Spreadsheets are handy—we’ve all used them in college or at work to organize data and make reports. But occasionally, we hear about a major blunder caused by a spreadsheet mistake, and we think, “That could never happen to me.”

But it does happen, even to the best. Take Public Health England, for example. They used Excel to track COVID-19 cases, but when their data file got bigger than Excel’s size limit, it excluded important data. Nearly 16,000 cases went unreported, leaving thousands of potentially infected people unaware they needed to self-isolate.

And then there’s Enron. Once a giant in the energy sector, Enron crumbled under the weight of its unethical practices—and spreadsheet errors played a role in that downfall. An analysis of their internal spreadsheets found that nearly a quarter contained errors, from simple formula mistakes to incorrect cell references. These errors weren’t just one-offs; they reflected deeper issues in how Enron managed its data.

Spreadsheets might work for quick calculations, but they’re prone to errors, like incorrect formulas and data entry mistakes, which can lead to costly inaccuracies. Plus, they lack strong security, making them easy targets for unauthorized access and data breaches—putting client information and your accounting firm’s reputation at risk.

Limitations of Using Spreadsheets in Your Accounting Firm

Collaboration Issues

Working on spreadsheets with your team or external partners can be a real headache. If you’ve ever tried to share a file, you know the drill – endless email threads, version mix-ups, and that dreaded “file is locked” message because someone else is editing. Spreadsheets just aren’t built for smooth teamwork. In fact, 18.5% of firms struggle to collaborate effectively without workflow tools—something spreadsheets simply don’t provide.

When multiple people need to access or update data in a spreadsheet, it becomes messy and time-consuming. This inefficiency can slow down and hamper collaboration in your accounting firm, especially when working virtually, and you can’t just slide over to a colleague’s desk to clarify things.

As Nayo Carter-Gray puts it, “Just because your firm is virtual doesn’t mean you shouldn’t have structures & processes mapped out that you can follow.” Without these clear processes for collaboration, the problems with spreadsheets—like lost changes, unsynced updates, and tracking issues—become even more problematic for your firm.

Lack of Data Integrity & Consistency

Manually updating spreadsheets can seriously undermine the integrity and consistency of your data. Every time someone makes a change, there’s a risk of human error—whether it’s entering the wrong number, forgetting to update a formula, or accidentally deleting important client information.

These mistakes can create inconsistencies in client records, leading to inaccurate reports and potentially costly errors. As you probably know, even the smallest errors in accounting can snowball into significant issues.

For instance, let’s say you’re working on a spreadsheet to track client billing for your accounting firm. One of your team members accidentally enters a decimal point in the wrong place, turning a $10,000 payment into $1,000. No one catches the error right away, and this incorrect data ends up in the monthly financial report sent to the client. Not only does this mistake paint an inaccurate picture of the client’s financial standing, but it also causes confusion when the client notices the discrepancy, leading to a stressful back-and-forth to resolve the issue.

This lack of data integrity can undermine client trust and lead to compliance problems, as discrepancies and errors in financial records can attract scrutiny from regulators and auditors.

Limited Security & Compliance

Numerous privacy regulations worldwide, such as the General Data Protection Regulation (GDPR) in Europe, the Privacy Act 1988 in Australia, the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada, and the Gramm-Leach-Bliley Act (GLBA) in the United States, have been established to protect sensitive client data and uphold consumer rights. These regulations require stringent measures for data security, including tracking data access, enforcing data encryption, and maintaining detailed audit trails.

However, spreadsheets often fall short in these areas, lacking comprehensive logging, monitoring capabilities, and advanced security features that are essential for meeting compliance requirements. Spreadsheets typically rely on basic password protection, which can be easily bypassed or compromised. They also lack robust access controls, meaning that once a spreadsheet is shared, anyone with access can view or alter sensitive client information.

This poses a significant risk, particularly in the accounting industry, where handling confidential financial data is routine. The absence of proper security measures can lead to unauthorized access, data breaches, and non-compliance with privacy laws—putting your firm’s reputation and client trust at risk.

Inability to Scale

As your client base expands, spreadsheets struggle to keep up. What starts as an easy tool for managing small data sets can soon turn slow and cumbersome as more information gets piled on. Spreadsheets are not designed to handle large datasets, as seen in the infamous Public Health England case, mentioned above.

The more data you add, the slower spreadsheets get. This makes it increasingly difficult to manage and track client information efficiently. As data complexity grows, so does the potential for errors; formulas that worked fine with a few rows can break or produce inaccuracies when scaled up to thousands of entries. Troubleshooting these issues can be tedious and time-consuming.

Consequences of Relying on Spreadsheets to Get Work Done

Version Control Issues

One of the major headaches of relying on spreadsheets is managing version control. When a spreadsheet is shared among multiple team members, keeping track of the most current version can be difficult.

Often, different people will work on separate copies of the file, leading to a jumble of versions that may not be synchronized. This can result in discrepancies between files, with some containing outdated information and others having recent updates.

The problems multiply as team members might make changes simultaneously or in different copies of the spreadsheet, leading to conflicting versions. Determining which version is the “correct” one can be a challenge, often requiring a painstaking review of each version to identify and consolidate changes. This not only wastes time but also increases the risk of errors.

Moreover, it becomes difficult to track changes or revert to previous versions without a version control system.

Time-Consuming Updates

Manually updating spreadsheets is a labor-intensive process. When you need to make changes across multiple fields, formulas, or tabs, the task often requires meticulous attention to detail and repetitive data entry. This can be particularly burdensome in complex spreadsheets with extensive data sets or multiple interconnected sheets.

One major issue with manual updates is the risk of accidental overwrites or deletions. A small mistake, such as entering data in the wrong cell or inadvertently deleting a crucial formula, can lead to errors that are not immediately apparent. These errors can affect the accuracy of the entire spreadsheet, potentially causing discrepancies and requiring additional time to identify and correct.

Lack of Central Source For Information

Spreadsheets are often saved on local drives or sent back and forth through email, making it tough to ensure everyone’s working with the latest information. When different team members are updating their versions, things can quickly get out of sync. For example, you might update a client’s contact info while a colleague is still working with an outdated version that doesn’t have those changes.

This lack of synchronization can create inconsistencies, with people across your team using different sets of data. And when you’re working together, especially in real-time, this becomes a bigger problem.

Spreadsheets aren’t built for multiple people to update at once, so changes one person makes might not show up instantly for others. This delay can lead to decisions based on outdated or incomplete information, causing miscommunications and affecting the overall quality of your work.

No Access to Reporting and Analytics

Spreadsheets are great for basic tasks like data entry and simple calculations, but when it comes to advanced reporting and analytics, they just don’t cut it. If your accounting firm relies on spreadsheets, you’re probably familiar with the struggle—they’re just not built for the heavy lifting that comes with deeper data analysis.

Creating detailed reports in spreadsheets can be a real hassle. You often end up dealing with complex formulas, pivot tables, and manual data merging, which can lead to errors and waste a lot of time. Ever tried pulling together a financial summary from multiple sheets? It’s usually a mess of copy-pasting and cross-checking, leaving plenty of room for mistakes.

Plus, spreadsheets don’t offer much when it comes to advanced analytics. They lack the powerful visualization and analytical tools that dedicated software provides, making it hard to spot trends or do predictive modeling. Without these insights, your firm might miss out on valuable patterns that could drive better decisions. In short, spreadsheets can end up holding you back from getting the most out of your data.

Clunky Client Onboarding Process

Onboarding new clients means gathering all sorts of details—personal info, financial documents, you name it. And when you’re managing all of this through spreadsheets, it can feel like you’re constantly battling slow processes and manual updates. According to this report, 51.4% of firms said their onboarding processes were clunky before they switched to automated tools.

One big pain point is tracking progress. Spreadsheets don’t have the dynamic features needed to keep you updated in real time, so it’s easy to lose track of where each client is in the onboarding process. Before you know it, deadlines are missed, or details slip through the cracks because your team doesn’t have a clear view of what’s been done and what’s still pending.

Plus, spreadsheets aren’t built to handle the more complex workflows that come with onboarding new clients. They don’t offer much in terms of automating tasks or integrating with other tools, like your CRM or document management system. Without automation, you’re stuck doing everything manually, which slows things down even more and opens the door to errors and inconsistencies.

Ditch Spreadsheets: Discover a Better Way to Handle Your Accounting Clients’ Data

Now that you know the downsides of using spreadsheets, let’s talk about a better way to manage client data in your accounting firm.

Switching to a cloud-based system can transform how you handle your accounting clients’ data. While spreadsheets may work for simple tasks, they often fall short when it comes to efficiency, security, and scalability—areas where cloud-based solutions like Financial Cents shine.

Improved Task Management

One of the standout benefits of cloud-based systems is their enhanced task management capabilities. These platforms typically include integrated tools that streamline workflows, assign tasks, and track progress, making it easier to manage client projects efficiently.

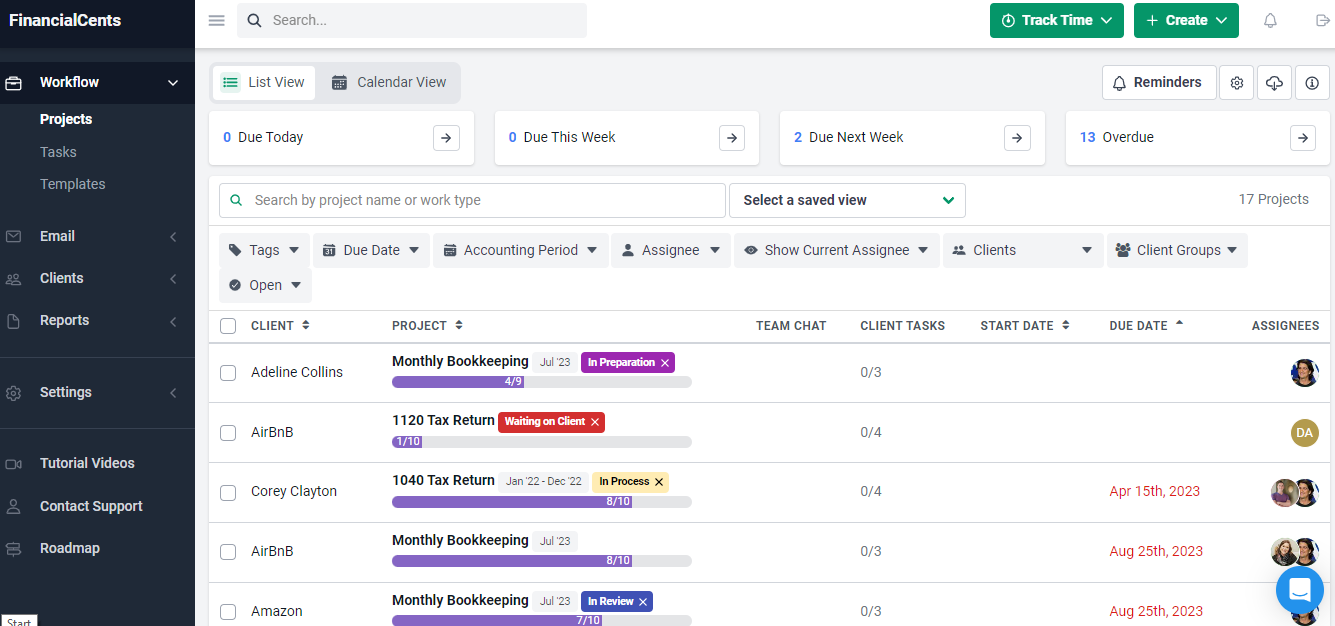

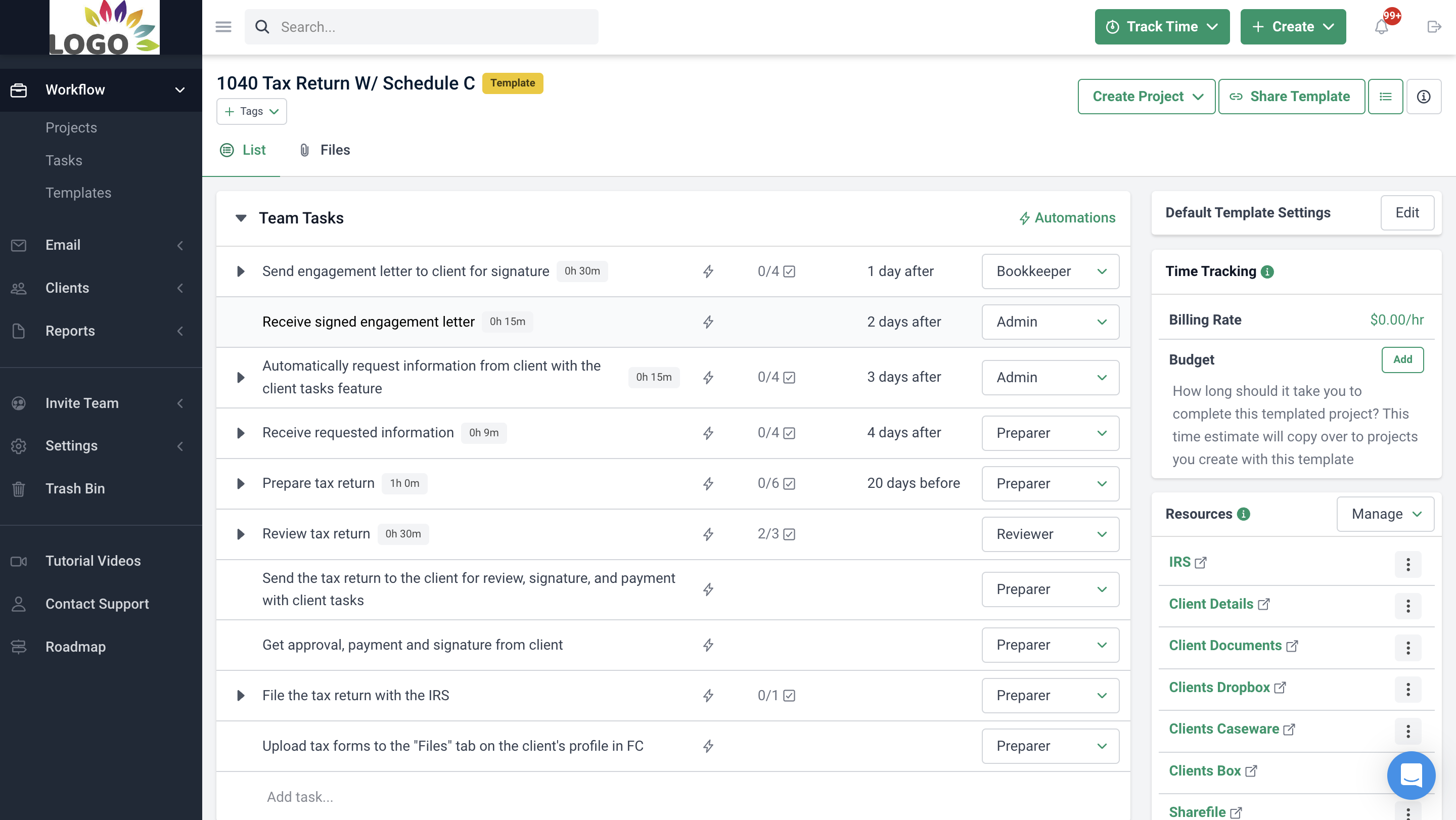

For example, Financial Cents, a task management tool, lets you track due dates and organize your workload so you always know what to focus on next. This helps ensure that critical deadlines aren’t missed, allowing you to meet client expectations consistently.

While team collaboration is also possible within Financial Cents, the real advantage is having a clear view of your tasks and deadlines, as shown below, especially if you’re working solo or with a small team.

Additionally, Financial Cents offers capacity management features to help you monitor your or your team’s workload and availability. This way, you can avoid overloading staff and ensure that tasks are distributed evenly, balancing workloads effectively and maintaining productivity.

Team Collaboration

One of the biggest perks of a cloud-based system is how easy it makes team collaboration.

Unlike spreadsheets, which can be a struggle to share and keep updated among multiple people, cloud platforms allow for real-time teamwork.

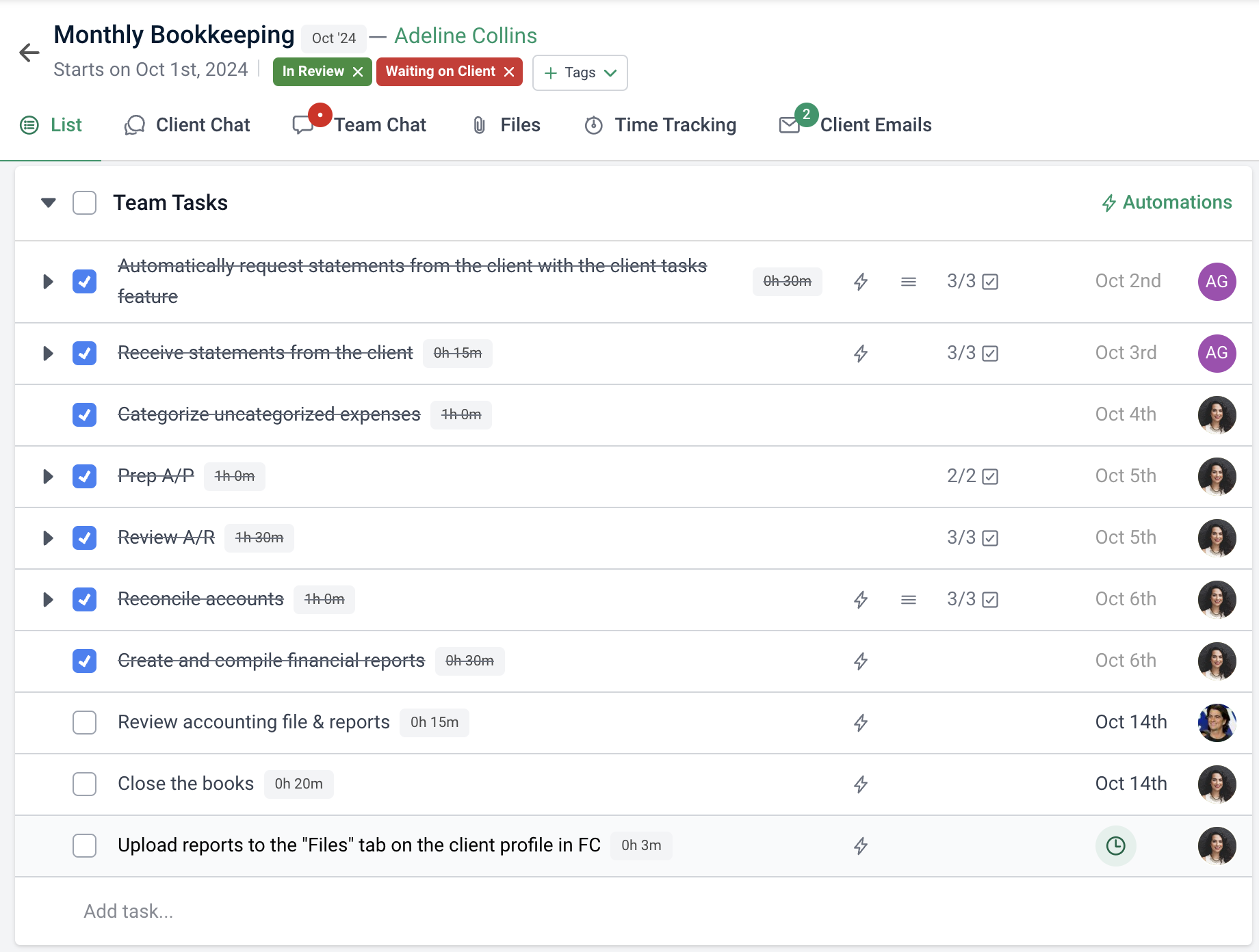

In Financial Cents, for example, you get a centralized workflow dashboard that gives you a clear overview of your projects and tasks. This feature helps you monitor progress at a glance, ensuring that all client work is on track and deadlines are met.

With real-time access, everyone can view, edit, and track changes as they happen, keeping the whole team aligned and minimizing errors. So if one person updates a project status or adds a new task, everyone sees the change immediately. For instance, if a team member updates a client’s deadline, everyone else instantly sees the new deadline and can adjust their work accordingly.

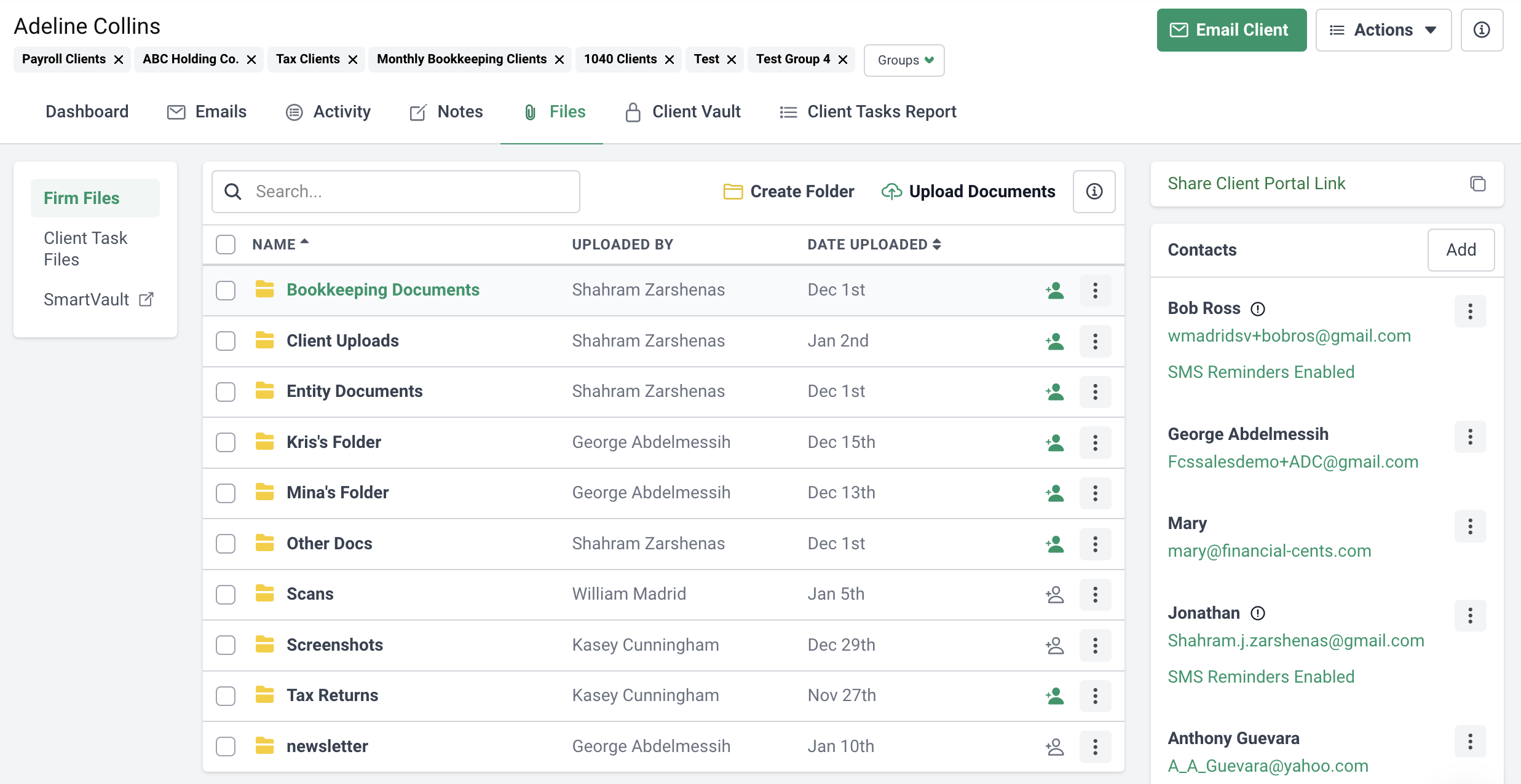

Additionally, Financial Cents makes managing client documents straightforward. Files are easily accessible and securely stored, with the ability to organize documents into categories and folders. This means that even if the primary contact for a client is away on vacation, other team members can still access the necessary files without any issues.

The task assignment and delegation features in Financial Cents make team collaboration more effective by letting you assign tasks clearly and efficiently. This improves project management by clarifying who is responsible for what and ensuring that each task is handled by the right person.

As team members complete their tasks, they can mark them as done, which automatically updates the project’s progress bar.

Advanced Data Protection And Security

Security is another significant advantage of cloud systems. Unlike spreadsheets, which rely on basic password protection, cloud platforms offer advanced security features like encryption, access controls, and regular backups. These measures help keep sensitive client data safe and ensure compliance with data privacy regulations.

With Financial Cents, you benefit from top-tier security practices, including:

- Bi-annual third-party security assessments and regular internal testing.

- Multi-factor authentication, restricted staff access, and thorough training on handling sensitive data.

- Data encryption both at rest and during transit.

- Secure data disposal and a comprehensive incident response plan.

- Use of SOC II, SOC III, GDPR, and HIPAA-compliant cloud services.

- Enhanced security for client portals with encrypted passwords and SMS-based authentication.

These features collectively ensure that your client data is well-protected and handled with the highest standards of security.

Automation

Instead of spending valuable time on repetitive tasks like data entry and report generation, cloud-based platforms like Financial Cents can automate these processes for you.

Take managing multiple client accounts, for example. Without automation, you’d be manually gathering documents, generating reports, and sending out reminder emails—time-consuming and error-prone tasks.

With Financial Cents, you can set up automated workflows to handle these client tasks smoothly.

For instance, you can automatically request documents and set reminders for deadlines. You can even use templates with checklists for your clients.

With Financial Cents, your clients get a secure magic link to access the platform without needing to remember passwords. The system also sends automatic reminders for any unfinished tasks, and you can communicate with clients directly within the platform.

This kind of workflow automation cuts down on errors and saves you time. Instead of handling repetitive tasks, you can focus on strategic work like analyzing client needs or developing new services. Plus, you can use or share templates with other accounting professionals to make your processes even smoother.

Why Financial Cents is Best Suited for Modern Accounting Needs

When it comes to modern accounting needs, workflow management software like Financial Cents offers more productivity than spreadsheets.

First off, efficiency gets a serious boost. Financial Cents automates routine tasks like client data collection and email reminders, so you and your team can spend less time on busy work and more on important activities. This means your firm operates smoother and faster.

Next, instead of wrestling with clunky spreadsheets, Financial Cents lets your team work together in real time. Everyone can see updates instantly, reducing confusion and keeping everyone on the same page.

When it comes to time management and resource allocation, it helps you track tasks, deadlines, and progress all in one place. This way, you can allocate your team’s time and resources more effectively. It also streamlines your workflow and process automation.

Finally, all these improvements lead to better client satisfaction and service delivery. With everything organized and automated, you can provide faster responses and more accurate work, which enhances your clients’ experience and keeps them happy.

Conclusion

Spreadsheets can drag you down with their inefficiencies. They’re slow, tough to collaborate on, and prone to errors, especially as your client base grows. These problems can mess with your accuracy and productivity.

It might be time to look at how you’re currently handling your workflow and think about moving to something better. A cloud-based system can make your processes smoother, improve team collaboration, and keep your data safe. Make the switch to a more modern solution like Financial Cents which can boost your firm’s efficiency and reliability.