Are you good with numbers? Do you enjoy working with small businesses, putting things in order, and helping businesses understand their finances?

If so, you may want to consider starting a bookkeeping business.

Bookkeeping is one of the most lucrative businesses to start right now! In this article, you will learn everything you need to know to start your own bookkeeping business.

Some typical duties of a bookkeeper include:

- Recording debits and credits

- Creating financial reports

- Entering data into spreadsheets and bookkeeping software

- Providing a CPA with financial records for tax purposes

- Handling bank reconciliations

- Maintaining budgets

- Managing payroll

- Highlighting any discrepancies and potential financial issues

- A bookkeeper is different from an accountant. Bookkeepers cannot file taxes or perform audits, and they don’t need an accounting degree to do their work. (Yes, you heard that right—you don’t need a college degree. As long as you know what you’re doing, anyone can be a bookkeeper!)

Overall, bookkeeping is more straightforward than accounting and is mostly about keeping track of the money in day-to-day transactions.

Setting a price based on the value to the customer, not based on how many hours something takes."

Mark WickershamMark Wickersham provides more insight about value based pricing in this video:

Research your competition and conduct a cost analysis to ensure your pricing is competitive while still allowing you to make a profit.

Typically, what’s most important to them is what you know, not what you do. Clients want to know that you can help them with the things going on in their business, that you know how to solve problems, and you have the resources and tools to do that — that’s where they see the value in working with you."

Loren Fogelman, Founder Business Success SolutionLearn how to Price Accounting and Bookkeeping Services For Ultimate Profitability by downloading this playbook we co-authored with Loren.

What do you think? Are you excited about the process of starting your own bookkeeping business?

If you’re ready to get started, keep reading! Alternatively, you can use the ultimate checklist for starting a bookkeeping business.

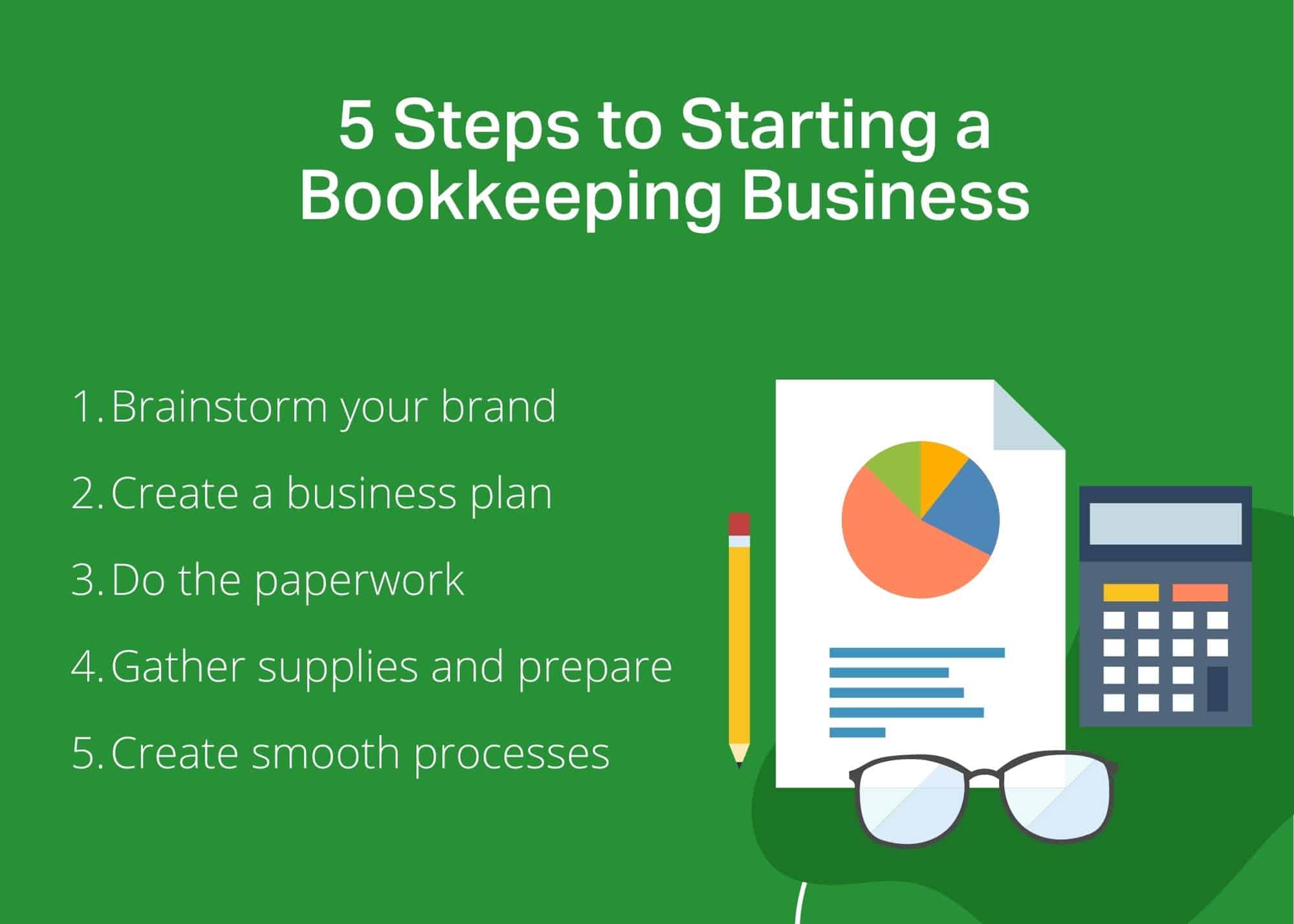

We’ll look at the process of starting your own bookkeeping business and go through all the steps one by one.

- Step 1: Brainstorm your brand.

- Step 2: Create a business plan.

- Step 3: Do the paperwork.

- Step 4: Gather your supplies and prepare.

- Step 5: Create a streamlined onboarding process for new clients.

Step 1: Brainstorm your brand

When creating a bookkeeping business, start by figuring out what kind of business you want to be.

- Do you want to pursue bookkeeping as a side-gig, or do you want to grow into a larger business with multiple employees?

- What does your ideal client look like?

- What type and size of businesses would you like to serve? What are their needs?

- What types of services do you want to provide?

- Do you want to have a particular specialization?

Consider the following:

- Business Name: Choose a name that’s professional, easy to remember, and relevant to your industry. Use our free bookkeeping firm name generator tool to get name ideas.

- Mission and Values: Define your business’s mission and values. What principles will guide your business? Think about how you want your staff, clients and people in general to feel when they think of your business.

- Target Audience: Identify your ideal clients. Who are they, and what industries do they operate in? This is very important.

Richard Roppa-Roberts, founder of Quaser Cowboy Consulting and Roundtable Labs, says this about identifying ideal clients:

You don't have to settle when it comes to clients. You want clients that complement your business, with goals you're able to identify and help them achieve"

Richard Roppa-RobertsYou can watch the video below to get more insights from Richard on how to identify ideal clients for your business:

- Unique Selling Proposition (USP): Determine what sets your bookkeeping services apart from competitors.

- Logo and Branding: Invest in a professionally designed logo and create a cohesive visual identity for your business.

Your brand will be the face of your bookkeeping firm, so make sure it reflects your values and appeals to your target market.

When brainstorming your brand, consider how you want your clients to perceive you. Do you want to be seen as a reliable, traditional bookkeeper, or a cutting-edge tech-savvy one? The answers to these questions will help shape your brand identity.

Step 2: Create a Business Plan

To move forward with your bookkeeping business, you need a business plan.

A business plan is a tool to help you plan and execute a successful business. It can be as simple or complex as you need it to be.

Your business plan should include:

- Executive Summary: An overview of your business, including your mission, goals, and vision.

- Market Analysis: Perform an extensive research on the target market, competitors, and identify trends in the industry.

- Services Offered: A detailed description of the bookkeeping services you’ll provide.

- Financial Projections: A forecast of your business’s financial performance, including income statements and cash flow projections.

- Marketing and Sales Strategy: This covers how you intend to attract clients and retain them.

- Operational Plan: Information on how your business will run day-to-day, including staffing and technology requirements.

- Legal and Regulatory Compliance: Ensure you understand and adhere to all legal and tax requirements.

A robust business plan not only helps you clarify your vision but also serves as a valuable tool when seeking financing or attracting potential investors.

Creating a business plan can take a lot of thought and time. For a more detailed guide to developing a business plan, check out this article by NerdWallet on How to Write a Business Plan, Step by Step.

Step 3: Do the paperwork

Now that you have a plan, it’s time to get started!

Before you begin gathering clients and crunching numbers, you need to think about a lot of fine details, paperwork, and requirements. You want to make sure you’re doing everything correctly and above board.

Bookkeeping requirements differ depending on where you live. However, you want to ensure you’re doing everything correctly and above board, here are the steps required to do that.

- Legally make your business an entity: Your business will probably be an LLC, although you should do your own research to figure out what type of business you want to create.

- Register your LLC with your state: To register your LLC with your state, go to your Secretary of State’s website and file an “articles of organization.” You will have to pay a one-time fee to do this.

- Get a business license: You may need a business license depending on where you are conducting your bookkeeping business. Check your state, county, and city websites to see what the requirements are in your area.

If your area requires a business license, you’ll need to renew it annually - See if you need an Employer Identification Number (EIN): Depending on how your business is set up and whether it’s just you or if you have employees, you may need an EIN. Check the IRS website to see if this is something your business needs.

- Open a business bank account: From the get-go, it’s important to keep your business money and your personal money separate. Do this by opening a business account, putting some money in it as an owner’s investment, and using it to pay all expenses related to your business.

- Get insurance: If something goes wrong and you don’t have insurance, it’s devastating for a new business. If you call your local insurance company, tell them you want protection for your new business, and ask about your options, they’ll help you choose the right plan for your type and size of business.

Step 4: Gather your supplies and prepare

You’re almost there! Now that you have your business plan in hand and all the paperwork and legal matters finalized, there are a few more things you need to do to make sure you’re prepared to begin bookkeeping.

Most importantly, don’t begin until you know how to bookkeep! You should also know your marketing plan, your prices, and what software you plan to use. In later sections, we will go more in-depth into each of these things.

You’ll also need:

- A computer

- A tax plan (we recommend saving a percentage of your income for taxes and paying quarterly)

- A business email address

You can also set up to work from home. Virtual bookkeeping is becoming increasingly popular due to advances in technology. It allows you to serve clients from anywhere, which can expand your reach and reduce overhead costs. However, a physical office may be necessary if you plan to cater to local businesses that prefer face-to-face interactions.

You can learn how to start a thriving virtual accounting firm here.

Nayo Carter-Gray, EA MBA, Founder of 1st Step Accounting, LLC discusses why virtual accounting and bookkeeping firms fail and how to build one that lasts in this video:

Step 5: Create a streamlined onboarding and retention for clients

You’ve set up your business, and you will start taking on new clients, but before you do this you need to create a streamlined onboarding process. This is essential as the first impressions and this process will set the stage for your relationship with the client.

To onboard new clients, start with a discovery call to get to know their business. Ask questions like

- How many employees do they have?

- How many transactions do they have each month?

- What bookkeeping services are they looking for?

- What are their expectations?

Collecting this information will help you understand the scope of work and if they are a good fit for your services.

The most important thing is to figure out their problems and offer a solution.

Once you’ve come to an agreement, it’s essential to sign an engagement letter. This way, both of you know the expectations, and everything is clearly communicated and agreed to in case any issues arise.

You can download our free accounting client onboarding checklist template to make onboarding seamless.

To retain clients, focus on delivering high-quality service, meeting deadlines, and staying proactive in addressing their financial needs. Happy clients are more likely to stay and refer your services to others.

Consider offering incentives for long-term clients, such as discounted rates or additional services. Show your clients that you value their business and are committed to their financial success.

And that’s that—you’re ready to start taking on clients and retaining them!

1. Be professional and prepared

If you’ve followed the steps in previous sections, you already have this taken care of! When you want to get new clients, the most important thing is to have completed all the proper preparation, so that you’re competent and skilled in what you do.

Out of all the things you’ve done so far to get your bookkeeping business off the ground, the most important thing when it comes to marketing is your website. Make sure your website is helpful and streamlined, giving potential clients all the useful info they need to know without being over-cluttered.

Also, make sure to put some customer testimonials on your website. You want all potential clients to see the great things your current customers have to say about you!

2. Utilize social media and current connections.

Here’s the thing: Many small businesses are looking for bookkeepers. Often small businesses do their own bookkeeping and are looking for someone to take that burden from them.

Or, they may need a bookkeeper but be too busy to actively search for one. If you show up in front of them with an offer, they may take you up on it just because that’s so much less stress than going out and trying to find someone.

Especially if they have connections to you already, they’ll want to hire you because they already feel they can trust you.

Because of this, the best place to start finding clients is within your own network.

Put the word out. Post on social media, and ask your friends if they know of anyone who’s trying to find a bookkeeper.

You can also build new connection by attending industry events and joining local business associations to network and build relationships. Here are top accounting in conferences 2025 you can attend.

3. Utilize job posting sites

You can also utilize job posting sites like LinkedIn and Craigslist to advertise yourself.

Since people on job posting sites won’t have much context for who you are, you need to put your best foot forward. Make sure you have:

- A great LinkedIn profile

- A professional, compelling logo

- A simple brand name that’s easy to spell

- A good website that’s streamlined, informational, and easy to navigate

- A straightforward, compelling list of what services you offer

4. Ask current clients to refer you

One of the best ways to continue growing as a company is to ask your current satisfied customers to refer you to people they know who are looking for bookkeeping services!

This helps you gain new clients, encourages existing clients to refer you to others, and helps you create a niche so you can stand out from the competition.

Hopefully, by now you should have some good ideas for how to market your firm and find new clients. Of course, we’re only scratching the surface here.

For more in-depth tips, check out our related blog: How to Get Bookkeeping Clients: 20 Predictable Channels .

In addition to traditional marketing methods, consider search engine optimization and content marketing. Creating informative blog posts, eBooks, or videos related to bookkeeping can establish you as an industry authority and attract potential clients who are seeking information and guidance. You can get bookkeeping clients by sharing your knowledge.

Without creating value through content, your ideal clients will always compare you (on price) with the accountant down the road, and they will choose them over you because they are cheaper."

Amanda C WattsAmanda shares detailed online and offline marketing strategies for accounting and bookkeeping firms in this video:

Recommended reading