Workflow software streamline processes, identify bottlenecks, and enhance overall efficiency in today’s rapidly evolving accounting landscape."

Dawn Brolin, CPA, CFE, President, Powerful Accounting Inc.Tax workflow software is the difference between:

- Tax firm owners who struggle with outstanding tax returns (or don’t know which returns are outstanding) during tax season.

And;

- Those with organized data and systems that enable them to work through tax seasons confidently.

That is why workflow automation is the most valuable feature in accounting practice management for many accountants.

This article reviews the seven (7) best tax workflow software to help you unlock employee performance, client satisfaction, and firm profit in 2024.

What is Tax Workflow Management Software?

Tax workflow software is an application that tracks a firm’s tax returns, their status, and what your team is working on to remove all interruptions, facilitate team (and client) collaboration, and help your team complete all tax returns on time.

Key Features of a Tax Workflow System

a. Workflow Management and Automation

Knowing all tax regulations, hiring unicorn employees, and finding quality clients will only matter a little if you have a good system to manage your team’s workflow.

A workflow tool without the recurring work feature is pointless for many tax accountants. You also need to be able to automate manual, repetitive tasks to free up brain power for critical tax work.

b. Due Date Tracking

Due date tracking features help to prioritize your tasks to meet tax deadlines consistently.

They display the dates by which projects must be done in the workflow dashboard, helping you confidently manage all tax deadlines.

c. Client Management (CRM)

New clients have lofty expectations. Organizing client information takes precious time and energy, which can prevent you from understanding client needs enough to meet those expectations.

Client management features in tax workflow software organize client information and automate client requests and reminders so your team can focus on nurturing the relationship.

d. Team Collaboration and Communication

Effective communication helps team members to understand their role in every tax project.

Whether it is comments (for providing feedback on a project), tags (that mention specific team members) or client notes (that provide client updates), communication and collaboration features build clarity in your firm so that your employees can focus on getting work done and finding solutions to emerging challenges.

e. Document Management

When documents are stored in different locations–email inboxes, sticky notes, and personal computers—it becomes difficult to access and use them for work. This increases the chances of using the wrong version of the document.

Document management features organize all documents in one place for everyone to access anytime and anywhere.

f. Automated Requests and Reminders

More than 65% of accounting professionals look for the client task feature before committing to a software solution because it saves them up to 10 hours weekly.

Client task features allow you to set up a list of the files and information you need from clients, making it easier to follow up with clients until they send the information you need.

These features also help with E-Signature collection. Tax workflow software, like Financial Cents, has an E-signature feature that allows online signatures with a few clicks.

g. Time Tracking

Time tracking gives you an idea of how your team spends its time, empowering you to adjust your processes, plan capacity, and bill clients.

Your tax workflows should have a time-tracking feature that tracks time (in the background) while your team works.

h. Data Security and Compliance

To protect tax and accounting data from theft, your tax workflow software data have security and compliance protocols that might include:

- Access Control: the ability to control employee access to information.

- Identity Authentication: PINs, passwords, and security tokens to verify user identity before giving them access.

- Encryption: converting plain text into a cipher code to render information inaccessible to unauthorized persons.

i. Integration

No fewer than 43% of accountants integrate their tax workflow software with their email service provider to access their client emails from their workflow software.

Your ideal tax workflow software should connect with other relevant applications to reduce the need to jump between apps, which wastes time and results in data entry errors.

The 7 Top Tax Workflow Management Software

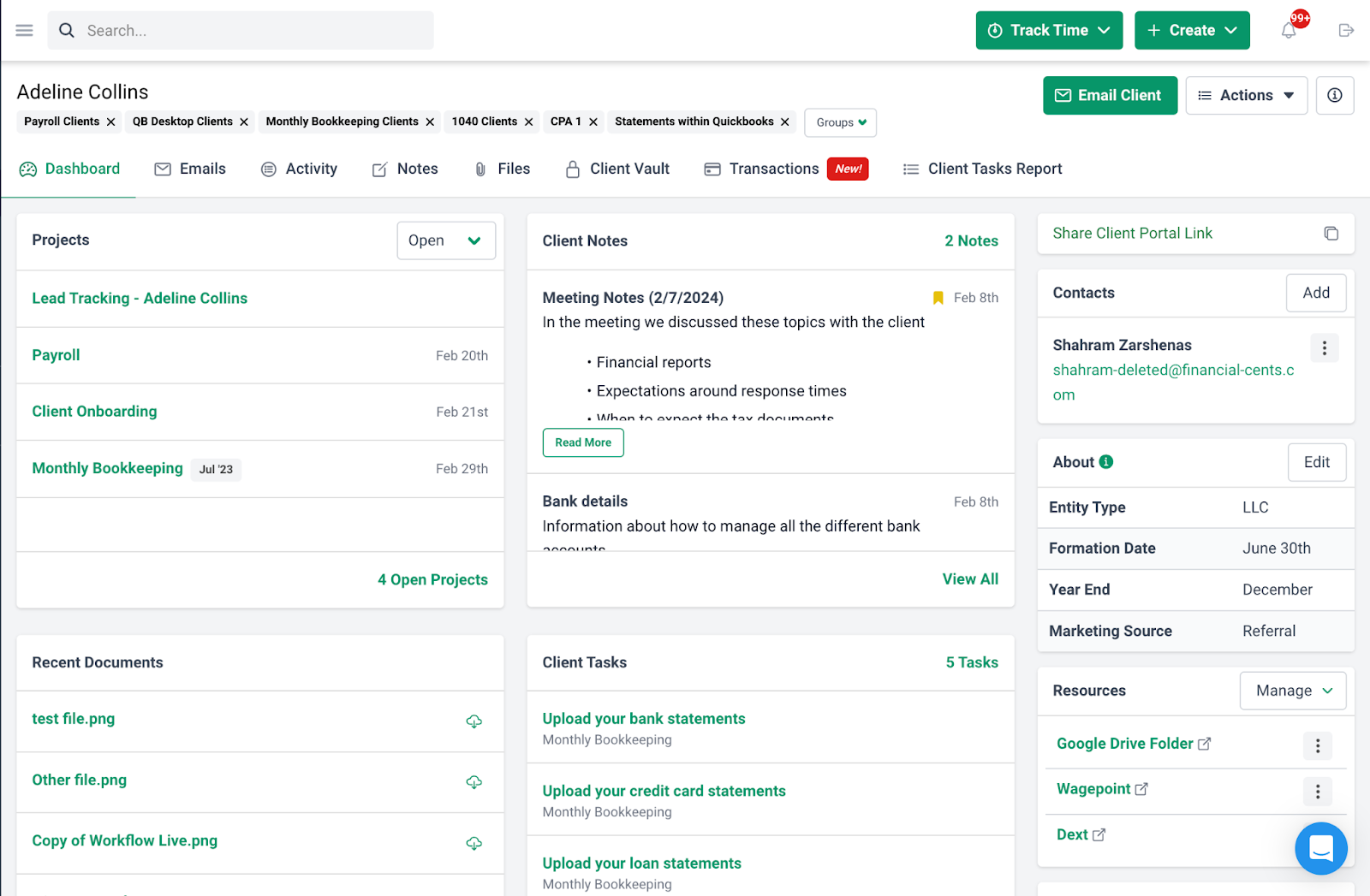

Financial Cents was designed to help tax accountants organize work (and client) information, collaborate with teams (and clients), and automate manual tasks, especially as they grow their team and client base.

Its features include

Workflow Management and Automation

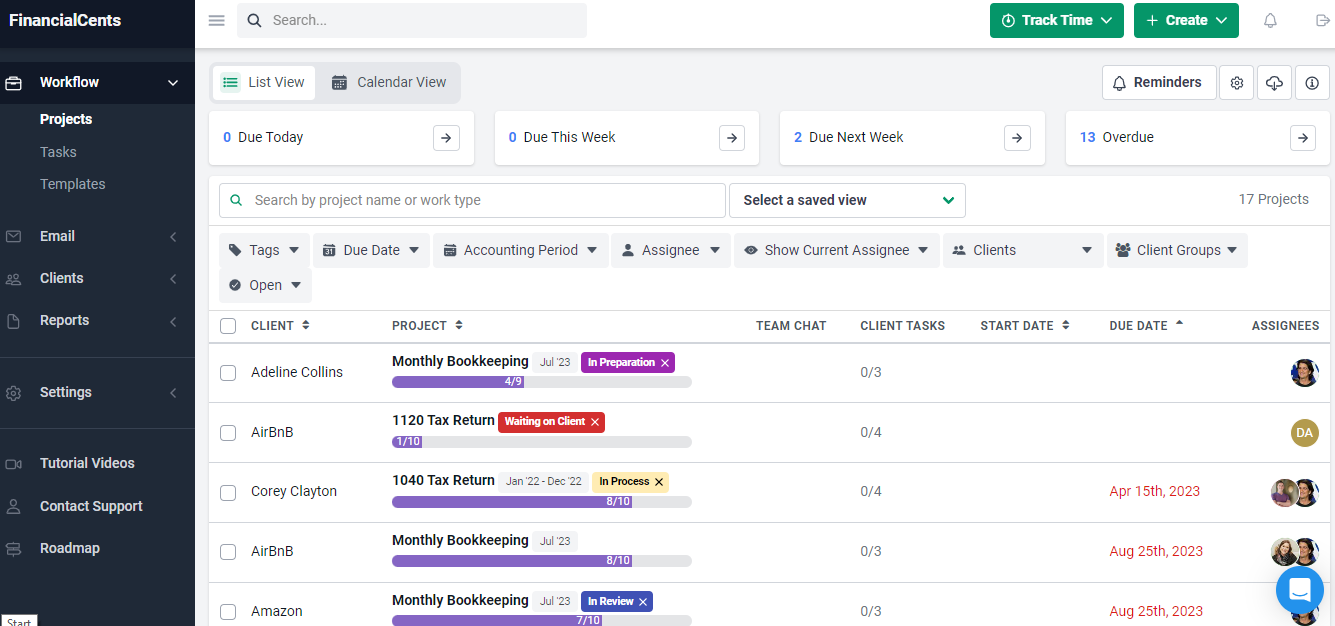

Financial Cents keeps you on top of all tax work and prevent things from falling through the cracks:

- Workflow Dashboard: track every tax project your firm is working on, including their status, due dates, and assignee in one view. Firm Owners and Managers can see everyone’s tasks, while Staff Members can only see their assigned work.

- Workflow Filters: sift through numerous information to get specific project details (such as assignee, work type, tags, due date, client group, etc.) quickly.

- Workflow Templates: a list of the steps that make up a project.

- Recurring Project: create projects on a repeatable schedule so they don’t slip through the cracks.

- Workflow Automation: apply rules that trigger specific actions such as:

- Auto-update tags as a project moves through the stages.

- Auto-send emails to a client when your team completes a task or section.

- Auto-create projects for a client when a task or section is completed.

Due Date Tracking

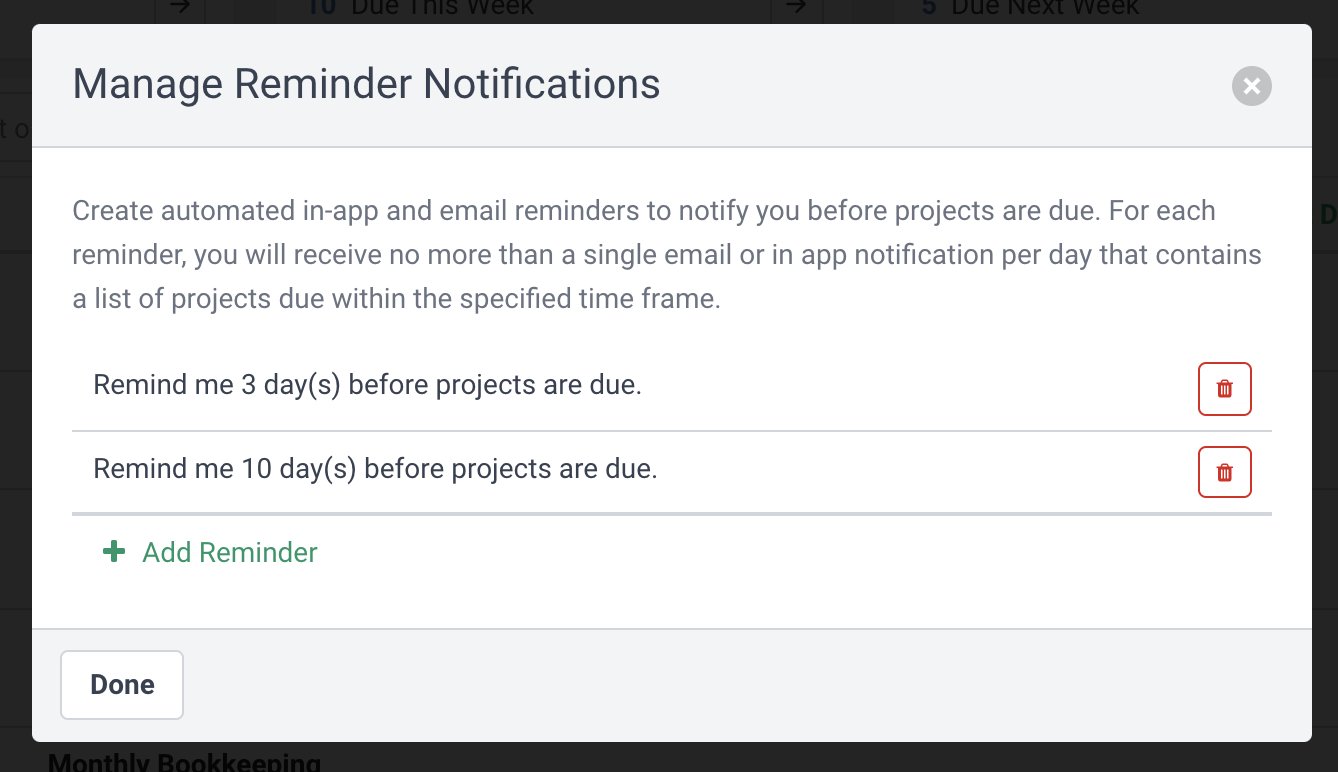

All tax projects and tasks in Financial Cents have due dates that keep everyone accountable to deadlines. Other due date tracking features include:

- Due Date Reminders for Projects: all team members can set up reminders to keep them focused on tasks, projects, and tax deadlines.

- Internal Due Dates: help your team complete tax work before the client deadlines by setting an earlier due date.

- Due Date Extension: flexibility to extend the timeline of tax projects as you see fit.

Client Management (CRM)

Everything you need to build quality client relationships is stored in the client profile. These include:

- Contact: client’s phone numbers, emails, etc.

- Upcoming Projects: a view of all tax work in your pipeline.

- Client Notes: important client updates are stored in the client profile.

- Recent Documents: client documents are stored in the client profile.

- Client Tasks: view outstanding client information requests.

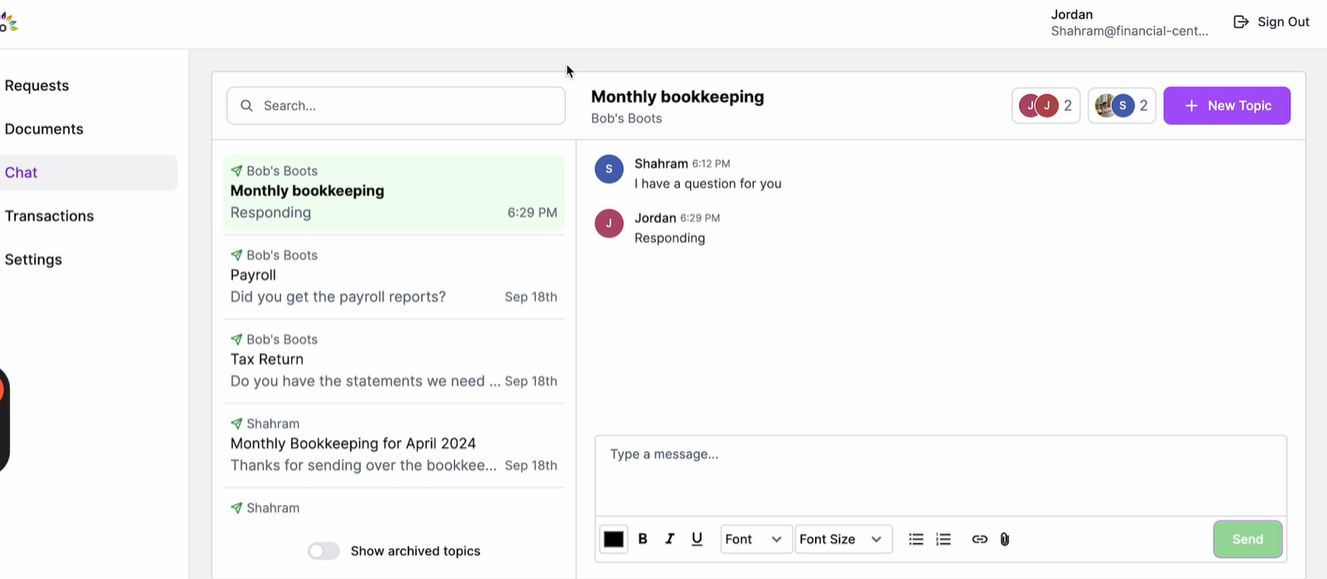

- Client Chat: discuss project and document requirements with clients in one place. This feature allows you to:

- Categorize client conversations into topics.

- Determine the collaborating team members.

- Activity Timeline: see when a client was last contacted, by whom, and what was discussed.

- Client Vault: a secure hub for sensitive client information such as usernames and passwords to third-party apps.

- About Section: save custom information that is specific to each client, such as entity type, EIN, and SSN.

- Work Resources: organize links to apps, SOPs, documents, videos, etc. that your team needs to do work.

- Client Tasks & Requests: collect files and information from clients automatically.

- Folder Sharing: organize documents into folders and share them with clients.

- ReCats: clarify uncategorized QBO transactions with your clients and resolve them inside Financial Cents.

Team Collaboration and Communication

Financial Cents provides a central platform for team collaboration inside the project and on the client’s profile.

Your team members can use the following features to stay up to date with tax work:

- Team Chat: a hub for team communication inside the tax project.

- The “Comments” Tab: hold work-related conversations inside the team.

- @Mention: draw a team member’s attention to your comment or question.

- Client Emails: all work-related emails are added here for team members to use.

- Files Tab: contains your client’s work-related documents.

- Notes: organize client-related updates in one place

- Activity Feed: an audit trail of client interactions.

- Automated Notifications: Financial Cents notifies your team members in-app and by email when they are assigned tasks, mentioned in a comment, and when a document is shared.

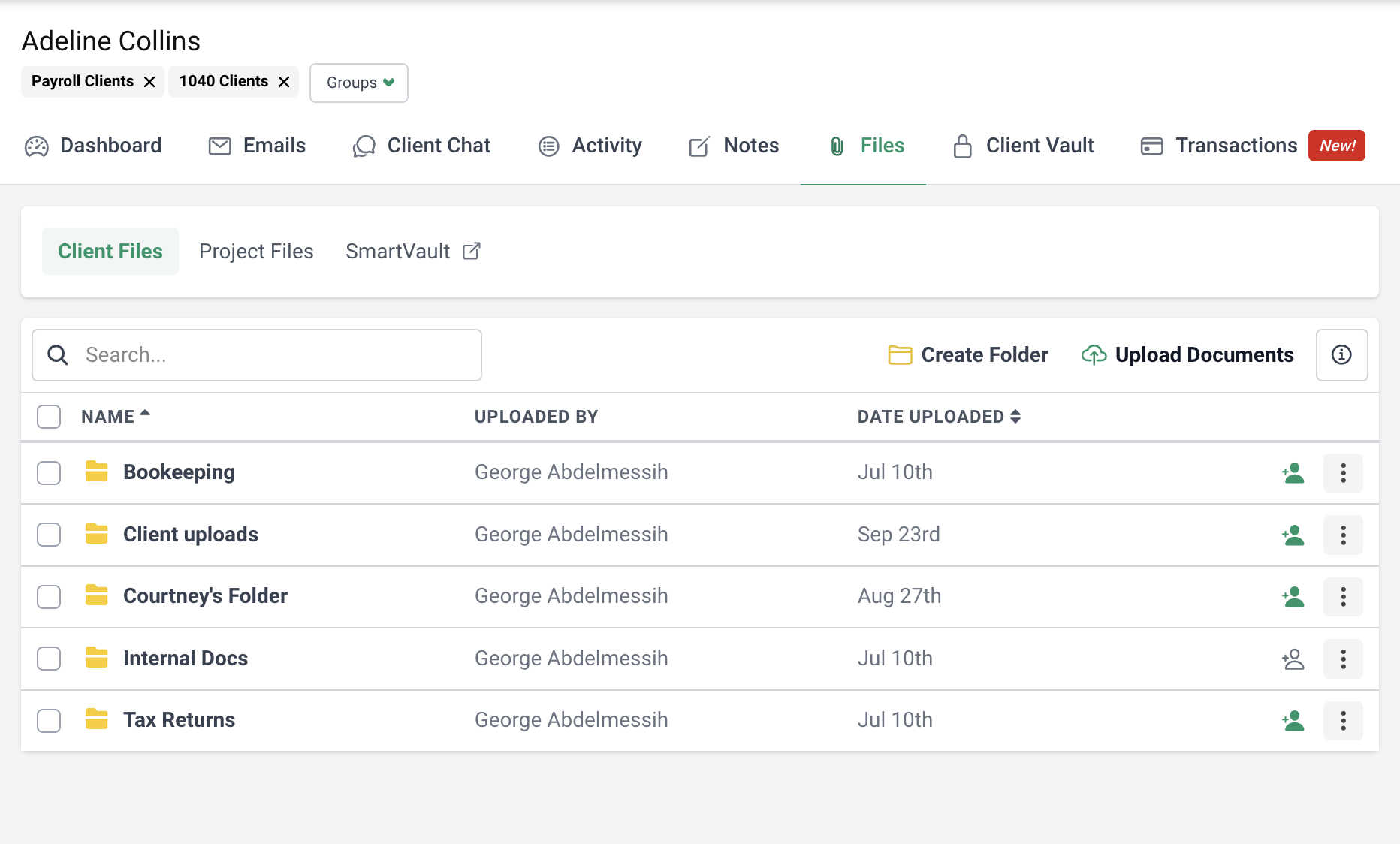

Document Management

Financial Cents stores all client documents inside the client’s profile. From there, you can:

- Create Folders to put related documents together.

- Move Documents between folders for ease of access.

- Search the Documents Hub to find specific documents quickly.

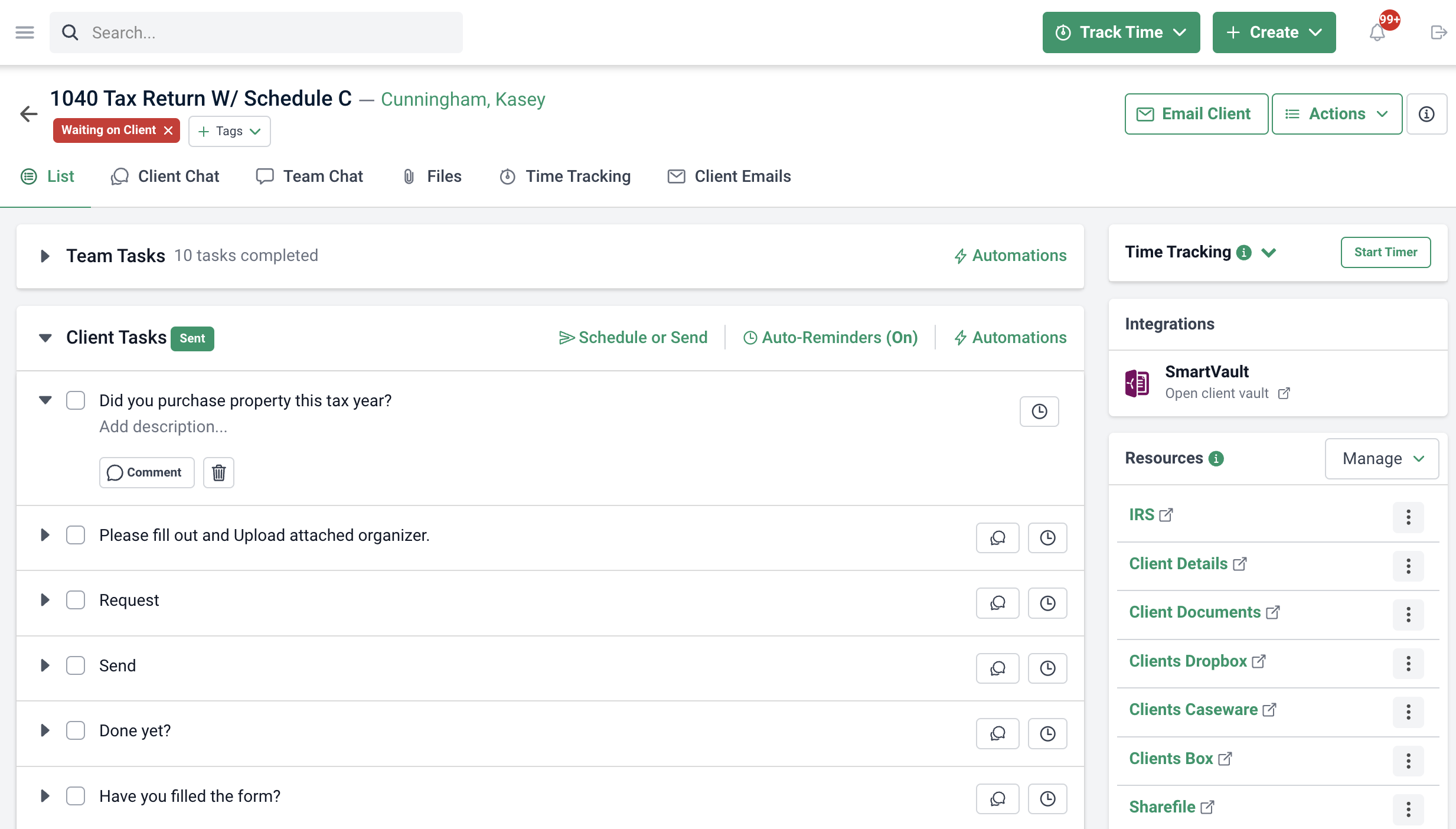

Client Tasks and Automated Reminders

This feature allows your team to access:

- Client and Team Tasks in One View: management team and client tasks in one place.

- Client Task Dependency: trigger the sending of client requests upon completion of a preceding task.

- Multiple Client Requests: send more than one request within one project.

- Multiple Client Contacts: send different requests to different persons at your clients’ company.

- Automated Reminders: set up Financial Cents to chase clients for information.

Time Tracking

Financial Cents’ built-in time tracker shows you where your team spends their time.

- Invoicing: enables you to invoice and bill clients for work done through the billing feature.

- Billable vs Non-Billable: allows you to determine which time is billable which is not.

- Actual Vs Budgeted Hours: shows how much you’re underestimating tax work.

- Effective Hourly Rate: compare client rates with time invested in their tax work.

Integrations

Financial Cents’ integrations include:

- QuickBooks Online: import and auto-sync clients and track time in Financial Cents for invoicing in QBO.

- Gmail and Outlook: a focused client folder in Financial Cents for all client emails.

- SmartVault: import clients and access client documents in SmartVault from Financial Cents.

- Adobe Sign: collect signatures for tax returns, proposals, and other documents online.

- Zapier: Connect Financial Cents with over 5,000+, such as Ignition, Typeform, Dropbox, and Xero.

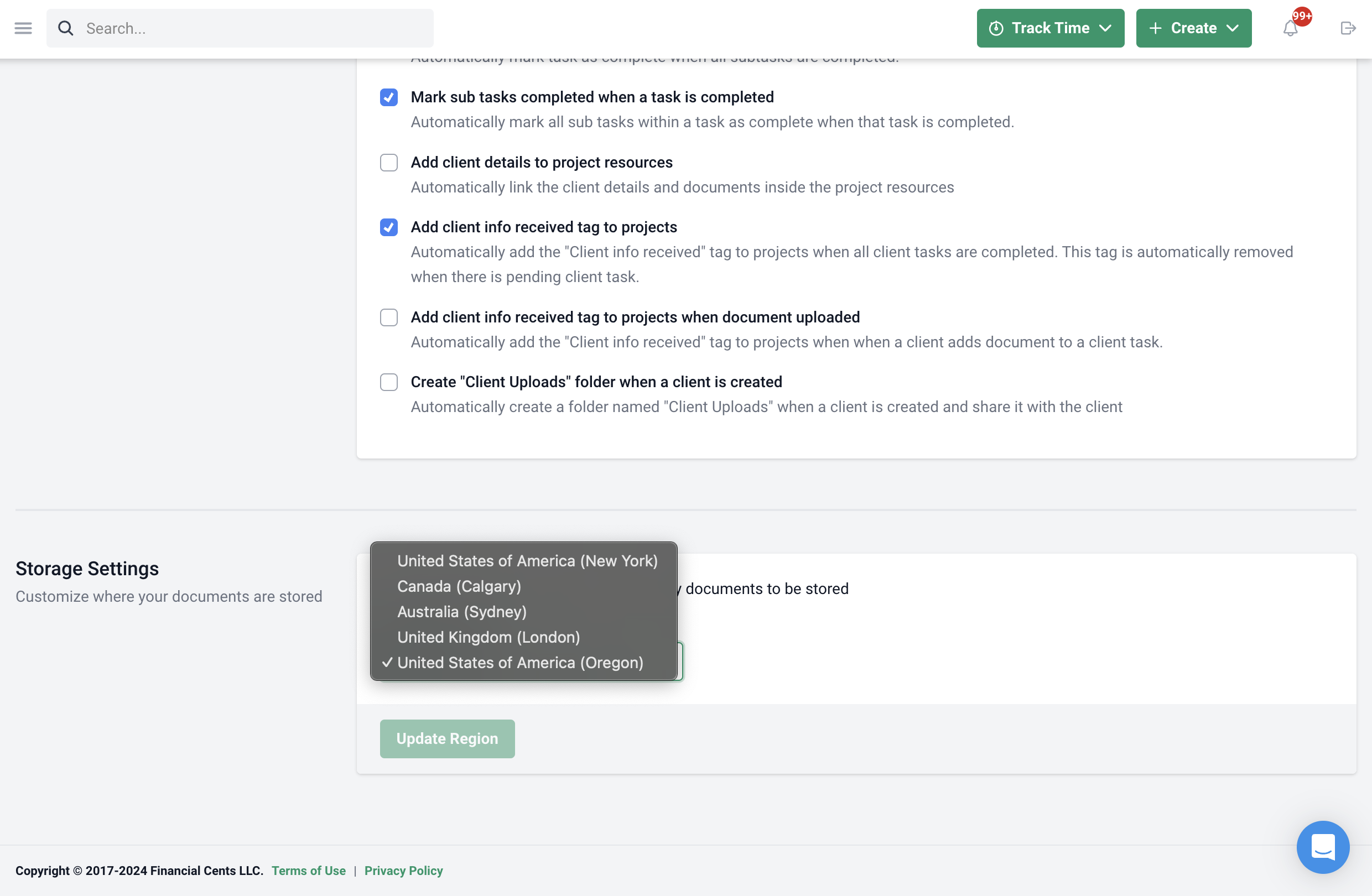

Data Security and Compliance

- Data Encryption: all personally identifiable data in Financial Cents is encrypted at rest and during transit. Data remains encrypted until a TLS secure connection is guaranteed.

- Data Privacy and Residency: Financial Cents has a data storage system in the US, Canada, UK and Australia. This helps the tax firms in these countries to comply with data residency laws by keeping their clients’ data within their respective national borders.

Pros

|

Cons

No kanban-style view (yet) |

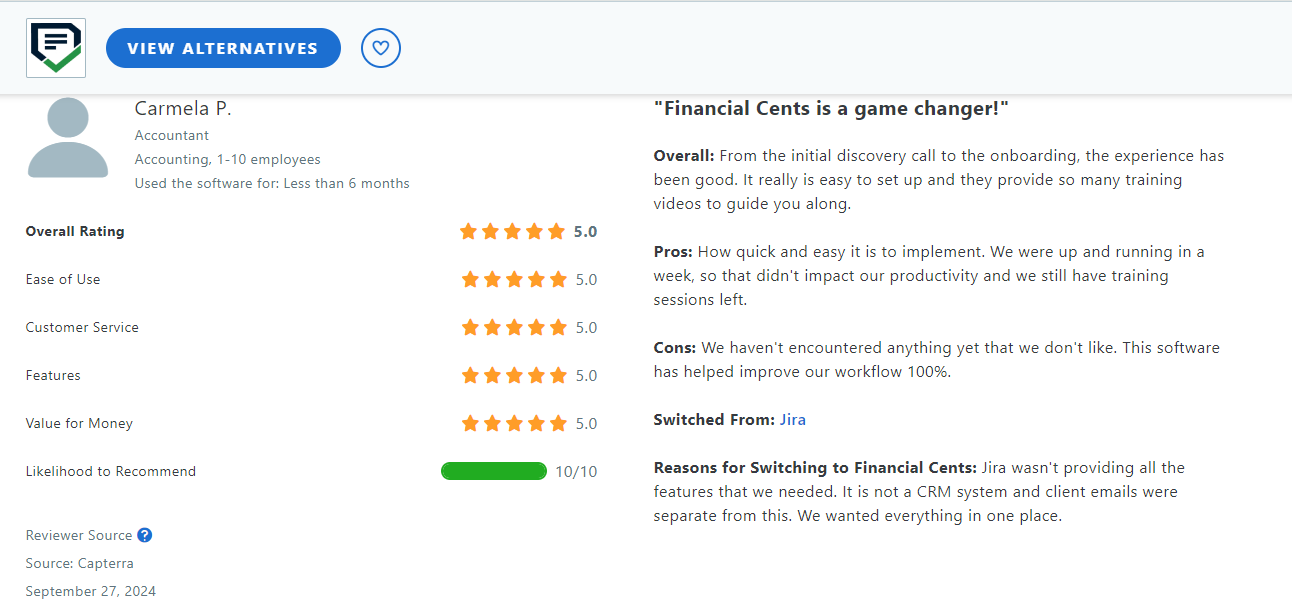

Rating

Reviews

Free Trial

Yes. 14 days.

Pricing

- Solo Plan is $19/month per user (annual billing)

- Team Plan is $49/month per user (annual billing)

- $69/month per user (monthly billing)

- Scale Plan is $69/month per user (annual billing)

- $89/month per user (monthly billing)

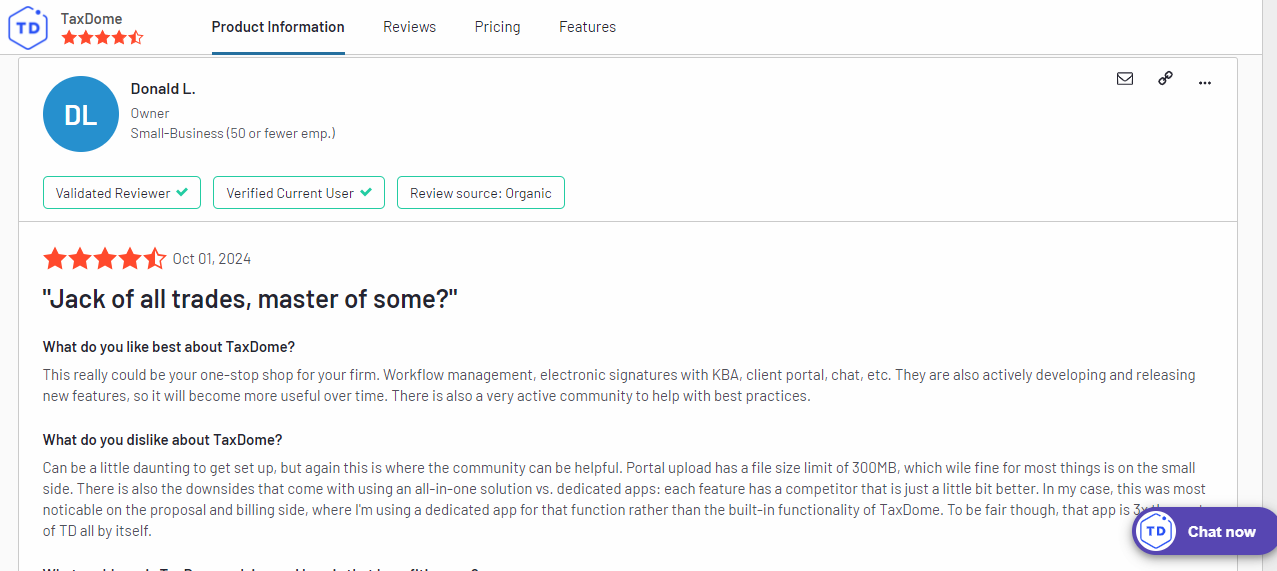

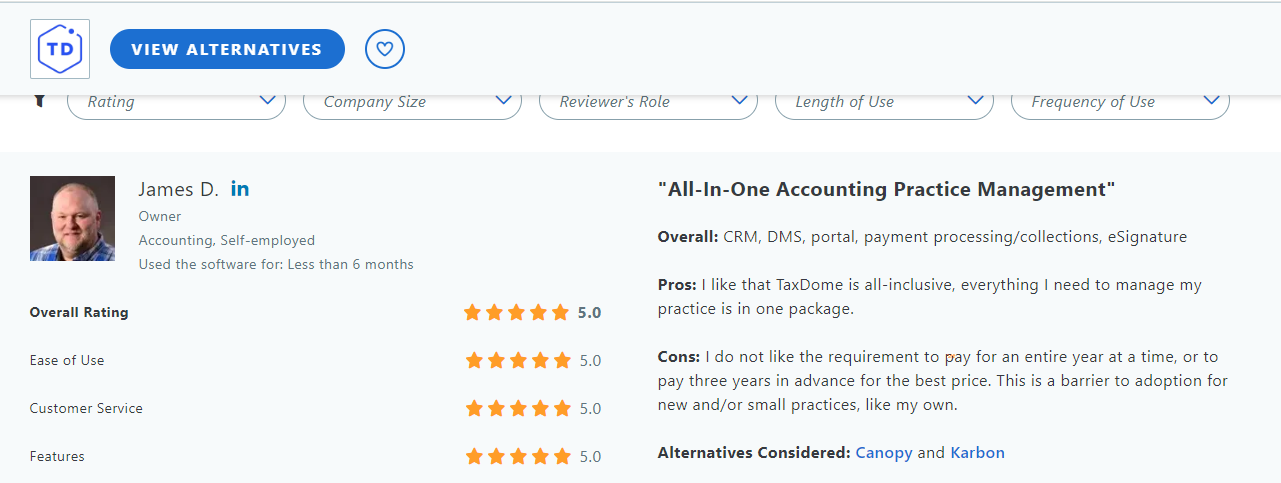

2. TaxDome

TaxDome’s all-in-one tax workflow solution helps tax accountants prevent the stress of endless spreadsheets, missed client calls, and last-minute deadlines by centralizing everything they need for work in one place.

TaxDome’s features include:

Workflow Management and Automation

- Insights Dashboard: review your team’s performance to make strategic decisions.

- Calendar: see your scheduled tasks ahead of time.

- Automove: move tax work between stages automatically. This allows you to:

- Send Email: send personalized emails to clients when the project reaches a stage.

- Create Organizer: send a tax organizer to the client and move the job to the next stage automatically when the client submits the organizer.

- Update Assignee: automatically assign the work to a team member once the project reaches a certain stage.

Client Management

- Client Record: client account and contact information in one place.

- Bulk Actions: save time by sending bulk client messages via chat, emails, and SMS.

- Schedule Client Emails: set up client emails to be sent in the future.

Team Collaboration

- Set and Modify Access Rights: regulate what your employees can see or do based on their roles.

- Wiki Pages: document your standard operating procedures to help your team know what to do.

- Chats: communicate with team members in real-time.

- @mention: tag team members in your comment quickly.

Tax Organizers

- Customizable Questionnaires: collect clients’ tax information at scale by sending them personalized forms to complete.

- Assign Tasks from Organizers: give the responsibility for tax work to specific assignees based on the client’s responses.

- Conditional Logic: set up your organizer to skip questions that do not apply to a client.

- Explanations for Questions: describe your questions to help clients answer accurately.

Time and Billing

- Payment Processing: Receives client payments inside TaxDome.

- Recurring Invoices and Payments: Bill your clients on a repeatable schedule to receive payment faster.

- Customized Invoice: add your firm’s logo to your invoices to maintain the same look and feel.

Client Portal

- Documents: receive and store client documents securely.

- Messaging: chat with clients on demand.

- Signatures: collect client signatures securely.

Pros

|

Cons

|

Rating

Reviews

Free Trial

Yes. 14 days.

Pricing

TaxDome has a seasonal staff plan of $100/month per user. Standard plans are:

- Solo – starts at $700/year per user (3 year plan).

- Pro – Starts at $900/year per use (3 year plan)

- Business – Starts at $1,100/year per use (3 year plan)

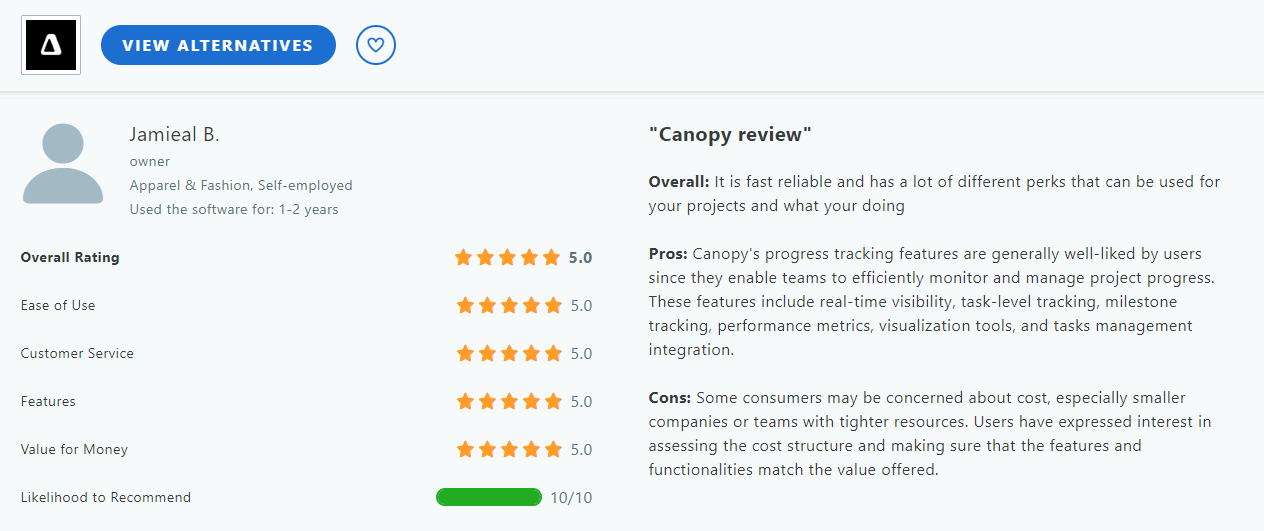

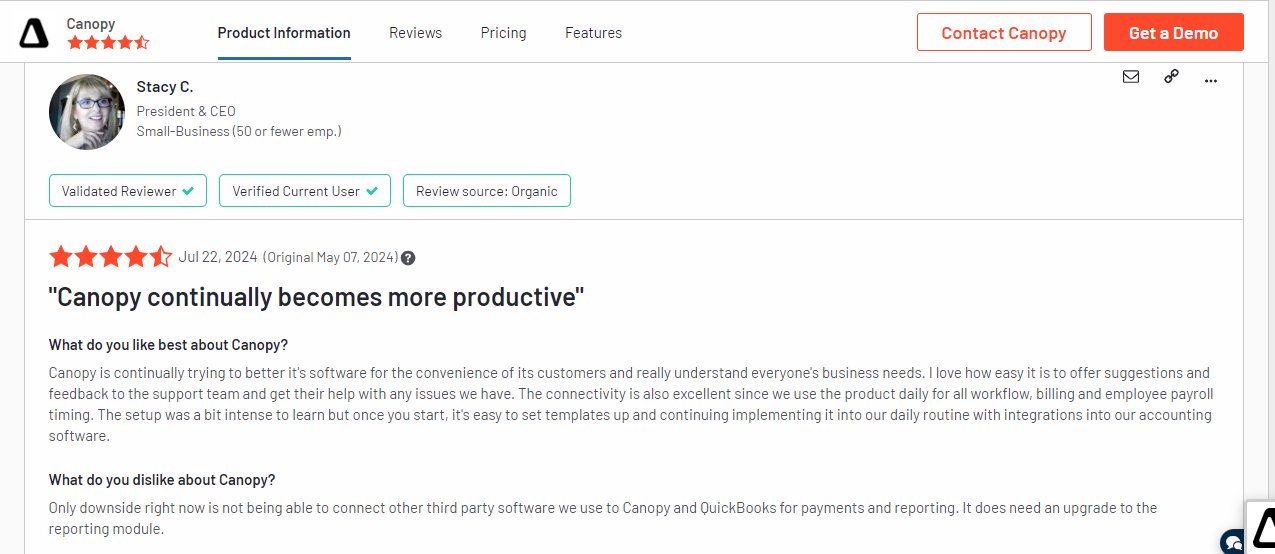

3. Canopy

Canopy gives tax accountants the visibility needed to remove bottlenecks and stay efficient and accurate. Its tax resolution features help tax accountants find the best solutions to tax controversies.

Canopy’s tax workflow features include:

Workflow Management and Automation

- Workflow Templates: rule-based automation that creates tasks and subtasks for your tax workflow.

- Client Reminder: keep your requests at the top of your client’s mind with Canopy’s automated reminders.

- Recurring Tasks: create recurring tax work based on due date or project completion.

- Automation Triggers: a list of events that set off succeeding actions.

- Comments: discuss client projects with comments.

- Document Annotation: collaborate with your team on client documents.

Client Management

- Lists & Dashboards: organize client data into lists and groups.

- Customize Client Data: Tag, sort, filter, and save client data as you see fit.

- Templated Emails for Client Requests: standardize your client requests and communications.

- Client Records: organize client data and collaborate with your team.

- Bulk Actions: perform the same action across multiple clients.

- Global Inbox: a dedicated folder for your client emails.

Transcripts and Notices

- Automatic Update: IRS notice workflow templates are updated without human effort.

- Timely Response: get visibility into clients’ notices so that you can resolve their tax cases on time.

- Automated Transcript Pull: timely tax information for your client’s financial planning.

- Easy-to-read Table: review client’s data on the go.

Time and Billing

- Built-in Timer: track work anywhere and at any time

- Payment Reports: visibility into your payment information.

- Work in Progress (WIP): to view your revenue potential.

- Invoice Reminders: help clients pay you time.

- Customizable Invoice: edit your invoice to suit your firm.

Insights

- Answers: get a visual picture of your firm’s data.

- Filters: shows specific firm information for accurate analysis.

- Live Dashboards: get a clear picture of your firm’s resources.

Pros

|

Cons

|

Rating

Reviews

Free Trial

Yes. 15 days.

Pricing

Client Management Module is 150 per month.

Additional features attract additional fees.

-

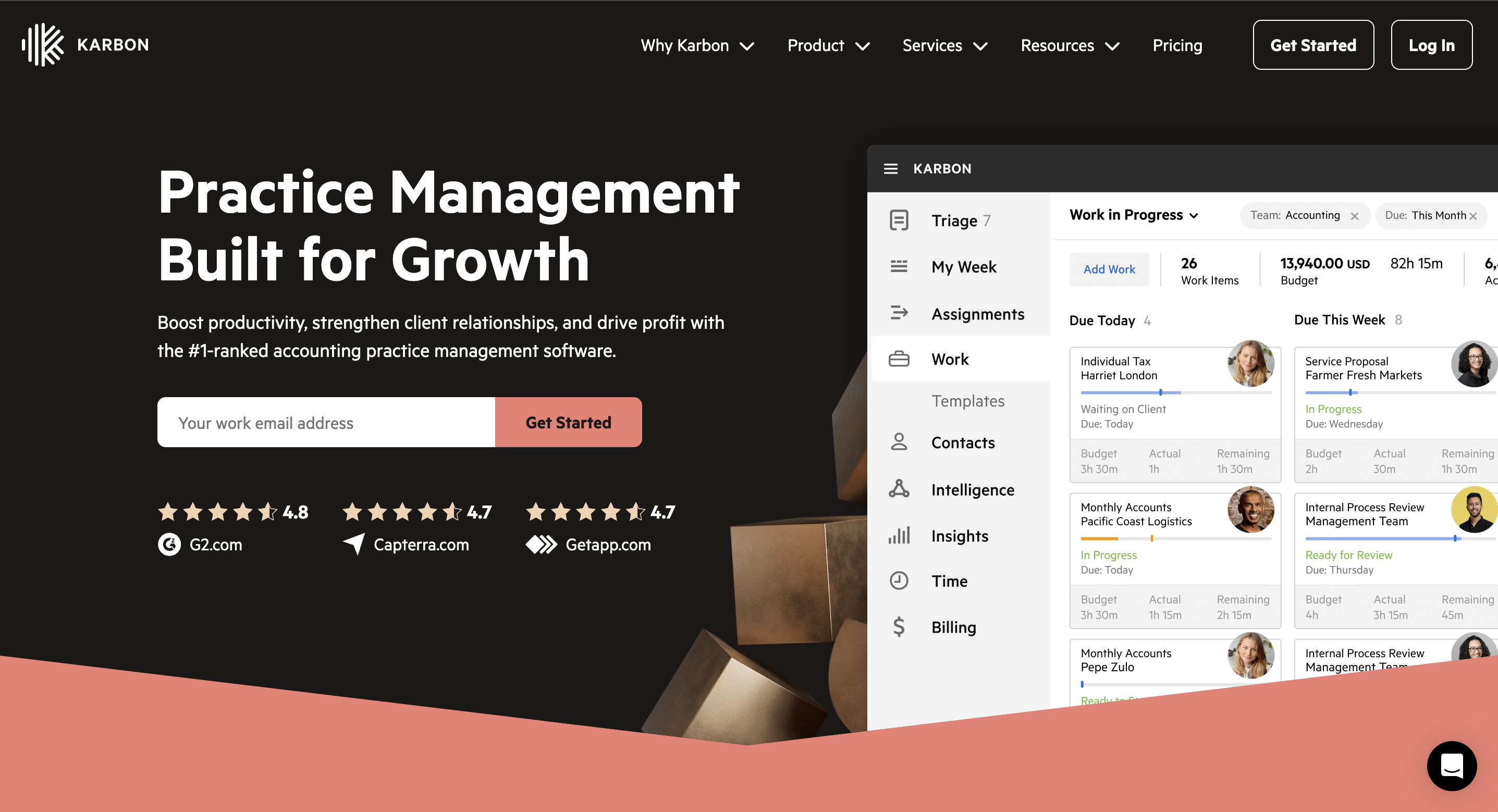

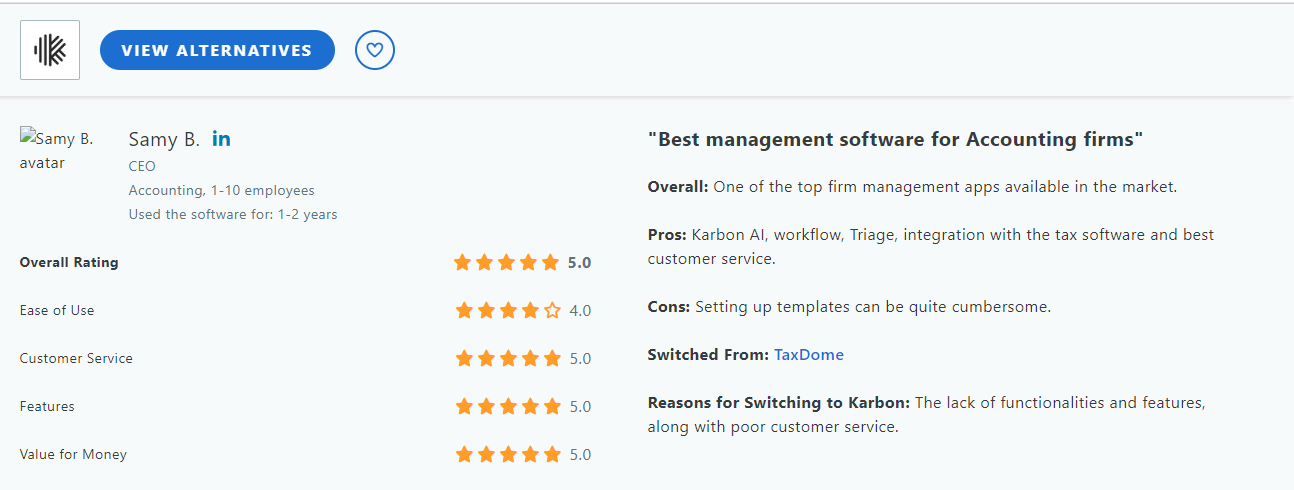

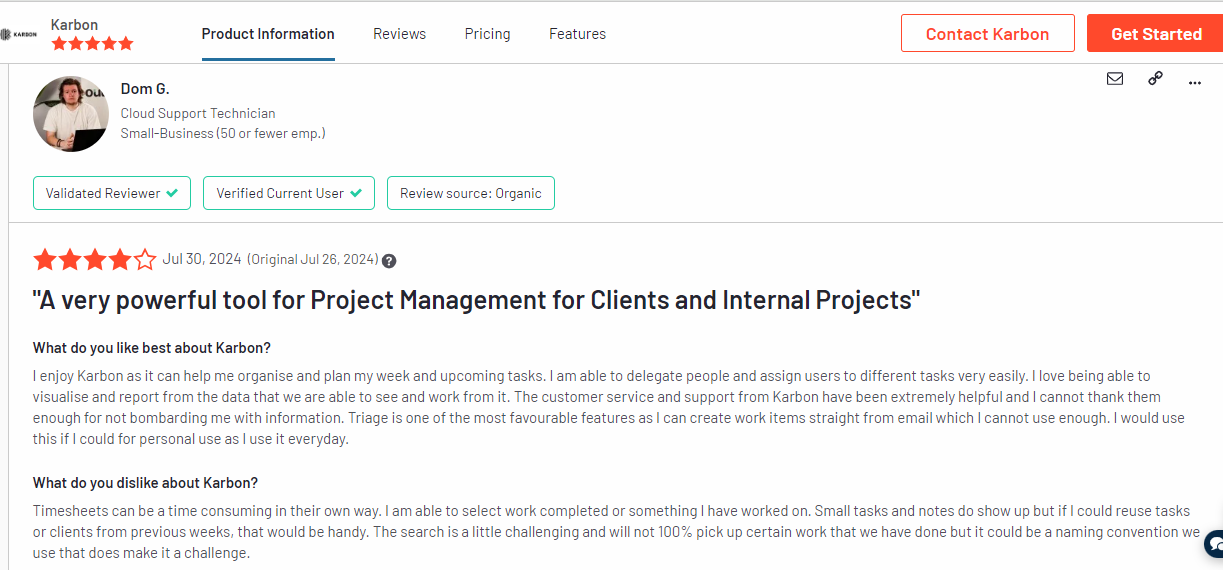

Karbon

Karbon provides a central platform for tax accounting firms, uniting their team in one place to stay on top of project planning, execution, and communication.

Its tax workflow features include:

Workflow Management and Automation

- Work Templates: standardize your tax processes with document steps.

- Kanban Board: visualize your tax projects to improve productivity.

- My Week: shows each employee’s assigned tasks for the week.

- Work Scheduler: create repetitive tax projects for their future dates.

- Email Actions: assign client emails to team members right away.

Team Collaboration

- Comments: share thoughts with your team members.

- Mentions: tag your team members with your comments on a project.

- Notes: discuss a client’s needs with your team in the client profile.

- Integrated Email: track email communication between your team and clients inside Karbon.

Client Management and Portal

- Activity Timeline: a view of your client’s interaction with your firm.

- Client Groups: group clients with similar needs together.

- Contact Type: separate clients from leads and prospects.

- Insights: Reports showing how well your clients are being served.

Client Portal

- Automate Data Collection: get Karbon to request the data you need from clients.

- Auto-reminders: make Karbon follow up with clients for outstanding data.

- Customization: add your logo and colors to make your portal feel like your firm.

- Multiple Languages: communicate with your clients in Dutch, English, French, or Spanish.

Pros

|

Cons

|

Rating

Karbon has:

Reviews

Free Trial

Yes. 7 days.

Pricing

- Team: $59/month per user (billed annually)

$79/month per user (billed monthly).

- Business: $89/month per user (billed annually)

$99/month per user (billed monthly).

- Enterprise: Custom Pricing

5. Jetpack Workflow

Jetpack Workflow is a software that helps you standardize your tax work, automate recurring work, and stay on top of all tax deadlines.

Its features include

Workflow Management and Automation

- Workflow Templates: standardize your work with checklist templates.

- Recurring Jobs: create repetitive jobs in advance.

- Dependencies: move work between two members automatically.

- Tags: flag projects to display their status.

- My Work: a list of every team member’s weekly tasks.

- Search: find any project in your dashboard quickly.

Clients Management

- Client Jobs: view your client’s current and future tax work.

- Edit Client Template: adjust your client’s project template to ensure nothing slips through the cracks in subsequent projects.

Team Collaboration

- Comments: help discuss project requirements.

- Tags: call team members in your comments on jobs.

- Notes: add work-related information to a job.

Pros

|

Cons

|

Rating

Jetpack has:

Reviews

Free Trial

Yes. 14 days.

Pricing

- Starter: $30/month per user (billed annually)

$45/month per user (billed monthly)

6. Pixie

Pixie is a basic workflow software for streamlining your tax workflows, enhancing collaboration, and organizing information for your team.

Its features include

Workflow Management and Automation

- Documented SOPs: workflow templates with instructions, links, and SOPs checklists and videos.

- Custom Date Triggers: deadlines based on fixed or custom schedules.

- Internal Deadline: make your team complete tasks before their due dates.

- Recurring Tasks: create a task once and make it repeatable.

- Tasks Templates: turn recurring projects into templates for future work.

Client Management

- Automated Client Record: integration with Companies House that imports client data into accounts in Pixie.

- Client Email: automatically add client data emails to client records.

- Client Notes: add work-related updates that your team members need to see on the client record.

- Custom Field: a hub for unique client information like key dates, reference numbers, usernames, and passwords.

- Bulk Actions: send emails to multiple clients simultaneously.

Team Communication and Collaboration

- Internal Notifications: show when team members complete tasks or read your emails.

- Reporting: see your firm’s data to understand what needs attention.

- To-do Lists: tell your team members their roles in their order of priority.

Client Tasks

- Client Task Checklist: request multiple files and information from clients with a checklist.

- Automatic Reminders: set up automated emails to keep your requests top of client’s minds.

- Client Chat: answer clients’ questions in real time.

Pros

|

Cons

|

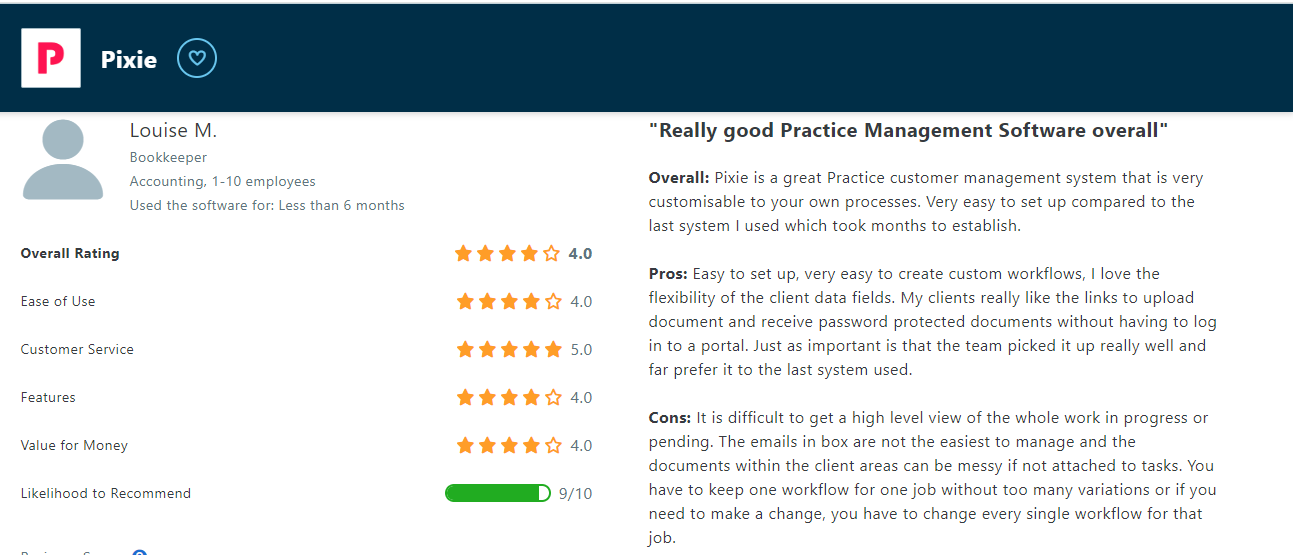

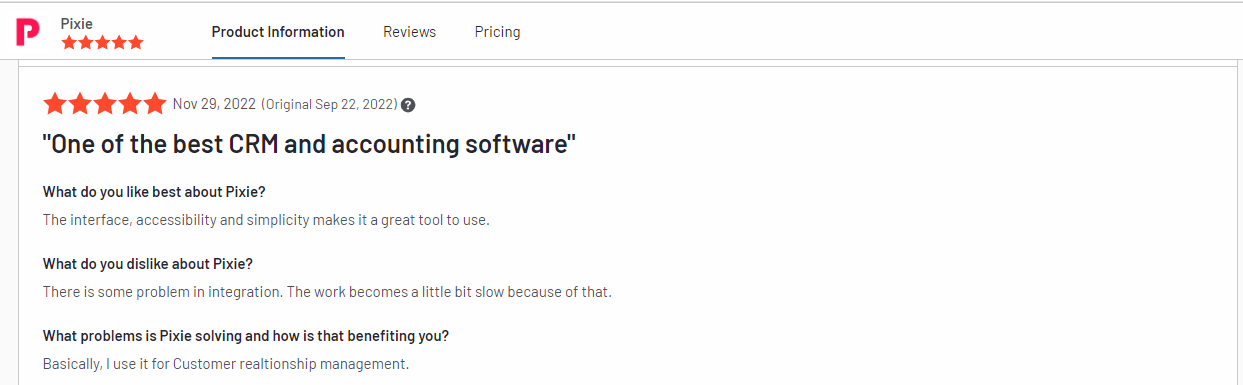

Rating

Pixie has 4.8 (out of 5) stars on Capterra and G2.

Reviews

Free Trial

Yes. 30 days.

Pricing

Less than 250 clients: $129/month.

250–500 clients: $199/month

501–1000 clients: $329/month

Over 1000 clients: custom pricing

7. Basil

Basil is an all-in-one practice management software that helps tax accountants get their day-to-day jobs done.

Its features include:

Workflow Management and Automation

- Calendar: the visibility to plan your tasks ahead of time.

- Time Tracking: keep an accurate record of the time your staff spends on client work.

- Charts: create graphs from your firm’s data to make visual sense of your performance.

Client Portal

- Passwordless Access: clients do not need to create login information to access the portal.

- Document Sharing: exchange documents and collaborate with clients and team members.

- Custom Client Portal Login: use your logo and colors on your welcome page to keep the client experience consistent.

Client Management

- Store Client Data: keep all relevant client information–contact, EIN, etc.–in the client’s profile.

- Customizable Client Dashboards: track and manage client information in one view.

- Client Contact: an audit trail of your client notes and conversations.

- Chat: discuss with clients and team members in real-time.

- E-Signatures: collect client signatures for as many documents as you want.

- Custom Email Notifications: add your logo to your client email notification.

- Automated Reminders: automate client follow-up to buy back time for core tax work.

Pros

|

Cons

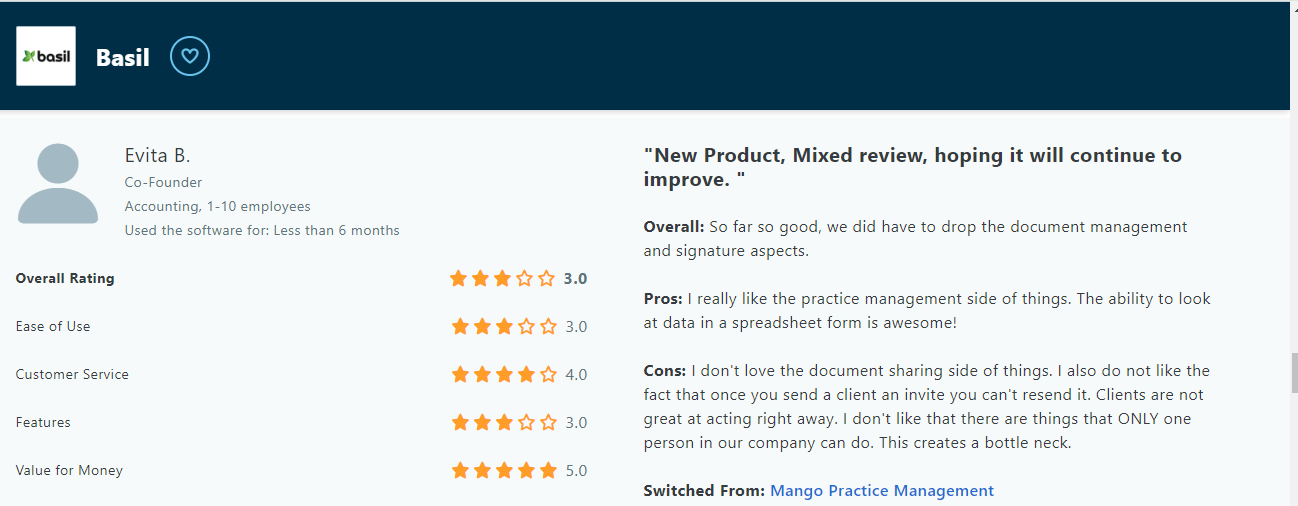

It is relatively new |

Rating

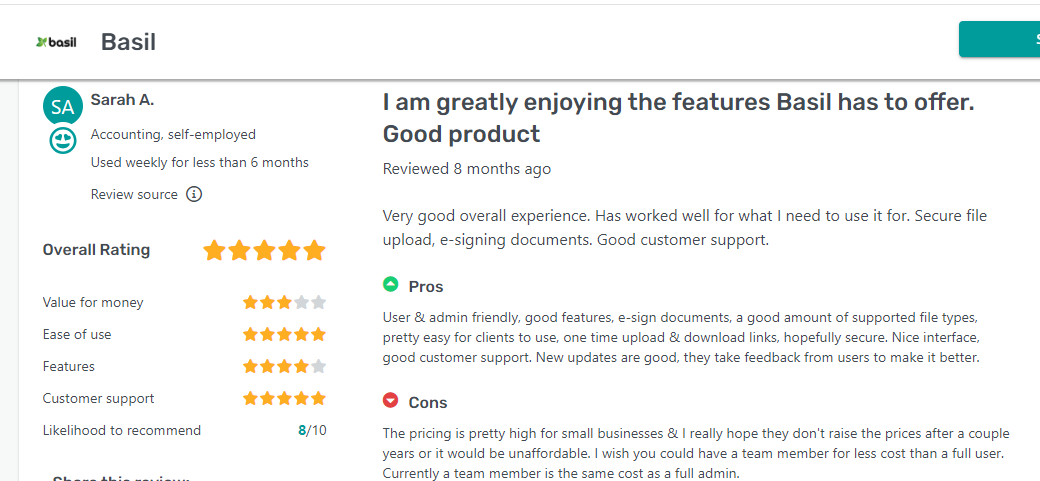

Basil has 4.6 (out of 5) stars on both Capterra and GetApp.

Reviews

Free Trial

Yes. 15 days.

Pricing

$30/month per user.

Key Considerations When Choosing Tax Workflow System

i. Ease of Use

This factor measures your ability to use software to smoothen your day-to-day tax processes without bottlenecks like 68% of accounting firm owners.

This is where you look out for the tool’s user-friendliness, simplicity of installation, and ease of Update.

ii. Your Budget

In setting a budget for tax workflow software, strike a balance between your workflow needs and financial strength.

An affordable tool is useless if it cannot address your unique workflow challenges. If you are going above your budget for a product, it has to be worth the cost. Many of the features of expensive software may not be relevant to you. A free trial of the available apps comes in handy here.

iii. Scalability and Future Growth

Software buying is a strategic decision. Every tax workflow software has a roadmap that may not align with your firm’s future.

In that case, its new features and updates will become irrelevant to your team with time.

iv. Automation and Integration

It’s one thing for a tax solution to have automation; it’s another for it to automate exactly what you need to automate.

The more time you can buy back with automation and integration, the better.

iv. Client Management

Without a client management feature, your team will have to constantly switch between two separate apps (many times a day) to access work and client information. This context-switching kills team productivity.

v. Customer Support

Even with easy-to-use tax workflow solutions, maximizing all features depends on the responsiveness of the customer support team.

Customer support also helps your tax software provider understand your day-to-day workflow needs to build features that serve your unique needs.

Go into Every Tax Season Confident of Your Workflow Processes and Client Information

Tax seasons are dreadful because you’re trying to juggle multiple client deadlines without a system to organize work information, collaborate with your team and clients, and automate manual processes.

Tax workflow software like Financial Cents was built to keep your firm together by organizing all information in one central place, automating tasks that would waste your time, and enhancing collaboration with your team and clients.

This lets you focus on using your expertise to file client taxes and resolve tax controversies.

Use Financial Cents for Free Today (for the next 14 days) and see how well it suits your firm.