects that are running over budget.

Its billing features allow you to:

- Accept ACH & credit card payments.

- Automate client reminders to help clients pay faster.

- Automatically bill clients as and when due.

- Create one-off or recurring invoices.

- Pass credit card fees to your clients.

- Run reports to gain insights that help your decision-making.

- Save payment methods for recurring billing.

- Send proposals and engagement letters.

- Sync invoices and payments with QuickBooks Online

- Use templates to create invoices (for speed).

- Etc.

6. Email Management

Linking your email service provider with your practice management software centralizes client communications by logging client emails against the client’s records to build context and enhance team collaboration.

Financial Cents’ integration with Gmail and Outlook allows users to stay on top of client emails by bringing their Gmail or Outlook inbox into Financial Cents.

This is a two-way integration that saves you the stress of performing the same action twice. Any action taken in Gmail/Outlook or Financial Cents (such as reading, sending, deleting, or archiving an email) is automatically reflected in the other app.

Other benefits of this integration include:

- Having a dedicated folder for your client emails inside Financial Cents.

- Monitor email communication between your staff and clients.

- Pinning important client emails to projects helps your team find them for work.

- Turning ad hoc email requests into projects in your workflow dashboard.

7. Team Communication

Team communication is only as effective as your employees’ ability to see and respond to emails on time (without sacrificing productivity).

That’s why integrating communication tools (like Slack and MS Teams) with your practice management solution will help your team maintain focus and efficiency.

However, when team communication is a core feature in your practice management software, you don’t need third-party input to communicate seamlessly with your team.

In Financial Cents, your team can communicate in a variety of ways:

- Inside a Project Using the Team Chat Tab

This allows your team to share ideas, ask questions, and mention each other for quicker responses.

- In the Client Profile Using Client Notes

This allows your team to share client-related updates.

The @Mention feature in Financial Cents lets team members draw their colleagues’ attention to relevant comments.

Activity Feed contains the report of your client interactions, helping teammates understand where the client’s communication stands.

Automated Notifications keep your team members in the loop to keep time-sensitive information from slipping through the cracks. These notifications are sent to a team member when they are @mentioned in a comment.

8. Client Relationship Management (CRM)

An integrated CRM (like Liscio or Hubspot) and practice management system ensures a steady stream of client data from your CRM solution into your practice management software.

This helps you to track client interactions, deliver personalized client service, and build better client relationships.

With Financial Cents, you don’t need a third-party CRM. Its built-in CRM allows you to store and retrieve standard and unique client information, such as contact information, recent documents, and upcoming projects.

Other information you can store in the client profile includes:

- About Section

- Activity Timeline

- Client Groups

- Client Notes:

- Client Tasks

- Client Vault

- Relationships

9. Client Portals

When a client portal is integrated with your practice management software, your clients will get to share files, E-Signatures, and information more securely with your firm.

This will reduce reliance on numerous email threads, streamline client engagement, and improve your client’s response rate.

In Financial Cents, the client portal is a built-in feature and provides a unified platform for managing your clients, from requests, documents, reports, invoices, resources, and communication.

Here are the five components of the client portal as of May 2025 (we’re constantly improving it to help clients engage with you more conveniently):

- Billing & Proposals

This section of the client portal allows your clients to view (and pay) outstanding invoices, view past paid invoices, and manage their payment methods.

- Client Chat

When your clients are not clear about what your team is asking for, they can ask questions using the Client Chat feature.

This feature also organizes client conversations into topics, allowing you to search across all client conversations and specify which team members & client contacts can view and contribute to conversations in the portal.

- Client Tasks & Requests

This section shows the files and E-Signature requests sent to clients. Automated reminders save your firm hours of chasing clients for files and signatures, helping you complete their work much faster.

Clients can upload documents with the click of a button.

- Folder Sharing

This component of the client portal helps you to share documents and folders with your clients. It also allows your clients to view shared folders, archived documents, and reports.

With your permission, the client can also upload documents unrelated to projects or requests to shared folders.

- ReCats

The ReCats section of the client portal streamlines your firm’s process for managing your clients’ uncategorized transactions.

It saves you the stress of downloading transactions and chasing down your client to clarify them by:

- Automatically pulling uncategorized QBO transactions into Financial Cents.

- Asking your client questions and requesting notes and documents about transactions.

- Automatically remind your client about the uncategorized transactions.

- Categorizing the uncategorized transactions in Financial Cents.

- Sending the updated transactions (with notes and documents) to QBO.

How to Choose a Practice Management Software That Plays Well With Others?

Here are the features and qualities that enable a practice management software to communicate and share information with the other apps in your tech stack.

A. An Open API

Native application uses API (Application Programming Interface) to integrate one application with another, enabling the free flow of information between the apps.

With Financial Cents’ Open API, you can integrate with business intelligence and reporting tools to automate your common tasks and insights.

B. Zapier or Native Connectors

Zapier and Native Connectors are third-party products that facilitate data synchronization between two apps.

While Zapier automates workflows across different applications (between your practice management solution and other mission-critical apps), native connectors provide pre-configured integrations that easily connect your practice management software with others.

Financial Cents’ Zapier Integration allows you to integrate Financial Cents with over 5,000 other apps, including Xero, GoProposal, Ignition, Box, Dropbox, etc.

C. Integration with the Tools You Already Use

Before committing to a practice management software solution, be sure it integrates with the tools you already use.

This will ensure data and workflow continuity, giving your team a more holistic view of work status and client information while preventing information silos.

D. Real-time Data Syncing

Real-time syncing of information between integrated apps makes up-to-date data available to users, facilitating decision-making.

Otherwise, you’ll need to wait for some time for important work or client information to update in an app before you can use it. In that case, it may be faster to enter the data, which makes the integration counterproductive.

E. Support and Documentation for Integrations

Detailed integration support and documentation improve the quality of app integration.

A well-done documentation provides guides, tutorials, and FAQs that are necessary for setting up and troubleshooting integrations.

Moreover, when there is downtime, responsive support will ensure speedy resolution, preventing data from falling through the cracks.

F. Vendors with Reliable Support and a Commitment to Integrations.

Vendors who prioritize integrations will be more likely to support your integration needs as you grow and your needs evolve.

They’d have a dedicated team that ensures APIs are up-to-date to support new features and a more seamless flow of data.

How to Get Started with Integration

-

Map Your Current Tech Stack

Take an inventory of all the apps in your tech stack and clarify their roles in your firm.

This will show you how data flows across them and which apps rely on the other in your tech stack.

-

Identify Redundant Apps or Integrations

The right practice management software should save you the trouble of using so many apps in the first place.

With a solution like Financial Cents, you get an all-in-one program built for the workflow, CRM, client portal, reporting, time tracking, and billing (with proposals and engagement letters) needs of the accounting community.

This automatically renders the apps providing these individual features redundant. The best part? You’ll significantly reduce the time and money spent on these other apps.

-

Use a Phased Approach—start with 1–2 key integrations

A phased approach enables you to start with the most important integrations while adding the rest as you go.

This saves your team from the overwhelming reality of managing too many integrations at once, which may cost you time for client work.

-

Train Your Team on the New Flow

Integrating new tools could alter your workflow. Your staff may need training to understand how to maximize the benefits of the new method of getting work done.

-

Monitor and Optimize Over Time

Issues may arise (such as sync errors or delays) as you use integrated apps, but proper monitoring and optimization will ensure that the performance issues are spotted and resolved on time.

If you encounter a challenge, contact the vendor for support. The API might need updating, or a new integration may be required to get the integration running smoothly again.

All the Features You Need, From the Apps You Need, In the App You Use

You are one app away from addressing your firm’s challenges, but that app may be the straw that breaks the camel’s back by wearing your team out with app fatigue.

Your best bet against app fatigue is integration.

Integration enables you to enjoy the features of third-party applications inside your practice management software.

The results?

- Less money spent on separate tools (which means more profits).

- Less time spent learning and maintaining multiple apps (which increases productivity).

- Fewer errors from migrating data across applications (which translates to a satisfied clientele).

Financial Cents all-in-one practice management software gives you all the features you need to manage your accounting processes in one place. Click here to find out with our 14-day free trial.