By now, you already know that running an accounting firm is more than just handling numbers. It is about balancing clients, team members, processes, and deadlines. That mix can feel manageable on a good day, but on a busy month, it becomes a real test of your strategies and systems.

Without the proper structure, it can feel like the firm is running you. The 2025 State of Accounting Workflow and Automation Report clearly shows this. Firms using manual scheduling spend more than 5 hours a week on routine admin, while 75.8 percent of firms that use workflow automation cut that time to under 5 hours and see better efficiency.

The gap between firms with strong systems and those without is widening every year. That is why these practical, modern strategies matter. Let’s dive in.

Why Effective Firm Management Matters

Poor firm management rarely causes problems all at once. It shows up gradually through missed deadlines, frustrated clients, and overwhelmed team members. Before long, you are stuck in a cycle of firefighting instead of running your firm with intention.

Strong management practices such as tightening your workflows, improving communication, and leaning on the right technology can change that trajectory. When your firm processes are clear and your workflow is structured, you reduce friction for both your team and your clients. For instance, your staff can move through tasks without stopping to ask what comes next, and clients know exactly when to expect updates or deliverables.

Productivity improves because everyone knows what to do, when to do it, and how work moves from one step to the next.

How to Manage an Accounting Firm: 18 Practical Strategies

1. Implement Capacity Planning and Management

You already know how quickly workloads can pile up in an accounting firm. Capacity management helps you stay ahead by showing who is available, who is overloaded, and where you need extra support. When you plan this well, you protect your team and keep client work moving smoothly.

To make this work, review workloads weekly, track recurring deadlines, and assign tasks based on real availability instead of guesswork. You can also use Financial Cents’ free Capacity Planner to assess your team’s workload in minutes and see whether you need to plan, hire, or delegate. It is a simple way to get a clear picture of your team’s capacity before things get too busy.

2. Invest in Continuous Staff Training and Development

It goes without saying that your firm grows when your people grow. Ongoing training keeps your team sharp, confident, and ready for new regulations or technology. It also shows your staff that you care about their development, which leads to better accuracy, client service, and engagement.

You can make this happen by creating a simple quarterly learning plan, offering CPE courses or webinars, pairing new hires with mentors, and encouraging your team to attend conferences that offer new insights.

3. Improve Internal Communication and Collaboration

Every accountant knows how quickly things fall apart when instructions are unclear or messages are scattered. Strong internal communication keeps your team aligned and minimizes unnecessary follow-up.

Tonya Schulte is no stranger to this, as she puts it:

I have the most amazing operations manager; she dials everything in and makes sure that the entire team has consistency of process across the board."

You can give your firm that same level of clarity by using one platform for updates, documenting your processes, setting clear response-time expectations, and creating a safe space for your team to ask questions or share feedback.

4. Mandate Mid-Season Breaks

Tax season can be very busy. Mid-season breaks give your team a chance to breathe and reset, even if it is only for an afternoon. A little rest goes a long way toward maintaining accuracy, energy, and morale. Exhausted accountants make more mistakes, so building intentional breaks into your schedule protects both your team and your work quality.

Plan short, staggered breaks during peak periods, encourage real lunch breaks, and celebrate completed milestones to keep spirits up.

5. Adopt a Hybrid or Remote Work Policy

Many accounting tasks can be done from anywhere, so offering a hybrid or remote option gives your team flexibility without losing productivity. It also helps you attract and retain talent, reduce stress, and support a healthier work-life balance.

To make this work, set clear expectations for availability and deliverables, use cloud-based tools for tasks and documents, and keep everyone aligned through simple check-ins.

Nayo Carter-Gray, EA (Owner, 1st Step Accounting), recommends using the three C’s to set your team up for success: comprehensive documentation, consistent check-ins, and centralized collaboration.

Providing reliable remote work equipment or small stipends also keeps your team effective, no matter where they work.

6. Hold Regular Meetings

Regular meetings help your firm stay aligned and prevent small issues from turning into bigger problems. They give your team space to raise concerns early, share updates, and stay focused on priorities. Even a simple weekly check-in or a quick daily stand-up during busy periods can make a big difference in keeping work on track.

Keep these meetings short, focused, and action-oriented so everyone leaves knowing what comes next.

7. Create a Client Onboarding Process

A strong relationship starts with a smooth and predictable client onboarding process. When clients know exactly what to expect, they trust you faster and follow your processes with less friction.

Poor onboarding creates confusion and delays, but a clear structure sets the right tone from day one.

To make this work, give clients a simple welcome packet, use automated reminders to collect documents on time, set clear expectations for deadlines and communication, and walk them through your workflow so they understand each stage of the process.

8. Enhance Client Communication

Clear communication is one of the biggest drivers of client satisfaction. Clients want to feel informed and supported without having to chase you for answers.

Miscommunication creates frustration and leads to avoidable rework. When your communication is consistent, clients feel taken care of and see your firm as a true partner.

You can make this easier by keeping all messages in one channel, setting clear response times, sending proactive updates during busy periods, and using your accounting firm’s client portal to share status updates and upcoming deadlines.

9. Collect Client Feedback

You cannot improve what you do not measure, and client feedback gives you a clear view of what is working and what needs attention. Many firms rely on assumptions, but when you listen to your clients, you strengthen relationships and spot issues before they grow.

Keep it simple by sending short surveys after onboarding or major deliverables, reviewing the responses with your team, and using recurring themes to refine your processes and training.

10. Standardize and Document Your Workflows

Standardized workflows remove the guesswork from your operations. When every task follows the same clear steps, your team works faster, makes fewer mistakes, and delivers more consistent results. Inconsistency slows everything down. If everyone handles tasks differently, you end up with delays, missed steps and rework.

You can start by choosing your top recurring tasks and mapping out each step from start to finish. Make it clear who owns each step and what “done” actually looks like. Store all workflows in a central place, such as an accounting firm’s management software, so your team can access them easily and update them whenever you refine or improve a process.

As Jeremy Wells, CPA at The HVAC CPA, puts it,

Growing your firm requires you to spend less time as the technician and the manager and more time as the entrepreneur. Because I knew this, I needed to build a firm that could run without me. That is why I started documenting and building out processes so I would not be the one doing everything forever."

11. Use Accounting Firm (Practice) Management Software

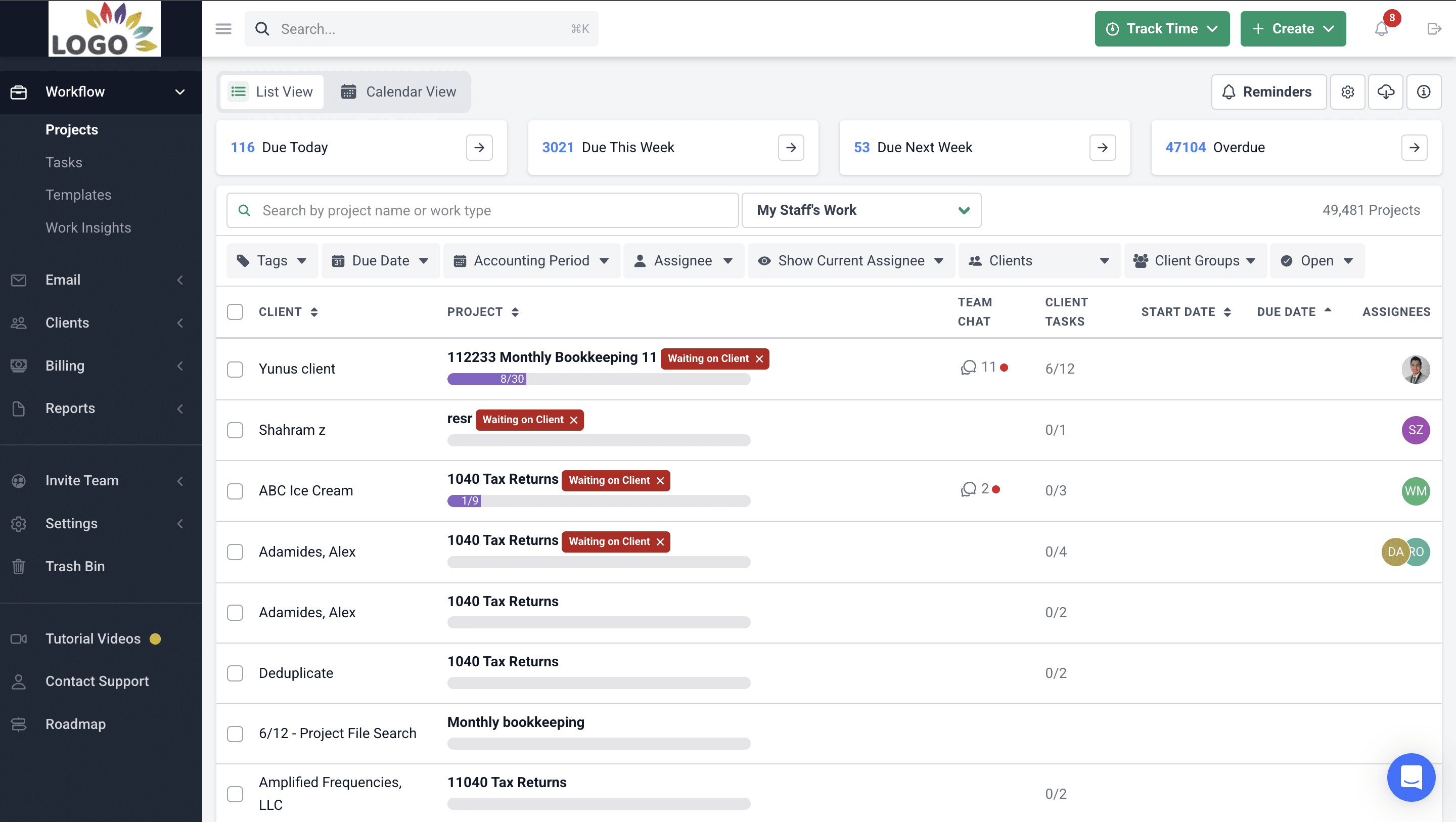

Managing client information, communications, deadlines, and tasks across emails and spreadsheets drains time and energy. Accounting firm management software brings everything into one system so you can work more efficiently and stay organized.

When you have clear visibility into what is assigned, what is overdue, and where work stands, you can spot issues early and prevent things from slipping through.

To get started, choose a tool like Financial Cents that combines client information, communications, task management, and time tracking.

Move all deadlines and tasks into the software, use automated reminders to keep everyone on track, and check your dashboard daily to stay ahead of bottlenecks.

12. Automate Recurring Tasks and Reminders

Every firm has tasks that repeat daily, weekly, or monthly. Automating them saves your team from repetitive work and helps you avoid missed deadlines. Manual reminders get lost easily, but automation keeps everything consistent, even on your busiest days.

To make this work, identify tasks that follow the same pattern each time and turn them into workflow templates. Add automated client reminders for approvals or documents, and review your automation rules regularly to keep them up to date.

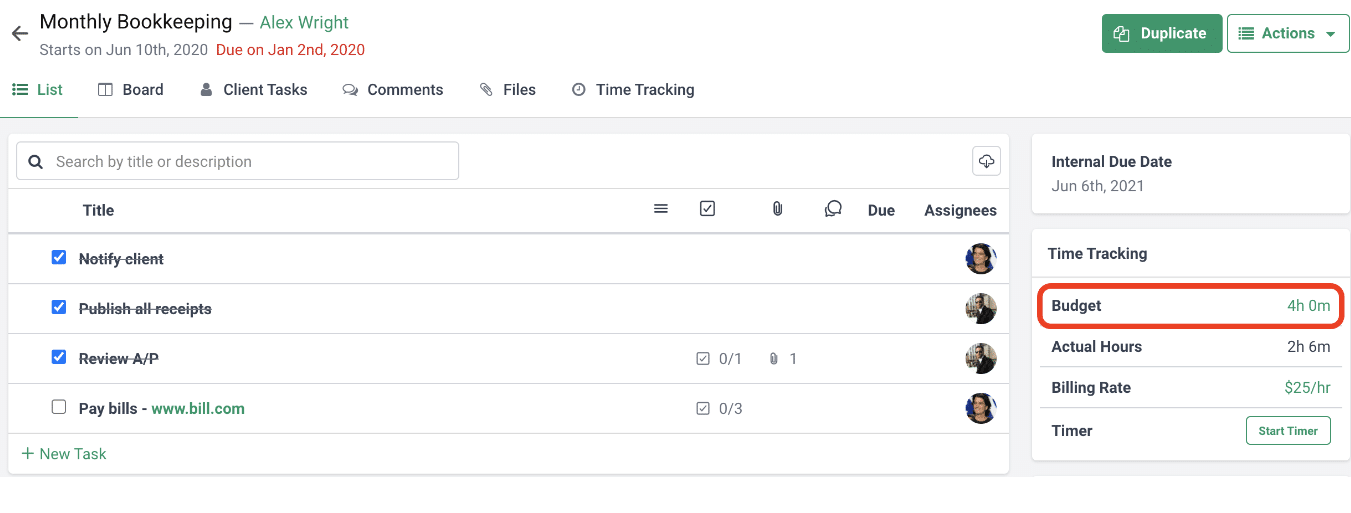

13. Adopt Time Tracking for Transparency and Billing Accuracy

Time tracking is not about micromanaging your team. It helps you understand where time is going so you can price work accurately, plan capacity better, and spot inefficiencies.

Without accurate time data, you risk scope creep, unclear workloads, and underbilling. With it, you can see which clients require more effort and where your processes need improvement.

Use an accounting workflow management tool to let your team log hours easily, encourage real-time tracking to avoid guesswork, and review reports regularly to spot trends. Then use those insights to refine your pricing, timelines, or capacity planning.

14. Schedule Recurring Workflow Reviews and Process Updates

Your processes should evolve as your team and technology change. Regular workflow reviews help you refine what works, fix what does not, and keep your operations running smoothly. Outdated processes slow your team down and hurt the client experience, so frequent check-ins keep everything fresh and aligned with your goals.

Set quarterly review sessions, gather feedback from your team, update your process documents, and share any changes to keep everyone on the same page.

For more practical tips on optimizing your firm’s workflow for success, listen to accountants like yourself in this video:

15. Use KPIs to Measure Firm Performance and Profit Margins

You cannot grow what you do not measure. KPIs give you a clear view of your firm’s health, help you spot issues early, and let you make decisions based on data instead of instinct. With the right metrics, you can see which clients are profitable, which services slow your team down, and where your processes or pricing need improvement.

Track core metrics like capacity profitability, realization rates, and turnaround times. Review them regularly, share key insights with your team, and use the data to refine your pricing, service mix, and workflows.

16. Prioritize Scalability

Scaling is not just about taking on more clients. It is about building systems that let you grow without lowering the quality of your work or overwhelming your team.

When your operations are scalable, you can accept new business with confidence.

Many firms grow faster than their systems can handle, which leads to burnout and inconsistent delivery. Clear roles, strong processes, and the right tools help you expand sustainably.

Document responsibilities for faster onboarding, standardize your workflows, streamline your service mix, and use tools that support long-term accounting firm growth, so your team can focus on high-value work.

17. Prioritize Data Security and Compliance

Your clients trust you with sensitive financial information, so keeping that data secure is essential. Strong accounting cybersecurity practices help you stay compliant, maintain client confidence, and reduce risk.

As part of the IRS and FTC requirements, every firm that handles taxpayer data must also maintain a Written Information Security Plan (WISP). This plan outlines how you protect your client’s data and is a mandatory safeguard. You can download a free WISP template here so you don’t have to start from scratch.

Remember, even a small lapse can damage your reputation, so a secure firm is always a stronger firm. Be sure to enforce strong passwords with multi-factor authentication, use secure cloud tools, train your team on privacy and phishing risks, and review access levels regularly to ensure only the right people can view sensitive information.

18. Establish a Dedicated Advisory Service Arm

If you have not expanded into advisory yet, this is a strong time to start. Advisory services help you deepen client relationships and position your firm as a strategic partner instead of only a compliance provider. Clients want guidance, not just filings, and advisory services allow you to deliver higher-value support while increasing revenue.

Begin with simple services, like cash flow planning or budgeting. Package them as monthly or quarterly offerings, assign or train a team member to lead the initiative, and use data from your systems to shape clear, informed recommendations.

Overcoming Common Firm Management Challenges

Every firm faces recurring challenges, but most of them become far easier to manage when you have structured processes and the right tools in place.

- Managing client expectations and communication

Set clear expectations from the start, use one communication channel, and share proactive updates. Automated reminders for documents also reduce unnecessary back-and-forth.

- Handling seasonal workload spikes

The busy season will always be intense, but it does not have to be chaotic. Capacity planning, clear responsibilities, and recurring task templates help you stay ahead of the rush. Even small habits like short daily check-ins or mid-season breaks make the pressure more manageable.

- Keeping remote or hybrid teams aligned

Remote teams succeed when everyone has access to the same information. Centralized workflows, cloud-based tools, and shared documents keep your team aligned.

- Maintaining data accuracy and version control

Outdated files slow everything down. A single source of truth solves this. When documents and updates live in one place, accuracy improves, errors drop, and your compliance posture stays strong.

- Balancing growth with quality of service

Growth should not come at the cost of client experience. Automate routine work, evaluate which services deliver the most value, and standardize workflows before scaling. With solid operations, you can grow confidently without overwhelming your team.

Effective Firm Management and Practice Management Software: Bringing It All Together

Practice management software, like Financial Cents, brings your client processes, team, and workflows into one organized system so your firm runs more smoothly.

- Brings all workflows and processes into one place

Everything lives in a single system instead of being scattered across emails and spreadsheets, making it easier to stay organized and focused.

- Improves visibility across the firm

You can see bottlenecks, deadlines, and workloads at a glance, which helps you step in early and keep work on track.

- Automates repetitive work

Follow-ups, recurring tasks, and reminders happen automatically, reducing admin work and lowering the risk of missed deadlines.

- Enhances team communication and accountability

Documents, notes, and updates stay in one place, keeping your team aligned and knowing exactly who is responsible for each task.

- Provides insight through reporting and KPIs

You get clear data on performance, productivity, and profitability, making it easier to improve processes and make informed decisions.

- Strengthens compliance and data security

Controlled access, protected communication, and secure file storage help you safeguard client information and stay compliant.

- Supports client management and transparency

Clients can see status updates, track deadlines, and upload documents without constant follow-up, creating a smoother experience for everyone.

If you want to see how practice management software can simplify your workload, strengthen your systems, and give you full visibility across your firm, you can book a demo with Financial Cents. It is an easy way to explore how the right tool can support your team and help you run a more organized, efficient practice.

Here are some additional firm management resources to get you started:

- 60+ Free Accounting Workflow Starter Pack

- 250+ Workflow Templates built by firm owners like you

- 5-day Email Courses

- Playbooks

- Practice Management Resources

Conclusion

Managing an accounting firm becomes easier when your strategies are intentional and your processes are well-structured. With clear workflows, strong communication, and a supportive team culture, you create a firm that delivers consistent, high-quality work without the daily stress.

Leadership matters, but technology is what brings everything together. It simplifies your operations, automates routine tasks, and provides full visibility across your firm, so you can work with greater confidence and clarity.

If you are ready to streamline your workflows and build a more organized, efficient firm, you can start using Financial Cents to manage your processes today.